13+ Sample Loan Proposals

-

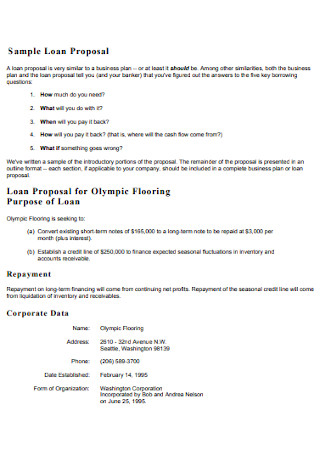

Sample Loan Proposal

download now -

Loan Application Proposal

download now -

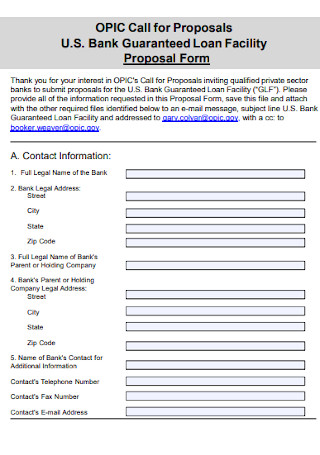

Bank Loan Proposal Form

download now -

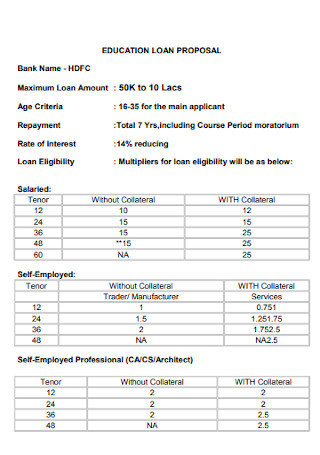

Education Loan Proposal

download now -

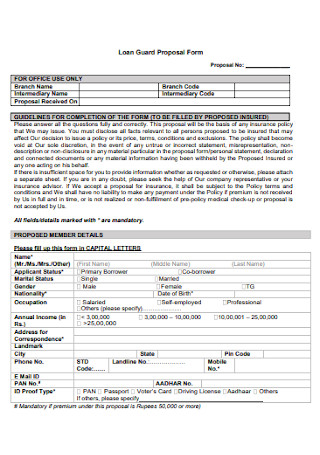

Loan Guard Proposal Form

download now -

Bank Loan Based Proposal

download now -

Redevelopment Loan Proposal

download now -

Proposal Requirement for Loan

download now -

Public Art Donation and Loan Proposal

download now -

Loan Shield Rider Proposal

download now -

Bank Loan Proposal

download now -

Business Loan Proposal

download now -

Aquaculture Loan Proposal

download now -

Basic Loan Proposal

download now

Writing a Loan Proposal can be tough. It is not just merely asking for money but a whole lot more that involves a lot of convincing and proving your financial capability to repay the loan. Find out more about what a Loan Proposal is as you read further into this article as well as how you can start preparing one of your own with the help of the samples we have prepared!

What is a Loan Proposal?

Firstly, a Loan Proposal is any document that an individual or a business entity prepares before applying for a loan mostly from banks or any other legitimate financial institutions. This is an important document as it outlines everything the lender needs to know regarding the loan request and the borrower, most importantly so that they can evaluate and then ultimately determine if the borrower is in fact, an eligible candidate for the amount that they are requesting. To sum it up, a loan proposal is essentially a proposal to acquire a loan, a certain amount of money for either personal reasons or business ventures with a repayment schedule established that to a lender, will dictate if you have the credentials, the experience and the ability to repay the loan.

A clearly defined loan proposal has higher chances of getting approved as all lenders want is to be assured that the risk analyzed for all loan applicants will be reduced in your hands. When money is involved, extra precautions are needed with the double amount of risks in place so it is of utmost importance to not only properly strategize your proposal incorporating a ‘soft sell’ technique that is really just one way of saying to be persuasive in presenting yourself or your business’ financial needs with a reassuring potential to afford the loan, but to also be transparent as much as possible. Honesty goes a long way and in the case of preparing a loan proposal, it can get you the funds to officially kick start your plans and hopefully, make the profit you have projected.

When everything is settled and the proposal is approved, both parties can move into a Loan Agreement that will effectively function as a Loan Contract that will legally bind them to perform the terms and conditions stated once the document is signed by the parties involved.

Different Types of Loans

There are a variety of loans in existence that are dependent on your situation and your needs. Learn more about what they could be and determine which kind of loan best fits your circumstance.

1. Personal Loan

Personal loans allow you to borrow money to cover a variety of purposes, literally everything and anything. With a typical repayment schedule of up to two to six years, a personal loan is commonly used for the following purposes: debt consolidation, wedding budget, honeymoon expenses, home remodeling and renovations, vacation costs and more. A Personal Loan is further divided into two namely: Secured and Unsecured.

- Secured Personal Loan

This type of personal loan sets a fixed condition that is a collateral or an asset in your possession that has valuable monetary value. This means that if you are unable to repay the loan according to the agreed terms and conditions, oftentimes the schedule, the lenders are legally allowed to be in possession of your collateral in order to satisfy their financial loss. Collaterals can include but are not limited to: Properties, cars, jewelries, cash assets like a savings account and a checking accounts, and life insurance.

- Unsecured Personal Loan

An Unsecured Personal Loan on the other hand, does not require a collateral before a borrower makes the request of borrowing money but solely through their creditworthiness best reflected through their credit score. Individuals with higher credit scores are obviously approved for the loan. This credit score pertains to the rating that a lender associates with you based on their evaluation of the financial statements you have provided them. This will single handedly depict a borrower’s creditworthiness that will significantly determine their financial direction in terms of acquiring loans. The credit score ranges from 300-850 and are divided as follows:

- 800 to 850 (Excellent)

- 740 to 799 (Very Good)

- 670 to 739 (Good)

- 580 to 669 (Fair)

- 300 to 579 (Poor)

However, because more risks are at stake for the lender, they tend to satisfy that risk by charging you with higher interest rates on your personal loan. If you were to default on an unsecured personal loan, the lender has all the legal means to resort to drastic measures such as taking your case to the court.

2. Mortgage Loan

Discussed more in-depth in two separate articles entitled, Mortgage Contract and Mortgage Agreement, a Mortgage Loan essentially allows the mortgagor to purchase their dream home or a real estate they have been eyeing on through the mortgage loan requested from a mortgage lender. The common types of mortgage loans include: Conventional Mortgages, Jumbo Mortgages, Fixed-Rate Mortgages, Adjustable-Rate Mortgages (ARM), Construction Loans, Interest-Only Mortgages, Balloon Mortgages and Government-Insured Mortgages that are further divided into three namely Federal Housing Administration’s FHA Loans, U.S. Department of Agriculture’s USDA Loans, and U.S Department of Veteran Affairs’ VA Loans. To be approved for a mortgage loan, you must go through a process where a credit score will be extracted from you based on your financial situation and your repayment capability. The range for a credit score in mortgage loans typically range from 0-999 and are divided as follows:

- 961-999 (Excellent) – This means that you are more than qualified to afford the best mortgage deals with lower interest rates.

- 881-960 (Good) – A credit score in this range means you are still eligible for most but not all of the ideal mortgage deals.

- 721-880 (Fair) – This means that you are still approved for mortgage deals with a sound interest rate that is appropriate to your financial status and repaying capacity.

- 561-720 (Poor) – While you are still eligible for mortgage deals, it will be charged with higher interest rates.

- 0-560 (Very Poor) – A credit score within this range is ultimately denied a mortgage deal that might not even get you one in other lending banks or if you could, it is usually charged with high interest rates that you may struggle even more to repay.

3. Home Equity Loan

A Home Equity Loan is also referred to as ‘Home Equity Installment Loan’ or ‘Second Mortgage’ as it is likened to a Mortgage Loan. This applies to homeowners who own a portion of their homes or an equity of their home that is no longer owned by the bank. Most lenders will allow you to borrow up to 75% to 90% against the equity in your home and this is proportionate to how much equity is available. To make more sense of this type of loan, you are essentially using your home as a collateral which if you default on it, there is a likelihood that you will lose your home. To calculate your home’s equity, you can simply subtract the amount of your outstanding balance on your mortgage from your home’s market value or your home’s appraised value. For example, if your home’s current value is $300,000 and your remaining mortgage balance is $150,000 then your equity would be $150,000 and considering the 85% loan limit, the amount you can likely borrow up to $105,000.

4. Student Loan

This type of loan should be pretty self-explanatory. A Student Loan allows you to borrow money you need in order to fund your college budge plans which you will have to pay back later once you finish studying but with an interest. This loan also helps students pay for other costs such as living expenses, tuition and books. There are two types of loans you can choose from when applying for a student loan and they are as follows:

- Federal Loans

These are loans that are provided by the U.S Government through the Federal Direct Loan Program. This is further divided into three:

- Private Loans

The key difference between a private loan and a federal loan is that the former is offered by banks, credit unions and other financial lending institutions. Another is that a borrower for a private loan does not have to prove they are in financial need but rather their creditworthiness. A poor credit history would need a cosigner on the loan which means another individual who would have to be responsible for repaying the loan should the primary borrower fail to make timely payments.

5. Title Loans

A Title Loan, whose common branch under it is a Car Title Loan, is a type of secured loan that requires an asset, most commonly a vehicle as collateral so this implies that a borrower must already be in possession of a car before applying for this kind of loan. This is an option taken by most loan applicants because it does not require a credit score to determine if the applicant is qualified for the loan they request. This is not to be confused with an Auto Title Loan because while similar in the sense that it requires an asset as collateral, an Auto Title Loan’s purpose is to purchase a car while the money granted from a Title Loan can be used for whatever you want.

Common Requirements Before Applying For a Loan

While the loans one might apply will vary, there are common requirements that banks and financial lending institutions must first evaluate before approving loan applications. Some of those are detailed below:

1. Credit Score and Credit History

An important requirement most financial lending institutions look into for evaluation and dare we say, the most important requirement, is an applicant’s credit history and their corresponding credit score. You may submit a Credit Report as it would have detailed a summary of an individual’s credit history along with their personal information, income and expense statements, total debt accrued, and the promptness of the applicant’s repayment. This would allow lenders to review your financial status and determine your creditworthiness before granting your request of borrowing a loan. Obviously, a good credit history would generate a good credit score which inevitably will allow lenders to approve your loan applications meanwhile a bad credit history would result with a bad credit score, rejecting lenders your loan application or reduce your options of good loan deals while charging you with higher interest rates that ultimately will be harder to repay unless you fix your spending habits and you develop a strict budget plan.

2. Business Plan

Businesses, be it small and massive ones, typically apply for a bank loan through incorporating their loan proposals in their business plans which they will have to submit to their bank of choice. Business plans require an extensive overview of your business’ performance, its vision and mission statements, its financial reports and profitability, the objectives it wishes to achieve and steps or activities to be taken to achieve your business’ goals. Through a clearly and an effectively written business plan that should accurately reflect the business’ finances and goals, lenders will be reassured to offer you the loan you are requesting.

3. Personal Information

This does not only mean surface-level relevant information about yourself but lenders also require your criminal record, personal financial statements, bank statements, tax returns and an asset list for further evaluation of your ability to qualify for a loan of your choice.

4. Collateral

These are the valuable assets of monetary value that a borrower offers a lender as their safety net for the loan.

Key Elements of a Loan Proposal

While preparing for a loan proposal, there are questions one must be able to keep in mind and should answer throughout their proposal. It responds to the following questions like how much you need, how you should be able to repay the loan, what you can offer in the case you default on a loan and how can you prove you are a reliable candidate for a loan? If your loan proposal is able to provide detailed responses to these questions, there should be a high probability of your loan application taken into consideration and eventually for approval.

Depending on the kind of loan you are applying for, components may vary but there are key elements that are universally shared by most loan proposals and these are the following:

FAQs

What is a Loan Proposal?

A Loan Proposal is a formal and written document that an individual and most times businesses prepare before applying for a loan or before they are to borrow a large sum of money that is to be repaid according to a schedule that the borrower and the lender are in mutual agreement with.

What are the 4 Types of Loans?

In reference to the information stated previously in the article, the different types of loans include

- Personal Loans (Secured and Unsecured Personal Loan),

- Mortgage Loans,

- Home Equity Loans,

- Student Loans (Federal Loans: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans and Private Loans),

- Title Loans

How do you write a Loan Proposal?

Loan Proposals generally share key elements and as what this article has discussed in summary, it includes:

- Executive Summary

- Loan Description

- Business Description

- Financial Documents