23+ Sample Project Investment Proposal

-

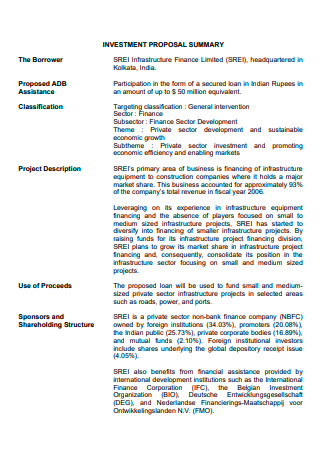

Project Investment Proposal Template

download now -

Project Public Investment Proposal

download now -

Basic Project Investment Proposal

download now -

Project Investment Proposal Example

download now -

Project Investment Proposal in PDF

download now -

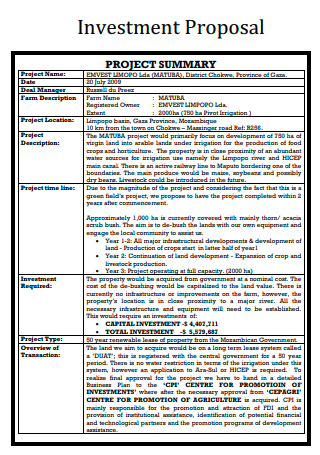

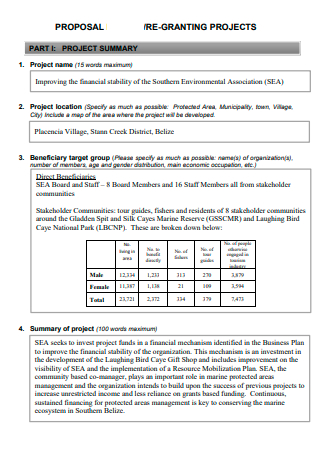

Project Summary Investment Proposal

download now -

Simple Project Investment Proposal

download now -

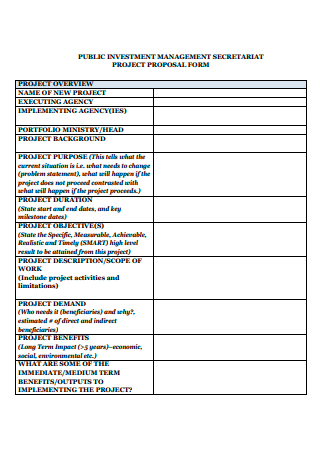

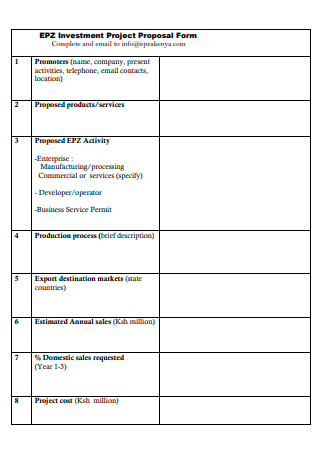

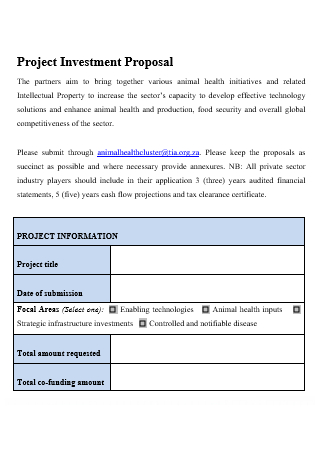

Project Investment Proposal Form

download now -

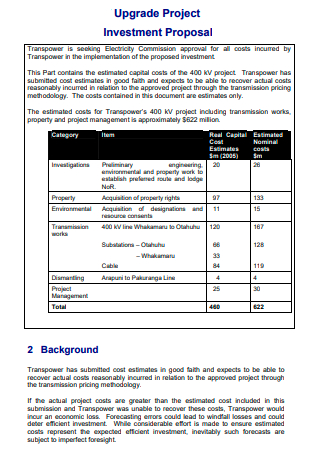

Upgrade Project Investment Proposal

download now -

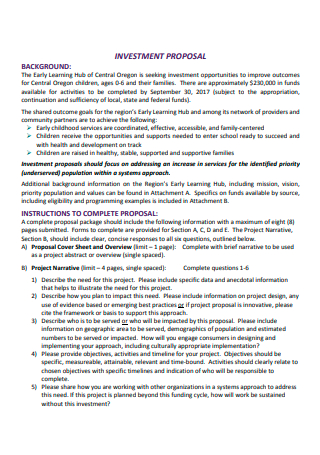

Standard Project Investment Proposal

download now -

Project Investment Proposal Format

download now -

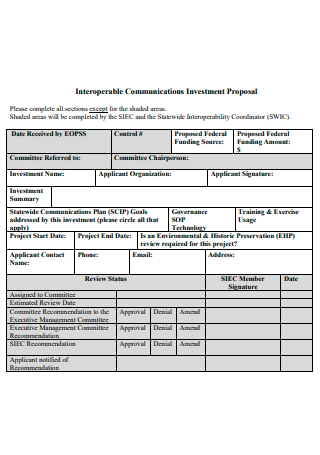

Project Communication Investment Proposal

download now -

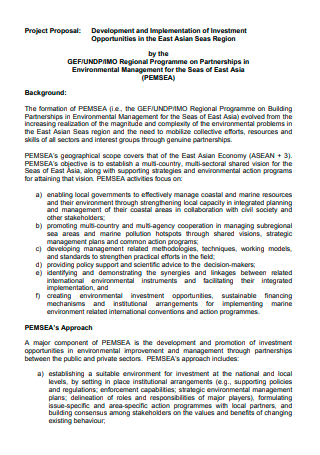

Project Description Development Investment Proposal

download now -

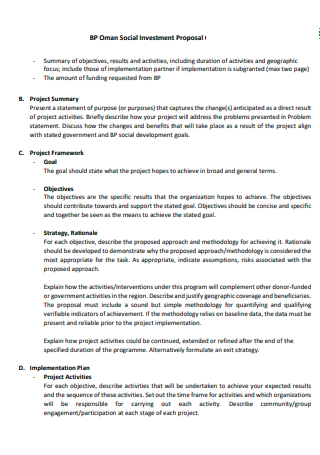

Social Project Investment Proposal

download now -

Project Application Investment Proposal

download now -

Project Expenses Investment Proposal

download now -

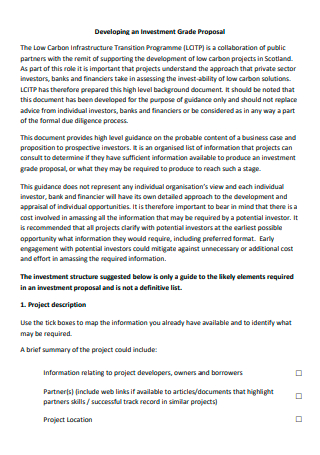

Project Investment Grade Proposal

download now -

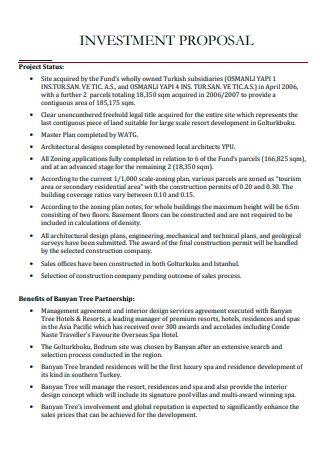

Project Status Investment Proposal

download now -

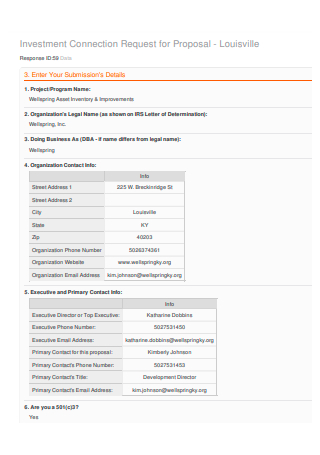

Project Investment Connection Proposal

download now -

Printable Project Investment Proposal

download now -

Formal Project Investment Proposal

download now -

Draft Project Investment Proposal

download now -

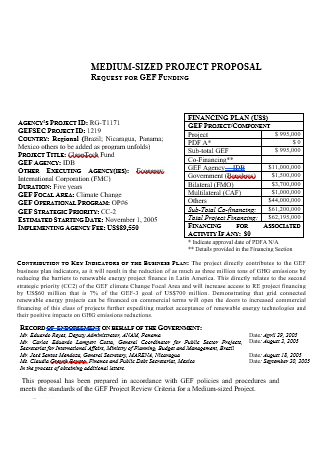

Medium Sized Project Investment Proposal

download now -

Project Investment Proposal in DOC

download now

FREE Project Investment Proposal s to Download

23+ Sample Project Investment Proposal

What Is a Project Investment Proposal?

What Are the Categories of Investors?

What Are Things to Avoid When Writing a Project Investment Proposal?

Elements of a Project Investment Proposal

How to Write a Project Investments Proposal

FAQs

What are the investing types?

How do you get investors to fund your company plan?

What is the difference between a proposal and a contract for investing?

What Is a Project Investment Proposal?

Entrepreneurial success is frequently achieved when a number of various factors come together to create an optimum environment in which a business can grow. And one of these critical aspects is the availability or quantity of money, sometimes known as investment capital in the business context. And, all too frequently, company ideas do not materialize as a result of a lack of finance or investment. However, if you are serious about launching a business or renovating an existing organization, you must first develop a good business strategy, which must be accompanied with an equally convincing investment proposition.

Other templates are available on our website, and you can use them whenever you need them. They are as follows: business professional proposal, buyout agreement, quantitative research proposal, bid contract proposal, position agreement, staffing agreement, investment proposal, work agreement, property purchase agreement, qualitative research proposal, security bid proposal, and other similar templates are available. This post will not only provide you with templates but will also provide you with important information that you need to know in order to complete your template.

What Are the Categories of Investors?

First and foremost, you must determine which types of investors you aim to attract. They can be divided into a few different categories, which are as follows:

1. Angel Investors and Angel Groups

These are high-net-worth people and groups who invest in businesses in exchange for shares, which means they are equally as involved in the success of the startup as they are in the return on their investment. Most of the time, they also have a wealth of entrepreneurial experience, which allows them to serve as a mentor or coach to you.

2. Banks

Despite the fact that banks are not the most prevalent source of investment for startups, you can still submit your application to one if your project begins to show signs of success (e.g., by gaining customers).

3. Venture Capital firms

These corporations typically conclude more agreements than angel investors, owing to the fact that they have a larger pool of capital to invest in startups. Because most venture capital firms are created equal, your choice of venture capital will almost always be determined by your geographic location.

4. Corporate Investors

Some organizations are interested in investing startups as a means of acquiring new assets and identifying new technology, all of which can assist them in growing their revenue streams.

5. Peer-To-Peer and Personal Investors

It is possible that this group will include close relatives and acquaintances, as well as P2P lenders and crowdfunding platforms. Friends and family are usually the first persons to come to mind when you need a loan, and they may be able to provide you with a substantial quantity of money. Alternatives include going directly to potential clients and launching a crowdfunding effort.

What Are Things to Avoid When Writing a Project Investment Proposal?

Creating a convincing project investment proposal for your project is critical since it can be the difference between success and failure for any entrepreneur. However, it must be concise and truthful in order to effectively demonstrate your expertise in the industry in which you work. Given that we’ve already explored the factors that will help you get there, here are some things you should avoid doing along the way:

1. Make Things as Simple as Possible

Not only should the material be understandable to your peers, but it should also be understandable to the general public. Furthermore, if you use a lot of jargon or complicated language, it may appear as though you have copied information rather than explaining it in your own words. Simple language also demonstrates that you are on an equal footing with your potential customers. Even if someone is interested in what you’re saying, they may not be able to comprehend what you’re saying.

2. Don’t be Afraid to Ask Questions

When it comes to discussing the financial assistance you require, don’t mince words. Predictably, you should specify the amount of money you wish to raise, what you intend to do with it, and why you require it.

3. Keep Out Stuff that Isn’t Relevant

Incorporate only the pertinent details into your document. However, if your abilities and experience are not relevant to the company or the project, they will just add to the amount of noise in the information stream.

4. Don’t be Obsessive About It

Avoid becoming obsessed with any of the details you present in the proposal, since this may be perceived as unprofessional.

5. Don’t Drag it Out for Too Long

It is possible that a lengthy proposal will not be read at all. Consider how much time someone will have to spend reading and evaluating your proposal, as well as how much time you will have to spend on your own.

Elements of a Project Investment Proposal

As previously stated, a project investment proposal might take the form of a plain text document or a PDF that includes graphics. Another type of presentation is one prepared using software such as PowerPoint or Keynote. The format of your proposal is heavily influenced by the type of investor you select, although it is always feasible to use any combination of the three types. However, there are certain aspects that must be included in every proposal. They are as follows:

How to Write a Project Investments Proposal

The most attractive project investment proposal is one that succinctly and accurately informs a potential investor of the benefits of funding the project. And to ensure that your investment proposal reflects these traits, we’ve compiled a list of the most critical sections or pieces of material to include in your written investment proposal.

-

Step 1: Detailed Description of the Proposed Investment

All investment proposals should begin with a concise description of the investment project or idea being proposed. This section of your proposal is where you get to tell the world about your business idea. Or, if you’re looking for additional funding for an already-established business, you’ll need to write about the things you intend to do to re-energize it.

-

Step 2: Business and Financial Reporting

A part detailing your company’s success and financial history is also required in each investment proposal. If you already run a business, you can easily include a snapshot of your financial records and achievements in this section.

-

Step 3: Marketing and Sales Strategy

One of the most crucial parts of a project investment proposal is Market Research and strategy. For example, extensive market research will reveal your industry’s competitors. After evaluating the study’s findings, you must devise new methods to retain or develop a market lead. And you must include all of these plans in your project investment proposal.

-

Step 4: Management Business Technical Operations

Before investing in your business idea or project, investors want to know everything about it. The technical and operational aspects of your prospective business must also be included. In other words, your proposal must include information about the individuals you plan to hire, the business location, operating costs, equipment suppliers, raw material sources, human resources, and other expenses.

-

Step 5: Provide Project Financing

Not all project investment proposals include project financing. This is critical for potential investors since it states what they will gain from sponsoring your business idea or project. The investment proposal should clearly outline the source of cash, return on investment, predicted gains and losses, business performance, and other financing choices. You’ll be able to explain to potential investors how their money or resources will benefit your company.

-

Step 6: Timeline and Exit Plan

Your project investment proposal should also include a business or project timeline so potential investors know how long they will be working with you (the business owner). Timetables also help business owners stay on track with their own ambitions. An Investment Proposal should also include an exit strategy. This section of your proposal should explain how investors can exit their interests in your business or firm. Exit plans should also cover how your company would handle failure.

That concludes our discussion of the six most critical components of an investment proposal. Optimize your proposal for them and make sure to include actionable language throughout the proposal narrative. This manner, you’ll have an enticing and persuasive proposal that will appeal to as many investors as possible. By the way, don’t forget to use one of the free proposal templates featured in this post to assist you in generating the greatest investment proposal possible for your business.

FAQs

What are the investing types?

If you want long-term growth, consider stocks, bonds, ETFs, mutual funds, options, CDs, and index funds.

How do you get investors to fund your company plan?

You can attract investors to your company plan by demonstrating your competitive advantage. Present your business plan and its potential for growth with style. Build trust so they can trust your vision.

What is the difference between a proposal and a contract for investing?

The “offeror” proposes to give goods/services at a set price. An investment contract is a legally enforceable agreement that specifies the nature of the commodities or services and their cost.

A project investment proposal is a critical document that every business must have in order to receive financial assistance. An ideal proposal has reliable data and predictions that demonstrate to investors your competency and ability to profit, which will ultimately enable them to recover their investment costs. If you want to maximize the likelihood of your project’s success, you should hold off on putting together a proposal. Take the time to gather all of the required material, and make certain that your proposal is written in accordance with widely acknowledged standards. After all, if the title isn’t interesting enough, an investor might not even bother to read it. Make great note of your proposal’s organizational structure, and include only important material that leads to a positive but realistic appraisal of the potential of your startup. Make no abstract claims, and be as specific as possible with your computations.