3+ Sample Rental Property Cash Flow

FREE Rental Property Cash Flow s to Download

3+ Sample Rental Property Cash Flow

What Is a Rental Property Cash Flow?

Benefits of Rental Property

Elements of a Rental Property

How to Make and Calculate Rental Property Cash Flow?

FAQs

What Is a Cash Flow?

What defines a Rental Property?

How to Calculate Cash flow?

What Is a Rental Property Cash Flow?

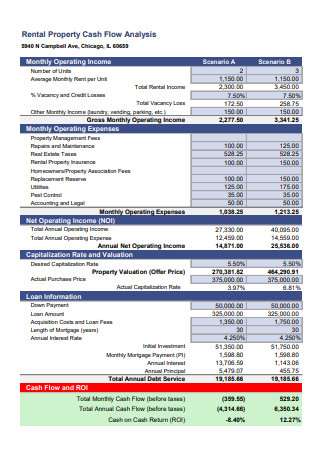

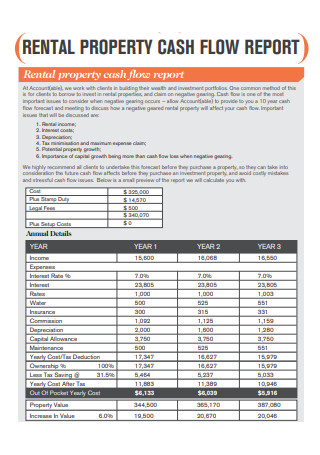

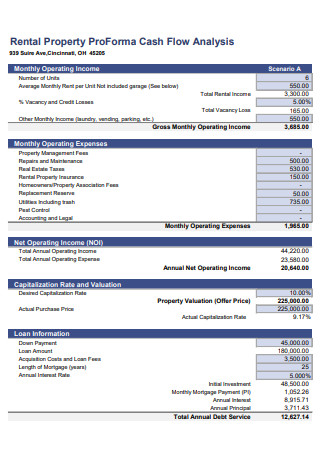

Let us define cash flow first before knowing how it will affect the rental property business. Rental property is a business that generates passive income, which means that there is less work while getting regular income. The investment you exert on your properties will make the cycle works and this is one of the primary benefits of having this business. The key to this is having a beautiful spot, great tenants, and secure property, you got this and more then you’re now ready to reap the benefits of owning a rental property. Cash flow on the other hand is like a vessel where you can monitor the flow of your income and expenses or basically the money coming in and out.

Cash flow occurs in our everyday life, from having money in our pocket to expending it on certain things. So when you merge both then you’ll know that cash flow is basically the flow of the money, only this time it has something to do with a business which is the rental property. In business knowing the flow of your money is one of the most important things, keeping the property from drying or bankruptcy. Knowing the flow of your cash is very essential in making your rental property business soar high, not only that but also it will help you value the efforts you invested in that work. This is getting interesting, right? Now take a look at some samples for more guidance and check for yourself what a rental property cash flow looks like.

Benefits of Rental Property

Rental property is one of the hottest businesses in the market right now and it is only worth knowing why. It is because of the benefits it provides not only to the owner but also to the tenants. One of the benefits is earning more with less work effort, which means that this is very fit for everyone who loves to start a business of their own. Imagine owning four or five rooms and consistently earning money from it without even working to the bone, you can sit and relax while waiting for the check to come in. Rental property may sound so risky due to security, but it can definitely carry you far, on good terms with the correct policies. Here are some benefits of having a rental property.

Passive Income – The idea of getting paid with minimal effort is what passive income is all about. This applies to everyone, whether you’re planning for retirement and wanting to secure savings, working and also wanted to have a business, or retired and still wanna earn. This is the biggest benefit of having this business, it is like investing and waiting for your money to grow larger every month. Passive income technically means getting money from not directly involving yourself in the work, it is letting your property work for you.

Security – Security is a two-way process, landlords making the environment safe enough to inhabit and tenants taking care of the property. This can work with properties having secured protocols and equipment to make sure that everyone can leave at ease. Security as a benefit can also define landowners leaving the country, but don’t wanna sell the house due to sentimental values with it, then they can feel secure knowing that there are people taking care of that property. The same goes with the tenants, whenever they settle somewhere far from home. As I said, security is a two-way process.

Management – The power to decide for the business and manage things your way is a great benefit, management not only means managing the business but it also means being able to manage your life. You’ll be more flexible knowing that you got control of the system. When you are in charge of something whether a business or not, it will always provide a self-worth feeling and that is part of management as a benefit. Running something with a sense of responsibility towards your own actions is a big deal that will boost your self-confidence. Self-confidence will lead to the success of the business.

Health friendly – Given the benefit mentioned above, it is only fitting that this is a health-friendly type of business. There might be some struggles but it is less stressful. Health isn’t just about physicality, it also includes mental health which is very necessary to work things out effectively. Our health is the most important key in life, and it is essential to prioritize it more than anything. Work or business can only be stressful in nature when they’re negatively affecting the mind of the body of the employee or owner but with rental property business, things will become less stressful due to less work. Less time, less work, fewer challenges, and more time for yourself. As they always say, prevention is better than cure.

Community Involvement – The good thing about having this business is to get yourself involved with the community. The tenants will provide different characters that will help you develop your character as well. Self-development is essential to life, this will give you more reason to attract tenants to your property. Community involvement is more on making your property profitable by letting them acknowledge how the community benefitted from it. Famous companies became known because of their stand in the community and rental property is about having tenants who trust the property.

Elements of a Rental Property

What makes a good rental property cash flow? or how to keep the cash flowing for a business like rental property? These were the questions that will hit you if you ever plan on starting this business. There is a lot to consider before starting one and having knowledge about these factors will give you a good overview of what is a rental property. You might have an idea of the business but if it lacks the component to make it successful then that idea won’t progress much. So here are important things to consider before diving into it.

How to Make and Calculate Rental Property Cash Flow?

Let us now get to the bottom of it by knowing how to make and calculate the rental property cash flow. It won’t be that easy, after knowing the things to prepare, the next part is to create a cash flow for the rental property. Starting from gathering information of your income and expenses, then to budgeting. Calculating the cash flow is a way to make a cash flow statement to have a visual of what is going on with your money. Here are some tips on how to make and calculate a rental property cash flow. You can freely check the samples as well to have a guide.

Determine the income

The best thing to do first is listing down the sources of the income, it can be from loans, investments, rent from tenants, etc. You can make a cash flow worksheet, labeling the items and the cash associated with them. The income is the cash in of the cash flow system and it comes in many forms. There are tangible and intangible incomes. Tangible means property, apartment, types of equipment, cash, or buildings. Intangible on the other hand is a non-physical, like trades that will generate income. The way of determining income can be done monthly or annually, depends on how you would like to see your cash flow.

Determine the expenses

Expenses can be in any form, they exist daily. Getting something out from your pocket and expending a penny on certain things will be considered expenses. Auditing expenses can be easy, but it requires an ability to understand what are the types of expenses. Fixed, recurring, non-recurring, and whammy expenses, are the types of expenses that evolve in a business type of expenses. You can start listing expenses from bills, trips, innovations, debt, etc. It is also important to keep the receipts or any documents related to it.

Calculate the cash flow

You can calculate the cash flow in various ways but the most effective method is by subtracting the expenses from the income. To determine correctly the income and expenses, you need to categorize them first into three activities. Cash flow from operating activities, which is the cash earned or spent on a regular basis during the operation, commonly these are the equipment, services, products, or any means on making money. Cash flow from investing activities, these are the cash earned or spent from investments to and from your company. Lastly, the cash flow from financing activities, which is the cash earned or spent over the course of financing your business or company, can be the loans, debt, or lines of credit. Separate the earned cash and the spent cash, subtract the spent cash from the earned cash, and then the remaining amount would be the gross cash flow. the gross cash flow is the savings, you can either use it to invest in your business, or budget till the next cash flow.

Make a budget

As it may not be closely related to the cash flow but making plans after assessing and evaluating your cash flow is a good option. Budget-making always works in different areas, from business to personal life. Going for a vacation, retirement plan, day-to-day basis, and more, the common thing on all of them is it requires a budget. Planning a budget is for you to keep the cash flowing, keeping the balance, and expand the money. There are a lot of benefits in doing this because it will prepare your business for what is coming.

Regularly monitor cash flow

Tracking your cash flow is essential and a basic thing for business. Regularly evaluating your finances will keep you updated on what is happening in your business because for that reason, you will have full control of your rental property. You can create a calendar, containing the results and the date it was calculated. There are various tracking applications as well, or you can just create using Microsoft Excel, label appropriately the results, associated with time and date, then you can also add remarks about the cash flow. This is very important once you do your budget as well for the following months or years.

FAQs

What Is a Cash Flow?

A cash flow is the movement of money, from income to expenses. Money that is being transported into and out of the business.

What defines a Rental Property?

Rental property is a house occupied by tenants or investors with a contract.

How to Calculate Cash flow?

The cash flow can be calculated by subtracting the expenses from the income to get the gross cash flow net.

The world is expanding and businesses too, if you are looking for a catch-up, you need to have a business that is in the market and that is a rental property. Rental property is a great business and keeping it can be tough. The way to sustain it is by making your cash flowing and expanding. That is why understanding cash flow is essential, this will help you track your money and expand for more properties.