Sample Check Writing, PDF

-

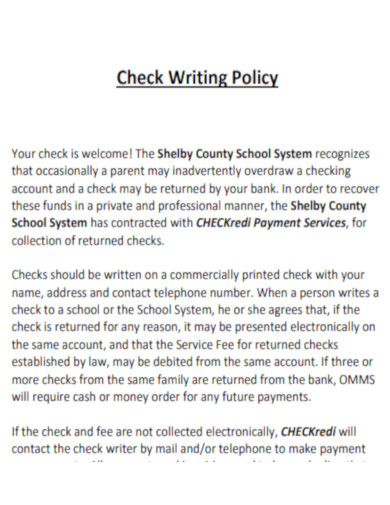

Check Writing Policy

download now -

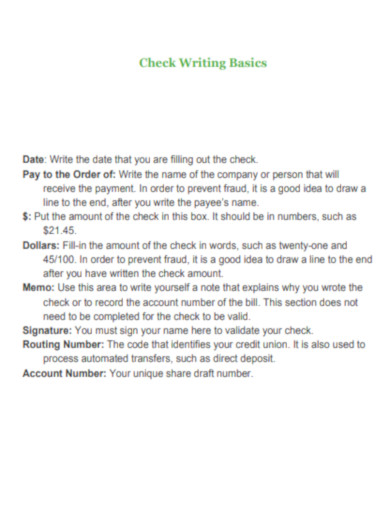

Check Writing Basics

download now -

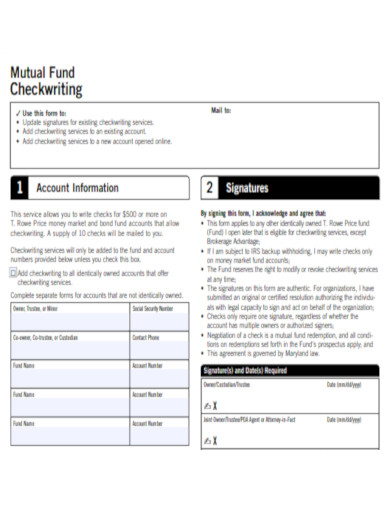

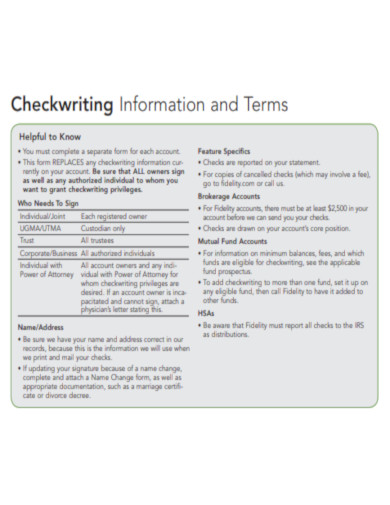

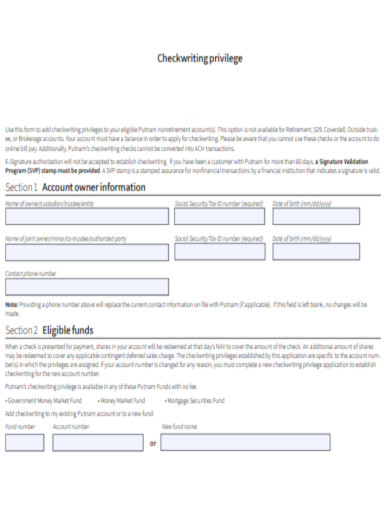

Mutual Fund Checkwriting

download now -

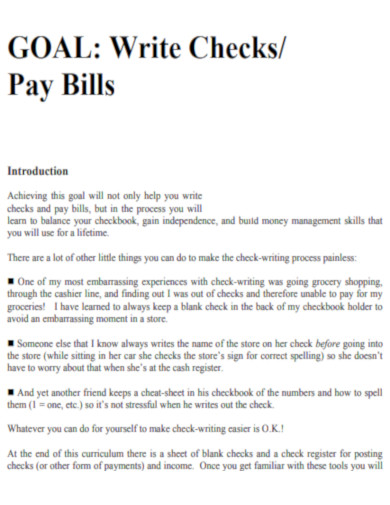

Check Writing Goal

download now -

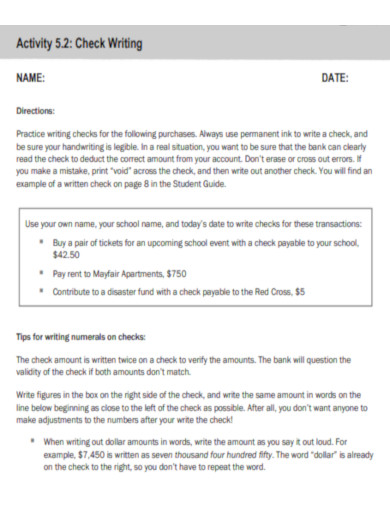

Check Writing Activity

download now -

Check Writing Information and Terms

download now -

Simple Check Writing

download now -

Check Writing Account Agreement

download now -

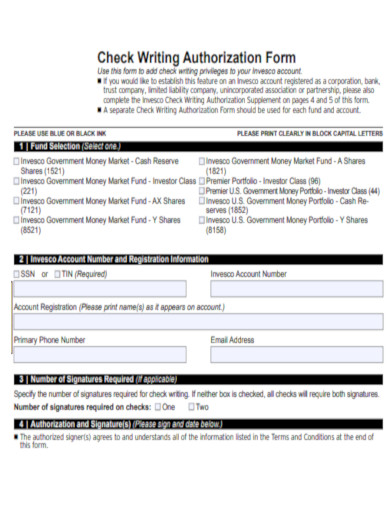

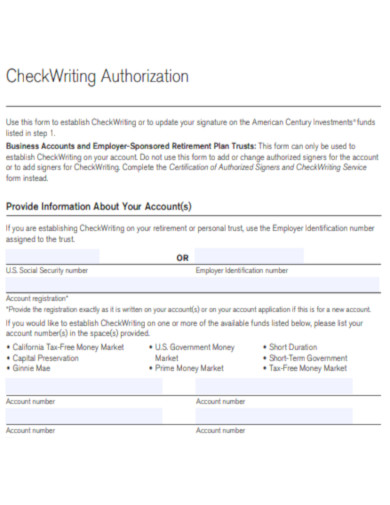

Check Writing Authorization Form

download now -

Printable Check Writing

download now -

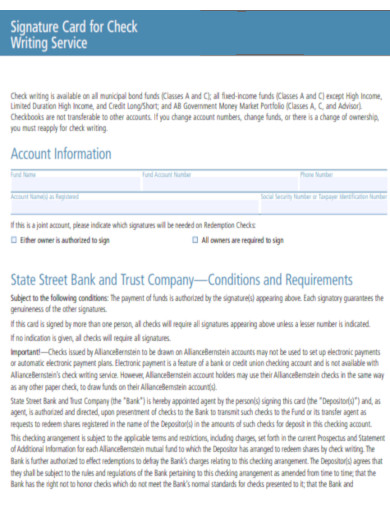

Signature Card for Check Writing Service

download now -

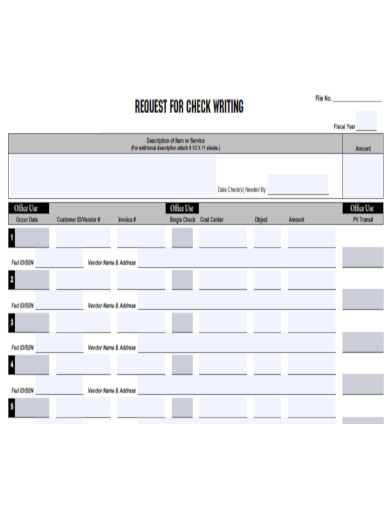

Request for Check Writing

download now -

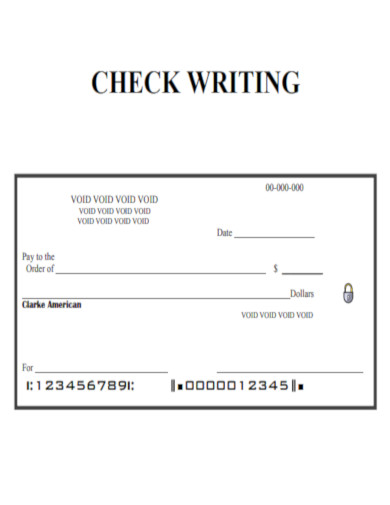

Blank Check Writing

download now -

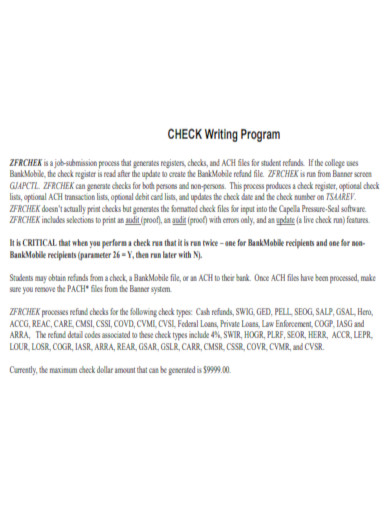

Check Writing Program

download now -

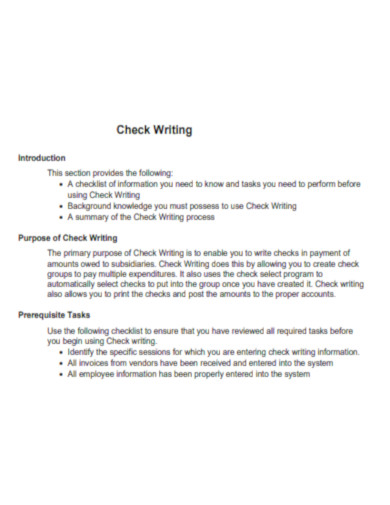

Check Writing User Guide

download now -

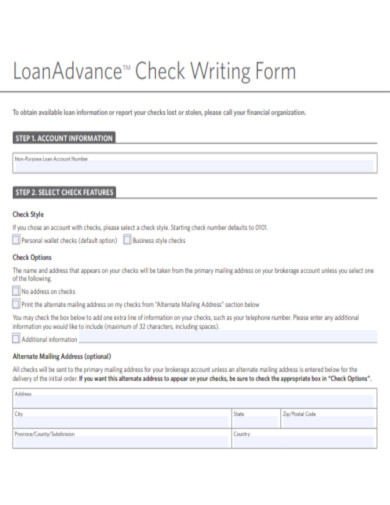

LoanAdvance Check Writing Form

download now -

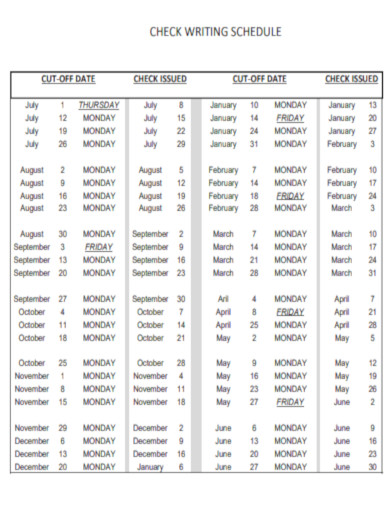

Check Writing Schedule

download now -

Professional Check Writing

download now -

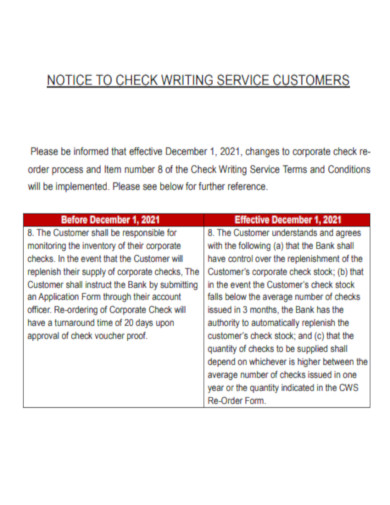

Notice Check Writing Service

download now -

Check Writing Example

download now -

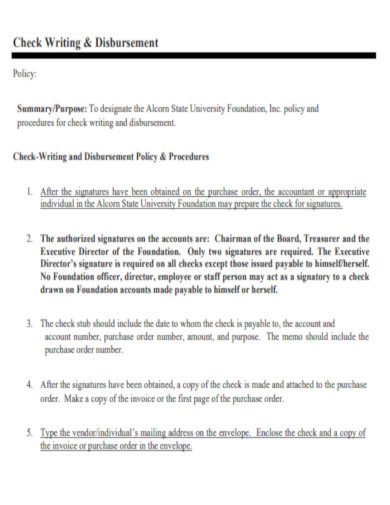

Check Writing and Disbursement

download now -

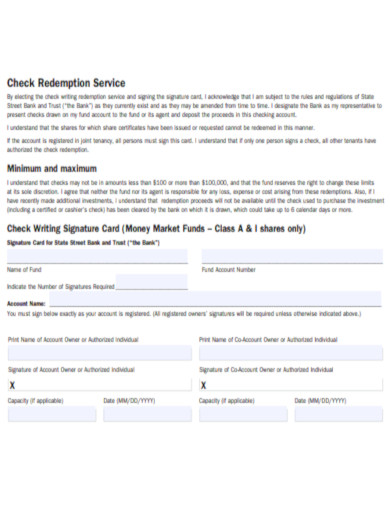

Minimum and Maximum Check Writing Signature Card

download now -

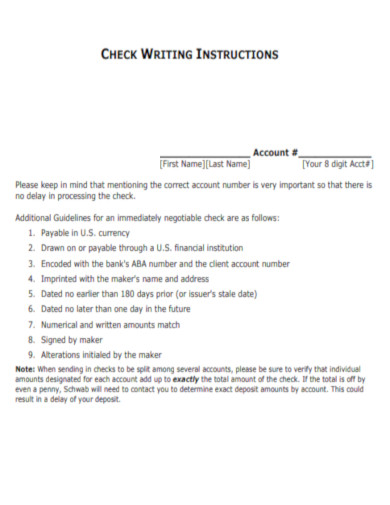

Deposit Check Writing Instruction

download now -

Check Writing Campaign

download now -

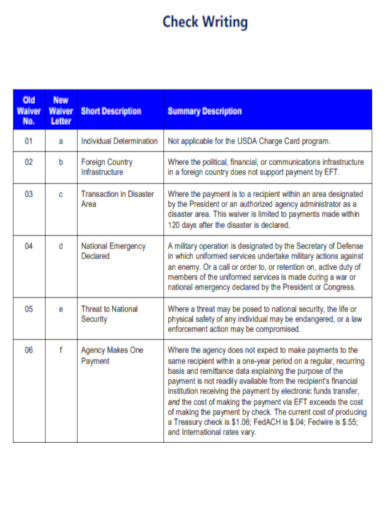

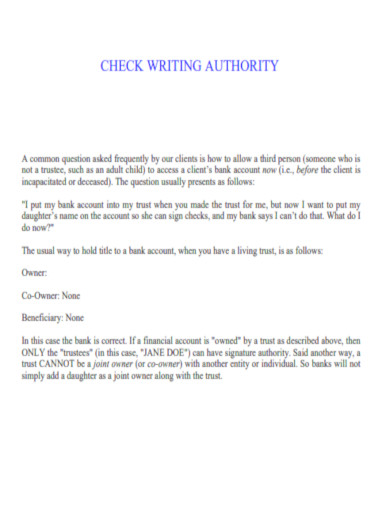

Check Writing Authority

download now -

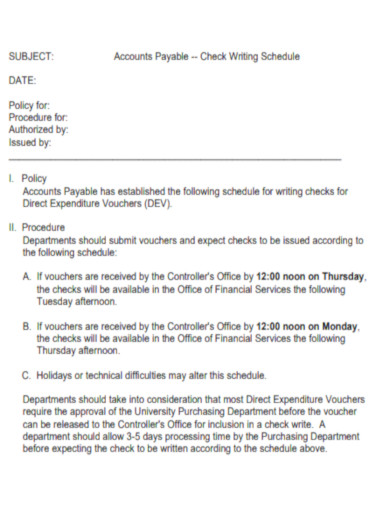

Accounts Payable Check Writing Schedule

download now -

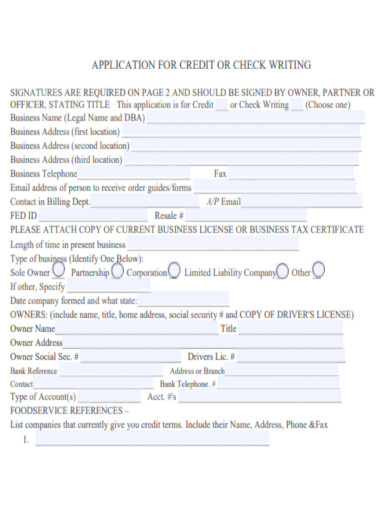

Application for Credit or Check Writing

download now -

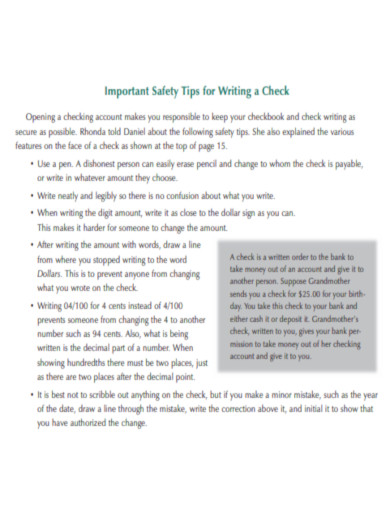

Check Writing Tips

download now -

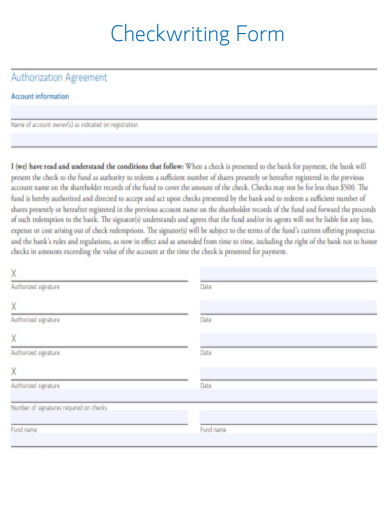

Check Writing Form

download now -

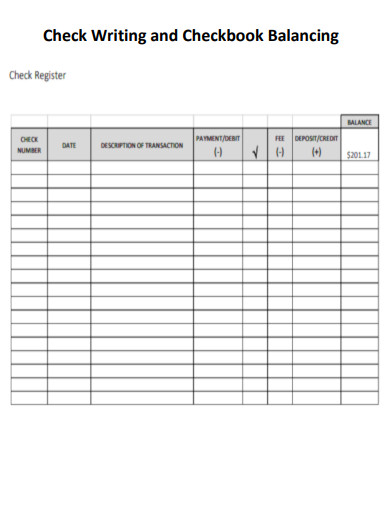

Check Writing and Checkbook Balancing

download now -

Housing Authority Check Writing and Wire Transfer Policy

download now -

Check Writing Software

download now -

Check Writing Policy Statement

download now -

Check Writing Services

download now -

Check Writing Debit Card Form

download now -

Editable Check Writing

download now -

Check Writing PDF

download now -

Check Writing Privilege Form

download now -

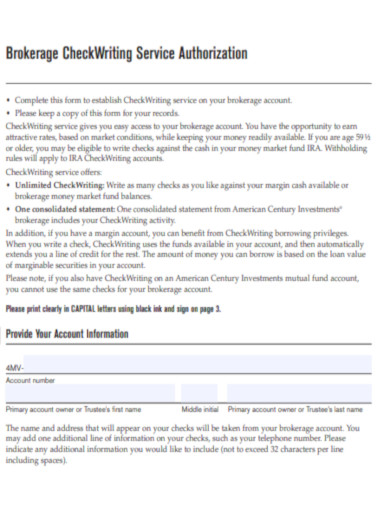

Brokerage Check Writing Service Authorization

download now -

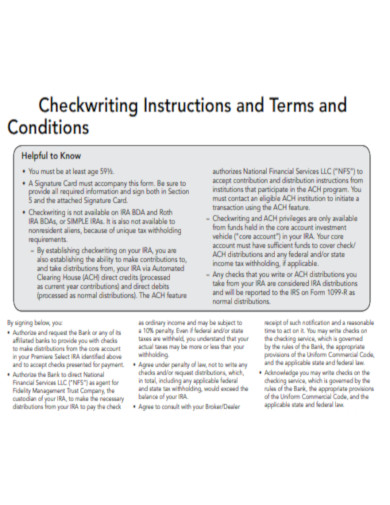

Check Writing Instructions

download now -

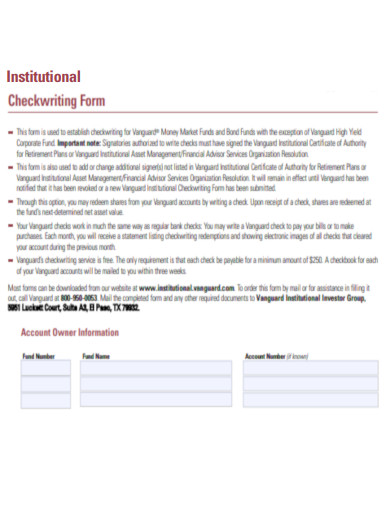

Institutional Check Writing Form

download now -

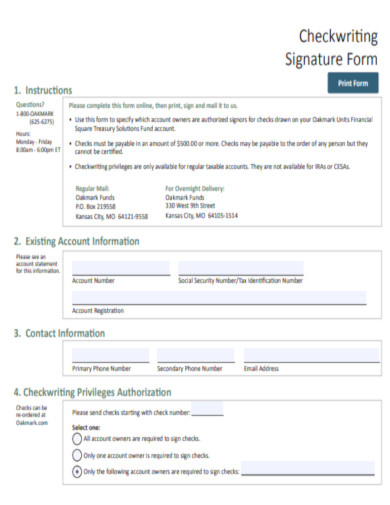

Check Writng Signature Form

download now -

Draft Signature Card for Check Writing

download now -

Check Writing Addition Form

download now -

General Check Writing

download now -

Overview On Check Writing

download now -

Check Writing System

download now -

Check Writing Signature Authority

download now -

Request to Reinstate Check Writing

download now -

Check Writing Simple Tips

download now -

Check Writing Requirements

download now -

Check Writing Point of Sale System

download now -

Proper Procedure for Writing Checks

download now

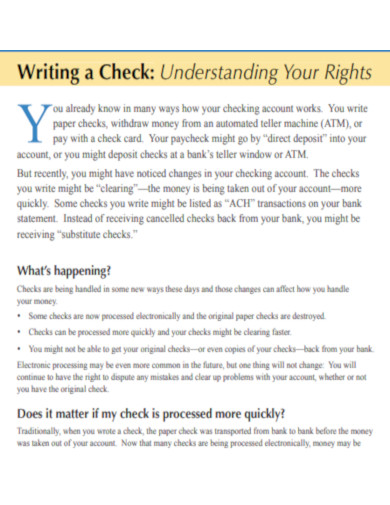

What is Check Writing?

Check writing is a process of writing checks for requests and approvals of payments such as when sending money for a bank deposit, purchasing an expensive product or service, paying taxes, and many others. A check is a written, dated, and signed business document that instructs a bank to transfer a specific sum of money from the payor’s account to the payee. This is a beneficial method to easily and quickly provide accurate, clear, and well-defined documentation that a bill was paid completely.

According to a published report, 97% of small and medium-sized business firms still depend on paper checks to create and accept payments such as using bank deposit slip templates. Although society continuously transitions to digital technology away from the pen-and-paper method, there are some advantages to check writing. Most businesses charge convenience fees for electronic payments but paying with a personal check helps you to avoid those fees. Writing checks is one of the safest ways to send money and show proof of payment.

Types of Checks

Choose from different types of checks when you make payments like paying rent or purchasing a house. For example, consider using a cashier check sample PDF if you need to issue a cashier’s check. Understand what these various types of checks offer so that you know which check is suitable for your needs or current situation.

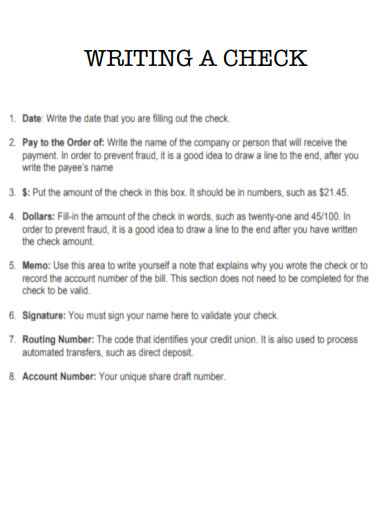

Parts of a Check

Are you confused about the proper format for check writing? This section helps you to learn and understand the different parts of a check so that you can easily and quickly complete, receive, and deposit paper checks.

How to Fill Out a Check

Before you fill out a check, you need to make sure that you have a sufficient amount of money to cover the purchase and think about alternative payment methods including debit card payments or electronic transfers. Also, use a sample check PDF to make things easy and quick. Here are the basic steps on how to fill out or write a check properly.

Step 1: Write the Date and Payee Line

Indicate the current date near the top right-hand corner of the check. Use today’s date to help you and the receiver keep clear documentation. Then, go to the line that says “Pay to the order of” as you accurately write the name of the person or organization you are paying.

Step 2: Specify the Amount in Numeric Form and in Words

In the dollar box or the small box on the right-hand side of the check, write the amount of your payment using numerical figures. Write as far over to the left as possible. After that, write out the amount using words. This will help you prevent confusion and fraud. If that amount in words is different from the numeric form that you specified in the previous step, the bank will follow the amount you wrote with words. Use all capital letters when writing the amount in words because it is more difficult to alter.

Step 3: Insert your Signature

On the line in the bottom-right corner of the check, sign the check legibly. Use the same full name and signature on file at your bank so that your check will be validated.

Step 4: Add a Note on the Memo Line

If you want to add a note, write a reminder on the memo line. This is an optional step. Simply write the reason why you filled up the check. For example, write an account number for utility payments or indicate your Social Security Number when you pay the IRS.

FAQs

Insufficient funds, unreadable or invalid account and routing numbers, inappropriate formatting, a missing or invalid signature, or too much time elapsing since the printed date are some of the common reasons that make a check invalid.

The different types of checks are cashier’s checks or business checks, certified checks, personal checks, payroll checks or payroll statements, out-of-state checks, traveler’s checks, and electronic checks or eChecks.

A good check must be written and properly signed, issued only to a specific bank, and have a clear, specified amount in both words and numerical figures.

What makes a check invalid?

What are the different types of checks?

What are the qualities of a good check?

Understand the importance of check writing, different types of checks, parts of a check, and the steps on how to fill out or write a check. Check writing helps you effectively order new checks, ensure check orders come out correctly, set up direct deposit instructions, and verify that any checks you got are filled out in an organized manner. After completing your checks, make a record of the payment using a check register so that you can track your spending and know where your money goes. Sample.net provides a diverse template collection of PDF documents for accounting, check writing, and business such as an accounting business proposal in PDF, an accounting agreement in PDF, an accounting checklist in PDF, etc.