19+ Sample Stock Certificates

-

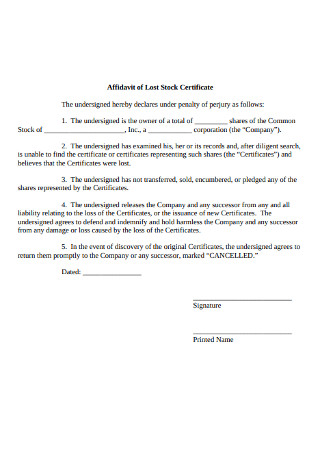

Affidavit of Lost Stock Certificate

download now -

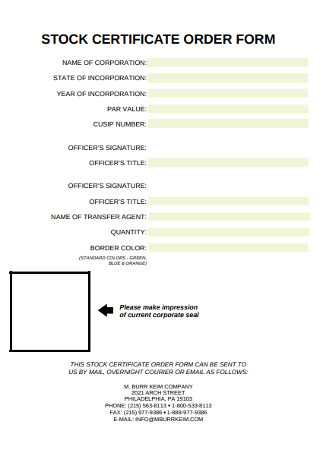

Stock Certificate Order Form

download now -

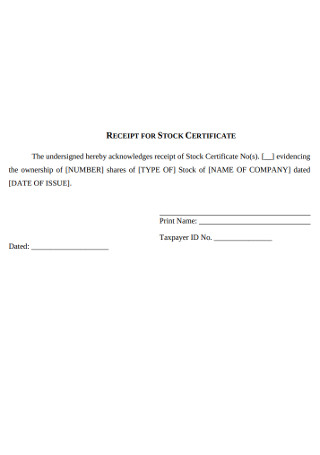

Receipt for Stock Certificate Template

download now -

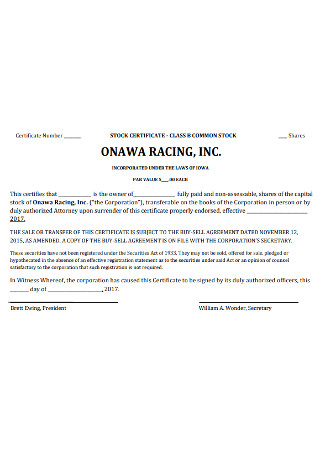

Company Stock Certificate Template

download now -

Sample Stock Certificate Template

download now -

Stock Market Certificate

download now -

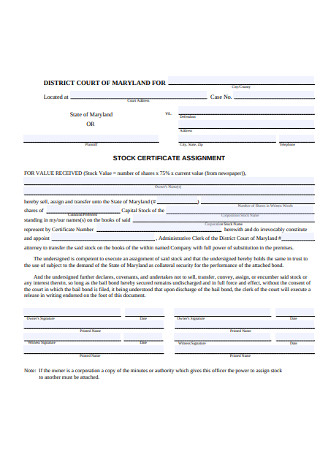

Stock Certificate Assignment Template

download now -

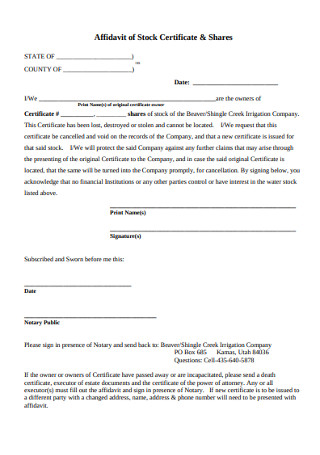

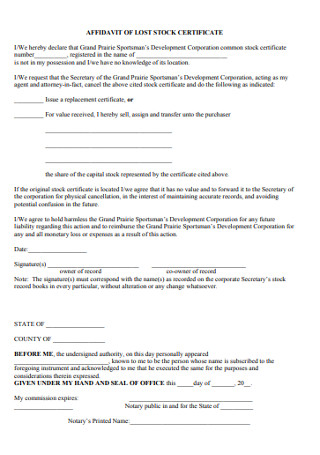

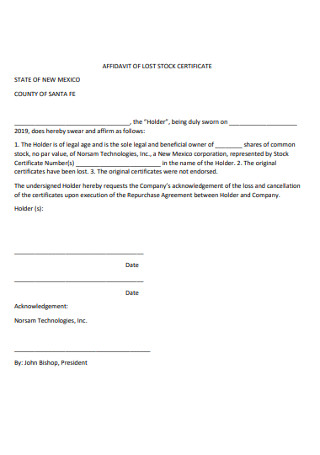

Sample Affidavit Lost Stock of Certificate

download now -

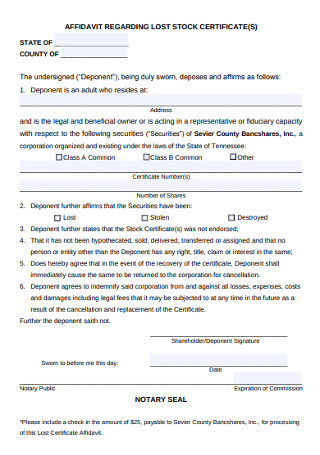

Affidavit Regarding Stock Certificate

download now -

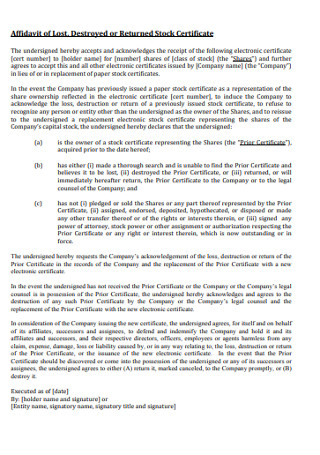

Returned Stock Certificate

download now -

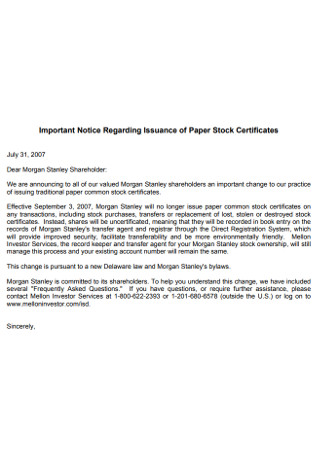

Notice Regarding Issuance of Paper Stock Certificates

download now -

Formal Stock Certificates

download now -

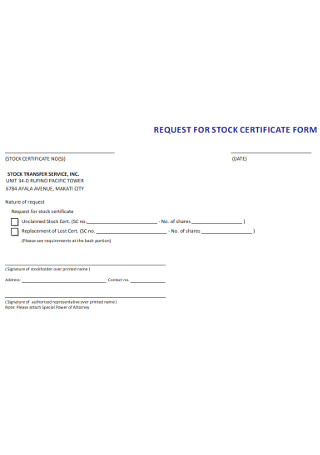

Request for Stock Certificate Form

download now -

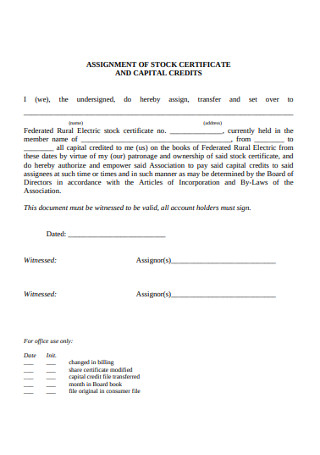

Capital Credits and Stock Certificates

download now -

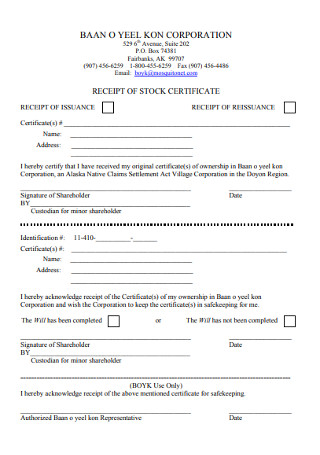

Corporation Receipt Stock of Certification

download now -

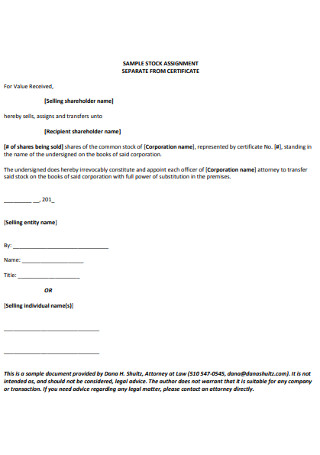

Company Stock Assignment Certificate

download now -

Simple Stock Certificate Template

download now -

Stock Certificate Dematerialization Template

download now -

Agreement for Stock Certificates

download now -

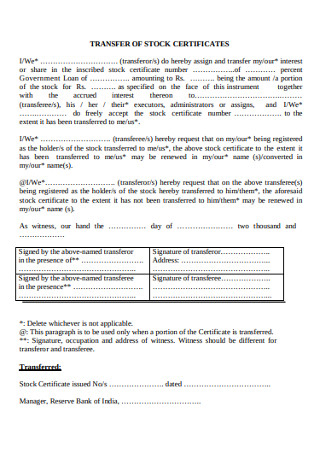

Transfer of Stock Certificates

download now

What Is a Stock Certificate?

First things first, what is a stock? Stock or also referred to as equity, is a representation of the ownership of an investor in a particular corporation. This will guarantee the investor a percentage in the asset or profit of the corporation. Measurement of stock is called shares.

A stock certificate or also known as share certificate is an official document that certifies the number of shares that a particular individual has over a certain corporation. In other words, this is a proof of stock ownership. The different key elements that are included in the certificate of stock are:

- The name of the corporation

One of the most important element to include in the certificate of stock is the title or the name of the corporation or the company. - The date it was incorporated

This section will state the date the corporation was publicized - The name of the investor

The full name of the person investing or buying the stock is also a must to include. This will include the suffix as well if there are any. - The date the stock was issued

This will include the exact date that the stock was purchased by the investor. - The numerical value of shares the investor purchased

This will determine and state how much stock was bought by the investor.

Other supporting elements that will help recognize the certificate of stock as a legitimate document are:

- The seal of authentication

For every corporation, there is a different seal. This seal is unique and only used by that particular corporation. This will verify that the certificate is recognized and legal. - The signature of the representative

Every corporation will have their representative to affix their signature on the certificate. This is usually a printed signature in order to save time. - The registered number of the certificate

Every certificate will have a number. This is done in order to easily identify and evaluate the legitimacy of a certificate. This is also done in order for easy tracking and keeping of records.

A certificate of stock may be issued as a physical piece of paper. However, now that we are past the printing age and we are at the moment in the digital age, certificate of stocks are more common in the form of an electric document. This is also done due to the fact that physical pieces of document are often misplaced and lost. Another reason is that physical documents are easier and faster to duplicate and counterfeit. It is considered safer to have an electronic certificate.

Two Main Types of Stock

Common Stock

From the word itself, this is the most well-known kind of stock. This is the type of stock that most people are familiar with. This will represent fragmentary ownership in a corporation. This is a type where a stockholder will have the power to vote on the next board of directors.

A common stock may be considered as a double-edged sword. This has the highest rate of returns Common stockholders will have claim to variable dividends. However, the risk is also great. In the event that the business is terminated, common shareholders will only have the right to claim assets after the preferred shareholders and other key personnel are paid. Meaning they will be last in line to harvest any asset.

Preferred Stock

On the other hand, a preferred stock is one where a stockholder will represent ownership in a corporation but he or she usually does not have any rights to vote for the next board of directors. The main difference between a preferred stock and a common stock is that in this type of stock, the stockholder will be entitled to a fixed sum of money or dividend. Another difference is that in the event that a company is out of business the preferred shareholders are paid before the common shareholders.

Step by Step Process in Creating a Stock Certificate

Step 1: Select a Template

A stock certificate is a legal and formal document. It is a must to create the certificate of stock with clarity and with organization. A template is a good way to help you do this. Make use of the templates that are available above in order to create a clear and organized certificate.

Step 2: Gather the Key Elements

First thing to do after browsing and choosing a template that is appropriate for you is to gather the necessary pieces of information. These are the details that people will usually look for when evaluating the certificate. It is a must to have a separate document before actually creating the certificate. Go over the investment agreement and point out the key elements that are needed to be included in the certificate. In this step it is a must to determine the type of stock, whether it is a common stock or preferred stock.

Step 3: Gather the Supporting Elements

After identifying the essential pieces of information that is needed in order to create the certificate, it is now time to know and go over the supporting elements. In this step, it is a must to go over the past documents or the log book in order to identify the correct share number or the certificate number.

Certificate number is usually done successively. This means that the number that will be given to the certificate actually corresponds to the numerical order that the investor has bought the share. An example is if the certificate has a registered share number of 0078, that means that you are the 78th investor to purchase a stock in that corporation.

Next thing to know is if the stock has a par value. The definition of par value is the face value of the stock. This means that in the long run the par value will determine the maturity value as well as the dollar value of the stock. An example of these values are those you usually see in advertisements saying that the value is 0.1 dollars per share. In general, the growth of the value of the share is parallel to the growth of the company. This means that the value per share will increase as the company grows. This is also known as the nominal value. In some cases, corporations will not issue a par value. In the event that this is the case, the certificate must indicate that there is no par value.

Next crucial detail to identify is the restrictions about the transfer of stock. This will determine the restrictions about selling the share or transferring the share into another individual. Usually, in the agreement with the shareholder, the corporation and the shareholder will already be aware of this as this is a key element of the contract. However, it is still a must to state it in the certificate of stock to make sure that the shareholder will comply with any legal and state law.

After identifying the transfer restriction, it is a must to have a section for transfer. This section will be left blank and will only be filled up upon the event of transferring the share. This section will include a statement that the shareholder will transfer it to the new recipient. It is also a must to indicate the specific number of shares being transferred. In case that there are multiple owners of the share, it is crucial to identify how much share a certain shareowner will transfer.

Next thing to include is the restrictive legend. This is a statement indicating that the shareholder fully knows and understands the restrictions about selling, sharing and transferring the stocks. This will also state that the shareholder agrees with the terms and conditions and that he or she will comply with the contract and the legal law. In analogy with a contract, this is the conclusion.

Step 4: Input the Necessary Details

Now that you have all the essential pieces of information, thoroughly evaluate and input what is asked in the certificate of stock template. In line with providing the crucial details, it is a must to proofread the document. The pieces of information provided in the stock certificate should be in line with the details included in the investment contract.

Step 5: Signature

After confirming that every detail is accurate and true, it is a must for the representative of the corporation to affix their signature. This will be proof that the document is legal. It is also a must that the seal of the corporation is included in the certificate of stock.

FAQs

Can Stocks Expire?

A share of the stock of the corporation does not have any expiration date. It can last for decades and it will still have value. However, there are certain circumstances that a stock will lose its significance. In cases where a company is bought by another company, a stock will likely lose its value. Also, one of the most common situations that a stock loses its value is when the corporation experiences bankruptcy. If this happen, it is best to go over the contract again or make use of a contract amendment.

What is Joint Ownership in Stock?

Joint ownership means that there is more than one person owning the stock. There are 3 main types of joint ownership.

Tenancy in common

This type of joint ownership means that there are two or more people sharing the ownership over a property. In this type, it is not necessary that the share is divided equally. Also, a tenancy in common does not have the right of survivorship. This means that in the event that one of the owners dies, the ownership is then transferred to his or her beneficiary. The different terms and conditions must be stated within the property management agreement.

Joint tenancy

On the other hand, joint tenancy is the complete opposite of tenancy in common. This means that joint tenancy has the right of survivorship, in the event that one of the owners dies, the ownership is then automatically transferred to the remaining owner. Also, in joint tenancy there are equal rights and share over the property.

Community property

A community property is also referred to as marital property. From the word itself, this type is applicable for those married couples. This means that every property or asset bought during the marriage is considered part of the community property and the property or asset both belong to both the husband and wife.

A stock certificate is a piece of document that will verify the number of shares that an investor has purchased in a corporation. This will be the proof of their ownership.

However, certificates of stock are not mandatory. It is not the obligation of a corporation to issue and provide a certificate for all its stockholders. These are not mandatory as they can cause delay in the process of purchasing a stock. Nevertheless, if the investor wishes for it, the corporation is obligated to manufacture a certificate. It is still better to be prepared as most investors will request a certificate in order to validate their shares.