22+ Sample Warranty Deed

-

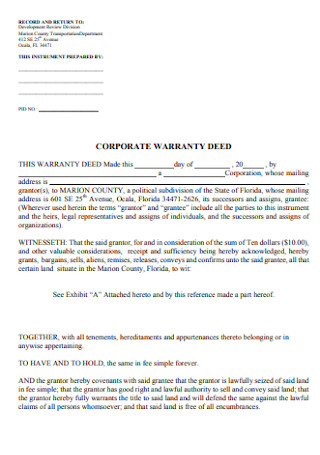

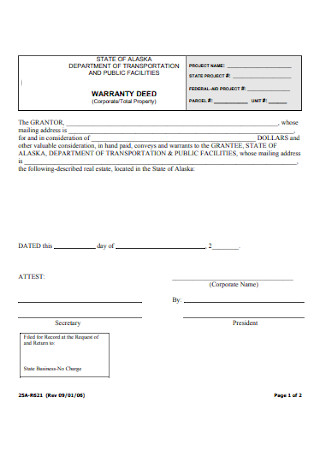

Corporate Warranty Deed

download now -

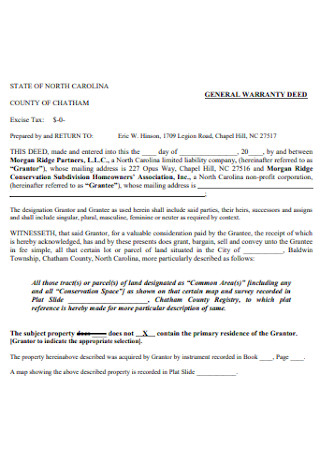

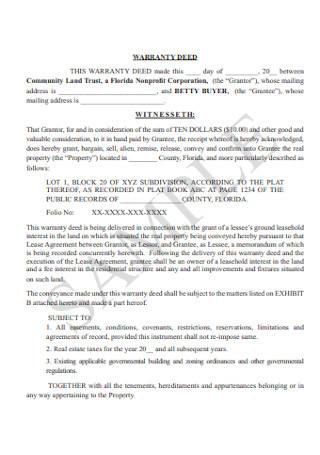

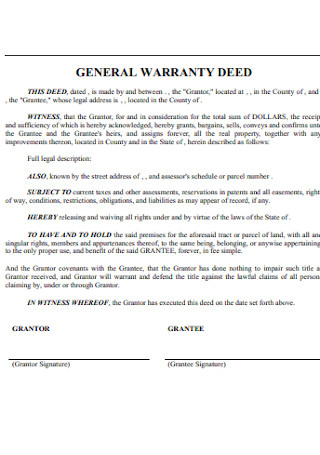

General Warranty Deed

download now -

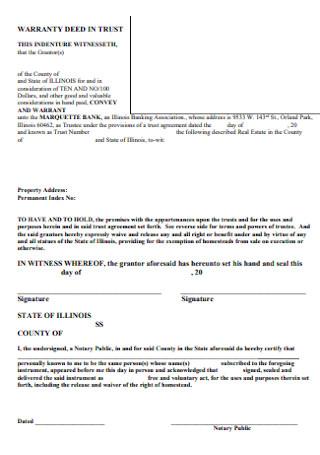

Warranty Deed in Trust

download now -

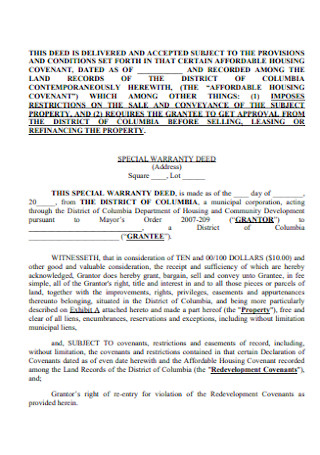

Special Warranty Deed

download now -

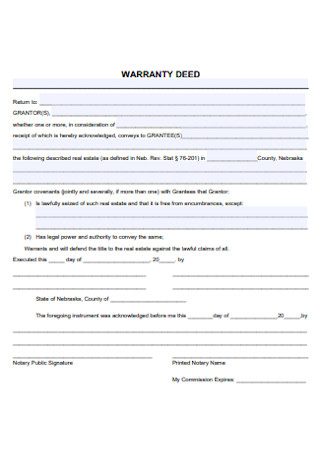

Sample Warranty Deed

download now -

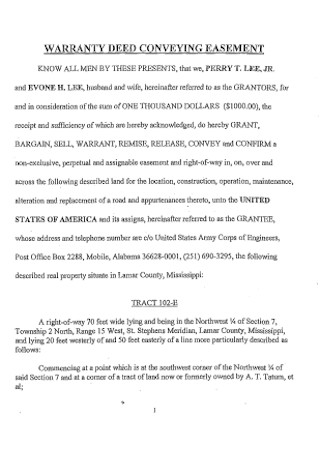

Warranty Deed Conveying Easement

download now -

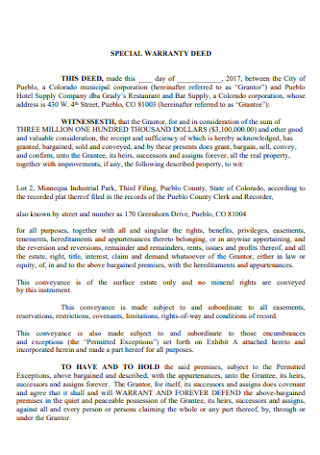

Sample Special Warranty Deed

download now -

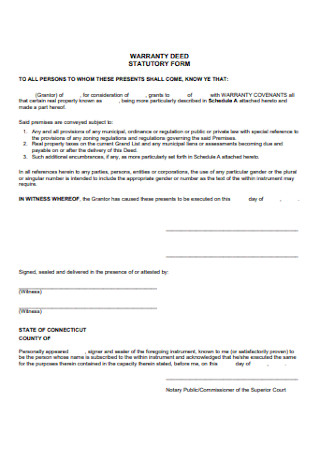

Warranty Deed Statutory Form

download now -

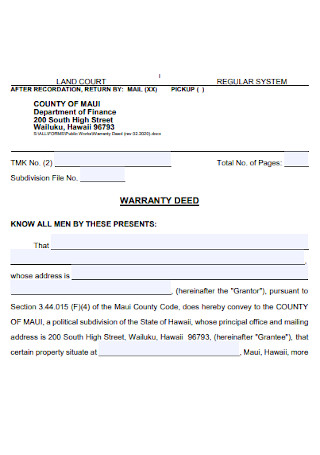

Land Warranty Deed

download now -

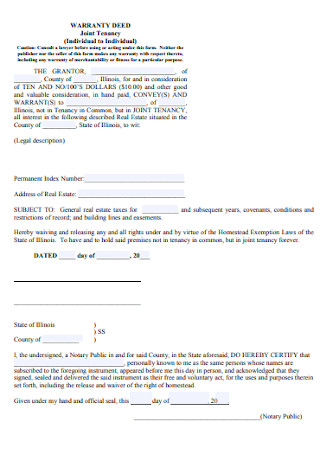

Joint Tenancy Warranty Deed

download now -

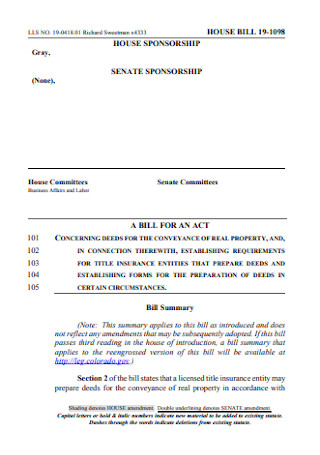

House Warranty Deed

download now -

Special Warranty Deed Template

download now -

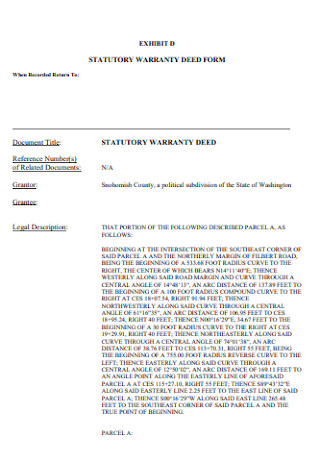

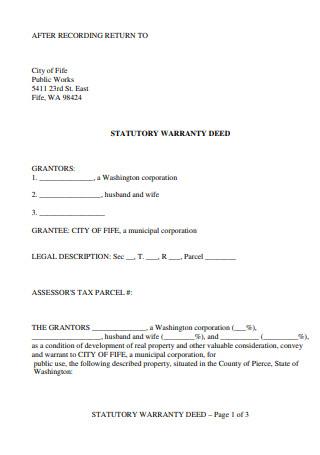

Statutory Warranty Deed Form

download now -

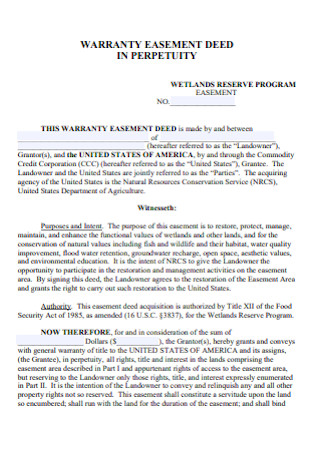

Warranty Easement Deed

download now -

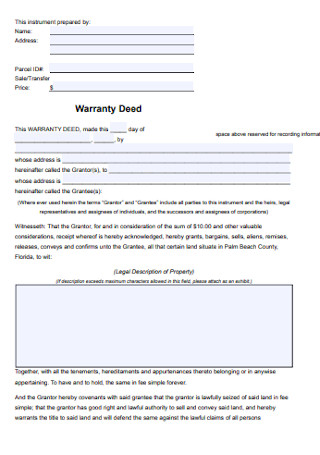

Simple Warranty Deed

download now -

Warraty Deed in Trust

download now -

Warranty Deed Format

download now -

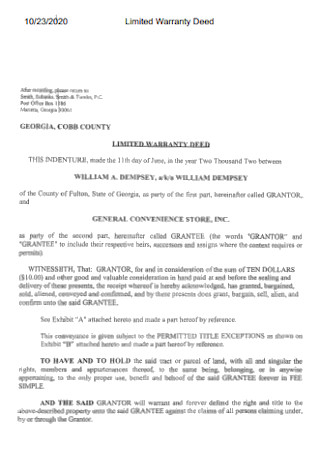

Sample Limited Warranty Deed

download now -

Basic General Warranty Deed

download now -

Corporate Warrantyh Deed

download now -

Formal Warranty Deed

download now -

Printable Warranty Deed

download now

FREE Warranty Deed s to Download

22+ Sample Warranty Deed

What is a warranty deed?

Different types of Warranty Deeds

How to make a warranty deed?

FAQs

General vs Special Warranty Deed

What is the difference between a warranty deed and a title?

What is the difference between a Deed of Trust and a Warranty Deed?

Although now is an excellent time to begin learning about deeds, if you are currently dealing with a claim against your property’s title, you should contact your title insurance provider as soon as possible so that they can handle the claim on your behalf and provide legal guidance. Here in this article, you can learn more about warranty deeds and how to make them. Check out the warranty deed samples below.

What is a warranty deed?

A deed is a legal instrument that transfers property from one entity to another, most commonly in a real estate transaction. A general warranty deed offers the buyer the most comprehensive protection. When a buyer is trying to secure a mortgage or title insurance, warranty deeds are frequently used. The date of the transaction, the names of the persons involved, a description of the property being transferred, and the buyer’s signature are all included on all deeds. Signing deeds in the presence of a witness and/or notary may be required.

A warranty deed is a form of deed that can be utilized when one person is purchasing a home from another. This deed gives the buyer a guarantee that there is clear and free title to the property that the seller is selling and there are no existing mortgages, liens, or other stipulations that might delay the transfer of ownership of the property. A warranty deed is typically used when the buyer or grantee does not know much about the seller or grantor of the property being bought. When applying for a mortgage or title insurance, this is also used. A warranty deed is basically used to add more protection and to take extra precaution when buying properties by being able to bring the former owner of the property into the lawsuit if a third party files a claim against the title of the property and holds you harmless.

Different types of Warranty Deeds

The numerous forms of real estate documents all fulfill distinct roles and provide varying levels of protection while transferring land or property. Knowing the difference between deeds will help you figure out what amount of protection is required for your property purchase. For your reference, the warranty deed grantor is the seller of property while the warranty deed grantee is the buyer. Below are the types of deeds.

How to make a warranty deed?

There are several types of warranty deeds in every state and each of these differ in terms of the varying protection they give to the grantee. Here are the steps in making a warranty deed but you can also download and fill out warranty deed blank form above.

Step 1: Choose a sample warranty deed.

Choose from the many samples of warranty deeds above. If none of them satisfies you, you can make your own by scanning through them and familiarizing the format and key parts.

Step 2: Encode the important parts.

Start by orderly typing in the key parts of a warranty deed and leave them blank first. These are names of the Grantor and Grantee and their basic information, mailing addresses of the Grantor and Grantee, joint tenancy stating the ownership by two or more persons of a property together and the portion of each one transferring on the death to the other, or of others, consideration or the amount of money to be paid for the property, parcel number, witnesses who watch the owners sign the deed, legal description that helps identify which piece of property is to be transferred and notary.

Step 3: Include applicable additional parts.

In addition to the key parts from step 2, you can also include these terms if these apply to your property: The easement stating the grantor may reserve the right to use (or some of) the land or property, life estate meaning the Grantor may, in the case that he wishes to remain the legal owner of the property until his death for tax purposes, reserve a life estate interest in the property. and mineral rights stating any residual property interest in the subsurface oil, gas, or other mineral rights may be reserved by the Grantor. .

Step 3: Fill out the necessary information.

Check the formatting and compare it to the samples above. Fill out the blank spaces that are applicable to you. Supply the requested information and provide the signatures. Make sure all the information that you provide is correct to protect yourself and to make the deed valid and useful when difficult issues arise.

Step 4: Have this notarized.

The last part of this legal document should be kept for the public notary who would make the form a notary. It is only by giving details such as location, signature parties and date that he or she may fill this space. Once delivered by the notary, these materials shall be supplied with the appropriate credentials for this document and the required notarization seal.

FAQs

General vs Special Warranty Deed

The Special Warranty Act only covers the period for which the seller held the property whereas warranties in a Warranty Deed cover the whole history of the property. While the seller shall defend the title against every other debt and compensate the buyer for unresolved debts or damages, the seller is solely liable for the debts or difficulties caused during possession of the property in the Special Warranty Deed.

What is the difference between a warranty deed and a title?

Title insurance and warranty deed assist to strengthen property transactions, give some security to parties that legal ownership exchanges take place and that the participants are entitled to enter into a contract. Title insurance provides financial protection, while legal protection is provided by warranty deed.

What is the difference between a Deed of Trust and a Warranty Deed?

A Warranty Deed simply ensures that a property’s title is clear of any encumbrances owned by others at the time of sale. A Deed of Trust preserves neutrality between a borrower and a lender by involving a third person, termed a trustee, in the transaction (usually a separate legal entity like a title company). In a Deed of Trust transaction, a lender lends money to a borrower in order for the borrower to purchase a property. A Deed of Trust, on the other hand, gives a neutral trustee legal title to the property until the borrower pays off the loan in full.

Consider getting a warranty deed if you want to take extra precautions and provide your property more protection. When you don’t know the person you’re buying the property from, or if you need financing for a mortgage or title insurance, a warranty deed is the best option. If you want to understand more about warranty deeds and your property protection alternatives, talk to a mortgage professional.. This article highlights the important role of a deed in transferring a property from one entity to another. The two subtypes of warranty deed provide varying levels of protection, only you have to choose which one you need. A number of vital elements must be contained within the warranty deed in order for it to be legally operative. However ,since deeds are important documents that affect ownership interests and rights, it’s always a good idea to consult a qualified real estate attorney.