8+ Sample Payroll Processing Checklist

-

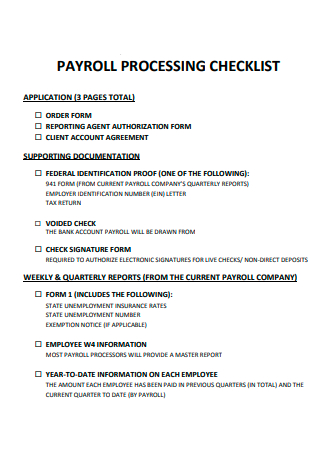

Payroll Processing Checklist Template

download now -

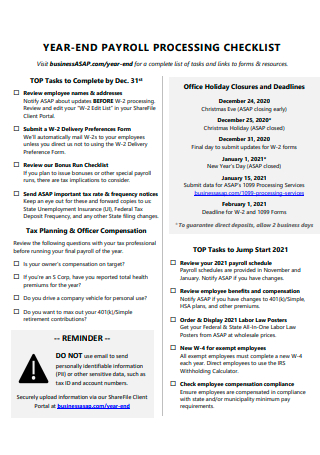

Year-End Payroll Processing Checklist

download now -

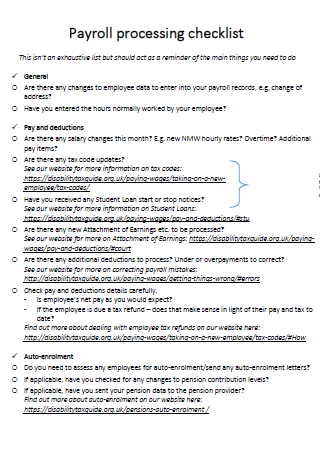

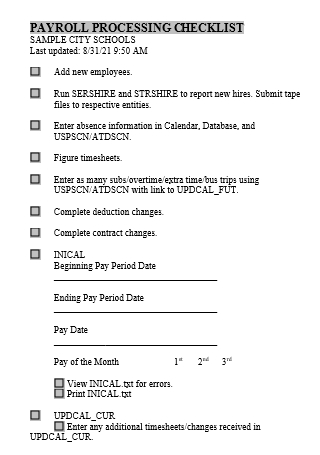

Printable Payroll Processing Checklist

download now -

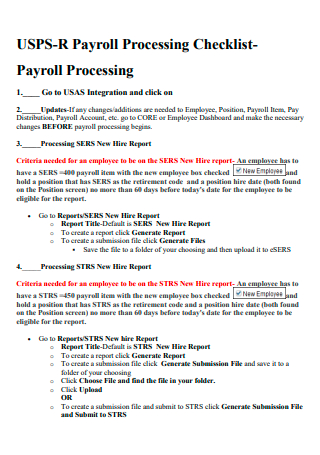

Human Resources Payroll Processing Checklist

download now -

Payroll Processing Checklist Example

download now -

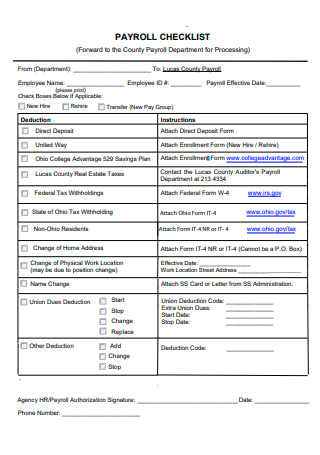

Payroll Department For Processing Checklist

download now -

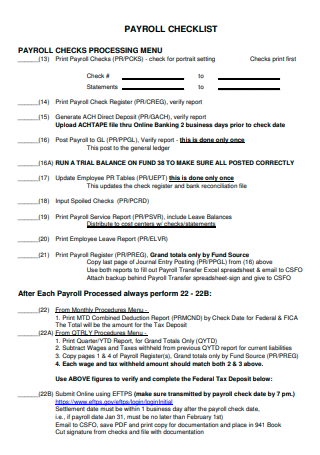

Standard Payroll Processing Checklist

download now -

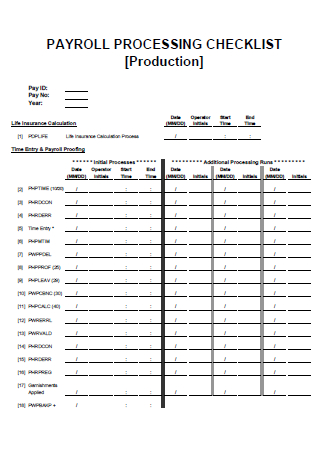

Production Payroll Processing Checklist

download now -

Payroll Processing Checklist in DOC

download now

FREE Payroll Processing Checklist s to Download

8+ Sample Payroll Processing Checklist

a Payroll Processing Checklist?

Benefits of a Payroll Checklist

Types of Payroll Systems

How To Utilize a Payroll Checklist

FAQs

How long does it take to complete payroll?

What time is payroll deposited?

What is a payroll fee?

What Is a Payroll Processing Checklist?

Payroll processing is a detailed process that requires various tasks to ensure that paychecks are processed accurately, and payroll tax and benefits compliance is met. Anyone tasked with processing payroll understands it’s a thankless job, and if they miss one critical detail, the process is harmed, and paycheck distribution is delayed. On the other hand, having a checklist helps staff stay on track and ensures no task is overlooked. Despite identifying these duties, Paychex discovered that 39% of organizations still conduct payroll manually — 23% using a desktop solution and 22% with an internet solution — and only 17% would consider outsourcing. While the checklist will vary depending on the company’s payroll system, this article will walk you through the typical payroll process. To learn more, read the article below.

Benefits of a Payroll Checklist

Payroll is an exciting process to be on the receiving end of. It is something that we expect employers to do correctly as one of their contractual obligations. However, payroll is more than issuing paycheck slips every two weeks. It’s a difficult task that can be stressful and overwhelming for those tasked with completing it. Any errors in the system can harm the organization’s performance and satisfaction levels. As a result, your payroll staff is under tremendous pressure to produce accurate results at the end of each pay period.

Types of Payroll Systems

As an entrepreneur, there are numerous factors to consider when running a firm. It takes a lot to keep your firm running well, from tracking business concepts and activities to satisfying your employees. One element that significantly impacts your employees’ happiness is how well you manage their payroll. Apart from keeping a primary record of the salaries paid to employees, each business must have a comprehensive system to ensure a well-managed payroll. To assist you in learning more about it, here are some of the most popular types of payroll systems as identified by specialists.

Internally Managed Payroll Systems

Internally managed payroll systems are a viable option for businesses with less than 100 employees. With few workers, payroll records can be more easily maintained and governed without substantial problems. Payroll management is something you may perform on your own or outsource to a professional. The minimum need is knowledge of payroll administration and familiarity with the different rules and taxes that apply.

Professionally Managed Payroll Systems

When discussing professionally managed payroll systems, bookkeepers and certified public accountants (CPAs) come into play. If you believe you lack the expertise necessary to manage your business’s payroll, you can outsource it to a bookkeeper or CPA. Additionally, you could contact an expert from a reputable accounting firm. Bear in mind, however, that these professionals will only assist you in managing your payroll records and will not execute the transaction, bank deposit, or deduction process.

Software Managed Payroll Systems

Although software-managed payroll systems are not frequently used, they are slowly gaining popularity. Numerous software programs and online portals are now available to help you manage your payroll without going through the complex calculation process. Please enter the information, and these digital platforms will capture and retain it. When it comes to managing your payroll efficiently, you have several alternatives. If you have an essential awareness of payroll administration, you may handle it manually or with software assistance. However, having a professional providing payroll services with industry expertise work on your payroll is always recommended as it significantly reduces the likelihood of anomalies.

Payroll Services Managed by Payroll System Agencies

Hiring a payroll services business is another option to ensure the correctness of your payroll system. These companies take care of your company’s real payroll needs, including monthly salary receipts, deposits, and deductions. These payroll service providers frequently guarantee complete accuracy and avoid late payments.

Bookkeepers and CPAs

Payroll can be outsourced to a bookkeeper or a certified public accountant; however, these professionals often calculate payroll and maintain tax records and may not offer bank interface services such as direct deposit or 401(k) deductions. Ascertain that the bookkeeper or CPA is knowledgeable about all of the services you require and has the flexibility to adapt last-minute modifications to avoid processing errors. Even if you outsource payroll processing, you are ultimately responsible for the accuracy of federal tax deposits and payments; if there are concerns, the Internal Revenue Service will contact you rather than the payroll service.

Online Payroll

Online payroll providers enable you to handle and monitor payroll details 24 hours a day, seven days a week, using a secure Web browser, with no additional software test or equipment required. You can enter and amend payroll, as well as track employee vacation and sick leave from the convenience of your PC or laptop. Numerous online payroll providers offer payroll tax filing and payment in addition to essential payroll services, freeing you up to concentrate on other elements of your business. If your provider offers email updates, you can subscribe to receive payroll status and additional pertinent account information for quick review.

In-House

In-house payroll processing is a possible alternative if your staff is small, often less than ten employees, and consistent weekly work hours. If your requirements are precise, an on-site professional can supervise the process and immediately answer questions and resolve issues swiftly. Payroll employees must be current and aware of staff changes and payroll tax rules to ensure fair pay, tax withholding, and filing. Additionally, by handling payroll in-house, you reduce security risks associated with financial reports.

How To Utilize a Payroll Checklist

Every company is aware of the difficulties inherent in creating a healthy work environment—which often include keeping employees happy and satisfied. You can provide your employees with all the facilities and equipment necessary to complete a task. Still, if you fail to compensate them for their efforts, you can expect their dissatisfaction to impair their performance. With the variety of payroll templates accessible, a payroll checklist is one of the few tools you can use to its full potential. Therefore, before you begin processing payroll, here are a few points to keep in mind to help streamline your system.

Step 1: Adjust Employee Records

Determine whether any changes to an employee’s current record are necessary. For example, employees promoted or transferred to a new role may receive additional benefits or a pay range that differs from their former job status. Remember to avoid ignoring any wage increases that employees anticipate seeing on their payslips. Additionally, newly hired and departed employees may have a unique set of papers for you to complete. One example would be an unused vacation or sick leave that your company’s policies can pay out. Regular updates, even for minor changes to your employment information, are critical.

Step 2: Examine timesheets for inconsistencies.

Every business should have a pay period for all employees, full-time, part-time, and independent. If you pay employees hourly or daily, you must also evaluate what constitutes overtime to be informed of their rights. Additionally, employees are responsible for time cards or timesheets to guarantee adequate compensation after each pay period. That means that this paperwork must be accurate, approved, and submitted on time; otherwise, compensating an employee will be extremely difficult.

Step 3: Check Additional Payments

Payroll is about more than an individual’s hours worked. When checking an employee’s sales records, you’ll discover that awarding them additional compensation for bonuses and commissions is all part of the job. This data is unique, as not every employee is entitled to a few extra dollars in their income based on their performance scores. Bear in mind that this typically depends on the nature of their work and the perks they are eligible for under your company’s benefits system.

Step 4: Paychecks should be issued.

You can never be assured when it comes to your payroll information, no matter how many times you review it. After all, you don’t want to send out paychecks riddled with errors because it would imply more revisions and complaints for you to deal with. Once you’ve double-checked everything, you’ll be able to start sending payroll checks or processing direct transfers in time for the salary release. You can also create payslips that break down specific accounts so that your employees have a physical record to refer to. Depending on your organization’s route, you can have it printed or emailed to each employee individually.

Step 5: Calculate and Deduct Taxes

Once the total has been calculated, it’s time to add taxes and payroll deductions to one’s salary. Examine this data for inconsistencies to see whether you need to clarify a few points before going to the next phase. This is particularly critical when taxing employees who live in another state or nation.

Step 6: Take a Photocopy of Your Payroll Records

Your entire team will rely on the data you’ve gathered to carry out their operations. These personnel, ranging from branch managers to department heads, may use the information included in your payroll records to make critical decisions for their respective teams. You must keep in mind that payroll is, understandably, the most significant budget item for most businesses, which is why they must be transparent, accurate, and simple to follow to give vital data for your company’s operations. Maintaining a copy of these records is also necessary for tax payments, financial document processing, and budgeting at the end of each year.

FAQs

How long does it take to complete payroll?

Payroll processing typically takes 1-2 days to complete. Once the paycheck is submitted to deposit accounts, it usually takes 2-3 days for the wages to be deposited successfully. Employees may receive their salaries on time or late, depending on the firm.

What time is payroll deposited?

The majority of employers ensure that employees’ paychecks are deposited into their accounts at midnight on the day before their pay date. Employees have already got their paychecks on the payday.

What is a payroll fee?

These expenditures include salary for employees and the employer’s share of any payroll taxes. Employer-paid taxes include FICA and government unemployment insurance programs. Commissions, bonuses, and paid leave are also included in payroll expenditures.

Payroll accuracy and compliance are just as critical to you as they are to your employees. Numerous firms are unaware of the ramifications of lousy payroll management, most notably how it affects employee engagement with the company. However, by following a checklist, you can reliably process payment using a payment form to meet the requirements of the state, industry, and the company’s employees. It’s a prudent strategy to expedite and accurately complete your pay run, avoiding costly errors that could cast a negative light on you with present and prospective employees, not to mention the authorities. It is critical for users not to overlook any essential components of the payroll checklist to avoid drastic changes affecting their operations. Therefore, whether you choose to automate your payroll system or continue with manual processing, utilizing a payroll checklist provides many benefits that can help keep your team on schedule.