7+ SAMPLE Property Appraisal Checklist

-

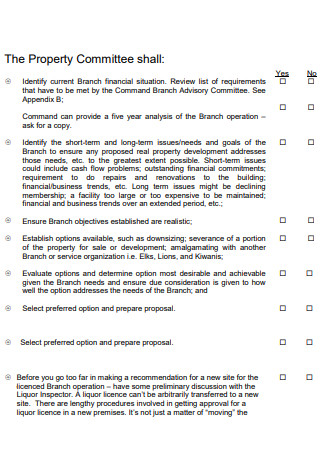

Property Appraisal Process Checklist

download now -

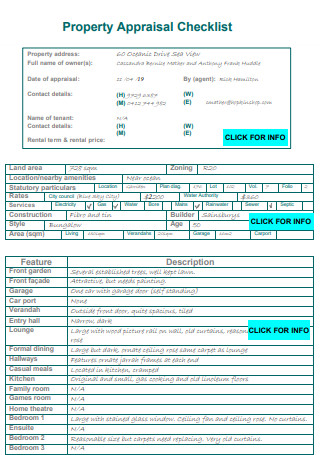

Property Appraisal Checklist

download now -

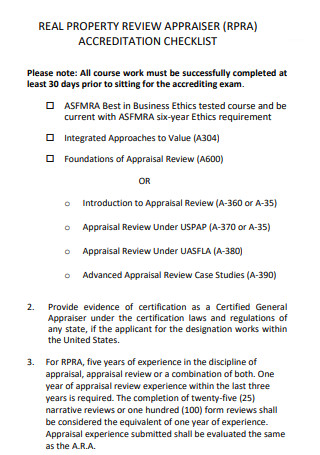

Real Property Appraisal Accredation Checklist

download now -

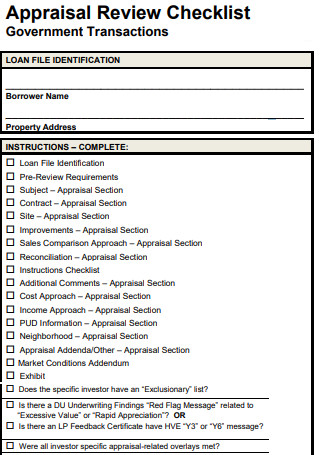

Government Property Appraisal Review Checklist

download now -

Preparation Checklist for Property Appraisal

download now -

Property Appraisal Trainee Checklist

download now -

Property Appraisal Report Checklist

download now -

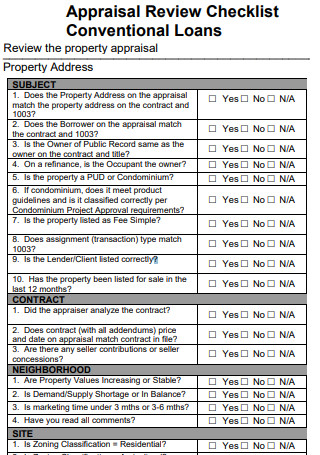

Property Appraisal Review Checklist

download now

FREE Property Appraisal Checklist s to Download

7+ SAMPLE Property Appraisal Checklist

What is a Property Appraisal Checklist?

Tips on Property Appraisal Checklist

How to Undergo a Property Appraisal

FAQs

Is a property appraisal checklist important?

What are the benefits of a property appraisal checklist?

What are things that you have to consider in creating a property appraisal checklist?

What is a Property Appraisal Checklist?

A property appraisal checklist is a list of things that you have to check before your house can undergo an appraisal. A checklist is needed so that you can fix your house to have a better appraisal that can help you in selling your house for a bigger price. Before the appraiser can go to your place, you have to fix everything or your house can have a low value. This will not be good for you if you want to sell your house and you want to sell it for a good price. By fixing all the parts of your house, the appraiser can have a better appraisal of the value of your house. Thus, if there will somebody who will want to purchase your house, you can get a good price as payment.

The appraiser will conduct an inspection throughout your house to assess the actual value of your property. He or she will examine the interior and the exterior of your house. A home appraisal checklist for sellers is the best so that you can do something to increase the value of your home. By fixing some parts of the house, your house can have a bigger value. So the checklist is a list of upgrades for appraisal. You have to polish the interior and exterior of the house to the extent that it will look new. By doing this effort, your home can have a higher value that can enable you to earn a lot of money.

To help you to get a better appraisal for your house, you may want to have a property appraisal checklist form that can guide you. You can have it by searching for a template on the internet. You can also get a home inspection form. By having this, you will know what to fix in your house. You will know how you can make the appraisal value higher. Even if you are having a property appraisal because you want to refinance your house, you may need a checklist that can help you. A home appraisal checklist for refinancing will do you good. You will know how you can arrange your house to get the highest possible value.

What do home appraisers look for when they are doing a property appraisal? Do you want to know how to check the appraisal value or how to check the appraisal value at home? Well, the checklist can help you that you will know what to do. You will know how you can fix your home so that it can have great value. The checklist will show you how to start so that your house will have the best value. You just have to repair a few things in your house and you can get what you need. You can sell your house at the highest possible price. You can be sure that appraisers will have a good assessment of your property.

Tips on Property Appraisal Checklist

There are a lot of factors you need to consider when appraising your property. And, believe it or not, it’s no easy task. So, should you wish to turn to a property appraisal checklist to lighten your work, then we can provide you with some tips you may apply. The following includes:

How to Undergo a Property Appraisal

Now that you have a better idea of what a property appraisal is, it’s time for you to know how to undergo a property appraisal. We offer you some valuable information to guide you through the way. And, if you need a property appraisal checklist template, we have tons of ready-made templates in this post.

Step 1: Know the Role of an Appraiser

The role of a property appraiser is to give an opinion regarding the value of the property. This way, the lender will know the value of the property and the buyer will know how they can lend from the lender. The lender will have protection if he or she will have an understanding of the role of the appraiser. He or she will know what to do in case the buyer defaults on the mortgage or when he or she will have to foreclose the property. The appraiser is the 3rd party expert that assures that if ever the bank will lend to the buyer, there is an actual value that can be collateral for the debt. The actual value of the property is completely assessed, including its bathroom and bedrooms. You should also know that the appraisers need to be licensed to do the appraisal. That way, they can provide the service to certified lenders. Many lenders give loans throughout the country. They need an appraiser’s help to know the property’s conditions. The appraisers serve as an eye and ear to the lender. They can appraise what will be important for the lender to do business. To have the right assessment, the appraisers need to visit the property. That way, they can assess the internal and external aspects of a property. During the visit, they will evaluate the upgraded features of the property and its location. They will compare the property with other properties within the area. Lenders count on appraisers to ensure that the property meets the minimum requirement for lending. The appraisal will be the last part when the lender will lend to a buyer.

Step 2: Have Flexibility in Scheduling

You can have 30 days between the appraisal and the report. To secure the time, you can have appointments according to your geographic location. Appraisers know that the owners of the house are busy. The seller may just be available on a certain day and the appraiser should know how to be flexible in scheduling. The delay in appraisal can be a big inconvenience. So, you should know how you can have the right schedule for the appraisal. You have to know how to rearrange your schedule so that you can save time.

Step 3: Research the Value of Your House

You must not rely upon the appraisers all the time. You must do something to do your research on the actual value of your property. Search the internet for homes that can be like yours. Know the price according to the size of the property and the features of the house. Know how you can price your house. By doing this, you will know the actual price of your house and no one will deceive you. There will be no chance that your house will be underpriced. You have to fight for your rights. It is your right to know the actual value of your property. So, you have to research to know everything. This way, you will know if the appraisal is right and just.

Step 4: Make a Home Fact Sheet

For your home to have a better value, you must make upgrades that can add to the price. As you do upgrades, you must keep a home fact sheet that will detail everything that you have done to your home. This document can be helpful by the time the appraiser will appraise your house. You can show it to the appraiser to let him or her know about the upgrades that you have done to your home. They can add value to your house. The appraiser can use the document to make the evaluation easier. The appraiser will know that you have spent something so this must add value to your property.

Step 5: Make Minor Repairs

Maybe the appraisal is about the actual value of your house and not about the repairs that you have done to it. But you should remember that you should do repairs to have a better value for your property. You can repair the exterior and interior of your house. Repair what is broken in the kitchen, bathroom, bedroom, and any other room in the house. You do not have to make a renovation. Just repair the little things so that everything will be fixed and perfect. You may want to repair the chipping tile, peeling paint, rotting wood, or broken pipe. Do the minor repairs that can make your house polished. Do this before the appraiser will visit your house. If you will do this after the visit of the appraiser, he or she might have to visit again. So, do this before the appraiser will have an appraisal of your property.

Step 6: Make Everything Accessible

Be sure that everything will be accessible for the appraiser when he or she visits. So, you have to arrange everything so that the appraisal will be easier. If there are grown bushes in your yard that can hinder the appraisal, you must cut them so that nothing can serve as an obstacle to the appraisal. You need to clean your house, your basement, and your attic because even these need to be examined by the appraiser. Be sure that the appraiser will have easy access to everything. In doing so, the appraisal will be easy and the appraiser will have convenience in assessing the value of your property.

Step 7: Tidy Your Home for the Photo Shoot

Pictures will be taken on your property. So, after cleaning your house, you also need to tidy everything. Your home must look perfect in pictures. This will help buyers will get interested in your property. If you want, you can have to practice this. Before the appraiser comes, you can take photos of your house. See if they will look great. Good pictures can also add up to the cost of your property. They may add a little cost because they look great.

Step 8: Make Necessary Documents Available

You may never know when your house will be bought. To be sure of everything, you must prepare all your documents. Even the appraiser may need them to check if you have all the required documents. So, prepare your documents for everyone to see. They will be proof that you own your house. If there will come an immediate buyer, you will not experience any delay in selling your property. You can have everything arranged at the soonest possible time.

FAQs

Is a property appraisal checklist important?

Yes, it is important. You need to be reminded of the things that you need to fix in your house before the appraisal will happen. Through the checklist, you can arrange everything.

What are the benefits of a property appraisal checklist?

The benefits of a property appraisal checklist are getting a higher value for your property and ensuring that you can sell a good property to the buyer.

What are things that you have to consider in creating a property appraisal checklist?

The things that you have to consider are the size of the property, exterior condition, interior condition, and home improvements and renovation.

If you want to sell your house for a great value, you must ensure that you can repolish your home. You need a property appraisal checklist that can tell you everything you need to do. After fixing everything, your home can have a better value that can help you with what you need. Well, do you need a template for a property appraisal checklist? This post has a 7+ SAMPLE Property Appraisal Checklist in PDF. You can make a great checklist with the help of these templates. Download now!