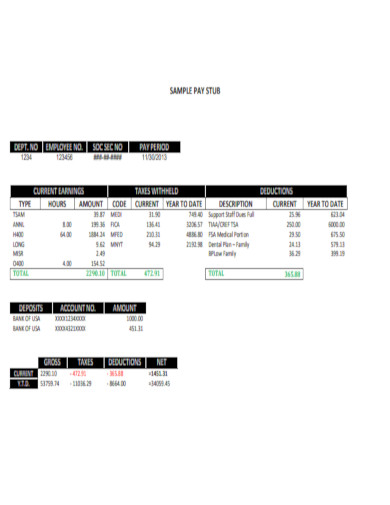

Sample Pay Stub, PDF

-

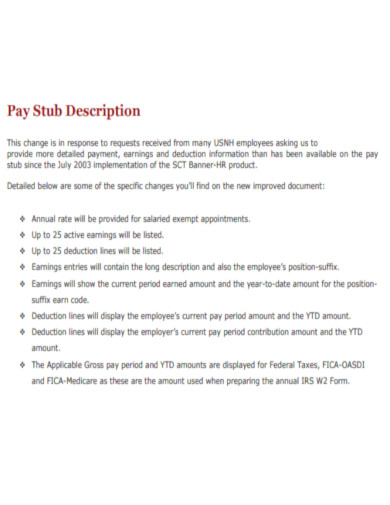

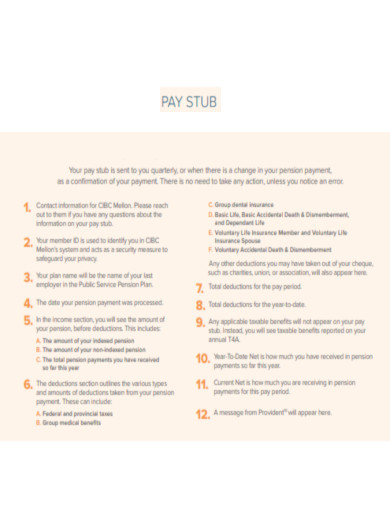

Pay Stub Description

download now -

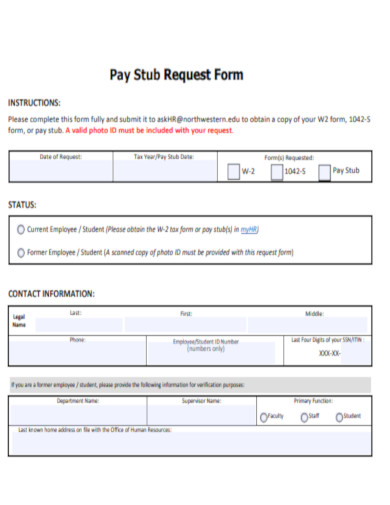

Pay Stub Request Form

download now -

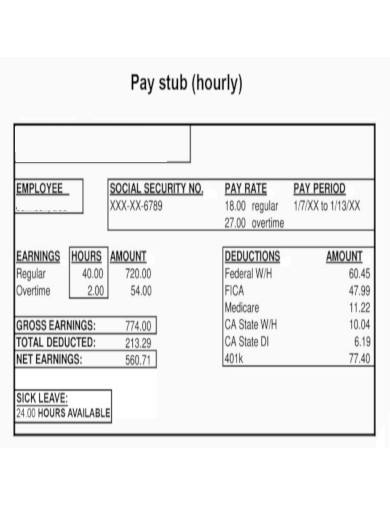

Pay Stub Hourly

download now -

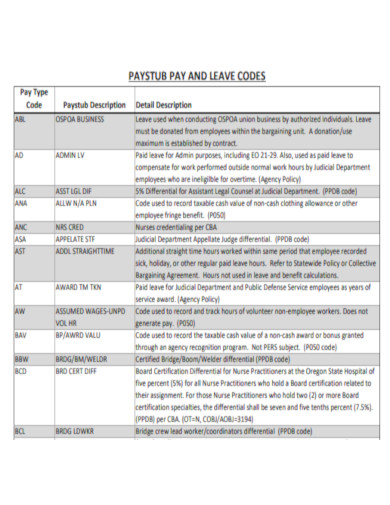

Paystub Pay and Leave Codes

download now -

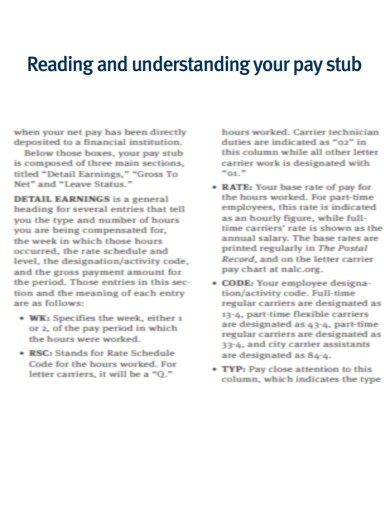

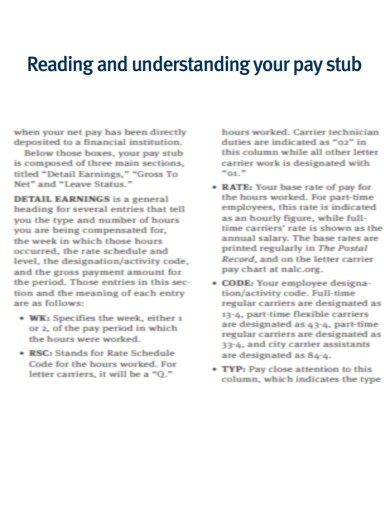

Reading and Understanding Your Pay Stub

download now -

Basic Pay Stub

download now -

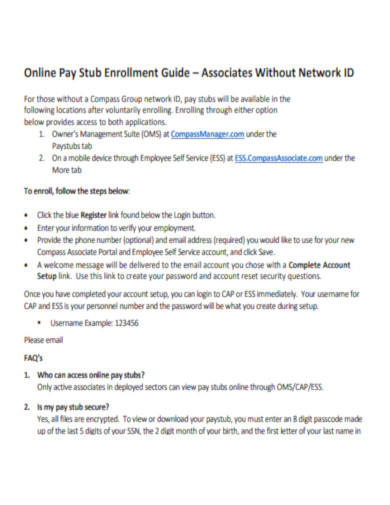

Online Pay Stub Enrollment Guide

download now -

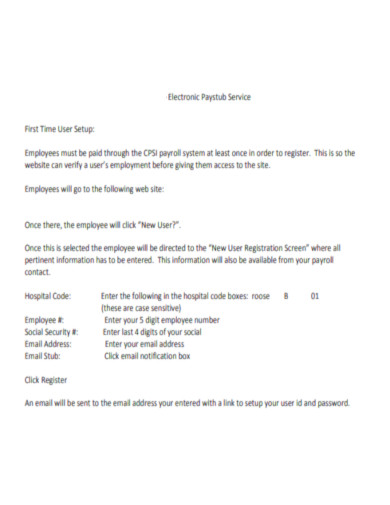

Electronic Paystub Service

download now -

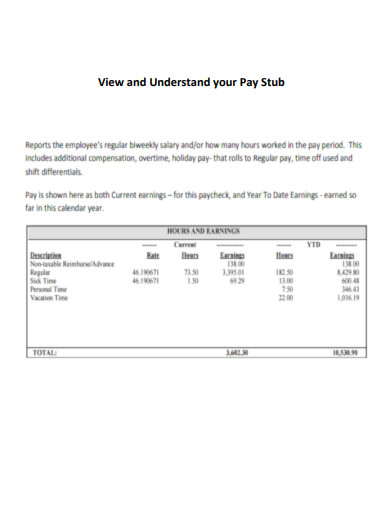

View and Understand your Pay Stub

download now -

Sample Pay Stub

download now -

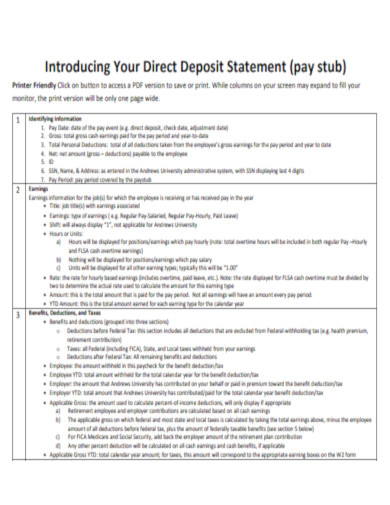

Pay Stub Direct Deposit Statement

download now -

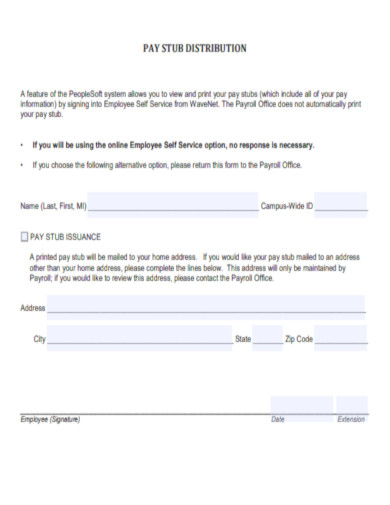

Pay Stub Distribution

download now -

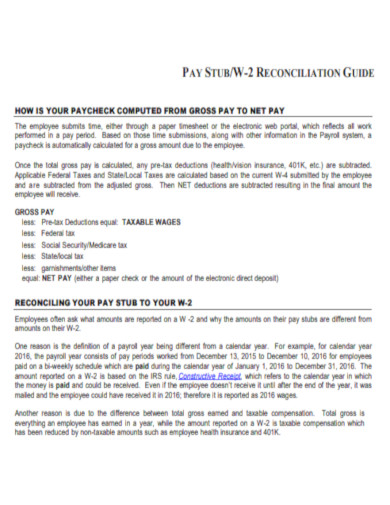

Pay Stub Reconciliation

download now -

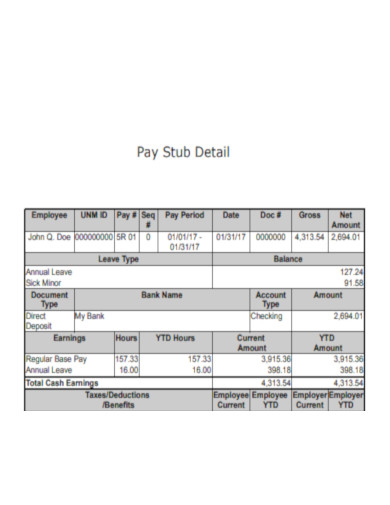

Pay Stub Detail

download now -

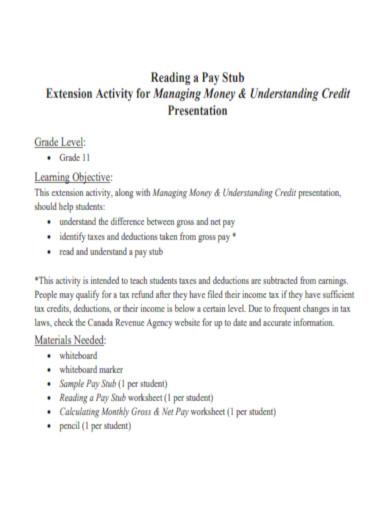

Reading a Pay Stub Extension Activity

download now -

General Pay Stub

download now -

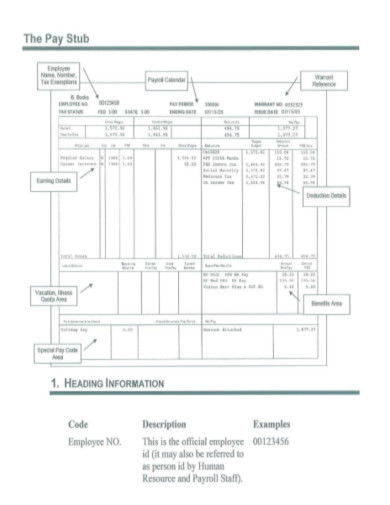

Understanding Pay Stub

download now -

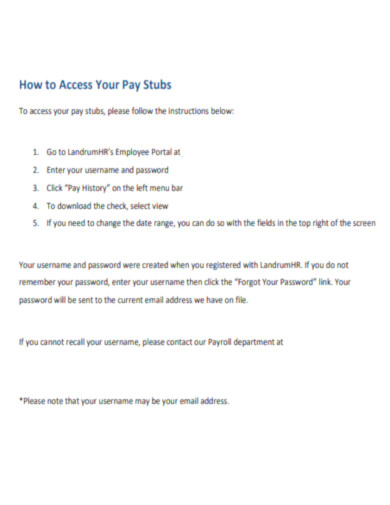

Access Your Pay Stubs

download now -

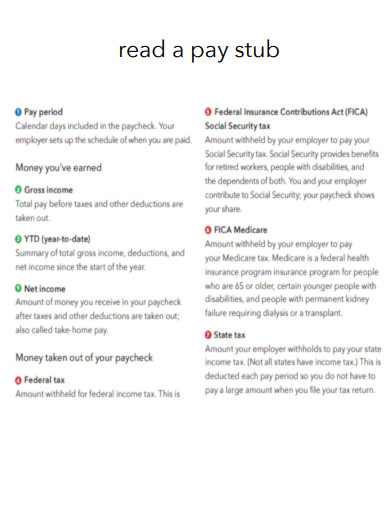

Read a Pay Stub

download now -

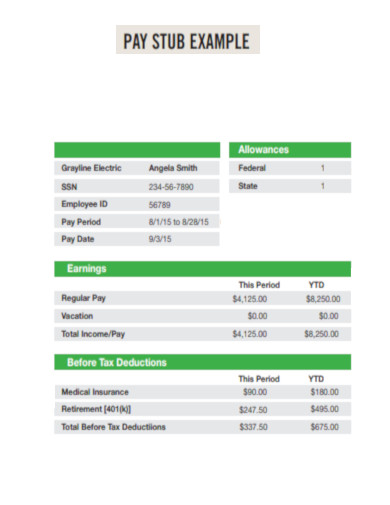

Pay Stub Example

download now -

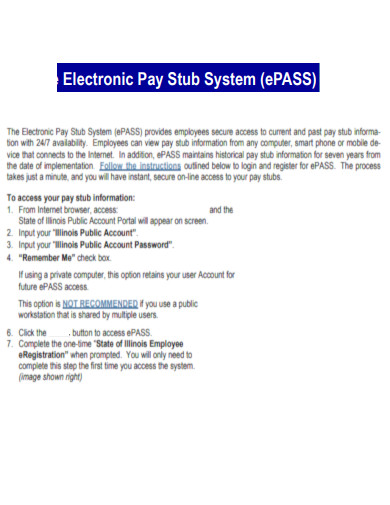

Electronic Pay Stub System

download now -

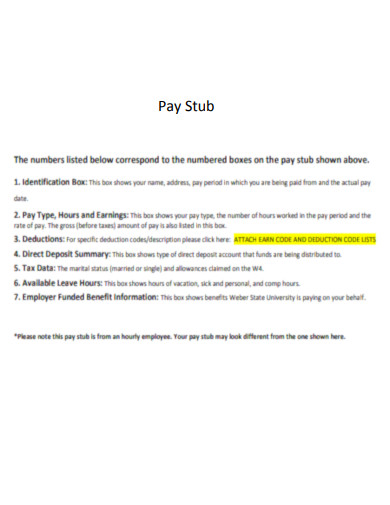

Professional Pay Stub

download now -

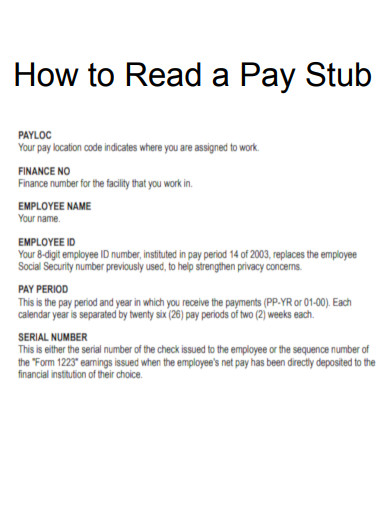

How to Read a Pay Stub

download now -

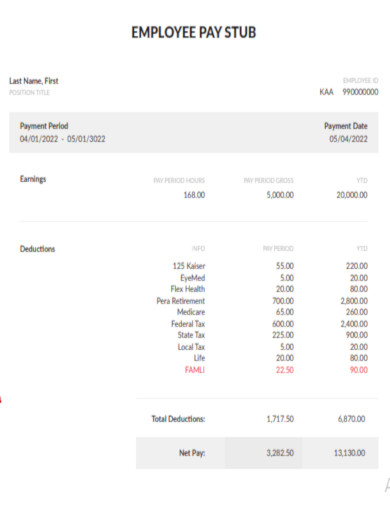

Employee Pay Stub

download now -

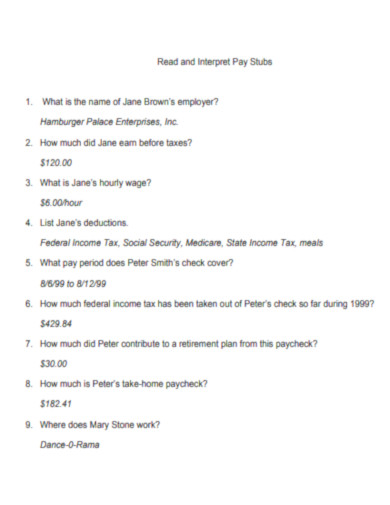

Read and Interpret Pay Stubs

download now -

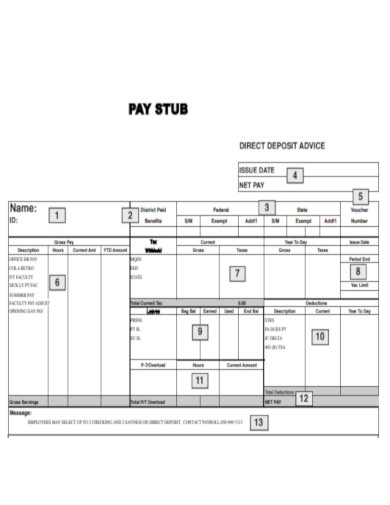

Printable Pay Stub

download now -

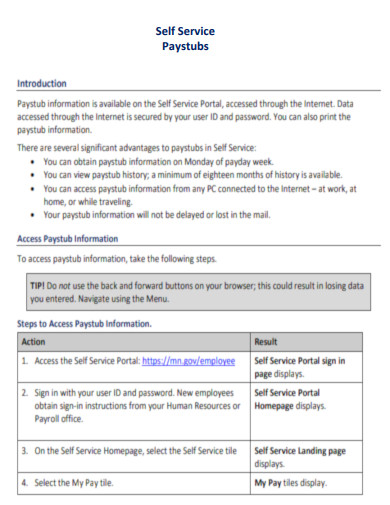

Self Service Pay Stubs

download now -

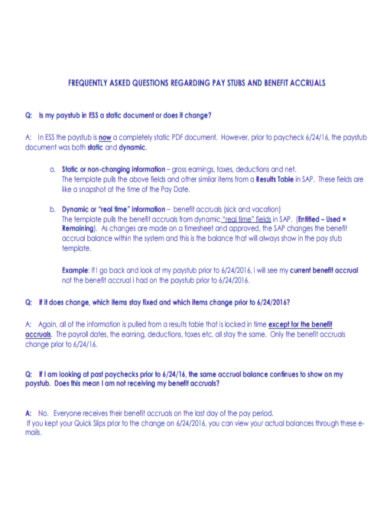

Pay Stubs Benefits Accruals

download now -

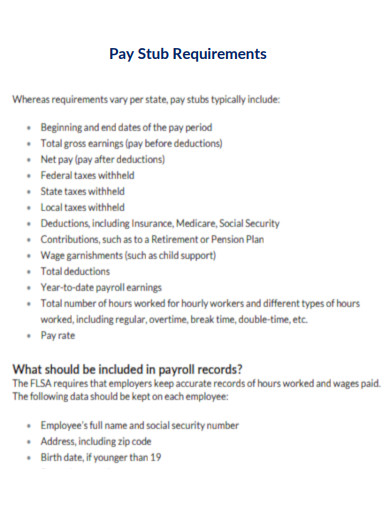

Pay Stub Requirement

download now -

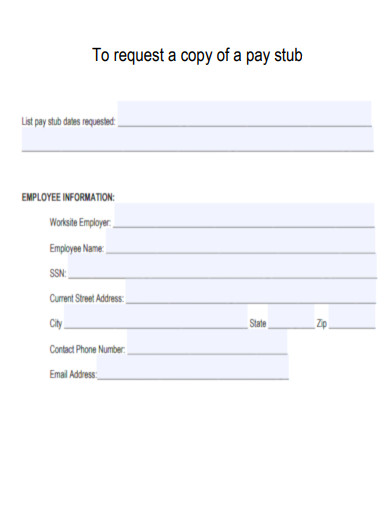

Request a copy of Pay Stub

download now -

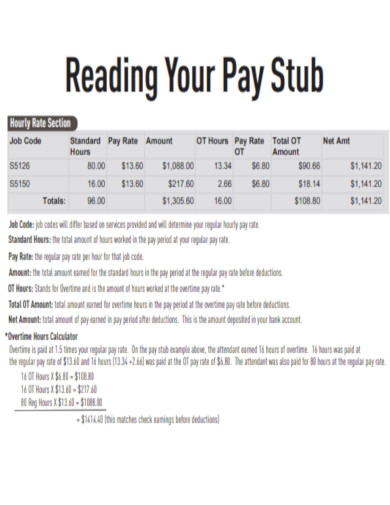

Reading Your Pay Stub

download now -

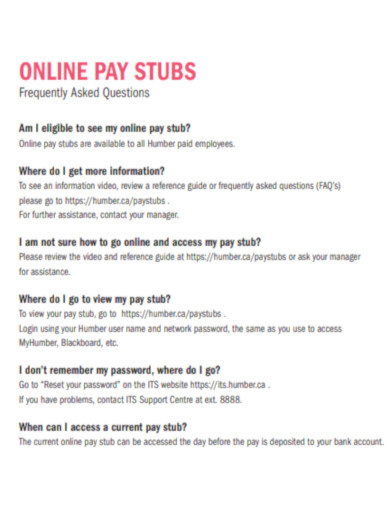

Pay Stub FAQ

download now -

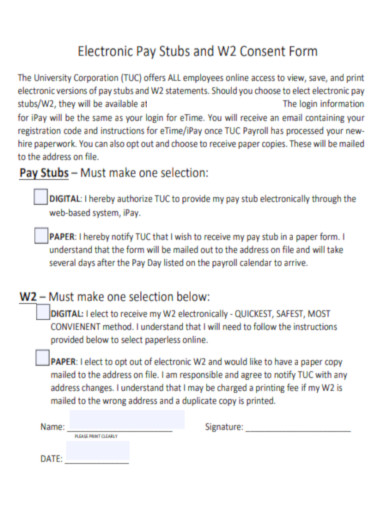

Electronic Pay Stubs and W2 Consent Form

download now -

Editable Pay Stub

download now -

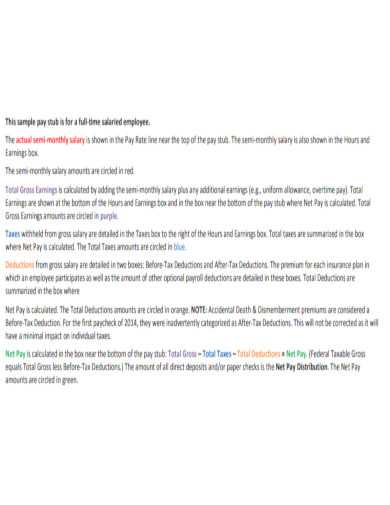

Pay Stub Salaried Employees

download now -

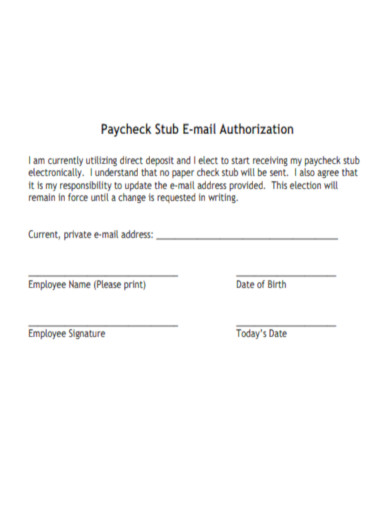

Paycheck Stub E-mail Authorization

download now -

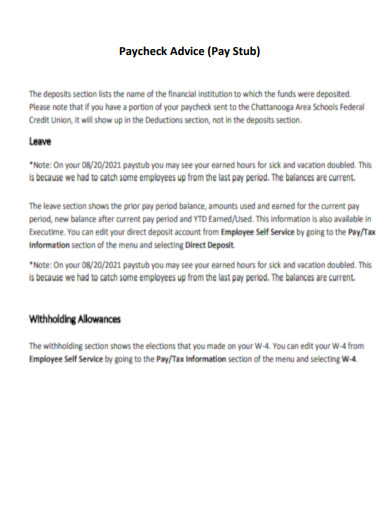

Pay Stub Advice

download now -

Request for Duplicate Pay Stub

download now -

Pay Stub Activity

download now -

Pay Stub PDF

download now -

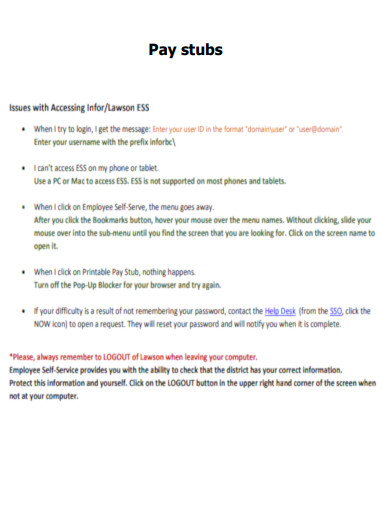

Pay Stubs Overview

download now -

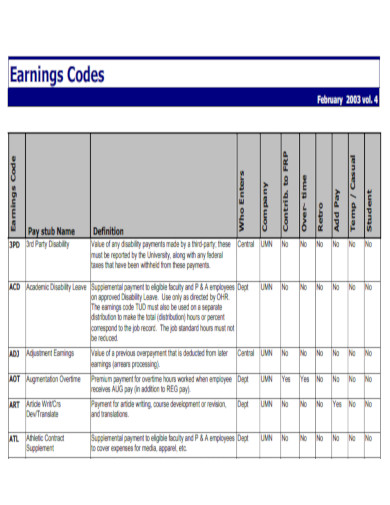

Pay Stub Earnings Codes

download now -

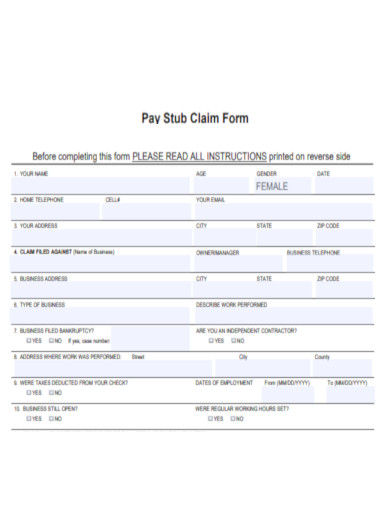

Pay Stub Claim Form

download now -

Pay Stub Guide

download now -

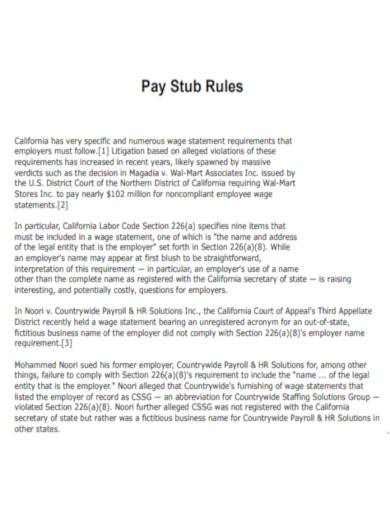

Pay Stub Rules

download now -

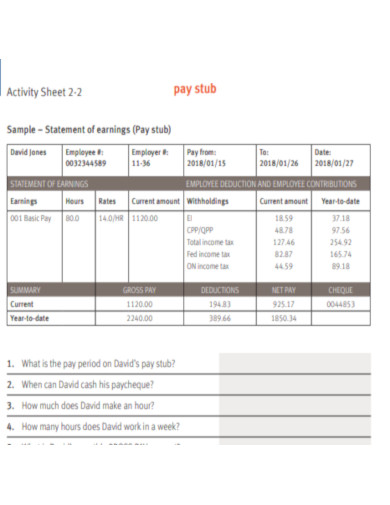

Pay Stub Activity Sheet

download now -

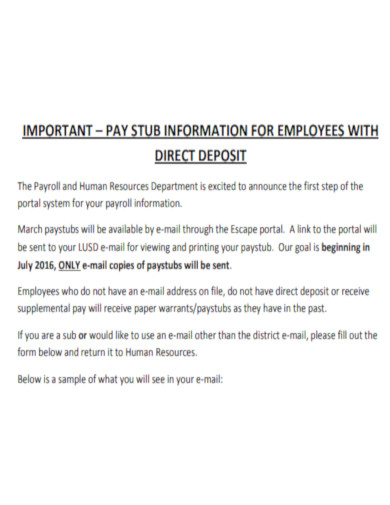

Pay Stub Information

download now -

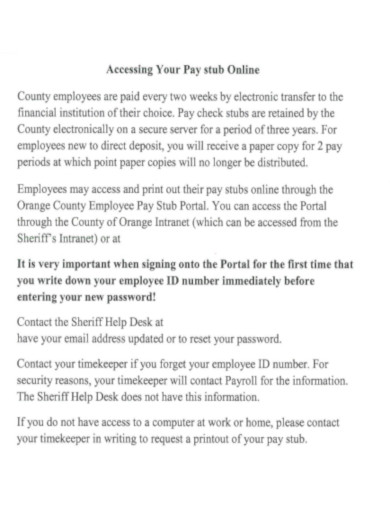

Accessing Pay Stub Online

download now -

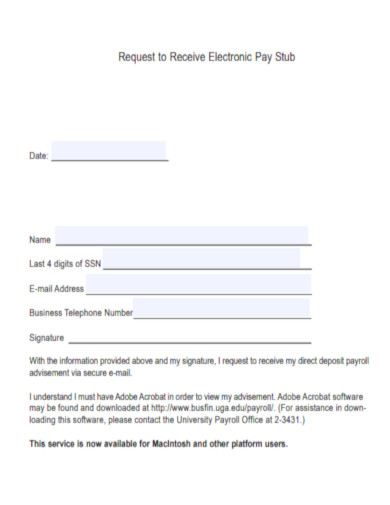

Request to Receive Electronic Pay Stub

download now -

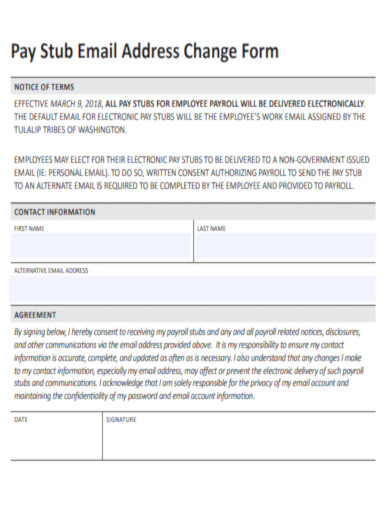

Pay Stub Email Address Change Form

download now -

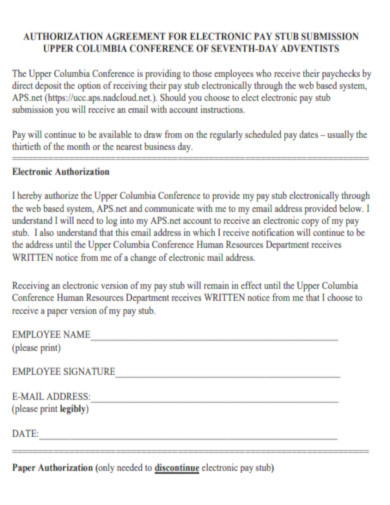

Agreement For Electronic Pay Stub Submission

download now -

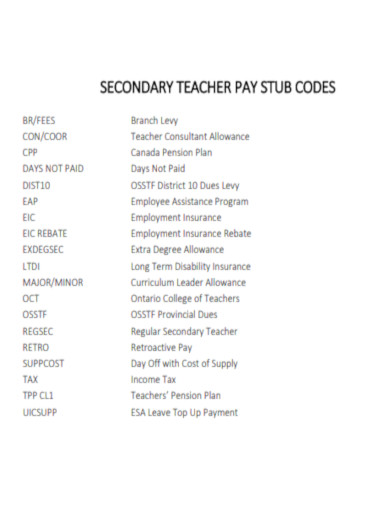

Secondary Teacher Pay Stub Codes

download now -

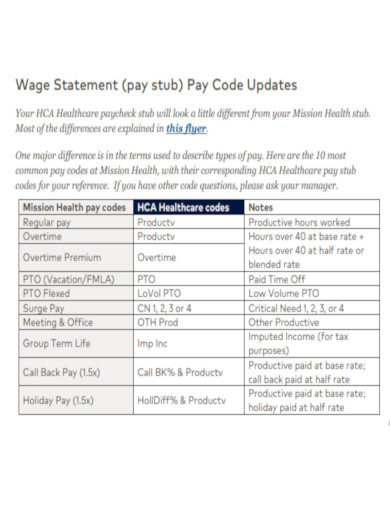

Wage Statement Pay Stub

download now

What is a Pay Stub?

A pay stub is a record of the salary, commission, and bonus of employees. It is a breakdown of the amount that will be paid to them. It is a good financial record where the employees can check their paychecks. It is a kind of financial statement or earnings statement. Pay stubs also contain details about taxes and other deductions. If you have health insurance premiums or retirement plan contributions, these will be stated in your pay stub. It also serves as a receipt that employers can give to you.

Pay stubs go together with your physical paychecks. Even a small business provides a pay stub to its employees. Everyone receives a pay stub, whether you are an employee or an independent contractor. Even self-employed have the right to get a pay stub that will detail their payment. Pay stubs are an important document that needs to be accomplished in a payroll. Some compute a pay stub through QuickBooks or Excel. Pay stubs can be given weekly or monthly. Without a pay stub, we can never be sure that we have been given the right payment for our work.

Benefits of a Pay Stub

Every employer provides a pay stub. This is also called a payslip or paycheck stub. Through this, you will know the money that can be credited to your account. It is proof of income that you are going to get. Many use pay stubs because they can give great benefits to a business. Below, you can learn some of the benefits that you can get from pay stubs. Read the following:

Tips on Pay Stub

It is a must that we understand our pay stubs. If we do, we know that we will receive the right amount that we deserve for our work. But how can we make the most out of our pay stubs? How can we be sure that we can get the benefits that we can have from it? Learn some of the tips that you can use for a pay stub.

How to Create a Pay Stub

Pay stubs provide insights into employees’ paychecks. But what are the things that you need to include in a pay stub? How can you create a pay stub? The following are the steps that you can do to create a pay stub:

1. Provide General Information

Pay stubs have general information about the employee and the employer. It has the name, address, and social security number of the employee. On the other hand, the company name and the business address are included in the pay stub.

2. Compute the Gross Wage

After getting a pay stub template, you can start computing the income of the employee. Start with the gross income. This is the amount that the employee has earned within the month or week. Calculate the total earnings. This is the amount before any taxes can be deducted.

3. Compute Deductions

After calculating the gross income, you have to compute the deductions that you should subtract from the gross income. This includes taxes, employee benefits, and other voluntary deductions. You have to put in detail all the deductions in the paycheck slip.

4. Provide the Net Pay

The net pay will be the take-home pay of the employee. This is the amount of gross income minus all the deductions. Be accurate in providing the net pay. Double-check your work to ensure that you are giving a right pay stub.

FAQs

How can you make a pay stub?

If you want to make a pay stub, you can refer to any pay stub generator or pay stub template that is available online. A pay stub example can help you so that your work will be easier.

Who should be given pay stubs?

Employers must know that they should give pay stubs to all employees. If they have independent contractors, they should give pay stubs to them also.

We should be aware of how to check our pay stubs to ensure that we are getting the right salary. So, a good understanding of a pay stub is important. Now, you have learned some things that improve your knowledge of pay stubs. Maybe you want to try our available templates that can help you in creating a pay stub. Download now!