50+ Sample Balance Sheets

-

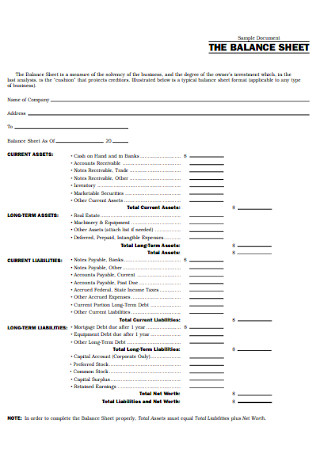

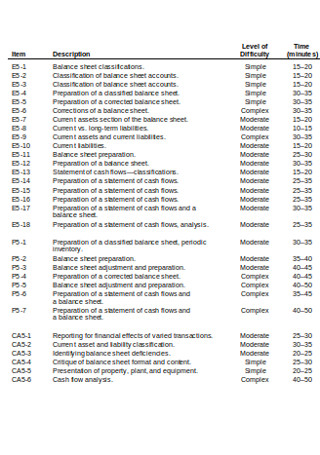

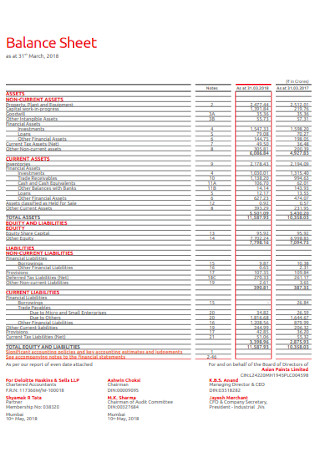

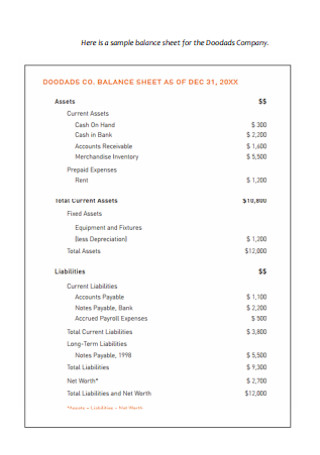

Sample Balance Sheet Template

download now -

Understanding Balance Sheet

download now -

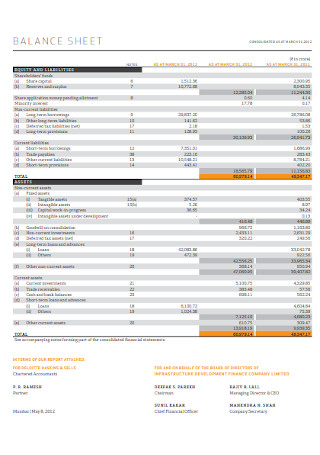

Annual Balance Sheet

download now -

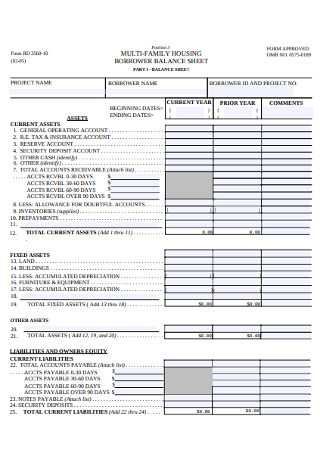

Financial Balance Sheet Template

download now -

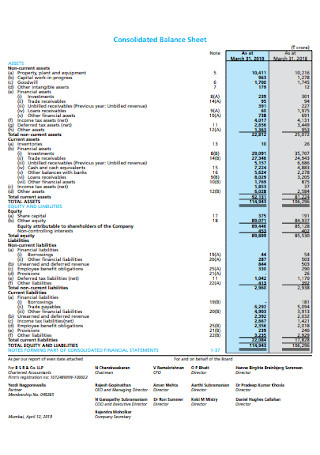

Consolidated Balance Sheet

download now -

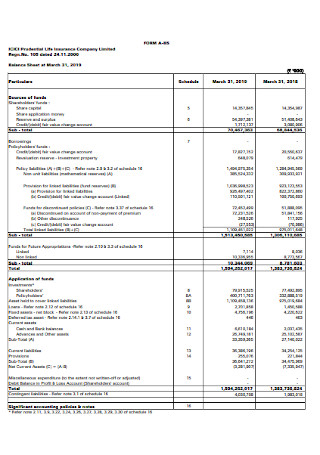

Insurance Company Balance Sheet

download now -

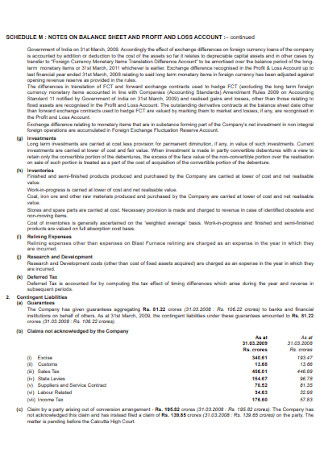

Profit and Loss Balance Sheet

download now -

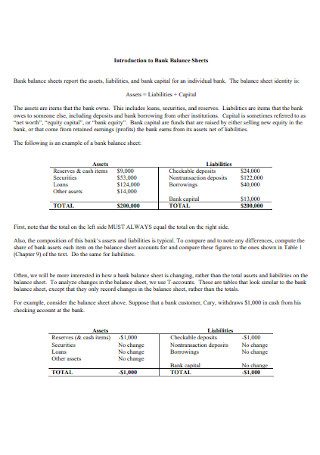

Bank Balance Sheets

download now -

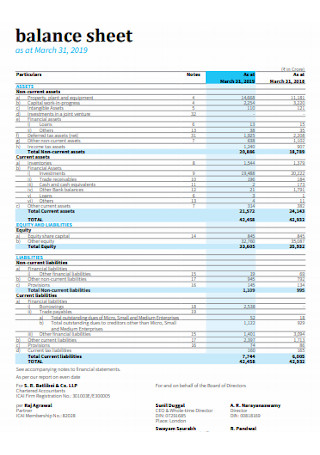

Simple Balance Sheet Template

download now -

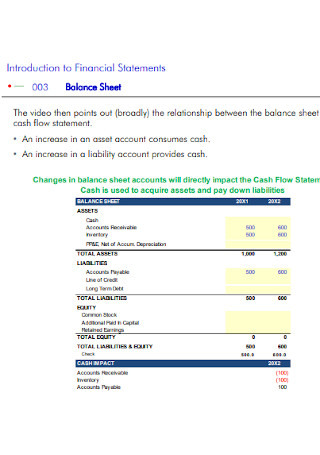

Balance Sheet of Cash Flow Statement

download now -

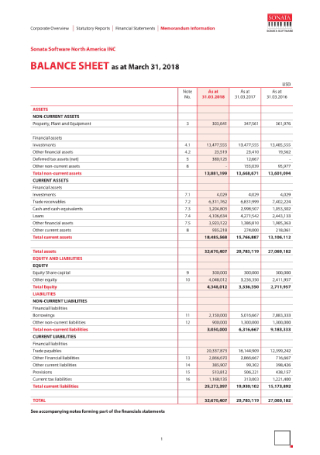

Company Balance Sheet Example

download now -

House Balance Sheet

download now -

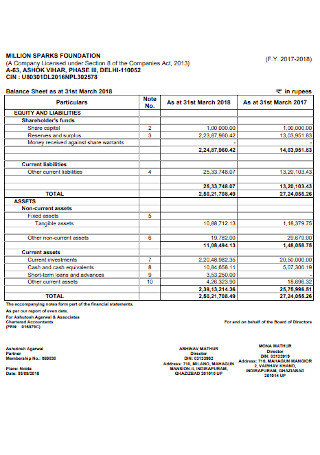

Foundation Balance Sheet

download now -

Annual Balance Sheet Report

download now -

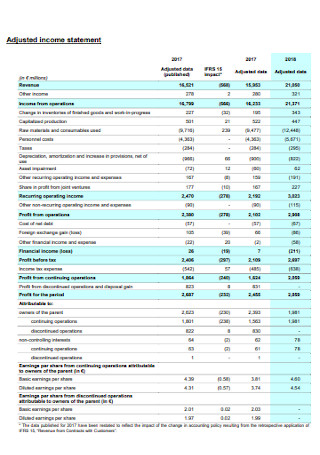

Income and Balance Sheet

download now -

Year Balance Sheet

download now -

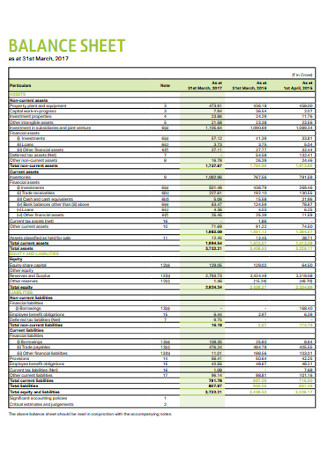

Balance Sheet Format

download now -

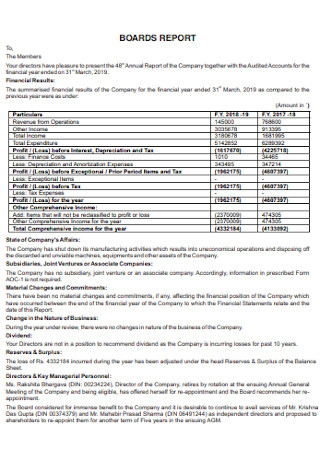

Board Balance Sheet Template

download now -

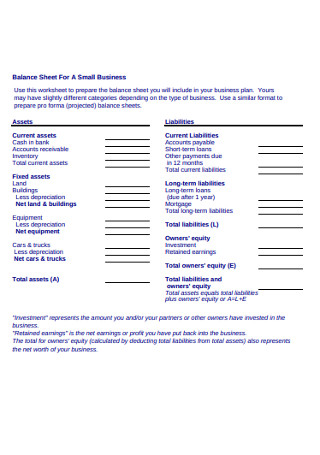

Business Balance Sheet

download now -

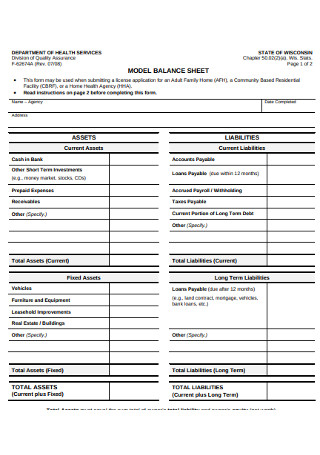

Model Balance Sheet Example

download now -

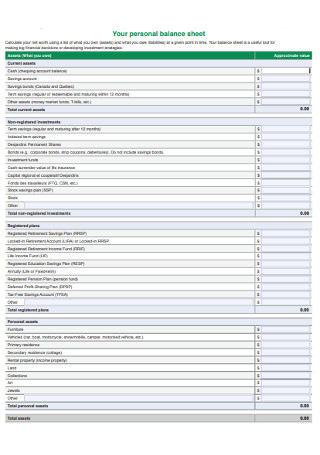

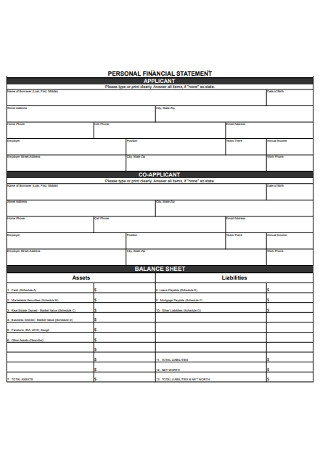

Personal Balance Sheet Template

download now -

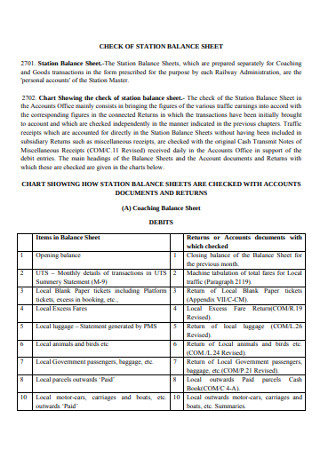

Station Balance Sheet

download now -

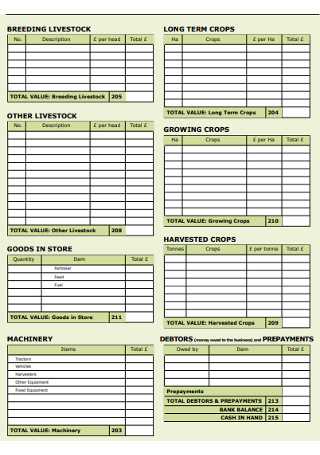

Former’s Balance Sheet

download now -

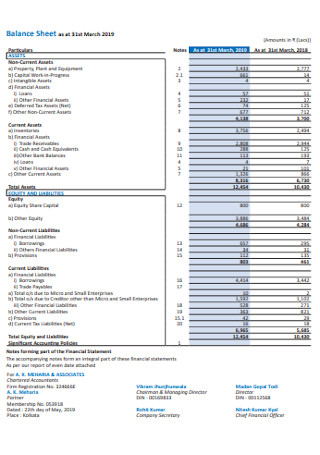

Balance Sheet Example

download now -

Liquidity and Off-Balance Sheet

download now -

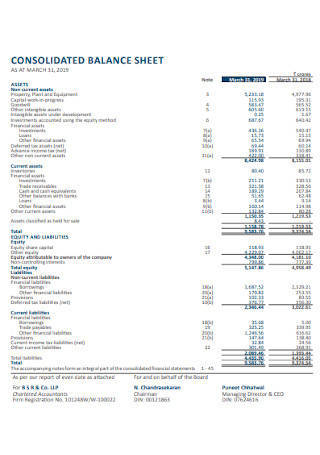

Consolidated Balance Sheet Template

download now -

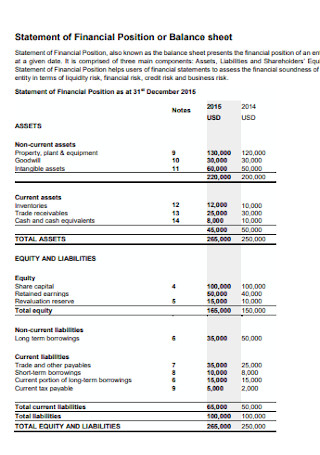

Financial Position or Balance Sheet

download now -

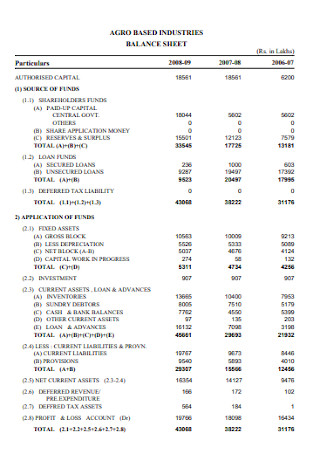

Industries Balance Sheet

download now -

Cash Flow Balance Sheet

download now -

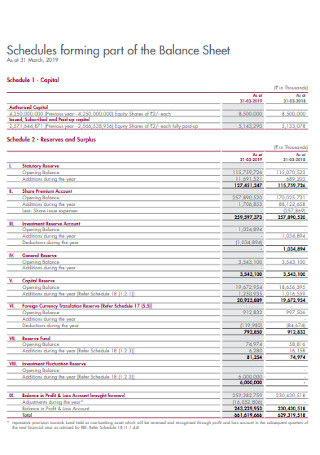

Schedules Forming Part of Balance Sheet

download now -

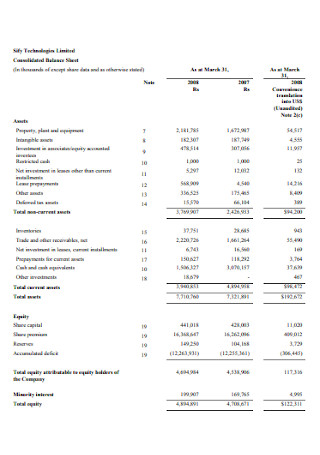

Consolidated Balance Sheet Example

download now -

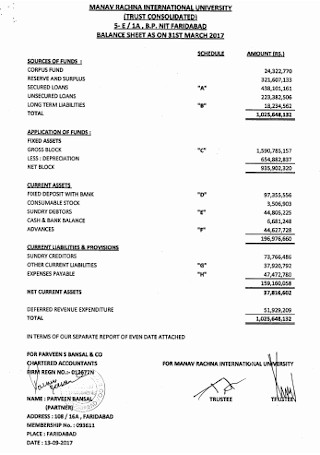

University Balance Sheet

download now -

Accounting Balance Sheet

download now -

Personal Financial Balance Sheet

download now -

Basic Balance Sheet Template

download now -

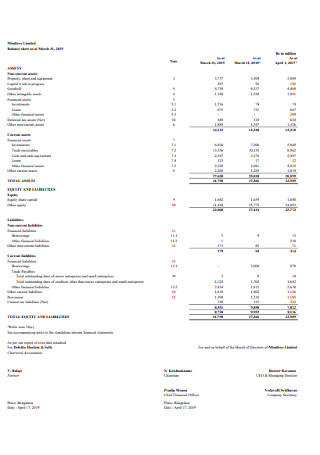

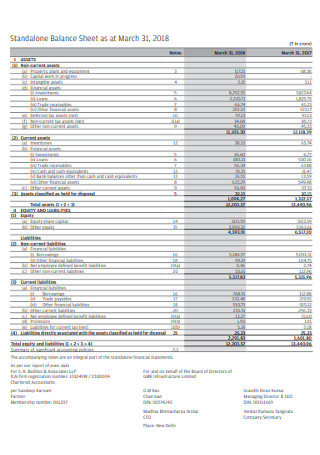

Standalone Balance Sheet

download now -

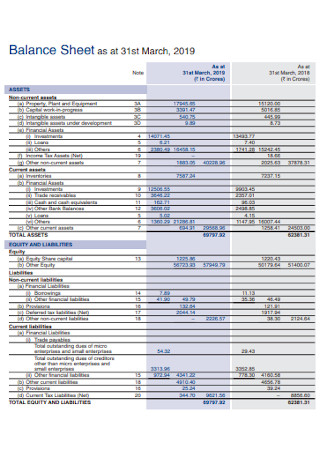

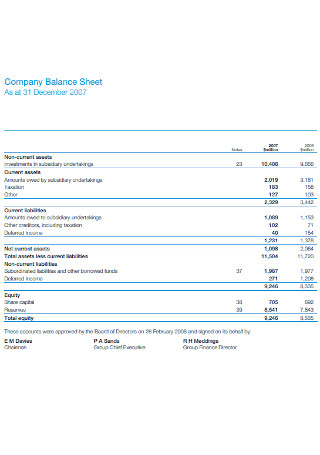

Company Balance Sheet

download now -

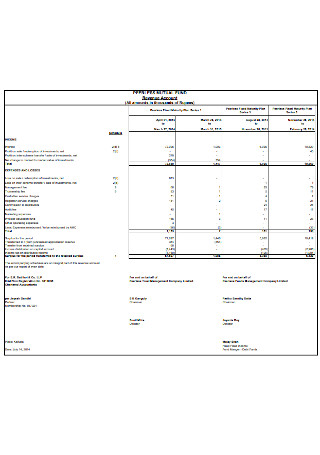

Mutual Fund Balance Sheet

download now -

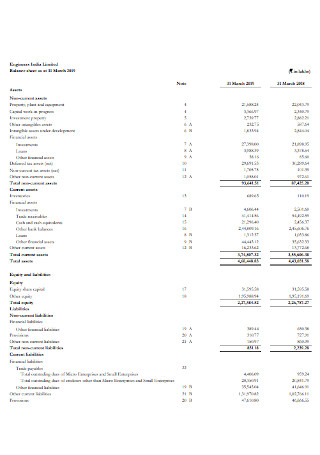

Engineers Balance sheet

download now -

Balance Sheets of Rural Banks

download now -

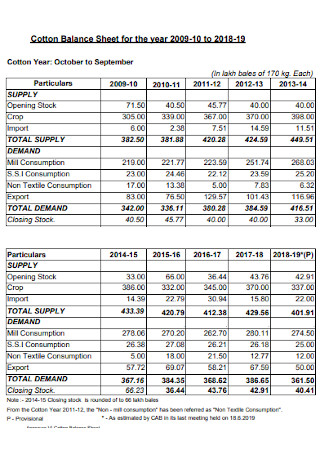

Cotton Balance Sheet

download now -

Cofeelab Balance Sheet

download now -

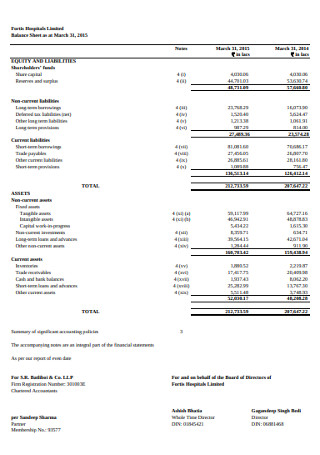

Hospital Balance Sheet

download now -

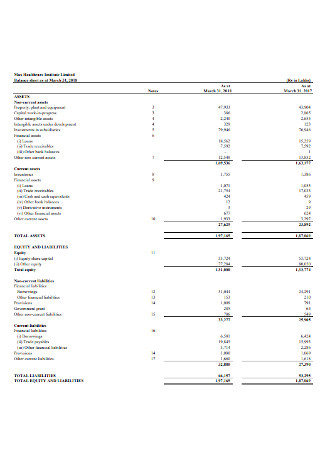

Healthcare Institute Balance sheet

download now -

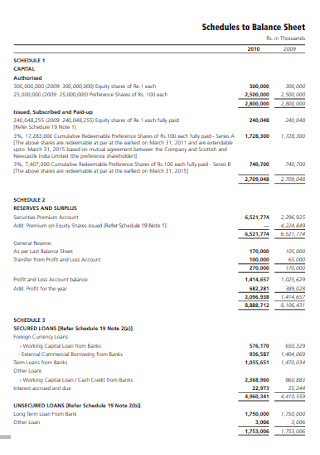

Schedules to Balance Sheet

download now -

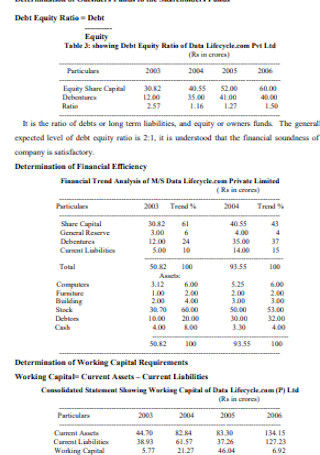

Study on Balance Sheet Analysis Template

download now -

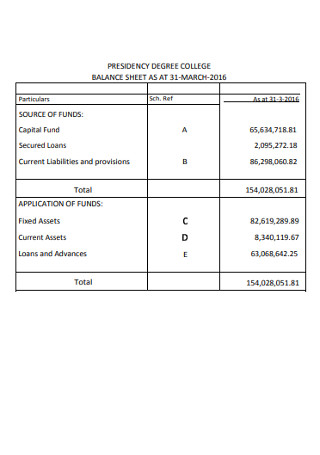

College Balance Sheet

download now -

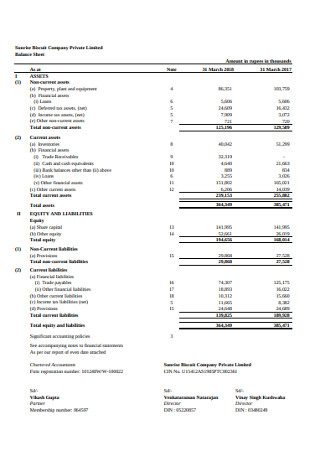

Biscuit Company Balance Sheet

download now -

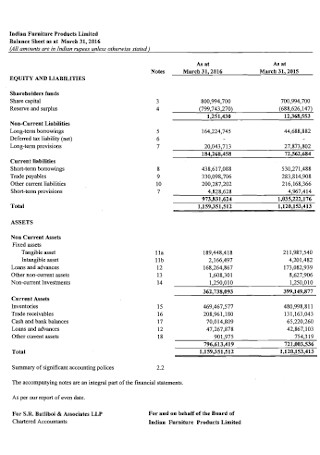

Furniture Balance Sheet

download now -

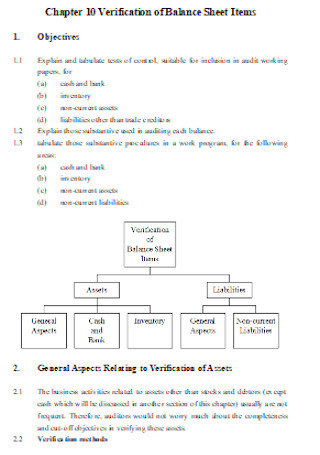

Verification of Balance Sheet Template

download now

What Is a Balance Sheet?

A balance sheet summarizes three factors—shareholders’ equity, liabilities, and assets. And this financial statement is useful to monitor and compute your organization’s capital structure, cash flow, financial health, and other data. For example, you refer to balance sheets in finding out how much money is left, if all assets have actually been sold, or if every debt has been paid back.

According to Investopedia, the standard formula for the balance sheet is Liabilities + Shareholders’ Equity = Assets.

The Three Main Sections of a Balance Sheet

A balance sheet’s basic formula is to add both liabilities and shareholders’ equity on one side and assets on the other side. But what exactly are these three factors? In this section, take a closer look at each balance sheet section and what they really mean.

How to Create a Balance Sheet

In the accounting sector, balance sheets play a great role in tracking finances and other data. But it hardly becomes a good reference when the balance sheet’s content is poorly made. So to ensure you come up with a proper balance sheet, kindly follow these steps:

Step 1: Set Your Balance Sheet’s Purpose

Every business has different objectives and purposes. So what about your organization? Focus on aspects related to what concerns the balance sheet like the income statement, cash flow, etc. Besides making a balance sheet for business, some people even create it for personal reasons. It really depends on your purpose and be sure to tailor it into your sheet.

Step 2: Identify the Assets, Liabilities, and Shareholders’ Equity

Of course, it is standard to insert the three sections of a balance sheet which are the shareholders’ equity, assets, and liabilities. You can conduct an analysis report towards your business first to identify those factors. Be careful with the numbers and data because some details are classified and you wouldn’t want to leak some. Also, it works best to be in partnership with other people in your team to work on this part quickly and effortlessly.

Step 3: Observe an Easy-to-Follow Format

You can freely decide how the format and design work for your balance sheet. The sample balance sheets listed above even have customizable features so you can change the details anytime. But, don’t overdesign the document where it ends up hard to follow already. Something simple yet understandable will already suffice. That way, you won’t have a difficult time understanding the content and how to use it.

Step 4: Update the Content Regularly

Making a balance sheet isn’t just a one-time process. Expect regular updates too that you may add, subtract, or alter the balance sheet daily, weekly, monthly, or anytime. And that regular assessment or monitoring is why you can keep track of whatever your company owes or owns. Aim to cover all important details from time to time and the balance sheet won’t fail you for sure.

FAQs

Who uses balance sheets?

Besides the accounting department, anyone concerned about a business’s financial health can use the balance sheet. This includes the investors, analysts, executives, regulators, and more.

What are the different types of assets?

The three types of assets are:

- Current assets (assets in the business for a short period or less than a year)

- Fixed assets (noncurrent and capital assets)

- Intangible assets (assets that can’t be touched like intellectual properties)

What are the types of liabilities?

Liabilities can either be short-term or long-term. They could all refer to loans, bills, charges, and other things a business owes. But the only difference is the duration. Short-term liabilities are payable in less than 12 months while long-term liabilities are payable in more than a year.

Using a balance sheet, you now have the official graphical data to state your organization’s different finances. Without it, you would have a hard time tracking your current assets, liabilities, and so forth. And failing to track them from time to time might have your business struggling financially. Thankfully, tracking has not been made easier with sample balance sheet templates up for grabs above. Download now!