34+ Sample Cost Sheets

-

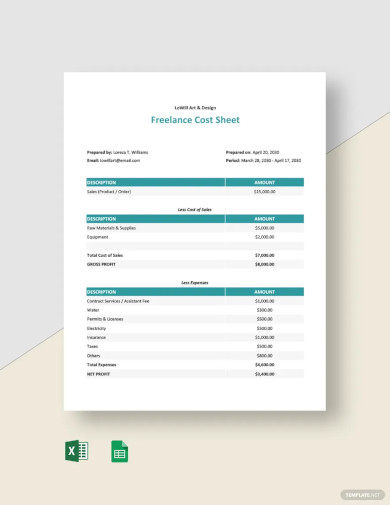

Freelance Cost Sheet Template

download now -

Start Up Business Cost Sheet Template

download now -

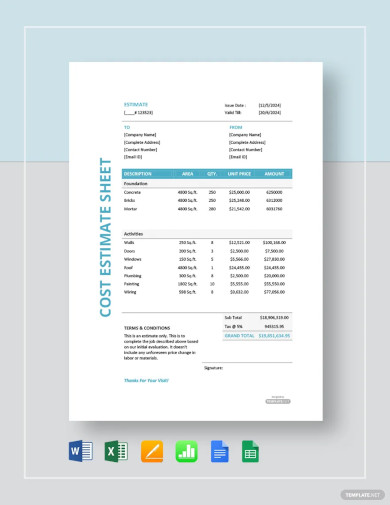

Cost Estimate Sheet Template

download now -

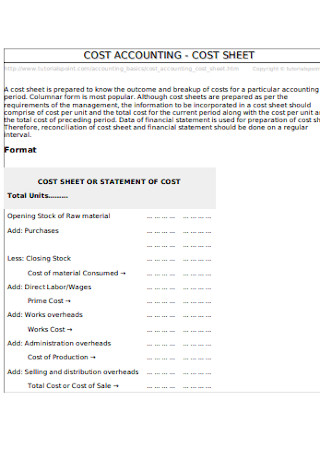

Cost Accounting Sheet

download now -

Cost sheet of Liquor Brands

download now -

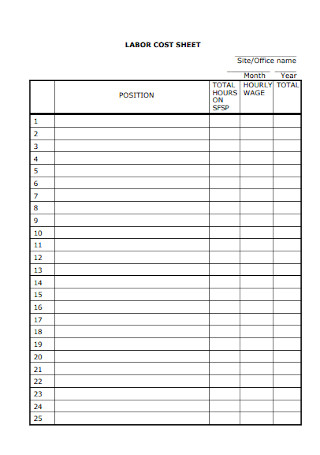

Labor Cost Sheet

download now -

Sample Cost Sheet Template

download now -

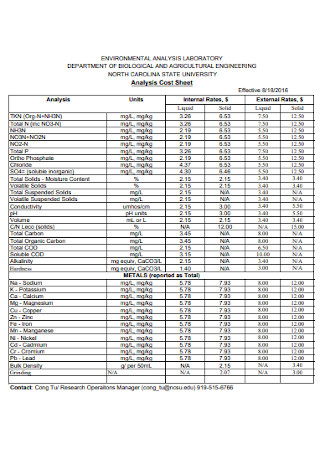

Analysis Cost Sheet

download now -

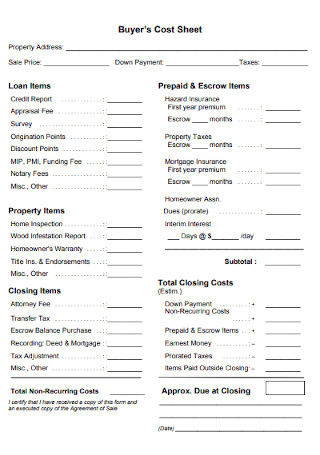

Buyers Cost Sheet

download now -

Listing Package Cost Sheet

download now -

Cost Estimate Sheet

download now -

Academic Year Cost Sheet

download now -

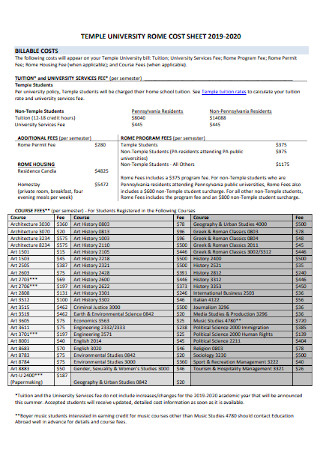

Temple Rome Cost Sheet

download now -

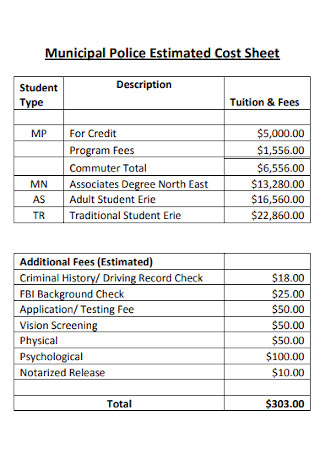

Municipal Police Estimated Cost Sheet

download now -

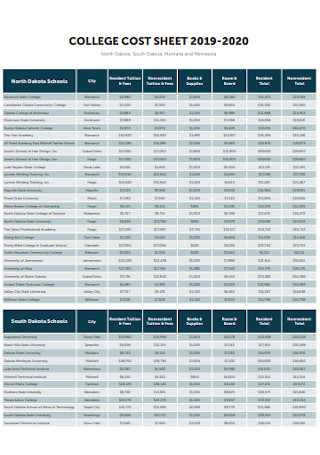

College Cost Sheet

download now -

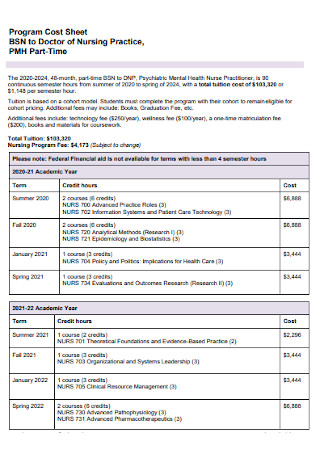

Program Cost Sheet

download now -

Water Transportation Cost Sheet

download now -

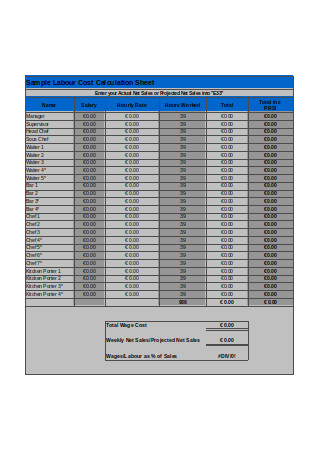

Labor Cost Sheet

download now -

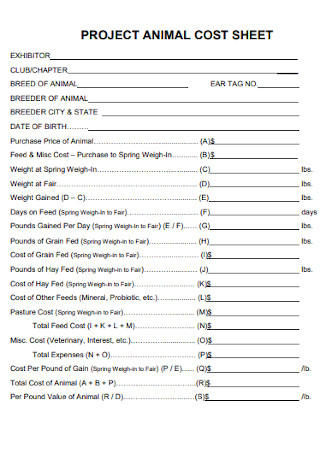

Project Cost Sheet

download now -

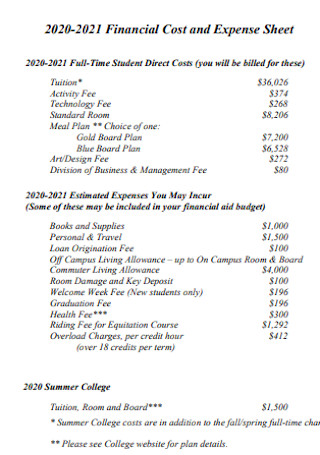

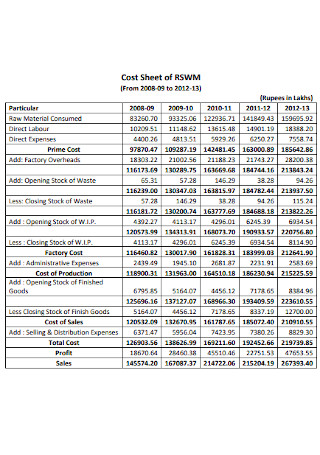

Financial Cost Sheet

download now -

Cost Sheet Format

download now -

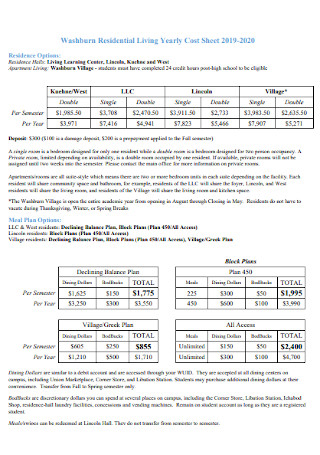

Residential Living Yearly Cost Sheet

download now -

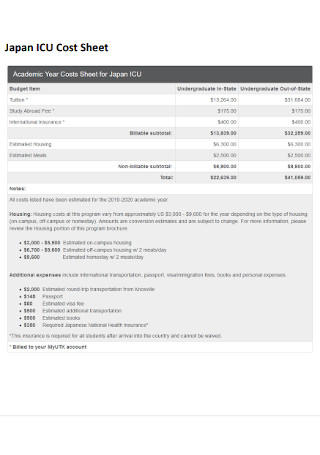

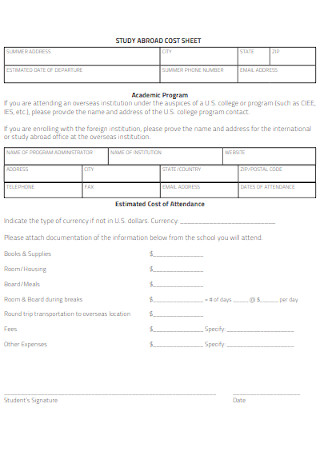

Study Abroad Cost Sheet

download now -

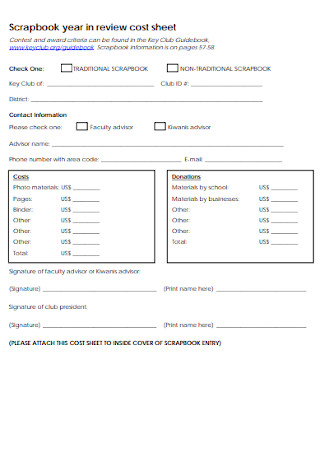

Scrapbook Year in Review Cost Sheet

download now -

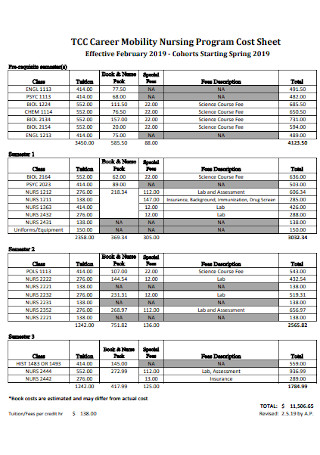

Mobility Nursing Program Cost Sheet

download now -

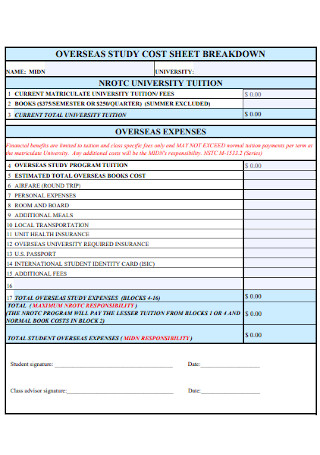

Overseas Study Cost Sheet

download now -

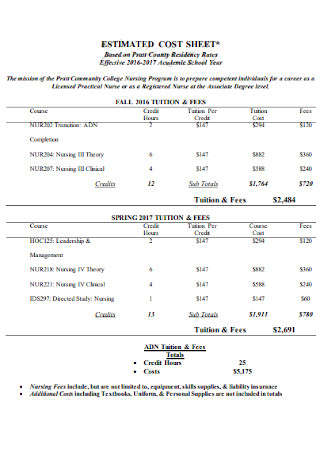

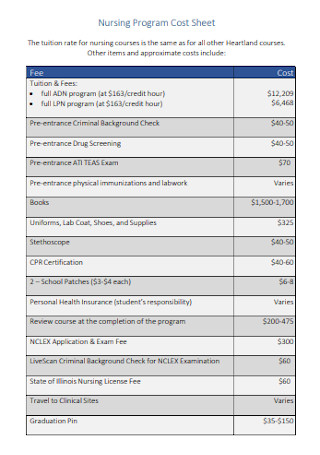

Nursing Program Cost Sheet

download now -

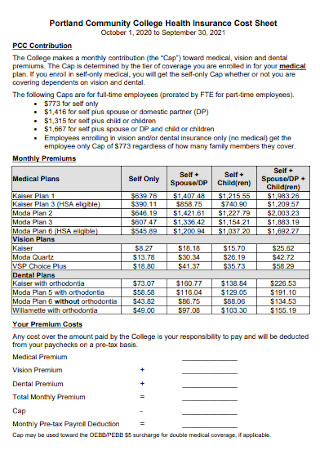

College Health Insurance Cost Sheet

download now -

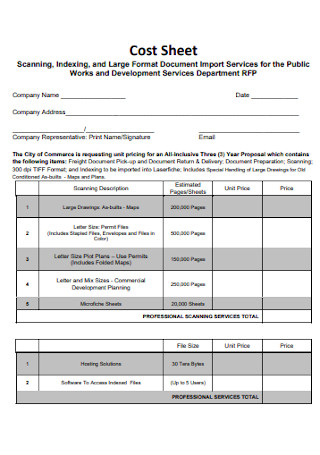

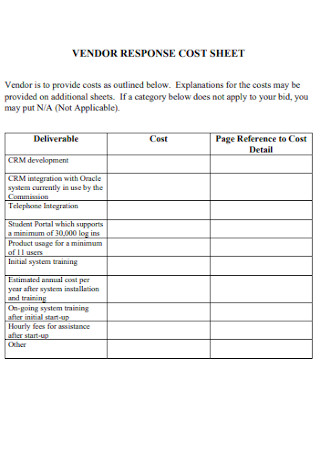

Vendor Response Cost Sheet

download now -

Simple Cost Sheet Template

download now -

Vendor Cost Sheet Template

download now -

Simple Estimated Cost Sheet

download now -

Basic Cost Sheet Template

download now -

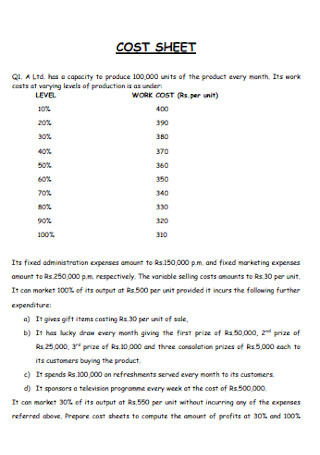

Cost Accounting Problem Sheet

download now -

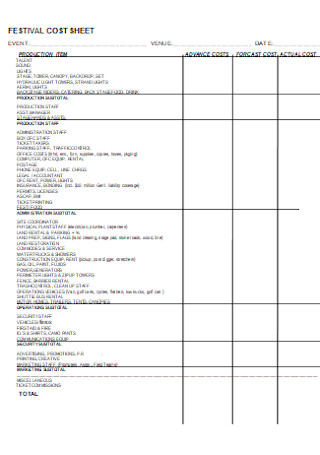

Festival Cost Sheet

download now

What Is a Cost Sheet?

A cost sheet is a detailed statement representing the many costs involved in an organization or business. Just like an expense sheet, the cost sheet is a document where you can compute the total cost of a business budget, the incurred cost of every service or product unit in periods, and more. And instead of having different sheets to use for every type of expenditure, the cost sheet compiles all costs presented in a table form.

Did you know that there are four main components of a cost sheet? These are the prime cost, works cost, production cost, and total cost.

The Core Four: Elements of a Cost Sheet

According to The Investors Book, a cost sheet consists of four major elements. These are the prime cost, works cost, cost of production, and total cost. But what exactly are they? In this section, you will be introduced to each cost sheet component.

How to Make a Cost Sheet

While you already know the cost sheet’s definition, components, and inherent formulas, apply your knowledge further in creating the cost sheet yourself. First of all, you won’t find the work a hassle because sample templates are available to accommodate you anytime. Just pick a sample cost sheet to customize and you can produce as many sheets as you want within minutes. And to ensure your sheet is properly made, follow these steps:

Step 1: Brainstorm All the Costs Involved

Identify all the costs in your business, project, or operation. You could focus on your main goal or type of business in case you run a food business, retail, or even construction. It is expected that your sheet contains a list of accumulated costs, like price lists, including the direct costs, raw materials, labor costs, and more. Any example where budget is concerned shall be identified until you can compile them all to your cost sheet.

Step 2: Present Clear and Organized Details

A messy cost sheet won’t help you effectively. You have to write properly and organize your details really well. Imagine trusting on one document that contains all the important costs of your business yet you hardly understand its details. That is a no-no. You can keep it simple actually. The key is to divide your costs into their types and categories. You may also set automatic calculations and formulas so it won’t be difficult to update the costs. Nonetheless, always go for the easy-to-follow structure.

Step 3: Personalize the Cost Sheet

Make the cost sheet your own. Or perhaps, you make it as your company’s by incorporating your business logo, theme colors, and branding. Changing the format and design is even something you can do in using the sample cost sheets above. That way, you come up with formal or credible results.

Step 4: Finalize the Output and Update It

When you are confident with the cost sheet’s content and results, focus on the format for its output. Do you plan to use MS Word or PDF cost sheets? And do you like a soft copy version or a printed sheet? Decide now. Lastly, update your cost sheets regularly as there may be changes with the costs from losses, profits, and other necessary alterations.

FAQs

Why is a cost sheet essential?

Cost sheets are important because they help you control and monitor your business expenses, as well as the costs of every good or service in your operations. A cost sheet even lets you trace numerous cost components at varying stages from production, manufacturing, selling, distribution, etc.

What are the types of a cost sheet?

Cost sheets have two major types. The historical cost sheet and the estimated cost sheet. And from their names alone, you can understand their differences. The historical cost sheet covers costs that were already experienced. Meanwhile, an estimated cost sheet is prepared early and it focuses on estimates; thus, costs aren’t actually experienced yet.

What are other advantages of a cost sheet?

There are plenty of things you can do with cost sheets. And some of its benefits are the following:

- Decides the proper selling prices of goods and services

- Adjusts the opening and closing stocks

- Documents the official cost statement

- Provides every product or service’s per-unit cost

- Helps compare the estimated and actual costs incurred

Material costs, shipping fees, taxes, labor costs, outsourced supplies, tools and equipment expenditures—there are literally a lot of costs to cover in a standard business. So as every expense increases and more expenditures must be monitored, it gets arduous to keep track of all different costs. Well, not anymore as you use professionally-made sample cost sheets. Download now!