46+ Sample Expense Sheet Templates

-

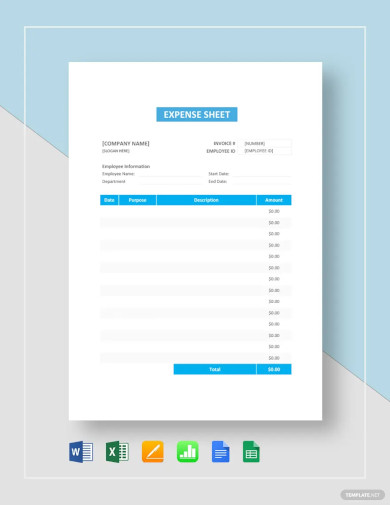

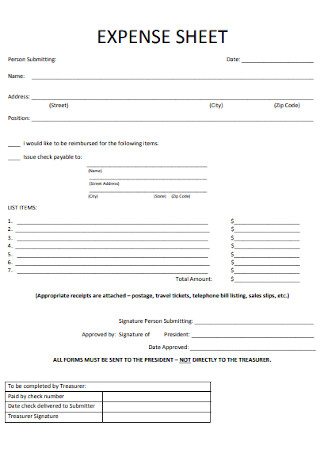

Expense Sheet Template

download now -

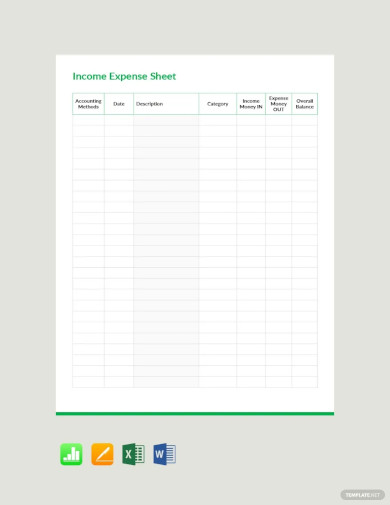

Income Expense Sheet Template

download now -

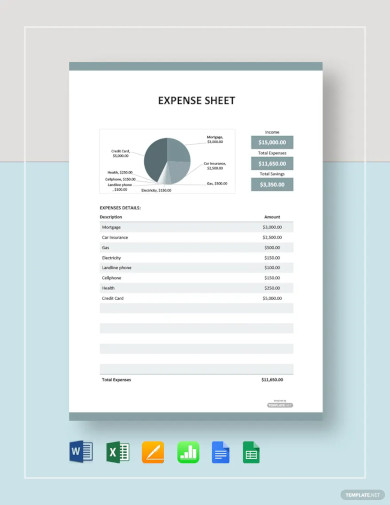

Daily Expense Sheet Template

download now -

Simple Expense Sheet Template

download now -

General Expense Sheet Template

download now -

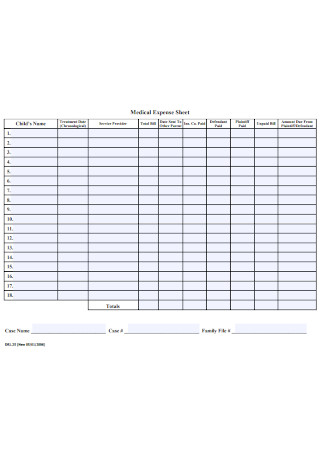

Medical Small Business Expense Sheet

download now -

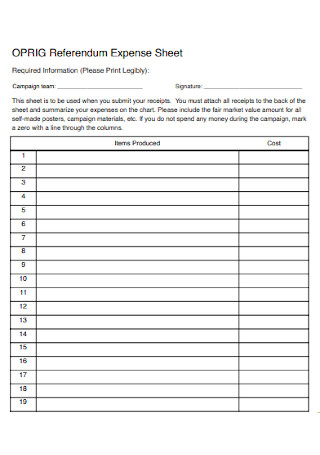

Referendum Budget Expense Sheet

download now -

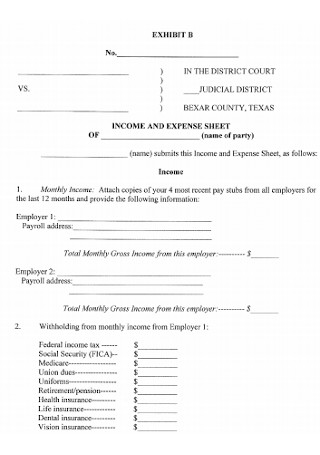

Simple Income and Expense Sheet

download now -

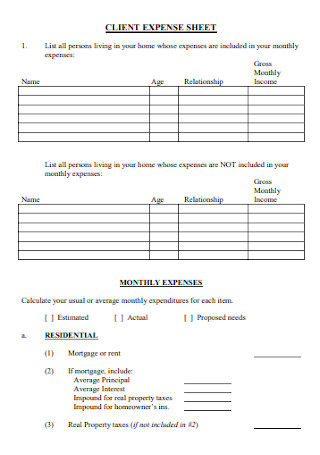

Employee Client Expense Sheet

download now -

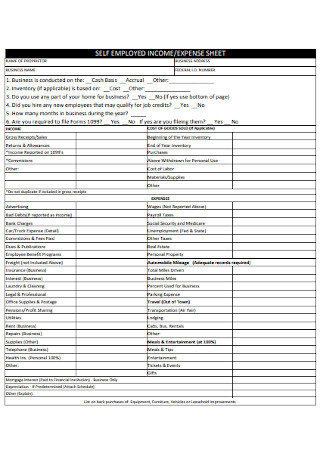

Construction Self Employed Expense Sheet

download now -

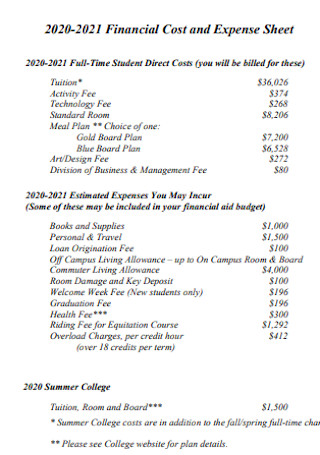

Expense Tracking Financial Cost and Expense Sheet

download now -

Daily Personal Expense Sheet

download now -

Monthly Money Expense Sheet

download now -

Vision Financial Expense Sheet

download now -

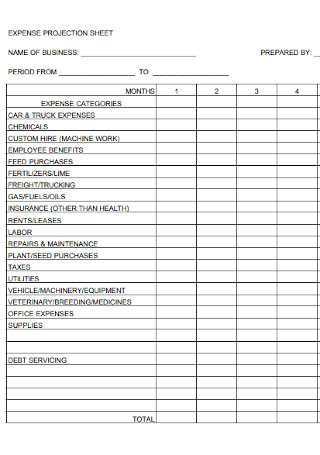

Weekly Expense Projection Sheet

download now -

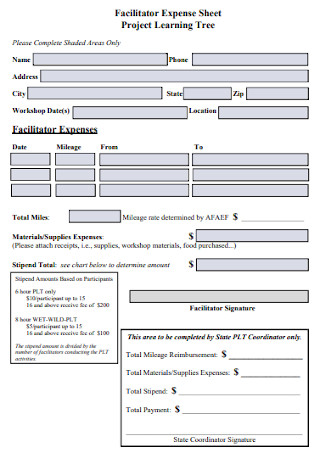

Facilitator Project Expense Sheet

download now -

Home Candidate Expense Sheet

download now -

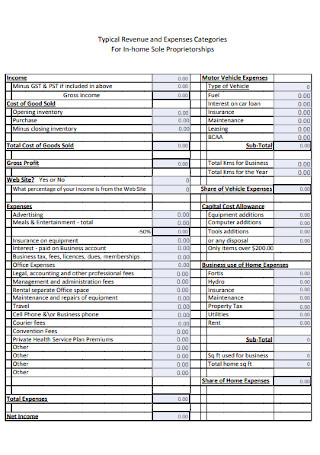

Revenue and Office Expenses Sheet

download now -

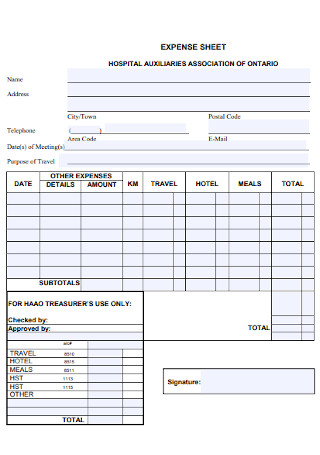

Hospital Trucking Expense Sheet

download now -

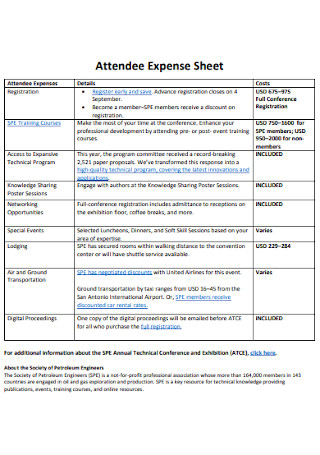

Restaurant Attendee Expense Sheet

download now -

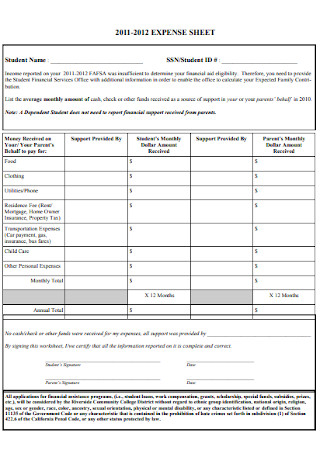

College Expense Sheet Template

download now -

Sample Household Expense Sheet

download now -

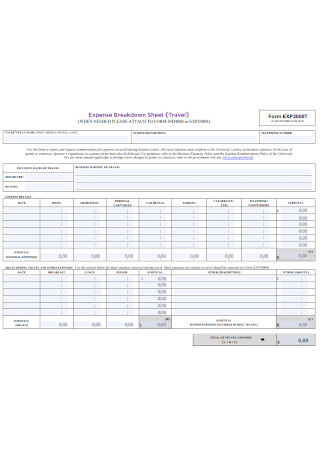

Expense Event Breakdown Sheet

download now -

Expense Sheet Format

download now -

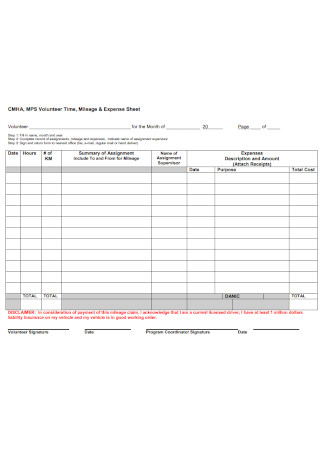

Sample Mileage and Expense Sheet

download now -

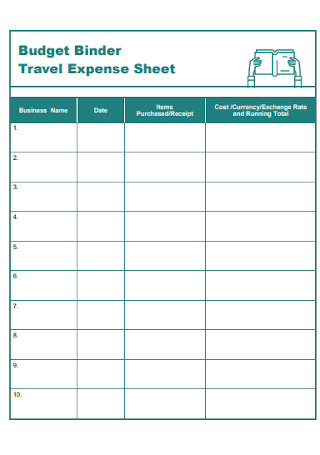

Travel Expense Sheet

download now -

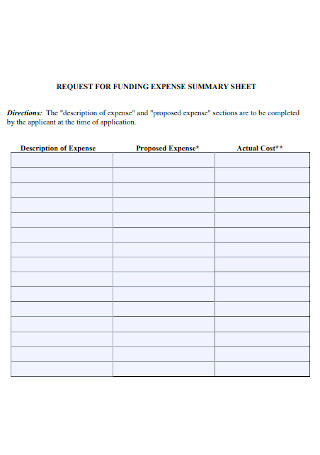

Funding Expense Summary Sheet

download now -

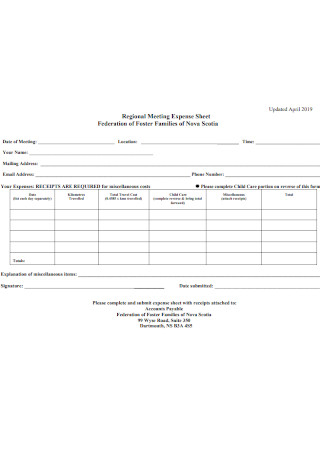

Regional Meeting Expense Sheet

download now -

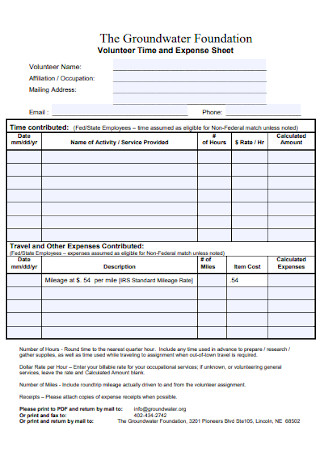

Volunteer Time and Expense Sheet

download now -

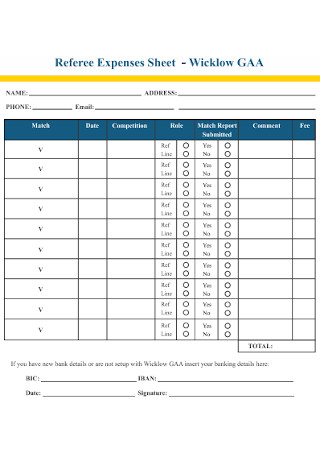

Sample Reference Expense Sheet

download now -

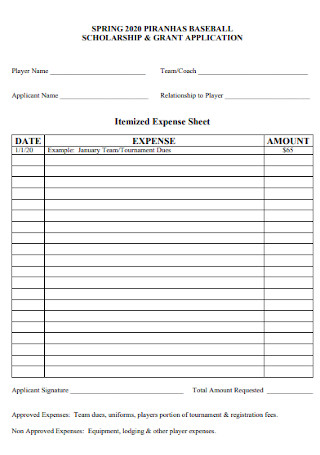

Itemized Expense Sheet

download now -

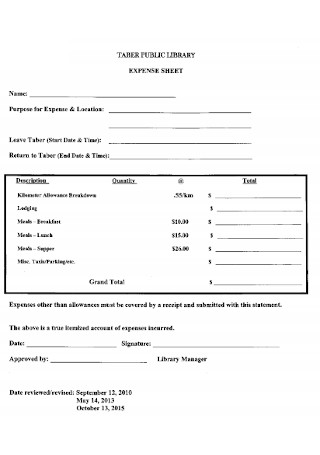

Sample Library Expense Sheet

download now -

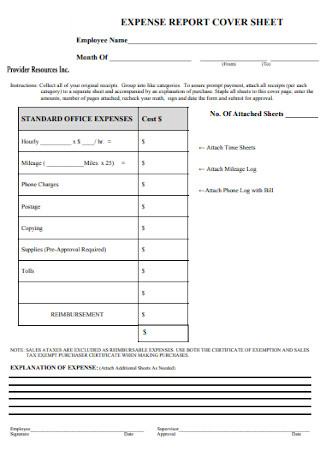

Expense Report and Cover Sheet

download now -

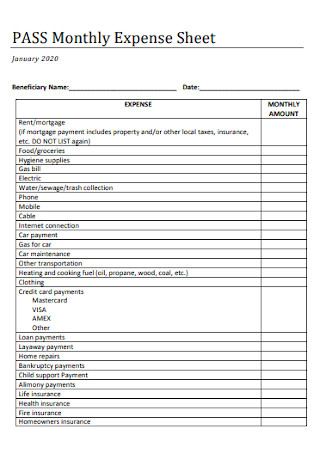

Pass Monthly Expense Sheet

download now -

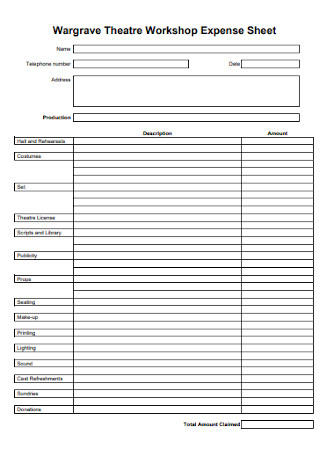

Theatre Workshop Expense Sheet

download now -

Sample Volunteer Expense Sheet

download now -

Interview Expenses Sheet

download now -

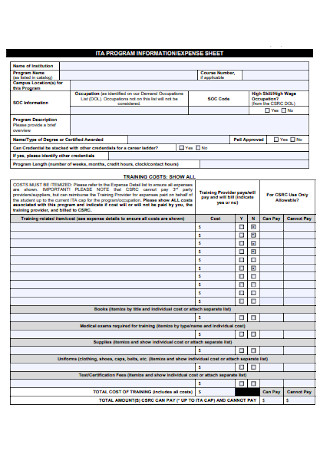

Program Information Expense Sheet

download now -

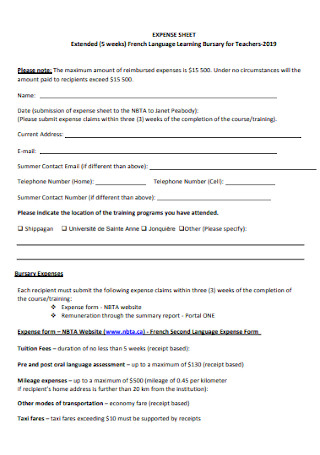

Teachers Expense Sheet

download now -

Sample Moving Expense Sheet

download now -

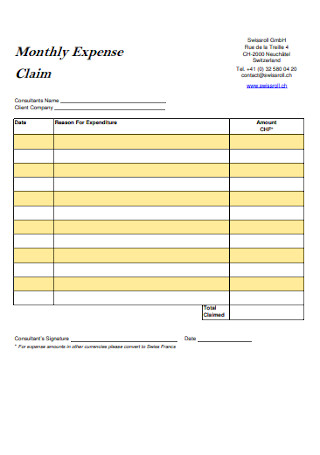

Monthly Claim Expense Sheet

download now -

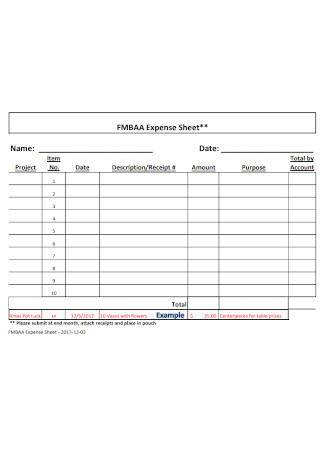

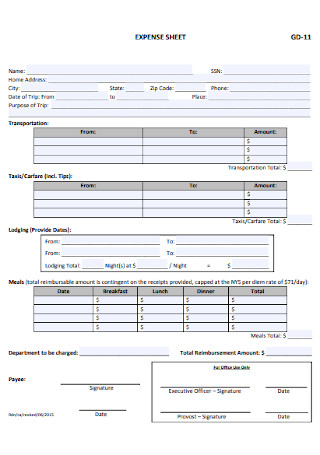

Printable Expense Sheet

download now -

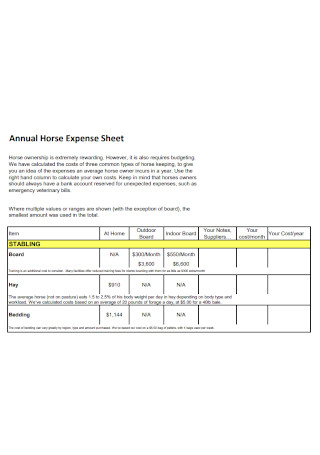

Annual Horse Expense Sheet

download now -

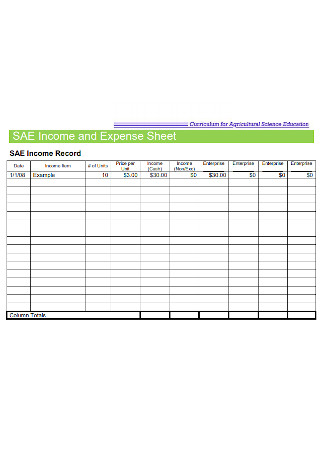

Income and Expense Sheet

download now -

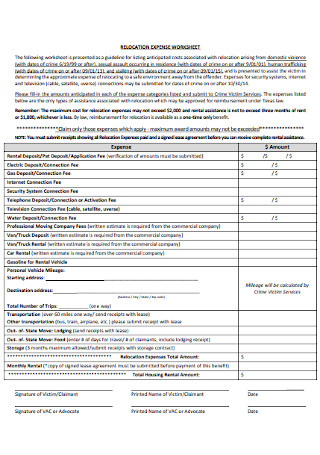

Relocation Expense Sheet Template

download now -

University Expense Sheet

download now -

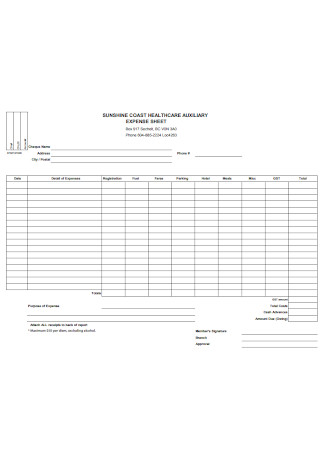

Sample Healthcare Expense Sheet

download now

FREE Expense Sheet s to Download

46+ Sample Expense Sheet Templates

What Is an Expense Sheet?

What Factors Are Inside a Standard Expense Sheet?

How to Craft an Excellent Expense Sheet

FAQs

What are some examples of monthly expenses?

What are some tips to keep track of spending?

What are the types of expenses?

What Is an Expense Sheet?

Keeping expense records helps in preparing financial statements correctly and quickly. With such records, it will be easy to control your finances and create smarter spending decisions regularly. And that statement explains why an expense sheet exists. Expense sheets record the daily, weekly, monthly, quarterly, or annual expenses of a person or a company—aka your official expense tracking system. So the next time you want to figure out where your money is going, then you know what document to use as a reference page and sheet.

According to Statista, business travel spending for businesses worldwide amounted to $1.33 trillion in 2017.

Meanwhile, Chrome Survey reported that American employers pay up to $2.8 billion yearly due to expense fraud.

The US, England, Germany, and other industrial countries measured success and development in terms of dollar amounts since the mid-19th century.

Why Are Expense Sheets Important?

In business, expense sheets are official business documents used by employees to write how much they spent. Along with receipts, weekly expense reports are useful to file for reimbursement or as a business requirement. So, employers will use the sheet as the basis if an employee should be refunded, or perhaps, be deducted from his or her income due to tax. And how that arrangement plays depends on what policy was already introduced in the employment agreement. Therefore, employees must work on accurate and detailed expense documents to increase their chances of being reimbursed.

Moreover, did you know that US employers pay up to $2.8 billion every year because of expense fraud? Indeed, and that news explains why effective expense tracking is crucial to businesses. No business owner wants to reimburse for fictitious expense reports or receive great losses in useless company expenses. What companies often do is to observe clear rules and format to validate the sheets. Aside from businesses, you can use an expense sheet to trace personal expenses. You could jot down the amount spent on travel fees, groceries, and more. Thus, you have a reliable budget management sheet for general expenses.

What Factors Are Inside a Standard Expense Sheet?

To record all expenses, whether related to work, school, and personal use, can be covered under expense reports. Although expense sheets vary from one application to another, there are common denominators placed in standard examples. In this segment, we outlined the common factors that you can see inside a general expense sheet.

How to Craft an Excellent Expense Sheet

An expense sheet’s purpose is impressive enough for detailing business spending, showing receipts, and more. But the problem is when the sheet itself was made poorly. Of course, there should be effort shown in making the document to serve its function. And not to worry because there are easy steps on how the process goes. Please follow these steps on how to create the expense sheet.

Step 1: Pick the Right Template

Have you checked out expense sheet templates already? There are lots of options available that are downloadable, printable, and editable. But you have to be careful in selecting the appropriate template. People even have different purposes on their expense reports. So, observe the content, structure, and details of each template if it matches your needs. A simple pattern can be edited to go according to your preference. And what makes these templates special is you never have to start from scratch. Just complete what is missing to expedite your document.

Step 2: Incorporate the Expense Sheet Elements

You already learned the elements of an expense sheet down from the title to the notes. Be sure to include every factor that is needed in the document. Also, observe a sense of format to every added factor; do not just enumerate. The sheets even have tables, circular Organizational charts, and other visual organizers since these records are not entirely words and numbers alone. Such organizers promote a better arrangement and presentation for the data in the sheet.

Step 3: Correct All Data and Calculations

As you encode all the details like the business name, expense descriptions, and prices of expenses, be sure to review for corrections. Maybe the numbers written for the business report costs did not match the numbers in the receipts. Most importantly, correct the calculations for tax deductibles, subtotal costs, and others. Leading to the wrong answers would automatically err the expense sheet, which is something you must avoid, no matter what.

Step 4: Insert Receipts or Evidence

Keep in mind that sample receipts and other files that justify expense report claims are essential. Otherwise, some people authorized to evaluate the expense sheet would not believe the data. Most companies have strict terms to include receipts and related data to be attached to the expense documents anyway. But it is still a concern to review the receipts attached if those belong to the wrong dates or expenses.

Step 5: Polish the Format and Presentation

Lastly, polish the overall format or presentation. Is every spelling, number, content, and format correct? Change every error. And once you are confident with the document’s outcome, print and submit it. The issue with submitting forms immediately without final touches is when mistakes or missing info are still observed. Of course, incorrect data would make expense sheets invalid—which is bad news for those who wish to get reimbursed by their manager.

FAQs

What are some examples of monthly expenses?

There are yearly, quarterly, weekly expenses, and more. And when you plan on making a monthly expense sheet, common expenses to record would include mortgage, rent, auto insurance, health insurance, and utilities.

What are some tips to keep track of spending?

Aside from noting down the details in the expense sheet, there are other ways to track your spending. You can use expense tracker apps, assign people to review periodic account statements, and prepare an easy spreadsheet.

What are the types of expenses?

Generally, there are four types of expenses. The first two are the variable expenses, which refer to different expenses per month, and fixed expenses, which refer to the same expenses per month. And the others are the intermittent and discretionary or nonessential expenses.

What else is an obvious reason to keep expense records, you might ask? Documentation. The sheet where you write all expense details will serve as a reliable source. Since financial information is already written and organized, there is no need to guess how much certain expenses were. Your records already contain the receipts, dates, covered amount, and so forth. And if you want to make your financial claims credible and valid, start by making a well-drafted expense sheet.