20+ Sample Donation Trackers

-

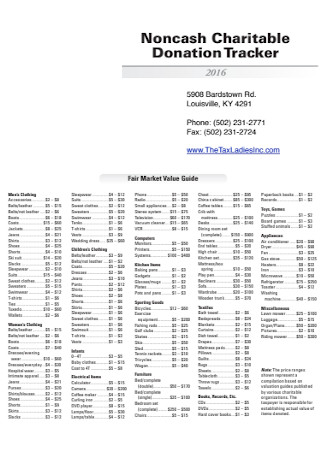

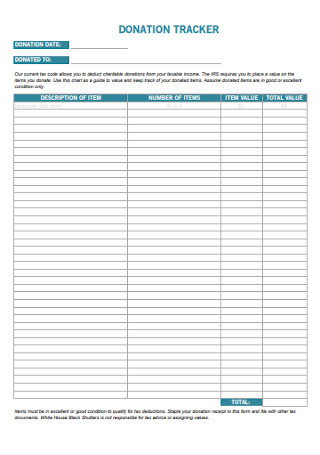

Charitable Donation Tracker

download now -

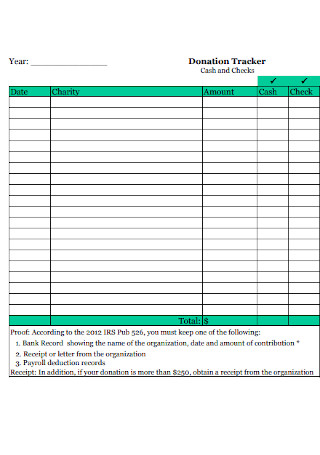

Cash Donation Tracker

download now -

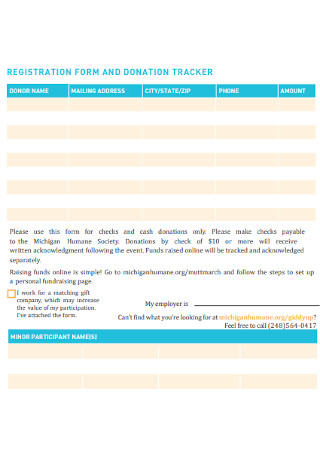

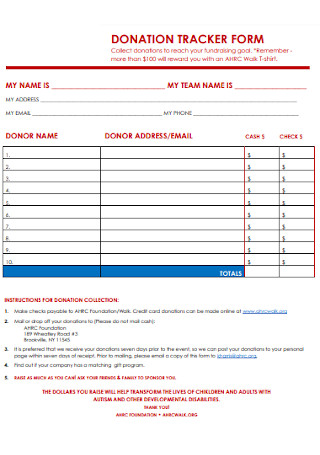

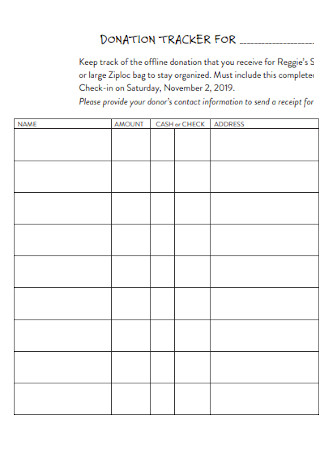

Donation Tracker Form

download now -

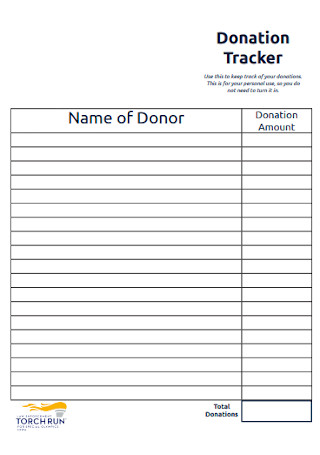

Standard Donation Tracker

download now -

Donation Amount Tracker

download now -

Sample Donation Tracker Form

download now -

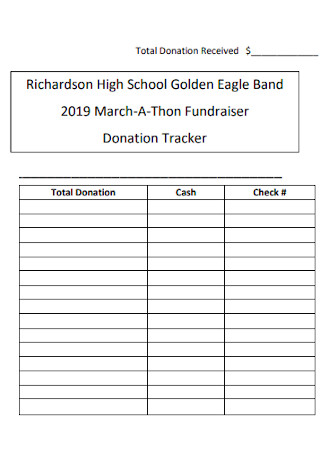

High School Donation Tracker

download now -

Health Foundation Donation Tracker

download now -

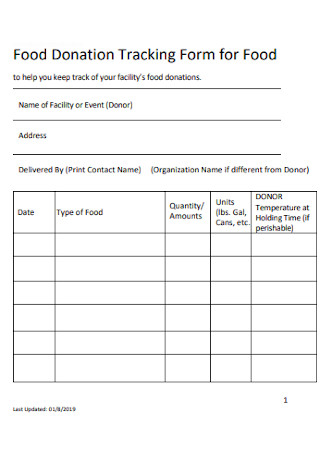

Food Donation Tracking Form

download now -

Blood Bank Donation Tracker

download now -

Basic Donation Tracker

download now -

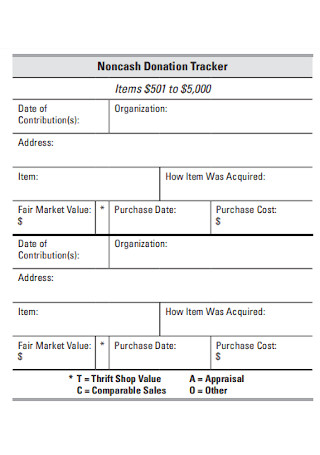

Noncash Donation Tracker

download now -

Charitable Donation Tracker Format

download now -

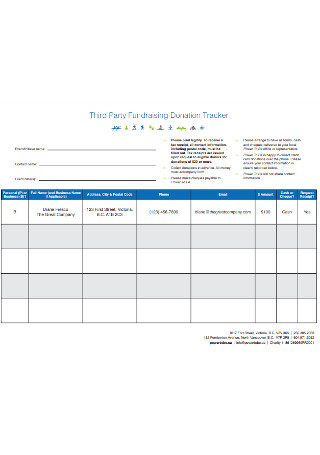

Third Party Donation Tracker

download now -

Simple Donation Tracker

download now -

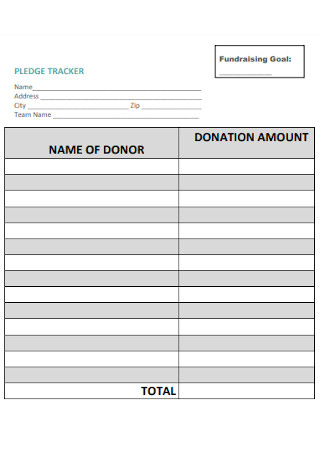

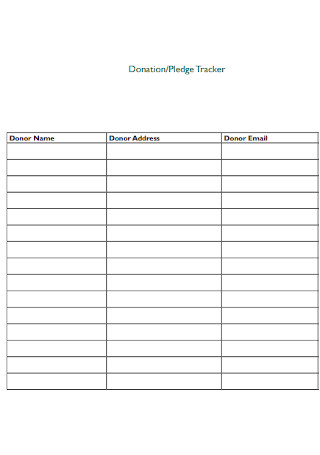

Donation and Pledge Tracker

download now -

Donation Fundraising Tracker

download now -

Sample Donation Tracker Format

download now -

Donation Tracker Receipt

download now -

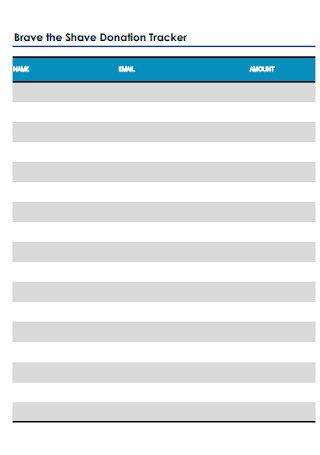

Brave the Shave Donation Receipt

download now -

Sample Donation Tracker Example

download now

FREE Donation Tracker s to Download

20+ Sample Donation Trackers

What Is a Donation Tracker?

What Are The Common Elements of a Donation Tracker?

How to Make a Smart Donation Tracker

FAQs

What is the basic rule in documenting donations?

What are some challenges when it comes to donating?

What are some tips to perfect tracking donations?

What type of donation is difficult to track?

What Is a Donation Tracker?

A donation and fundraiser tracker is a printable or digital tool you use to track funds of a donation. This tracker documents the essential details from who donated, how much was donated, the date of the donation, and so much more. And donation trackers are responsible for monitoring charitable gifts in any fundraising or charitable event. That way, you can really see if the donated funds were actually used as intended or that the right amount was calculated.

Based on a 2017 survey, it was reported that a total of $410.02 billion was collected for charitable purposes.

Also, a 2018 research survey confirmed that in America, there were over $292.09 billion of individual donations made.

Why Is a Donation Tracker Important?

Donation trackers are essential to document for proof. How sure are you that 100% of the money donated for a certain cause actually went to the nonprofit’s intended purpose? Also, how else can you calculate all your charitable contributions daily, weekly, monthly, or yearly? That all leads down to how important a donation tracker is. When you need to trace who the donors were and how much they have contributed, you can see every log about it in the donation tracker spreadsheet.

Moreover, a donation tracker helps you know the donors you can send an acknowledgment for donating, refer to the tax laws involving donations, and even review your whole contribution. And your donation tracker stays reliable if you update the donation tracker’s log sheet regularly. That means you note the details per donation and if there will be changes to the data. Otherwise, your donation tracker would not be of any help if its information is already dated. Hence, treat your donation tracker as your visual reference for all donation-driven data.

What Are The Common Elements of a Donation Tracker?

Every nonprofit’s donation tracker may differ in data, format, and design. But you can expect common elements per tracker as well. To ensure that your donation tracker is informative enough, be sure to include the following elements to it:

How to Make a Smart Donation Tracker

After everything you learned about the donation tracker’s definition, importance, and basic elements, apply your knowledge further in making the donation tracker itself. It will not be a complicated process, for sure, especially when sample templates are part of the picture. So without further ado, here are the steps on how to create a proper donation tracker:

Step 1: Always Store Donation Receipts and Documents for Safekeeping

As you begin to create a donation tracker, always be responsible for keeping donation receipts and other related documents that you would use as a basis on what to write in the tracker. Keep every receipt safe or you might not have enough data or reference on what to add to the tracker. And if you won’t have receipts to keep for long, that is why you should log about all the donation details in the donation tracker so you won’t need to keep such documents forever. Also, keep track of your purpose in making the tracker or its content might end up different from what you expected.

Step 2: Choose a Sample Donation Tracker

The easiest part of the process is you never have to make donation trackers out of scratch. Simply use the sample donation tracker templates listed above this article. Each sample is premade and is acceptable according to business document standards. You can edit the tracker as to however you want it from using a printed paper, a digital copy, or any other format. And the best part is you have many templates to choose from so don’t simply use one example.

Step 3: Personalize the Donation Tracker

Don’t go for the general route on how to make a donation tracker because there is room for personalization too. Customize the tracker by adding visual charts, tables, and other categories. You can even include your nonprofit’s official logo and branding to beautify the form. Keep it creative as long as you can cover the important details in the tracker. Think about how your tracker should look like in the end if it is worth using for the many months or years to come. Go for whatever seems easy to work with if you will be the one who will use it.

Step 4: Complete the Elements of a Donation Tracker

To ensure you got everything covered in your donation tracker, don’t forget to insert the important elements of a donation tracker, as discussed earlier. You must have the title, fundraiser’s information, donor name, amount of donation, and so forth. You can even insert more elements that you think are relevant to your official donation tracker. A tip is to make a checklist of every element you plan to add so that you won’t forget any detail and that some details would not be doubled there.

Step 5: Keep It User-Friendly and Easy to Follow

An easy-to-follow structure marks the best idea to ensure you can keep your tracker as user-friendly as possible. Ensure that you used the appropriate labels per category or that you wrote specific words to lessen confusion in understanding the data. If another person will use the donation tracker, then you have to consider what seems convenient or not for them. You could insert additional instructions to guide them on how to use the tracker. The same goes for ensuring your language is easy to understand for them.

Step 6: Update the Tracker from Time to Time

Once you are happy with how the donation tracker turns out, produce it. But your task doesn’t simply stop there. You still need to continue monitoring the upcoming donations because you will have to write them down in the tracker. Also, take reviews and evaluations in the tracker seriously so that everything you write is actually correct. And if there will be changes or errors in the tracker, correct them immediately. That is how you can keep the tracker as reliable as possible.

FAQs

What is the basic rule in documenting donations?

Keep in mind that the rules for documenting donations, whether it is cash or property, are different. But generally, you can accept cash donations under $250 anytime via check, credit card, or bank. But if the donation surpasses $250 and more, you must send an acknowledgment to the donor already. Documenting serves as proof of the donation.

What are some challenges when it comes to donating?

Although the concept of donating which is to give and share is easy, there are also some challenges in its practice. Some of the challenges are the high donor expectations, funding cuts, competition, lack of resources, distrust of fundraisers, and lack of cause.

What are some tips to perfect tracking donations?

You can ace the practice of tracking donations by following these simple tips:

- Set a clear and realistic fundraising goal, typically a SMART goal.

- Know your donors’ profiles.

- Record every accomplishment or benchmark in the nonprofit.

- Market your cause to the public.

- Continue tracking the fundraising’s progress regularly.

What type of donation is difficult to track?

Monetary donations are the easiest to track. However, donated services, in-kind gifts, and noncash donations are usually hard to track. But even if it is challenging, it doesn’t mean you cannot track it. noncash gifts or donated services still have an estimated value. And that will be what you used to record the amount of the donation.

In 2018 alone, America garnered over $292.09 billion worth of individual donations. So no matter how small or big a charitable donation is, it can always make a difference for the chosen causes when you add up the numbers. And you can’t let any amount go to waste by ensuring you have monitored not only every amount of donation but also the rest of the donation details. Make that plan happen by starting with a quick download from sample donation trackers.