Costco is a membership warehouse club committed to providing its members with the lowest possible pricing on high-quality brand-name goods. With hundreds of locations worldwide, Costco offers a vast…

continue reading

25+ Sample Monthly Expenses

-

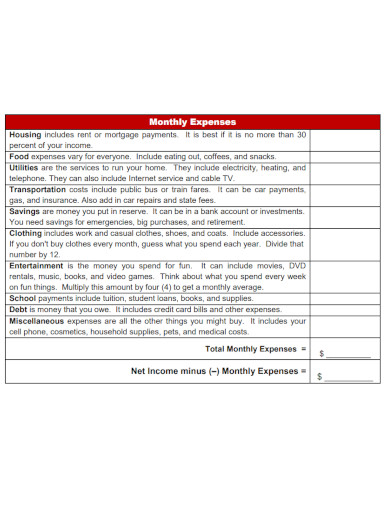

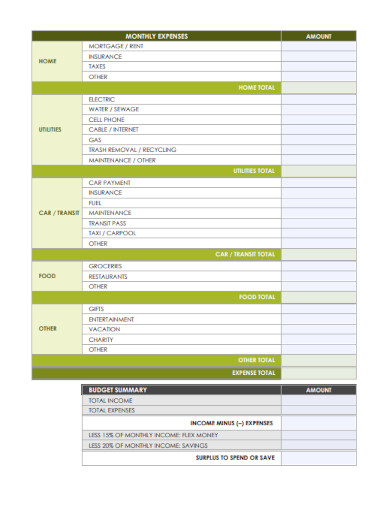

Monthly Expense Sheet

download now -

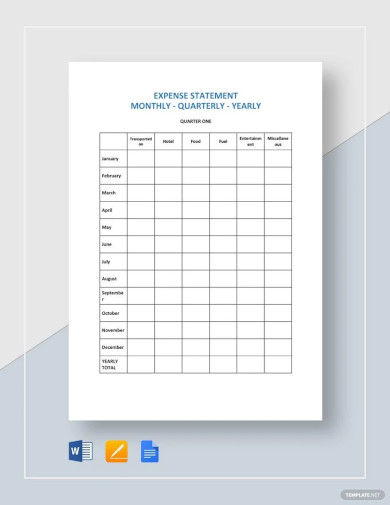

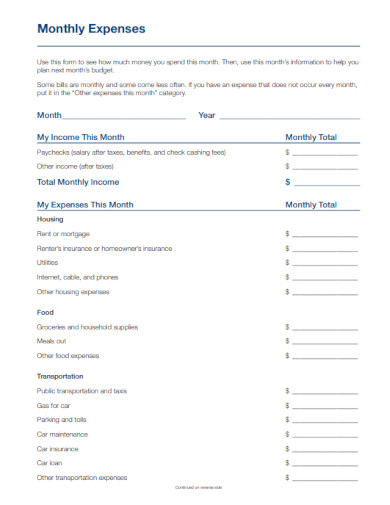

Expense Statement Monthly

download now -

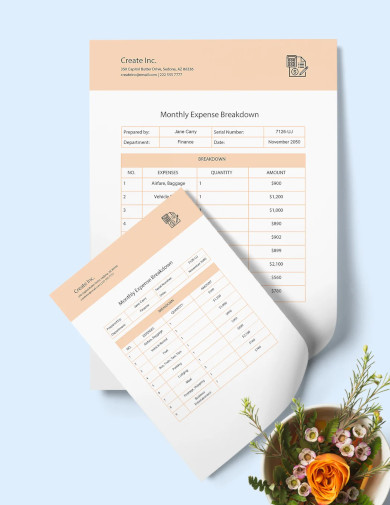

Monthly Expense Breakdown

download now -

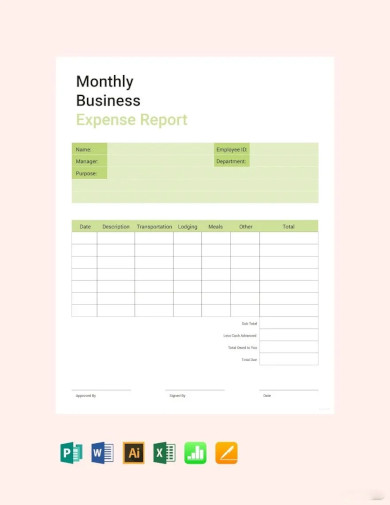

Monthly Business Expense Report

download now -

Simple Monthly Expense Sheet

download now -

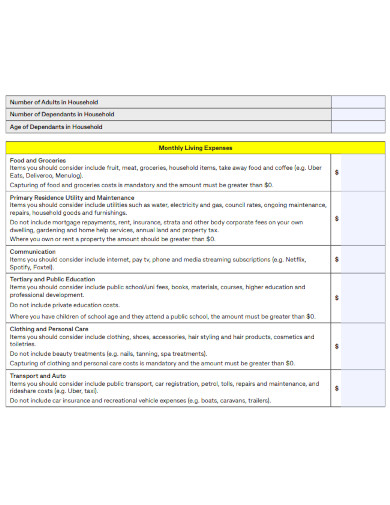

Monthly Living Expenses

download now -

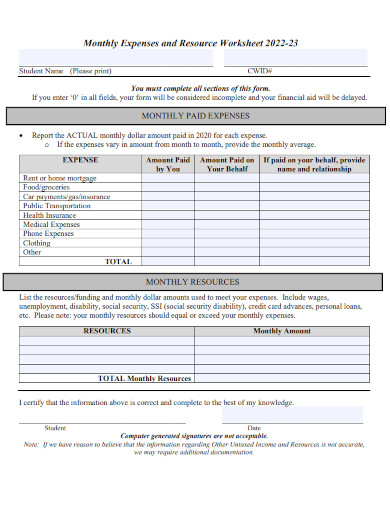

Monthly Expenses and Resource Worksheet

download now -

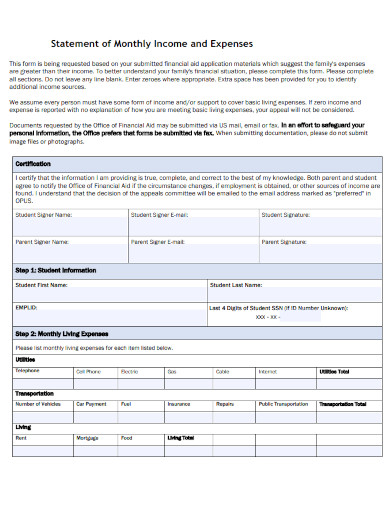

Monthly Income and Expenses

download now -

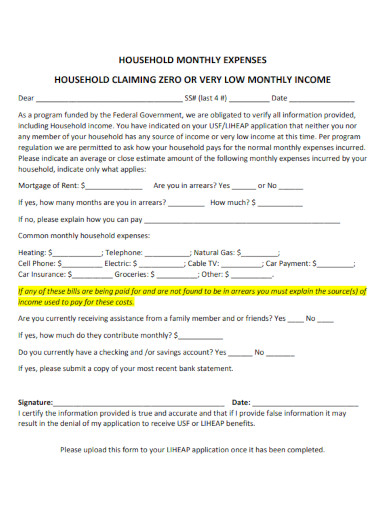

Household Monthly Expenses

download now -

Editable Monthly Expense

download now -

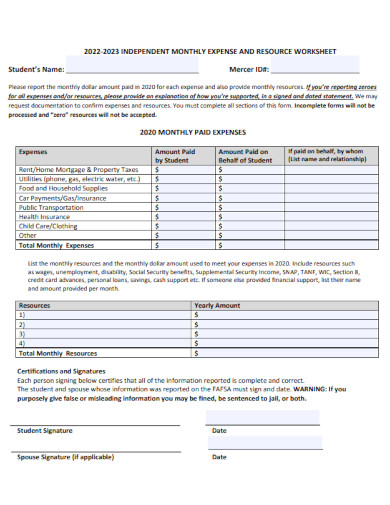

Independent Monthly Expenses

download now -

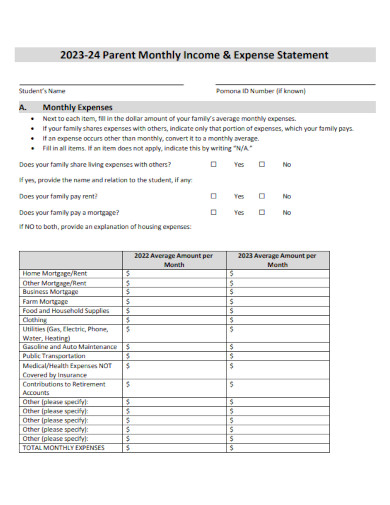

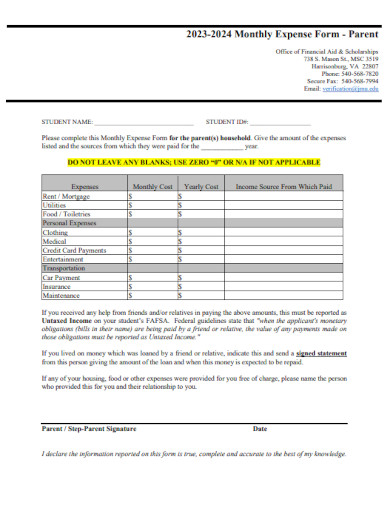

Parent Monthly Expense Statement

download now -

Monthly Expense Example

download now -

Personal Monthly Expense

download now -

Monthly Expenses Budget

download now -

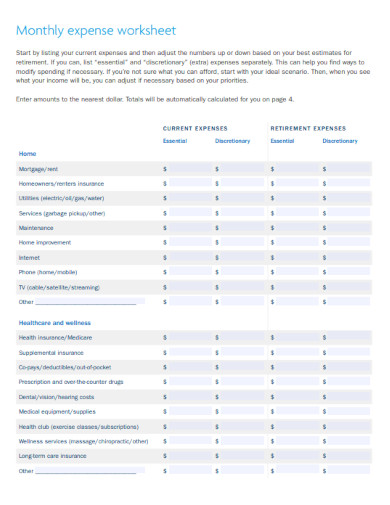

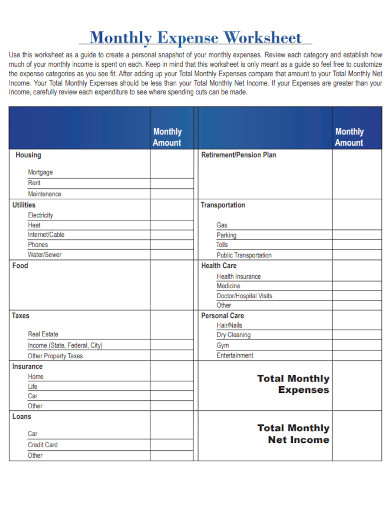

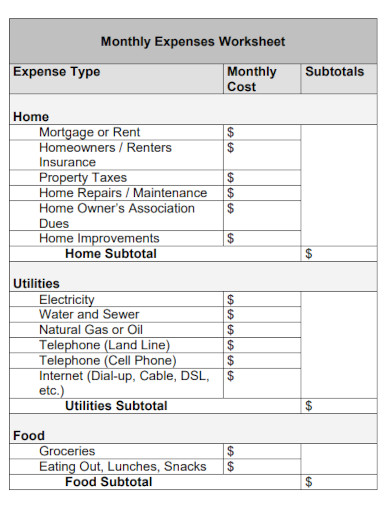

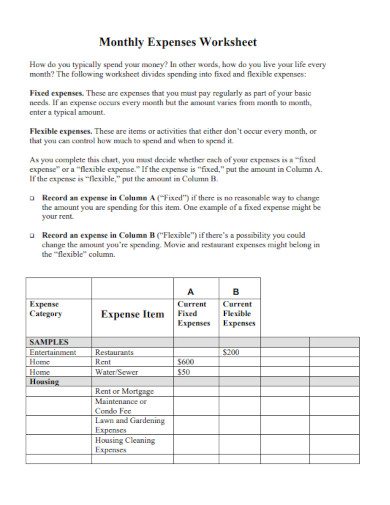

Monthly Expenses Worksheet

download now -

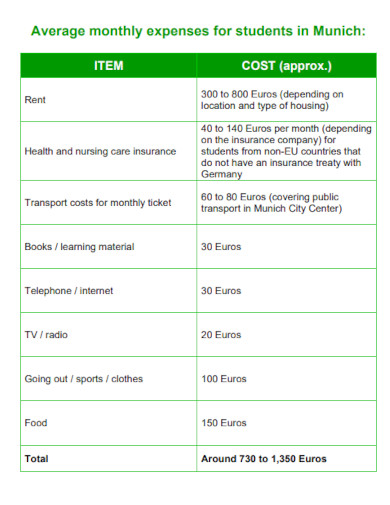

Student Monthly Expenses

download now -

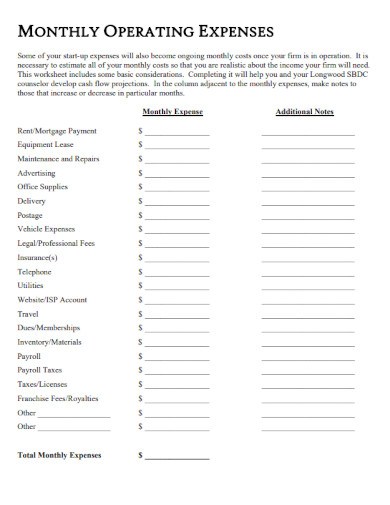

Monthly Operating Expenses

download now -

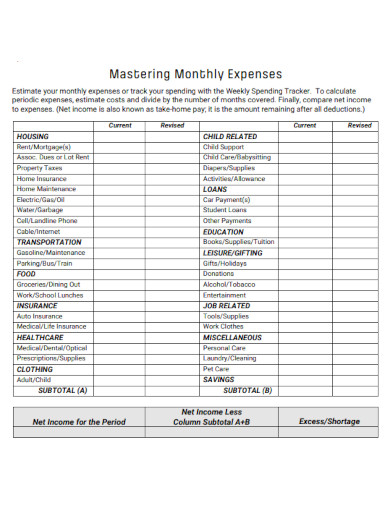

Mastering Monthly Expenses

download now -

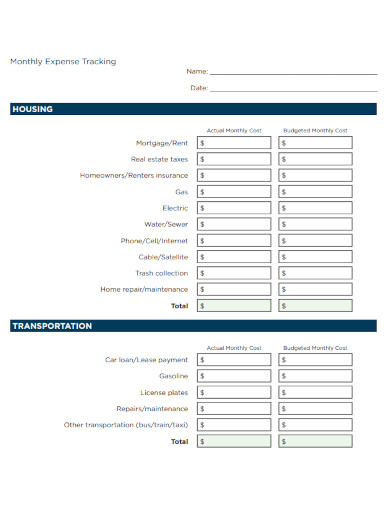

Monthly Expense Tracking

download now -

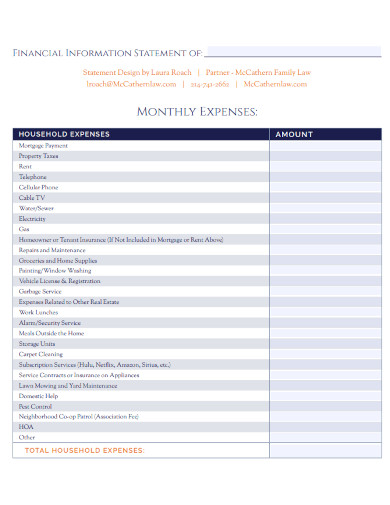

Monthly Financial Expenses

download now -

Monthly Normal Sources Expenses

download now -

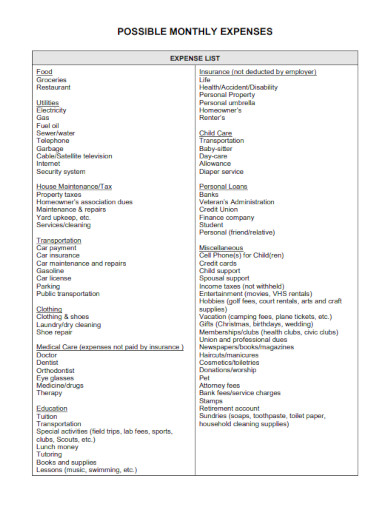

Possible Monthly Expenses

download now -

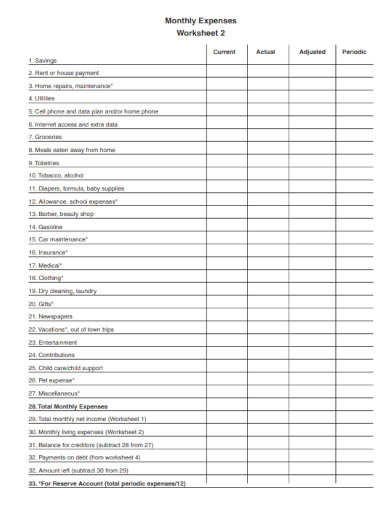

Monthly Spending Expenses

download now -

Monthly Expenses Example

download now -

Monthly Expense Form

download now

What Are Monthly Expenses?

Monthly expenses are the recurring and regular charges that people or households must pay each month to cover various expenses in their lives. These costs, which cover a wide range of mandatory and optional spending, are crucial to managing personal finances. Monthly expenses include rent or mortgage costs, utilities like electricity and water, transit, grocery expenditures, insurance premiums, loan agreements, and other regular charges supporting one’s life level.

Benefits of a Monthly Budget

Budgeting is the most fundamental instrument for managing your finances. Still, most individuals avoid budgeting because it is “extra work.” People frequently believe that budgeting also prohibits having fun and enjoying life. Let me inform you from over a decade of experience with budgeting that this is entirely false; in fact, it has the opposite effect. What budgeting genuinely accomplishes is demonstrating how to allocate funds. It gives you a thorough comprehension of what you can spend your money on and your financial limitations. Budgeting will save you the trouble of overspending, which many of us need help with and may cause us to incur more debt. Below are some of the advantages budgeting can provide.

How to Create a Monthly Expense Budget

A monthly budget can help you track how you spend your money and make future spending decisions. A budget can be simple or complex but always begins with income and expenditures. Once you understand how your money is being spent, you can determine if you want to increase or decrease your income or spending. A budget begins with a comprehension of past income and expenditures. Once you observe the monthly patterns of your spending, you can begin to foretell and alter your spending habits. This procedure has been divided into six steps:

1. Calculate Your Monthly Income

Before deciding how much money is available for expenses, you must determine your monthly income. If you receive a single payment each month, you need only examine the check or direct deposit you receive to ensure that it is identical each month. If you receive multiple paychecks each month, add them up and verify that the sum is the same from month to month. If your salaries fluctuate or you do not receive a fixed income, you can determine an average by averaging your payments over several months. Add the income from at least three months and divide by the months you examined. When creating a monthly budget, consider your average earnings for various times of the year if your income fluctuates due to seasonal employment.

2. Document all of your expenditures

Now that you have chosen your monthly income, you must decide on your monthly expenditures. This is easily accomplished by reviewing your bank statements or receipts, depending on how you typically pay for items. Start with monthly expenses that remain constant. These fixed expenses include rent or mortgage costs, monthly subscriptions, and insurance receipts. Examine multiple months to ensure that you notice all regular prices. You must identify your variable costs once you have accounted for all your fixed expenses. These costs will vary monthly and may include your utility and grocery bills. Some individuals divide these costs into categories, such as food, entertainment, and health care proposals. Others may monitor everything that enters and exits their account. After identifying your expenses, determine the monthly average for your variable costs.

3. Determine a Mean for Variable Expenses

Sometimes, monthly expenses fluctuate. An annual subscription, for instance, is charged annually rather than monthly. Gas is another example of a variable cost. The amount you spend on petroleum will depend on how much you move and the price per gallon when you fill up. To account for this in your budget, examine the average of several months. If you want to know how much you spend on foodstuffs each month, add up all of your grocery receipts or records and divide that total by the number of months you examined. If you want to determine how much you spend on varying monthly costs, you would add up all of your expenses, then divide by the number of months.

4. Check Your Calendar

Examine your upcoming calendar once you have compiled a list of your monthly expenses. You can set aside funds if you anticipate an event or birthday shortly. Consider how the season may affect your variable costs. For instance, if you expect cold weather in the following month and will require a new parka, you may want to include this expense in your budget early in the month so you have the funds to purchase it when you need it.

5. Include All Anticipated Income and Expenditures for the Month

After accumulating your expected monthly expenses and revenues, record them all in one location. You could use a printable template, a spreadsheet on your computer, or a mobile application. Some individuals list their income first, followed by their expenses, while others may list in alphabetical order. You have many options for this phase, so choose something simple.

6. Make Adjustments if Necessary

Now that everything is consolidated, you can assess your monthly income and expenses. If your costs exceed your income, you will have to make adjustments to your budget. If you earn more than you spend, you can maintain your current budget or consider storing some of your earnings in an emergency fund or retirement budget. You may be surprised by how quickly minor expenses add up over the month; therefore, this is an excellent time to consider modifying some of your spending habits. To reduce your expenditures, you may start with non-essential costs, such as dining at a fancy restaurant or a monthly subscription to a service you no longer use. Increase your monthly income by taking on a secondary job or negotiating a pay increase. Determine the changes you wish to make and revise your budget.

FAQs

What is the meaning of expenses in life?

Living expenses are expenditures required for basic daily living and excellent health maintenance. The primary categories are housing, food, clothing, healthcare, and transportation. Understanding what each of these areas entails will help you budget for them.

What is income and expense?

Revenue is the money you earn, while expense is the money you expend. This lesson will teach you about your income and fees and how to create an action plan to save money.

What are the expenses and costs?

Costs and expenses are similar concepts, sometimes used interchangeably, but businesses must be aware of their distinctions. A cost typically refers to the amount paid to acquire an asset. In contrast, an expense is a recurring cost, such as an employee’s salary or the rent on a commercial location.

Understanding where your monthly expense income goes can improve every aspect of your life. By adhering to a budget, it is possible to save money for the future or an unexpected expense. After establishing and sticking to a budget, you can rest more knowing you have sufficient funds to cover your living expenses. You might even discover you have room to save for a vacation or a significant purchase. However, the most essential reason to calculate a budget is to ensure your money is spent on things you value.