Credit Card Authorization Form

-

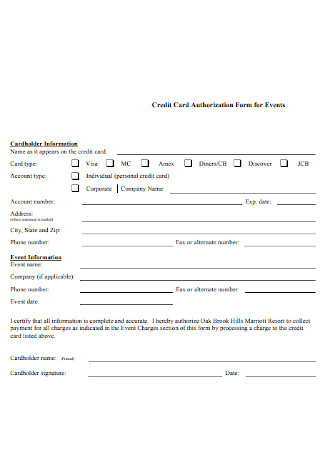

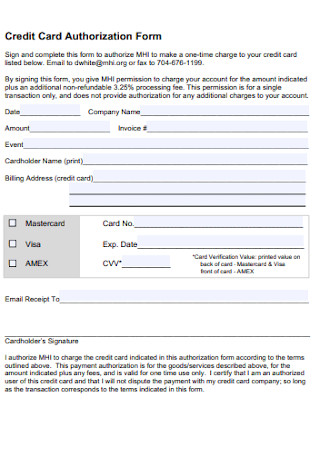

Credit Card Authorization Form for Events

download now -

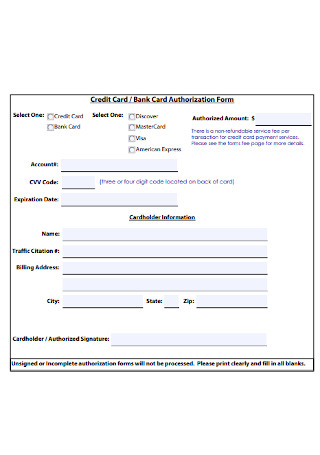

Credit Card and Bank Card Authorization Form

download now -

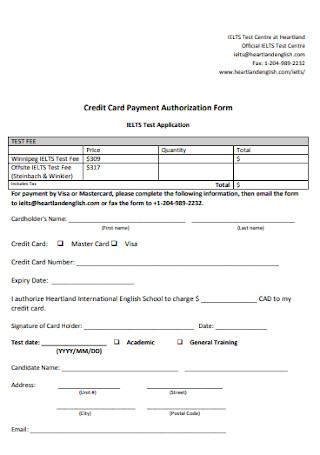

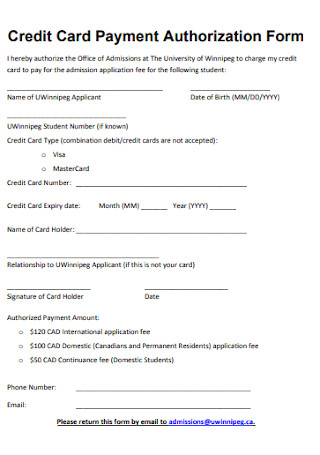

Credit Card Payment Authorization Form

download now -

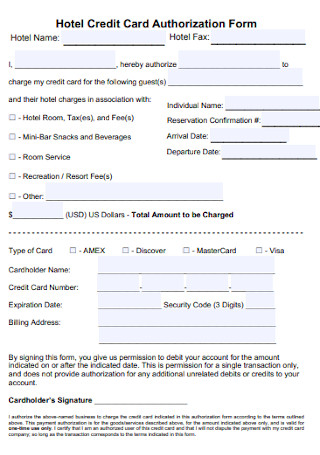

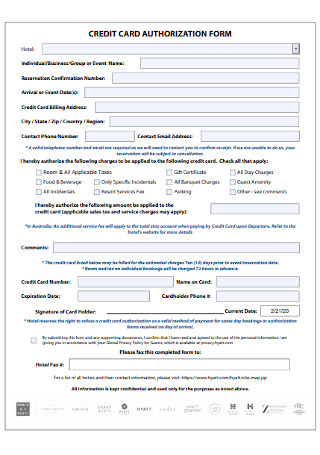

Hotel Credit Card Authorization Form

download now -

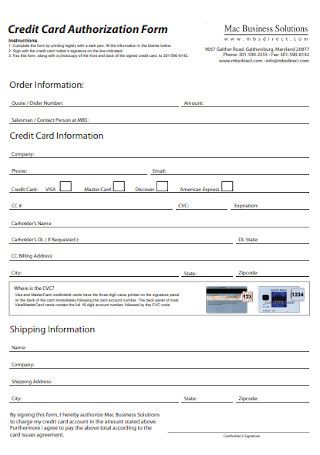

Buainess Credit Card Authorization Form

download now -

Sample Credit Card Authorization Form Template

download now -

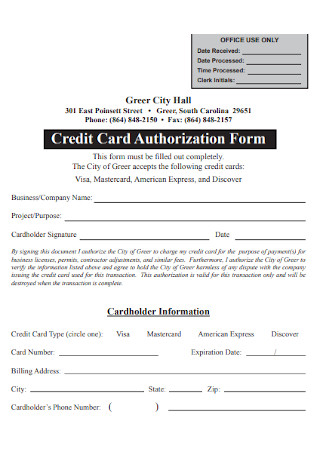

Credit Card Office Authorization Form

download now -

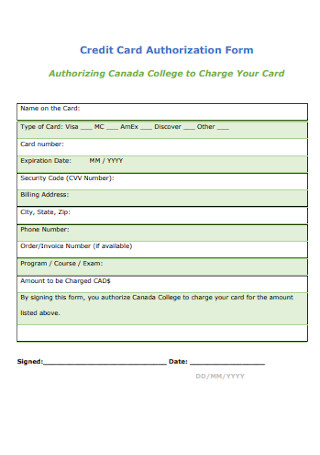

Credit Card College Authorization Form

download now -

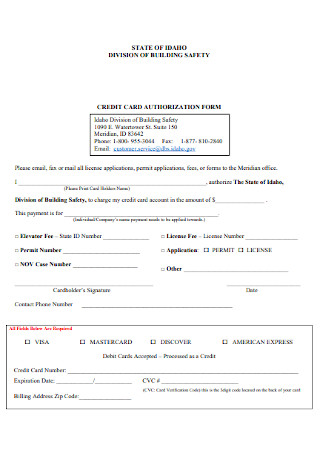

Credit Card Safety Authorization Form

download now -

Simple Credit Card Authorization Form

download now -

Sample Credit Card Payment Authorization Form

download now -

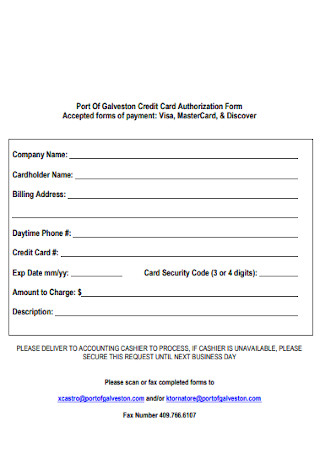

Port Of Company Credit Card Authorization Form

download now -

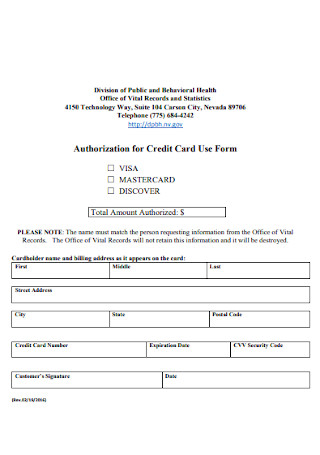

Authorization for Credit Card Use Form Template

download now -

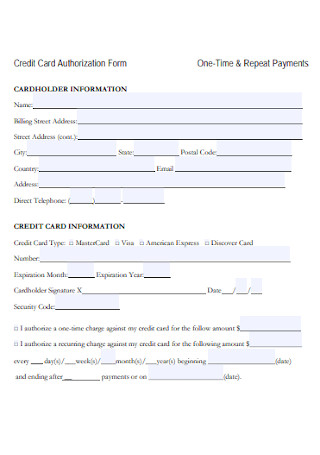

Credit Card Repeat Payments Authorization Form

download now -

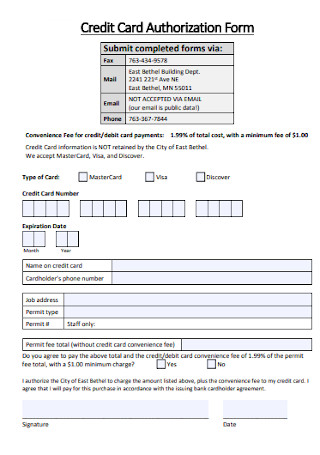

Credit Card Community Development Authorization Form

download now -

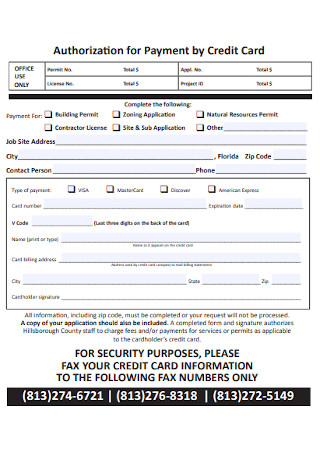

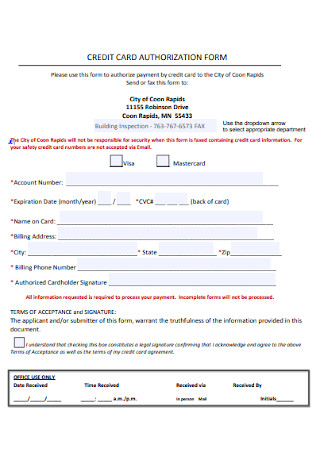

Authorization for Payment by Credit Card

download now -

Basic Credit Card Authorization Form Template

download now -

Sample Office Credit Card Authorization Letter

download now -

Credit Card Company Authorization Form

download now -

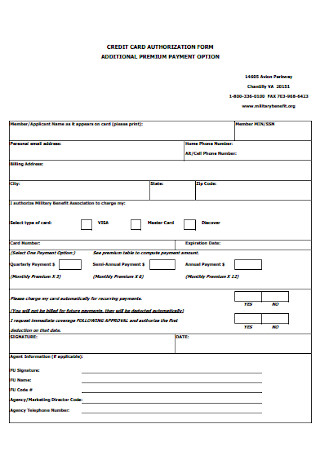

Additional Premium Credit Card Payment Authorization Form

download now -

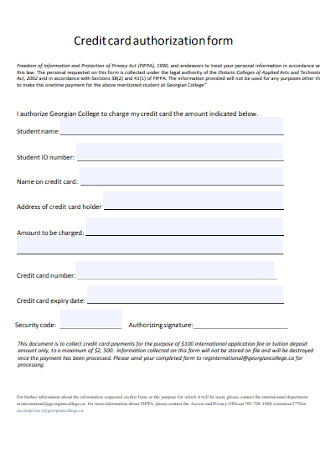

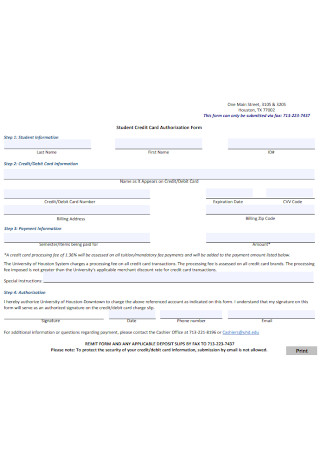

Student Credit Card Authorization Form

download now -

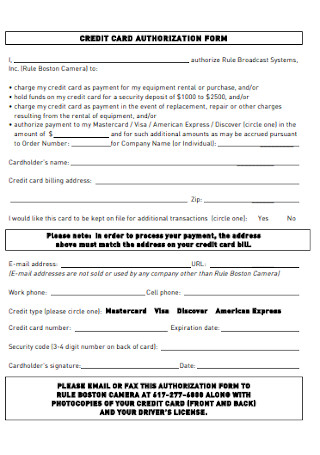

Standard Credit Card Authorization Form

download now -

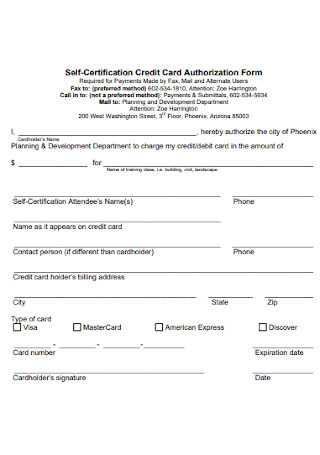

Self-Certification Credit Card Authorization Form

download now -

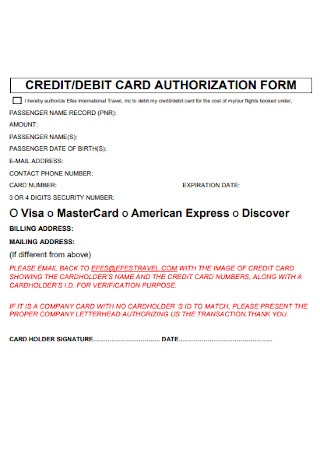

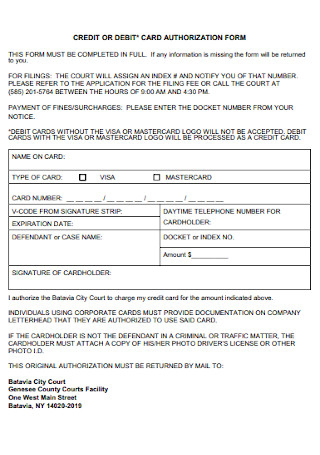

Credit and Debit Card Authorization Form

download now -

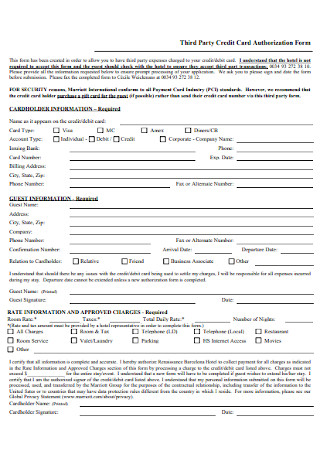

Third Party Credit Card Authorization Form

download now -

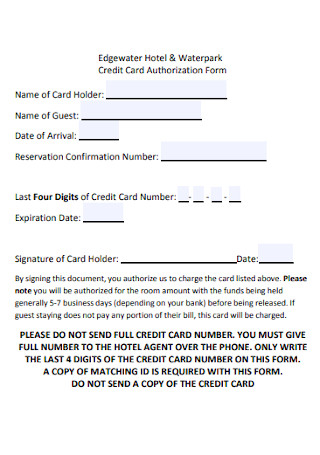

Waterpark Credit Card Authorization Form

download now -

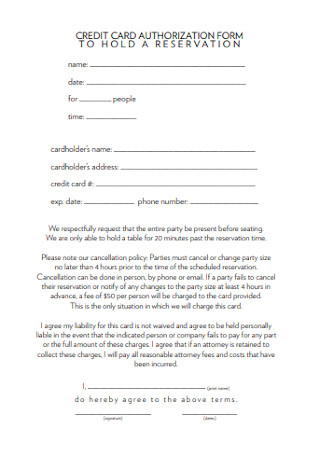

Credit Card Authorization Form to Hold a Reservation Template

download now -

Sample Credit and Debit Card Authorization Form

download now -

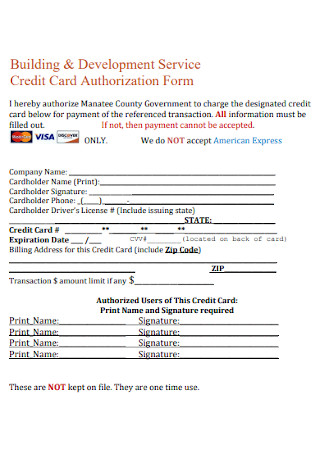

Credit Card Development Service Authorization Form

download now -

Membership Credit Card Authorization Form

download now -

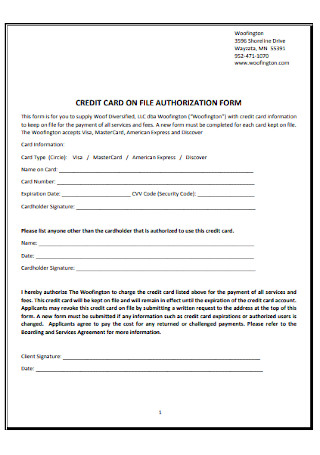

Credit Card on FIle Authorization Form

download now -

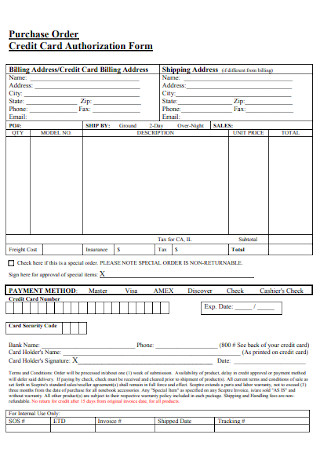

Purchase Order Credit Card Authorization Form

download now -

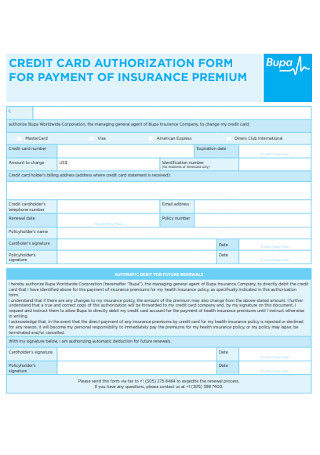

Credit Card Insurance Premium Authorization Form

download now -

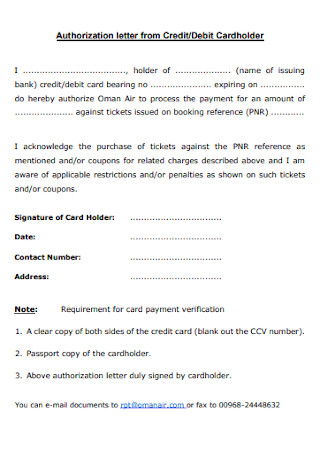

Authorization Letter from Credit and Debit Cardholder

download now -

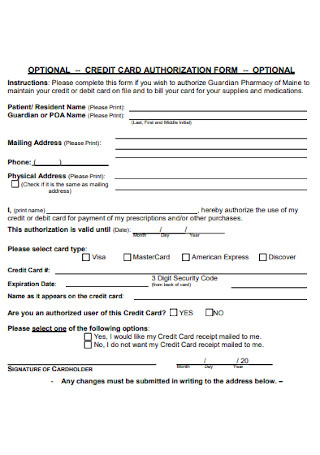

Sample Optional Credit Card Authorization Form

download now -

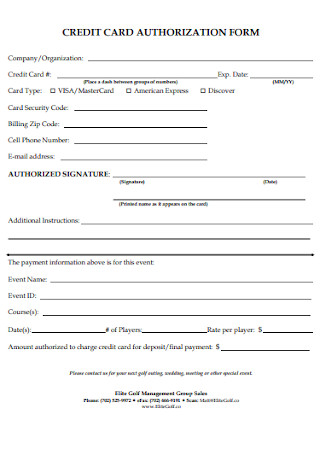

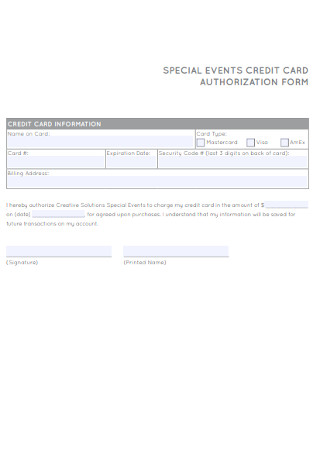

Special Event Credit Card Authorization Form

download now -

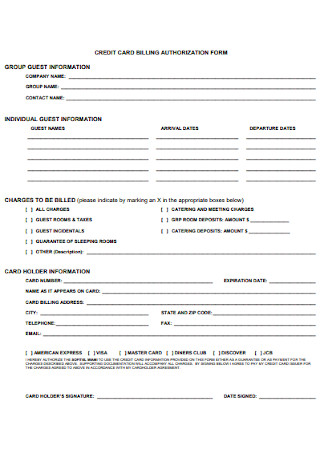

Credit Card Billing Authorization Form

download now -

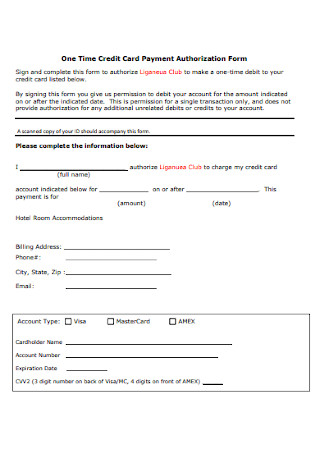

One Time Credit Card Payment Authorization Form

download now -

Credit Card Holder Authorization Form

download now -

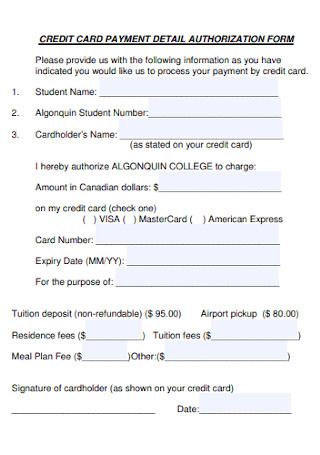

Credit Card Payment Detail Authorization Form

download now -

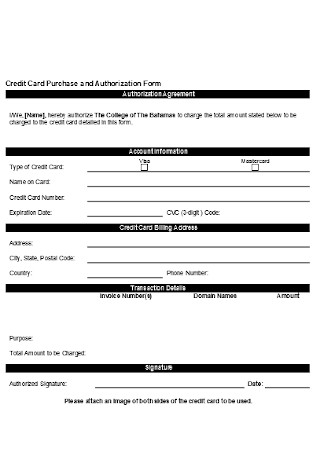

Credit Card Purchase and Authorization Form

download now -

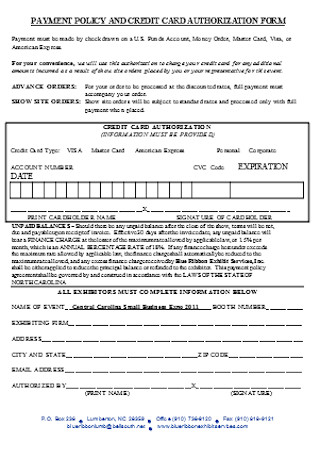

Payment Policy and Credit Card Authorization Form

download now -

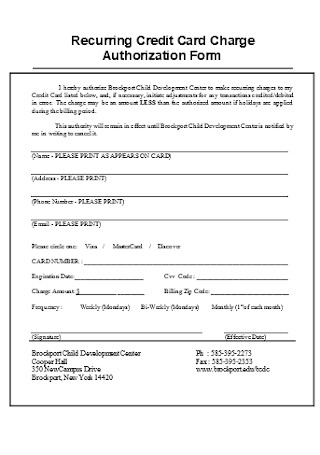

Recurring Credit Card Charge Authorization Form

download now -

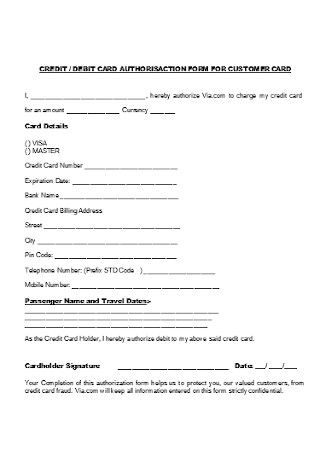

Credit Card Authorization Form for Customer Card Template

download now -

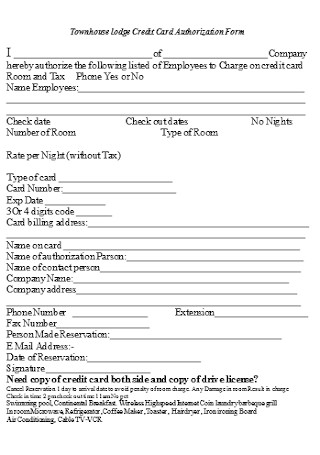

Townhouse lodge Credit Card Authorization Form

download now

FREE Credit Card Authorization Form s to Download

Credit Card Authorization Form

What Is a Credit Card Authorization Form?

Benefits of Using Credit Card Authorization Forms

How To Accept Payment Using a Credit Card Authorization Form

FAQs

What does it mean when a person has a Card on File?

What is payment authorization?

How long should I store signed credit card authorization forms?

What is a third-party credit card authorization form?

Is it safe to email a credit card authorization form?

What Is a Credit Card Authorization Form?

A credit card authorization form can be considered as a substitute for an actual credit card. Let’s say a customer forgets to bring his credit card and he does not have the cash on hand to pay for the service or item, you can hand him a credit card authorization form instead of declining him service which is bad for business. Another example, in the case of customers for a subscription or membership, they need to regularly pay the subscription fee or membership fee on an ongoing basis. Instead of asking for their credit card every time you need to collect a payment, you can have them sign a credit card authorization form instead. Having the form in your possession means, you have an ongoing authority to charge the account of the cardholder on a recurring basis, whether it’s a daily, weekly, monthly, or quarterly basis. This makes the payment process easier and more efficient for both the merchant and the customer.

Benefits of Using Credit Card Authorization Forms

A credit card authorization form is commonly used when a client or customer cannot show a physical copy of his payment card at the time of the transaction. To mitigate the risk, the merchant has to require the customer to sign the form in order to secure payment. There are some benefits for adopting credit card authorization forms in your business, as follows:

1. It’s Efficient

Especially for those transactions that need recurring payments like gym memberships or sports illustrated magazine subscriptions. Instead of having a customer complete and fill out multiple forms each time the period payment is to be made, you can just use the credit card authorization form and automatically bill his credit card whenever his payment is due. You can indicate in the form the schedules when you make a charge in his account for transparency.

2. It Builds Customer Trust

If you successfully handle the transaction and everything goes smoothly, you will earn your customer’s trust. Think about it, the credit card information is sensitive data. A customer has entrusted you with this information knowing that it is safe in your hands. Once you acquired this information, you need to protect it and store it in a safe place. The law requires you to keep the data safe at all times, and when no longer in use you must discard the data.

3. It Encourages Transaction

Instead of declining a sale with a potential customer due to forgetting to bring cash or his physical credit card, just ask him to fill out a credit card authorization form to secure the payment of the transaction. As mentioned, the form is a great substitute for a credit card.

How To Accept Payment Using a Credit Card Authorization Form

Working in front of the register, you have probably come across a situation where a buyer forgot his wallet and is asking you if there is any way he can pay for the services. He is a regular customer and you see him almost every day. You ask your manager for advice and he hands you a form called credit card authorization form. From there you have to figure out the rest. Below are some steps you can follow on how to accept payment using a credit card authorization form.

Step 1: Ask for the Cardholder’s Credit Card Information

The does not have his card on hand, ask him if he remembers his credit card details. The details are as follows; card type (MasterCard, Visa, Discover, American Express, others), cardholder name, card number, and expiration date (mm/yy). You can try and call the bank to confirm the details given by the customer. In addition, ask him for an identification card such as his business card, driver’s license, social security number, or any government-issued ID.

Step 2: Confirm the Billing Address

Do not confuse a billing address with a mailing address. Although some people have the same billing and mailing address, the two are quite different. The billing address is the address where the bank who issued your credit card sends you your bank statement. The billing address should, at all times, match the address your credit card issuer bank has on file. Make sure the customer provides you with the correct billing address connected with his credit card account so there will not be any problem during the release of payment.

Step 3: Include a Statement Authorizing You to Charge the Client’s Card

The credit card authorization form should provide a clear statement of authorization. The form works much like a power of attorney, the customer is giving the merchant the power to use his credit card details, store it for a reasonable amount of time, and bill his account for any services he has acquired. The authorization statement should sound like this, “I (provide a blank for cardholders name) authorize (the name of your store, restaurant, or hotel) to process and bill my credit card account in the amount of $ (the price of the service or product).”

Step 4: Have the cardholder sign the authorization form

Lastly, make sure the customer or client signs the credit card authorization form. Ask him to include or write down the date next to his signature. It is standard in contracts such as authorization forms, that in order to be valid it must be signed and dated accordingly. Further, check his signature and compare it to the signature found on the identification card he had provided. Make sure it is the same signature.

FAQs

What does it mean when a person has a Card on File?

The term is associated when a customer or client pays your services using his debit or credit card. A Card on File transaction is an arrangement where the cardholder authorizes a merchant store or service provider to temporarily store and save his credit or debit card details. Later on, the cardholder may or may not authorize the merchant to bill his account for services he has obtained from the merchant store or service provider. Other times, both parties may agree on a payment scheme that bills the cardholder’s account on a recurring basis, such as daily, weekly or monthly payments billed to his credit or debit account.

What is payment authorization?

In the event that a customer uses his debit or credit card or any cashless mode of payment, it typically means you will receive the payment from the customer’s bank. Once the customer signifies his intention to pay via card, you will need to ask him to sign the receipt as confirmation and that will serve as a payment authorization. However, there are some instances such as wherein it is the bank that has to give the payment authorization. Before you can receive payment, the bank has to release the funds. A credit card processor has to run through the bank’s records to determine the card has sufficient funds to cover the cost of the transaction. Once done, the bank will give the signal and release the funds.

How long should I store signed credit card authorization forms?

According to the Payment Card Industry’s reference guide in line with Security Standard Council compliance standards, merchants and business establishments that accept and process payment using credit or debit card information should restrict actress to the cardholder’s data at all times. Although there is no law that exists that makes it illegal for businesses to keep their customer’s credit card information on file, it is strongly advised that you discard the information once the transaction with the customer or client has ended. The longer you retain the credit information on file, the more likely the information is susceptible to breach. Once the information is leaked, you may be held liable for a data breach.

What is a third-party credit card authorization form?

Third-party credit card authorization forms are predominantly utilized by hotels, resorts, and the likes. The form allows third parties to bill your credit card. In this arrangement, the cardholder does not need to be physically present and sign anything before you can bill his credit account.

Is it safe to email a credit card authorization form?

It is highly advised that you should never send you credit card details over mail unless it is reliably secured. The rule is also applicable to other sensitive information such as your bank account number, social security number, and even your driver’s license. These situations make it easy to do away with identity theft. If you have sent you credit information through email, make sure you notify the bank and have them monitor your account for suspicious transactions or activities.

Some successful businesses offer a flexible payment plan to their regular customers to encourage them from coming back. This builds trust and confidence between the merchant and his client. One form of flexible payment plan is the use of credit card authorization forms. The customer need not have to be physically present and give his credit card to swipe, instead, he can just give out his credit card information to the merchant and the latter will keep a tab of his purchases. His final billing will be tabulated once the transaction has come to an end. Our printable blank credit card authorization form template makes it easier for you and your business. You can use our downloadable credit card authorization forms above and start using one now.