50+ Samples of Durable Power of Attorney Templates

-

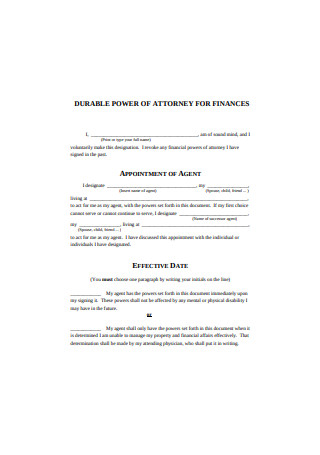

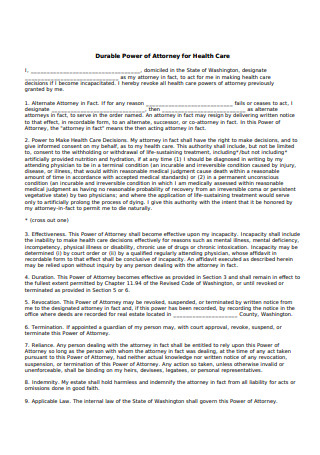

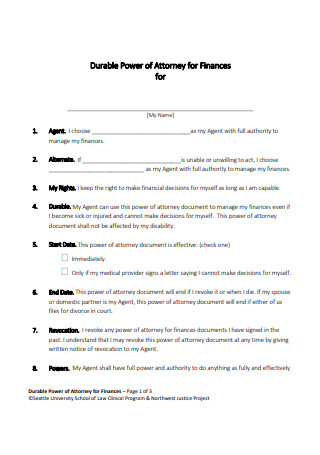

Durable Power of Attorney

-

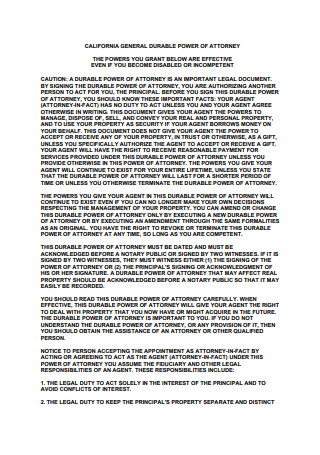

General Durable Power of Attorney

-

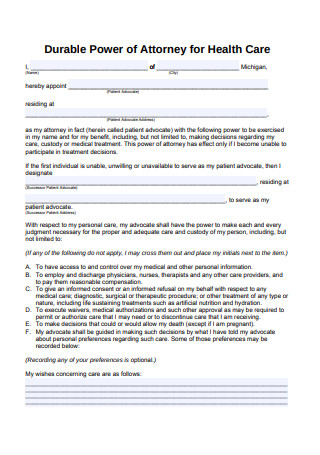

Durable Power of Attorney for Health Care

-

Sample Durable Power of Attorney

-

Durable Power of Attorney for Healthcare Statutory Form

-

Power of Attorney Individual Agent and Durable

-

Statutory Durable Power of Attorney Form

-

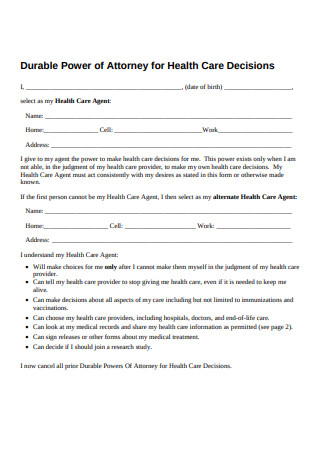

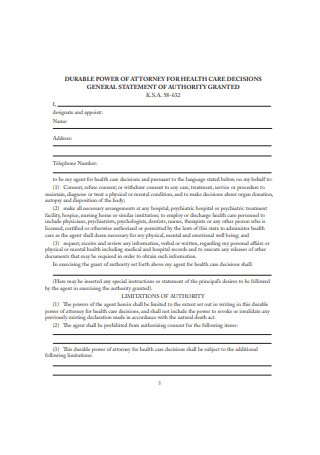

Durable Power of Attorney for Health Care Decisions

-

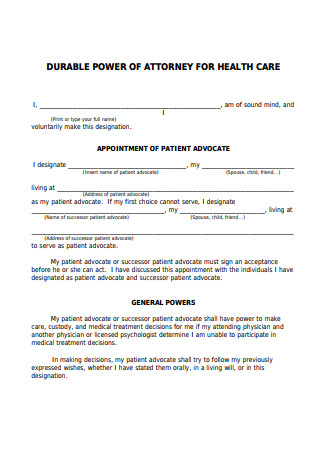

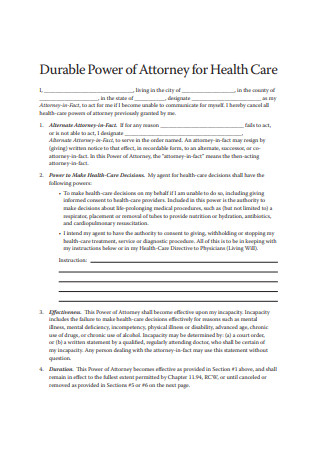

Sample Durable Power of Attorney for Health Care

-

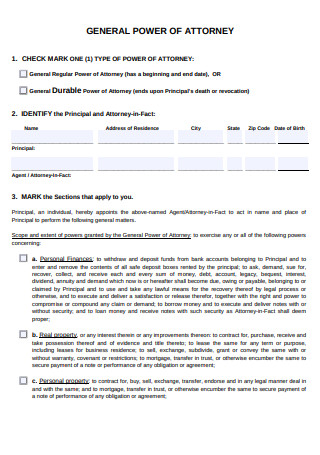

General Power of Attorney

-

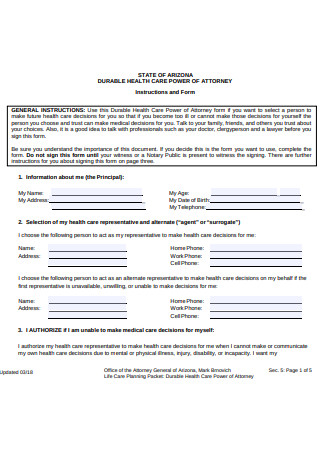

Arizona Durable Health Care Power of Attorney

-

Durable Power of Attorney for Patient Health Care

-

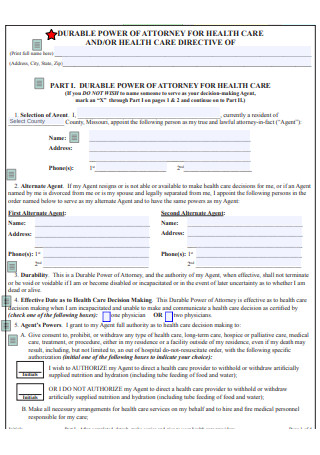

Durable Power of Attorney for Health Care and or Health Care Directive

-

Durable Power of Attorney Documents

-

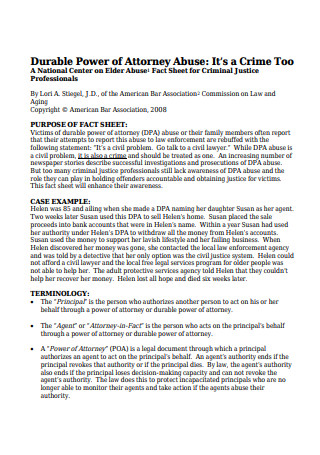

Durable Power of Attorney Abuse

-

Sample General Durable Power of Attorney

-

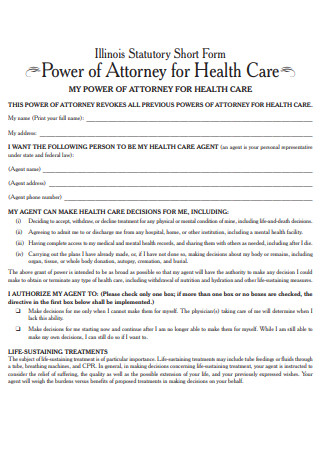

Power of Attorney for Health Care

-

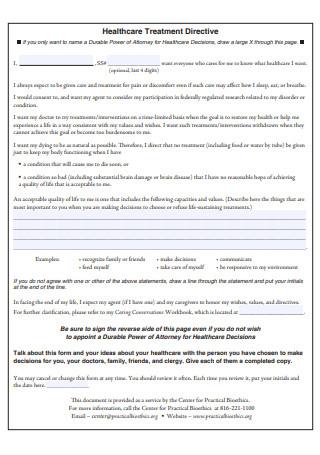

Power of Attorney Healthcare Treatment Directive

-

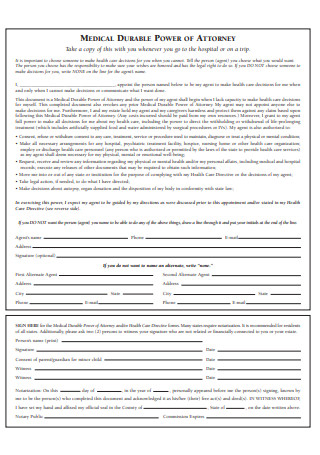

Medical Power of Attorney

-

Basic Durable Power Of Attorney

-

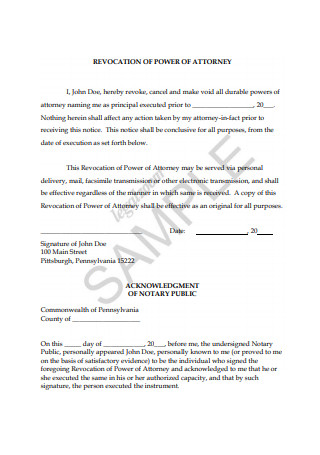

Revocation of Durable Power Of Attorney

-

Basic Durable Power of Attorney for Health Care

-

Durable Power of Attorney and Authority to Access Health

-

Agents Under a Power of Attorney

-

Agents Statutory Power of Attorney

-

Durable Statutory Short Form Power of Attorney

-

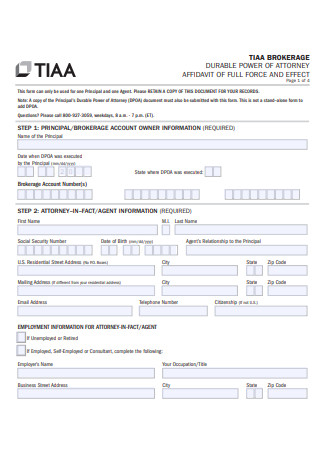

Brokerage Durable Power Of Attorney

-

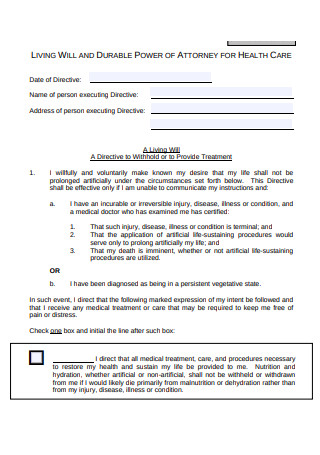

Living Will and Durable Power Attorney for Health Care

-

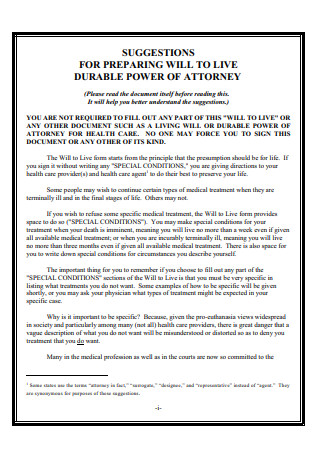

Preparing Live Durable Power Attorney

-

Health Care Power of Attorney

-

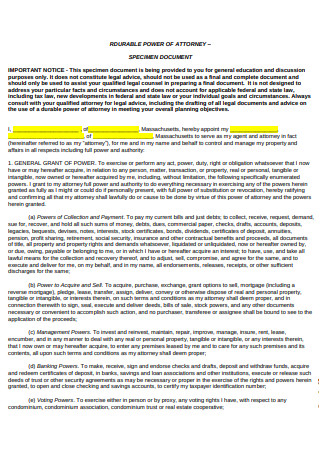

Durable Power of Attorney and Specimen Document

-

Sample Living Will and Durable Power of Attorney for Health Care

-

Fact Sheet Durable Power of Attorney for Health Care

-

Durable Power Attorney for Health Care Agent

-

Durable Power of Attorney forms

-

Durable Power of Attorney for Health Care Decisions and General Statement

-

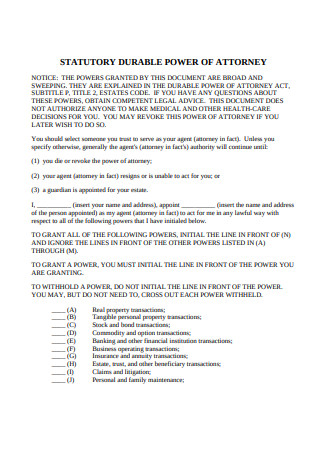

Statutory Durable Power of Attorney

-

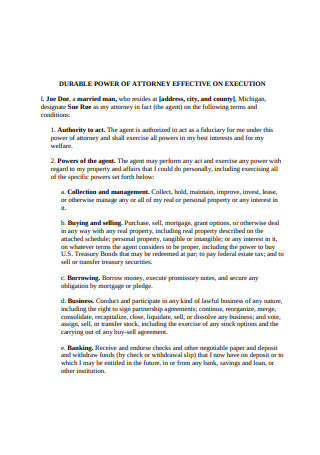

Durable Power of Attorney Effective on Execution

-

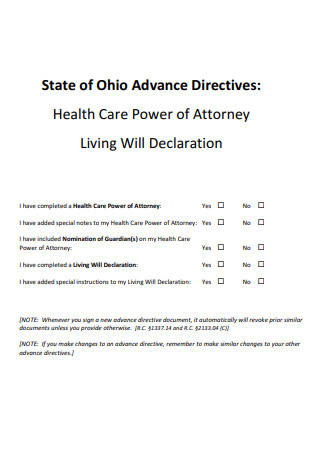

Health Care Power of Attorney Living Will Declaration

-

Securities of Durable Power of Attorney

-

General Statement of Durable Power of Attorney

-

Florida Durable Power of Attorney

-

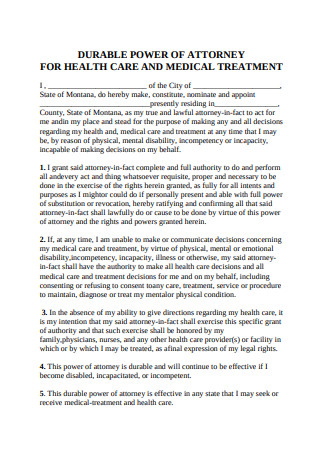

Durable Power of Attorney for Health Care and Medical Treatment

-

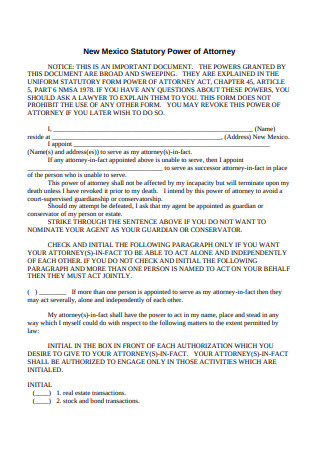

New Mexico Statutory Power of Attorney

-

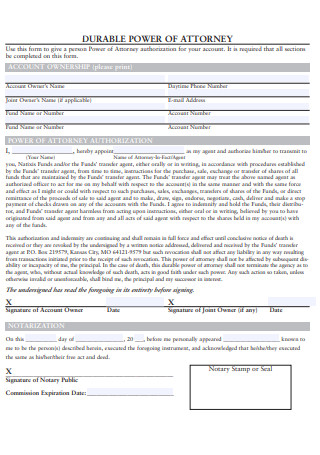

Durable Power of Attorney Authorization

-

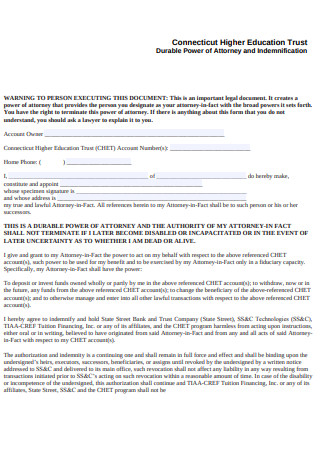

Connecticut Higher Education Trust Durable Power of Attorney

-

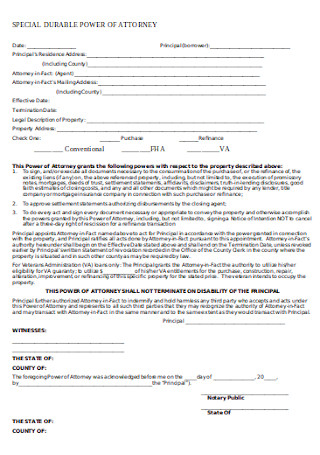

Special Durable Power of Attorney

-

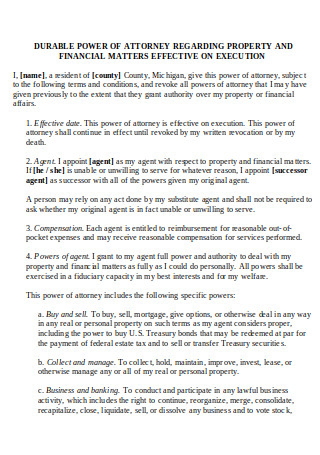

Durable Power of Attorney for Property

-

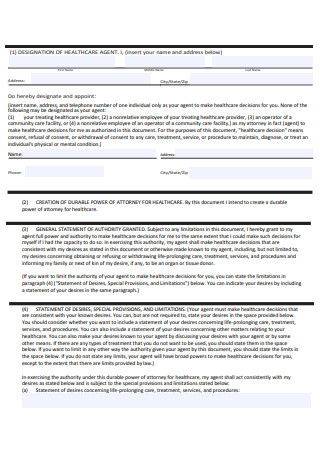

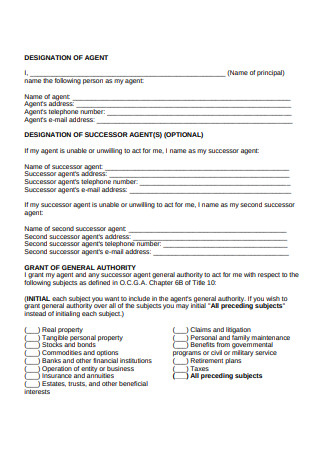

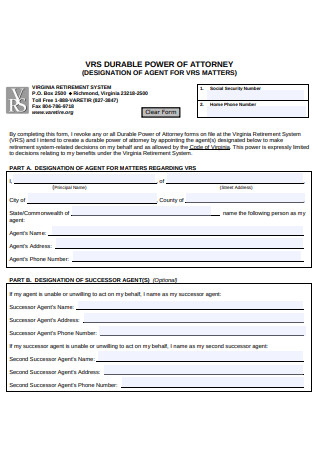

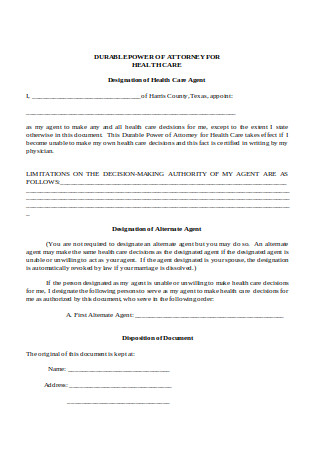

Power of Attorney Designation of Health Care Agent

-

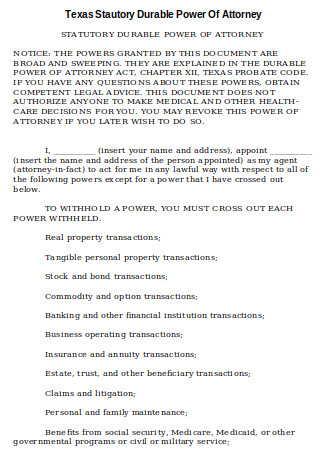

Texas Statutory Durable Power of Attorney

-

Durable Power of Attorney Format

What Is a Durable Power of Attorney?

To define what a durable power of attorney is, attention must first be paid to the basic definition of a power of attorney. This is, after all, the legal document that is capable of providing an individual of your choice with the power to act on your behalf. By saying that a power of attorney is ‘durable,’ you only refer to those documents that continue to stay in effect even after you have been incapacitated and completely unable to take matters into your own hands. The person assigned to act for you can be anybody that you deem competent and trustworthy enough to handle your affairs. It could be someone from your family, an old friend, your spouse, or even any of your children. Some even go as far as having more than one assigned person.

Despite how useful a durable power of attorney can be, there are still concerns that need to be looked into. According to AARP, it has been estimated that around 55% of elder financial abuse is done by family members, some of whom have been given permission to act by a power of attorney. Yet other sobering statistics have been revealed courtesy of MarketWatch: the unfortunate fact that older Americans are known to lose around $2.9 billion due to financial abuse on an annual basis. Despite the tragedies that befall the vulnerable and elderly, there is still much to reap from durable power of attorney and its many similar types and counterparts.

The Types of Power of Attorney

A durable power of attorney is just variation among many. If this topic in particular interests you, then perhaps the list below will come in handy someday. Each of these variants is given a compact description to help them stand out from one another.

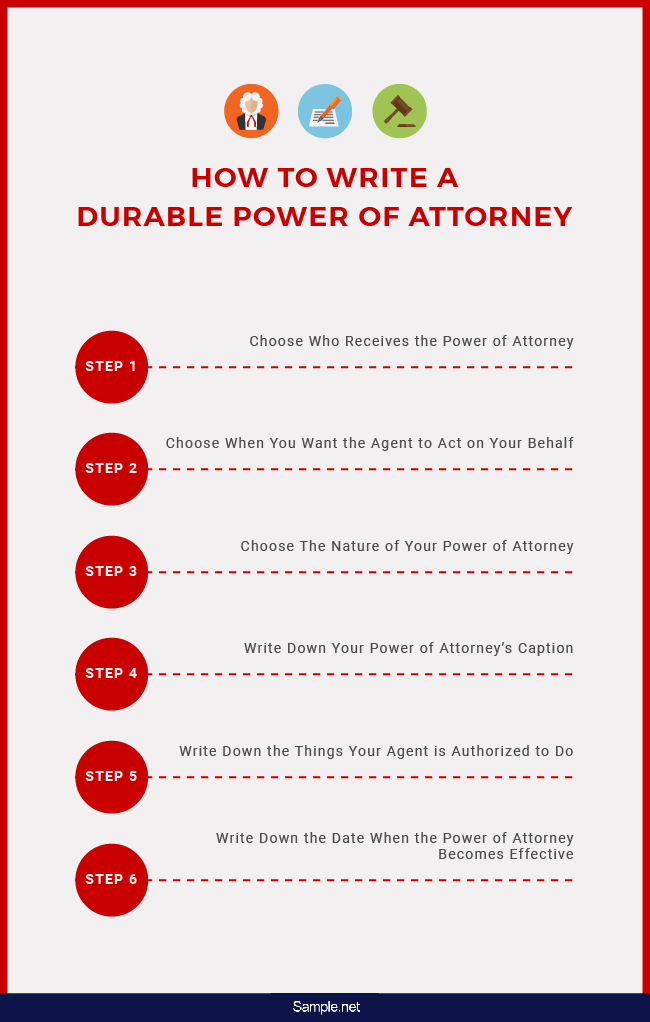

How to Write a Durable Power of Attorney

For the best results, it is wise to employ an attorney to draw up the document for you. However, if you want to do it on your own, then there are a few steps that you can follow in order to be successful in the endeavor. Follow the ones detailed below and make the process much easier and faster for yourself.

Step 1: Choose Who Receives the Power of Attorney

Understandably, the first step in the entire process is to determine who among your friends and family members is going to step up and act on your behalf during those times when you simply cannot act for yourself. The considerations that go into the choice can even merit an entire step-by-step process by itself. So let’s cut straight to the chase instead. Once you have made your decision, you may proceed to the second step.

Step 2: Choose When You Want the Agent to Act on Your Behalf

A person to act as your agent is one thing, but the effective start date of his or her duties is another thing entirely. Remember that a non-durable power of attorney is only meant to allow somebody else to act for you when you are incapacitated. Contrasting that would be the durable power of attorney, which allows your agent to act for you now if you so choose.

Step 3: Choose The Nature of Your Power of Attorney

Step number three entails deciding just what your power of attorney’s nature is all about. You can do this by first listing down all of the things that you need your agent to do for you. This may include, for example, making appropriate health care decisions on your behalf. Another would be the management of your personal business. After taking care of this step, move on to the next.

Step 4: Write down Your Power of Attorney’s Caption

Your power of attorney’s caption is going to be written at the top of the page and will be based on the choices that you have made thus far. As an example, you may have decided that your agent is only going to make finance-related decisions for you effective right now and even after your incapacitation. A durable power of attorney can afford you the opportunity to do just that. Since that’s the choice you’ve made, you can write “Durable Power of Attorney for Finance.” Under that caption will be your name and address, along with a notation declaring that you are of sound mind.

Step 5: Write down the Things Your Agent is Authorized to Do

Now that you’ve confirmed your decisions, put it all in writing starting with the appointment of your selected agent, his or her name, and home address. Afterward, write down all of the things that you have authorized your agent to do for you. Be sure to include language that will specifically indicate your desire to make your power of attorney durable.

Step 6: Write down the Date When the Power of Attorney Becomes Effective

The last thing for you to include before having the document signed by you, a notary public and your agent would be the date that you desire your power of attorney to become durable. Doing so will wrap up the creation process of the document nicely and make things official.

The Dos and Don’ts of a Durable Power of Attorney

Even when working side by side with an attorney, it is worth reading up on things that can help you out with a durable power of attorney. Just as worthy is being on the lookout for potential pitfalls. Help yourself overcome those and take a closer look at the following dos and don’ts.

Dos

Do choose the right attorney to help you out.

The first thing you need to do is select an attorney to not only draft the power of attorney document, but also someone who is an overall right fit for your needs. An excellent trait for an attorney to have in general is patience. You may have a lot of questions and requests, so the attorney will need to be able to accommodate you without hassle. Another trait would be the competence to explain everything to you clearly, which is immensely helpful to those who have yet to have any experience with a durable power of attorney.

Do choose someone financially literate for an agent.

The person you choose to act on your behalf needs to be capable, to say the least. Since he or she will be the one ensuring that your bills are paid on time and that your tax returns will be filed, then it pays to have someone in mind who can do all of those things. Avoid choosing friends or family who are known to borrow money frequently or are generally careless with their finances. Their terrible habits are not likely to change when it comes to your own affairs.

Do ensure the agent is still properly supervised.

Even when you have sufficient confidence and trust in your chosen agent, it is of practical use for an outside monitor to be appointed. This will be the person responsible for making sure the agent performs all of the necessary duties assigned to him or her. An outside monitor will have the authority to request the agent to produce all transaction records made while he or she was acting on your behalf, as well as review all of the activities should something questionable take place. Even if you feel no need to question your chosen agent, having an outside monitor can still appease any anxieties your family members may have.

Do have a backup just in case.

It is not unheard of to have more than one durable power of attorney. One can act as your primary and the other one can simply be your backup. Although this may seem like an unnecessary move to some, it does pay to be prepared in the event that the primary agent is unable to fulfill his or her responsibilities. There are even times when the primary agent turns out to be less trustworthy than expected, necessitating the use of the backup. Remember that regret is always something that pops up in hindsight, so it is better to be safe than sorry.

Do set in place a reasonable fee for your agent’s compensation.

Even the services of an agent assigned to the durable power of attorney are not for free. You need to pay a certain amount for all their work on your behalf, but it would help if you could somehow eliminate all of the guesswork involved. Talk it through beforehand and see if the two of you can agree to a specific amount. It is also worth taking note of the fact that you may also have to pay the ones monitoring the agent just in case.

Don’ts

Do not be afraid to ask questions.

Unless you are a licensed attorney yourself, it is expected that there will be a lot of information that you won’t be privy to. Even those who have already been involved in situations requiring the use of a durable power of attorney would be wise to make certain clarifications from time to time. When you find yourself unsure of anything at all, do not make any assumptions and do not hesitate to consult your attorney. Asking the right questions before, during, and after drawing up a power of attorney can save you from tons of potential problems, allowing your affairs to be managed by your chosen agent or agents in the smoothest way possible.

Do not grant powers to an agent who does not hold your confidence.

One of the most important considerations to make when it comes to your durable power of attorney is who you will choose to act in your stead. An agent needs to be not only completed up to the task, but also somebody whom you implicitly trust. There may be times when you feel rushed or compelled to select the first person who seems even remotely competent, but it would be wiser to stay your hand. Think it through and consult with your friends, family members, and attorney first. Only once you have considered all of the potential candidates should you make the final decision.

Do not grant powers to multiple family members at the same time.

Who says that you need to stop with just one agent or power of attorney? It is entirely possible for you to create multiple durable power of attorneys, assigning a different person as the agent for each one. However, let it be known that there are still massive downsides to this, especially if each of your agents happens to be closely related to one another. Conflicts of interest will arise among them, as it often does within families. There will be some that will think that only their way or views are the right one, which will, unfortunately, lead to trouble since there won’t be any cooperation between your agents when that inevitably happens. If ever you do decide to create more than one power of attorney, for whatever reason you may have, be wise enough not to appoint your family as agents.

Do not allow agents to take out loans or spend for themselves without your consent.

While your agent is meant to act on your behalf, it should really go without saying that he or she should not be permitted to do anything that is dishonest or something that you would not consent to. In the event of your incapacitation, explicit instructions must be left behind for your agent to strictly follow. See to it that trusted friends and family members also help in preventing any misuse of power by the agent. It can be too easy for loans to be taken out in your name that has nothing to do with your affairs, which is one of many blatant examples of financial abuse. By anticipating this possibility, you can prepare accordingly and prevent it from ever coming to pass.

A durable power of attorney can be of great help to anyone that needs it, regardless of its potential for danger and abuse. It is a nuanced document that should not be taken lightly or ignored in any shape or form. If you find yourself in need of one, but also cannot afford or want to avail of a lawyer’s services, then take comfort in the fact that there are several options online for your benefit. Just like with resources centered around estate planning, service contracts, and other templates, wonderful durable power of attorney form templates awaits you. Once you have downloaded one, all you need to do is make sure that you completely edit it so that the document will fit well into whatever it is that you want and need from it before printing it out.