49+ Sample Expense Forms

-

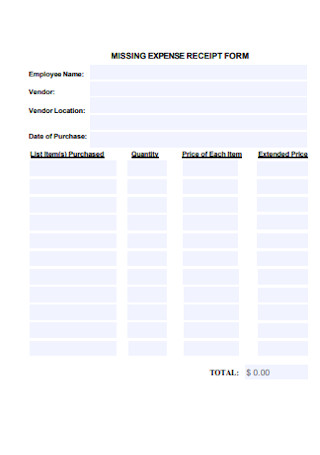

Missing Expense Receipt Form

download now -

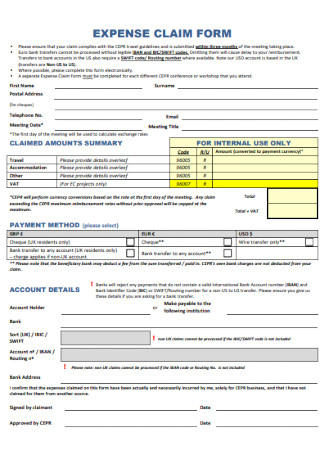

Expense Claim Form

download now -

Employee Expense Claim Form

download now -

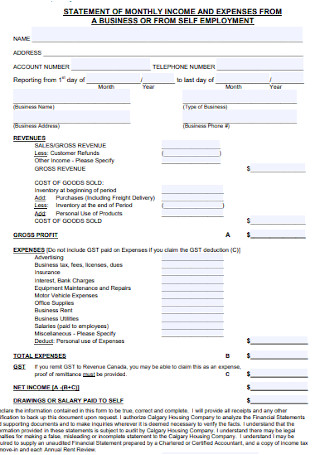

Income and Expense Statement Form

download now -

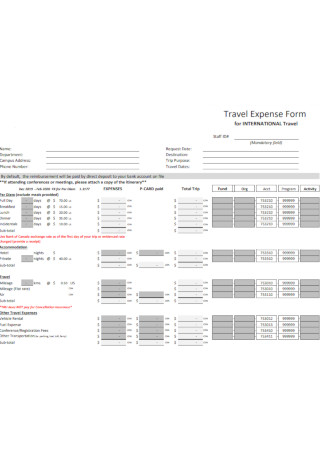

Travel Expense Form

download now -

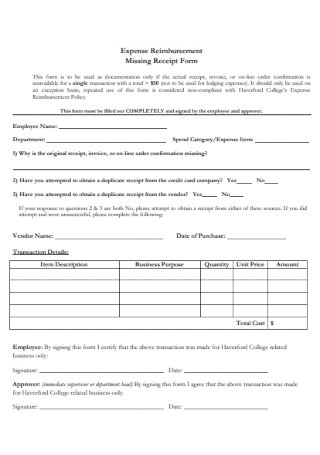

Expense Reimbursement Receipt Form

download now -

Non Staff Expense Claim Form

download now -

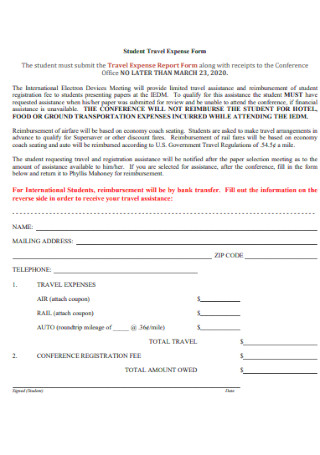

Student Travel Expense Form

download now -

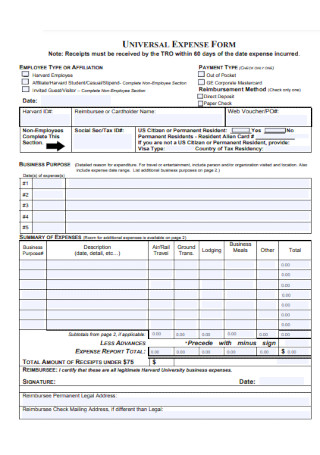

Universal Expense Form

download now -

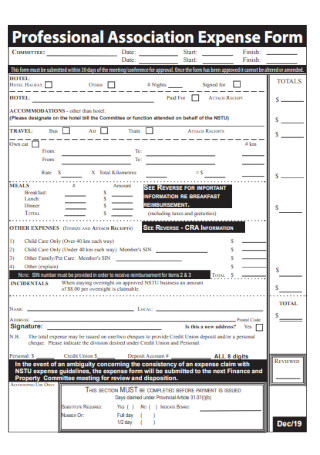

Professional Association Expense Form

download now -

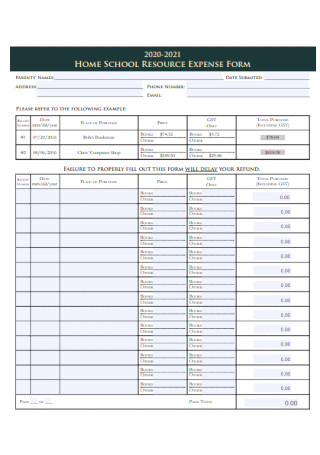

School Resource Expense Form

download now -

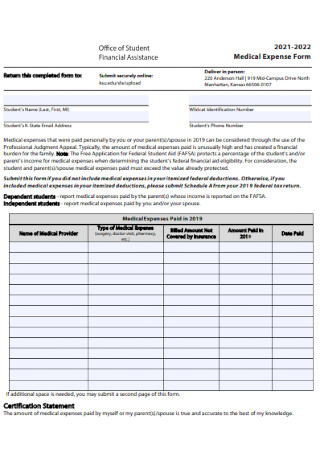

Medical Expense Form

download now -

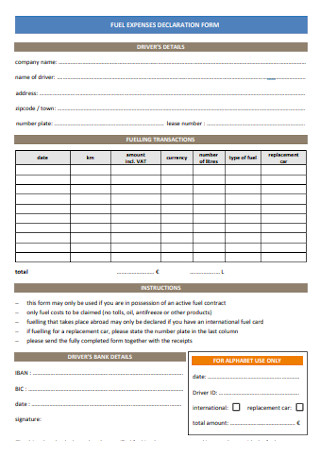

Fuel Expense Declaration Form

download now -

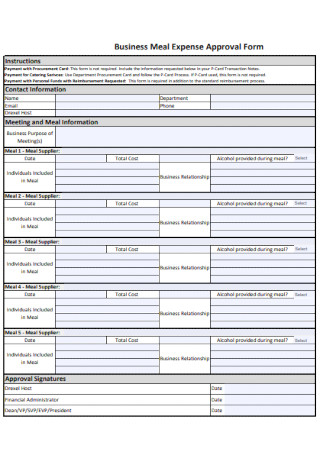

Meal Expense Approval Form

download now -

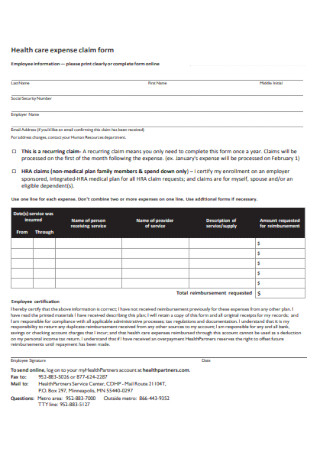

Health Care Expense Claim Form

download now -

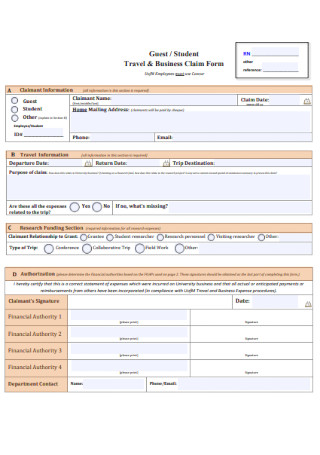

Travel Business Claim Form

download now -

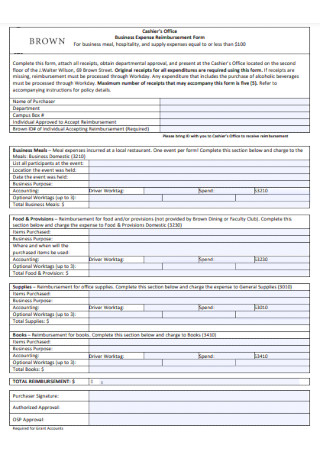

Business Expense Reimbursement Form

download now -

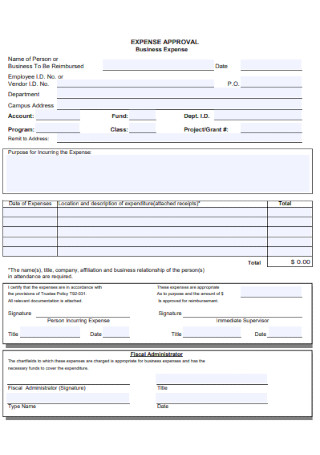

Expense Approval Form

download now -

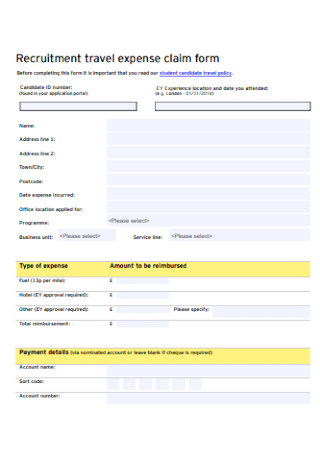

travel Expense Claim Form

download now -

Vehicle Expense Claim Form

download now -

Minimum Expense Form

download now -

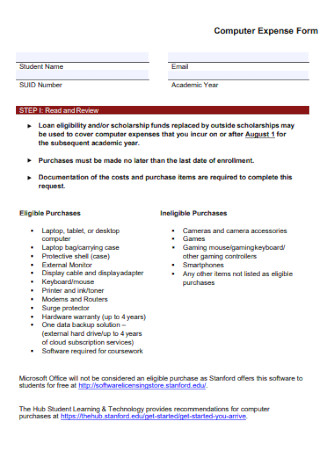

Computer Expense Form

download now -

Unreimbursment Medical Expense Form

download now -

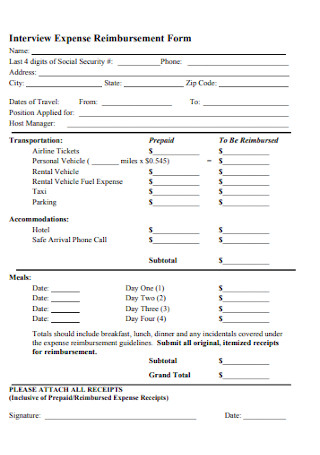

Interview Expense Form

download now -

Education Expense Reimbursement Form

download now -

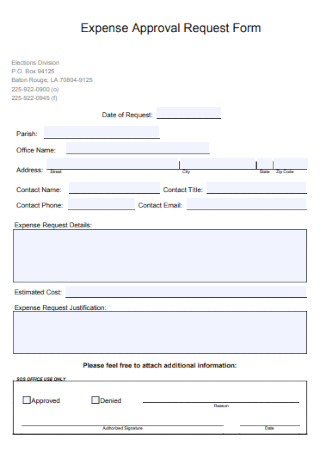

Expense Approval Request Form

download now -

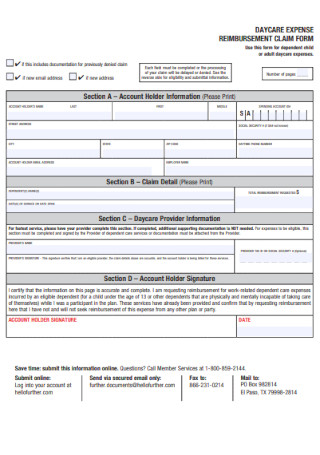

Day Care Expense Form

download now -

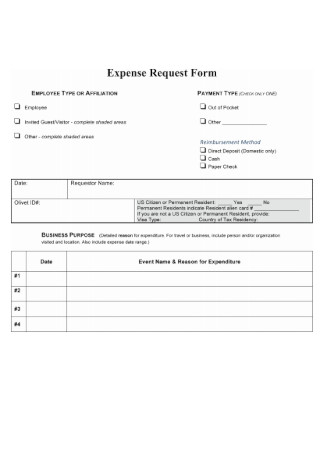

Expense Request Form Template

download now -

Authors Expense Claim Form

download now -

Competition Expense Form

download now -

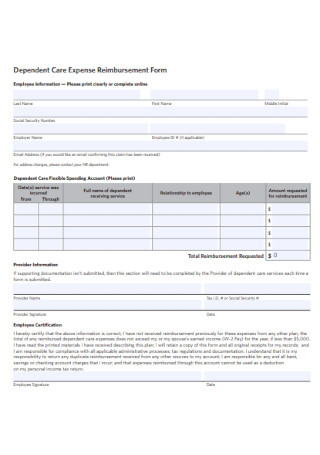

Dependent Care Expense Form

download now -

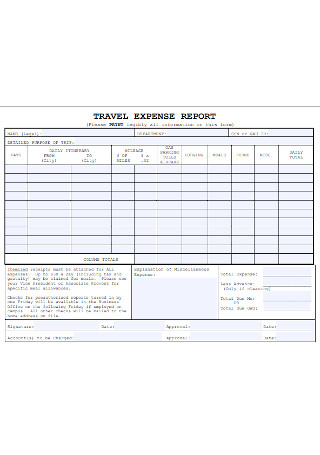

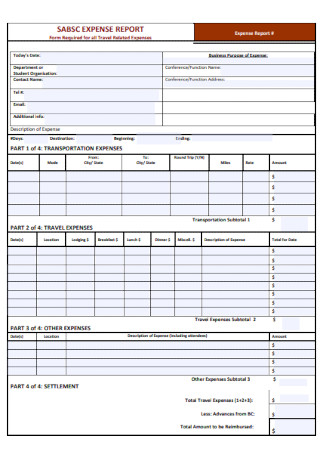

Travel Expense Report Form

download now -

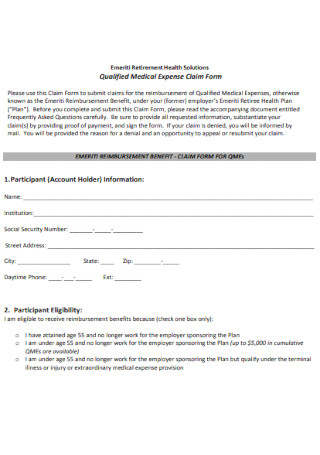

Qualified Medical Expense Claim Form

download now -

Simple Expense Form Template

download now -

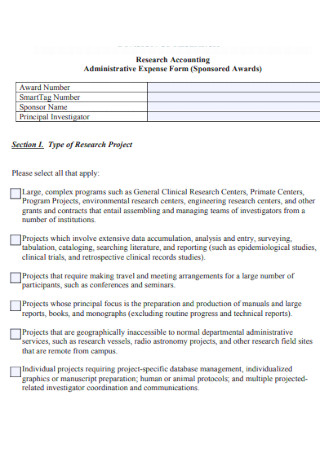

Administrative Expense Form

download now -

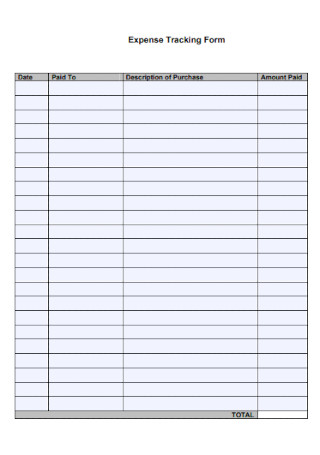

Expense Tracking Form

download now -

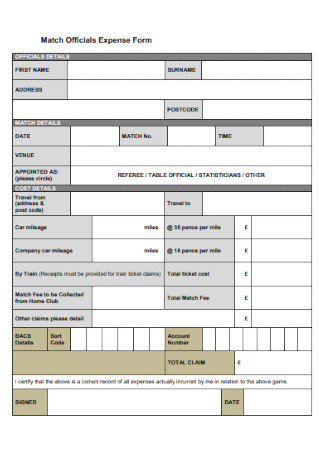

Match Officials Expense Form

download now -

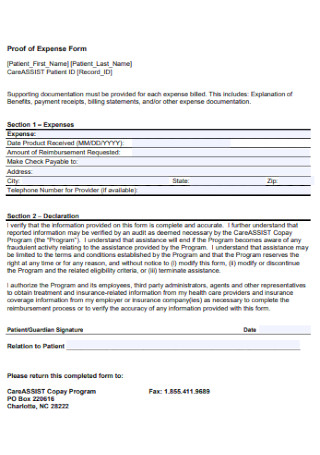

Proof of Expense Form

download now -

Non-Travel Related Expense Form

download now -

Novated Vehicle Expense Claim Form

download now -

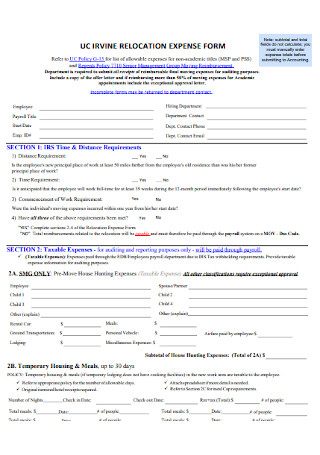

Relocation Expense Form

download now -

Graduate Recruitment Expense Form

download now -

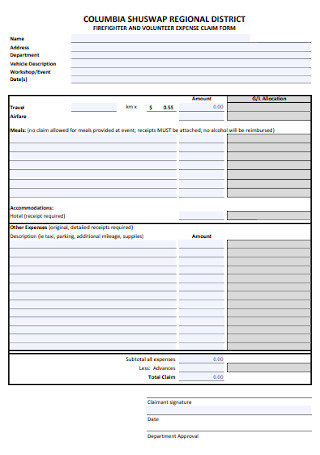

Colunteer Expense Form

download now -

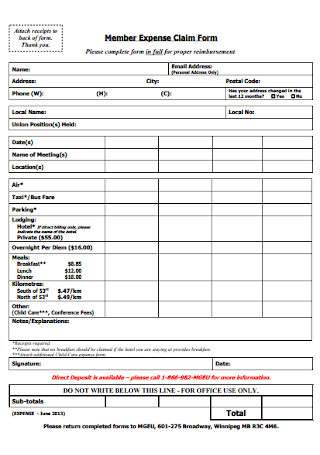

Member Expense Claim Form

download now -

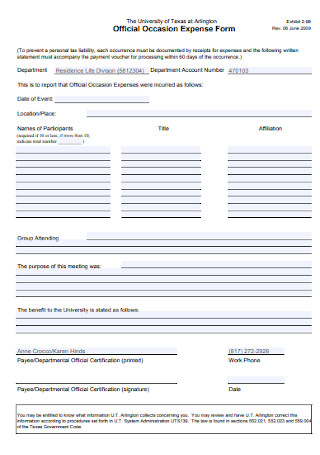

Official Occasion Expense Form

download now -

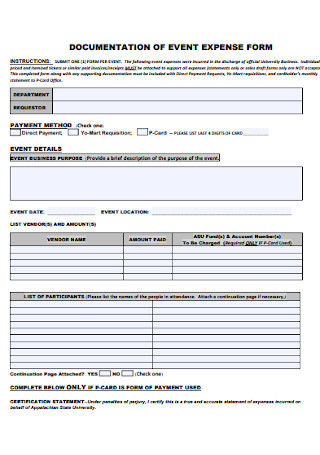

Documentation of Event Expense Form

download now -

Parents Additional Expense Form

download now -

Expense Transfer Entry Form

download now -

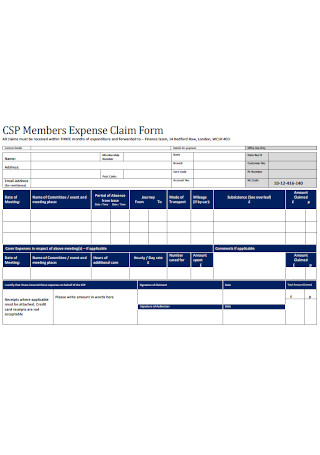

Members Expense Claim Form

download now

What Is an Expense Form?

An expense form is a formal document that is used to itemize or list down various expenses of an individual, typically an employee or a professional. In most cases, an expense form is used to expedite the process of reimbursement.

According to a recent article by TravelPerk, the average cost for a US business trip is $1,293- based on a 2019 Runzheimer report. When it comes to international business trips, the average expense was about $2,525.

Types of Employee Expenses

There are all kinds of expenses and it’s important to classify them into groups. There are household expenses, office expenses and also personal expenses. But for the purpose of this article, the following examples below describe the common types of employee expenses that are generally eligible for reimbursement.

Tips for Filing an Expense Form

If you want to claim your refund or be reimbursed properly, then you need to keep in mind these important tips. Of course, each company or organization has their own process or system for expense tracking. But needless to say, you also should be responsible for your own expenses especially if the funds you are using belong to the company.

How to Create an Expense Form

To create an expense form, you first need to ensure that you have all the important information regarding your expenses. And if you are looking for a quick way to create an expense form or report, then using a ready-made template is the most practical option. Simply choose from the dozens of printable templates above and follow the basic steps below.

Step 1: Select a Template

The first step is to choose a suitable template. Of course, you also have the option to start from scratch. But if you are short on time and need to get the job done quickly, a template is the easiest option. With a pre-designed template, you don’t have to worry about getting the format right. All you need to do is input the important details. In the case of an expense form, it is best to use a table to establish a more organized report. With a table, you can easily list down or enumerate your various expenses in a clear-cut way. Plus, it makes it more reader-friendly. Alternatively, you can also use an Excel spreadsheet; the application also has several templates that you can use.

Step 2: Itemize Each Expense

The most important step in creating an expense form is enumerating your expenses. It is crucial that you itemize each and every expense incurred. Whether it’s a pricey business dinner with a client or a seemingly trivial purchase like duct tape for a company event, list it down. When it comes to refundable company expenses, the main categories are usually meals, transportation, and travel (or accommodation). With this in mind, you can categorize the items or cluster it according to the nature of the expense. For instance, list down your breakfast, lunch, dinner, and snacks under meals. And for transportation-related costs like taxis or gas, you can place them under another section.

Step 3: Double Check the Data

After listing all your expenses, it is important to double check the amounts. Double checking the information and reviewing your report before submitting is a vital step. Doing this can save you a lot of potential problems or inconvenience later on. See to it that it is the correct amount for each item or expense. The expense report needs to reflect what is stated in the receipt. It might also help to provide a brief description for each item, if space and time permits. This will help clarify or justify your expenses better. Lastly, you can include dates in your report as well. Official receipts come with receipt numbers and time stamps. So basing it on the receipts you’ve kept, you can indicate the date of each expense under a different column in the table.

Step 4: State the Total Amount

The last step is to total all your expenses and indicate the amount at the bottom of the form or table. You can highlight the total amount or type it in bold numbers to further emphasize it. If you are comfortable using Excel, you can easily obtain the total by using the sum function in the application. Providing a summary of your expenses is necessary when crafting an expense report. Lastly, don’t forget to include your name, signature and date in the expense form before submitting it.

FAQs

What is an expense claim form?

An expense claim form is a business document that itemizes a list of official expenses to be reimbursed by a company.

What is an expense form used for?

In business, an expense form is commonly used to document business expenses for reimbursement or refund purposes.

How do you create an expense form?

To create an expense form, the easiest way is to use a template and simply fill in the necessary expenses or items along with their corresponding amounts.

An expense form is a useful business document that can help promote greater accountability and transparency. Browse the wide collection of editable and printable templates above, choose one that suits your needs and create your own expense form today!