Guarantor Form Samples

-

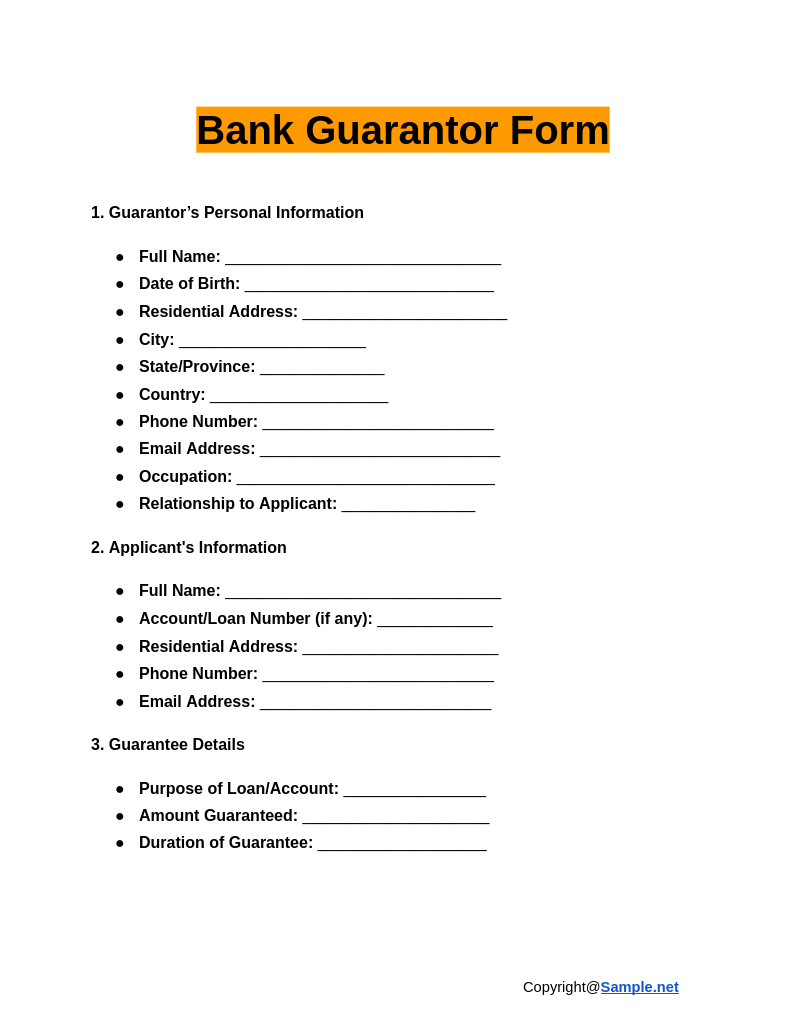

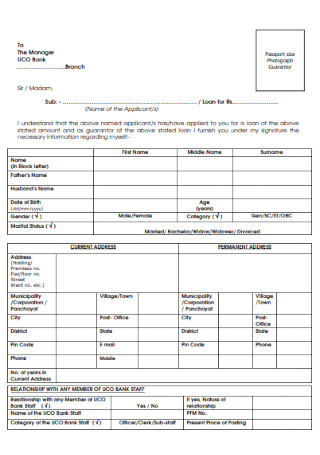

Bank Guarantor Form

download now -

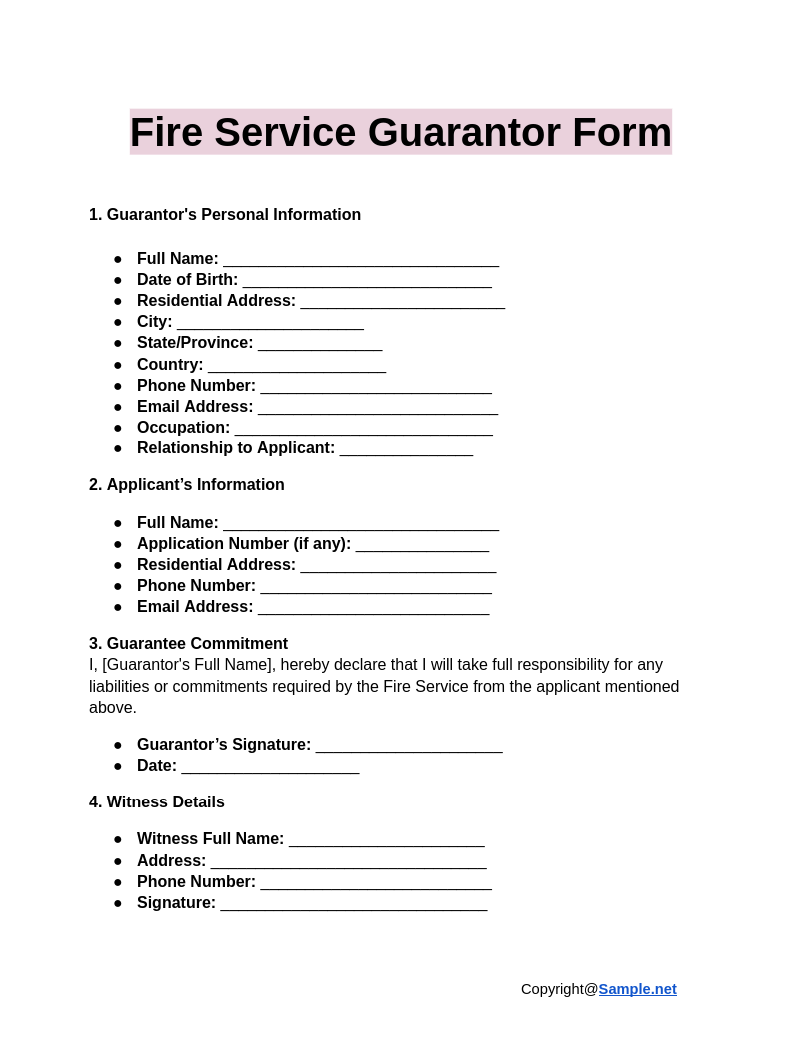

Fire Service Guarantor Form

download now -

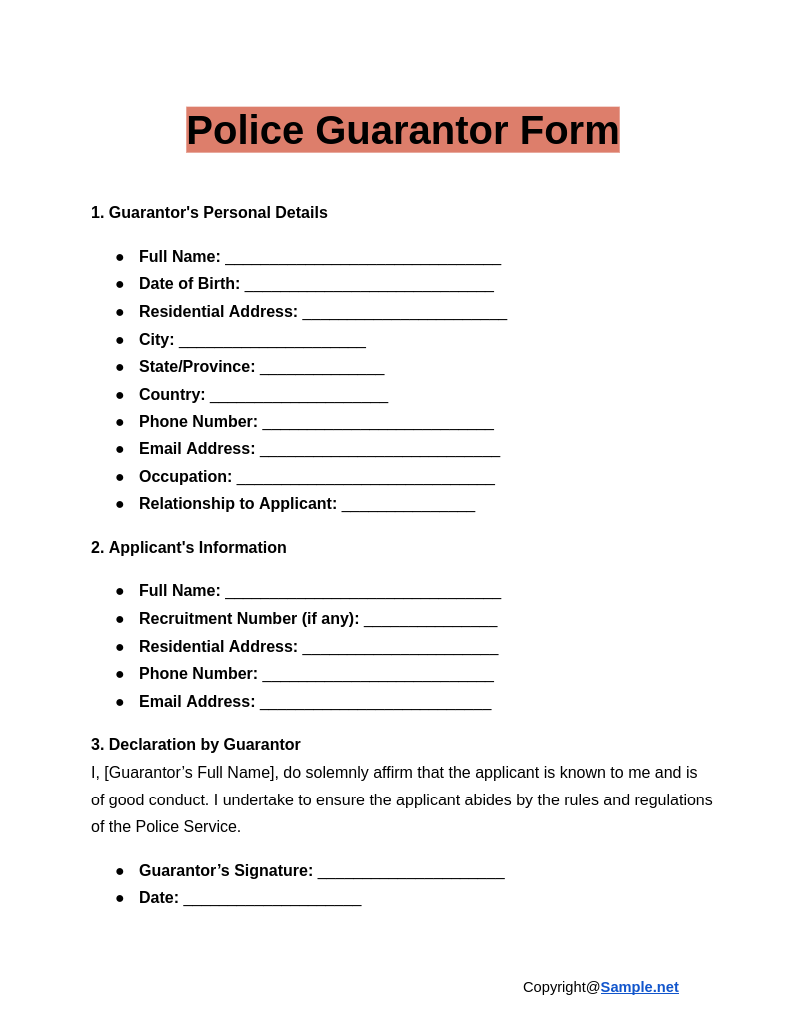

Police Guarantor Form

download now -

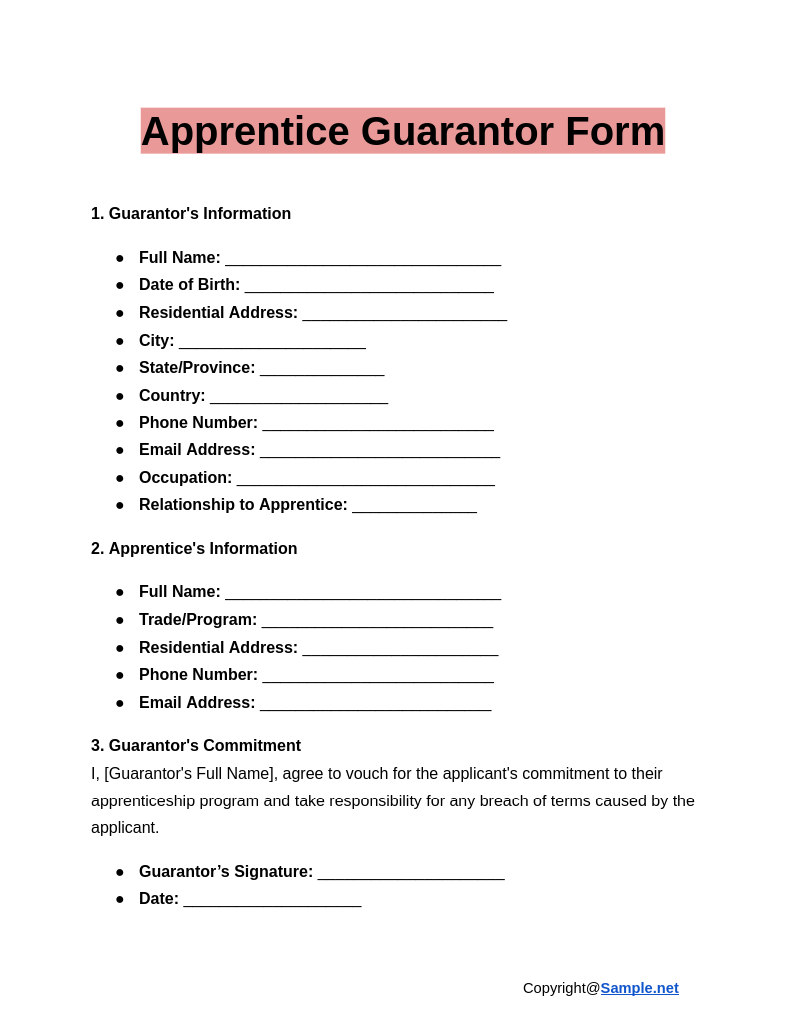

Apprentice Guarantor Form

download now -

Guarantors Statement Form

download now -

Company Guarantor Form

download now -

Home Loans Guarantor Form

download now -

Guarantor Form Format

download now -

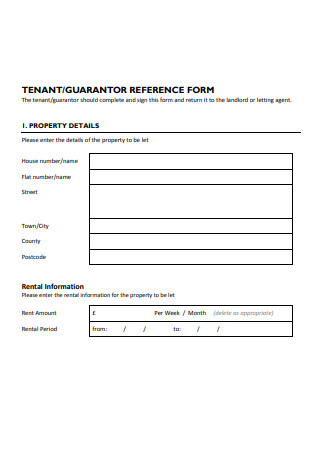

Guarantor Reference Form

download now -

Estate Guarantor Form

download now -

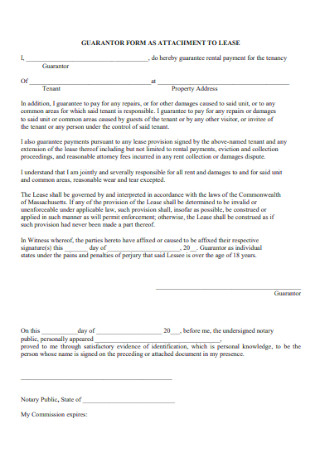

Guarantor Form for Attachment Lease

download now -

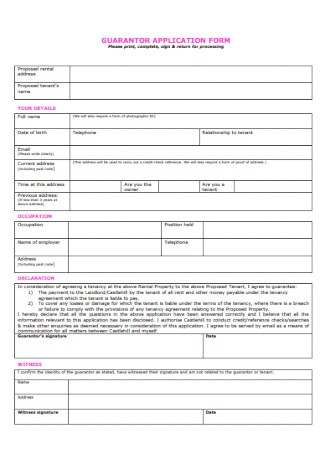

Guarantor Agreement Form

download now -

Full Reference Guarantor Form

download now -

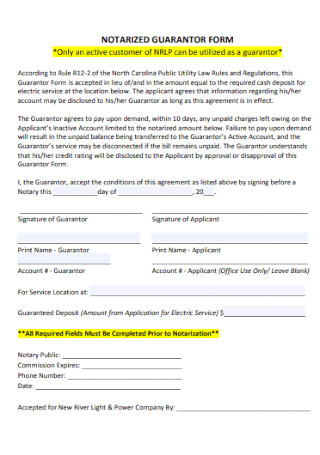

Notarized Guarantor Form

download now -

Guarantor Information Form

download now -

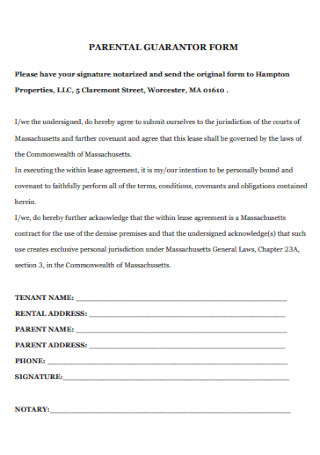

Parental Guarantor Form

download now -

Basic Guarantor Form Template

download now -

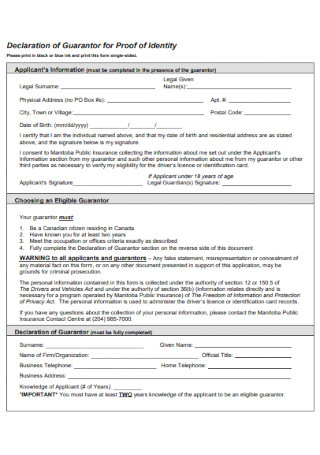

Declaration of Guarantor Form

download now -

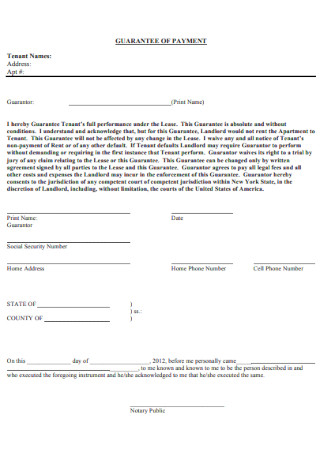

Guarantee Payment Form

download now -

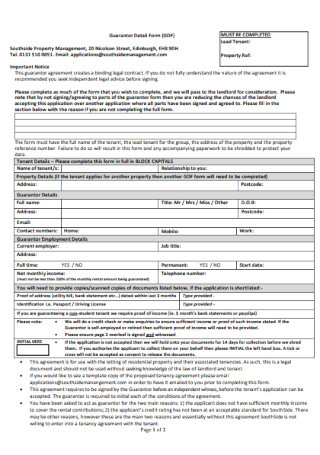

Guarantor Detail Form

download now -

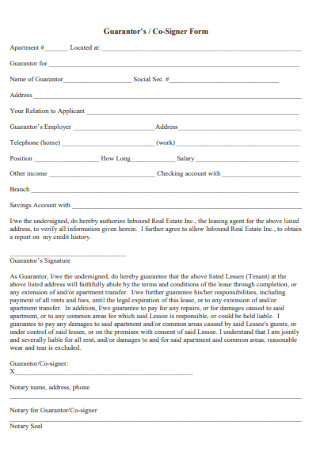

Guarantors Co-Signer Form

download now -

Residential Lease Guarantor Form

download now -

Formal Guarantor Form Template

download now -

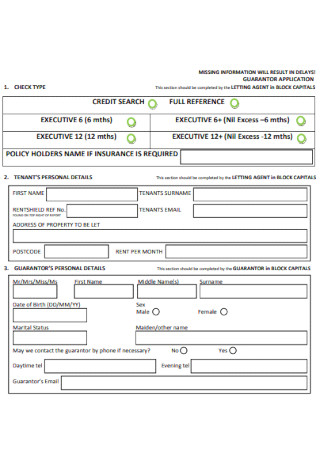

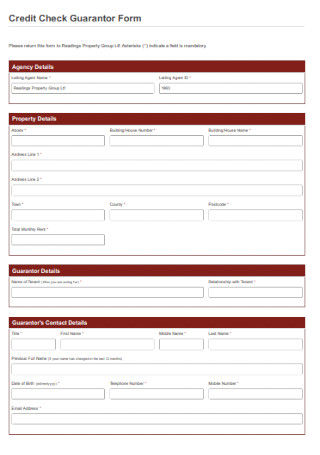

Credit Check Guarantor Form

download now -

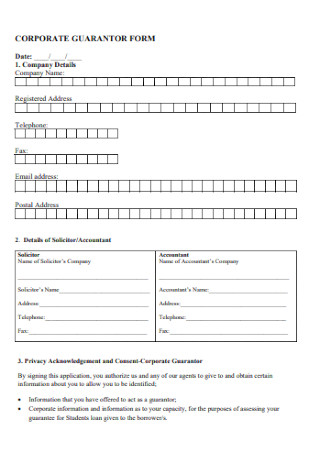

Corporate Guarantor Form

download now -

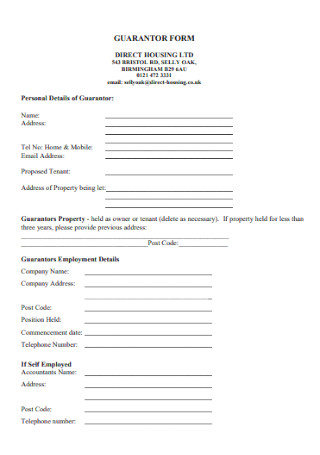

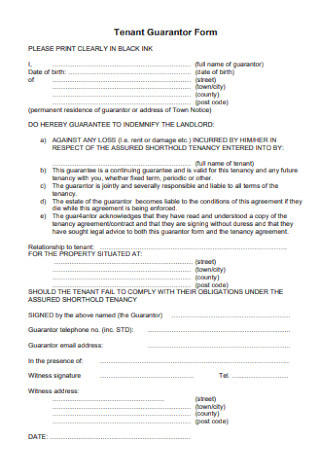

Tenant Guarantor Form

download now -

Guarantor Assessment Application Form

download now -

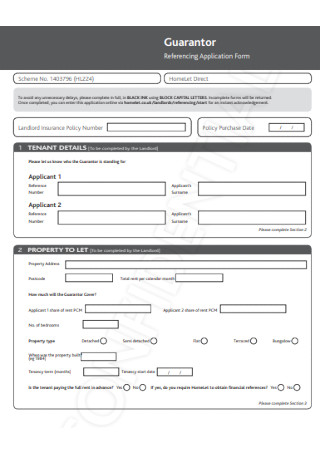

Guarantor Referencing Application Form

download now -

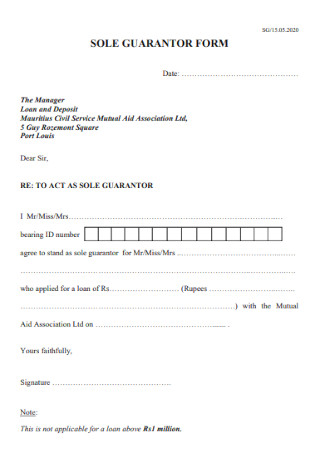

Sole Guarantor Form

download now -

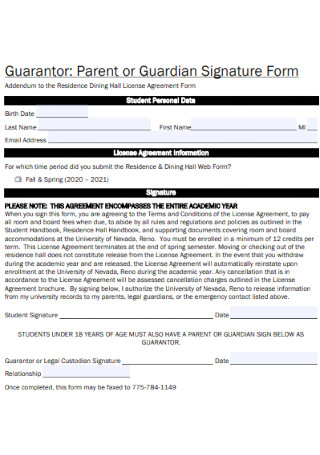

Guardian Signature Form

download now -

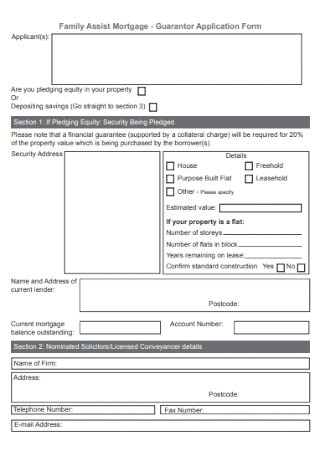

Family Guarantor Application Form

download now -

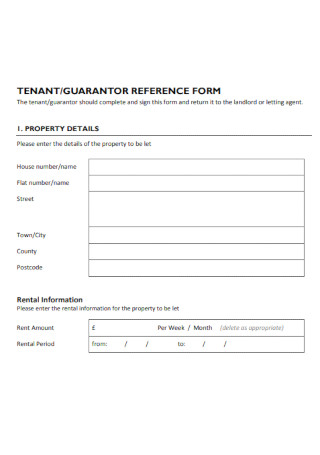

Tenant and Guarantor Form

download now -

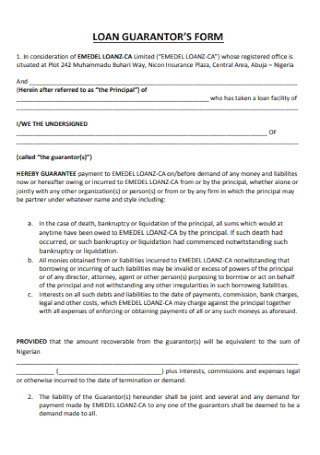

Loan Guarantor Form

download now -

Financial Guarantee Form

download now -

Guarantor Requisition Form

download now

FREE Guarantor Form s to Download

Guarantor Form Format

Guarantor Form Samples

What is a Guarantor Form?

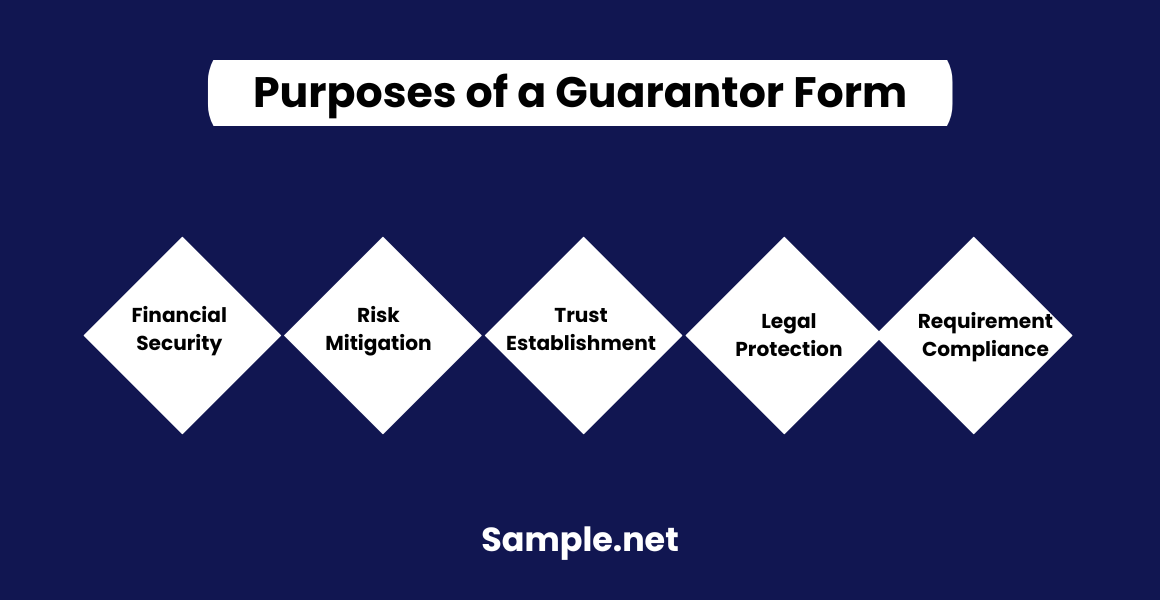

Purposes of a Guarantor Form

How to Create a Guarantor Form

FAQs

What are the elements of a guarantor form?

What are the benefits of a guarantor form?

What details should be included in a guarantor form?

How can a guarantor protect themselves from risks?

What happens if the guarantor cannot fulfill their obligations?

What details should be included in a guarantor form?

Download Guarantor Form Bundle

Guarantor Form Format

1. Personal Information of the Guarantor

- Full Name: _______________________________

- Date of Birth: ____________________________

- Residential Address: _______________________

- City: _____________________

- State/Province: ______________

- Country: ____________________

- Phone Number: __________________________

- Email Address: ___________________________

- Occupation: _____________________________

- Relationship to Applicant: _______________

2. Applicant Information

- Full Name: _______________________________

- Address: ________________________________

- Phone Number: __________________________

- Email Address: __________________________

3. Guarantee Details

- Type of Obligation Guaranteed: (e.g., Loan, Rent, etc.)

- Amount Guaranteed: ______________________

- Duration of Guarantee: ____________________

- Start Date: ______________________________

- End Date (if applicable): __________________

4. Terms and Conditions

- The guarantor agrees to assume full responsibility for the obligations of the applicant should they fail to meet their commitments.

- The guarantor certifies that the provided information is accurate and agrees to remain bound by the terms of this guarantee.

- This guarantee will remain in effect until the specified obligations have been fulfilled or released in writing.

5. Supporting Documents (Attach Copies)

- Valid ID (e.g., Passport, Driver’s License, etc.)

- Proof of Income (e.g., Payslips, Bank Statements, etc.)

- Proof of Address (e.g., Utility Bill, Lease Agreement, etc.)

6. Declaration and Signature I, [Guarantor’s Full Name], declare that I have read and understood the terms and conditions of this guarantee and agree to abide by them.

- Guarantor’s Signature: _____________________

- Date: ____________________

7. Witness Information This guarantor form was signed in the presence of:

- Witness Full Name: ______________________

- Address: _______________________________

- Phone Number: __________________________

- Signature: ______________________________

What is a Guarantor Form?

A guarantor form is a legal document where a third party agrees to fulfill the obligations of a primary party if they fail to meet their commitments. This agreement typically applies to financial contexts, such as loans, rental agreements, or service contracts. By signing the guarantor form, the guarantor legally accepts responsibility for ensuring the terms of the agreement are fulfilled. You can also see more on Assessment Forms.

Purposes of a Guarantor Form

1. Financial Security: A guarantor form provides assurance to creditors, landlords, or service providers that financial obligations will be fulfilled even if the principal party fails to meet their commitments.

2. Risk Mitigation: It reduces the risks for the party offering credit, loans, or services by having a third party agree to take responsibility in case of a default. You can also see more on Declaration Form.

3. Trust Establishment: A guarantor form builds confidence between the involved parties, making it easier to secure agreements like loans or rental contracts.

4. Legal Protection: By clearly outlining responsibilities and obligations, the guarantor form offers legal protection to all parties, ensuring clarity and recourse in case of disputes.

5. Requirement Compliance: Many financial institutions, landlords, or service agreements require a guarantor form as part of their eligibility criteria, ensuring a layer of security in transactions. You can also see more on Loan Application Form.

How to Create a Guarantor Form

Step 1: Begin with the basic details.

Include the names, addresses, and contact information of the primary party, the guarantor, and the beneficiary. Ensure these details are clear and precise.

Step 2: Define the agreement terms.

Specify the responsibilities the guarantor agrees to fulfill, such as payment amounts, deadlines, or other obligations. This step should be thorough to avoid misunderstandings.

Step 3: Add legal clauses.

Incorporate clauses related to liability, duration, and terms of termination. Ensure these are written in accordance with applicable laws to provide legal validity. You can also see more on Payment Forms.

Step 4: Include signatures.

Provide spaces for the guarantor, primary party, and a witness to sign. Signatures validate the document as a binding agreement.

Step 5: Notarize the document.

For enhanced legal enforceability, have the guarantor form notarized by a licensed professional. This step is optional but highly recommended.

FAQs

What are the elements of a guarantor form?

The elements of a guarantor form are the personal information, the financial information, the loan or contract details, the guarantor obligations, the release of information, and the signatures. You can also see more on Work Forms.

What are the benefits of a guarantor form?

The benefits of a guarantor form are increased chances of approval, lowest interest rates, access to larger loans, improved rental opportunities, and better business partnerships.

What details should be included in a guarantor form?

A guarantor form should include names, addresses, contact details, obligations, liabilities, termination terms, and signatures of all parties involved. Including legal clauses ensures its enforceability. You can also see more on Submission Forms.

How can a guarantor protect themselves from risks?

Guarantors can limit their liability by defining specific terms, such as capping financial responsibility or including a termination clause in the form.

What happens if the guarantor cannot fulfill their obligations?

If a guarantor defaults, legal actions may be taken against them, such as asset seizure or credit score impact, depending on the agreement’s terms.

What details should be included in a guarantor form?

A guarantor form should include names, addresses, contact details, obligations, liabilities, termination terms, and signatures of all parties involved. Including legal clauses ensures its enforceability. You can also see more on Request Form.