Loan Application Form Samples

-

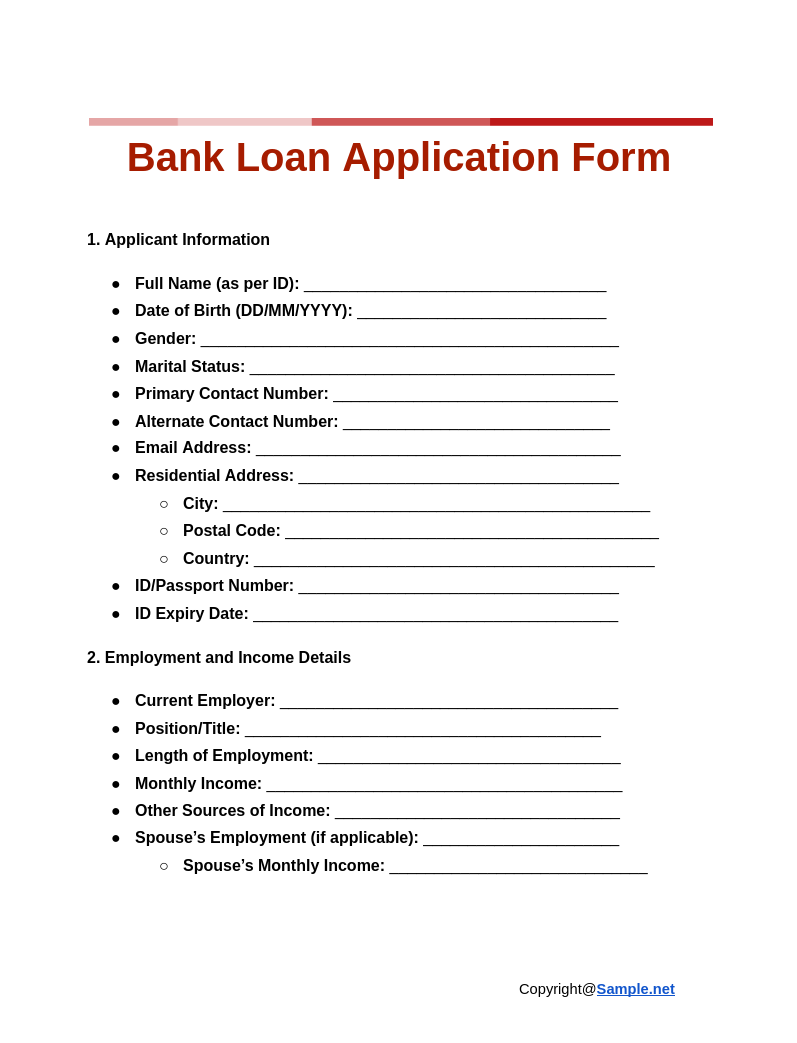

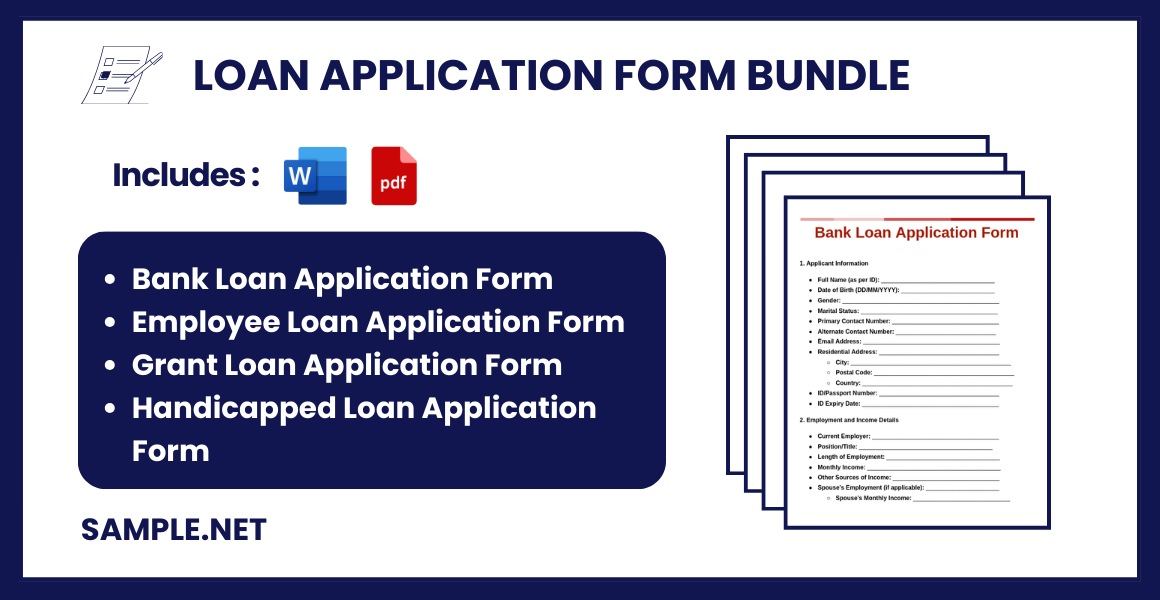

Bank Loan Application Form

download now -

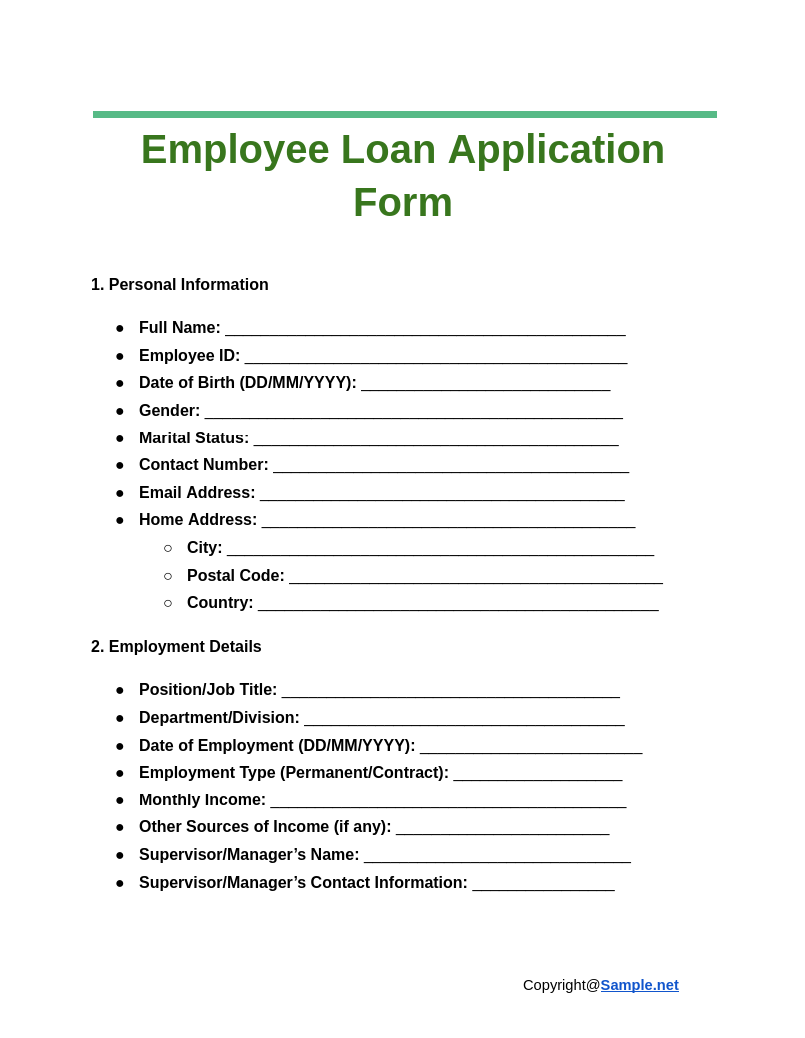

Employee Loan Application Form

download now -

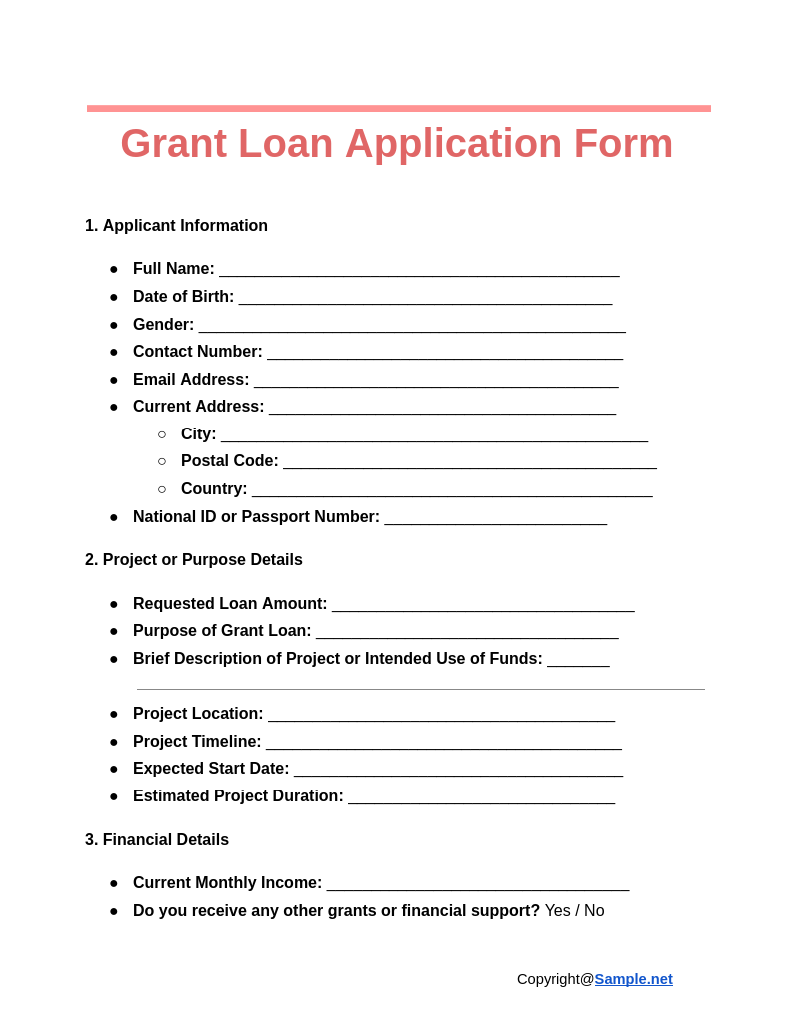

Grant Loan Application Form

download now -

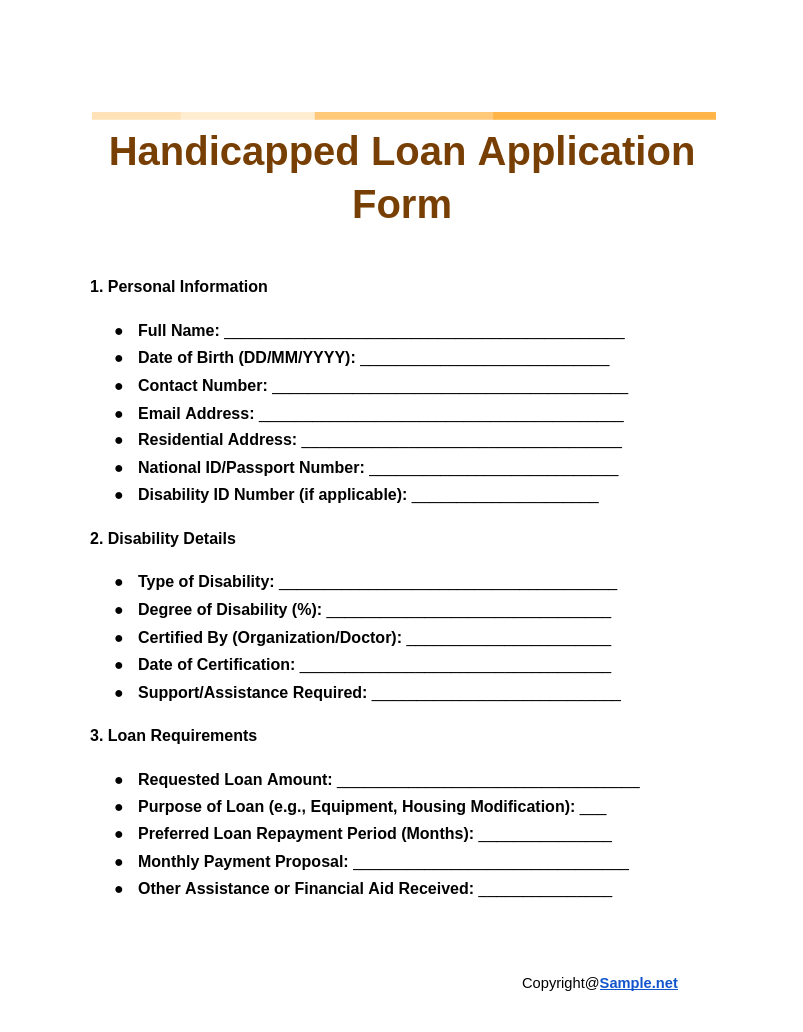

Handicapped Loan Application Form

download now -

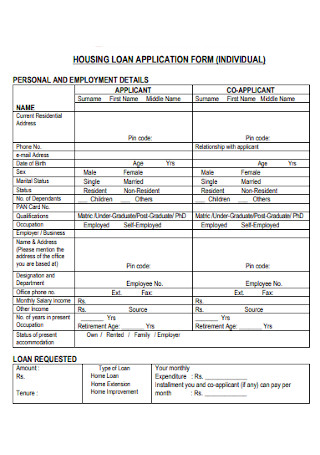

Housing Loan Application Form

download now -

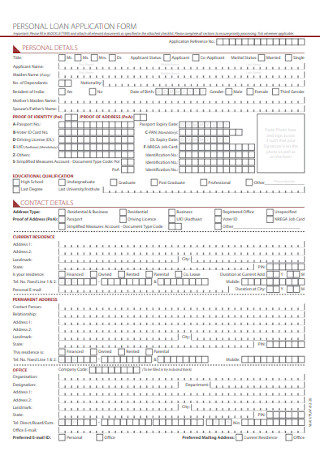

Personal Loan Application Form

download now -

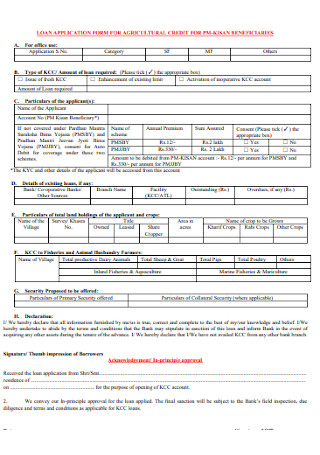

Loan Application Form for Agriculture

download now -

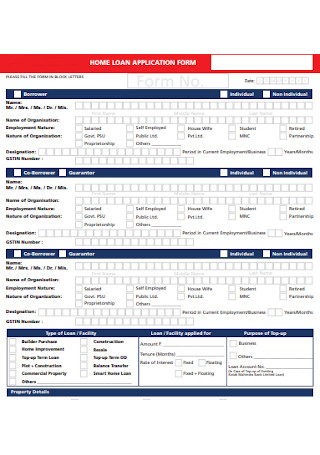

Home Loan Application Form

download now -

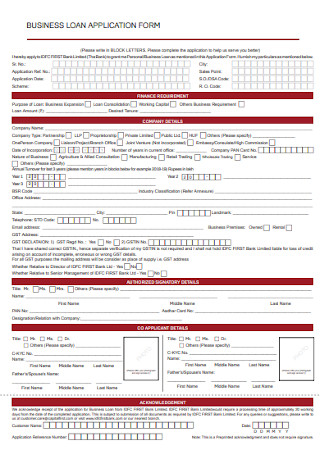

Business Loan Application Form

download now -

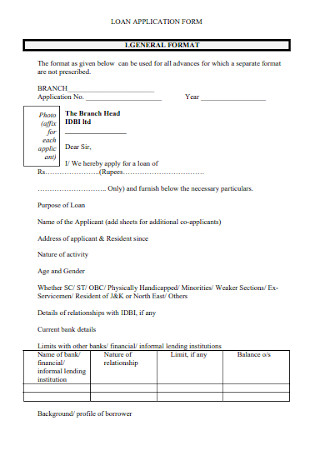

General Loan Application Form

download now -

Mortgage Loans Application Form

download now -

Loan Application Form Format

download now -

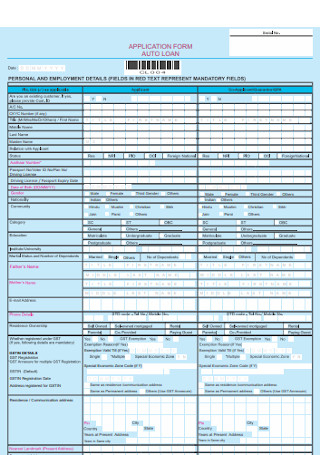

Auto Loan Application Form

download now -

Basic Loan Application Form Template

download now -

Vehicle Loan Application Form

download now -

Loan Security Application Form

download now -

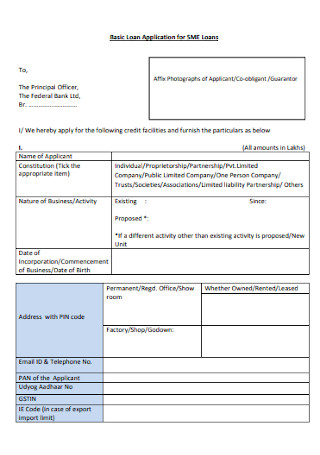

Basic Loan Application Form

download now -

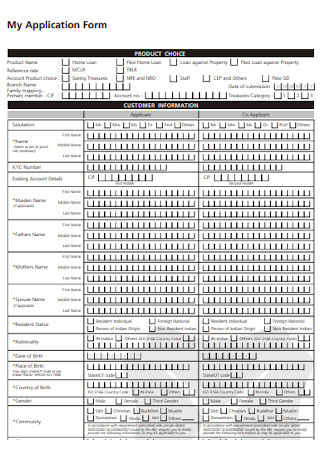

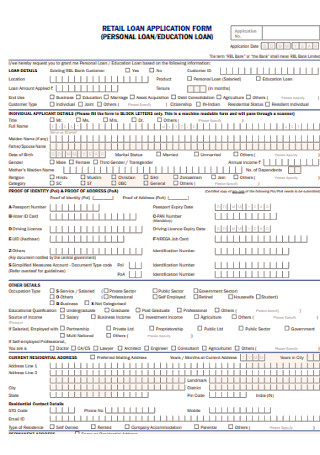

Retail Loan Application Form

download now -

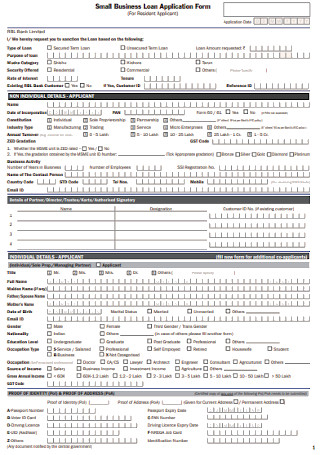

Small Business Loan Application Form

download now -

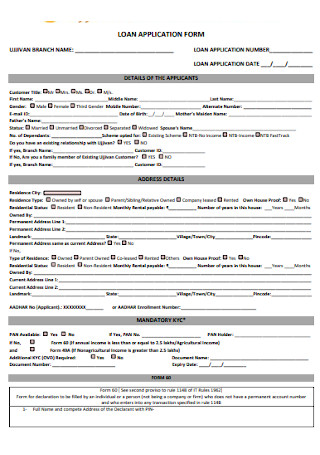

Finance Loan Application Form

download now -

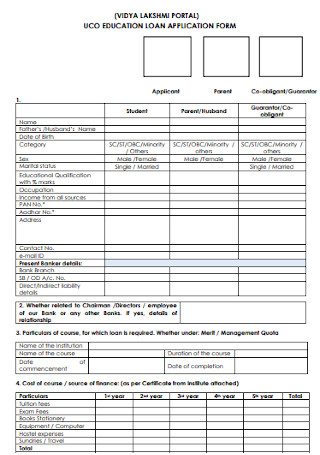

Education Loan Application Form

download now -

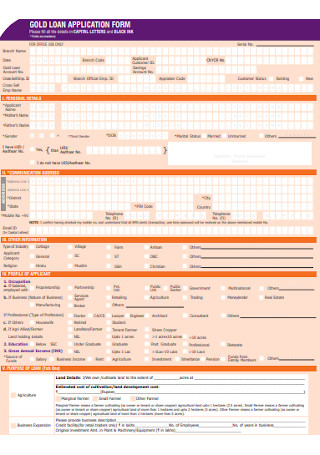

Gold Loan Application Form

download now -

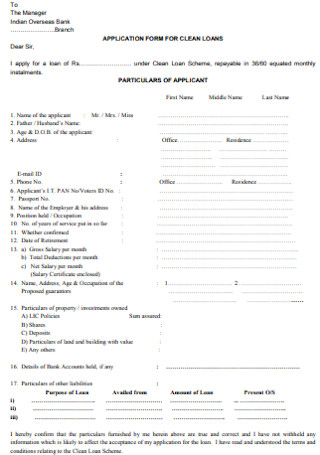

Appliication Form for Clean Loan

download now -

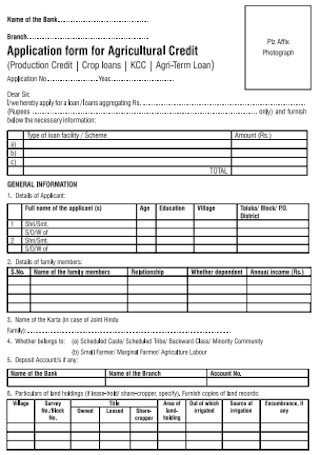

Application Form for Agriculture Credit

download now -

Common Education Loan Application Form

download now

FREE Loan Application Form s to Download

Loan Application Form Format

Loan Application Form Samples

What is a Loan Application Form?

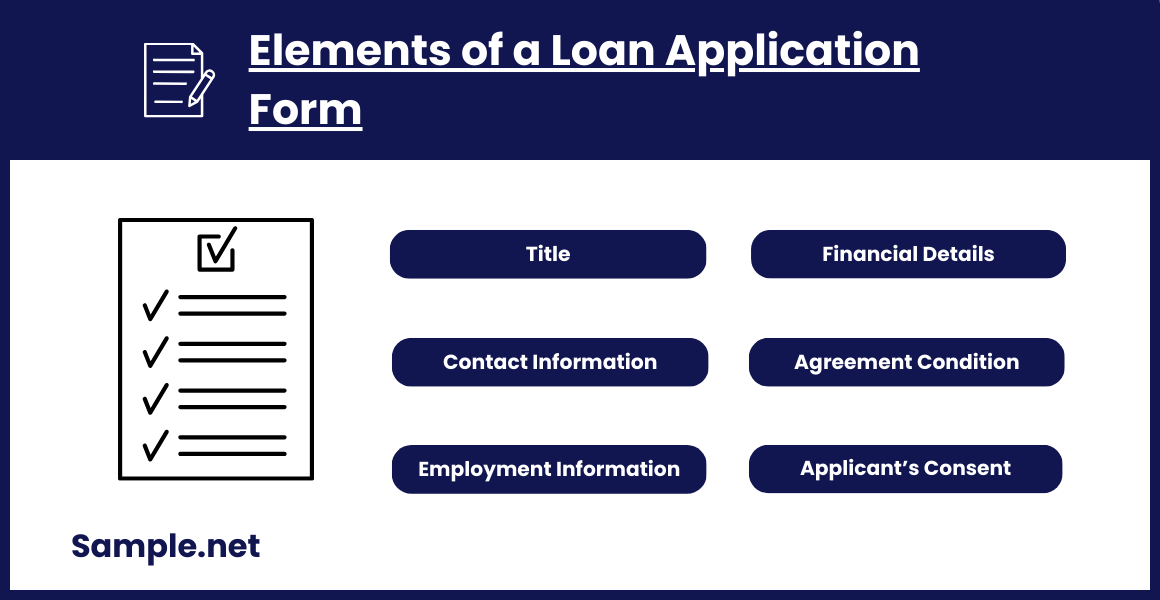

Elements of a Loan Application Form

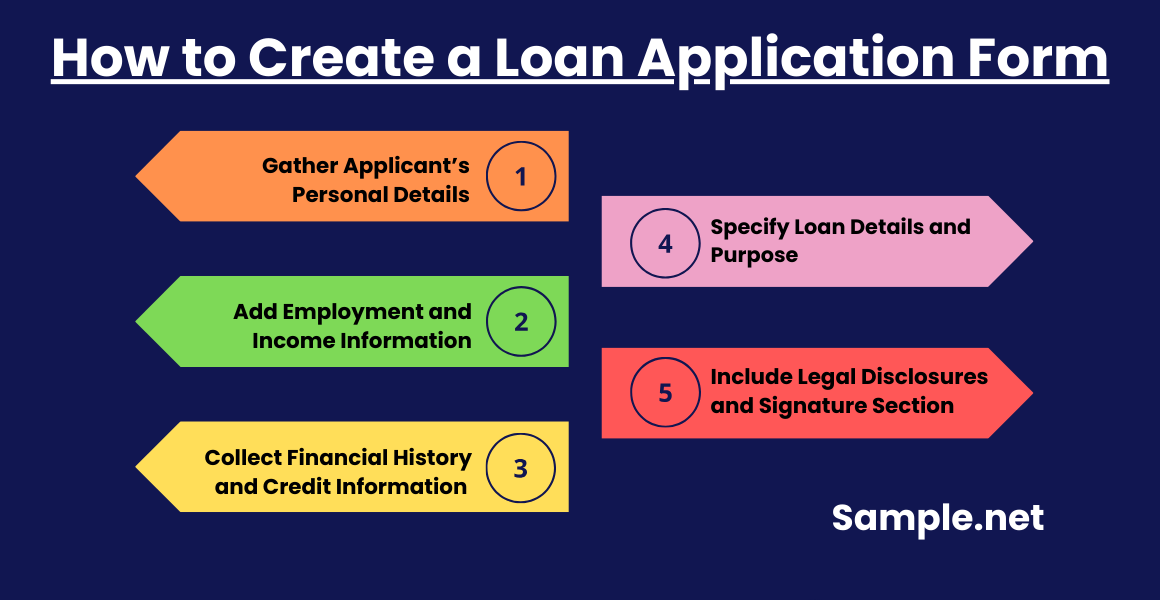

How to Create a Loan Application Form?

FAQs

What are the different types of loans?

When to use an application form?

What is a student loan?

What should I do if my loan application is denied?

How can I increase my chances of loan approval?

What happens after I submit a Loan Application Form?

Download Loan Application Form Bundle

Loan Application Form Format

Applicant Information

- Full Name:

- Date of Birth:

- Address:

- Phone Number:

- Email Address:

- Social Security Number (or National ID):

- Marital Status: (Single / Married / Divorced / Widowed)

- Number of Dependents:

Employment Information

- Employer Name:

- Position:

- Employment Type: (Permanent / Temporary / Self-Employed)

- Monthly/Annual Income:

- Years with Current Employer:

- Employer Address:

- Work Phone Number:

Loan Details

- Loan Amount Requested:

- Loan Purpose:

- Loan Type: (Personal / Business / Mortgage / Auto)

- Preferred Loan Term (Months/Years):

Financial Information

- Current Monthly Expenses:

- Rent/Mortgage Payment:

- Utilities:

- Other Monthly Obligations:

- Assets:

- Property Value (if owned):

- Savings:

- Investments:

- Existing Debts:

- Credit Card Balance:

- Other Loans (Auto, Education, etc.):

References

- Personal Reference Name:

- Relationship:

- Phone Number:

- Personal Reference Name:

- Relationship:

- Phone Number:

Declarations

- Do you have any outstanding legal judgments? (Yes / No)

- Have you declared bankruptcy in the past 5 years? (Yes / No)

- Are you a co-signer or guarantor for any other loan? (Yes / No)

Consent and Signature

- I hereby declare that the above information is true and accurate to the best of my knowledge. I authorize [Lending Institution Name] to verify the details provided and to perform necessary credit checks.

Applicant’s Signature:

Date:

What is a Loan Application Form?

A loan application form is a standardized document used by banks and lenders to collect essential data from individuals or businesses seeking financial assistance. It includes sections for identity verification, income, employment, and debt, allowing the lender to evaluate the applicant’s creditworthiness and repayment ability. You can also see more on Scholarship Application Form.

Elements of a Loan Application Form

Before creating your application forms, it is important to understand that there is no similar application form as every application process is different from each other. A single form cannot be used in several processes. It should be specifically made; otherwise, the form could compromise the convenience it could have contributed. Since there are various types of application forms, it means these important business documents are consist of different parts—called the elements. These are the labeled fields in the form in which users input the information needed. Below are the descriptions of different elements that compose a simple loan application form. Continue reading this article.

Agreement Condition: A loan application’s fourth section is the agreement condition. We can all agree that money is a contentious issue to discuss. And most disagreements arise over this. That is the reason behind the agreement condition. In this part, the terms, rules, and guidelines of acceptable behavior are set. This will keep both borrower and lender perform their obligations and roles. Moreover, they must find a common ground and agree on helpful clauses. Although it seems like a loan agreement, this part is just a preliminary agreement between the parties. The signing of the agreement will follow after the client qualifies in the application process. Applicant’s Consent to the Term: In most loan application processes, terms and conditions are already fixed by the lender. For some, clients have the opportunity to choose the most suitable terms for them. If it happens that you apply to a lender with predetermined terms, read them carefully before agreeing. Anything that is written in the application form can either make or break the deal. Because of that, be mindful when you fill out the document. You can also see more on Data Entry Form.

How to Create a Loan Application Form?

Now that you know what different elements a loan application form is made up of, creating one is the next thing you should learn. You do not need to be an accountant or a bank employee to make a form like this. It may seem overwhelming because it deals with financial terms, but it is not as hard as you think. There are word processors and spreadsheet editors that you can easily access to help you organize the elements accordingly. That is why we will not teach you how to format an application form. You can also see more on Credit Card Forms. Instead, the list below are tips intended to guide you in making a working loan application form. Find out more.

Step 1: Gather Applicant’s Personal Details

Start by creating a section to capture basic information about the applicant, such as their full name, date of birth, address, and contact details. This information will help the lender identify the applicant and serve as the foundation for further processing.

Step 2: Add Employment and Income Information

Include a section where applicants provide details about their employment status, employer name, job title, and monthly or annual income. For self-employed applicants, add fields to record business information and average monthly revenue. This part helps lenders assess the applicant’s income stability and repayment ability. You can also see more on Request Forms.

Step 3: Collect Financial History and Credit Information

Next, create a section for the applicant’s financial history, including their credit score, outstanding debts, and any existing loans. This data provides insights into the applicant’s creditworthiness, allowing lenders to evaluate their financial obligations and risk profile.

Step 4: Specify Loan Details and Purpose

In this section, ask applicants to indicate the loan amount they’re seeking and the intended use of the funds. Clearly defined loan purpose options, such as personal use, business expansion, or home renovation, help lenders understand the nature of the loan and assess associated risks. You can also see more on Payment Forms.

Step 5: Include Legal Disclosures and Signature Section

Finish the form with a section for legal disclosures, terms and conditions, and a space for the applicant’s signature. This part ensures that applicants acknowledge the loan’s terms and consent to the lender’s review and approval process, making the application legally binding.

Completing a loan application form accurately is essential for expediting the loan approval process. By providing complete and honest information, applicants can enhance their chances of obtaining the desired loan. This form serves as the initial, critical step in securing the financial assistance they seek. You can also see more on Project Forms.

FAQs

What are the different types of loans?

- Personal Loan

- Credit Card

- Home-Equity Loan

- Home-Equity Lines of Credit

- Credit Card Cash Advances

- Small Business Loans

When to use an application form?

Application forms are ofter associated with the job application process. However, this sample form can also be used in various transactions that require the selection of candidates. Whether they will proceed to the next stage of the process will depend on what they fill out in the form.

What is a student loan?

A student loan is money borrowed from the government or private lenders to support an individual’s education. The borrower has to repay the loan later, on top of the interest that accumulates over time. According to Forbes magazine, student loan debt in the US has reached 1.56 trillion US dollars in 2020.

What should I do if my loan application is denied?

Review the reasons for denial provided by the lender, which may include low income, high debt, or poor credit history. Improve on these aspects and consider reapplying or choosing a different loan product. You can also see more on Submission Forms.

How can I increase my chances of loan approval?

Ensure your Loan Application Form is complete and accurate, and be prepared to provide any supporting documents. A stable income, good credit score, and minimal debt can improve your chances.

What happens after I submit a Loan Application Form?

After submission, the lender reviews the application, checks your credit and financial background, and may ask for additional documents. If approved, they’ll offer loan terms for your review and acceptance. You can also see more on Membership Application Forms.