34+ Sample Profit and Loss Statement Templates & Forms

-

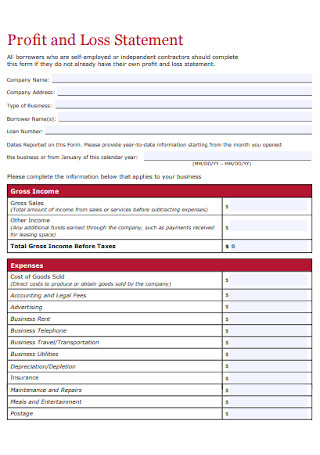

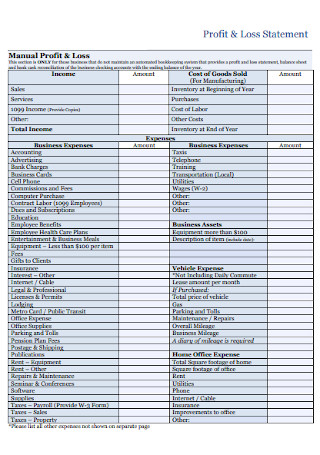

Sample Profit and Loss Statement Template

download now -

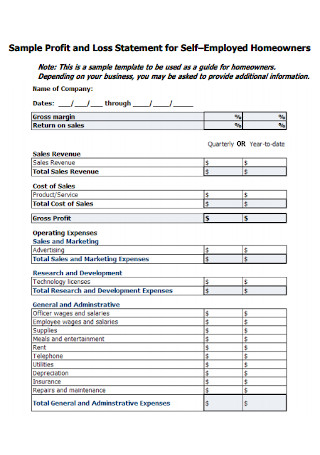

Profit and Loss Statement for Self–Employed Homeowners

download now -

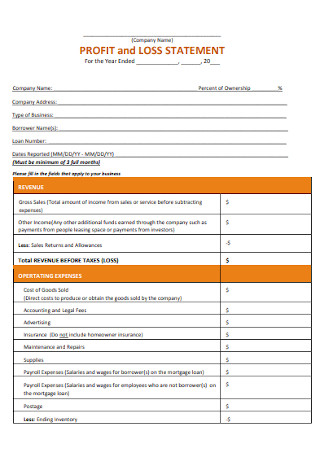

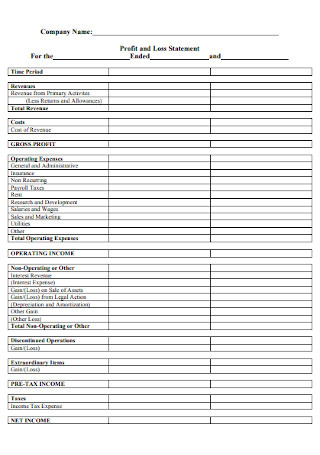

Company Profit and Loss Statement

download now -

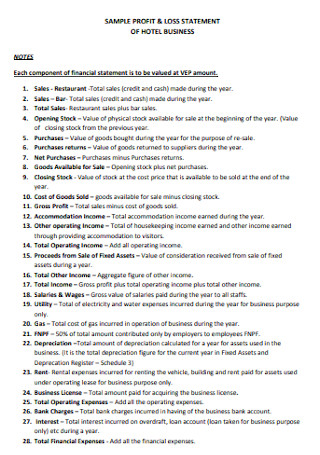

Sample Profot and Loss of Hotel Business

download now -

Tax Profit and Loss Statement

download now -

Company Profit and Loss Statement Template

download now -

Ratios of Profit and Loss Statement

download now -

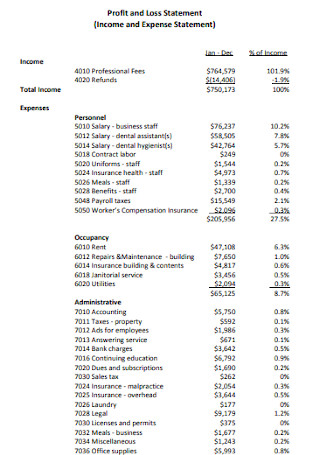

Income Profit and Loss Statement

download now -

Business Profit and Loss Statement

download now -

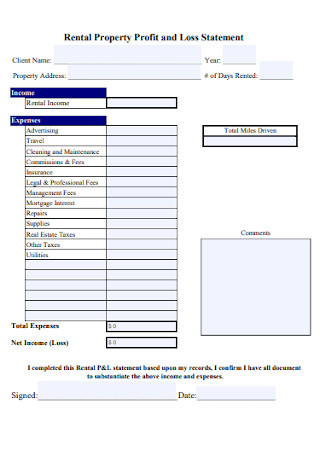

Rental Property Profit and Loss Statement

download now -

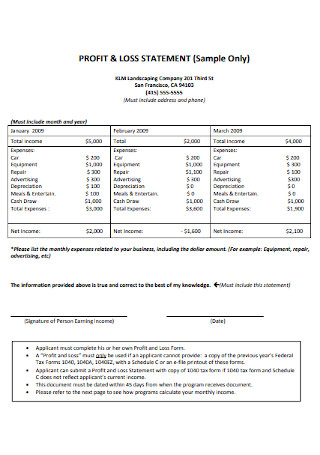

Sample Profit and Loss Statement Example

download now -

Year End Profit and Loss Statement

download now -

Basic Statement of Profit and Loss

download now -

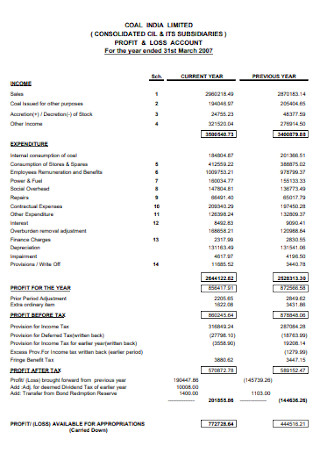

Profit and Loss Account Statement

download now -

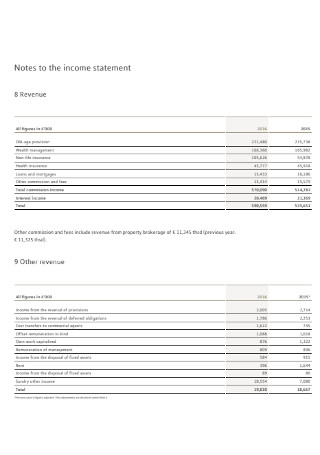

Notes to the Income Statement

download now -

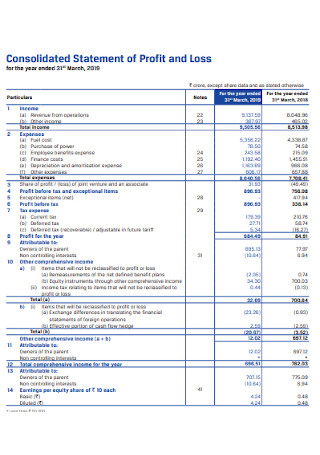

Consolidated Statement of Profit and Loss

download now -

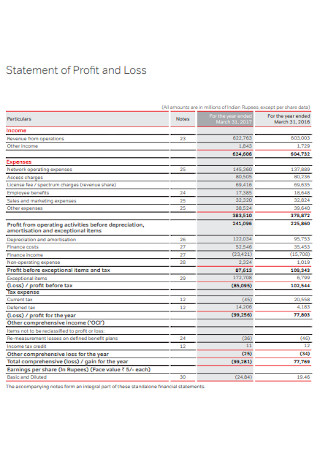

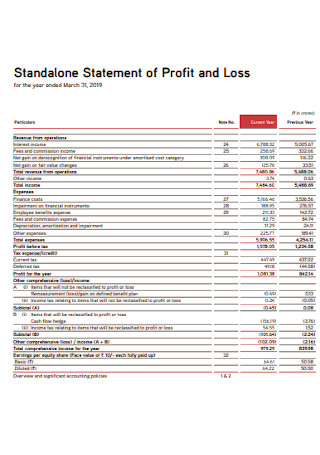

Standalone Statement of Profit and Loss

download now -

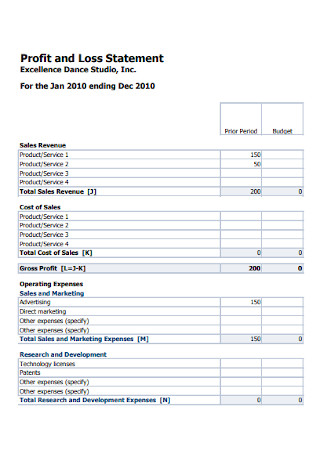

Studio Profit and Loss Statement

download now -

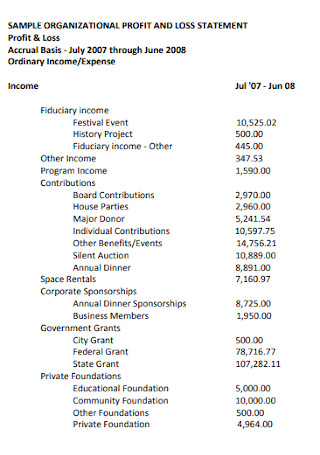

Sample Organizational Profit and Loss Statement

download now -

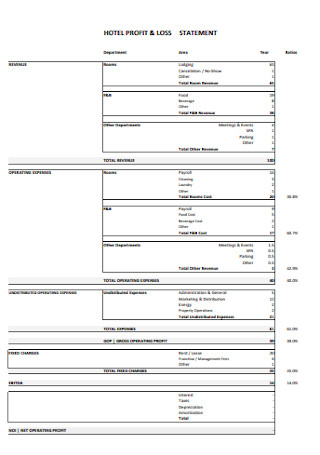

Hotel Profit and Loss Statement

download now -

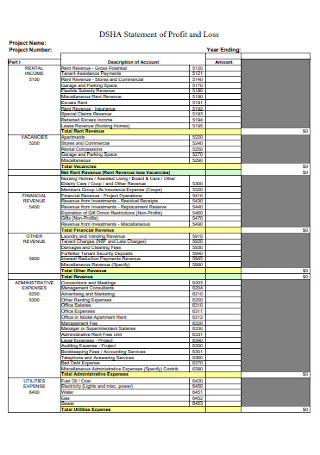

Project Statement of Profit and Loss

download now -

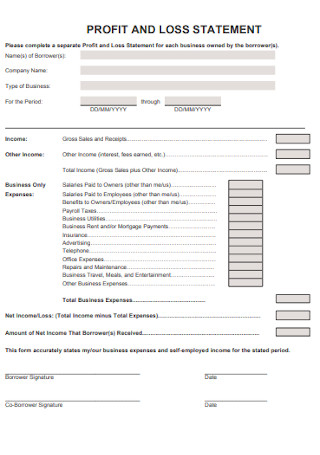

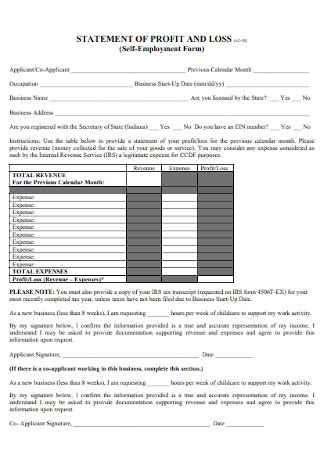

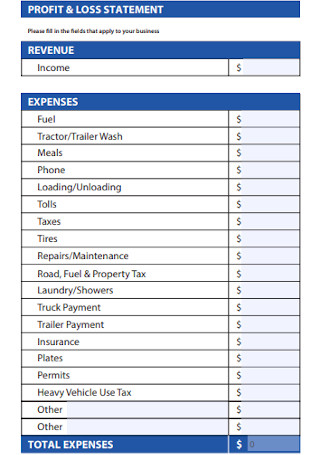

Profit and Loss Statement Form

download now -

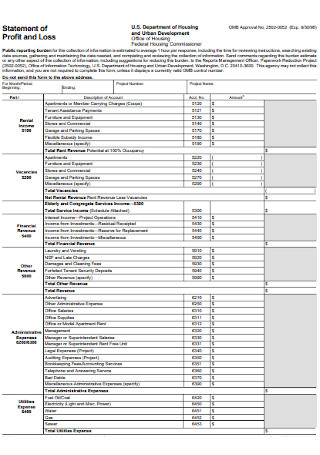

Statement of Housing Profit and Loss

download now -

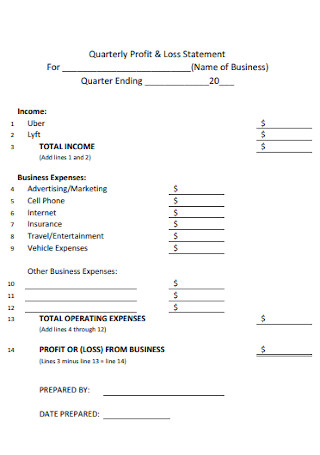

Sample Quarterly Profit and Loss Statement

download now -

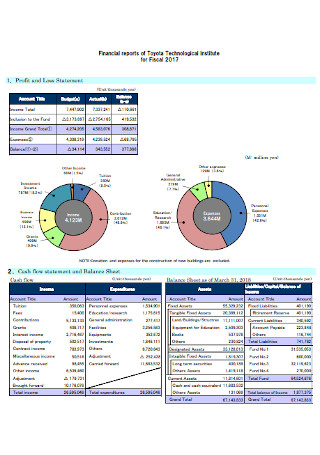

Technological Institute Profit and Loss Statement

download now -

Balance Sheet ad Profit and Loss Statement

download now -

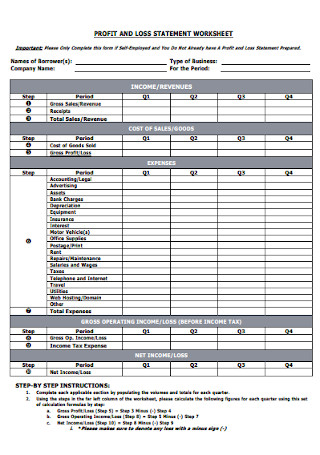

Profit and Loss Statement Worksheet

download now -

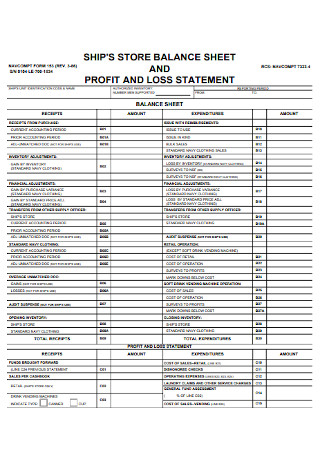

Ships Store Profit and Loss Statement

download now -

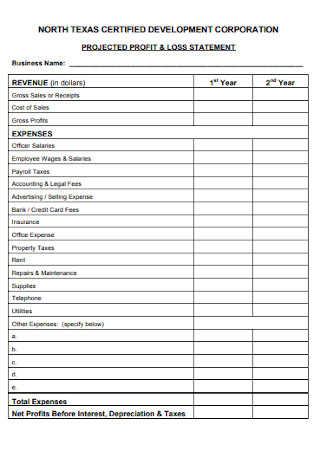

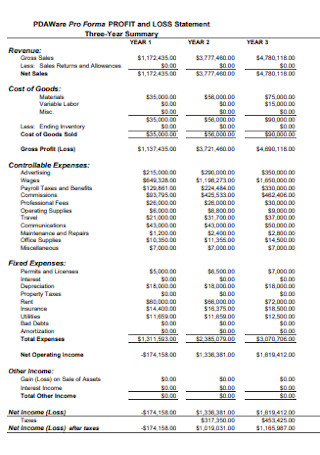

Projected Profit and Loss Statement

download now -

Basic Profit and Loss Statement Template

download now -

Standard Profit and Loss Statement Template

download now -

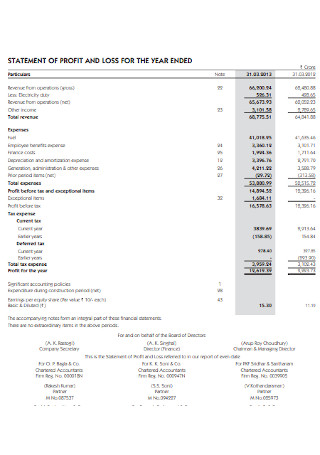

Statement Profit and Loss for the Year

download now -

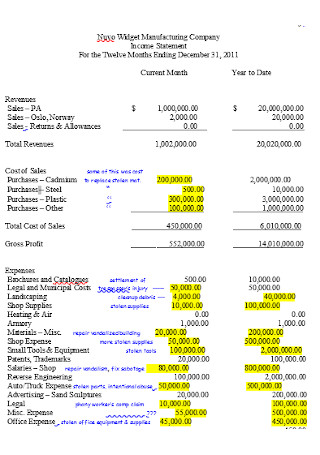

Company Income Profit and Loss Statement

download now -

Basic Business Profit and Loss Statement

download now -

Three Years Profit and Loss Statement

download now

FREE Profit and Loss Statement s to Download

34+ Sample Profit and Loss Statement Templates & Forms

What Is a Profit and Loss Statement?

Two Types of Profit and Loss Statement

The Components of a Good Profit and Loss Statement

How To Make a Profit and Loss Statement

FAQs

Why are profit and loss statements important in business?

What is the difference between profit and loss statement and balance sheet?

How do you calculate the profit and loss?

What are the three main components of a financial statement?

What Is a Profit and Loss Statement?

A profit and loss statement or P&L statement is a financial document that serves a vital function in both profit and nonprofit organizations. This type of financial report allows you to identify the amount your business gained and spent for a specific period. According to the article featured in Chron, companies and organizations need to prepare a business profit and loss statement since it shows precise information about revenue and expenses. These factors are one of the financial health indicators. Apart from that, having a profit and loss statement is also in compliance with the United States law. The profit and loss statement is also helpful in identifying who amongst businesses are profitable and who lost much money. However, the development and problems in society also have an impact on the profitability of a company.

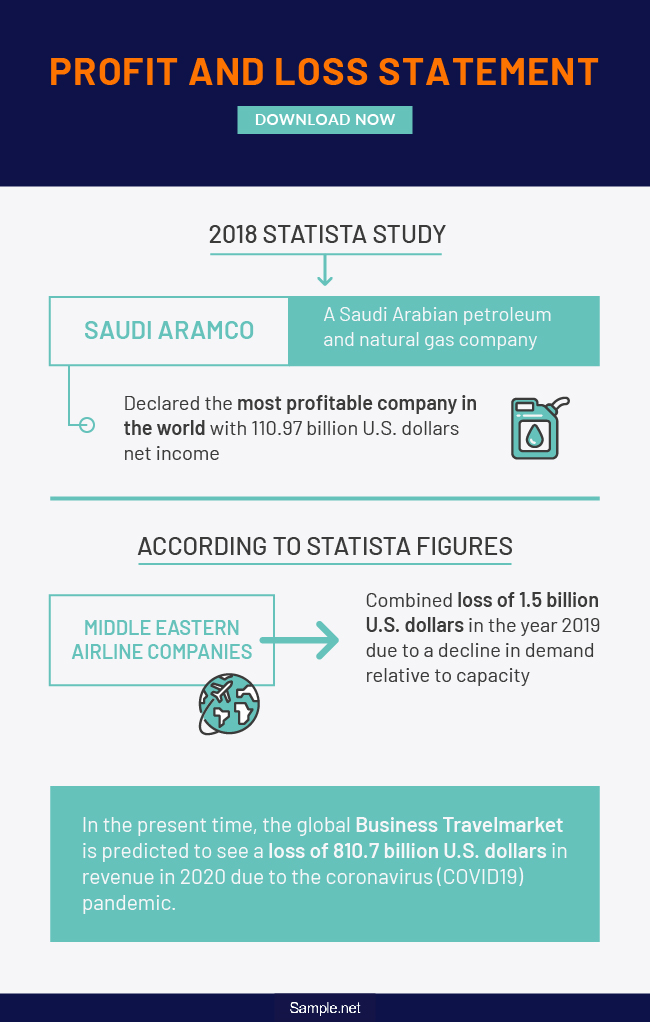

In the 2018 Statista study, Saudi Aramco, a Saudi Arabian petroleum and natural gas company, was declared the most profitable company in the world with 110.97 billion U.S. dollars net income.

On the other hand, the Middle Eastern airline companies have a combined loss of 1.5 billion U.S. dollars in the year 2019 due to a decline in demand relative to capacity, according to Statista figures.

In the present time, the global business travel market is predicted to see a loss of 810.7 billion U.S. dollars in revenue in 2020 due to the coronavirus (COVID19) pandemic.

Two Types of Profit and Loss Statement

A profit and loss statement or income statement is an accounting document that outlines the result of a business’s operations within a specified period. It showcases how much the business earned and how much they have lost. It is also an important component in your financial management report. A profit and loss statement comes in two types: single-step income statement and multi-step income statement.

Single-step Income Statement

A single-step income statement refers to a financial statement format that lays out all company expenses and totals them in a single column. This type of accounting document does not break down expenses by categories and descriptions. In this financial statement format, there are no subtotals, which are gross profit, operating income, etc. The single-step profit and loss statement is the commonly used format by companies since it is simple to prepare.

Multi-step Income Statement

Compared to the single-step income statement, the multi-step income statement is more complicated since it outlines more financial data and figures. In this, it is necessary to separate both operating income and expenses from nonoperating revenues and expenses, gains, and losses. Moreover, intermediate figures such as gross profit, operating income, etc. are calculated and presented. Although preparing this kind of financial statement format entails complexity, it is still necessary since it presents the total gross profit that is also useful in decision-making.

The Components of a Good Profit and Loss Statement

You should incorporate various categories in your profit and loss statement. These categories include revenue, expenditure, direct costs or cost of goods sold, gross profit, operating expenses, earnings before interest and tax (EBIT), earnings before tax (EBT), and net income. To fully understand these terms, read the following descriptions below.

How To Make a Profit and Loss Statement

Running and managing a business is not that easy. There are a lot of important things to consider to ensure that your business is successful—making concrete business plans, business sales plans, marketing plans, and a proper financial plan. These things are the components of a leading and successful business. However, the heart of the business is finance. You may have effective business strategic plans, but if you are not efficient in assessing your finances—income, expenses, and the likes—success for your business will be too shallow. Hence, writing a financial statement is essential.

A profit and loss statement presents the breakdown of your business income and spending. P&L statements help business owners to indicate the financial health status of their businesses, and it is a valuable tool that drives your business to success. Since it holds an essential function in the business system, it is only necessary to ensure that it is well-written, and all information stated in the financial statement is accurate. Without leaving you hanging, we have presented you with some guidelines on how to write and prepare a precise and detailed profit and loss statement.

Step 1: Focus on the Statement Type

As you know, profit and loss statements come with two types—single-step and multi-step financial statement format. These two may be different, but both serve a similar purpose, and that is to provide an accurate picture of your company’s profit and spending. So, the first step to make your P&L statement is to focus on these two income statement types and choose what fits your financial report. Doing this allows you to have a better understanding of how to make a P&L statement and prepare the needed information and figures beforehand.

Step 2: Gather the Essential Data

Now that you have already chosen the profit and loss statement type to use, the next thing you need to do is to gather the necessary information to incorporate into your document. The profit and loss statement includes data and figures of your company revenue and expenses. However, it is also crucial that both information falls within the same period, whether monthly, quarterly, or yearly.

So, to gather this information, you need to track your company’s invoices to determine your profits. For your company expenses, it usually includes advertising expenses, office supply expenses, travel expenses, and the likes. To track your expenses, you may evaluate transaction receipts.

Step 3: Create the Structure of Your P&L Statement

Once you finish gathering the necessary information for your P&L statement, it is time to create its structure. Profit and loss statements come with a company letterhead that states your company details—name, logo, tagline, contact information, and address. Also, this is where you state the period your profit and loss covers. The bottom part of your profit and loss statement must contain a table where you will input the income and expenses figures. However, if you want a simple and quick process, you may utilize pre-made profit and loss statement templates and forms that you can find in this article. Simply choose and download the template that you think best suits your objectives.

Step 4: Fill In Your Profit and Loss Statement

Finalize your business profit and loss statement by filling in the needed information. In doing so, make sure that you put the data and figures on its corresponding column. List down first your revenues and follow all your operating expenses. On the other column, place the figures that correspond to each category. After that, you may now calculate your profit and loss statement following the correct formula. Also, make sure to evaluate and check your P&L statement to correct mistakes.

FAQs

Why are profit and loss statements important in business?

A profit and loss statement is important for businesses because it outlines the total income and expenses of the business—either monthly or quarterly. It helps the business managers understand and evaluate the business’ revenue, which is essential in decision-making and generating strategic business plans. For example, a business owner will be able to weigh whether or not their income for a specified period is enough for purchasing other equipment.

What is the difference between profit and loss statement and balance sheet?

Although both important business documents and accounting documents are necessary for business, they still serve different purposes. A profit and loss statement refers to summarizing the company revenues, costs, and expenses within a matter of time. On the other hand, a balance sheet records the business’ assets, liabilities, and stockholders’ equity within a specified period.

How do you calculate the profit and loss?

Calculating your company’s profit and loss is not that difficult. You just need to have the right figures to come up with an accurate result. To calculate profit and loss, simply subtract your business’ total revenue with your total expenses, all in the same period. The profit and loss statement is essential for your business, so make sure you do the calculations right.

What are the three main components of a financial statement?

Financial statements serve a vital role in financial management, planning, and cost-benefit analysis processes. Its purpose is to help a company owner or manager identify the financial health status of their business. There are three main components of a financial statement that are present and used by almost every business—statement of profit and loss, balance sheet, and cash flow statement.

Indeed, analyzing company revenue and expenses is essential for a business to have a better idea when it comes to decision-making and financial planning. A profit and loss statement is, no doubt, one of the most important financial statements businesses should never ignore. With this, proper financial management will be observed. So, if you want to have an accurate picture of what comes and goes in your business financially, make sure to have an efficient and precise profit and loss statement.