Sample Size Calculator, PDF

-

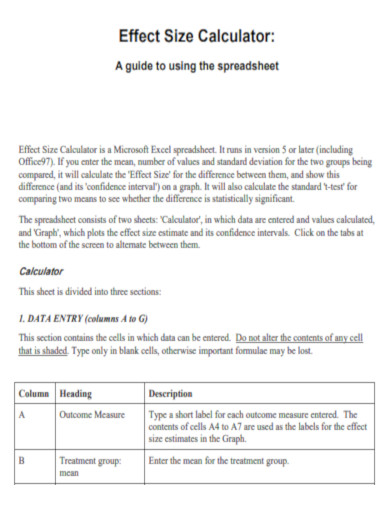

Effect Size Calculator

download now -

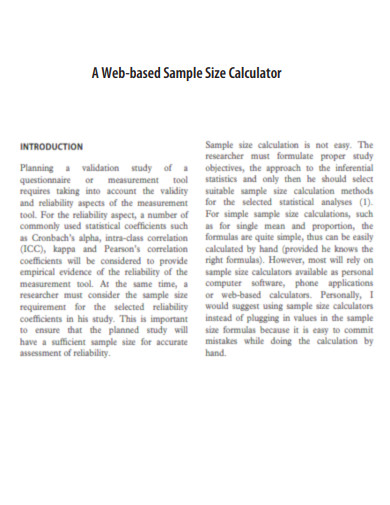

Web-Based Sample Size Calculator

download now -

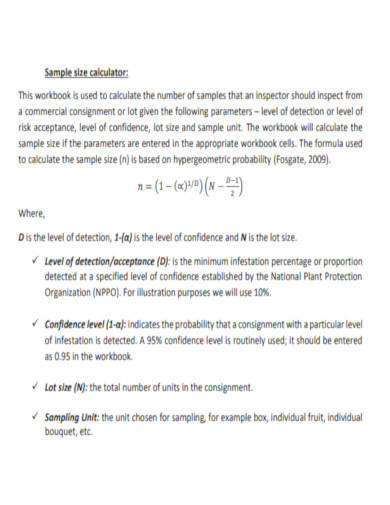

Using the Sample Size Calculator

download now -

Practical Meta-Analysis Effect Size Calculator

download now -

Sample Size Calculator for MRT with Binary Outcomes

download now -

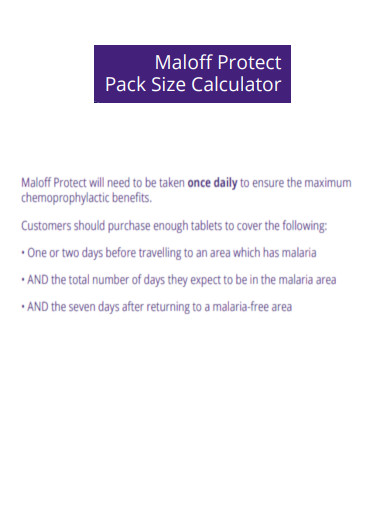

Maloff Protect Size Calculator

download now -

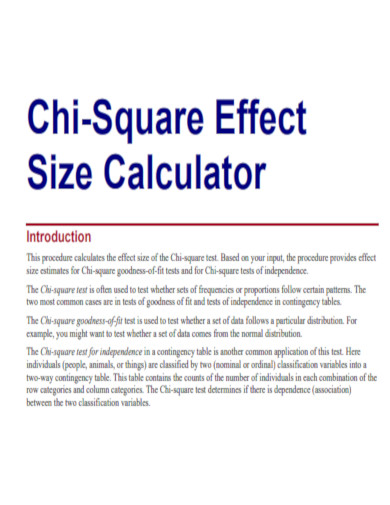

Chi-Square Effect Size Calculator

download now -

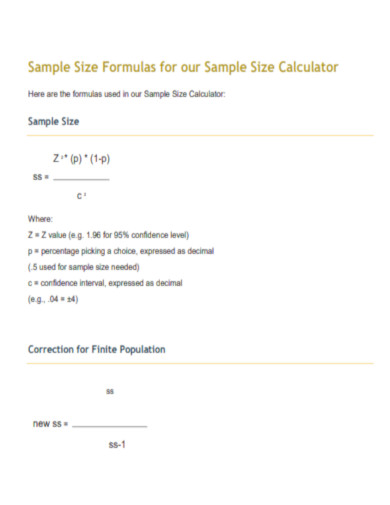

Formulas for our Sample Size Calculator

download now -

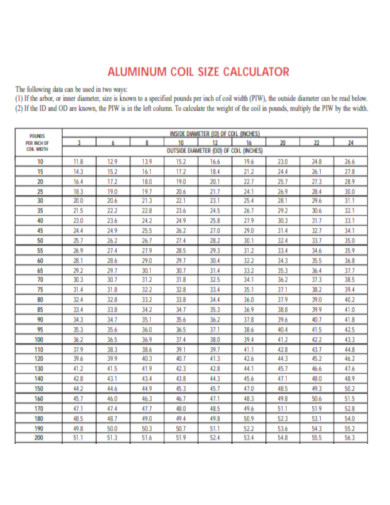

Aluminum Size Calculator

download now -

Online Sample Size Calculator

download now -

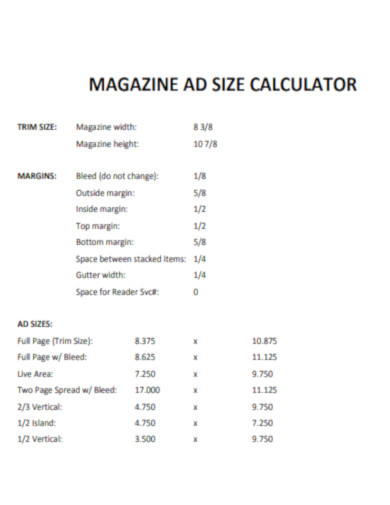

Magazine AD Size Calculator

download now -

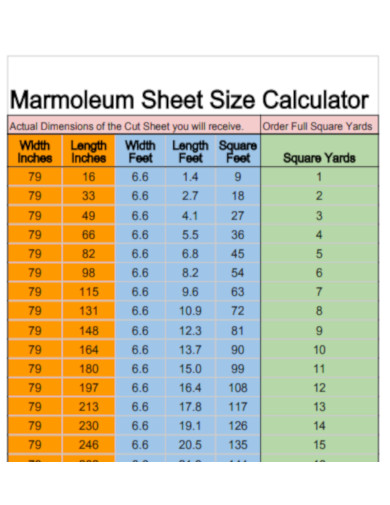

Marmoleum Sheet Size Calculator

download now -

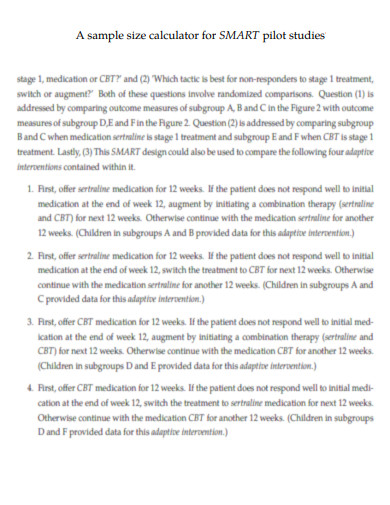

Size Calculator for SMART Pilot Studies

download now -

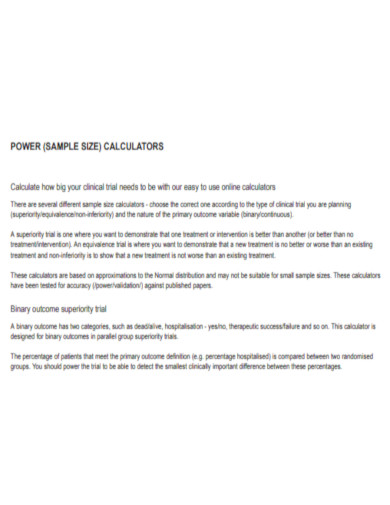

Power Sample Size Calculator

download now -

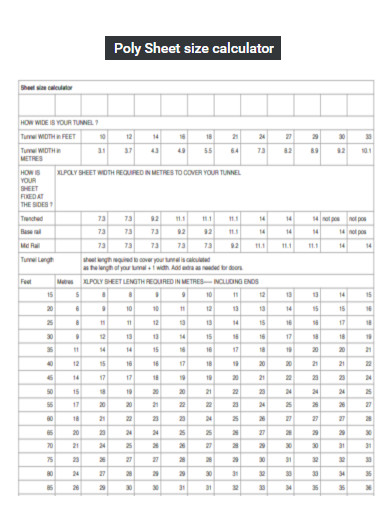

Poly Sheet Size Calculator

download now -

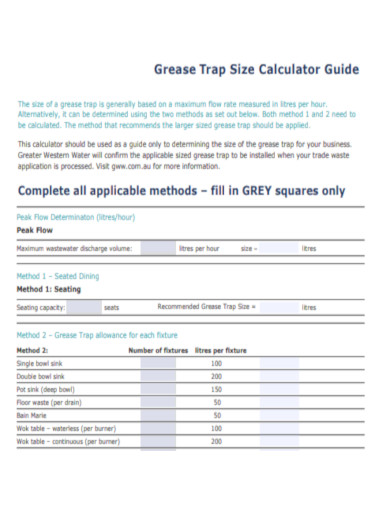

Grease Trap Size Calculator Guide

download now -

Decision tool Size Calculator

download now -

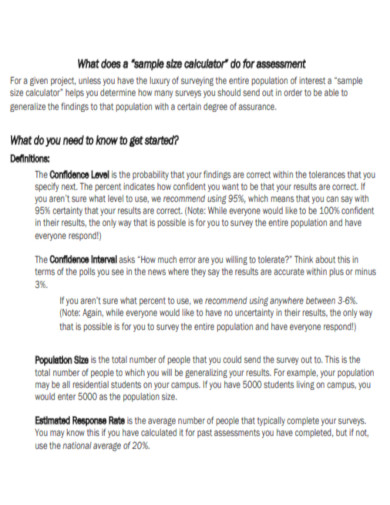

Size Calculator For Assessment

download now -

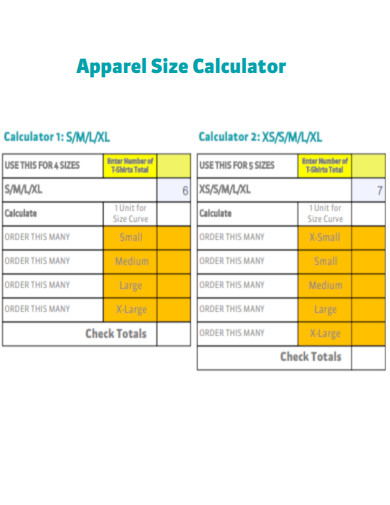

Apparel Size Calculator

download now -

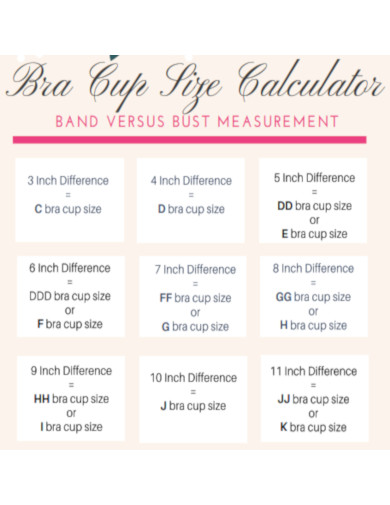

Bra Cup Size Calculator

download now -

Tire Size Calculator Instructions

download now

What Is a Sample Size?

In market research, sample size refers to the sample size included in a survey, study, or experiment. In large-population surveys, the sample size is of paramount importance. This is because of the impracticality of obtaining responses or results from everyone; instead, a random sample of persons can be selected to represent the entire population. An April 2018 article determined that the average survey response rate was approximately 33% but admitted that other factors exist. In most instances, a survey response rate of 50 percent or more should be regarded as excellent. A high response rate is often the result of high levels of motivation or a strong personal relationship between the business and the consumer.

Benefits of Surveys

Managers know that when they get the questionnaire findings, they have the consumers’ feedback and can use it for future projects. However, this information can be collected from responders in various methods. This is why some corporate leaders select feedback collection methods other than surveys. However, businesses benefit the most from surveys. There are multiple benefits that many do not recognize and, as a result, do not exploit. Here are the benefits you may not be aware of.

Tips for Designing a Survey

Whether gauging client satisfaction or assessing a new marketing campaign, you’ll want to ensure that your survey engages your intended respondents. In the end, the quality of your survey questions is irrelevant if no one responds. These are the primary aspects that influence your survey design and help differentiate decent surveys from exceptional ones.

1. Set an Objective for Your Survey.

Before constructing your survey, you should establish a specific set of objectives. Without this benchmark, it is simple to stray off-topic and lose sight of the purpose of your survey. Your goal should be both primary and specific. Consider a more precise objective, such as “I want to understand what’s causing a high turnover on our customer-facing teams,” instead of “I want to measure employee happiness.” This will give a roadmap for your design plan, making it easier for you to identify your questions and the optimal sequence for them.

2. Maintain a Proper Balance Between Question Kinds.

There are two primary survey questions to pick from: closed-ended and open-ended. Closed-ended questions are those with predetermined responses created by the survey creators. Typically, these questions are presented in multiple-choice or checkbox format, and respondents select their preferred answer from a list. Your survey should include more close-ended questions because they offer quantifiable findings. These outcomes are simpler for both consumers and you to interpret. Use open-ended questions to get qualitative data. However, because they require more time to complete and evaluate, it is preferable only to use them when seeking specialized input or working with smaller audiences. Be careful to add any open-ended questions after the survey, as they require more time and can sometimes be overwhelming for respondents. The optimal time is approximately three-quarters of the way through the study before participants suffer survey tiredness.

3. Avoid Leading or Biased Inquiries.

It is simple to incorporate biased or leading survey questions mistakenly. Common examples of ultimate questions include, “How fantastic was your experience with our customer service team?” Such inquiries damage the reliability of your results. You must rely on something other than the accuracy of your data because your staff has subjectively influenced the participants.

4. Incorporate Response Scales.

Response scales show how strongly someone feels about a particular subject. Without asking open-ended questions, these kinds of answers tell you a lot about how your audience feels. Participants are given a series of statements and then asked to rate their feelings on a scale with two ends.

How to Find Your Sample Size

During your market research, you may need help to collect data from the complete target demographic. Although higher sample sizes bring you closer to a 1:1 depiction of your target demographic, dealing with them can be time-intensive, costly, and inconvenient. However, small sample sizes risk producing results not representative of the intended population. You may pick an optimal subset that accurately represents the population and yields statistically significant, robust results without consuming all of your resources. This article explains how to determine sample size with a margin of error to identify the subset in question. Follow these four procedures to obtain the appropriate sample size for your research needs.

1. Determine the Population Size

Your sample size requirements will vary based on the actual population size or the number of individuals you wish to conclude about. Determining the minimum number of individuals necessary to represent your selection adequately is a crucial first step. Choosing the population size can be easier said than done. While there is a wealth of population data reports accessible, you may be targeting a group that is particularly complicated or for which there are no accurate data. When working with relatively small, easy-to-measure groups of people, it is crucial to understand the population size. When dealing with a larger population, you should rely on your best estimate. This initial step in a sample size formula yields more accurate results than a simple estimate and correctly reflects the population.

2. Designate Your Margin of Error

Errors in sampling are inherent whenever a subset of a population is utilized. You can be confident that your results are accurate by specifying the margin of error you plan to allow. A margin of error, often known as a “confidence interval,” determines how far you are willing for the sample mean to deviate from the population mean. It is sometimes expressed with statistics as a plus-minus () number, indicating a reasonably specific range. Suppose, for instance, that a sample fraction of your coworkers with a specified margin of error of 3% reveals that 65 percent of your office utilizes some voice recognition technology at home. If you were to survey your whole office, you could be sure that anywhere between 62% and 68% of individuals utilize voice recognition technology at home.

3. Determine How Confident You Can Be

Your degree of assurance indicates how certain you are that the genuine proportion of the population would select an answer within a given range. The most typical confidence levels are 90%, 95%, and 99%. Typically, researchers adopt a 95% confidence threshold. Confusing confidence levels and intervals is a mistake (i.e., mean of error). Remember the distinction by considering the concepts’ relationship to the sample with greater assurance. In the preceding step’s example, when confidence levels and intervals are combined, you may be 95% confident that the actual percentage of your colleagues who use voice recognition technology at home lies within three percentage points of the sample mean of 65%, or between 62% and 68%.

4. Decide the Variance to Expect

The final factor to consider when estimating sample size is the variation you anticipate among participant replies. The standard deviation measures the amount by which sample data points differ from the population mean. How much variation should I expect? Use a standard deviation of 0.5 to ensure that your sample size is sufficient.

FAQs

What increases the sample size?

The sample size increases proportionally to the square of the standard deviation. It reduces proportionally to the square of the difference between the alternative hypothesis’ mean value and the null hypothesis’ mean value.

What is the best way to sample data?

Simple random sampling is the simplest straightforward method for sampling data. The subset consists of observations selected randomly from a more extensive set; each observation has an equal probability of being chosen from the more comprehensive set. Simple random sampling is quite simple to implement.

What is the purpose of sample data?

Sampling aims to approximate a larger population on key traits so that researchers can conclude the larger group.

Calculating sample size may sound complicated, but sample size formulas and calculators are now accessible to make this tiresome aspect of research more efficient. Now is the time to collect a sample and conduct a focus group proposal form or customer satisfaction survey. Regardless of your choice, you now know how to make confident decisions.