44+ Sample Living Trust Templates

-

Benefits of a Revocable Living Trust

-

Sample Living Trust

-

Revocable Trust Accounts

-

Advantages of a Living Trust

-

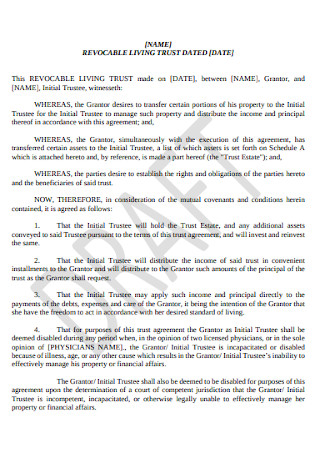

Revocable Living Trust

-

Living Trust Sales

-

Revocable living trusts

-

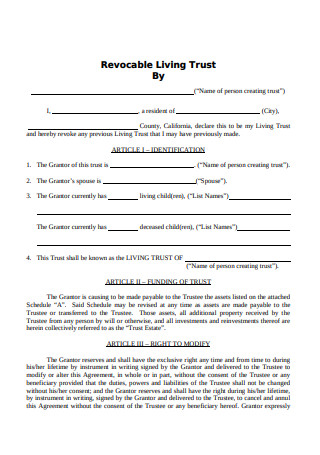

Sample Revocable Living Trust

-

Consumer Info Revocable Living Trusts

-

Human living trusts

-

Revocable Living Trust Questionnaire

-

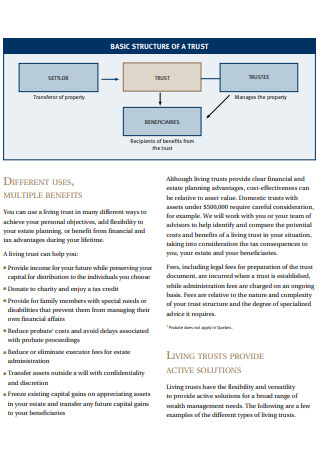

Basic Structure of Living Trusts

-

Beware of Living Trust Scare Tactics

-

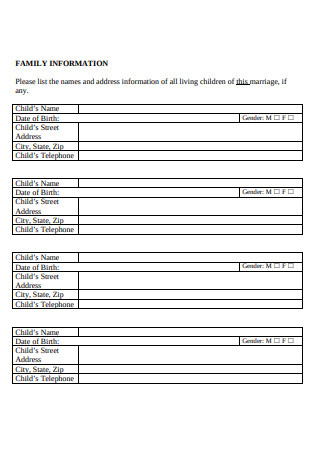

living trust Family Information

-

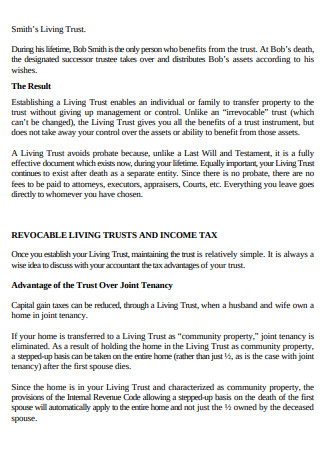

Document of People Living Trust

-

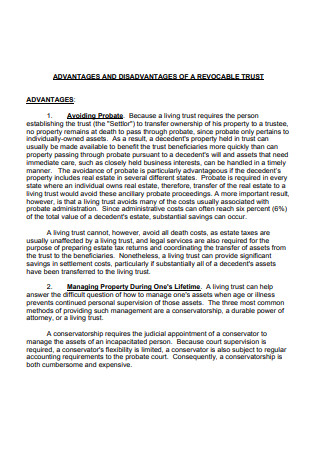

Advantages and Disadvantages of a Revocable Living Trust

-

Revocable Living Trust and Estate Planning

-

Client Living Trust

-

Benefits of a Living Trust

-

Comparison of Living Trusts and Wills

-

Living Trust Additional Information

-

Considerations in Forming a Living Trust

-

Living Trust Worksheet

-

Memorandum Regarding Living Trust

-

Care and Maintenance of Your Revocable Living Trust

-

Revocable Living Trust Form

-

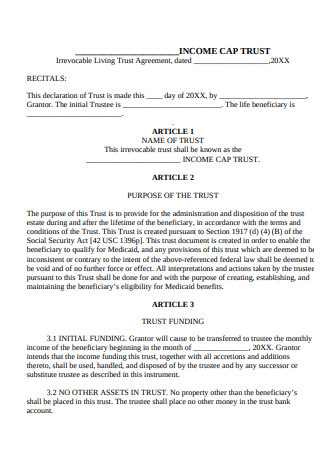

Irrevocable Living Trust Agreement

-

Understanding Living Trusts

-

Consequences of Living Trusts

-

Living Trust and Annuities Scams

-

Living Trusts Example

-

Standard Revocable Living Trust

-

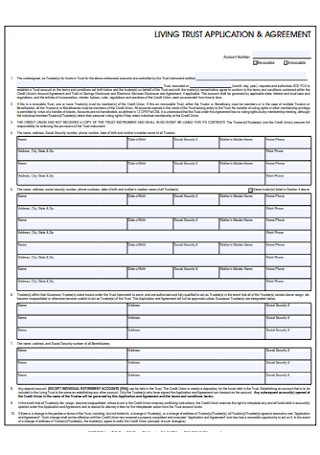

Living Trust Application and Agreement

-

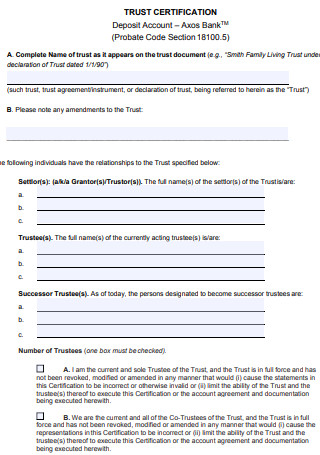

Living Trust Certification

-

Living Trustee Certification Form

-

Irrevocable Living Trust and Agreement

-

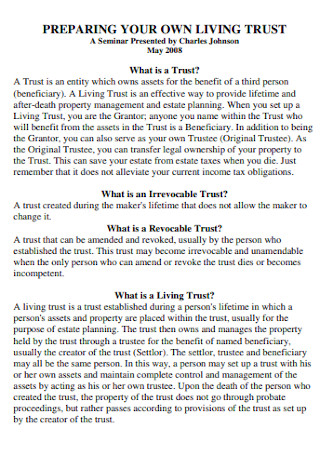

Preparing Your Own Living Trust

-

Basic Revocable Living Trust Form

-

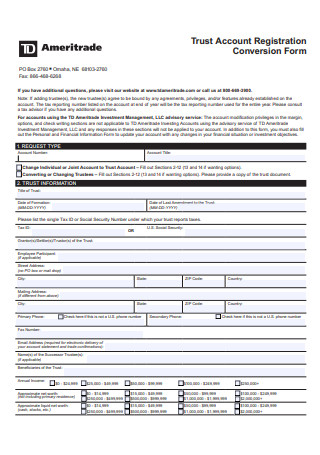

Trust Account Registration Conversion Form

-

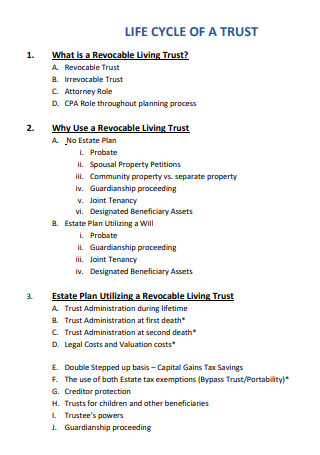

Life Cycle of a Living Trust

-

Basic Revocable Living Trusts

-

Living trusts in DOC

-

Irrevocable Living Trust Agreement Income

-

Basic Irrevocable Living Trust

-

Medicaid Planning Living Trust

What Is a Living Trust?

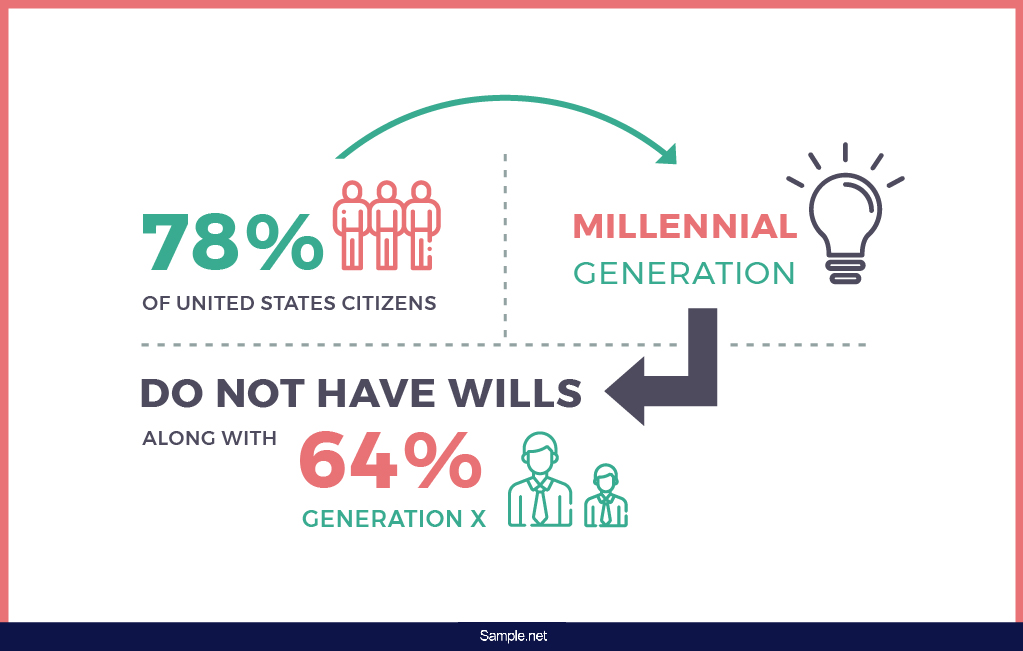

A living trust is a legal document that is written in order to place one’s assets into a trust during that person’s lifetime. Upon death, those assets are then transferred to the designated beneficiaries by a chosen representative, who can be referred to as your trustee. An alternative term for this document is a revocable trust. According to AARP, around 78% of United States citizens belonging to the millennial generation do not have wills, along with 64% of those from Generation X. Another estimate is that only 20% of all Americans have living trusts. Among the reasons why so many do not have living trusts or wills is because they either don’t possess enough assets to leave to their heirs or they simply haven’t gotten around to it yet.

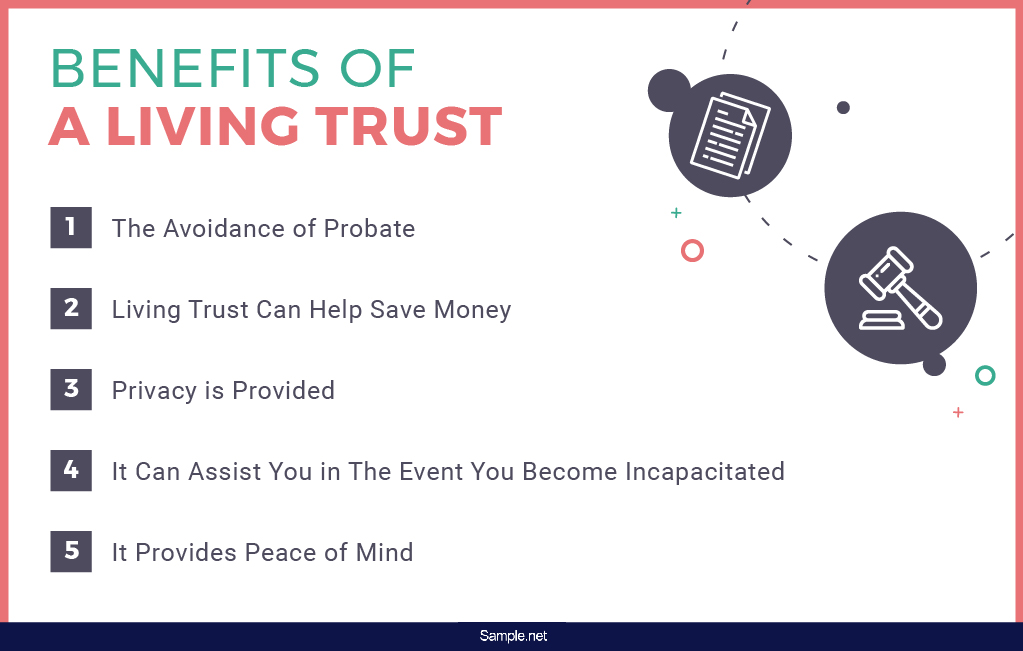

The Benefits of a Living Trust

Those who do not yet belong to the 20% of Americans with living trusts may need further convincing about what they can gain from it. Fortunately, the following benefits should be more than enough to help anyone see why having such a legal document at their disposal is ultimately a worthy undertaking.

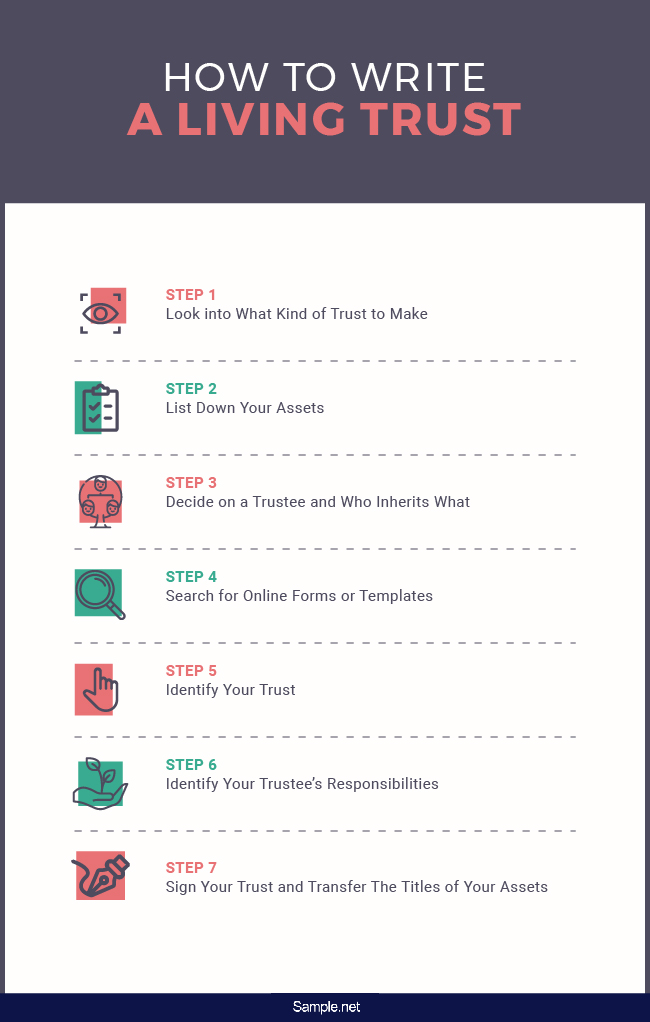

How to Write a Living Trust

Now that you are aware of the benefits of having a living trust, the next part is to actually learn how to come up with one. The following instructions will provide you with a step-by-step guide that you can use to your advantage. Be aware that you aren’t just coming up with a marketing contract or a sales contract. Living trusts are on a different level and must be considered appropriately.

Step 1: Look into What Kind of Trust to Make

An example of this step would be for married couples to decide if they are going to come up with individual living trusts or go for joint trusts. Remember that individual trusts are only going to include your property, as opposed to joint trusts which will extend towards the property owned by your spouse. Complications arising from individual trusts can also stem from your shared assets, which is nullified by getting a joint trust.

Step 2: List Down Your Assets

A tip to help you out with this step is to consider only some of your assets. There is no need to list all of them. From this list, you can later decide on how you would want to distribute these assets in your trust. Having a list will also help you take note of which assets to gather paperwork for, which is important for your living trust to fully take into effect.

Step 3: Decide on a Trustee and Who Inherits What

These are the important people involved in your trust for different reasons. For the former, this will be the one in charge of distributing your assets to your beneficiaries. Because of that, you will need to choose the assigned person very carefully. For the question of who gets to inherit what from you, a helpful tip would be to refer to the list of assets from the step above. Take a closer look at each one and see which of your heirs is most suitable for what asset or who needs what the most.

Step 4: Search for Online Forms or Templates

With all of those important details decided, the next step is to actually begin writing the document. If you do not want to start from scratch or if you are unfamiliar with the formatting, then you can always look for forms online. Alternatively, you may download templates and simply make the necessary edits to whatever you find. There are many online resources for you to rely on, but take care to get only the ones that are best suited to your specific document.

Step 5: Identify Your Trust

For your trust’s first sections, you need to include your name as well as the name of the trust. As the owner of the property that will be included in the trust, you may list down your own name as the document’s grantor. Take note that your trust’s name does not have to be particularly fancy. Some may even just use their own name and then proceed to the identifying of the kind of trust they are creating.

Step 6: Identify Your Trustee’s Responsibilities

The penultimate step in this process is the identification and specification of the responsibilities expected of your trustee. This can also include whatever responsibilities a successor trustee can have, in the event that you decided to go with one as well. In truth, you are the primary trustee whilst you remain alive, and anybody else serves the role of a successor trustee. Among the duties expected from a trustee would be the reporting of any earned income from the assets included in the trust, as well as the transferring of property ownership from your trust to a listed beneficiary. Speaking of the beneficiaries, they must be the next ones to be listed.

Step 7: Sign Your Trust and Transfer the Titles of Your Assets

The signing of your declaration of trust is typically going to be done in the presence of a notary. Take note that a trust won’t be officially finalized until you put the assets in the trust’s name. That means transferring titles becomes necessary since the assets will still be in your name. Doing so will involve adding language that will indicate that it is now held in trust.

The Dos and Don’ts of a Living Trust

Knowing what to do and what not to do is guaranteed to help you achieve a greater level of quality and impact on any document. Below are the dos and don’ts of a living trust; take a close look at each one and see what unique help it provides.

Dos

Do conduct your own research.

Although you can already gain a lot of knowledge from consulting with your attorney, doing your own research comes with its own perks. After all, it never hurts to be well-informed, especially when you are about to get involved in legal matters concerning your own assets. Greater personal knowledge of the topic at hand can also guarantee a much easier time in drafting your living trust. Rather than rely solely on your attorney’s efforts, you’ll be in a position to make actual contributions on your own merit.

Do seek advice from a professional.

Although the first do advocates attaining knowledge for yourself, it is still a good idea to get advice from a trusted attorney. As knowledgeable as you may get through your own research, it won’t beat years of law school and even greater years of actual practice. The combination of your attorney’s competency and your own can assure you a higher-quality living trust, so don’t be afraid to reach out if ever you come across specific situations in the drafting that is beyond your own comprehension or level of expertise. As a related example, doing a real estate survey on your own is great, but professional advice will always be better.

Do be careful with whom you place in charge of all your affairs.

The responsibility that comes with handling a living trust is not something to be taken lightly. Your successor trustee must be someone trustworthy and competent enough for the job. Do take care and choose the person wisely. Also related to this would be choosing someone who is not only capable but also willing to be left in charge of your assets after your death. Simply naming a person without their consent may lead to irresponsibility and incompetence on their part because they just never wanted the job in the first place. Find someone just as capable of handling your real estate assets as he or she is with other kinds of assets.

Do think about your pets.

Those who do not have any pets can choose to skip this one altogether, but those who do may have an unlikely consideration to make. Many may be under the impression that animals do not count within estate planning but the law considers pets to be the personal property of their owner. As a result, you need to think about who is going to take care of your beloved dog or cat once you have passed away. There is also a consideration to make over setting up a completely separate pet trust so that funds and instructs can be set aside for whoever ends up taking care of your pet.

Do consider all of this as early as possible.

You may be in the prime of your life, making the thought of living funds, wills, and estate planning practically inconceivable, but you can never really guess where the road of your life will take you. Many people have many the mistake of believing they have more time, only to realize towards the end that they’ve wasted too much time putting off this very important endeavor. Do not wait until you are old or sick to start thinking about all of this. As soon as you start acquiring assets, put some thought into where they are headed should the worst case scenario happen.

Don’ts

Do not forget to write the names of grantors, beneficiaries, and trustees.

There are a few details that are absolutely crucial to a living trust. Said details would include the name of the grantor, who happens to be you, the trustee, who happens to be the one you will assign to oversee your trust and with the distribution of your assets, and finally there are the beneficiaries. Concerning that last one, be sure to specify each person that you intend to leave certain assets to. All of the names need to be clearly stated on any self-written living trust. Another wise tip would be to name a successor trustee in the event that your preferred or chosen trustee dies before you.

Do not neglect to fund your trust.

Funding the trust is another thing that you may want to be reminded of. This may be quite expensive but it is also necessary. Separate paperwork will need to be drawn up before you can start transferring your stocks, bank accounts, and various other assets to your trust. Do take care to remember that if your living trust never gets funded then you are not going to have any real assets that you can pass to your chosen beneficiaries.

Do not make use of precatory language.

When you talk about precatory language, you refer to a type of language expressing a wish but will not create any form of legal obligation. It is worth saving all your niceties for a document that is more personal, like a personal letter or even a greeting card, because all of that need to be avoided when it comes to living trusts. In particular, avoid the use of phrases that start with “I hope you will…” or “I want you to…” because legal documents make use of more concise and specific language and terms. Leave instructions for your trustee, not suggestions.

Do not forget to hire the services of a notary public.

There will be those among you who will opt out of hiring lawyers or attorneys for the drafting of the document, but one thing you cannot skip should be the hiring of a notary public for its notarization. The state you live in may not necessarily require it, but it will add to your living trust’s overall legitimacy.

As you can see, there is much to consider when it comes to complex documents such as living trusts. Again, those who do not want to start from scratch can choose to seek out online resources. Be sure to download trust agreement templates, edit them as you see fit, and print it out for your convenience.