35+ Sample Secured Promissory Note Templates

-

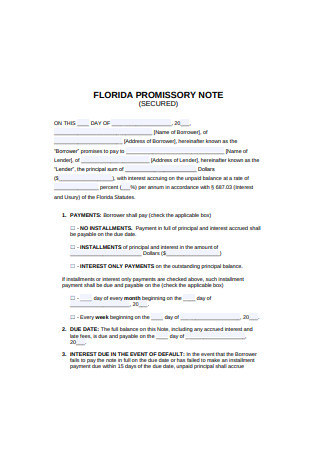

Secured Promissory Note

-

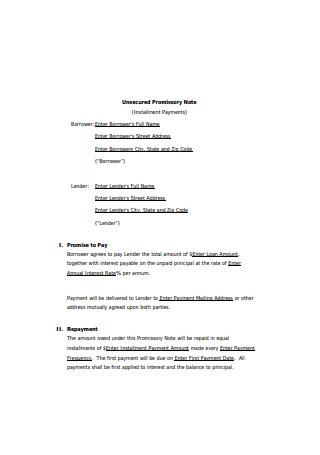

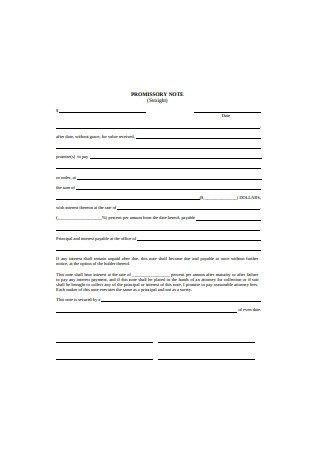

Unsecured Promissory Note

-

Sample Secured Promissory Note

-

Promissory Note Secured by Assignment of Lease

-

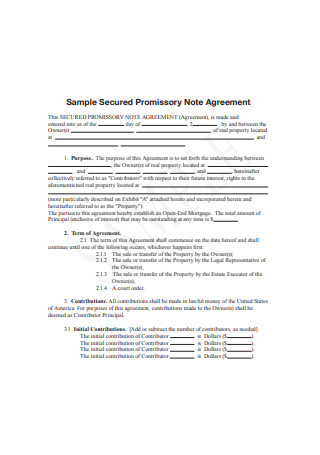

Sample Secured Promissory Note Agreement

-

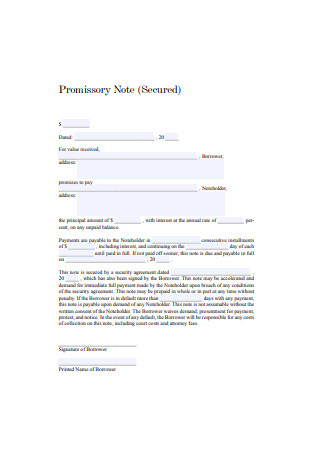

Simple Secured Promissory Note

-

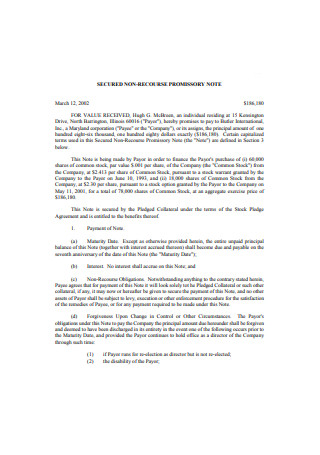

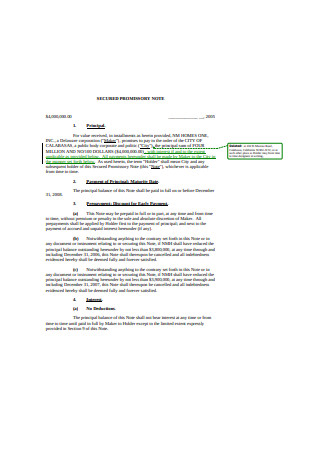

Secured Non-Recourse Promissory Note

-

Formal Secured Promissory Note

-

Secured Promissory Note Form

-

Promissory Note Secured by Deed of Trust and Security Agreement

-

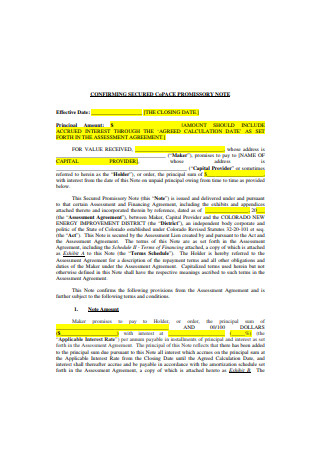

Confirming Secured Copace Promissory Note

-

Basic Secured Promissory Note

-

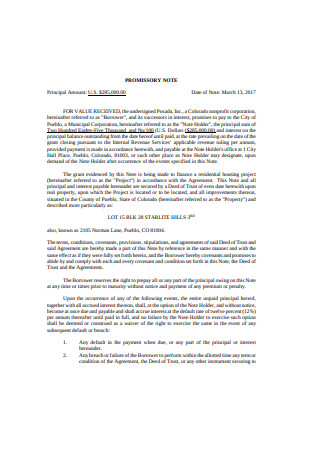

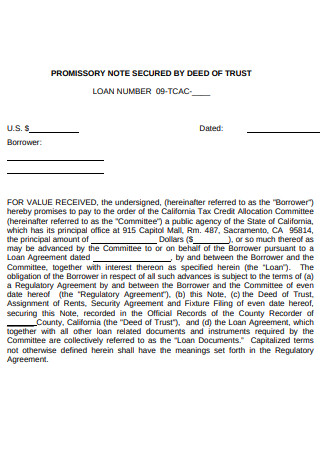

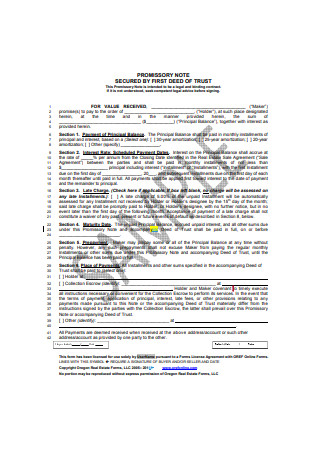

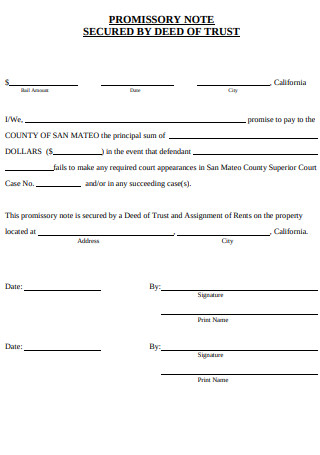

Promissory Note Secured by Deed of Trust

-

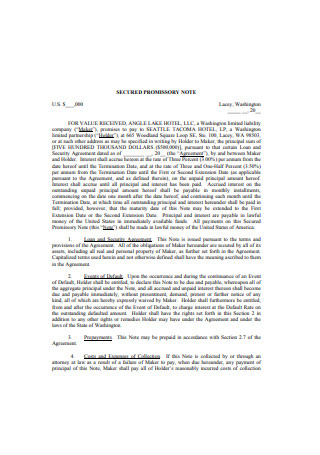

Secured Promissory Note Example

-

Inclusive Promissory Note Secured by Deed of Trust

-

Secured Promissory Note Form Example

-

Promissory Note Secured by First Deed of Trust

-

Secured Promissory Note Format

-

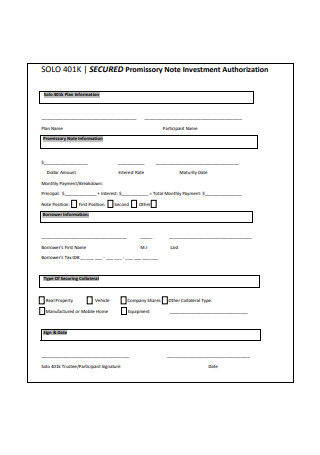

Secured Promissory Note Investment Authorization

-

Unsecured Promissory Note Example

-

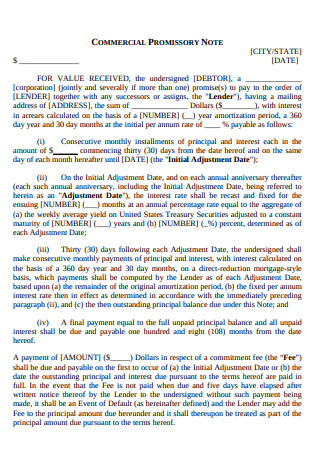

Commercial Secured Promissory Note

-

Official Secured Promissory Note

-

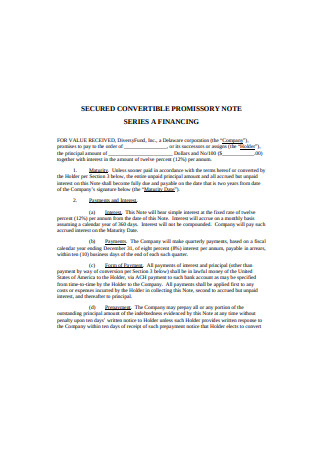

Secured Convertible Promissory Note

-

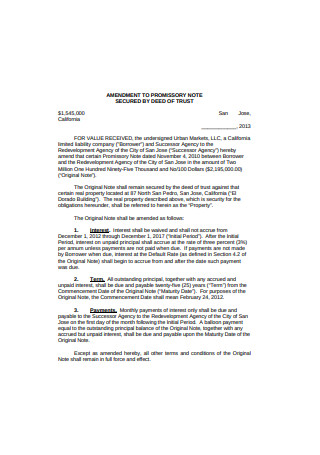

Amendment to Promissory Note Secured by Deed of Trust

-

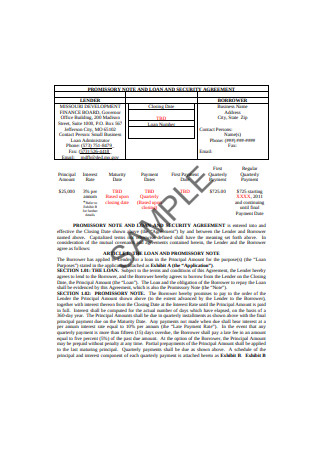

Secured Promissory Note and Loan and Security Agreement

-

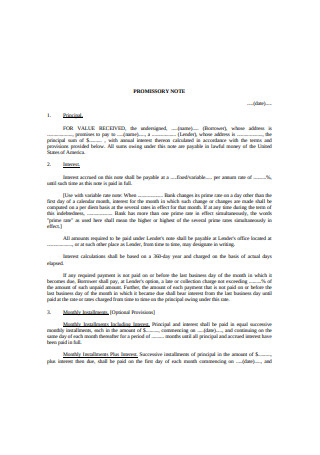

Property Secured Promissory Note

-

Secured Promissory Note Set-Up Form

-

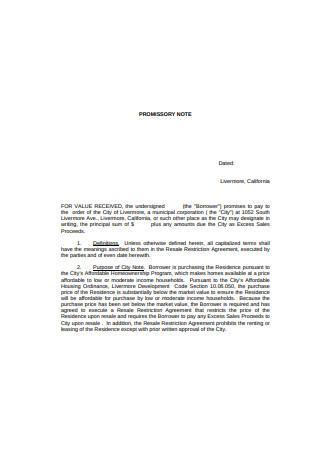

Sample Secured Promissory Note Form

-

Payment Secured Promissory Note

-

Secured Convertible Promissory Note Example

-

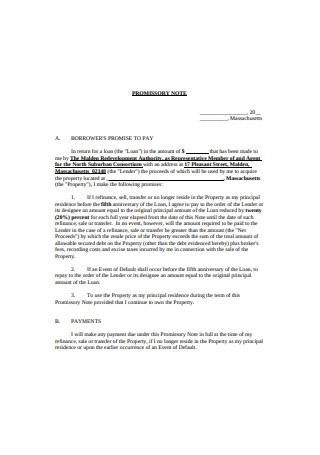

Sample Promissory Note Secured by Deed of Trust

-

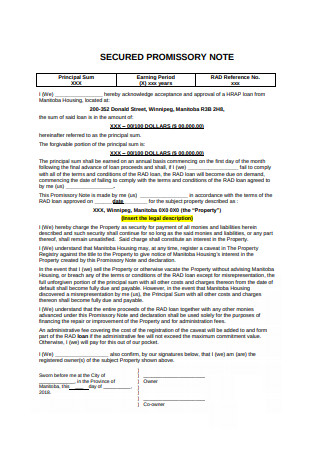

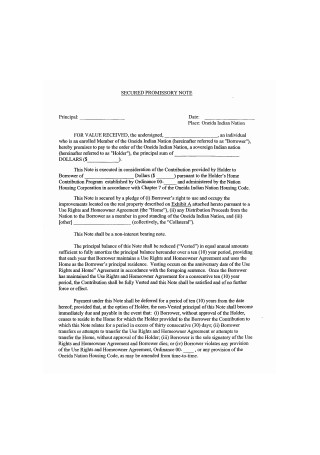

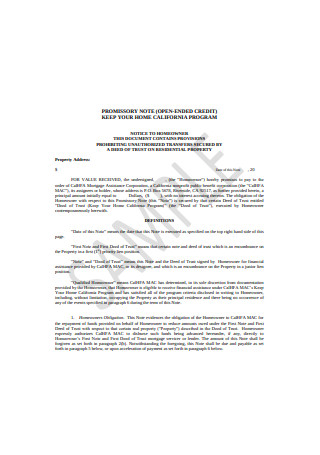

Housing Secured Promissory Note

-

Secured Promissory Note and Real Property Disclosure

-

Formal Promissory Note Secured by Deed of Trust

-

Standard Secured Promissory Note

-

Secured Promissory Note Agreement

-

Securrity Agreement and Promissory Note Template

download now

FREE Secured Promissory Note s to Download

35+ Sample Secured Promissory Note Templates

What Is a Secured Promissory Note?

Importance of a Secured Promissory Note

Elements of a Secured Promissory Note

Secured Promissory Note v.s. Unsecured Promissory Note

How to Write a Secured Promissory Note

The Dos and Don’ts of a Secured Promissory Note

What Is a Secured Promissory Note?

When loaning a reasonably large sum of money, a secured promissory note is necessary so that the loaned amount will have a security interest. The security interest, which is the collateral, is either the personal property or real property that serves as the added insurance. If the borrower defaults, the collateral can be seized by the lender to reimburse for any unpaid loaned amount. A secured promissory note carries a lesser risk to the lender. On the borrower’s end, they get a lower interest rate in return.

Secured promissory notes are used by lenders who want to get backup and assurance that goes beyond the borrower’s good word. It’s not a matter of pure distrust but one cannot deny that lending money, particularly in big amounts, is a big risk that anyone would not make without any assurance that it gets paid back and on time at that.

A secured promissory note lays out the terms or repayment periods of when the borrower should make fixed-interest payments to the lender in exchange for the loan. It also lays out the terms or repayment periods when these payments should be made. This period ranges from a few months to years.

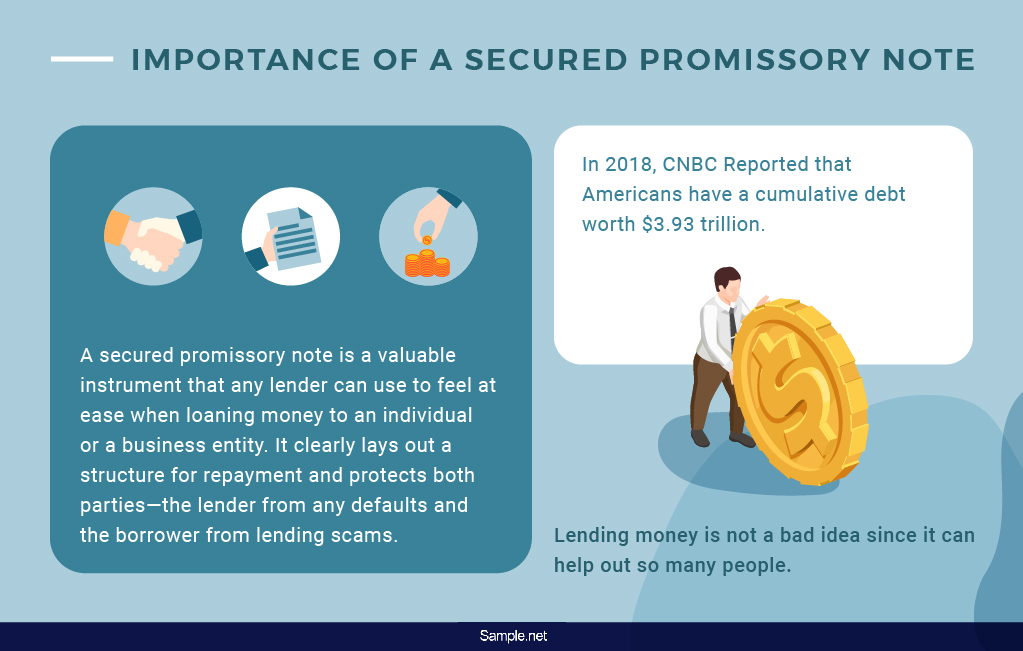

Importance of a Secured Promissory Note

In 2018, CNBC reported that Americans have a cumulative debt worth $3.93 trillion. It sounds alarming enough that it scares people off from getting a loan but debt is actually not a bad thing. It allows people to send children to school, purchase houses, buy cars, and other things people need at the present time. Lending money is also not a bad idea since it can help out so many people. The problem only comes in when the borrower defaults and no collateral is set as reimbursement for the loan. This is when the role of secured promissory notes enters.

A secured promissory note is a valuable instrument that any lender can use to feel at ease when loaning money to an individual or a business entity. It clearly lays out a structure for repayment and protects both parties?the lender from any defaults and the borrower from lending scams. When you lend money to someone, there is that one underlying risk that the loan does not get repaid on time or repaid at all. In the event that the borrower does not heed and act upon the agreed terms, the lender, with the help of the secured promissory note, can legally seize the designated property or the collateral secured in the promissory note. The collateral that is attached to the secured promissory note is of value that is sufficient enough to recover the amount of the unpaid principal, interests, fees, and expenses.

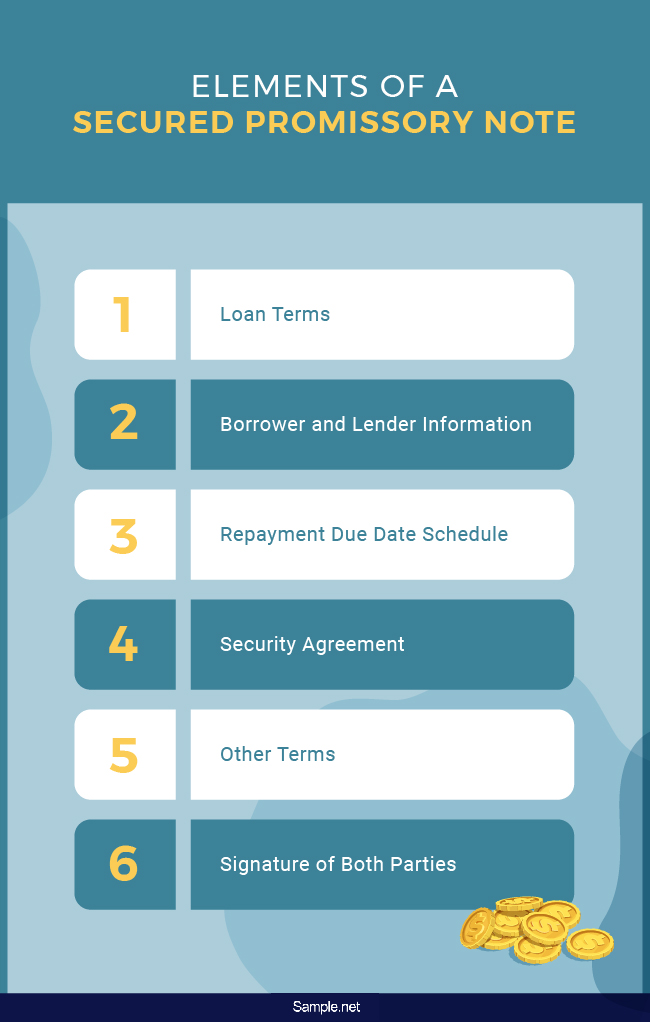

Elements of a Secured Promissory Note

To ensure that your secured promissory note is as effective as you want it to be, you need to supply it with all the necessary elements. The following are the basic elements that you need to secure when making your own secured promissory note.

Secured Promissory Note v.s. Unsecured Promissory Note

There are two types of promissory notes, namely the secured promissory note and the unsecured promissory note. While both have similar elements that are necessary for a promissory note, it has one main difference. The main difference between secured promissory notes and unsecured promissory notes is the collateral. An unsecured promissory note does not include any form of collateral, unlike the secured promissory note where the borrower has to secure one or else their loan does not get approved. This means that in the event that the borrower defaults or files bankruptcy, those with secured promissory notes will be prioritized and repaid before the lenders with unsecured promissory notes. There is also the possibility in which the unsecured lender would not get repaid at all and would have to file in small claims court or any other legal processes while the secured lender can obtain the property of the owner.

How to Write a Secured Promissory Note

While it is best to work with an attorney when making a secured promissory note, you, as the lender, can make a promissory note yourself. To guide you throughout the process, follow the easy-to-follow steps below to ensure that you are making an effective and legally binding secured promissory note.

Step 1: Make Use of a Template

Consider the use of a secured promissory note template that you can download and customize. Not all templates you can find across the web can meet your preferences?just look for one that has the ideal content you are looking for in a promissory note. Once you have downloaded a template, you can customize the document to make further adjustments that fit your needs.

Step 2: Know the Elements Needed

To create an enforceable secured promissory note, you have to know the required elements. Ensure that these elements will go in your promissory note or else it will be difficult for you to collect the money you loaned to the borrower. The important elements include the loaned amount, repayment due dates, interest rates, security agreement, signature, and other terms you and the borrower have agreed upon.

Step 3: Establish the Schedule for Repayment

When plotting the repayment schedule, see to it that the secured promissory note indicates the specific due dates especially if there will be weekly or monthly payments. You may also indicate if there is a grace period before the due date of the first payment.

Step 4: List the Parties Involved

Indicate your name as the person making the loan and the borrower who is the person with the obligation to repay the loaned amount. In doing so, be sure to write the full names of both parties and home addresses. By writing the full names of both parties, you create a sense of accountability among those who are involved.

Step 5: State the Loan Terms

As mentioned, the loan terms are the very core of a secured promissory note. Hence, see to it that your promissory note contains the amount of money borrowed and the means of transfer from the lender to the borrower. Be sure to include the added interest to the total sum the borrower has to pay on the agreed schedule.

Step 6: Write the Terms of the Security Agreement

Since it is a secured promissory note, it must have a security agreement that states the specified asset or property pledged by the borrower as his or her collateral. You, as the lender, can seize and sell the collateral if the borrower defaults. This part of the promissory also includes other terms and default provisions that you and the borrower have agreed upon covering each of the said essential elements.

Step 7: Make the Secured Promissory Note Enforceable

If you want to ensure that your secured promissory note is enforceable, see to it that it is signed by both parties. With that, you must add signature lines at the bottom part of the note. Another thing you must do is to make a copy of the note so that each party has a copy of it and has a responsibility to keep it until the debt gets completely paid off. If your promissory note is not signed by either one of the parties involved, the secured promissory note will not hold up in court. Hence, be sure to include the legal names of all parties, address and contact numbers, and the affixed signatures of the borrower, the lender, and the witness.

Step 8: Check and Proofread the Secured Promissory Note

Before a document gets considered as complete, it has to be proofread first. As soon as you have incorporated all the required elements into the promissory note, be sure to take some time to check and proofread everything before you print and start using the note you just made. Look out for grammatical mistakes and spelling errors and make sure to correct all these. Aside from that, see to it that you have also thoroughly checked the accuracy and completeness of the details you input in the secured promissory note.

Step 9: Consult an Attorney

To ensure that the secured promissory note you have created conforms to the laws in your state or country, consider having your final draft checked and reviewed by an attorney. Your attorney will make all the necessary modifications to your final draft that is tailored to protect both the legal rights of the borrower and the lender.

Step 10: Consider Notarization

If you find the need to enforce the repayment of the promissory note, consider having a witness or a notary public during the signing of the note. By having the note signed in front of a notary public, you can use this as proof that the borrower has indeed signed the note and agreed with all the terms and conditions that comes with it.

The Dos and Don’ts of a Secured Promissory Note

When you write or make use of a secured promissory note, you have to make sure that you are already knowledgeable or at least familiar with how to write or make use of it. If you are all new to this, do take notes from our list of dos and don’ts below to help you out in the process of creating and utilizing one.

Dos

1. Do know the goals of the note.

Before you start writing a secured promissory note, you have to determine what your goals are. Determine how much money gets borrowed. Know the applicable interest rates. Determine the intentions and interests of both parties. Decide on the terms and conditions that should be followed. Be sure to determine all the things that you want to achieve out of the secured promissory note before you get things into writing.

2. Do review the promissory note.

Avoid the possibility that one party would claim that they were not able to understand the terms and conditions. They might use this as an alibi in the event that they breach the agreement. It is the responsibility of both parties to comprehend any document and their obligations under the document before signing it.

3. Do ensure all points are discussed.

In reviewing the note, you must ensure that both parties can find all the points that they want to discuss and agree on in the secured promissory note. Any verbal argument after signing each note shouldn’t be considered valid unless the note has terms that allow it.

Don’ts

1. Do not modify the note to suit any circumstances.

Whatever changes there are in the circumstances, never modify the contents of a secured promissory note to suit any changes in circumstances unless both parties have agreed with it. Any adjustments in the plan midstream can affect any original calculations made in determining the loan payment amount.

2. Do not forget to sign the promissory note.

Even if the secured promissory note contains a well-composed content, it would be invalid and would have no value if either or both the lender or the borrower would not sign the promissory note.

3. Do not forget to make copies for both parties.

To be constantly reminded of each other’s responsibilities, each of the lender and the receiver should have a copy of the secured promissory note

Making secured promissory notes should not be too complicated to do?all you need is the right details and you are good to go. Another way to make things easier for you is by using a template. We have provided well-made secured promissory note templates and examples uploaded in this article that you can instantly download and customize according to your preferences and needs. Be sure to download any of these today to start making a secured promissory note that is tailored for your lending business.