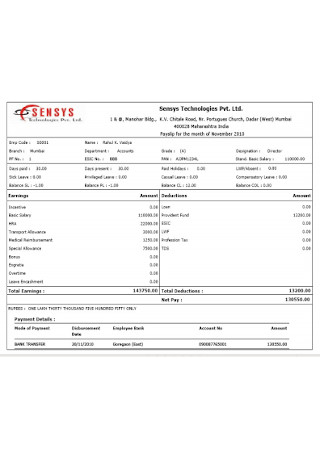

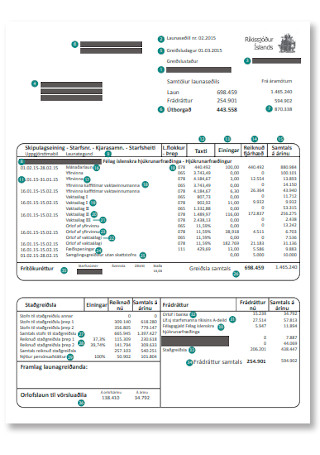

Payroll Slip Samples

-

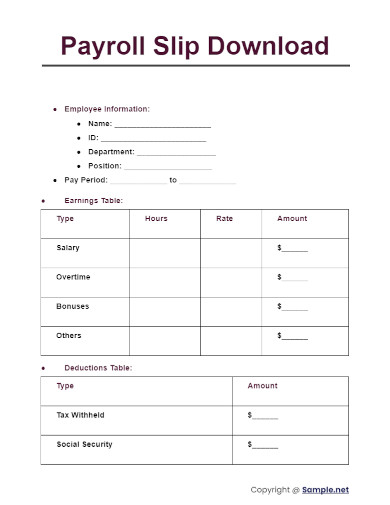

Payroll Slip Download

download now -

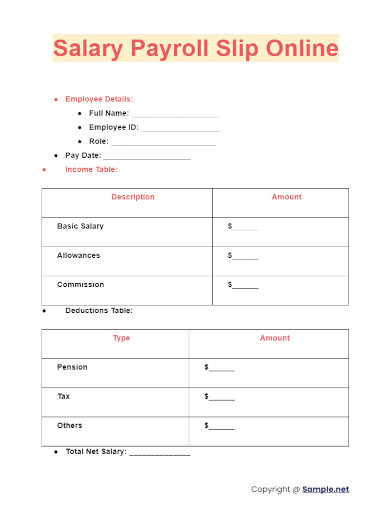

Salary Payroll Slip Online

download now -

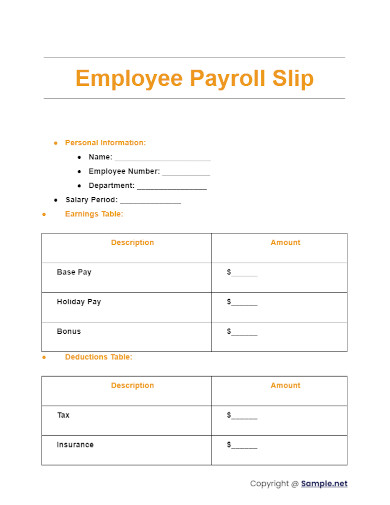

Employee Payroll Slip

download now -

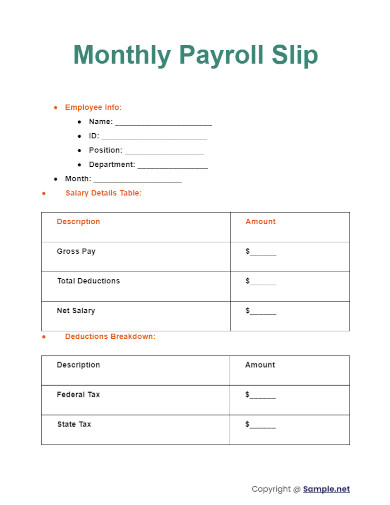

Monthly Payroll Slip

download now -

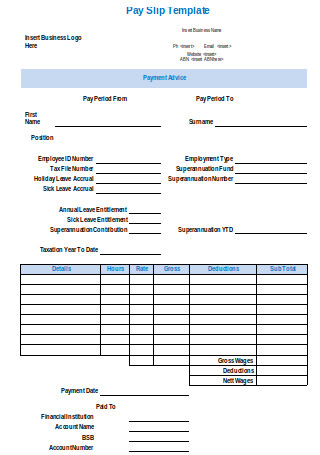

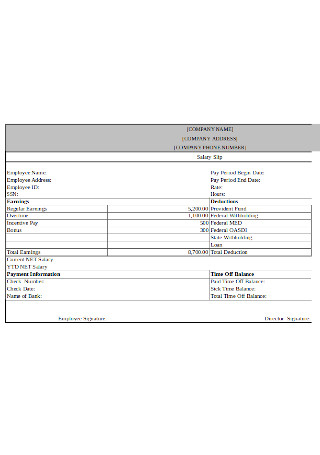

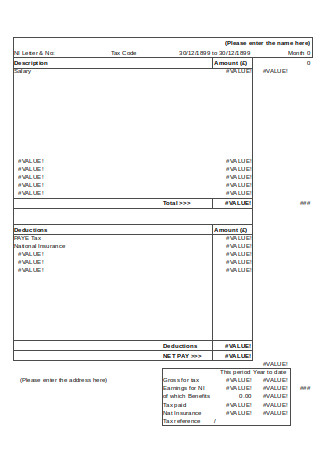

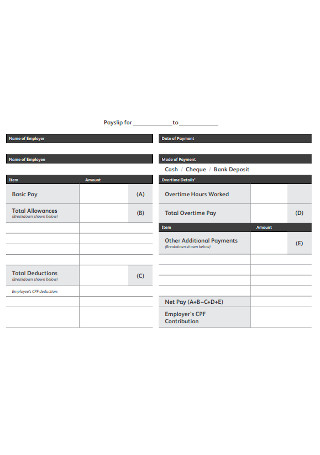

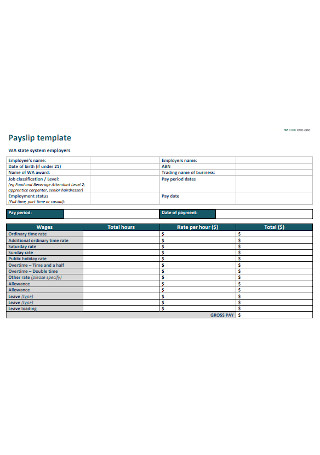

Payslip Template

download now -

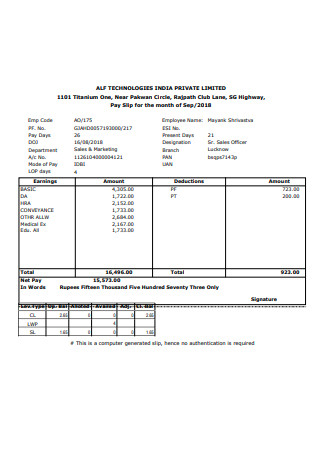

Sample Payslip Template

download now -

Printable Payslip

download now -

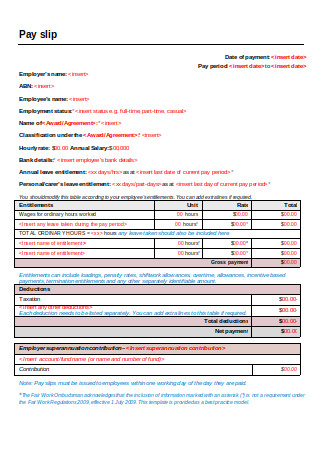

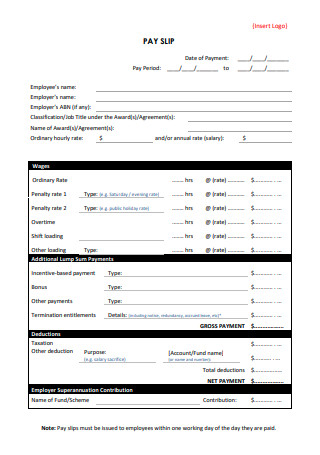

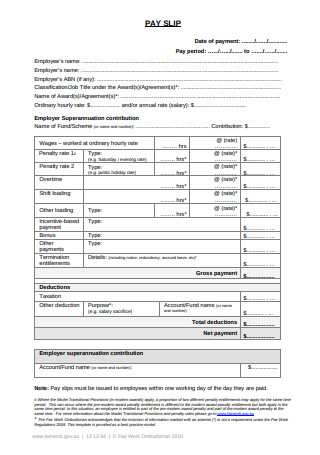

Free Pay Slip Template

download now -

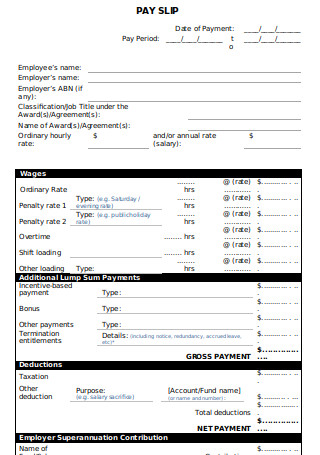

Pay Slip Template

download now -

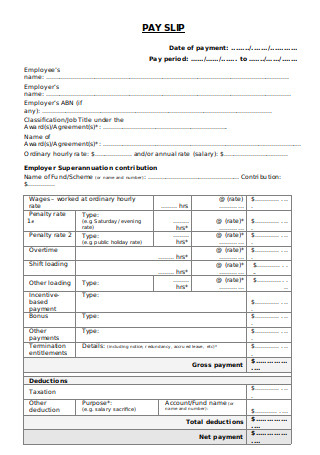

Salary Slip Template

download now -

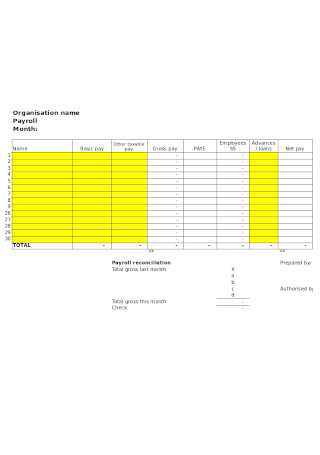

Monthly Payroll Template

download now -

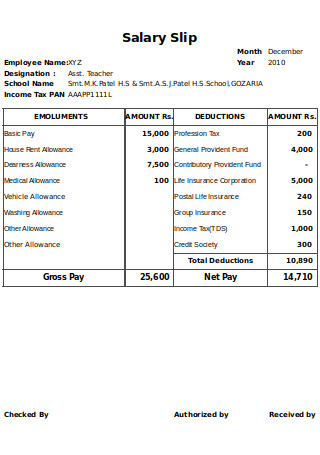

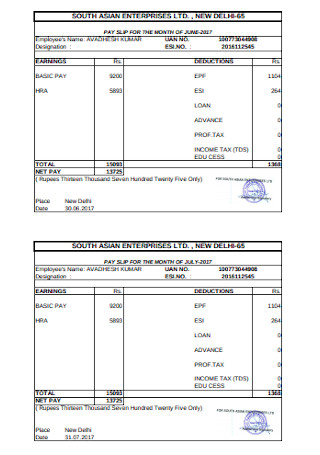

Salary Slip

download now -

Salary Slip Format

download now -

Payroll Slip Template

download now -

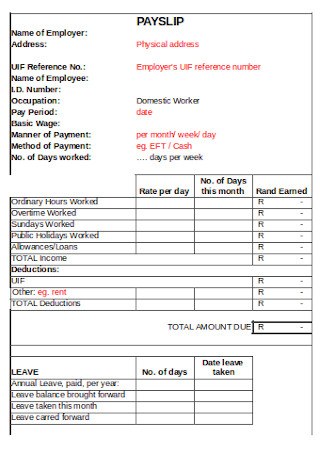

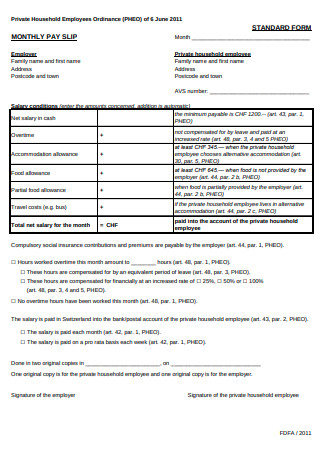

Domestic Employee Payslip

download now -

Editable Payroll Slip

download now -

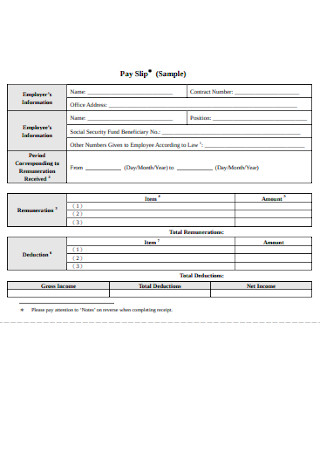

Payroll Slip Sample

download now -

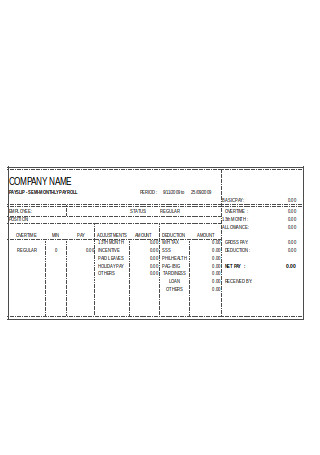

Semi-Monthly Payroll

download now -

Payroll Reports Screen Shots

download now -

Payslip Sample

download now -

Payment Slip

download now -

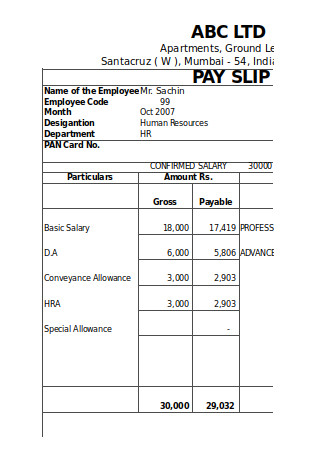

Salary Slip Example

download now -

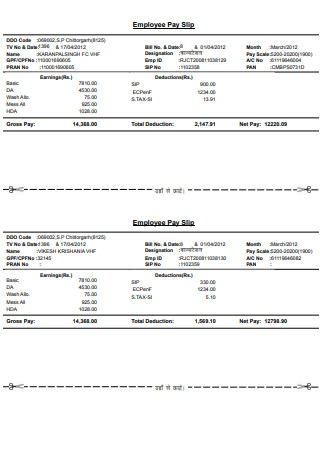

Employee Pay Slip

download now -

Monthly Pay Slip

download now -

Payment Slip Template

download now -

Simple Pay Slip Template

download now -

Basic Payslip Template

download now -

Pay Slip Format

download now -

Monthly Pay Slip Template

download now -

Sample Pay Slip Format

download now

FREE Payroll Slip s to Download

Payroll Slip Format

Payroll Slip Samples

What is a Payroll Slip?

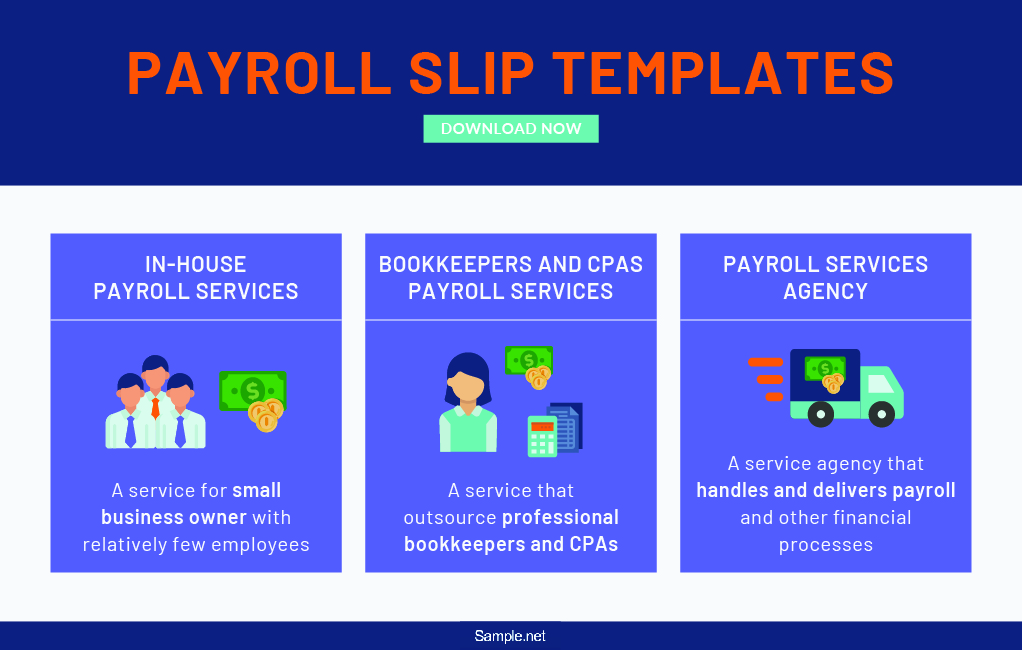

What are the Different Types of Payroll Services?

What are the Benefits of Having an Online Payroll Slip?

How to Create a Payroll Slip?

Are handwritten payroll slips legal?

What would happen if I didn’t present my employee’s payroll slip?

Do banks check your payroll slips?

How many payroll slips are required for a mortgage?

Are payroll slips confidential?

What is HR payroll salary slip?

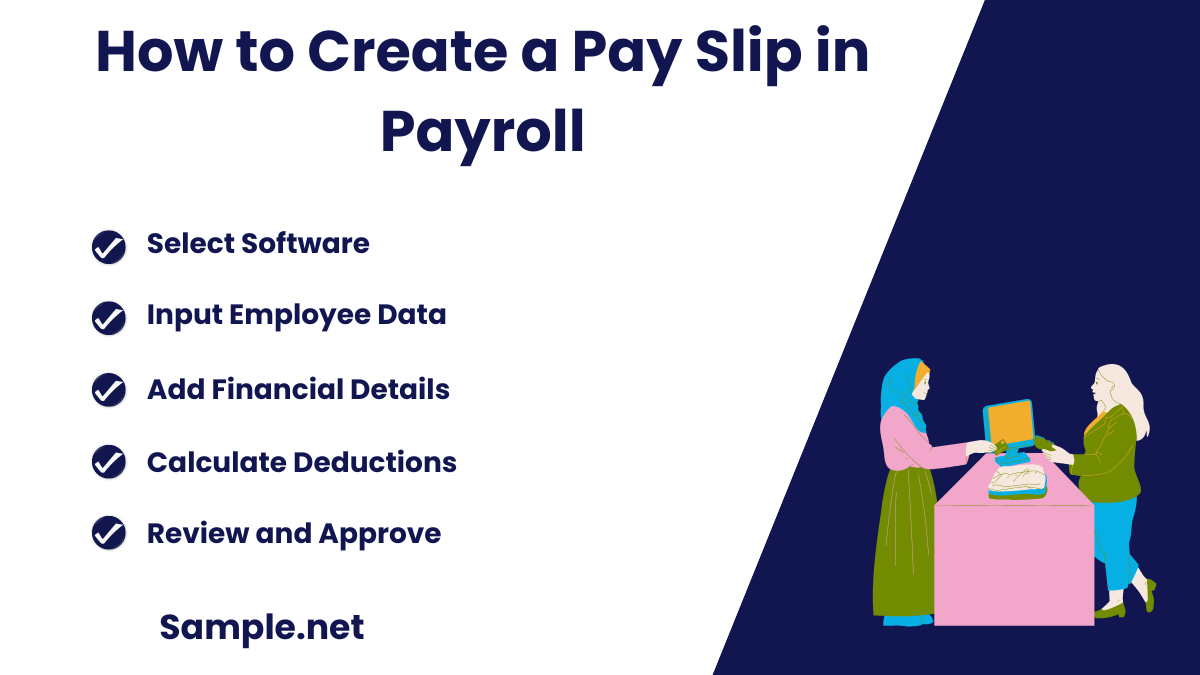

How do I create a pay slip in payroll?

How to check salary slip?

What is salary details in payroll?

How to fill a salary slip?

How to get salary slip from bank?

What is a monthly salary slip?

What is an HR payroll job?

Can I ask for salary slip?

What is payroll staff?

How do HR verify salary slip?

What does payroll mean?

Is payroll and salary slip the same?

Payroll Slip Format

Employee Information

Section 1:

- Employee Name

- ID Number

- Position

- Department

Payroll Details

Section 2:

- Pay Period

- Hours Worked

- Gross Pay

- Deductions (e.g., taxes, benefits, contributions)

- Net Pay

Summary

Section 3: Provide a summary of the pay details, including year-to-date figures.

Approval

Section 4: Include a space for signatures from the payroll department and the employee as a confirmation of the accuracy of the payroll slip.

What is a Payroll Slip?

A payroll slip provides the necessary financial information of your employee’s gross payment, their total amount of deductions, and their take-home pay for a specific period. Commonly, a payroll slip is given a few days or a day before your employee’s payday twice per month. At the same time, this document includes additional information, although not required, in your employee’s payroll slip. This includes your tax code, your national insurance number, your annual or hourly pay rate, as well as your other additional compensation (overtime, bonuses, or tips). And with technology nowadays, payroll slips may be given to your employees via print or online.

What are the Different Types of Payroll Services?

Before you can disseminate your employee’s payroll slips, you need people to manage and process your entire payroll. Commonly your payroll is handled by your accounting department with the aid of your human resources department. However, if you are still a small business, you, the owner, and your associates can handle your company’s payroll. Keep in mind that as your business grows, you’ll need more personnel to handle the task. Listed below are a few payroll services your company may implement.

What are the Benefits of Having an Online Payroll Slip?

Although most of you are used to having printed payroll slips distributed to your employees a day before their payday, have you ever thought of sending it to them online through their emails? There are a lot of benefits to converting to online payroll slips, and some of them are listed below.

Cost-Effective, Efficient, and Secured

Think about it, with less paper used to print your payroll slips every month; you are not only saving mother earth, but your company does not need to purchase many paper supplies nor to maintain your equipment to print your slips. Thus, allowing you to save your finances and allocate some of them to your other expenses. And since you don’t need to print your payroll slips, a lesser process is required to complete your payroll process, making it more efficient and secure for your company to perform your daily operations. You may also see Payroll Change

Environmental Friendly

Lesser paper means lesser trash. With all your payroll slips forwarded via email, your company no longer produces a lot of paper and would no longer require much ink for printing. Therefore, you are helping the environment. But here’s the question, is it secured? The answer is yes. Since your payroll slips are stored online, there is a lower risk of other employees peeking at your monthly salary as well as losing your payroll slips in the area. You may also see Payroll Checklist

Viewable Anytime and Anywhere

The moment you send your employee’s monthly payroll slips to their respective email accounts, all their payroll slips are automatically stored in their email account, where it is safe for them to access anytime and anywhere. They can easily access them on their personal computers during work as well as on their mobile phones even when they are already at home. At the same time, since everything is stored online, it is already more comfortable for them to download their payroll slips during their convenient time and keep a copy of their previous payroll slips. You may also see Payroll Check Format

How to Create a Payroll Slip?

Is having a payroll slip really important? According to Chron, “completing payroll is essential in running a business.” Why? Because your payroll has a significant impact on your business finances, your daily operations, and even to your employee’s morale. After all, who doesn’t want to get paid at work? Now that you have finished your payroll process, how will you present your employee’s monthly salary? Well, for years, many business owners have been using a payroll slip to give their employee’s monthly compensation. As a small business owner who just started with your business, we provide you with a few tips on how to create your payroll slips most conveniently in no time. You may also see Biweekly Payroll

Step 1: State the Informational Details of Your Employees and Your Company

Start by adding your company name, logo, business address, and contact information. Then proceed to write your employee’s data, such as their names, position, and ID number. Add the period of your payroll slip, but before you proceed in listing your employee’s salary details, review your report and make sure that there are no discrepancies between their attendance, names, and salary amount to avoid complaints from angry employees. You may also see Payroll Deduction

Step 2: Indicate the Payment Period of Your Payroll

Your employees are paid twice a month. Depending on your company policy, your payroll period may vary from the 1st to the 15th and the 16th to the 30th day of the month, or the 11th to 25th and the 26th to the 10th of each month. After adding the payment period of your payroll, include your payroll’s other information. You may also see Income and Expense Statement

Step 3: Include Your Taxes and Other Financial Information

Aside from your employee’s absences and tardiness salary deductions, you also need to include any applicable tax deductions (pre-tax deduction, post-tax deduction, taxable wages, etc.) from your employee’s monthly salary. Make sure to describe the necessary deductions written in your employee’s payroll slip to inform them of the reasons for the deductions made in their pay. You may also see Income Statement and Balance Sheet

Step 4: Summarize Your Employee’s Salary and Deduction

Upon totaling the amount of your employee’s take-home pay, make sure to summarize all financial details in your payroll slip. This includes all the gross payment, salary deductions, and additional compensations (incentives and bonuses) your employee acquired for the entire payroll period. Then add the name of the person-in-charge of processing your payroll. You may also see Income and Expense Worksheet

Step 5: Review Your Payroll Slip Before Submission

Now that everything is set, always remember to review everything before sending out your final output for the approval of your administration. Make sure to double-check the names and ID number of your employees, their compensation and deduction, as well as the payroll period in your payroll slip. You may also see Income Worksheet

Are handwritten payroll slips legal?

Handwritten payroll slips are not illegal. What’s important is you present a copy of your payroll slip to your designated employees before their payday to avoid penalties due to your non-compliance with the law. However, most banks and money lenders don’t accept handwritten payroll slips since they are not sufficient evidence of your current income and may even require you to present further documentation and letters of certification from your employers.

What would happen if I didn’t present my employee’s payroll slip?

Your employees have the right to know how much they are earning each month. Failing to give your employees an accurate copy of their payroll slip may lead to future complications. Depending on the laws of your state, violating the Fair Labor Standards Act (FLSA) may lead you to pay penalties or facing lawsuits against your employees.

Do banks check your payroll slips?

When you apply for a loan, banks and money lenders will verify your eligibility for one by either checking your bank statements or your payroll slip and gross salary during the transaction. Through this process, they can detect possible fraud and will have sufficient knowledge of your monthly income, spending activities, and lending history. Hence, they can check whether you are capable of repaying them on time or not.

How many payroll slips are required for a mortgage?

For you to apply for a mortgage loan, your lenders require substantial proof of your income and capacity to pay them back. One way for you to assure your lender is by handing them your payroll slip, your bank statements, or your employment contract. If your lender requires you to provide them a copy of your payroll slip, you need to provide at least two consecutive payroll slips, which are dated less than four weeks prior to your date of application, for your loan to be processed.

Are payroll slips confidential?

Payroll slips are confidential. However, there is no general rule not to disclose its information once it falls on the hands of your designated employee. The right to disclose any information regarding your employee’s payroll slip remains on them. However, as the employer, if you do not wish your competitors to know about your company’s payroll, you may indicate the non-disclosure of your business affairs in your employee contract, and this includes your employee’s payroll slip. You may also see Quarterly Income Statement

What is HR payroll salary slip?

An HR payroll salary slip is a detailed document issued by employers that outlines an employee’s earnings and deductions for a specific period, vital in Payroll Schedule.

- Identify Personal Details: Includes employee’s name, ID, and department.

- List Earnings: Show gross salary, bonuses, and overtime.

- Detail Deductions: Itemize taxes, insurances, and other deductions.

- Calculate Net Pay: Subtract deductions from total earnings.

- Date and Signature: Ensure the slip is dated and authorized.

How do I create a pay slip in payroll?

Creating a pay slip involves systematic data entry and calculations, integral to maintaining accurate Payroll Register.

- Select Software: Use payroll software or a spreadsheet.

- Input Employee Data: Enter personal and employment details.

- Add Financial Details: Include salary, bonuses, and overtime.

- Calculate Deductions: Apply tax rates and other deductions.

- Review and Approve: Double-check for accuracy and authorize.

How to check salary slip?

Checking a salary slip ensures the accuracy of payment and deductions, part of a thorough Payroll Audit Checklist.

- Access Your Slip: Retrieve it from HR software or email.

- Verify Earnings: Confirm salary and additional payments are correct.

- Examine Deductions: Check tax, social security, and other deductions.

- Review Net Pay: Ensure it matches your records.

- Query Discrepancies: Report any inconsistencies to payroll or HR.

What is salary details in payroll?

Salary details in payroll encompass all aspects of an employee’s earnings, which are documented within Payroll Statement.

- Base Pay: Basic monthly wage.

- Variable Earnings: Includes bonuses, commissions, and allowances.

- Benefits: Such as health insurance or pension contributions.

- Deductions: Tax withholdings and other statutory deductions.

- Net Salary: Total earnings minus all deductions.

How to fill a salary slip?

Filling a salary slip accurately is crucial for correct employee payments, closely tied to Payroll Deduction management.

- Employee Information: Fill in personal and job details.

- Earnings: List all types of earnings.

- Deductions: Detail each deduction clearly.

- Total Calculations: Sum up earnings and deductions.

- Final Checks: Ensure accuracy before distribution.

How to get salary slip from bank?

Obtaining a salary slip from a bank is necessary for loan applications and financial verifications, related to Payroll Receipt.

- Contact HR: Request the latest salary slip if directly deposited.

- Online Banking: Download the slip from your online bank account.

- Visit Bank: Request a printed slip at your local branch.

- Customer Service: Call or email bank support for assistance.

- Proof of Employment: Sometimes required to release the slip.

By following these guidelines, employees and HR departments can manage payroll effectively, ensuring transparency and compliance with financial and legal standards.

What is a monthly salary slip?

A monthly salary slip is a document that details an employee’s earnings and deductions for the month, essential for Employee Payroll management.

What is an HR payroll job?

An HR payroll job involves managing employee compensation, benefits, and deductions, ensuring accuracy and compliance as outlined in the Payroll Processing Checklist.

Can I ask for salary slip?

Yes, employees are entitled to request their salary slips for personal records or financial verification, often supported by Income Verification Letter.

What is payroll staff?

Payroll staff are responsible for executing payroll procedures, calculating wages, and ensuring timely payments as per the Payroll Checklist.

How do HR verify salary slip?

HR verifies a salary slip by cross-referencing employee records and transaction details against the Payroll Verification Report to ensure accuracy.

What does payroll mean?

Payroll refers to the process of managing the payment of wages by a company to its employees, which includes detailed Payroll & Calculator.

Is payroll and salary slip the same?

No, payroll is the process of managing employee payments, while a salary slip is a document issued as part of that process, often reviewed in a Payroll Review Audit Report.

In conclusion, payroll slips are crucial for ensuring clear and accurate financial communication between employers and employees, similar to how Salary Negotiation Letter facilitate clear discussions about compensation. This article has covered the essentials of understanding and utilizing payroll slips effectively, offering samples and guidelines to aid in their preparation. Whether you’re issuing or receiving a payroll slip, the insights provided here will help you manage financial records more proficiently, aiding in everything from routine salary assessments to important financial negotiations.