17+ Sample Biweekly Payroll Templates

-

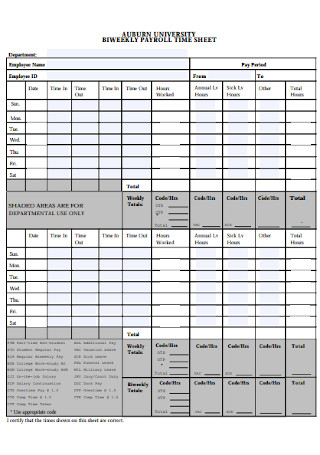

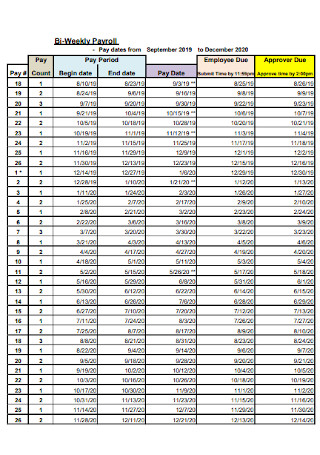

Bi-Weekly Payroll Timesshet

download now -

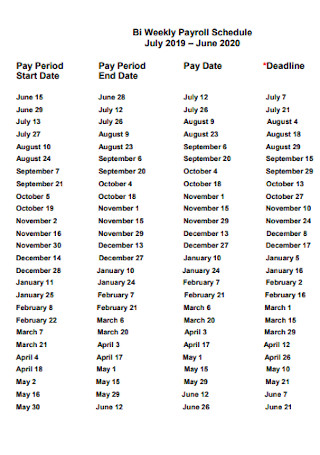

University Bi Weekly Payroll Schedule

download now -

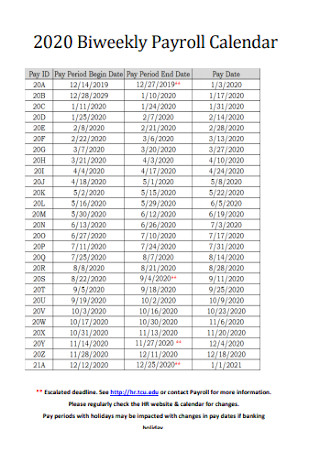

Biweekly Payroll Calendar

download now -

Biweekly Payroll Accruals Template

download now -

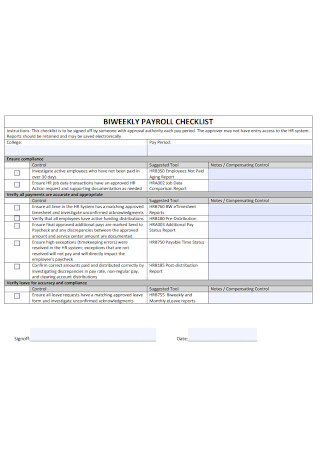

Bi-Weekly Payroll Checklist

download now -

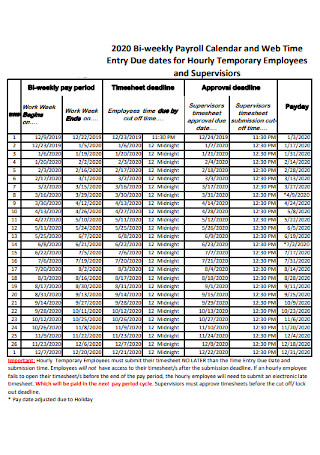

Temporary Employees Bii-Weekly Payroll

download now -

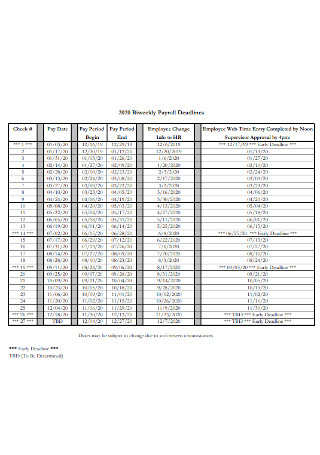

Biweekly Payroll Deadlines Template

download now -

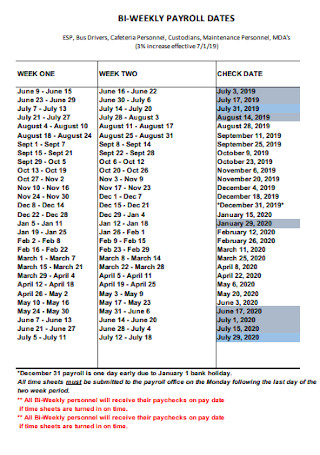

Bi-Weekly Payroll Dates Template

download now -

Biweekly Payroll Coordinator Checklist

download now -

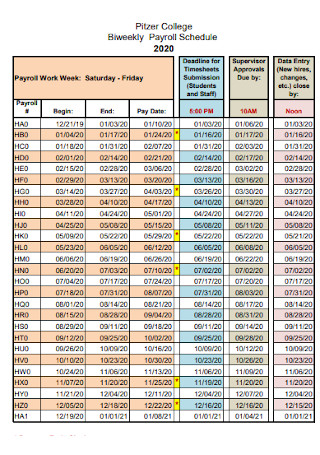

College Biweekly Payroll

download now -

Biweekly Payroll Template

download now -

Student Employment Bi-Weekly Payroll

download now -

Option Form for Seventh Bi-Weekly Payroll Payments

download now -

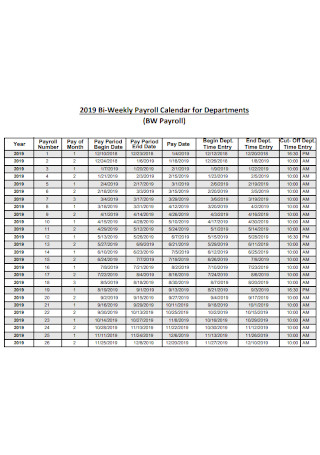

Bi-Weekly Payroll Calendar for Departments

download now -

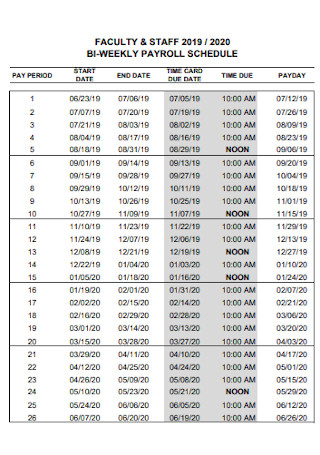

Staff Biweekly Payroll Template

download now -

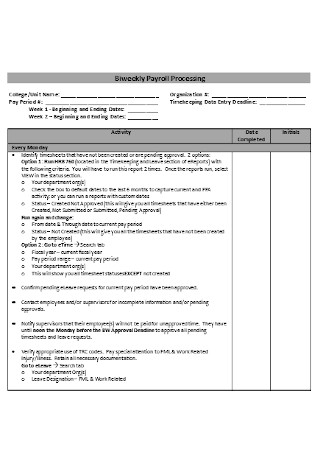

Sample Biweekly Payroll Processing Template

download now -

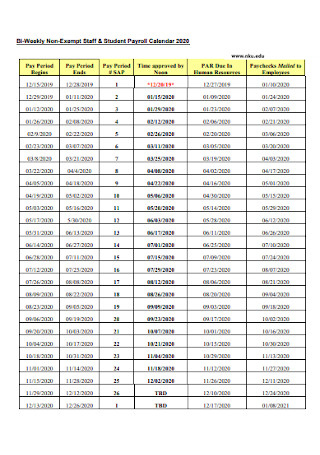

Bi-Weekly Non-Exempt Staff Payroll

download now -

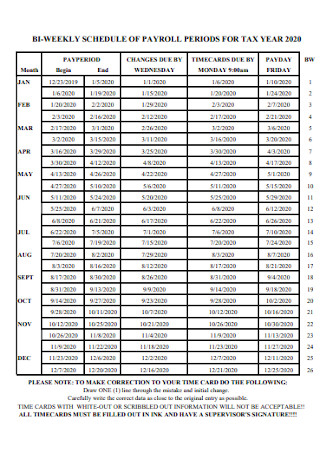

Biweekly Payroll for Periods for Tax Year

download now

FREE Biweekly Payroll s to Download

17+ Sample Biweekly Payroll Templates

What is a Biweekly Payroll?

All You Need To Know About Payrolls

How To Properly Execute Payroll Processing

FAQs

What are Medicare and Social Security Taxes?

What is an EIN?

Is there such a thing as supplemental pay?

What are unemployment taxes?

How long do payroll records last?

What is a Biweekly Payroll?

Before we proceed to define what a biweekly payroll is, let’s first describe the word “payroll.” Payroll is a process where a company pays its employees for the services they render. It is the computation and allocation of payroll checks to workers every payroll schedule. Also, we can define payroll as a document that records the wages, withholdings, bonuses, and deductions on every employee’s paycheck. Now, what is a biweekly payroll? A biweekly payroll speaks of an event where employees receive compensation every two weeks. It means that employees work 80 hours per pay date. Usually, the date employees receive their salary are days after the biweekly period because of the need to compile and convert the work hours into net pay. Net pay is equal to the gross pay minus all taxes and other necessary deductions.

You may ask, what is the difference between a biweekly payment and a semi-monthly payment? A semimonthly pay happens two times a month, which is 24 pay periods in a year. It typically happens during the 15th and 30th day of the month. On the other hand, biweekly payments happen 26 times a year. According to the U.S. Bureau of Labor Statistics, biweekly compensation was the most commonly used payment system utilized by private companies in 2014. About 36.5% of private businesses in the U.S. used this type of system, while only 19.8% of establishments used the semimonthly process.

All You Need To Know About Payrolls

As we have tackled earlier, payroll can refer to a worker’s payday or a company’s financial records concerning compensation. There are also a lot of terms that relate to payrolls, which all business institutions must be familiar with.

How To Properly Execute Payroll Processing

Both state and federal laws require employers to compensate their workers. The laws set how much the minimum wage should be, how employers must pay their employees, and how much the overtime pay must be. Note that if you, as an employer, break the regulations set by the law, you may face some serious penalties. So, before you begin to pay your employees, make sure you follow the steps below.

Step 1: Prepare Tax Forms

The federal government requires that a business organization withholds federal and FICA taxes from a worker’s paycheck unless the worker qualifies for tax exemption. So, every time you hire an employee, let him/her fill out a Form W-4. This gives you an idea of the amount of money you need to withhold from your employee’s income. Moreover, you must check the specific guidelines of your state concerning income tax.

Step 2: Classify Your Workers

You have to classify your workers if they are independent contractors or employees. By doing this, you will be able to identify those who qualify and do not qualify for tax-exempts. Typically, a non-exempt worker is entitled to overtime payment while an exempt employee may not be. These regulations are complicated, that is why the Department of Labor provides a memo for employers to easily classify their employees. The memo addresses the questions: Is an individual’s work an essential part of the business? Do the laborer’s skills impact his/her chance for gain or loss? How do you compare a worker’s investment from the employer’s investment? Does the job require initiative and a special skill? What is the relationship term between the employer and worker? How far can an employer control the worker?

Step 3: Report New Hires to Your State

The Personal Responsibility and Work Opportunity Reconciliation Act of 1996 require employers to report new hires to the state directory. The report should be within 20 days right after hiring. The document must contain the employer’s name, address, and employer identification number. Also, it should comprise the worker’s name, address, Social Security number, and the date of hire. Every state has different requirements, therefore, it’s better to visit the Small Business Administration website.

Step 4: Determine How You are Going to Pay your Employees

The Fair Labor Standards Act, specifically, requires business owners to compensate employees depending on their work hours, but it didn’t provide specifications concerning payment periods. Nevertheless, many states practice the semimonthly, biweekly, or weekly pay periods. States such as Pennsylvania and Nebraska permit employers to decide on paydays, while other states (e.g., Arizona) require their employers to compensate workers twice a month. For that reason, it is important to review the guidelines of your state before you decide on a payroll system that is fitting your business. Weekly payroll checks are usually given every Friday, while monthly checks must be given in the first week of every month. For a biweekly payroll, it is issued every other Friday of the month.

Note that the FLSA lets you decide on how you are going to pay your workers. Checks, cash, direct deposits, and money orders are payment methods you can apply. Moreover, you can also meet the “minimum wage” requirements by using other forms of payment, such as lodging, food, utilities, etc. Bear in mind that the FLSA prohibits employers from paying their workers with discounts, coupons, vouchers, or tokens.

FAQs

What are Medicare and Social Security Taxes?

These taxes are also known as FICA (Federal Insurance Contributions Act) taxes. They are used to finance and support the government in its health and income programs for Americans when they get old. The idea is to pay taxes now so that Americans will benefit from these funds when they get older. For Social Security, the present rate is at 6.2% for salaries that are above $132,900, while for Medicare the rate stands at 1.45%. For workers with higher wages, the Medicare tax demands an additional 0.9%. Also, note that the threshold for taxpayers who are single stands at $200,000 while it is $250,000 for taxpayers who are married.

What is an EIN?

The identification number the Internal Revenue Services assigns to a business organization is called an Employer Identification Number. It is mainly used for accounting and reporting taxes. It can also be referred to as the Federal Tax Identification Number, but when it serves the purpose of a corporation, it is called a Tax Identification Number. Getting an EIN is free and an online form is available on the website of the IRS. An employer simply needs to fill-up the form and submit it digitally. Once the IRS approves the information, an EIN is immediately provided. However, the location of the company must be in the U.S, and it also should have a taxpayer identification number for the IRS to issue an EIN.

Is there such a thing as supplemental pay?

Supplemental pay is money a business entity gives its workers on top of their regular salaries. Examples of supplemental wages include commissions, bonuses, and even severance payments. Taxes for these additional payments are not part of the worker’s regular income. Two methods apply, aggregate and percentage. In an aggregate method, an employer must add a worker’s supplemental pay to his/her regular income and take a withholding based on the current tax bracket. In a percentage method, an employer simply withholds 25% from a worker’s supplemental wage.

What are unemployment taxes?

There are state and federal unemployment taxes. With employees, an employer is responsible for settling SUTA or State Unemployment Tax Act tax and FUTA or Federal Unemployment Tax Act. A company must not withhold these taxes from a worker’s wages. The rate for FUTA tax is 6%, but many companies only settle about 0.6% because of tax credits. A business only has to pay FUTA tax when an employee first earns $7,000. For SUTA tax, the rate depends on which state you belong to.

How long do payroll records last?

The FLSA requires employers to keep their payroll records for a minimum of three years. According to the IRS, a business entity must keep all employment tax documents for a minimum of four years after the fourth quarter filing. Generally, all payroll records must be kept for a long time.

Paying your employees on time is vital in keeping your business in operation. By choosing to compensate your workers on a timely basis, you give them a reason to keep laboring. If you wonder how a biweekly payroll looks like, you can download one of our templates seen in the earlier part of this article.