36+ Sample Employee payrolls

-

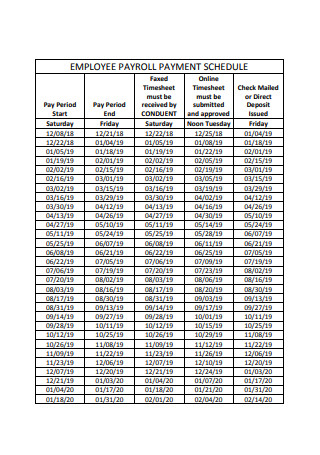

Employee Payroll Payment Schedule

download now -

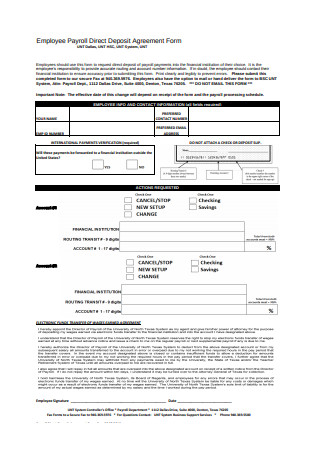

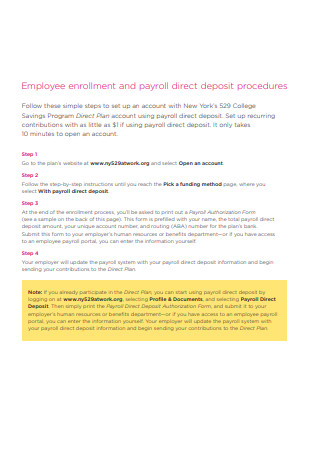

Employee Payroll Direct Deposit Agreement Form

download now -

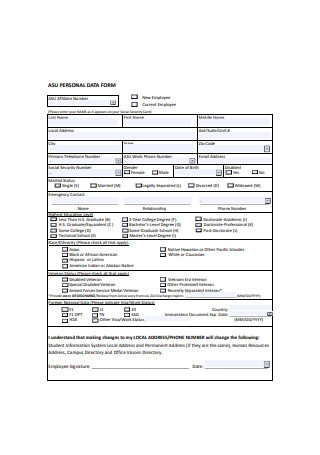

New Employee Payroll form

download now -

Employee Payroll Notice

download now -

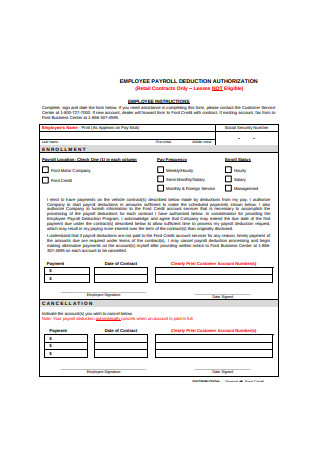

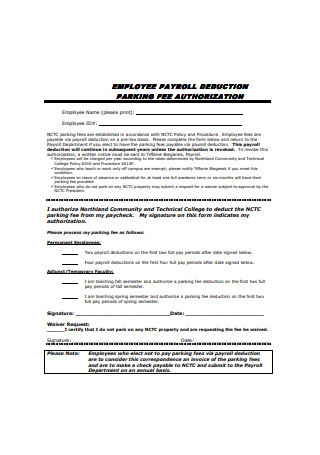

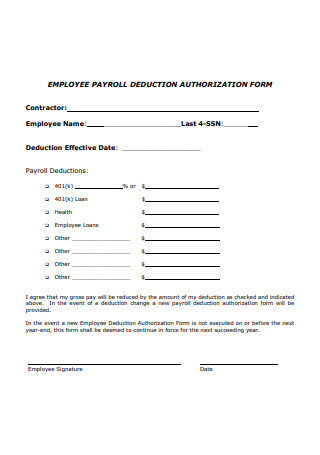

Employee Payroll Deduction Authorization Form

download now -

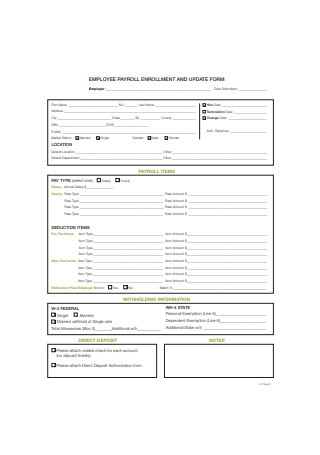

Employee Payroll Enrollment and Update Form

download now -

Year End Employee Payroll Checklist Sample

download now -

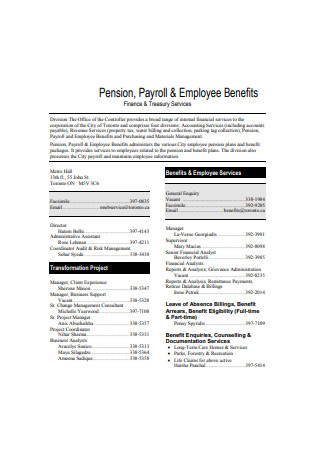

Employee Payroll Benefits

download now -

Employee Payroll Deduction Authorization Format

download now -

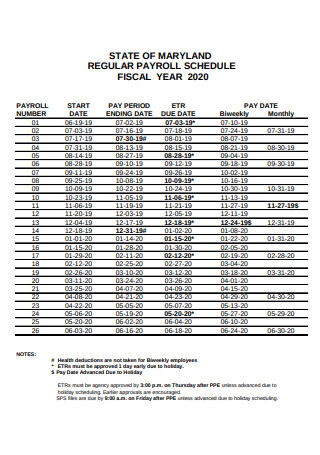

Employee Regular Payroll Schedule

download now -

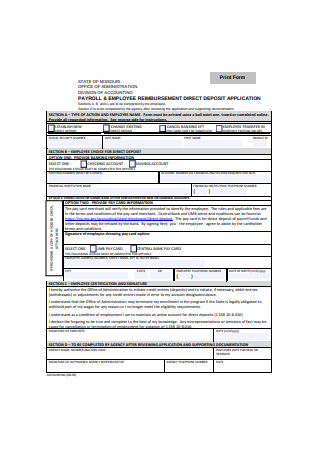

Employee Payroll Reimbursement Direct Deposit Application

download now -

Employee Payroll Format

download now -

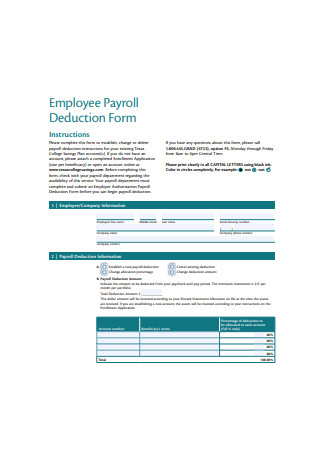

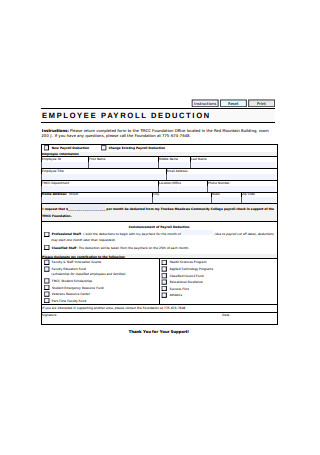

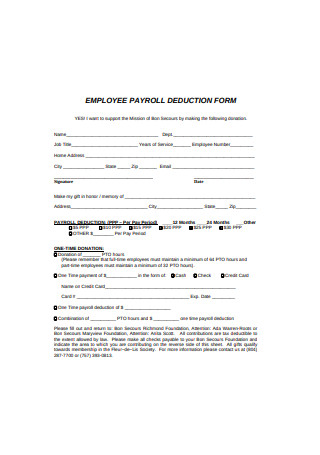

Employee Payroll Deduction Form

download now -

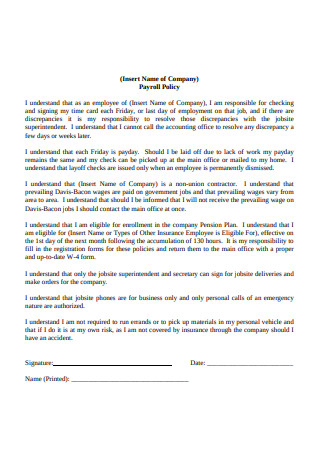

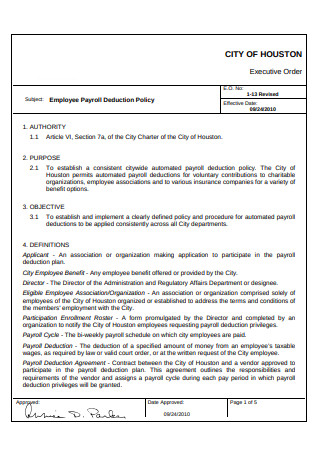

Employee Payroll Policy

download now -

Employee Payroll Schedule Format

download now -

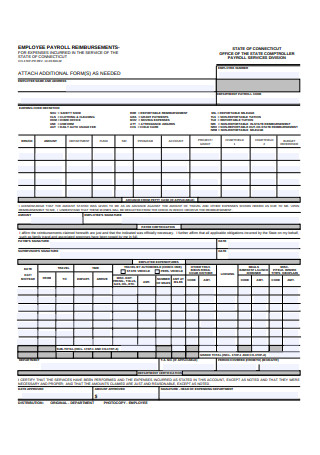

Employee Payroll Reimbursement Form

download now -

Basic Employee Payroll Deduction Form

download now -

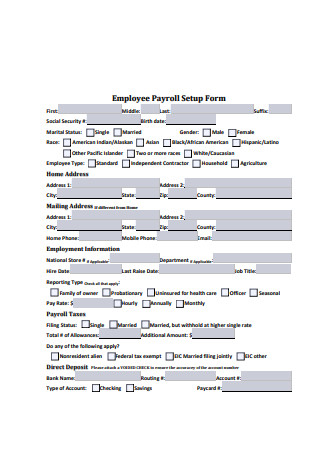

Employee Payroll Setup Form

download now -

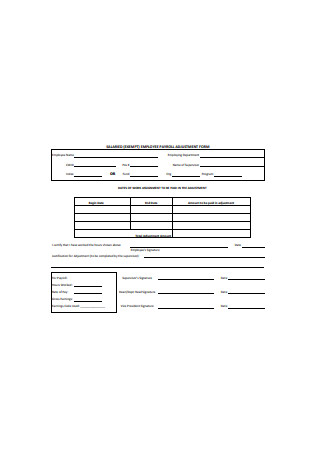

Employee Payroll Adjustment Form

download now -

Employee Payroll Deduction Form Example

download now -

Employee Payroll Deduction Authorization Form Sample

download now -

Standard Employee Payroll Deduction Authorization Form

download now -

Employee Payroll Policy Format

download now -

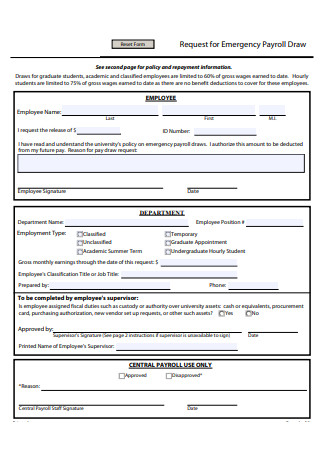

Employee Payroll Request Form

download now -

Employee Payroll Example

download now -

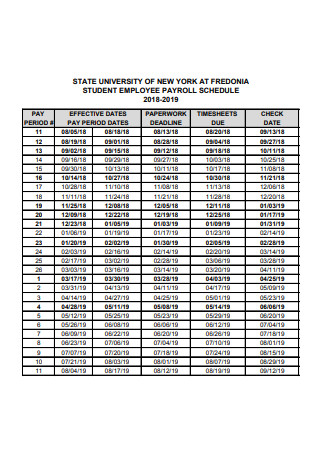

Student Employee Payroll Schedule

download now -

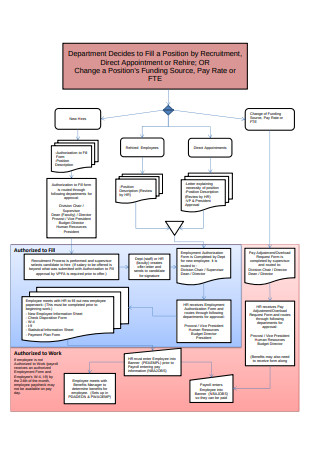

Employee Payroll Change Process Flowchart

download now -

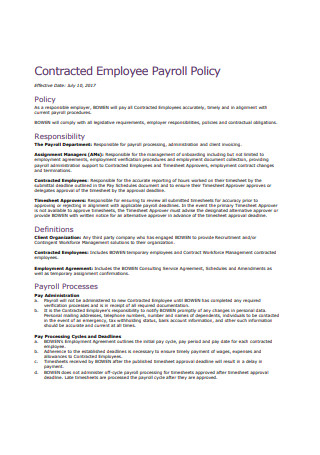

Contracted Employee Payroll Policy

download now -

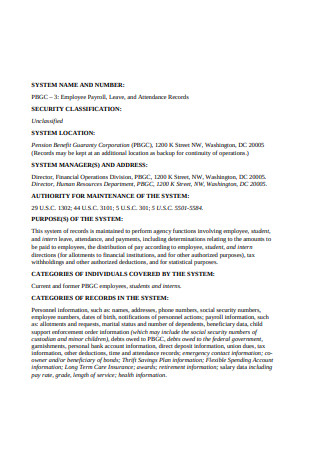

Basic Employee Payroll Format

download now -

Employee Payroll Deduction Policy

download now -

Hourly Employee Payroll Format

download now -

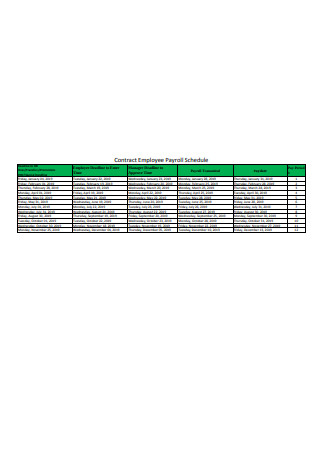

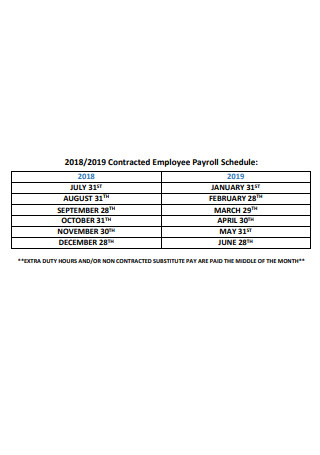

Contracted Employee Payroll Schedule

download now -

Formal Employee Payroll Deduction Form

download now -

Sample Payroll Checklist for Hourly Employees

download now -

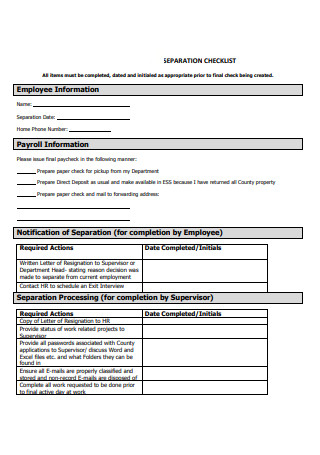

Employee Payroll Action Checklist

download now -

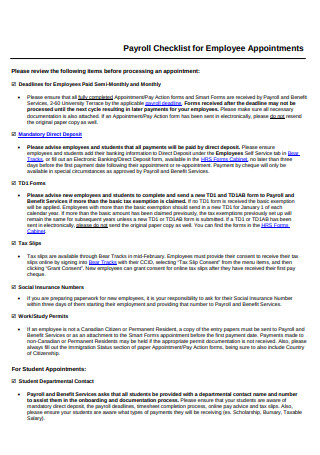

Payroll Checklist for Employee Appointments

download now -

Employee Payroll Checklist Format

download now -

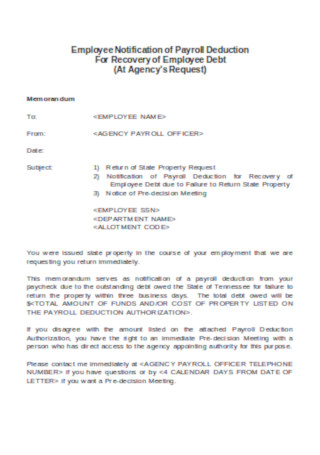

Employee Notification of Payroll Deduction Template

download now

FREE Employee Payrolls s to Download

36+ Sample Employee payrolls

What Is an Employee Payroll?

Terms You Should Know About Payroll

How to Set Up a Payroll System for Your Business

FAQs

What is the role of the Internal Revenue Service?

What are FICA taxes?

Are there employee payment violations?

What should I do if I don’t get paid?

How much do online payroll services cost?

What Is an Employee Payroll?

A payroll can determine a company’s success or failure. When a company is spending money on employees without gaining any profit, it means the company needs to cut off some workers. Employee payroll is the compensation a company gives its workers on a set date. Owners of small businesses usually handle the payroll themselves, but medium to large-sized entities make use of professional payroll services. A business organization hires an employee to do a job at a specific pay rate. Some workers are paid per hour, while others get fixed payments every month. Workers who labor beyond their usual time receive overtime payment. Moreover, the employer may withhold some payment from employees and set it aside for taxes such as FICA taxes and income taxes.

Terms You Should Know About Payroll

If you want to do payroll for your own company, you must learn the terms related to it. Bear in mind that employee payroll and payroll deductions are bound by the regulations of the Internal Revenue Service. So, before starting with the payroll procedures, here are some terms you must know.

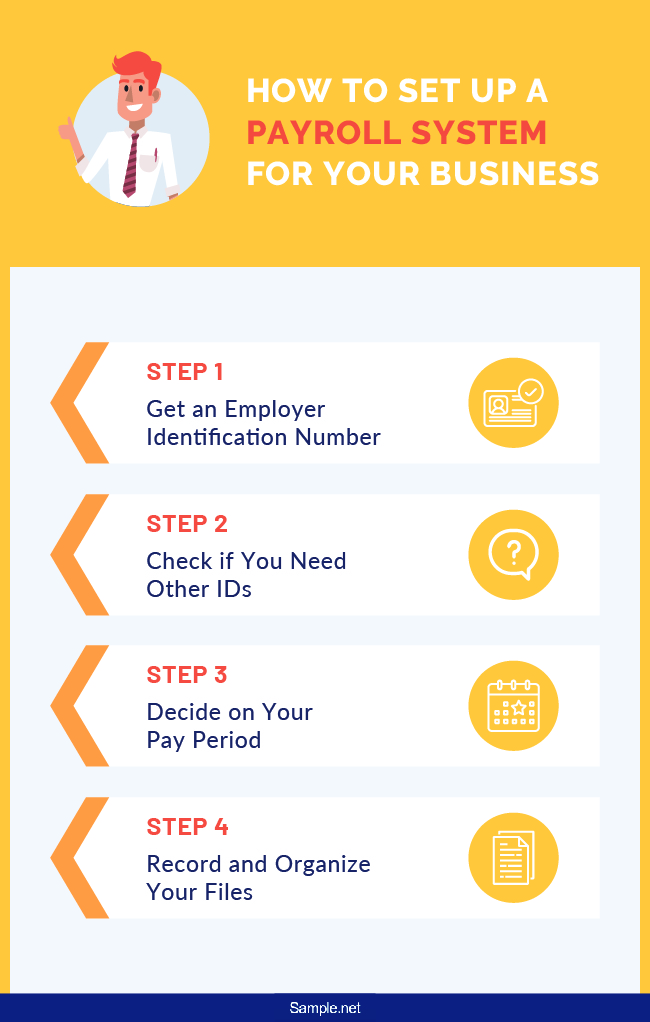

How to Set Up a Payroll System for Your Business

Now that you know the common terms related to payroll, you can set up a payroll system for your business. There are different ways you can set it up. You can do it on your own, or you ask for help from software, accountants, or other professional services. If you are confident enough to do it on your own, then follow the steps below.

Step 1: Get an Employer Identification Number

An EIN is an identification number unique to every business organization. It is what employers use to report their taxes to the IRS. It comprises a nine-digit number and also has information about the state where the company is registered. You can get one by communicating with the IRS.

Step 2: Check if You Need Other IDs

Different states may have different requirements. You can check the list of requirements on the U.S. Small Business Administration’s website to see if you need to obtain other IDs. Also, in their guide, you will find what you need to know about taxes.

Step 3: Decide on Your Pay Period

The usual pay periods in the United States are weekly, bi-weekly, semi-monthly, or monthly. Busy accountants prefer semi-monthly pay periods so that deductions from benefits, which are monthly, will be easy to compute. For hourly employees, they prefer bi-weekly pay periods so it will be easy to calculate for overtime pays. For construction workers, weekly periods are more favorable.

Step 4: Record and Organize Your Files

It is crucial to keep a document that records your employee compensation. To do that, you need a system that can track your employee’s work hours and manage other payments and deductions. Both federal and state laws will require you to keep some essential documents for a specific period. Normally, employers would keep W-4 and W-2 forms for their employees.

FAQs

What is the role of the Internal Revenue Service?

The IRS is a government agency in the U.S. that was established by the former president Abraham Lincoln in 1862 under the power of the Department of the Treasury. Its job is to collect taxes and enforce laws regarding taxes. It also manages estate, gift, excise, and corporate taxes.

What are FICA taxes?

According to Investopedia, the Federal Insurance Contributions Act is a law in the United States that regulates payroll taxes to support Medicare and Social Security programs. FICA taxes depend on a worker’s salary. Individuals with higher salaries will have to pay more. As of 2019, the tax rate for Social Security is 6.2% and 1.45% for Medicare. For individuals who earn more than $200,000, they contribute an additional 0.9% tax for Medicare. For married couples, it should be more than $250,000. So, the total tax for Medicare is 2.35%. For example, a person with an income of $75,000 will pay $5,737 for FICA, where $4,650 is for Social Security and $1,087 for Medicare. For a person earning more than $200,000, there is a different formula in place. For example, a worker earning $300,000 will have to pay a total of $24,125. First, he/she will have to pay $18,600 for Social Security and $4350 for Medicare, with an additional $1175 for Medicare, which is 2.35% of $50,000 from the $300,000 income.

Are there employee payment violations?

The answer is yes. Here are three common payment violations that some employers commit. (1) Applying deductions without consent (except for FICA taxes). This applies to other non-obligatory deductions such as retirement and health plans. (2) Punishing a worker by withholding his/her compensation. An employee with bad behavior can still collect his/her full wage as long as he/she worked for it. (3) Offering compensation below the minimum. You can’t pay an employee below the minimum and change what has been agreed upon from the very beginning.

What should I do if I don’t get paid?

There is a proper way to address an issue, especially when we talk about work. So, what is the right way to complain? Communicate with your employer. If you think your compensation is lacking, then confront your employer with the issue in a formal manner. If your request is ignored, you can file your complaint to your own state’s Wage and Hour Department or the Department of Labor Wage and Hour Department. You will have to follow their processes for them to hear you out.

How much do online payroll services cost?

According to Business News Daily, there are a lot of payroll companies available online. Out of the many companies they found, they chose five best picks. (1) Paychex is a company that offers custom pricing. (2) Gusto has a base fee ranging from $39 to $149 per month. (3) OnPay has a base fee of $36 per month. (4) QuickBooks has a base fee ranging from $20 to $109 per month. Lastly, (5) SurePayroll has a base fee of $39.99 per month. Online payroll services commonly serve small businesses. Not only do they calculate for the correct salary for employees, but they will also manage obligations concerning payroll taxes. In summary, monthly base fees may cost $30 to $150, or “per-employee” fees may cost $2 to $15. Note that some companies may ask for set-up fees and tax services at the end of the year.

Doing payroll is not as easy as it looks. An employer must consider many things to fully process one legally. These things may include knowing federal and state laws, understanding payroll taxes, issuing tax forms, classifying employees, reporting newly hired employees, deciding how and when to issue salaries, and more. According to a survey done by the National Small Business Association in 2014, the number one most financially burdensome mandatory contributions were payroll taxes, and the second most weighty obligations were federal taxes among small businesses. For that reason, an employer should study every bit of detail concerning employee payrolls. Employee payrolls should not go below or beyond what is fair for the company and its workers.