22+ Sample Monthly Payrolls

-

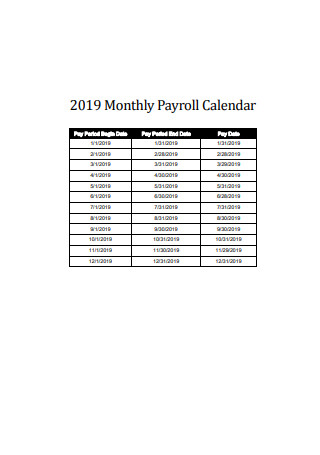

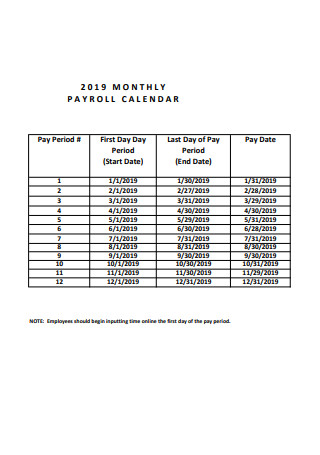

2019 Monthly Payroll Calendar

download now -

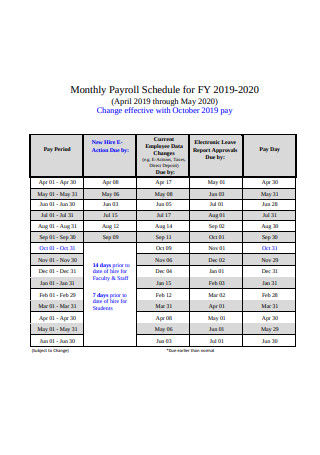

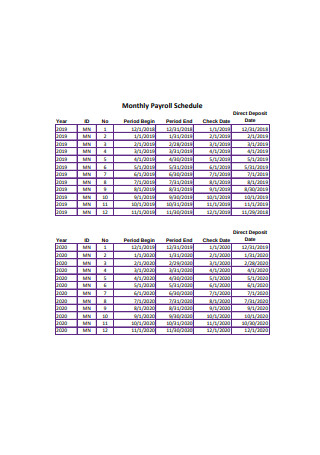

Monthly Payroll Schedule

download now -

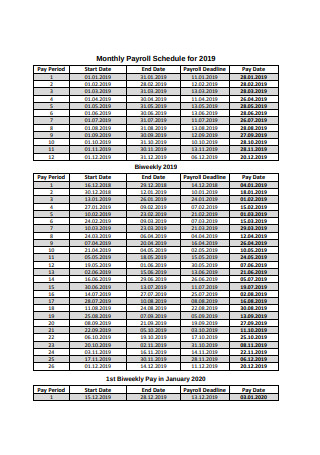

Monthly Payroll Schedule for 2019

download now -

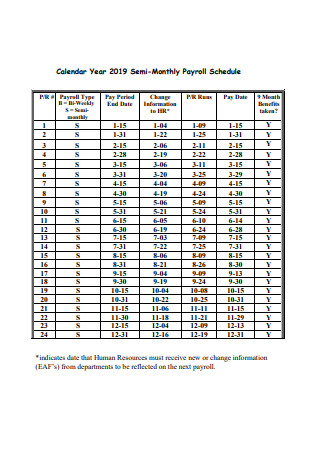

Semi-Monthly Payroll Schedule

download now -

Monthly Payroll Calendar

download now -

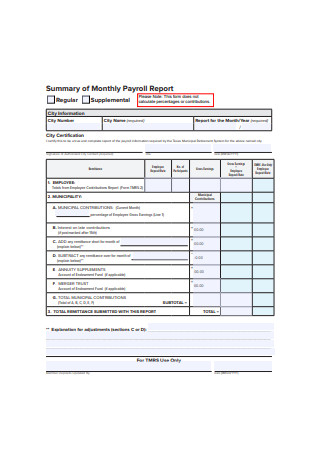

Monthly Payroll Report

download now -

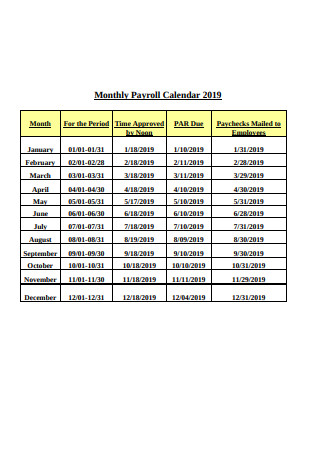

Monthly Payroll Calendar 2019

download now -

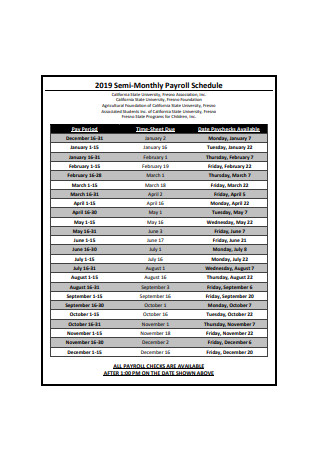

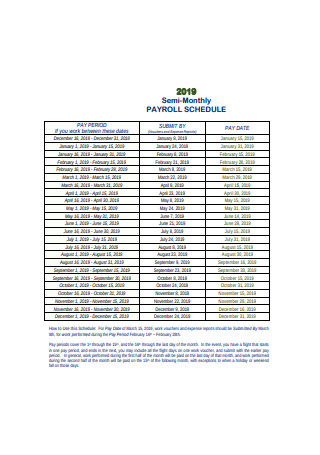

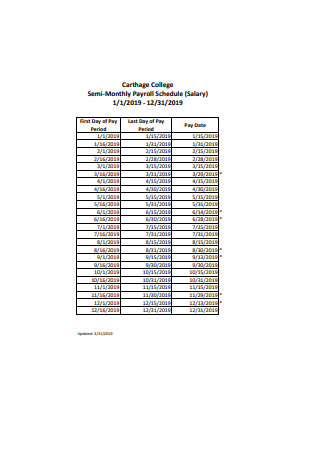

Semi-Monthly Payroll Schedule Format

download now -

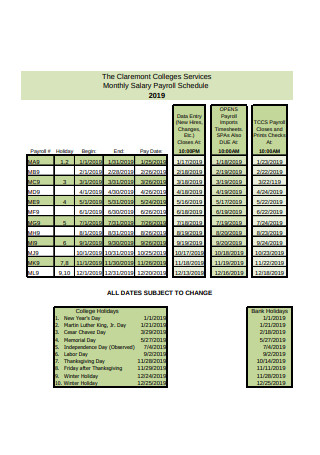

Monthly Salary Payroll Schedule

download now -

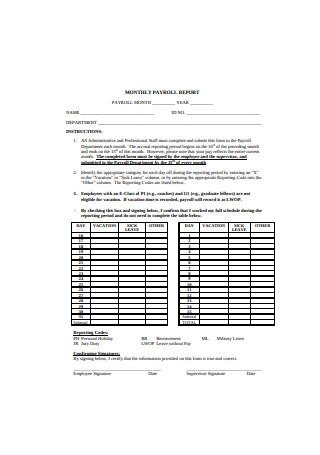

Sample Monthly Payroll Report

download now -

Basic Monthly Payroll Schedule

download now -

Monthly Payroll Timeline

download now -

Semi-Monthly Payroll Schedule Example

download now -

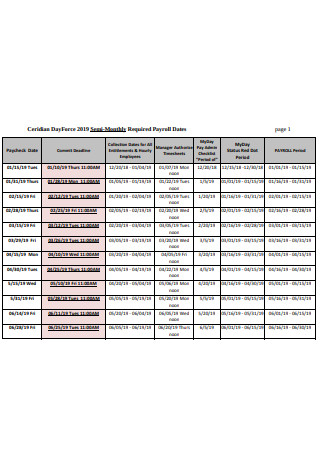

Semi-Monthly Required Payroll Dates

download now -

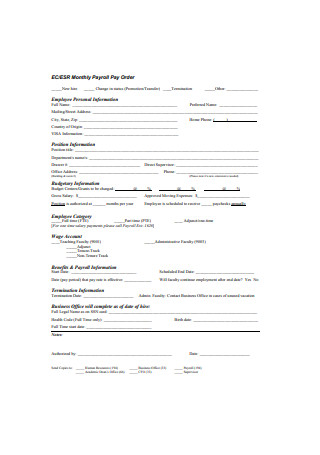

Monthly Payroll Format

download now -

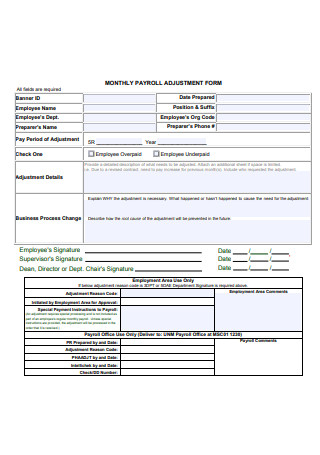

Monthly Payroll Adjustment Form

download now -

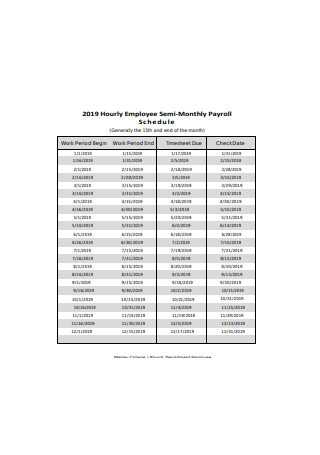

Sample Hourly Employee Semi-Monthly Payroll Schedule

download now -

Semi-Monthly Payroll Schedule Sample

download now -

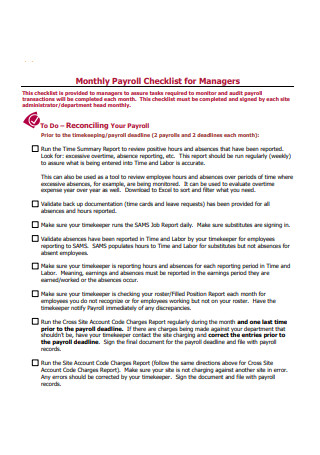

Monthly Payroll Checklist for Managers

download now -

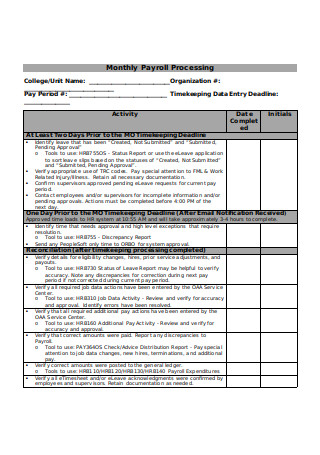

Monthly Payroll Processing Checklist

download now -

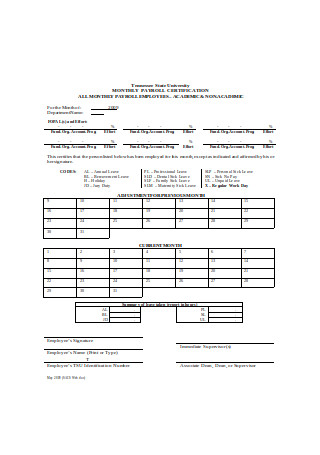

Monthly Payroll Certification Format

download now -

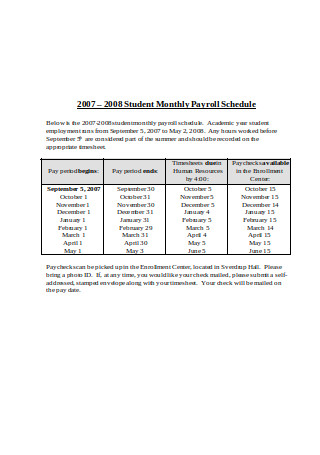

Student Monthly Payroll Schedule

download now -

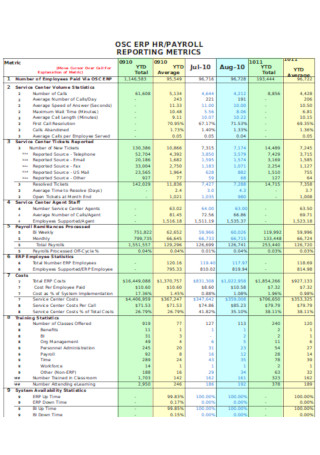

Monthly HR Payroll Report Template

download now

What is a Monthly Payroll and What is its Role in an Institution

A company cannot stand firmly without a stable human resources department. It handles issues concerning the workforce. More specifically, it oversees recruitment, retention, and attrition. As part of employee retention and engagement, the department also takes on the responsibility of coming up with a competitive compensation package. For the most part, the package is streamlined according to the employees’ contribution to the organization. To successfully deliver this role, human resource specialists come up with accurate monthly payrolls to compensate each employee for the number of hours they served the company.

In general, payrolls mean two things. It can mean the employees who receive compensation, and it is also a term used for the payment that these employees receive. For the latter part, the payment factors in several key features that are either added or deducted from the total amount. It factors in the base rate of the position and the number of rendered hours. It also includes bonus pays, commissions, and paid vacation pays. As for the deductions, these are usually the taxes, sick leaves, undertime work, and payment for government-mandated fees, such as for Medicare and Social Security. All of these features are in monthly payrolls, but its primary difference from other payroll schedules is that the dispensing of the compensation happens once a month.

The Benefits of Employing a Monthly Pay Scheme

With the presence of bi-weekly and weekly payroll schedules, one can ask what the benefits of using monthly payrolls are. A person may easily conclude that a monthly dispensing of income will bring more problems. But, it may result in the opposite. It actually encourages the employees to plan—making them more efficient in budgeting their expenses for the next months. Aside from this advantage, the list below presents several other benefits that monthly payroll causes.

Benefits that Attract the Loyal Employees

Circling back to the fact that the majority of the working population belong to the Millennial generation, they have needs that are distinct from other age cohorts. Completely different from how mainstream media portrays this age as carefree and somewhat detached, these individuals are in the midst of taking care of their children and caring for their parents. Contrary to what we believe in, the Millennial population is in their mid-20s to mid-30s. In order to attract the best and most loyal workers from this population, make sure to appeal to their needs.

Security of Tenure

An unfavorable notion about the Millennial workforce is that they have a habit of jumping from one company to another. In their perspective, they can jump ship as often because they believe they are capable of finding better paying and more accomplishing jobs. Among the age cohorts, they are ones of the, generally, most accomplished in the academe. However, they remain tied to companies that offer a well-meaning job for an extended period. Anyone will choose to stay in companies that provide security for their tenure. Having tenured employees in your company boosts its image, as well. It gives the impression that the organization knows how to take care of employees.

This employee benefit is eligible for everyone. The best way to showcase this advantage to your employees is by being transparent on the rules in terminating workers. Clear company policies and a comprehensive code of conduct or employee handbook will also help in upholding transparency.

Competitive Industry Salary

One of the factors that employees consider before accepting a job is the salary rate. It is not an uncommon practice that individuals apply for several companies and weigh their options after. Smart employees compare the offer to the standard industry salary rate. Industry rates are the average of the salary rates from different companies. Newcomers in a particular industry often base their pay scheme on the existing value.

It comes with no doubt that employees look into the value written on their payslips, rather than its format. Whether monthly or bi-weekly, it does not matter much when the gross salary is more than what they expect. Most industry salaries are before deducting withheld tax and government-mandated fees.

Insurances

As employees and business owners work-life integration rather than balance, employees are highlighting the significance of insurance more than before. As an employee, it is impossible to completely separate work from personal life, especially from one’s health and well-being. Stressors from work cannot be left alone in the workplace, we bring it everywhere we go, and it can affect our other daily interactions.

People are now looking for employers who value their health as much as they do. Companies that offer comprehensive insurance programs that uphold medical, dental, visual, and mental well-being, have more chance of attracting potential employees because of this benefit alone.

Leaves

Still part of the organization’s drive for upholding work-life integration, employees are allowed times off work for several reasons. Companies with over fifty employees are mandated by the government to award sick leaves to employees. As per the Family and Medical Leaves Act, parents are also entitled to paternal leaves for caring of family members, for childbirth, and for adopting. As for vacation days and other particular leaves, it is according to the company if they will make these available for the employees.

Potential employees also look into the availability of these leaves among their target companies. As much as they want to give their best efforts in the workplace, they also want to be present during family gatherings and special occasions.

How to Make an Accurate Monthly Payroll

A layman’s perception of a monthly payroll is a pile of timesheets containing employees’ names, identification details, and salary for a particular month. And that’s it. On the contrary, there is more to it than what we often perceive it. There are several factors to consider before even starting to make a monthly payroll. After making the payroll, there are still other factors to review. Here are some steps to factor in if you want to employ a monthly payroll for your company.

Step 1: Secure Accurate Employee Information

The first, and probably the most important, step in creating payrolls, is to ensure the accuracy of the employees’ information that will reflect on their payslips. Aside from the necessary personal information, it is essential to get their job positions correct. For most companies, the base salary is tied to the post, not according to the credentials of the one assuming the role. It also requires other identification details, especially those that are granted by the government, such as Social Security Numbers. Aside from these data, make sure that you have access to the employees’ overtime pays, bonuses, and deductions.

Pro-tip: You can organize these sets of information by using a table format if you want to input the data manually. You can also opt to use spreadsheets in payroll systems.

Step 2: Choose the Preferred Payroll Method

After organizing all the information concerning the primary contents of a payslip, it is time to choose the best payroll calculation method for the company. Starting with the basic detail that you will use a monthly payroll scheme, evaluate among the available choices on how to calculate it. Some companies prefer to do their calculations in-house, whether with an employed accountant or by using payroll software. On the other hand, some companies prefer to outsource this task to third-party accounting firms. Go for the method that is cost-efficient for the company.

Step 3: Factor in the Deductions

Accurate monthly payroll accounts for all the details to result in the net salary of the employee. As mentioned earlier in this article, monthly payments have fewer bases for deductions. Its permissible deductions are for days when the employee is not present for the entire day. If the employee is present for several hours for a particular day, the company can choose to pay the full base rate. Aside from the deduction for an absence, other salary deductions are allocated for government-mandated funds. These funds are usually for healthcare, social development, and unemployment assistance. And of course, salary deductions also include withheld taxes. If the company offers programs such as student loan assistance, a portion of the payment is also subtracted from the monthly rate.

Step 4: Uphold Transparency

After gathering and organizing the needed data for a monthly payroll, present it to your employees and be open for inquiries. Slight changes in the payslip can make the employees raise eyebrows and ask for clarifications. Monthly payrolls have a more rigid nature than other payroll schedules because it accommodates to employees with daily rates. Therefore, the organization must be open to questions. If in case, the organization outsources the task to third-party firms, the company can choose to request a professional to visit onsite and clarify the issues.

Tip: Transparency within the workplace encourages positive company culture. It fosters an environment of growth out from constructive criticisms and valid questions.

Working with a more diverse workforce poses new challenges for established companies. They are encouraged to make changes in their current benefits package to appeal to this new market, especially with their salary rates. And with the availability of various payroll schedules, companies can play around with it until they settle with the scheme that matches the needs of the company. If you are yet to try monthly payrolls, let the details in this article serve as a guide when you start to implement it in your organization.