Payroll Check Format

-

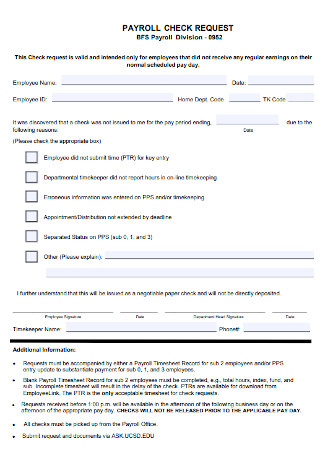

Payroll Check Request Template

download now -

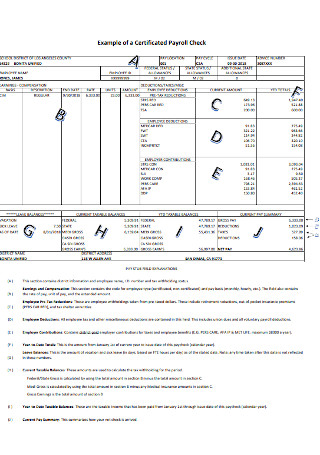

Certificated Payroll Check Example

download now -

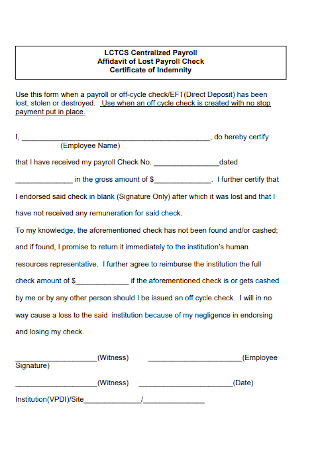

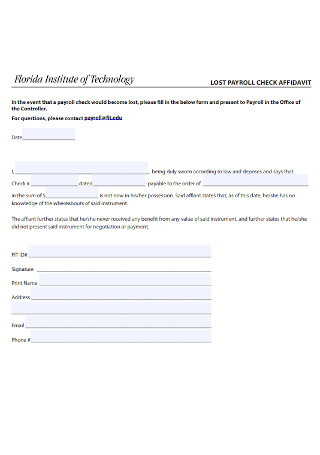

Affidavit of Lost Payroll Check Template

download now -

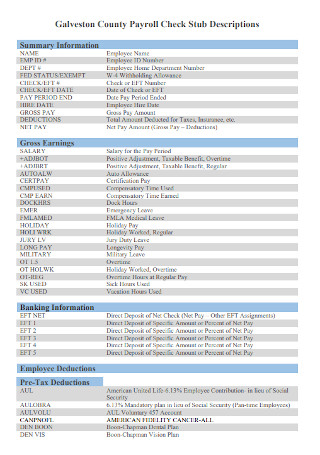

Payroll Check Stub Descriptions Template

download now -

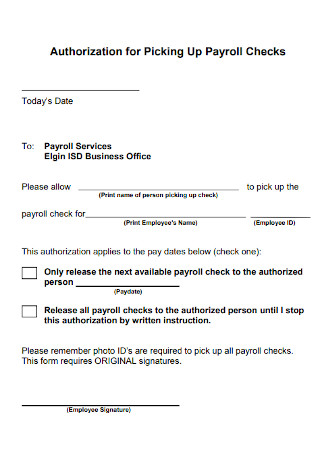

Authorization for Picking Up Payroll Checks

download now -

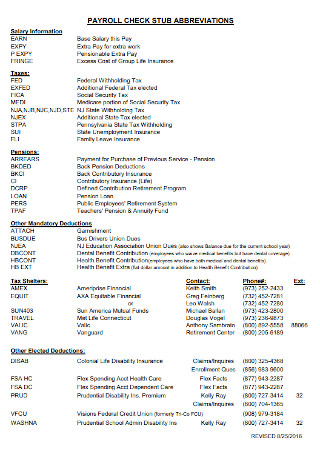

Payroll Check Stub Aabbreviation Template

download now -

Employee Payroll Check Template

download now -

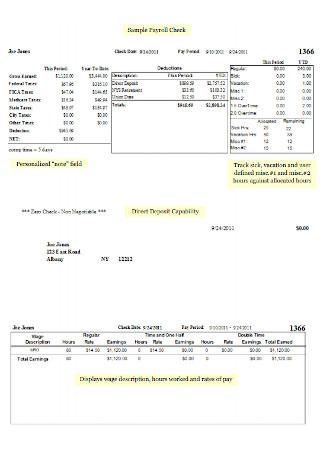

Sample Payroll Check Template

download now -

Lasr Payroll Check Affidavit Format

download now -

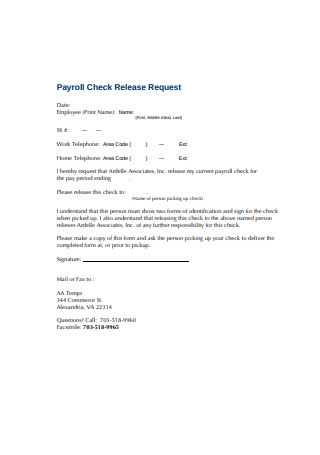

Payroll Check Release Request

download now -

Agreement for Direct Deposit of Payroll Check

download now -

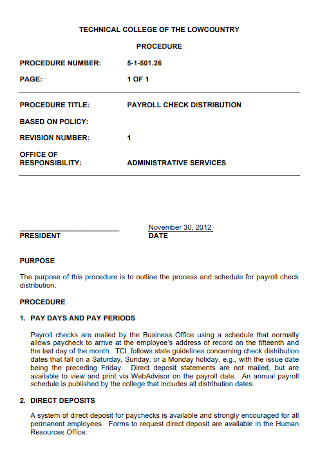

Payroll Check Policy Template

download now -

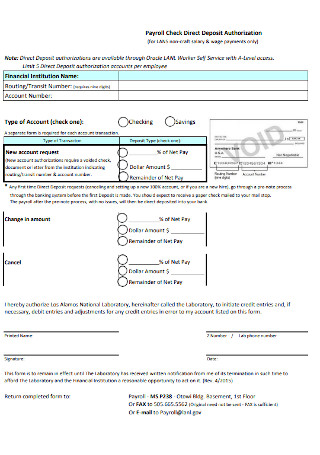

Payroll Check Direct Deposit Authorization Template

download now -

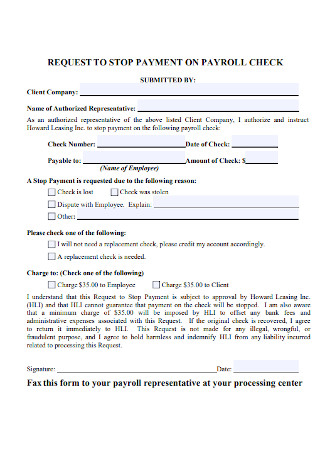

Request to Stop Payment on Payroll Check Template

download now -

Payroll Check Example

download now -

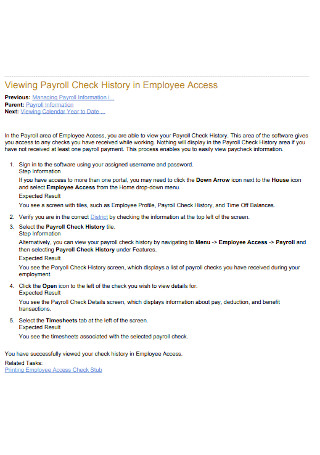

Payroll Check History in Employee Access Template

download now -

Payroll Check Process Example

download now -

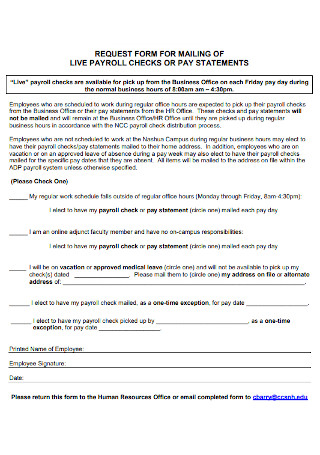

pay Statement and Payroll Check Format

download now -

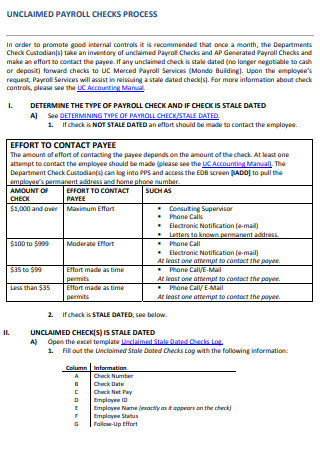

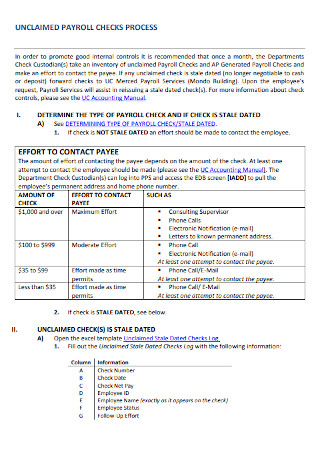

Uncliamed Payroll Check Process Template

download now -

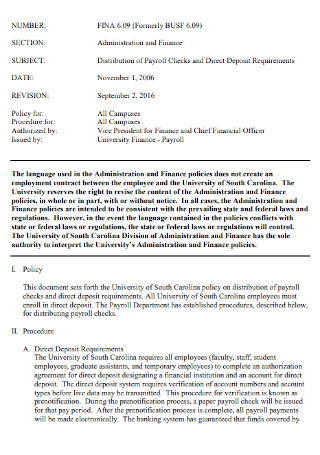

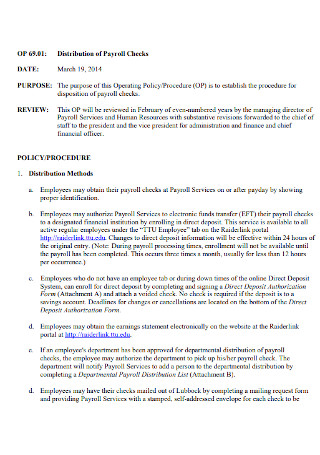

Distribution of Payroll Checks Templates

download now -

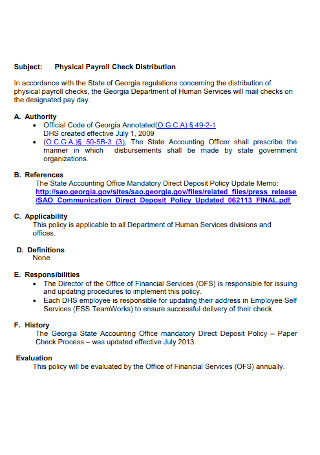

Physical Payroll Check Distribution Template

download now -

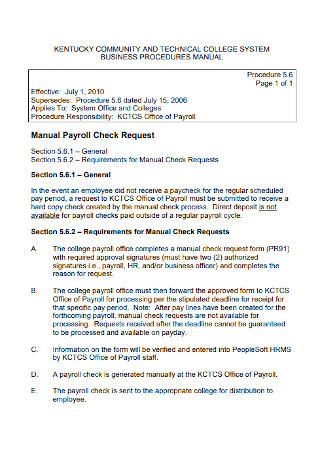

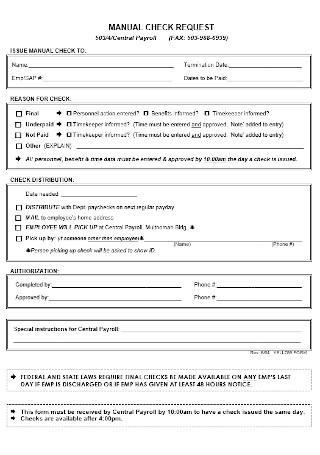

Manual Payroll Check Request Template

download now -

Payroll Check Release Request

download now -

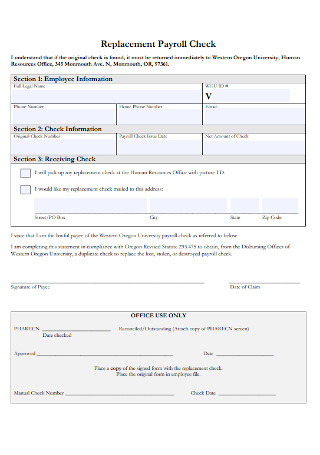

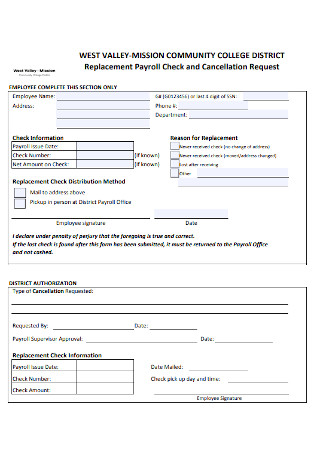

Replacement Payroll Check Template

download now -

Unclaimed Payroll Check Policy Template

download now -

Customize Payroll Check Template

download now -

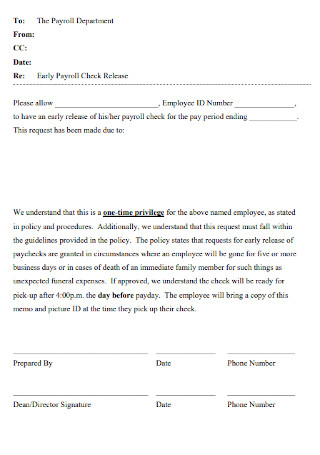

Early Payroll Check Release Template

download now -

Payroll Reissues Check Templates

download now -

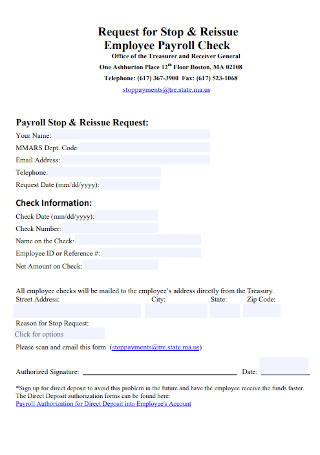

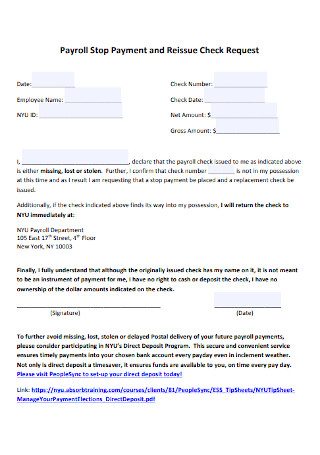

Payroll Stop Payment and Reissue Check Template

download now -

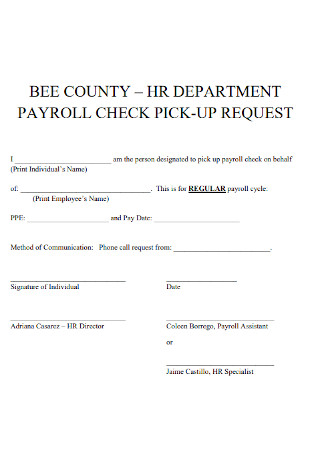

HR Department Payroll Check Template

download now -

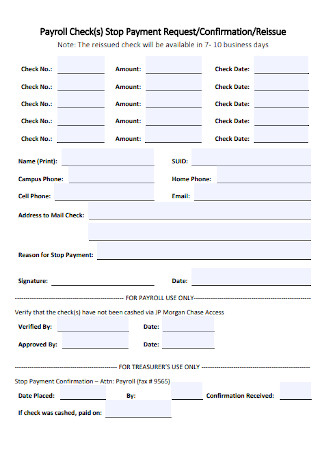

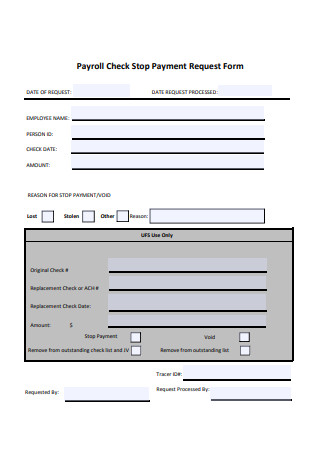

Payroll Check Stop Payment Form

download now -

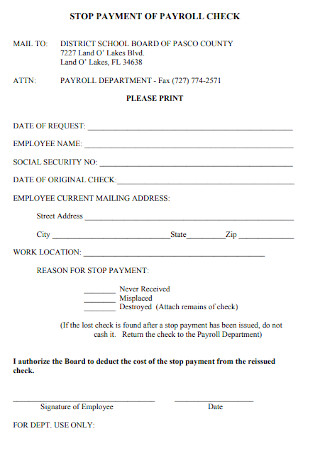

Stop Payment of Payroll Check Template

download now -

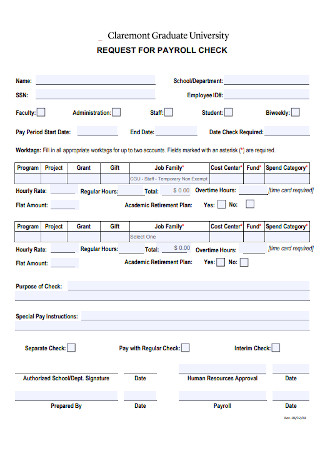

University Payroll Check Template

download now -

Request for Payroll Check Stop Payment

download now -

College Payroll Check Template

download now -

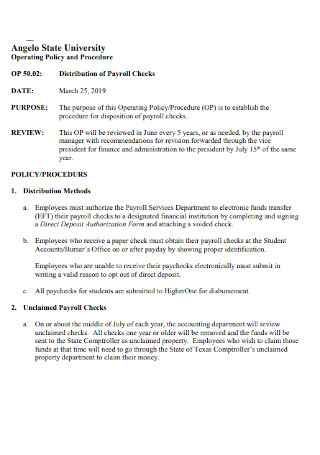

Distribution of Payroll Checks

download now -

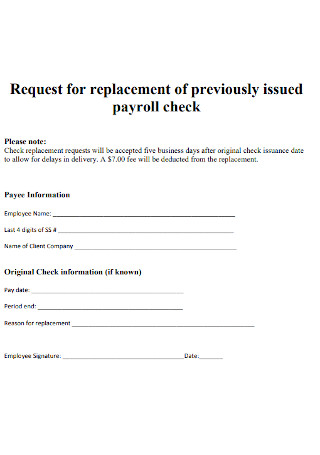

Sample Replacement Payroll Check Template

download now -

Replacement of Previously Issued Payroll Check

download now -

Evolution Payroll Check Calculator At a Glance Template

download now -

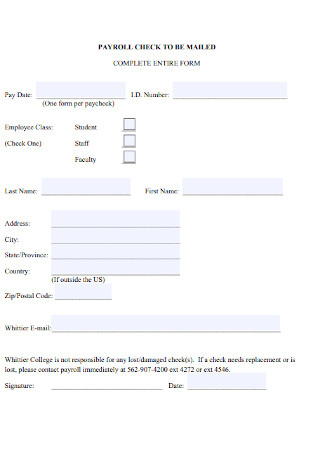

Payroll Check Complate Entire Form

download now -

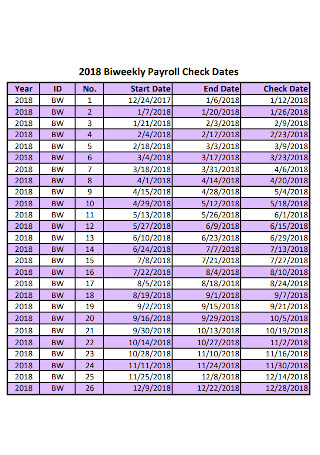

Biweekly Payroll Check Dates Templates

download now -

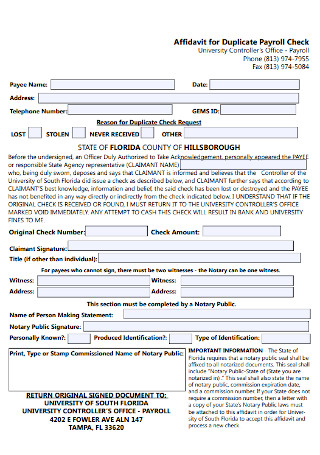

Affidavit for Duplicate Payroll Check Template

download now -

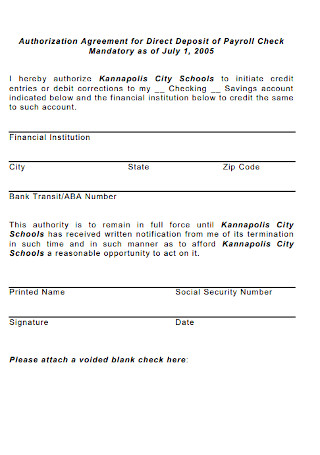

Agreement for Direct Deposit of Payroll Check Template

download now -

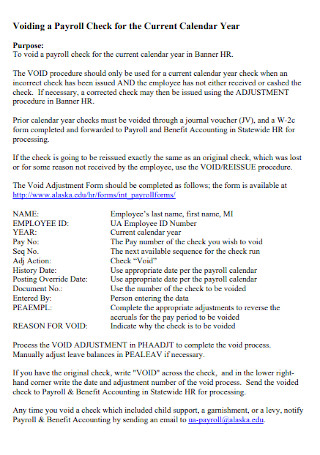

Payroll Check for the Current Calendar Year

download now -

Payroll Check Correction Form

download now -

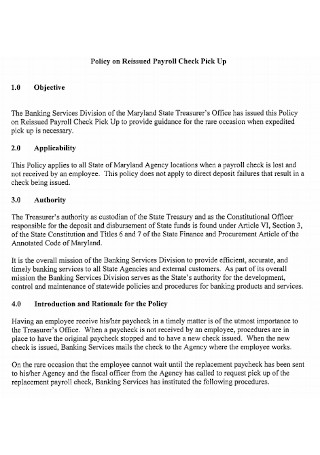

Policy on Reissued Payroll Check Pick Up Template

download now -

Special Payroll Check Format

download now -

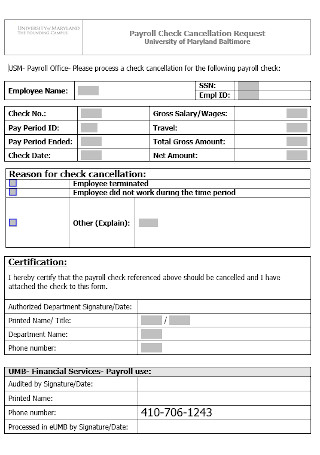

Payrolll Check Cancellation Request Template

download now -

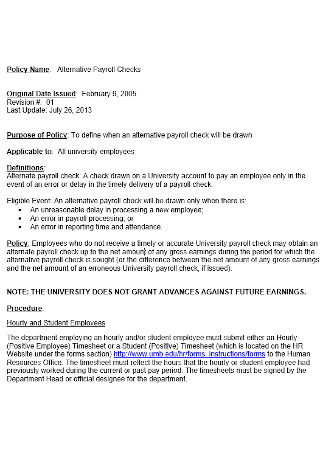

Alternative Payroll Checks Template

download now -

Manual Payroll Check Template

download now -

Payroll Check Register Template

download now

FREE Payroll Check Format s to Download

Payroll Check Format

What Is a Payroll Check?

Cashing Your Payroll Check Without a Bank Account

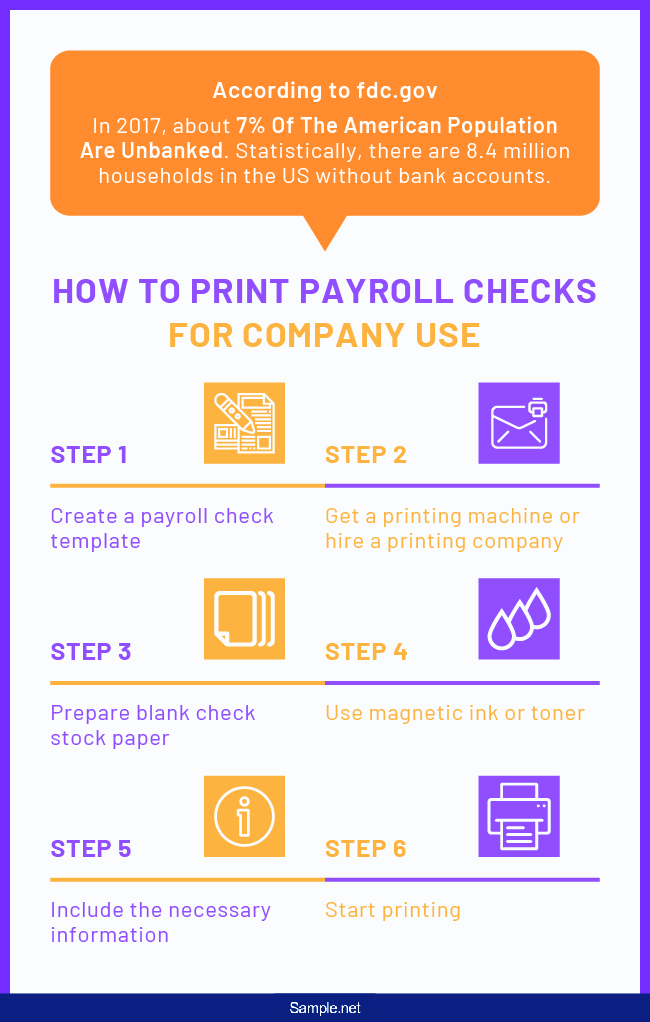

How To Print Payroll Checks For Company Use

Step 1: Create a payroll check template

FAQs

Is a handwritten payroll check acceptable?

How can I verify a payroll check?

Can I deposit someone else’s payroll check into my account?

Is a pay stub the same as a payroll check?

What Is a Payroll Check?

A payroll check is a type of check specifically used by employers to pay their employees for their services. As an employer, you can choose to pay your employees by cash, checks, or direct deposits on a daily, weekly, or bi-monthly basis. If you use a check, you need to make sure you include all the necessary information a bank will require to accept the check your employee presents them. The amount on the check represents the net pay of your employee. The payroll check is different from a payroll stub. In a payroll stub, you will have to write the breakdown of a worker’s pay. It must reflect the deductions from taxes and government contributions made. Basically, gross pay minus payroll deductions equal net pay. The payroll stub is typically attached to the payroll check for reference.

Cashing Your Payroll Check Without a Bank Account

Once your boss hands you your payroll check, you need to go to your bank and have the amount deposited to your account. Ideally, a person should have a bank account to cash a check. According to a 2017 national survey conducted by FDIC, approximately 7% of the American population are unbanked. Statistically, there are 8.4 million households in the US without bank accounts. If you are one of these people, there are alternative ways for you to cash your paycheck.

How To Print Payroll Checks For Company Use

In this digital age, more companies are choosing to pay their employees via direct deposits. An employer can conveniently transfer money in a matter of minutes to his employee’s checking or savings account. By using online electronic transfer banking systems, an employee can receive his pay easier and faster compared to physical checks. Although there is a growing trend for businesses opting for direct deposits, there are still several businesses that prefer the traditional way of paying their workers via checks. To help you get started in printing your payroll checks, below are some guidelines you can take note of.

Step 1: Create a payroll check template

If you don’t want to purchase costly software to do your payroll, you can do it manually by using a payroll check template. Don’t know how to make one? Use our readily printable templates. All you have to do is scroll up, choose from a wide selection of payroll check templates, download the file in either PDF or Microsoft Word format, fill in the blanks, and print.

Step 2: Get a printing machine or hire a printing company

You don’t need to purchase an expensive printer to print the checks. A regular printer works fine, as long as it is compatible with the magnetic ink you will use to print MCIR codes (see step 4). If you don’t want to hassle yourself and deal with the check printing process, consider hiring a printing company to print the payroll check template for you. They will make sure to use special ink for the MICR code, so all you need to do is add the necessary information such as the name of the payee, the date, and the amount.

Step 3: Prepare blank check stock paper

A check stock paper is a special paper used specifically for check printing. It contains security features that help to keep your check from being altered or copied. Don’t worry about your printer; check stock paper are compatible with most printing machines. You can find them in your local office supply stores, or you can contact your company bank to ask them for stocks you can use. Check stock paper can be expensive, but it’s worth it. Writing your payroll check in check stock paper is not legally required, but it will provide you the extra security, peace of mind, and the stress of possible dealings with fake company checks.

Step 4: Use magnetic ink or toner

A bank’s computer specifically used for check reading can only read checks printed with magnetic ink. The MICR technology allows a bank to verify the legitimacy of a check faster. If you use regular ink, the bank will have to process your check manually. If manual checking is done, some banking institutions will charge you an extra fee and the money transfer to your bank account will be delayed. Hence, it is better to use magnetic ink or toner when printing your employee’s payroll checks.

Step 5: Include the necessary information

Before you start printing the payroll checks, make sure all the required fields are filled out. Double-check the name of the receiver, account number, and amount. A bank will not accept a check with inaccurate information.

Step 6: Start printing

Do a final reading check before printing. Once the payroll check is printed, have it signed and certified. Then, you can now hand it over to your employee so he can cash it in his preferred bank or outlet.

FAQs

Is a handwritten payroll check acceptable?

Yes, a handwritten payroll check is acceptable as long as it contains all the essential requirements for a valid check. However, it can be difficult to cash in. There are only a few places that accept handwritten checks since they carry a higher risk compared to electronically printed ones. The best place to cash the handwritten payroll check is with the issuing bank—the bank where the issuer has his account and where the money will come from. Typically, you will have to pay for additional service fees for check encashments if you are a non-costumer of the issuing bank. To be sure, call the bank beforehand.

How can I verify a payroll check?

You can verify a payroll check by calling the issuing bank. Don’t use the number found on the check itself. Instead, do your research. You can find the bank name somewhere on the face of the check. Find the contact information of the bank through online searching. A reliable place to look for the contact details is on the certified website of the bank. Once you have the phone number, call the bank and tell the customer representative that you would like to verify your payroll check. You will need to provide him with the bank account number and the amount written on the check. He will inform you whether the check is fake or not.

Can I deposit someone else’s payroll check into my account?

Yes, you can. Some banks will allow you to deposit checks that belong to another person. Provided, the person to which the check is addressed to must first endorse it to you. Meaning, he has to write at the back of the check, “pay to the order of” and your printed name. Also, you will have to sign the check below that statement. Be sure to bring a copy of the original check payee’s identification card as well as an original of yours. The banks will require you to present both IDs when you deposit the check.

Is a pay stub the same as a payroll check?

No, a pay stub is not the same as a payroll check. The pay stub provides a detailed breakdown of an employee’s salary. Not only does it show the amount he receives, but it also reflects the taxes and deductions made to his gross earnings. On the other hand, a payroll check merely provides the actual salary an employee receives. You cannot cash a pay stub, but you can cash a payroll check.

Payrolls are an integral part of business operations. As a business owner, one of your main responsibility is handling the finances of the company, which includes paying the salaries of your workers. To make the process easier for you, you can use our sample payroll check formats above. You can find one most suitable for you and your needs. Download the file, fill out the blanks, and print.