21+ Sample Payroll Statements

-

Payroll Statement Template

download now -

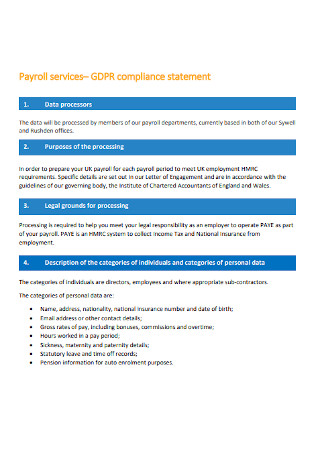

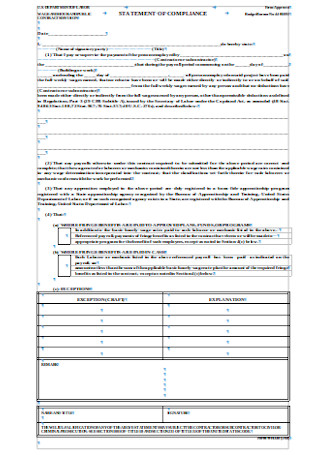

Payroll Compliance Statement

download now -

Payroll System Problem Statement

download now -

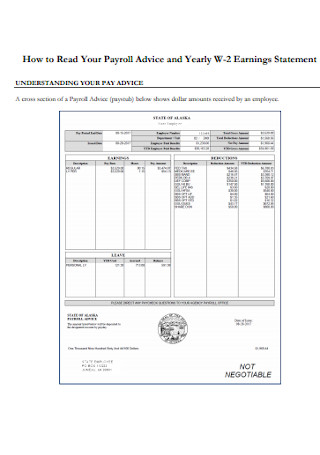

Payroll Advice and Earnings Statement

download now -

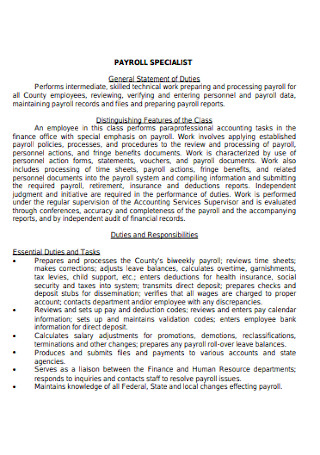

Payroll Specialist Duties Statement

download now -

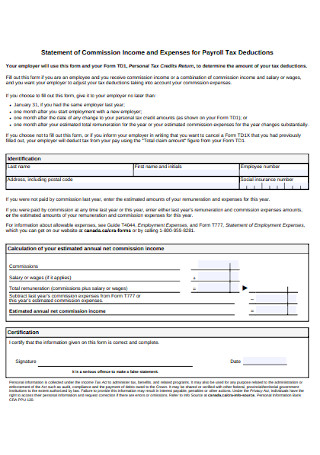

Payroll Tax Deductions Statement

download now -

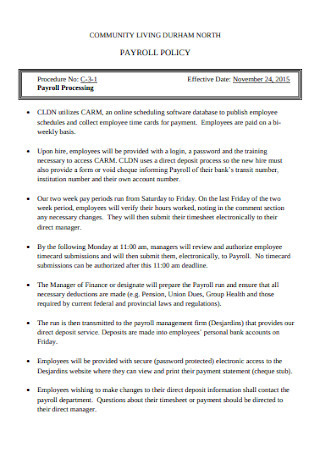

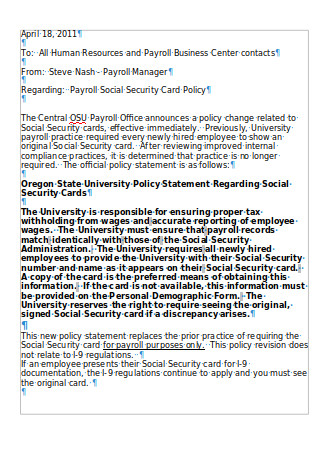

Payroll Policy Statement

download now -

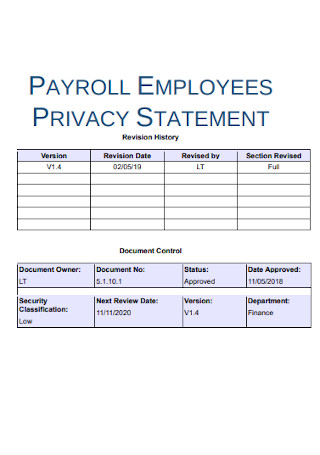

Payroll Employee Privacy Statement

download now -

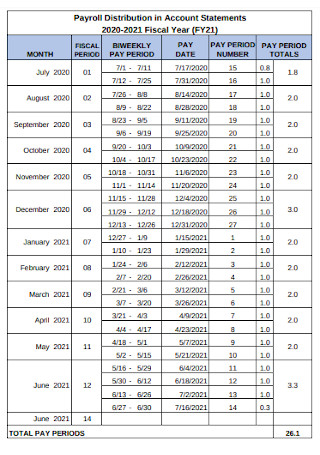

Payroll Distribution in Account Statements

download now -

Sample Payroll Policy Statement

download now -

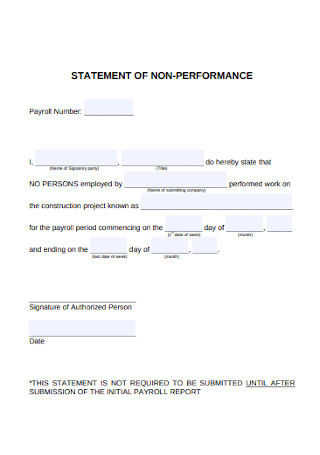

Payroll Statement of Non Performance

download now -

Employee Payroll Policy Statement

download now -

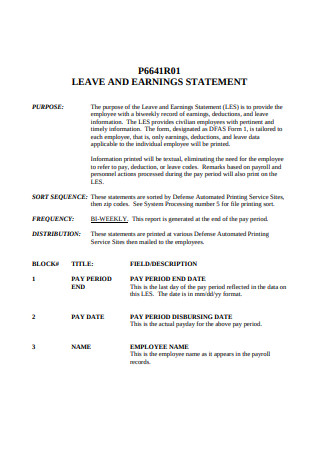

Payroll Officer Earning Statement

download now -

Payroll Expense Tax Statement

download now -

Formal Payroll Statement

download now -

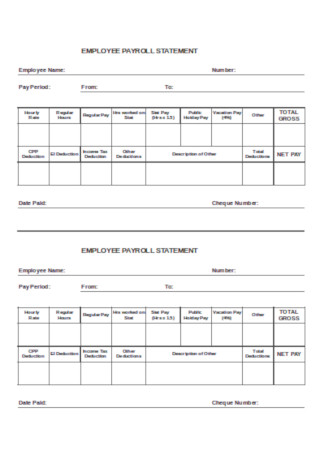

Employee Payroll Statement

download now -

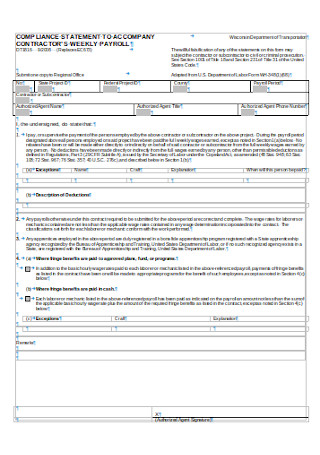

Weekly Payroll Statement

download now -

Payroll Statement Example

download now -

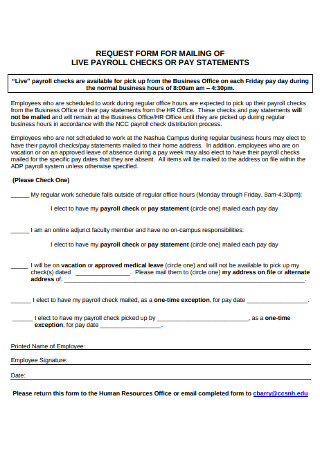

Payroll Checks and Pay Statement

download now -

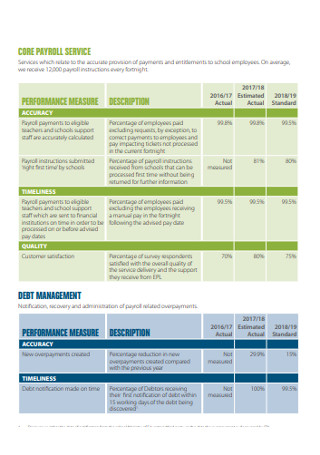

Education Payroll Statement

download now -

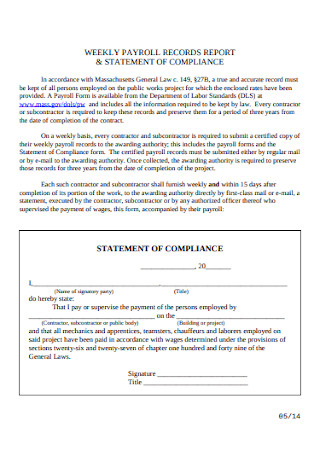

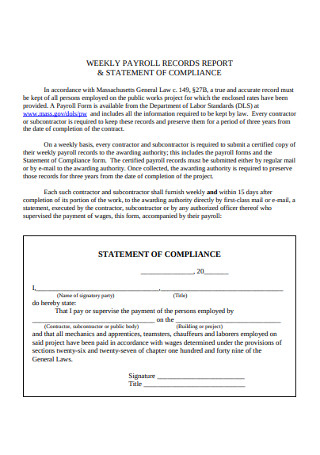

Weekly Payroll Records Reports

download now -

Sample Employee Payroll Statement

download now

FREE Payroll Statement s to Download

21+ Sample Payroll Statements

Payroll Statements: What Are They?

The Important Functions of Payroll Statements

What Are the Qualities to Observe in Forming Payroll Statements?

How to Create an Excellent Payroll Statement

FAQs

Should payroll be calculated by the accounting team or HR?

What job has the highest payroll rate?

What are payroll expenses?

What does an employee benefit statement mean?

How can I calculate total compensation?

Payroll Statements: What Are They?

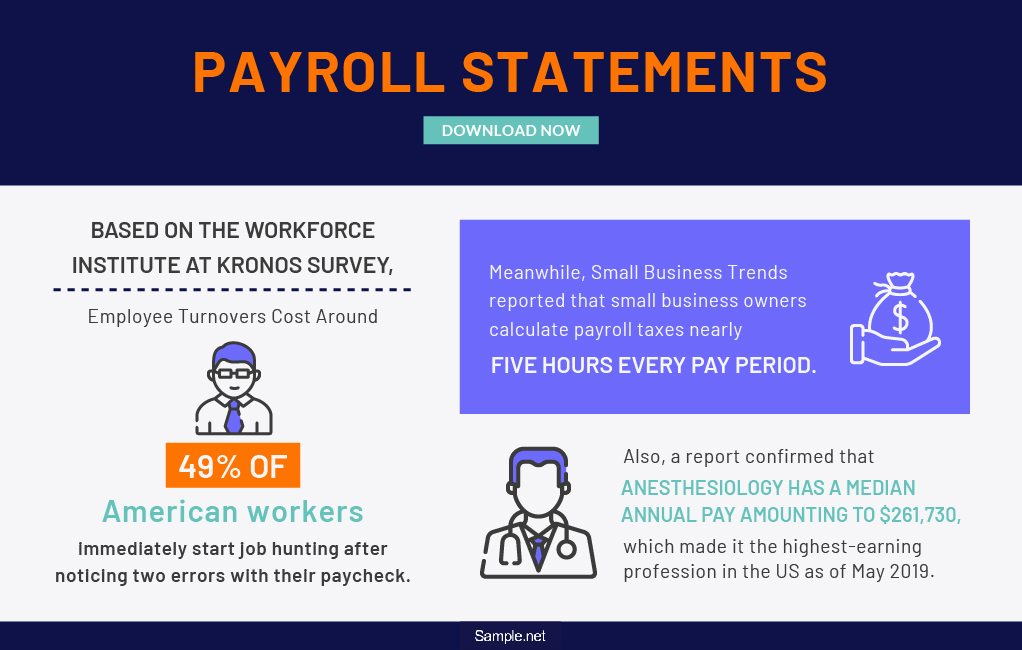

A payroll statement is a detailed written statement about the earnings or payroll done weekly, biweekly, monthly, quarterly, or yearly. HR also uses earnings statements to record every employee’s working hours, including withholding taxes, pay rate, and more. Thus, not only the salary amount will be written in the statement but also other expenses. More so, this statement serves as documentation in case any organization asks for proof of a company’s financial condition or if any employee wishes to see how payroll is calculated.

Based on The Workforce Institute at Kronos survey, 49% of American workers immediately start job hunting after noticing two errors with their paycheck.

Meanwhile, Small Business Trends reported that small business owners calculate payroll taxes nearly five hours every pay period.

Also, a report confirmed that anesthesiology has a median annual pay amounting to $261,730, which made it the highest-earning profession in the US as of May 2019.

Why Is a Payroll Statement Important?

A payroll statement is vital since it provides facts and information about payroll-related data. Questions related to employee information, payroll costs, payment schedules, and others will finally be answered. Also, the whole statement is prepared for documentation purposes. If you need evidence of how an enterprise runs its business related to payroll, then the statement lets you see if they go in compliance or not. And the best part is how a payroll statement provides many details but presented easily. Other data are presented in a chart, graph, or any graphic organizer to show information and be understood quickly.

The Important Functions of Payroll Statements

Yes, a payroll statement is important. But what makes it useful aside from how much the salary paid is? In this segment, we outlined and specified the essential functions of payroll statements. And these are the following:

What Are the Qualities to Observe in Forming Payroll Statements?

Before you create a payroll statement, it is necessary to identify the top qualities worth observing in forming the statement. Generally, there are three major qualities you should look out for until an excellent result commences. And the following are the elements you must observe:

Accuracy

The top priority in making payroll statements is that every detail is accurate. Wrong details already make the whole statement null, so depending on it is useless. HR will even scrutinize if the information is correct from top to bottom to avoid being fired with complaints and conflicts. For example, many small business owners calculate the payroll taxes up to five hours each pay period. The process can be time-consuming and daunting, but the results are worth it when payroll statements are error-free.

Organization

All details should be presented in an organized manner. Even though you have all the important info in a document, it will still be pointless if they are hard to follow. Find a way where people can take in the information without consuming too much time and effort. Organized results even help increase efficiency so you can save time and money. And a tip is to present the details in a way where it supports your workflow.

Versatility

A payroll statement is usually a printed document, but you can try other formats via PDF, MS Word, Excel, and anything you can download or send online. Keep in mind that people may need different formats for the statement, so prepare a versatile template for different formats, like our sample templates above. In fact, payment options are also versatile besides the traditional paper check. Many would prefer a bank direct deposit, debit cards, and other payment methods. Make sure the statements are also flexible.

How to Create an Excellent Payroll Statement

Payroll statements are quite easy to make, especially when ready-made templates are available. From our sample payroll statements, you only need to fill in the details to complete the form. But there are a few steps you should bear in mind to make sure the document’s outcome is top-notch. Kindly follow the steps on how to make an excellent payroll statement:

Step 1: Review the Employee List and Payroll Info

It is hard to set up a good payroll statement without full knowledge and background about the payroll details and the employee list. Be sure to know who every employee is until they will be recorded in the payroll statement. Also, finalize the common payroll factors like the regular salary amount, tax deduction breakdown, health insurance program deduction, and so forth. Reviewing these details is crucial, so you will know what to put in the statement.

Step 2: Find a Template to Use and Edit

Have you checked our sample payroll statement templates already? Explore each example and select which example best suits your application. You will need a template to use and tweak its content afterward. Decide the payroll statement’s size, format, design, and more. The best option is something which you find the easiest to use. And as these templates are editable, there is no need to stick with a standard-looking document because you can always polish the content with how you want it to become.

Step 3: Fill the Template with the Important Elements

It is expected that there are elements and labels to familiarize in crafting the payroll statement. And some of the essential elements you should note in the document are the salary rate, number of working hours, total amount earned, tax deduction breakdown, insurance, and other deductions. Ensure that there are labels involved because anyone who reads the statement might be confused if a certain budget refers to the regular salary rate or the current amount earned. Be specific in presenting the elements.

Step 4: Organize How You Present Data

Present organized data, and you can do that, starting with sequencing. Be sure your payroll statement begins with an introductory statement, followed by the body, and ends with a closing statement. Why so? You would not just give calculations without even introducing what the sheet is, its purpose, and others. Otherwise, people might not know what the document is for and why there are random calculations written. Before launching the payroll statement, read if you think you would understand everything if you were in the shoes of readers.

Step 5: Update the Statement Regularly

Once you are confident with how you created your payroll statement, do not forget that your job is not done yet. You still need to update its details from time to time. You need to record each employee reaches the expected business hours or even change the number of deductions if adjustments are a must. Most importantly, double-check the figures if they are correct and updated. And the best part is you can edit the templates on a real-time basis.

FAQs

Should payroll be calculated by the accounting team or HR?

Indeed, payroll involves money, so you would expect the accounting department to manage it. However, payroll is also considered an employee-facing purpose, which considers HR. Typically, HR calculates the payroll since they know about the payment changes, starting and termination dates, tax deductions, and changing benefits details.

What job has the highest payroll rate?

According to Statista, anesthesiology marks as the highest-earning job in America, as of May 2019. The research survey confirmed that the profession has a median annual pay of $261,730.

What are payroll expenses?

In terms of payroll and income statements, payroll expenses are included in labor costs. Therefore, payroll expenses include every employee salary, health insurance fee, tax, commission, bonus, and more.

What does an employee benefit statement mean?

The employee benefit statement refers to what HR provides to the workers to showcase their benefits’ associated value and costs. The management would need the statement for a clear vision and calculation of benefits. Also, such benefit statements may be referred to as total reward or total compensation statements.

How can I calculate total compensation?

In calculating the total compensation, start by reviewing the paid time off’s value you get yearly. Next, multiply the number of days off by the amount of paid money you get from your daily work. And the answer is your total.

Whether you work at a large or small business, never forget that tracking payroll and staying up to date with the payroll schedules are essential. Thanks to payroll statements, you can document and manage payroll effectively. You can even store all information and give access to anyone allowed to see it. And with our sample payroll statement templates, recording payroll-driven data and making real-time updates have never been easier. Download now!