35+ Sample Payroll Deductions

-

Employee Payroll Deduction

download now -

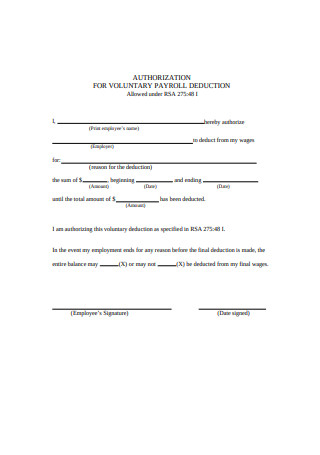

Payroll Voluntary Deduction Form

download now -

General Payroll Deduction

download now -

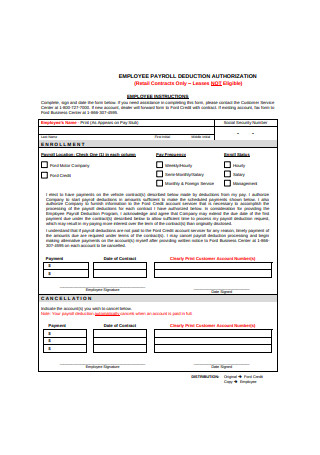

Employee Payroll Deduction Authorization

download now -

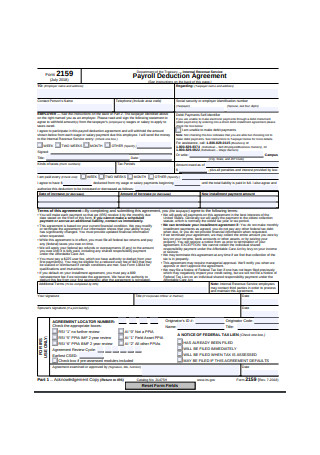

Payroll Deduction Agreement

download now -

Sample Payroll Deduction

download now -

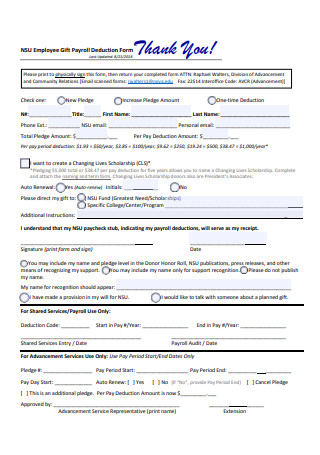

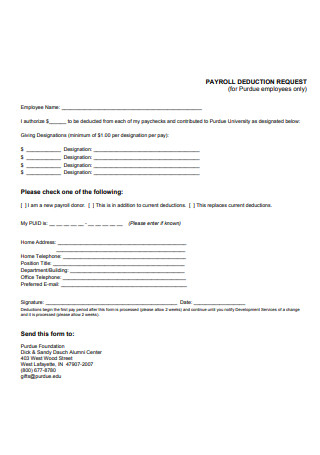

Employee Gift Payroll Deduction Form

download now -

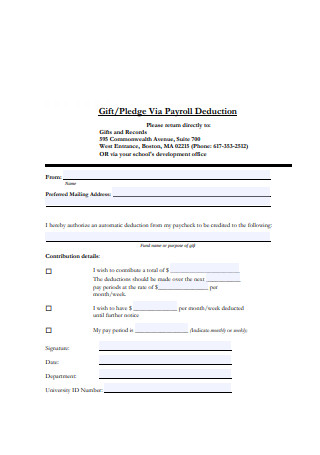

Gift Payroll Deduction Format

download now -

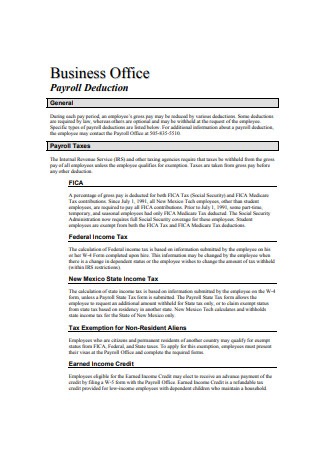

Business Office Payroll Deduction

download now -

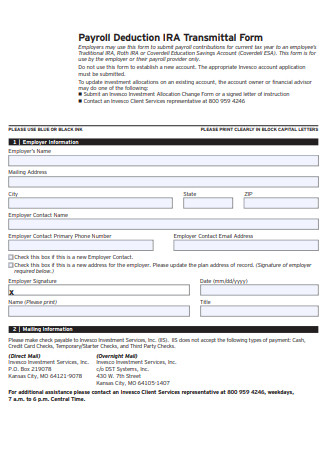

Payroll Deduction IRA Transmittal Formal

download now -

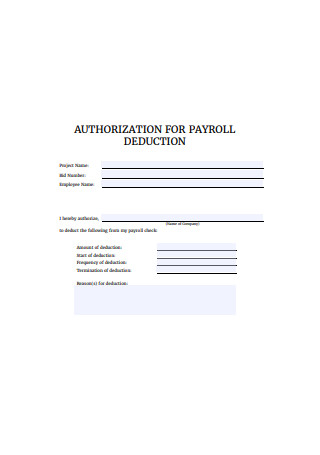

Authorization for Payroll Deduction

download now -

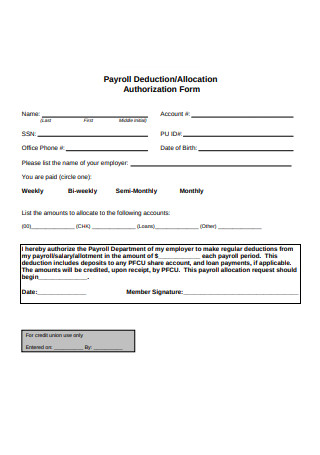

Payroll Deduction Authorization Form

download now -

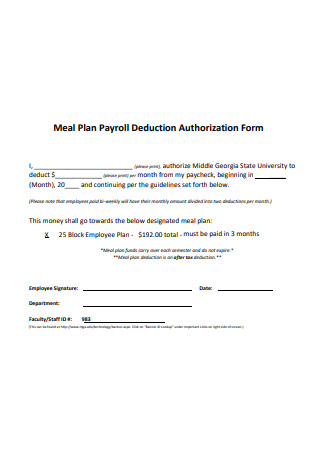

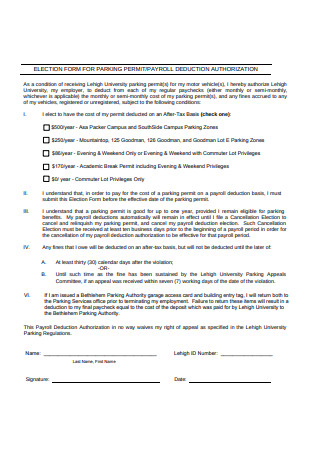

Meal Plan Payroll Deduction Authorization Form

download now -

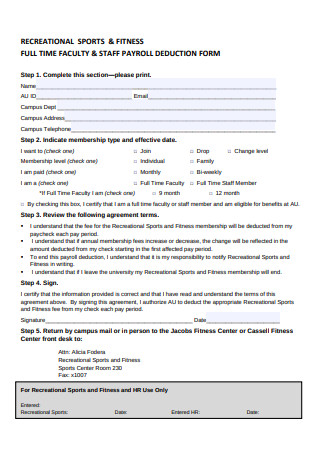

Staff Payroll Deduction Form

download now -

Employee Payroll Deduction Sample

download now -

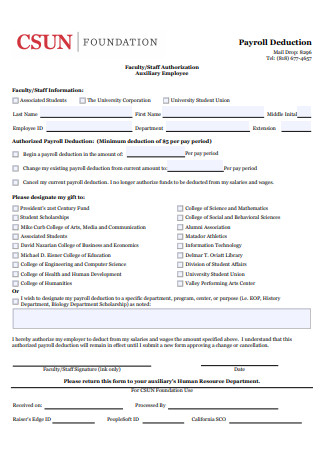

Faculty Payroll Deduction Form

download now -

Employee Gift Payroll Deduction

download now -

Payroll Deduction Program

download now -

Payroll Deduction Authorization Form Example

download now -

Committee Payroll Deduction Authorization Form

download now -

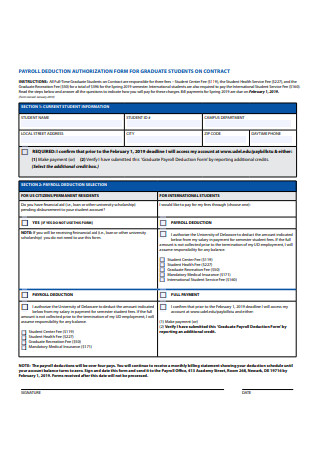

Payroll Deduction Authorization Form for Graduate Students

download now -

Payroll Deduction Authorization Change Form

download now -

Payroll Deduction Application Format

download now -

Employee Payroll Deduction Format

download now -

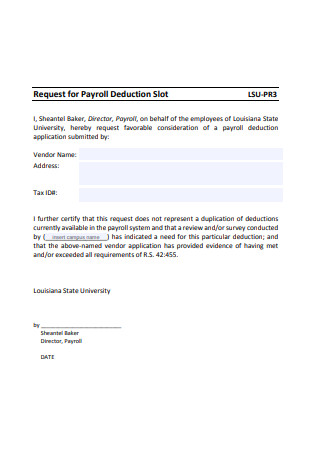

Request for Payroll Deduction Slot

download now -

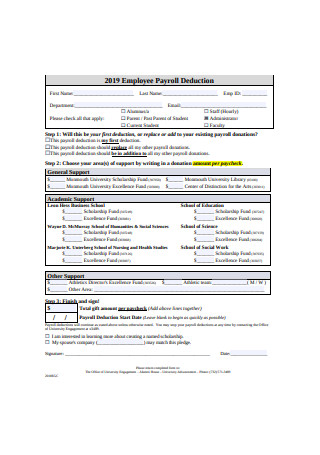

2019 Employee Payroll Deduction

download now -

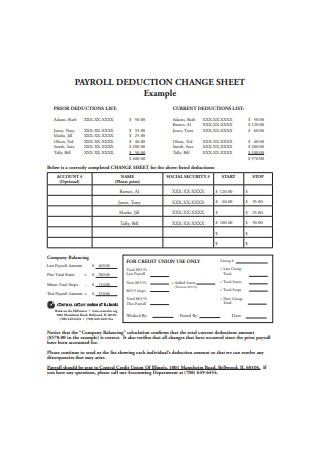

Payroll Deduction Change Sheet

download now -

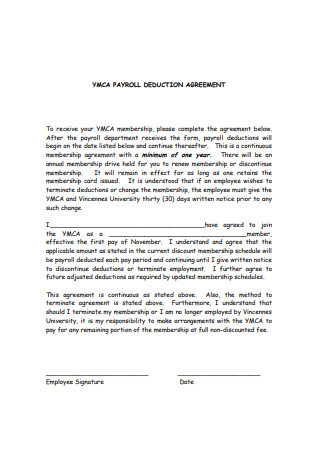

Sample Payroll Deduction Agreement

download now -

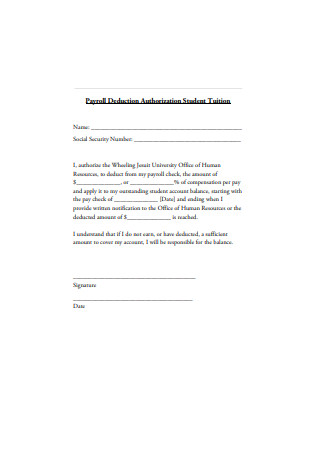

Payroll Deduction Authorization Student Tuition

download now -

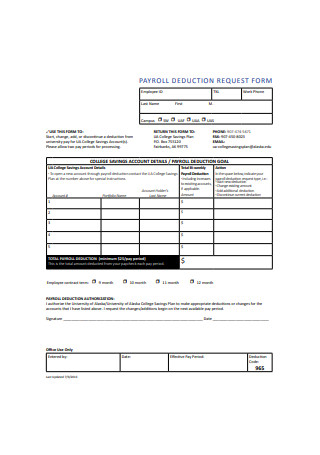

Payroll Deduction Request Form

download now -

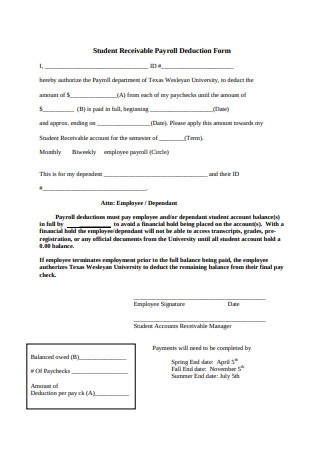

Student Receivable Payroll Deduction Form

download now -

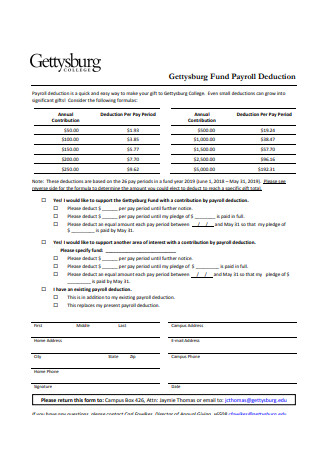

Payroll Deduction Pledge Form

download now -

Fund Payroll Deduction Format

download now -

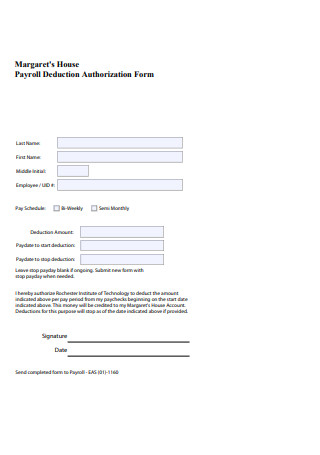

House Payroll Deduction Authorization Form

download now -

Payroll Tax Deduction Format

download now -

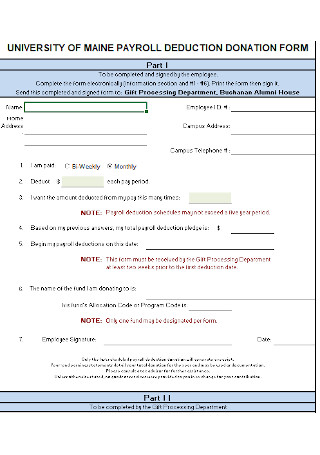

University Payroll Deduction Donation Form Template

download now

What Is a Payroll Deduction and Why Is it Important?

The calculation of an employee’s take-home pay is not an easy task. Aside from the gross pay, a lot of numbers are involved in coming up with the net pay. The difference between gross pay and net pay is that gross pay is the total amount of cash or similar value that an employee has before the deductions. On the other hand, net pay is the sum of money the employees will receive during payday. And whether we like it or not, it is a must for employers to withhold specific amounts from their employees’ paychecks in regular intervals—understandably, we refer to this as payroll deductions. Regardless of the amount of time an employee has rendered in the workplace, there will always be deductions incurred in their salary. It is the employer’s responsibility to inform each of their employees about the payroll deduction program the company follows. Its purpose is to keep the employees from feeling dismayed as they receive their paychecks. When clearly communicated, payroll deduction is not a thing companies should worry about.

The demands of a company should equate with the compensation each employee receives every payday. However, that does not make payroll deductions unlawful. It is the government that mandates companies to incur tax deductions from their employee’s paychecks. Why? To fund the federal and state programs. Because where else can the government generate enough finances for their programs, right? Besides, the substantial amount for tax withheld from an employee’s payroll will come back to them in the form of government-funded projects and benefits. Moreover, other payroll deductions aide workers in saving up for unforeseen circumstances where finances will be necessary.

What are the Types of Payroll Deductions?

With over 327.2 million people in the United States as of this writing, approximately 157 million are employed. The majority works for a company, which means that there will be amounts withheld from paychecks as a directive from the government. However, payroll deduction is just a broad concept. It consists of various types that serve different purposes to the company and its stakeholders. Listed below are the different types of payroll deductions that may reflect in an employee’s payslip.

Payroll Withholdings and Deductions: Mandatory vs. Voluntary

The types of payroll deductions mentioned beforehand fall into two major categories—mandatory and voluntary. Clearly, mandatory payroll deductions are the ones required by the government. These are the amounts withheld from your paychecks to help fund programs ran by the government for the public. Since they are statutory deductions, failure to pay may result in penalties. Federal Insurance Contributions Act (FICA) tax, federal income tax, state and local tax, and garnishments belong to this type of payroll withholdings and deductions. In addition, under the FICA tax are Social Security and Medicare taxes. Unlike other payroll taxes wherein the deductions are incurred on the employees’ paychecks alone, FICA tax obliges both the employer and employee to contribute an equal amount to the government. On the other hand, state and local taxes depends on the area where the business operates. Note that each state or locality has its own income tax structure. While some require individuals and corporations to pay taxes, others don’t.

Aside from mandatory payroll deductions, employers may need to deduct an additional amount from their employees’ paychecks if they opt to participate in various benefits offered. However, there will be a need for the employer to ask consent from their employees if they dock certain amounts on their paychecks. It isn’t called voluntary payroll deductions for no reason. Among the types of payroll deductions mentioned in the previous section, health insurance, and retirement plans belong to voluntary payroll deductions. In addition to that, some businesses withhold particular amounts from their staff’s paychecks for job-related expenses, which include meals, uniforms, and union dues. Although the government does not require employers to cut a portion of their employee’s salaries or offer such benefits, there are federal and state laws that may affect these payroll deductions.

How Do You Create a Payroll Deduction Authorization Form?

Documents hold a great significance in the various processes of a company. However, some professionals find the task of writing documents a hassle, especially when they have some other responsibilities to handle. But you should also note that documents are not just for compliance; it also helps streamline business operations and ensure consent. One type of document employers must prepare is a payroll deduction authorization form. This document provides evidence that an agreement about payroll deductions has been made between the employer and its employees.

Moreover, a company’s staff can refer to it when they want to see if the deductions incurred during their payday are accurate. Most importantly, it provides the employees with a way to grant the company the authority to dock particular amounts in their paychecks. If you are given the task to create a payroll deduction authorization form, read the step-by-step instructions outlined below for you to accomplish the task more easily.

Step 1: Know the Legal Payroll Deductions

Before setting up a payroll deduction program for a company, it is crucial to know what the law considers legal and what is not. That is why it is important for you to have a full understanding of the laws your country, state, or city adheres to. Doing so will help prevent lawsuits, litigations, and costly legal processes. Generally, payroll deductions are deemed illegal when it drags the worker’s salary below the minimum wage of where the business operates. Furthermore, you should also read about state laws about payroll taxes and deductions in addition to the federal laws if your company carries out its operations in the United States.

Step 2: Start With the Basics

The first part that should reflect on a payroll deduction authorization form is the basic details. This includes the current date and relevant employee information. In the blank sheet, insert the following text: present date, employee name, job title, number, social security number, department, and company name. Then, put blank spaces next to each item. Make sure that they would be enough for the employees to write down the needed information later on.

Step 3: Insert a Table

Now that you have created a section for the employee’s information, the next component of a payroll deduction authorization form is the specification of the payroll deductions. After writing a brief authorization statement, insert a table with three columns and type on the topmost portion: type of payroll deduction, amount to be deducted, and amount of deduction per payday. In this section, both mandatory and voluntary payroll deductions should be specified. For voluntary payroll deductions, though, it is up for the employees to decide whether or not they will avail of the benefit.

Step 4: Pen a Statement of Agreement

An employer creates a payroll deduction authorization form for two main purposes—to make the employees aware of the money deducted from their salary and to have evidence that the employee agreed that such tax contributions and other allocations for the amount deducted are of their responsibility. Therefore, the form should have a statement agreement followed by the signature blocks. The statement should make it clear that the employees have a clear understanding of the arrangement made in relation to the deductions. It is also important to include in the statement other terms and conditions that apply.

Step 5: Inform Employees

Employer-employee misunderstandings and disputes may occur if payroll deduction arrangements aren’t communicated clearly. As an employer, you must inform the employees about the payroll deductions applicable in your company so that they won’t have to question why they receive such amounts when they receive their payslips and paychecks. The best time to inform the employees of this arrangement or program is during employee orientation or right after they get hired. After discussing the matter with the workers, make sure that they fully understood the settlement and have the document signed.