29+ Sample Travel Expense Reports

-

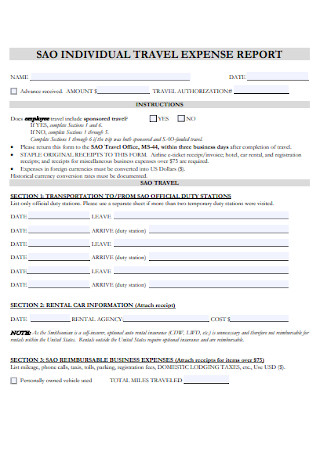

Individual Travel Expense Report

download now -

Standard Travel Expense Report

download now -

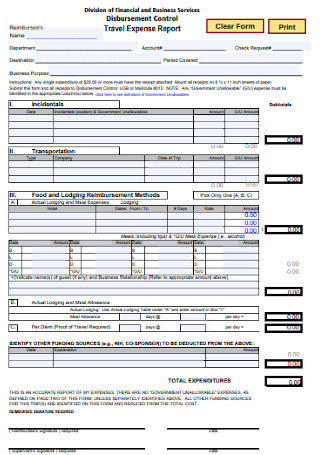

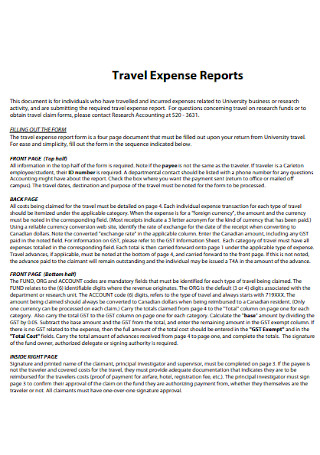

Travel Expense Report Completion Instructions

download now -

Office Travel Expense Report

download now -

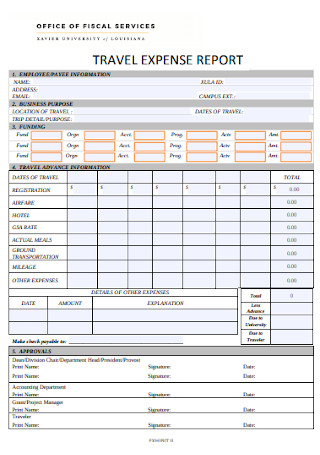

Financial Services Travel Expense Report

download now -

Domestic Travel Expense Report

download now -

Employee Travel Expense Report

download now -

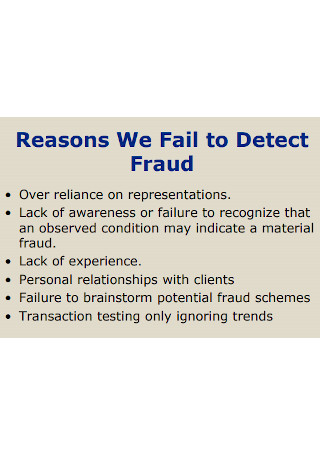

Travel Expense Reporting Fraud

download now -

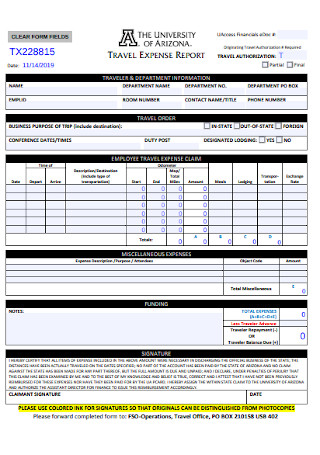

University of Arizona Travel Expense Reports

download now -

Regular Travel Expense Report

download now -

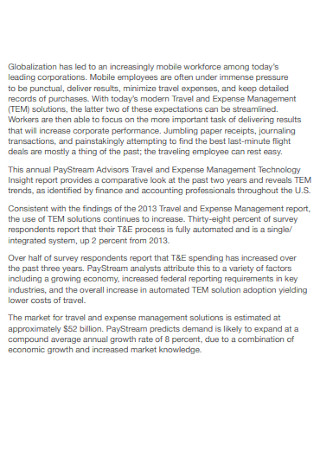

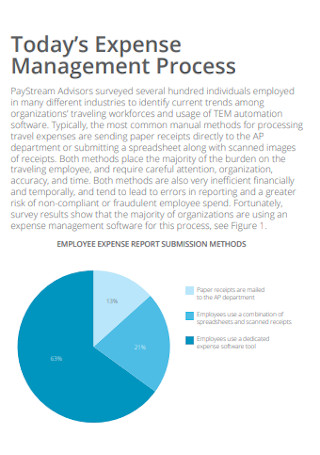

Travel Expense Technology Insight Report

download now -

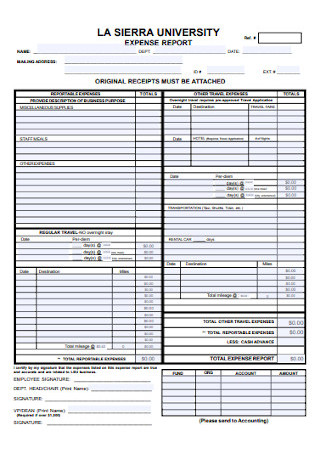

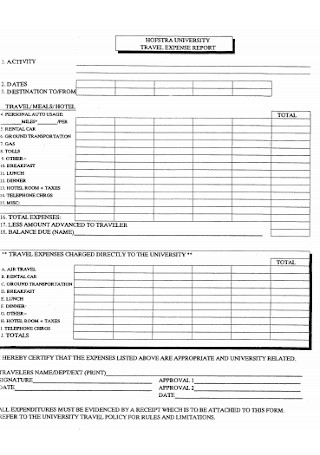

Sample University Travel Expense Report

download now -

Travel Expense Center Report

download now -

Travel Expense Management Report

download now -

Travel Spend Authorization & Expense Report

download now -

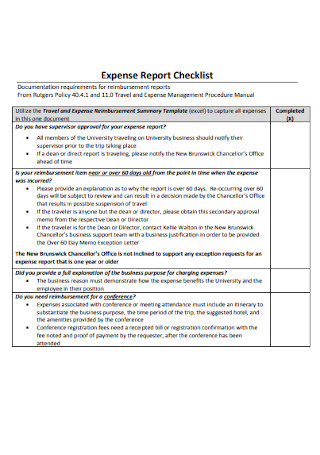

Travel Expense Report Checklist

download now -

Travel Expense Report Training

download now -

Travel Expense Reporting Policy

download now -

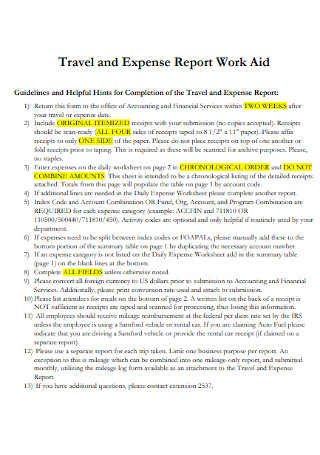

Travel and Expense Report Work Aid

download now -

Formal Travel Expense Report

download now -

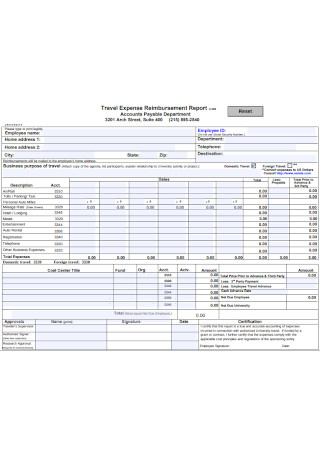

Travel Expense Reimbursement Report

download now -

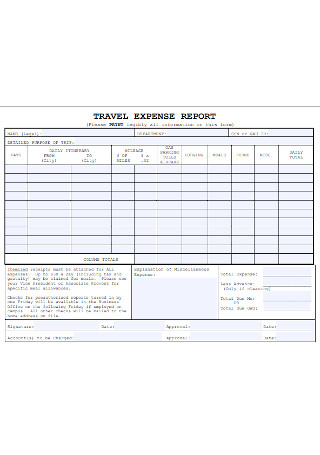

Travel Expense Report Form

download now -

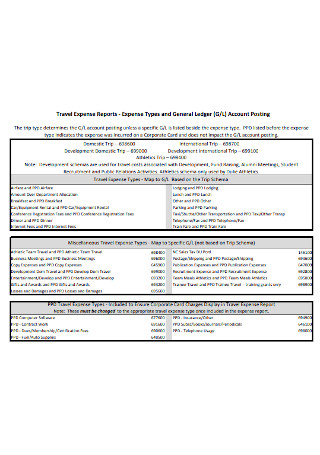

Travel Expense Report and Expense Types

download now -

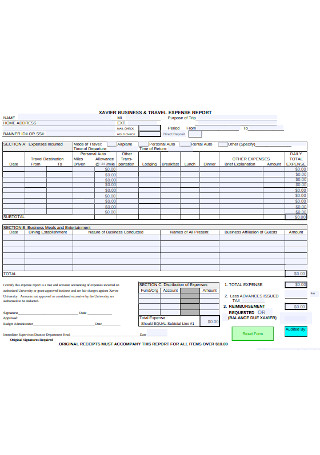

Business and Travel Request Expense Report

download now -

Travel Expense Report Format

download now -

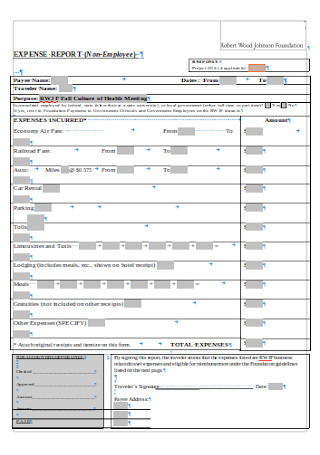

Non Employee Travel Expense Report

download now -

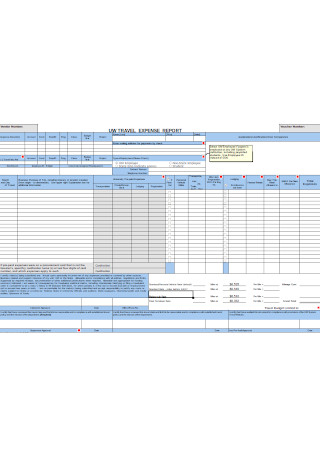

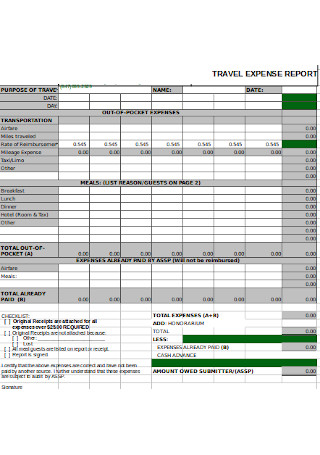

Excel Travel Expense Report

download now -

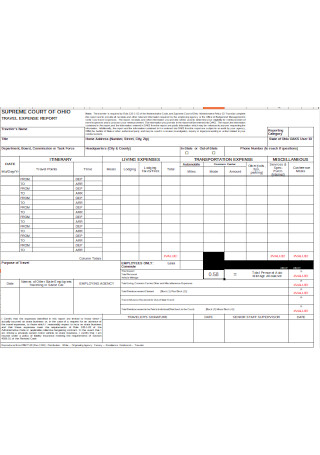

UW System Travel Expense Report

download now -

Simple Travel Expense Report

download now -

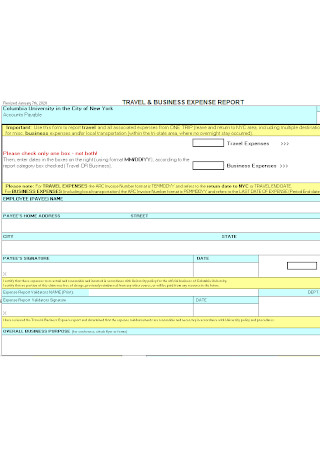

Travel and Business Expense Report

download now

What Is a Travel Expense Report?

Statista reports that the travel industry of the United States contributes more than 10 trillion USD not only to the US economy but also throughout the globe. Within the travel industry, business travels to play a considerable part in its growth as it contributes 1.23 trillion USD to the global economy. Another Statista report reveals that in 2018 alone, 463.6 million US business individuals traveled domestically for business trips. In addition to that, Statista was also able to forecast that by 2022, the number will increase up to 493.7 million. With all the travels that businesses spend within a year, it is only imperative that you make and submit a travel expense report for the company to maintain proper expense management continuously.

A travel expense report tracks your expenses throughout your business trip. These expenses should be relevant and necessary for you to execute the task required for you to accomplish. This type of business report usually comes in a printed sheet that should be filled out by the employee. In this sheet, the total incurred expenses get thoroughly documented and the contents should serve any accounting and tax purposes. If the employee fails to appropriately fill out an expense report, let alone submit one, it causes financial risks on the company’s end. And if the employee used their own money during the trip, getting a reimbursement will be tricky. The travel expenses that are not covered with refunds include personal expenses and unnecessary, extravagant ones. The only valid ones that guarantee reimbursement include plane tickets, transportation, accommodation, and meals.

If you are required to hand in a travel expense report as soon as you arrive from your business trip, chances are you will have limited time to come up with your own from scratch. Luckily for you, there are travel expense report examples and templates uploaded below that you can readily download and customize with ease.

Importance of a Travel Expense Report

During business trips, incurring expenses are inevitable and this also means that writing travel expense reports are equally inevitable as well. These expenses are part of your company’s operating expenses and are also an important factor in the company’s profit; hence, travel expense reports are not only important to the employer but as well as the accounting department of the company and the tax office. Below are some of the reasons why writing travel expense reports are important and this should convince you to take travel expense report writing seriously so you can stop procrastinating and start your report writing.

How to Make a Travel Expense Report

Creating travel expense reports is easy; however, if you lack the basic knowledge of creating one, you will find it tricky to make one. To help you complete your travel expense report, be sure to take note of the easy-to-follow steps below to be guided.

Step 1: Download a Suitable Ready-made Template

Whether you are short on time to come up with your travel expense report from scratch or if you simply don’t have an idea to make one, then consider downloading a ready-made template that will help you complete a travel expense report in no time. Whatever expense report template you download online, ensure that it is suitable for your needs and that it does not need significant customization. To do it, check if it already contains most of the sections you would need for in an expense report such as the expenses incurred, type of expenses, the amount spent, and so on.

Step 2: Enter Preferred Headers

As you fill out your travel expense report, see to it that you start filling the header section so you can quickly fill out the rest that follows. If the template you downloaded already comes with headers, check whether those are the headers you want for your expense sheet. If not, be sure to customize further the template you downloaded so it lives up to your intended purpose. The possible headers you should indicate on your travel expense report include employee or payee information, business purpose, travel information, and approval signatures.

Step 3: Fill Out Employee Information

Under this under, indicate your full name, address, email address, ID number, position, assigned department, and other information that can identify you as the employee of the company. See to it that you write the details of this section so the reimbursement will be given to the right individual. Ensure that your contact details are accurate and updated so that in the event when your employer or the HR department would like to get in touch with you, you are just a call or an email away.

Step 4: Cite Business Purpose

With the number of people sent for a business trip, the company would find it tricky to pinpoint your specific business purpose. That is why you need to indicate the details of your business trip. Such details include the location of your business trip, the purpose of the trip, dates of travel, and other additional information that are relevant to the company. For the dates of travel, indicate the specific arrival dates and return dates.

Step 5: Write Travel Details and Expenses

This is the section of your report where you list down not just the information related to your travel but also a rundown of the expenses incurred during the trip. The subheadings you may include for this part of your report include the expense date, expense type, amount spent, payment type used, and billing type. Expenses include the individual dates of travel, incidental fees, airfare, hotel and accommodation, actual meal costs, ground transportation, mileage, and other expenses. For other expenses, it is also essential to write down the date, its amount, and the explanation as to why you have bought or availed of it. Get the total of the overall expenses right after. Do not include your personal expenses. Be sure to write the exact costs beside each expense and attach relevant proof such as receipts so you can be reimbursed if you need it.

Step 6: Finalize and Print Out Your Travel Expense Report

Before you hand in your expense report to your employer for signing or to the Human Resources department, make sure that you have thoroughly review its contents. Check the accuracy and completeness of every single detail you include in your expense report. If you can already say that everything looks good, you can already print it out. Attach the receipts and invoices to the expense report before you submit the report to the employer or HR department.

Dos and Don’ts of a Travel Expense Report

You might initially think that going on a trip as part of your job as a fun experience. Sure, it can be both fun and fulfilling, but things can also get tricky and challenging—especially when you get back from your business trip—because you will be required to submit a travel expense report. Listed below are some dos and don’ts that can serve as your guidelines as you create your travel expense report.

Dos

1. Do keep complete and accurate documentation.

For your report to be considered complete and accurate, you need to provide equally provide complete and accurate documentation throughout your business trip. This will help you if you spend your own money on some expenses and that you would need reimbursements. If the service you’ve availed cannot provide a receipt, such as a taxi ride, see to it that you have a petty cash voucher or at least an ordinary notepad that can help you consistently keep track even of your minor transactions.

2. Do hand in your expense report as soon as possible.

Ideally, you hand in your expense report as soon as possible after your business travel. In doing so, the expenses you incurred are still fresh in your memory and that it will be possible for you to create a report that is as accurate as possible. Submitting a travel expense report as soon as possible is beneficial on your end especially if you were not able to continually monitor your expenses. Another benefit you can get from handing your expense report earl is that you can avoid misplacing any receipts. Even if you are most likely given a deadline, it will be best if you submit earlier than the set date.

3. Do familiarize yourself with your company’s travel policies.

It is your responsibility as the employee to familiarize yourself with your company’s travel policies. Doing so is imperative especially if your job description requires to go on business trips. Before you go on any business trip, ensure that you are already acquainted with your company’s travel policies so you would know what expenses are covered for reimbursement. You should be extra careful when the expenses you have incurred do not fall under what is being stated in the travel policy.

Don’ts

1. Don’t make unnecessary expenses.

You may be given an ample budget to spend during your business trip but this does not mean that you should not take advantage of the situation and make unnecessary expenses. Unnecessary expenses include upgrading your flight to first or business class when economy class is manageable, getting a movie rental in the hotel room, and buying expensive meals when simple ones will just cut it. When you take advantage of the situation, you only encourage yourself to commit one of the typical schemes of travel expense reporting namely multiple reimbursement scheme, fictitious expense scheme, overstated expense scheme, and mischaracterized expense scheme. Business owners find it challenging to deal with employee overspending as it is a cultural one that has been going on for ages. In fact, according to Inc., employees sent to business trip incur overspending expenses that takes up a fifth to a third of the total allocated business trip budget.

2. Don’t forget to schedule a pre-travel expense planning.

Do you have an upcoming business trip? Do not forget to schedule a pre-travel expense planning before the trip. If you determine and plan for the possible expenses beforehand, it will be easier for you to come up with a travel expense report later on. Upon planning, you can already create a system on how you keep and manage your receipts, you can update yourself of your company’s travel policies, and you can also determine a strategy on how you can avoid any unnecessary expenses.

3. Don’t forget to attach receipts.

No matter how well-organized your list of expenses is, it will not be recognized as valid by the company if you were not able to attach receipts that prove you’ve indeed made those expenditures. During the trip, be sure that you keep every single receipt no matter if it’s just the cab fare. Doing so ensures that nothing gets missed out when you start writing your travel expense report. That is why it is important to ask for a receipt for every single transaction you make. Each receipt should include relevant details such as the date, place, and the breakdown of charges, if any. Other documents that can support your expenses include canceled checks and bills. Failure to attach any proof of the expenditure also means failure to get a refund in a timely banner.

Creating an expense report for a business trip can be stressful especially if you have no idea how to make one and if you have no idea about what goes into your report. Luckily, you came across this article that does not only come with essential insights on travel expense report content but also with handpicked sample travel expense reports that you can use and follow through as a guide. Be sure to download and customize any of the expense report templates and examples provided here so you can create a report with the utmost ease.