25+ Sample Blank Invoice

-

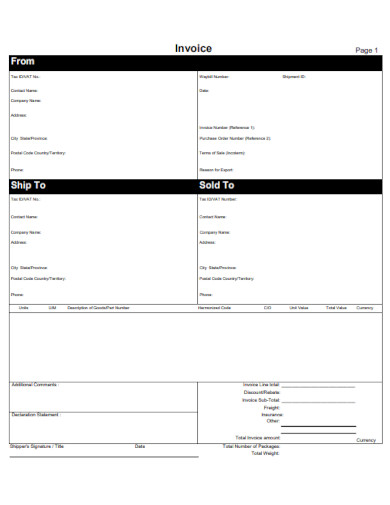

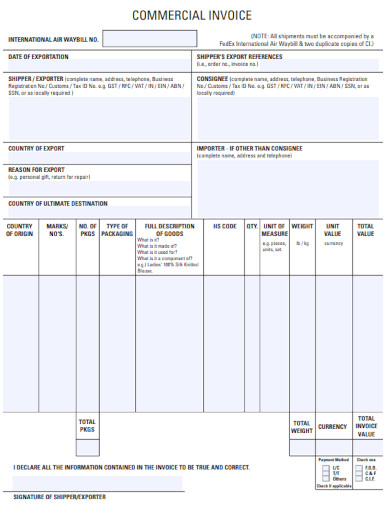

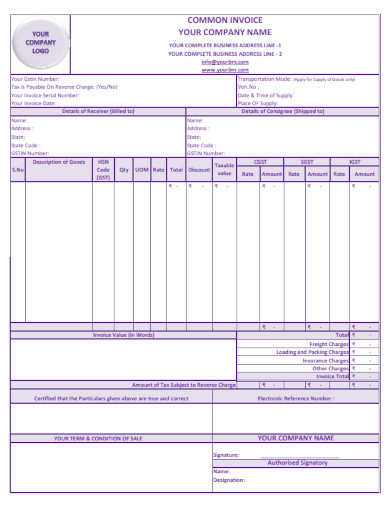

Blank Commercial Invoice

download now -

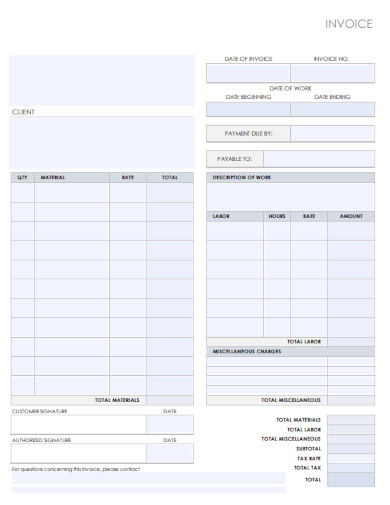

Blank Contractor Invoice

download now -

Blank Cash or Payment Invoice

download now -

Blank Advertising Agency Invoice

download now -

Blank Cleaning Service Invoice

download now -

Client Blank Invoice

download now -

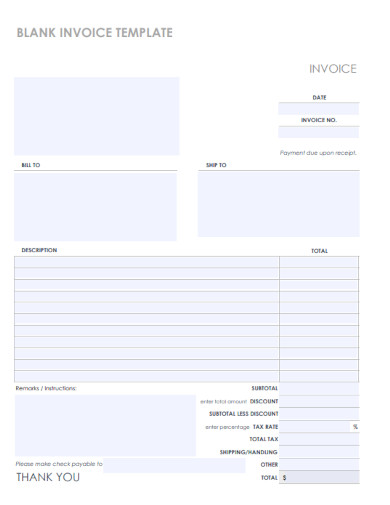

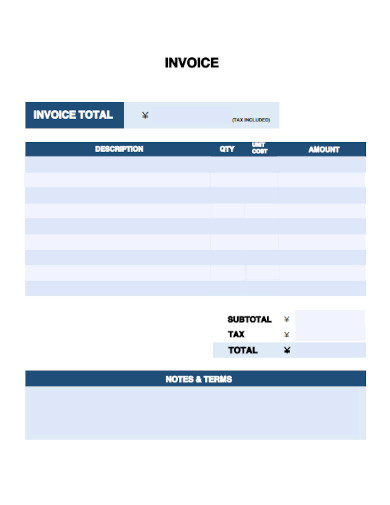

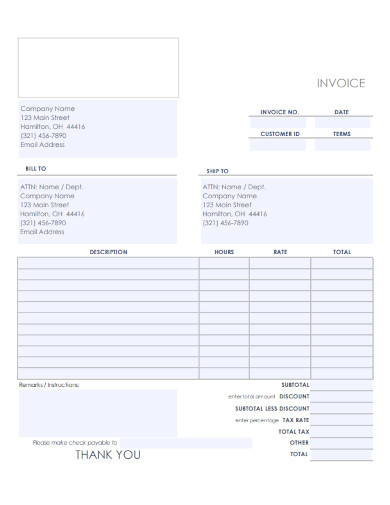

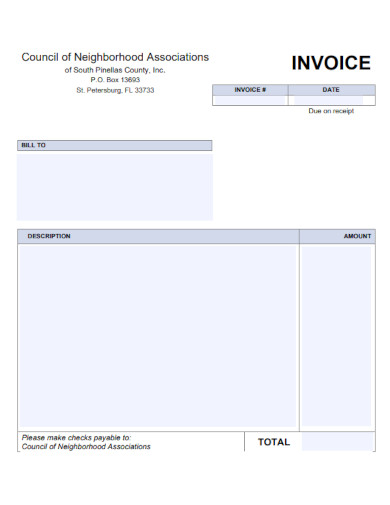

Sample Blank Invoice

download now -

Company Blank Invoice

download now -

Order Blank Invoice

download now -

Blank Invoice Receipt

download now -

Commercial Blank Invoice

download now -

Blank Invoice Form

download now -

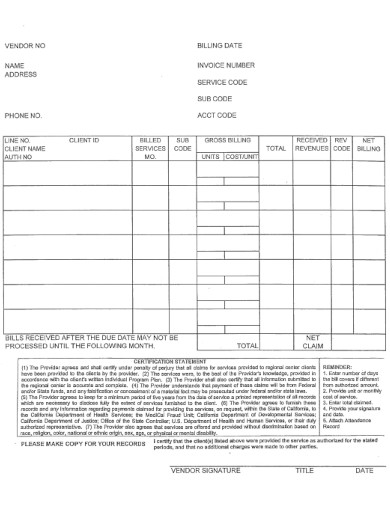

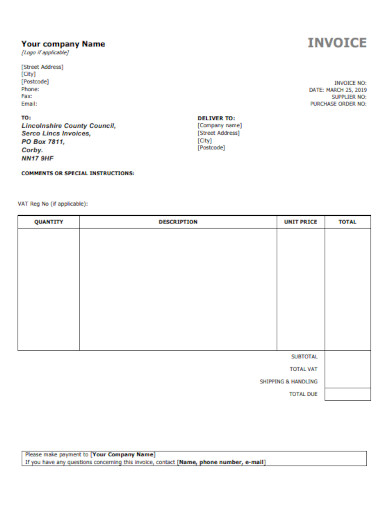

Vendor Blank Invoice

download now -

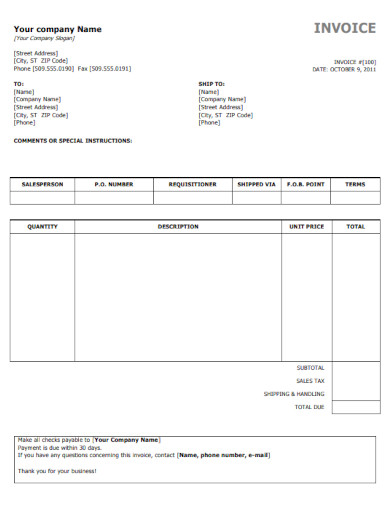

Basic Blank Invoice

download now -

Business Blank Invoice

download now -

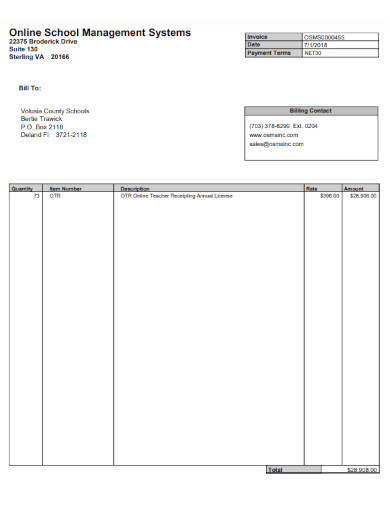

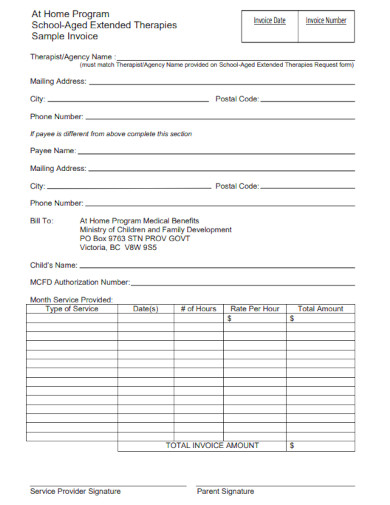

Blank Invoice for School

download now -

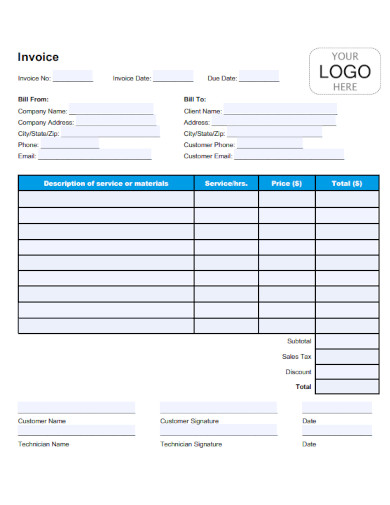

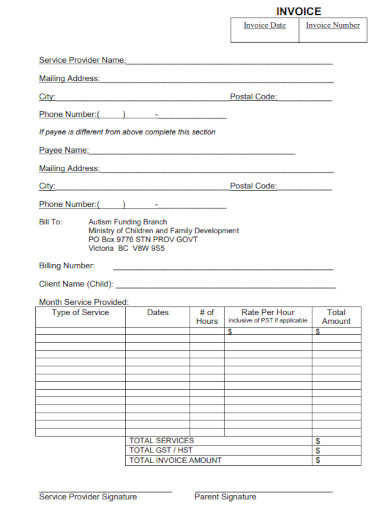

Service Provider Blank Invoice

download now -

Blank Invoice Format

download now -

Blank Fillable Invoice

download now -

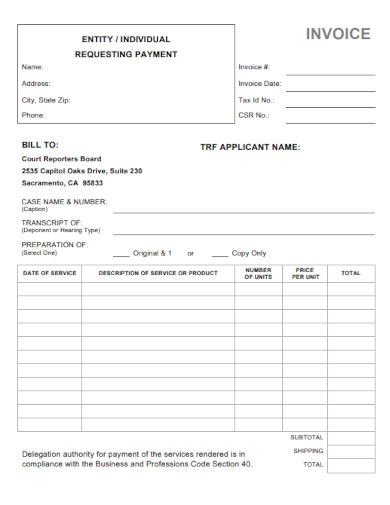

Requesting Payment Blank Invoice

download now -

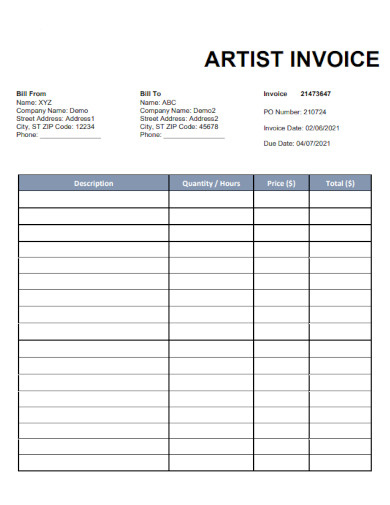

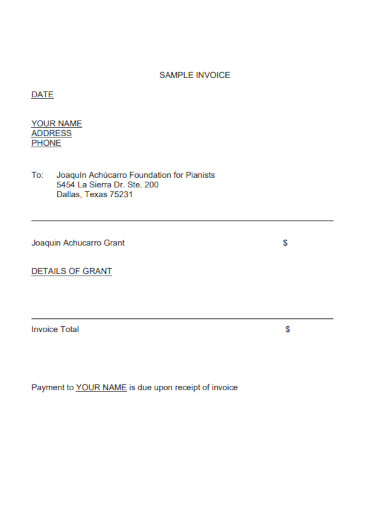

Artist Blank Invoice

download now -

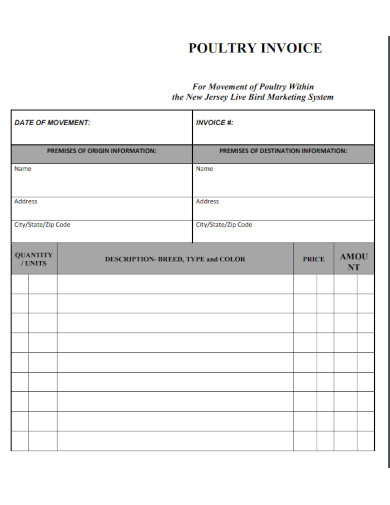

Poultry Blank Invoice

download now -

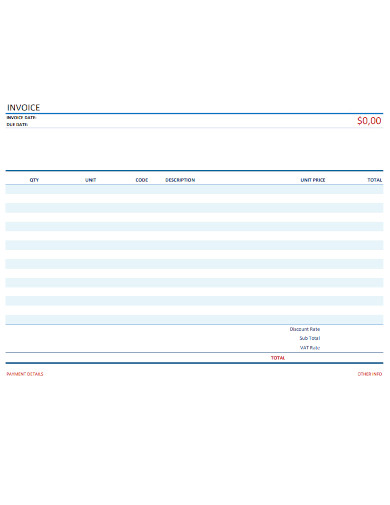

Modern Blank Invoice

download now -

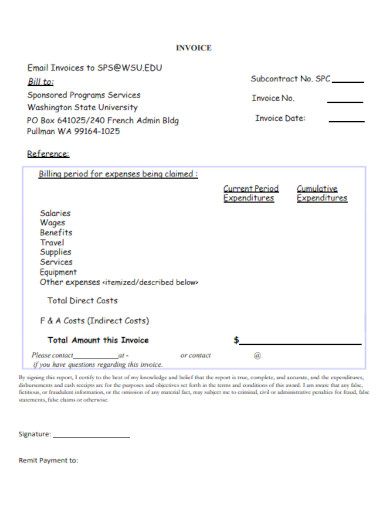

Blank Invoice Example

download now -

Professional Blank Invoice

download now -

Tax Blank Invoice

download now

What Is an Invoice?

An invoice is a document that enumerates and records a business transaction with a client. It functions as a request for payment and specifies the customer’s outstanding balance and payment invoice. An invoice is also a tax document; businesses must retain copies of each invoice to demonstrate the revenue earned and taxes collected. According to a report, 85% of B2B transactions involve invoicing procedures; invoices are commonly used by B2B SaaS and professional services companies with high average order values or that require custom contracts with customers. However, any business can use professional invoices to request payment from customers.

Benefits of Invoices

If you operate a small business, you understand that your responsibilities extend beyond mere supervision. Payroll administrator is one of the many hats you must do. This is where bills come in. You’ve read the beginner’s guide to invoicing and intend to begin sending business invoices to customers. However, is there a more direct method for accepting remote payments? Will you require a billing system? Is it simply additional paperwork? These are potential concerns you may have. Fortunately, we’re here to answer your questions. Here are some of its benefits if you’re intrigued.

Elements of an Online Invoicing System

Businesses frequently need to pay more attention to the complexity of billing. To reduce the cost of large invoices, you may accept alternative payment methods, such as bank transfers. Collecting these bank payments can be tedious and error-prone without the proper instruments. If you begin sending invoices internationally, you must navigate the various regulations governing billing in each region where your customers are located. Finding the correct software or system for online invoicing can relieve you of these manual, repetitive tasks list and streamline your operations, saving you time and resources. Digitally storing all your invoices and payments in one location makes a single source of truth for your accounting, finance, and legal departments. As your business expands and you manage a more extensive customer base, these benefits will continue to accrue. While most online invoicing solutions allow you to customize invoices, accept credit card payments, and generate basic reports, the best solutions offer advanced features to help you get paid quicker, improve your customers’ payment experience, and integrate with your workflows. Here are four characteristics to search for in an online billing system:

1. Ease of Use

Find a solution that facilitates the creation of new invoices and the modification of existing ones. You should be able to modify the appearance of your invoice to reflect your company’s branding by adding your logo and colors. Additionally, you should be able to alter the invoice number, product details, payment schedules, customer information, tax rates, and line items and add discounts, promotions, legal footers, and notes. Ideally, you can save these details so that you do not have to start from the beginning with each invoice. You desire multiple means to share branded invoices with customers based on their preferences and internal procedures. For instance, you can text some consumers a link to an invoice and email a PDF version to others. The best online invoicing systems allow you to automate this process, sending emails to customers when an invoice is available and sending payment reminders based on due dates.

2. Support for Multiple Payment Methods and Reconciliation Instruments

Customers anticipate a relevant and familiar payment experience; the simpler you make the invoicing procedure, the faster you will receive payment. Utilize an online invoicing system that supports multiple payment methods to receive payments more quickly. For instance, when invoices are paid monthly, you may only see a dollar quantity in your bank statements if you know which invoice corresponds to which payment. The finest online invoicing system will automatically match outgoing invoices with incoming payments, eliminating the need for your accounting and finance departments to check each invoice manually.

3. Streamlined Assortments

Your cash flow statements and overall business health may improve if you effectively manage unpaid invoices. Look for an online invoicing system that automatically transmits payment reminders when invoices are due or past due, rather than manually monitoring which customers have or have not paid their invoices and sending one-time reminder emails. You also require the ability to generate detailed reports and reports on the age of your accounts receivable so that you can monitor unpaid invoices and prioritize your collections efforts. In addition to managing past-due invoices, you should seek a solution to manage unsuccessful payments. For instance, a customer’s payment attempt may fail due to expired cards, insufficient funds, or out-of-date card information.

4. Reports and Reconciliation

The finest online invoicing solutions automatically generate comprehensive reports and dashboards to simplify billing processes. You want to be able to view all invoices sent and their status at a glance, as well as filter invoices by outstanding, past due, and paid. Invoices should be able to be automatically voided, duplicated, refunded, or marked as delivered, with the option to alter each status if desired manually. It should also enable you to keep invoices as paid if the transaction occurs outside your invoicing system, such as when a customer pays by check or currency.

How to Make an Invoice

If you need help to create a professional-looking invoice, this guide is for you. We will provide detailed instructions below to assist you in optimizing your invoicing and receiving payment as quickly and accurately as feasible. Learning to design custom invoices is a fantastic way to maintain brand consistency when billing clients. To create a sample invoice from inception, you must follow these steps to ensure that you include all the essential information your client will require:

1. Create an Invoice Header

Your business information should appear at the head of your invoice. Include the name of your business, address of your business, phone number, and email address. If your company has a logo, it should be included in the masthead. Having your business name prominently displayed is the most effective method for clients to recognize you and your company. Contact information should immediately follow, as this is the crucial step that allows the customer to reach you readily.

2. Include Your Client’s Contact Details

Next, include all your client’s contact details. Ensure that the correct individual is listed as the recipient of your invoice. Confirming the best point of contact before submitting your first invoice to a new client is advisable. Include the company’s address, the customer’s name, phone number, and your contact’s email address.

3. Provide Billing Details

Each invoice you submit should include a unique number so you can easily track your various invoices. Choose an effective invoice numbering system and use it consistently to avoid confusion. The simplest method for numbering invoices is to commence with Invoice 1 and count from there. You should also include the invoice’s date of issuance. Having a date on the invoice simplifies any future references and aids in keeping track of everything during tax season.

4. Specify Your Terms of Payment

Your invoice must indicate when and how clients are expected to pay. Include an invoice due date. It is typical for freelancers to use a 30-day billing cycle, so if you send an invoice on April 1st, payment is due on May 1st. If you charge late fees, specify the terms of those fees on your invoice. It’s a good idea to discuss your payment terms with a client before they sign on so they are satisfied with all the details when you submit your first invoice.

5. Add Notes

Although not required, you may include a note after your invoice that expresses gratitude to the client. Not only is it beneficial for your brand, but a simple thank you can also help you get paid more quickly.

FAQs

Can I create an invoice myself?

You can bill for services rendered if you own multiple businesses or partner in numerous companies. For instance, if your construction company outsources work to your house painting company, you will need an invoice to document the dealing and keep track of payments.

Can an invoice be handwritten?

Yes, invoices can be written by hand, but it is only sometimes recommended. The risks and benefits of handwritten invoices are discussed below. Invoices are merely itemized lists of provided products or services and payment terms for the client.

Do invoices require a signature?

A bill is merely a record of a transaction and not a contract. Due to this, it is optional for an invoice to be signed for it to be genuine. However, requesting the customer’s signature on an invoice is standard practice.

You can purchase cloud-based invoicing software to generate a professional invoice. Invoicing software provides more options and assistance for creating and monitoring invoices. A tool that produces invoices will keep your information accurate and save you the trouble of making one manually.