18+ Sample Consultant Invoices

-

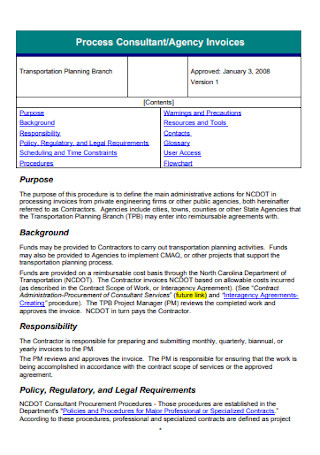

Consultant and Agency Invoices

download now -

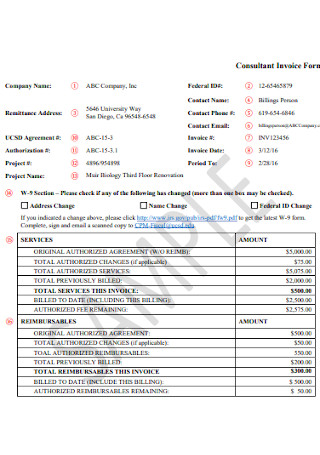

Consultant Invoice Form

download now -

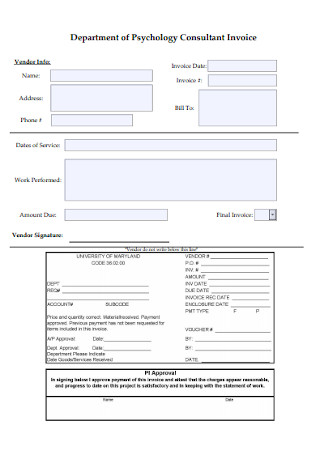

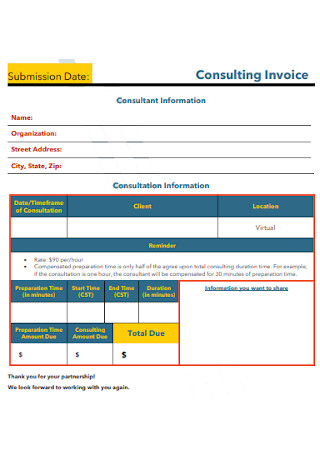

Department of Psychology Consultant Invoice

download now -

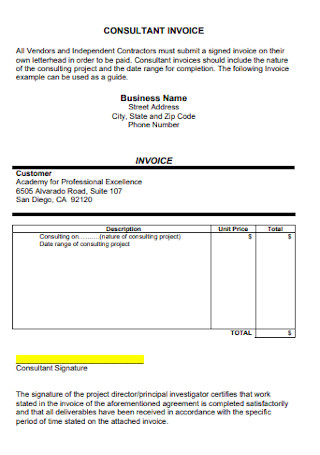

General Information Consultant Invoice

download now -

Consultant Invoice Narrative

download now -

Formal Consultant Invoice

download now -

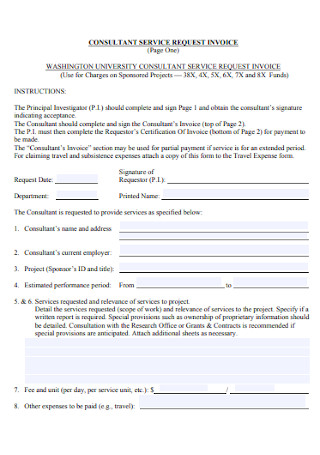

Consultant Service Request Invoice

download now -

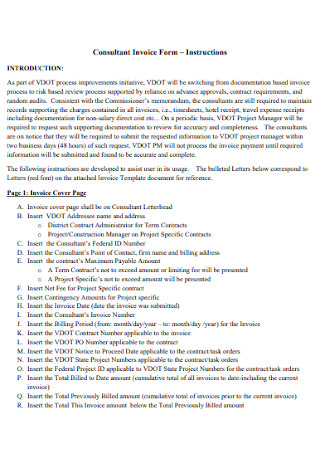

Consultant Invoice Form Template

download now -

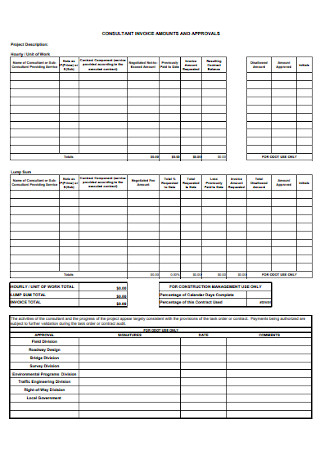

Consultant Invoice Approval Form

download now -

Basic Consltant Invoice

download now -

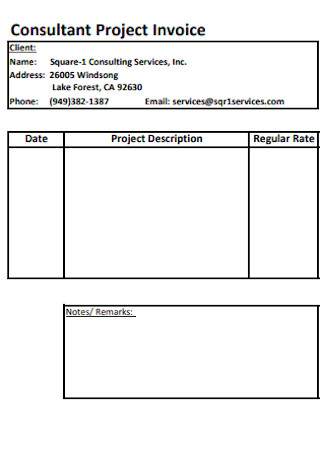

Consultant Project Invoice

download now -

Consultant Invoice Format

download now -

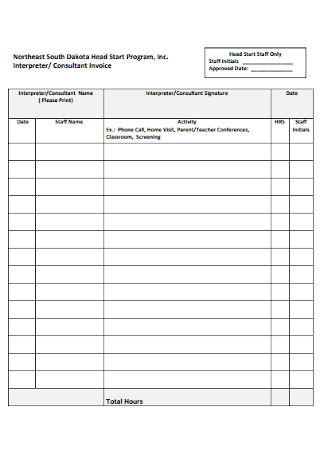

Interpreter and Consultant Invoice

download now -

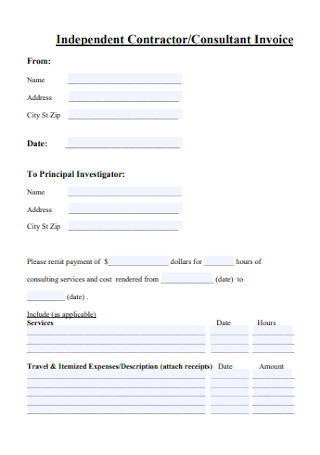

Independent Contractor and Consultant Invoice

download now -

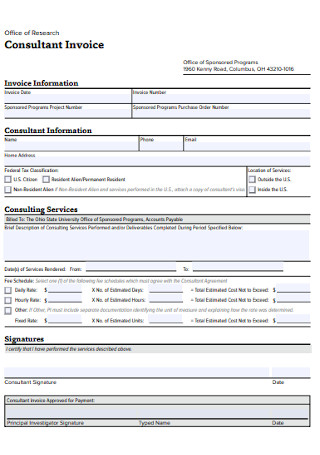

Office of Research Consultant Invoice

download now -

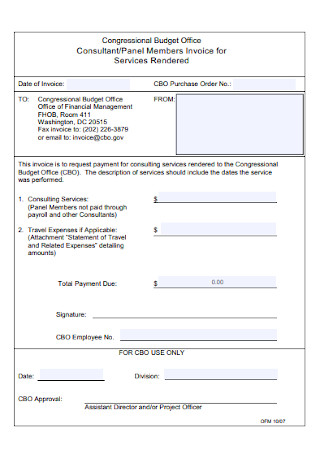

Consultant and Panel Members Invoice

download now -

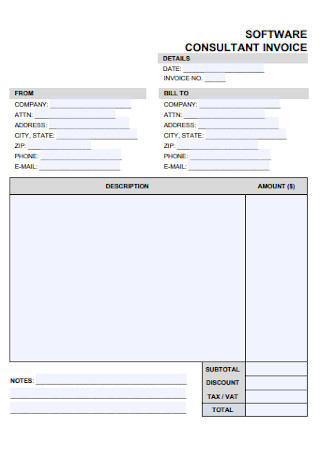

Software Consultant Invoice

download now -

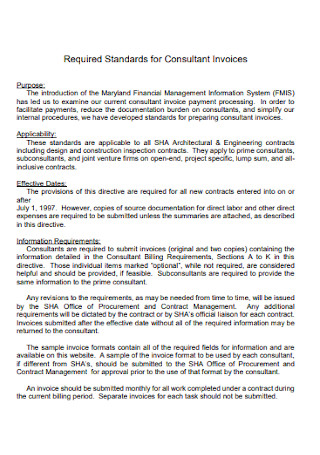

Required Standards for Consultant Invoices

download now

FREE Consultant Invoice s to Download

18+ Sample Consultant Invoices

What Is a Consultant Invoice?

What Is a Retainer Fee?

How to Charge Consulting Fees?

Elements of a Consultant Invoice

How to Write Consultant Invoice

FAQs

Who Is Responsible for Invoicing a Consulting Firm?

Why Do You Need a Professional Services Invoice Template?

How to Bill a Consultant for Free Consultation?

Providing professional advice on a variety of topics to clients of a business or organization is the primary responsibility of a consultant. Following the provision of such services, the organization is responsible for compensating the consultant. Accordingly, the consultant must deliver an invoice to their clients in order for the company to pay them for the services they have provided to them as quickly and completely as possible. A consultant invoice is a document presented by the consultant to the customer that details the amount of the bill that is due for the consulting services that were provided. It also provides a description of the consultancy, the number of visits and sessions, and the date by which payment is to be made in full.

What Is a Consultant Invoice?

It is used to request payment for consulting services, to record personal information about the customer and the consultant, and to spell out payment terms to the client in a clear and concise manner. The template is available for download in the following formats: PDF, Word, RTF, and Excel, and it may be completely adjusted to meet the specific demands of the consultant. The invoice enables the consultant to charge for both their hourly services and any other expenditures that may have arisen during the course of the project.

The provision of an itemized statement of services in the form of invoices by professional consultants is required in order to ensure that payments are made on time and in full. It is possible for IT consultants to make extensive use of these templates because they include separate columns for hourly rates and other fees, such as equipment or parts for setups. Clients will get this once the service has been rendered or at a later date from the consultant, whichever occurs first. Other templates are available on our website, and you can use them whenever you need them. They are as follows: legal consulting invoice, free consulting invoice, general consulting invoice, billing invoice, educational consultant invoice, advertising consultant invoice, general ledger, modern consultant invoice, security consultant membership invoice, standard consult invoice, service request invoice, professional design consultant invoice, and other similar template are available. This post will not only provide you with templates but will also provide you with important information that you need to know in order to complete your template.

What Is a Retainer Fee?

A retainer fee is a cost that an individual incurs up in advance in order to pay for the services of a consultant. This is frequently used for freelancers proposals or lawyers (third parties) who are frequently consulted by a single individual or company. An additional benefit of a retainer fee is that it allows a client to demonstrate their commitment to obtaining the service being supplied by demonstrating how serious they are about receiving it. The term “unearned” retainer fee refers to when work has not yet begun but an individual has provided money upfront, as opposed to “earned” retainer fees, which refer to when a portion of the money is retained by the consultant after all work has been done.

How to Charge Consulting Fees?

A consultation invoice template is a fill-in-the-blank form that can be readily customized to meet a variety of requirements. One thing that will never change is the name, logo, address, and contact information of your firm. The structure of the other fields is entirely up to you; for example, you may want distinct layouts for different services rather than a long list of each invoice. A template allows you to customize the appearance of each document exactly the way you want it to be.

1. Investigate the rates of your competitors.

It is possible that the charge for delivering Consulting Fees will fluctuate, and a consultant should offer a reasonable rate. In the face of stiff competition from national consulting firms, consultants have the chance to convince clients that they can deliver a more personal approach or faster response time, which can alleviate concerns about why the consultant is charging a lower fee than the national businesses. However, a national firm may possess greater expertise and experience, and as a result, a contractor should be prepared to address any discrepancies or base rates that significantly exceed or are significantly less than those of national firms or other local competitors, as appropriate and necessary.

2. Select a fee structure.

A model should be evaluated in relation to the consulting services that are given. Alternatively, if a contractor believes that their services will take only a few hours on a constant basis, an hourly charge may be appropriate for them. However, if the service they provide is likely to take several weeks or months to complete, a per-project price may be a better option.

3. Make use of Consulting Invoice to keep track of all of your labor.

A consultant will want to keep track of all of the work that is accomplished and all of the payments that are paid. This will be crucial if the project will take anywhere from a few weeks to several months to complete and the consultant wishes to be compensated throughout the project to ensure that revenue continues to flow into the company.

4. Send the Consulting Invoice to the client for payment.

In order to eliminate any potential complications, the client should be billed as soon as the service is delivered or the project is completed. The final invoice should include any payments that have been made up to that point to verify that the final invoice is accurate. In order to avoid payment delays, it is necessary to reiterate the time period for payment.

Elements of a Consultant Invoice

Due to the fact that it is necessary to generate a consultant invoice for clients after providing them with the services they have requested, it is imperative that a company understands what information should be included in an invoice. Listed below are the items that need to be included in the invoice:

How to Write Consultant Invoice

Whenever we find ourselves in a difficult position regarding the law, we must seek the advice of a qualified legal specialist. This form will be extremely beneficial to legal experts in order to ensure that they receive fair remuneration for the expertise and services that they have offered to the customer. This will be useful in creating a straightforward structure with well-written suggestions for the content, which will allow one to list down the services that have been delivered as well as the costs associated with them.

1. Begin with your contact information.

The top of your consulting invoice should include all of your pertinent contact information, such as your mailing address, phone number, and email address. If you have a company logo, you should also include it on your website. Also, if you have a unique tax identification number, such as the GST in India, make sure to provide that information.

2. An invoice Number is an alphanumeric code that identifies a certain invoice.

After that, you’ll want to include an invoice number, the date the invoice was created, and the date on which payments are due. Following that is the address of the customer. If the client is a business entity, you should address them as a business entity. If your client is an individual, you should make the invoice payable to that specific person.

3. Name of the project, as well as your role

After that, you’ll learn about the project’s name and your role within it. The idea here is to be succinct while still getting all of the pertinent information out there. Explain what type of consultancy services you provided, whether you were a financial advisor or a compliance consultant, in your cover letter.

4. Disseminate Your Services in Detail

Then there’s a thorough itemization of all of the consulting services you supplied in a logical order, as well as their associated prices. Make your points as succinctly as possible. After all, the ultimate goal here is to be compensated for all of your efforts. You have the option of charging an hourly cost or a per-item rate.

5. Financial Information

After that, you’ll want to provide a list of the things that are subject to taxation, followed by the applicable tax rates. If there are any discounts available, make sure to list them as well. Including payment terms such as a form of payment and penalties for non-payment of dues is regarded as sound business judgment.

This invoice template provides a clear notion of the elements that should be included in an invoice so that the consultant may create a tangible structured format for the service that has been performed while also complying with all legal requirements. This template will greatly simplify the invoicing process because it is user-friendly, informative, and legally compliant at the same time.

FAQs

Who Is Responsible for Invoicing a Consulting Firm?

The majority of the time, consulting businesses are founded by a single individual. As a result, during the initial stages, these employees assume all responsibilities, including invoicing for the services rendered.

Why Do You Need a Professional Services Invoice Template?

It is simple and straightforward for the service provider to invoice their clients when they use a template like this. The invoice template makes it possible to create invoices on the fly while on the go. Simply put, a professional services invoice template is a tool that enables suppliers of professional services to invoicing their clients in a more efficient manner.

How to Bill a Consultant for Free Consultation?

Consider including a line item for any free initial consultations you provided, as many consultants do, to provide complete transparency. Rate of billing: It is possible that you will wish to bill by the hour, by the item, or even by a flat price depending on the consulting service you provide – look for a tool that allows you to bill in the manner that is most appropriate for your business.

An organization or corporation that provides expert assistance to clients or consumers on a variety of difficulties is referred to as a consultant. Customers who use such services must pay in full, and it is preferable if a company provides its clients with a consultant invoice in order to expedite the payment process. In the event that a company does not have a consultant invoice template, they may still generate a professional invoice by incorporating the features listed above in the invoice.