13+ Sample Delivery Invoice

-

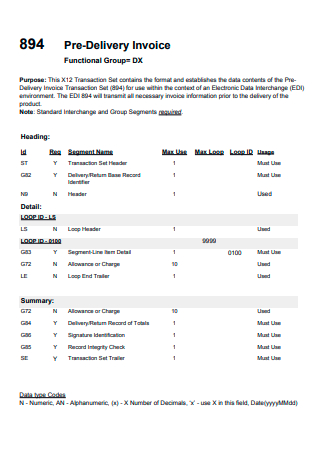

Pre-Delivery Invoice

download now -

Delivery Consent Agreement Electronic Invoice

download now -

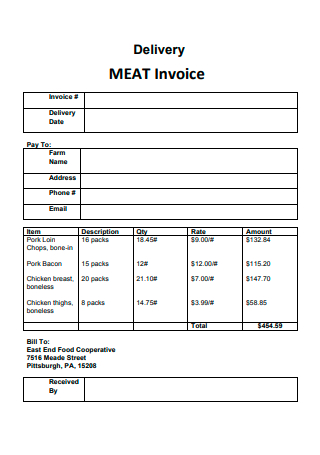

Delivery Meat Invoice

download now -

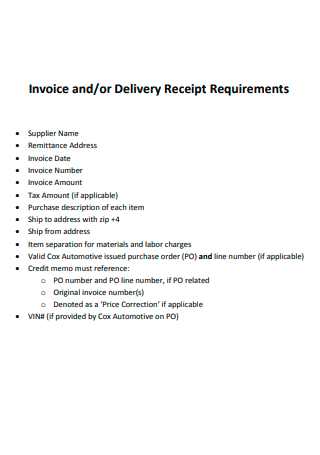

Delivery Receipt Requirements Invoice

download now -

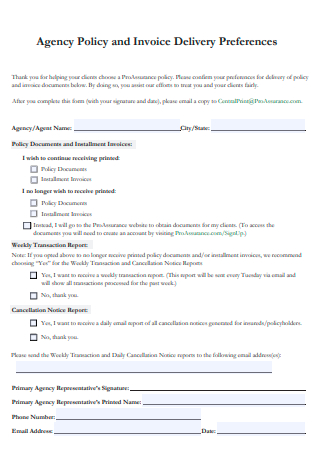

Delivery Preferences Agency Policy and Invoice

download now -

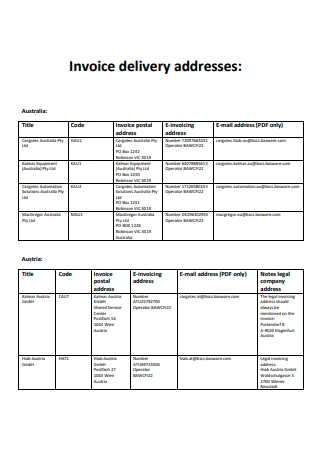

Delivery Address Invoice

download now -

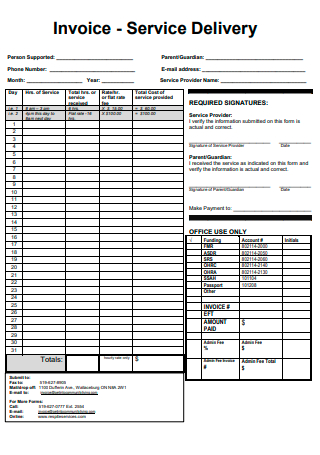

Delivery Services Invoice

download now -

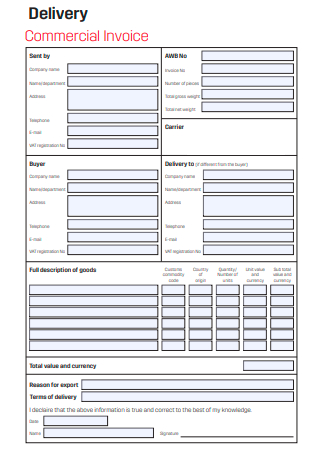

Delivery Commercial Invoice

download now -

Delivery Process Invoice

download now -

Mail and Delivery E-Invoice

download now -

Delivery Note Invoice

download now -

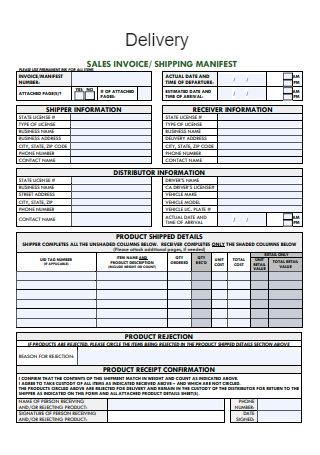

Delivery Sales Invoice

download now -

Delivery Customer Invoice

download now -

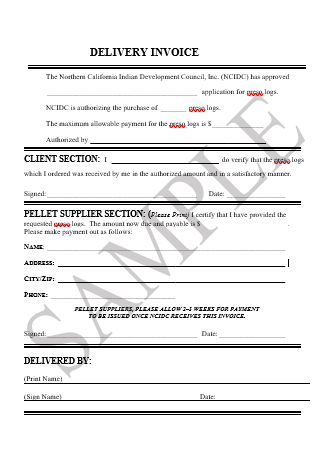

Sample Delivery Invoice

download now

What Is a Delivery Invoice?

A delivery invoice is a document provided by a seller or the sender of a package or parcel to the recipient. The record will typically include the sender’s contact information, an itemized list of contents, and pricing. According to statistics, the company’s On-Time Delivery (“OTD”) ratio is merely 76 percent. Upon reflection, you understand that efficiency can be increased by focusing exclusively on this metric when managing operations.

Benefits of Using an Electronic Invoice

A digital invoice is frequently confused with an electronic invoice or e-invoice. Both can be processed electronically from creation to payment, but there is a significant difference between the two. An electronic invoice is generated in the seller’s invoicing system, online bank, or via a web-based form. The electronic invoice file can then be downloaded or directly sent to the buyer’s software. If you’re interested, here are a few of its advantages.

Types of Invoice

This section discusses the various forms of invoices that are used in the majority of commercial transactions. These are a few of the numerous invoices that you may encounter in the business world. Nonetheless, it is beneficial to understand what you are up against. Additionally, the invoice types will differ according to where you live in this magnificent world. While one could argue that an invoice is an invoice, each invoice discussed in this article differs slightly. The explanations below are beneficial regardless of whether you use invoicing software or must make your invoices.

Standard and Credit Invoice

A business issues and submits a regular invoice to a client. This is the most popular type of invoice created by small firms, and the style is varied enough to support a wide variety of industries and billing cycles. Meanwhile, a firm sends a credit invoice to provide a discount or a refund to a customer or repair an invoicing error from the previous period. A credit invoice will never have a negative total.

Debit Invoice

A debit invoice, alternatively referred to as a debit memo, is sent by a firm that wants to increase the amount owed by a client. Debit invoices can be advantageous for small firms and freelancers that want a minor modification to an existing invoice. For instance, if you invoiced a client based on your projected hours and ended up working extra hours on a project, you could send the client a debit invoice for the extra hours billed. Positive numbers are always used on debit invoices.

Mixed and Commercial Invoice

Mixed invoices combine credit and debit charges into a single statement, and the total amount might be expressed as a definite or negative number. Although small businesses rarely need to issue mixed invoices for their services, it may be necessary if you’re reducing a client’s debt for one of the projects you’re invoicing and raising the debt for another project invoiced on the same invoice. At the same time, a commercial invoice is provided by a business for items sold to overseas clients. Commercial invoices contain information about the sale that is required to calculate customs charges on cross-border deals.

Expense Report

An expense report is a form of an invoice that an employee submits to their employer to be reimbursed for business-related expenses. For example, if you send an employee to a lunch meeting with a client, the employee can submit an expense report and invoice your firm for the cost of the food, parking, and gas that they pre-paid. According to research, it exerts an average of 20 minutes to complete one expense report. On average, it costs $58 to submit one expense report. In general, 19% of expense reports contain inaccuracies. On average, it takes 18 minutes to correct an expense report.

Interim Invoice

Interim invoices are used to bill for significant projects where the firm and the client have agreed on arrangements requiring repeated payments. When certain milestones of a larger project are fulfilled, a corporation or freelancer will issue interim bills. Interim invoices assist small businesses in managing their cash flow while working on lengthy projects.

Recurring Invoice

Recurring invoices are advantageous for firms that bill clients the same amount for their services on a recurrent basis. Regular bills are popular in the IT industry when clients pay the same monthly fee for a package of IT services. Alternatively, you might offer your clients monthly social media marketing packages if you’re a freelance digital marketer. Cloud-based invoicing software automates making recurring invoices and can even schedule bills to be sent out on the same day, so you don’t have to.

Miscellaneous Invoice

When a buyer owes money for services such as shipment or setup, miscellaneous invoices are used. Often, these functions are performed without the need for any goods or components. These invoices are used for fast financial transactions or to make minor revisions to an invoice already sent. Frequently, miscellaneous invoices lack an invoice number that differentiates them from other invoices.

Expense Claims

Is it possible that the corporation neglected to pay for previously committed expenses? Are they withholding payment? It’s time to submit an expense report! Expense claims are frequently employed by business employees when they make purchases on the company’s behalf. These expense claim forms may be used by businesses that reimburse employees for travel, meals, and lodging.

Past Due Invoice

A firm will send a past due invoice if its client does not pay by the due date specified on the final invoice. You should send past unpaid invoices to clients immediately upon their failure to meet a payment deadline. Past due bills contain all of the service and payment information specified on the final invoice, as well as any overdue fees or interest charges.

How To Create a Delivery Invoice

Invoices serve as proof of services or products completed or delivered by a firm. In this section, we’ll discuss some helpful hints for writing a delivery invoice:

Step 1: Provide essential information about your business.

The full and legal business name is a critical component of an official business invoice template. This demonstrates the nature of your business and defines your brand identity. If you have a corporate logo, include it in your invoice template to lend your business an air of professionalism. You may develop your distinctive business logo using several graphic design or logo maker tools or hire a logo design specialist. Then, include your business’s contact information, which will advise your clients on contacting you with any queries or issues about the invoice. Additionally, it assists them in reaching you for future jobs.

Step 2: Define the terms of payment and the due date.

Small firms often employ three different payment agreements. These invoice payment periods are often determined by industry standards, your connection with the client, and your cash flow requirements. On the other hand, including a due date on the invoice is a courteous and professional method to ensure that your client understands the precise date they must pay. Set up payment reminders to keep your clients on track.

Step 3: Include the contact details for the client.

Don’t forget to provide your client’s complete contact information and personal details. For instance, give the company’s or recipient’s name, phone number, address, country, and postal code.

Step 4: Include information about the product.

Complete the details of the commodities, products, or materials. Indicate the description, the quantity, the rate, the amount, and the subtotal. You also recommend giving further descriptions of your products to ensure that your client is informed about the delivery state.

FAQs

Is an invoice synonymous with a receipt?

According to a reference, an invoice is a payment request, whereas a payment receipt is proof of payment. It is a document that verifies that a consumer received the goods or services for which they paid a business or that the company received adequate compensation for the items or services delivered to a customer.

What is the purpose of preparing an invoice?

Businesses must generate invoices to be paid by their clients. Invoices act as legally binding contracts between a firm and its customers, detailing the services given and payment due. Additionally, invoices assist firms in tracking sales and managing their finances.

Who is authorized to issue tax invoices?

A registered vendor provides a tax invoice to another registered seller to obtain the input tax credit. It is simply a summary invoice that can record GST/HST monthly, quarterly, or annual. When your consumer is GST registered, you must produce a tax invoice. Date of the invoice’s issuance.

Producing a basic yet structured delivery invoice for your business or organization is a critical component of capturing your business’s transactions and activities. Essentially, it is a formal document given by a firm to request payment in full for a specific product or item being delivered. Additionally, it keeps track of a business’s sales and inventories. Without it, managing your firm will be complex. As such, we’ve included some downloadable and printable samples of delivery invoices below in a variety of different formats to assist you. To begin downloading the templates in this article, click on them!