21+ Sample Payment Invoice

-

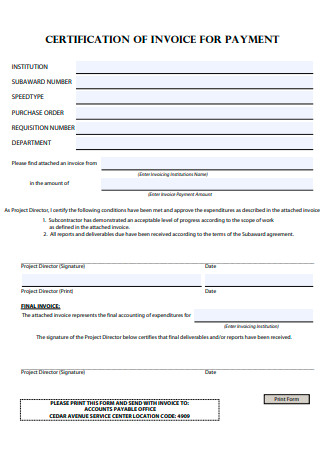

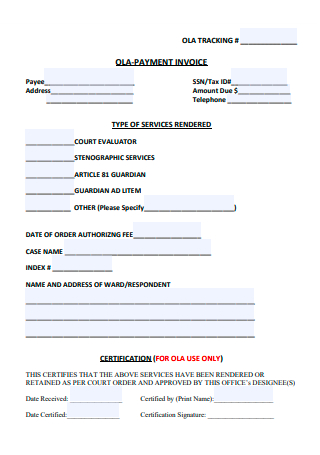

Payment Invoice Certification

download now -

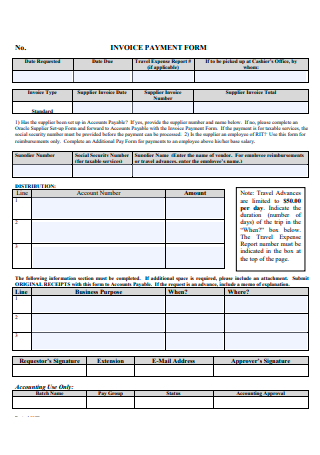

Payment Invoice Form

download now -

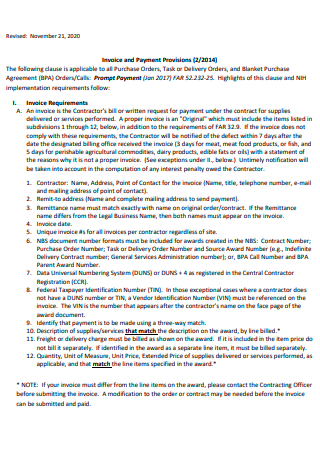

Payment Provisions Invoice

download now -

Payment of Invoices Policy

download now -

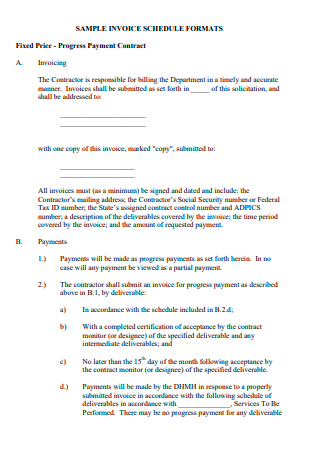

Progress Payment Contract Invoice

download now -

Payment Invoice Requirements

download now -

Invoice Payment Reconciliation

download now -

Basic Payment Invoice

download now -

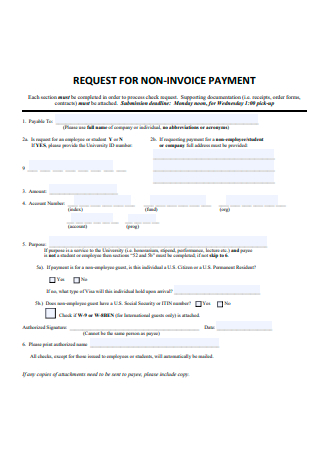

Payment Request For Non-Invoice

download now -

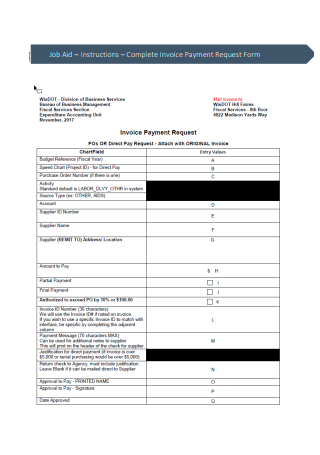

Payment Invoice Request Form

download now -

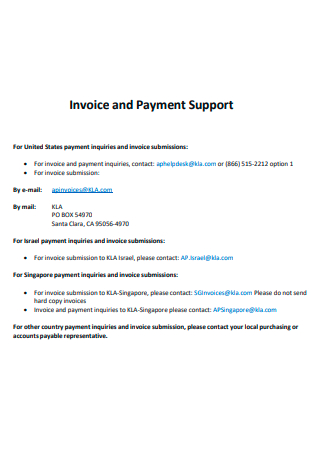

Payment Support Invoice

download now -

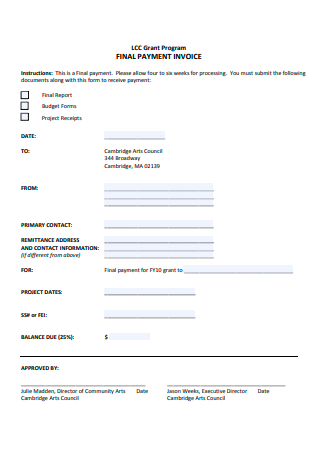

Final Payment Invoice

download now -

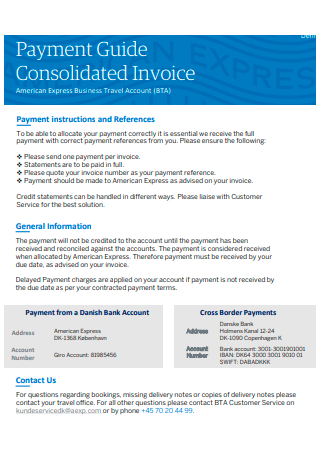

Payment Consolidated Invoice

download now -

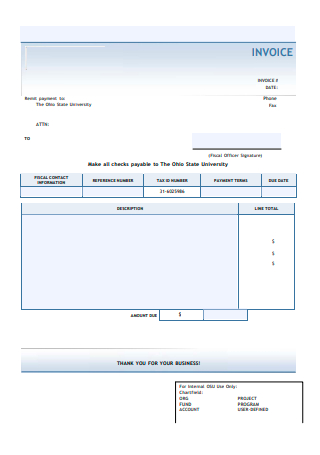

Payment Supplier Invoice

download now -

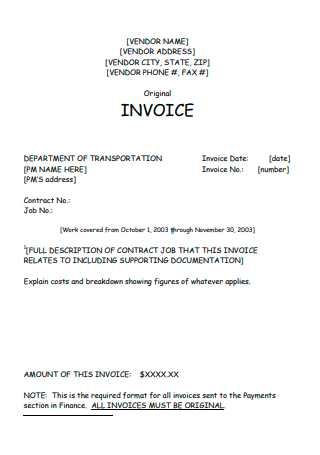

Formal Payment Invoice

download now -

Standard Payment Invoice

download now -

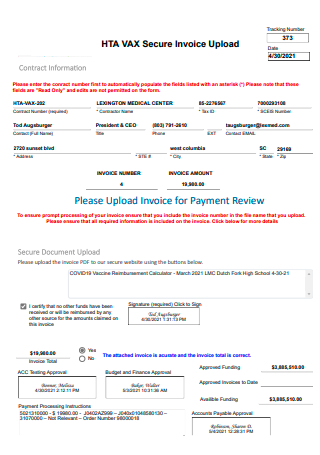

Payment Review Secure Invoice

download now -

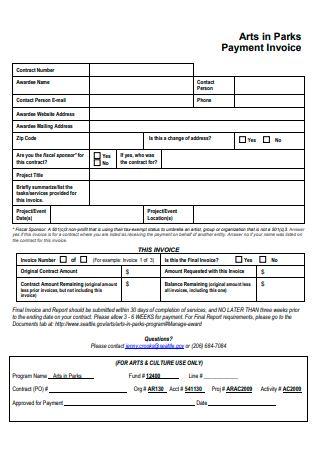

Printable Payment Invoice

download now -

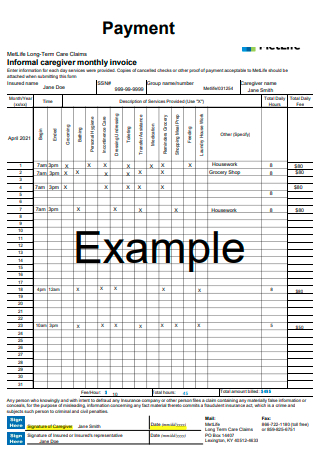

Payment Monthly Invoice Example

download now -

Payment Status Information Invoice

download now -

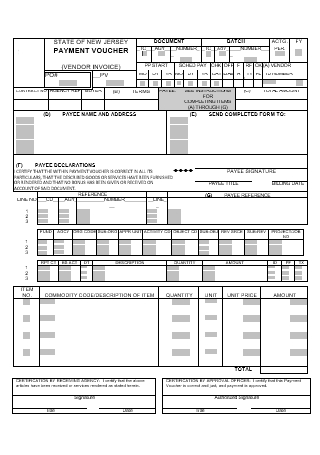

Payment Voucher Vendor Invoice

download now -

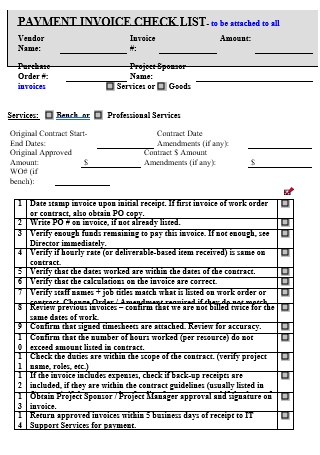

Payment Invoice Checklist

download now

FREE Payment Invoice s to Download

21+ Sample Payment Invoice

a Payment Invoice?

Benefits of Fast Invoice Processing

Tips in Tracking Payment Invoices

How To Get Invoices Paid More Effortlessly

FAQs

Is the invoice the same as the payment?

What is a post-payment invoice?

Invoices are processed in the following manner.

What Is a Payment Invoice?

A business submits a payment invoice to pay for products and services received from vendors. Small companies must issue invoices to their clients and pay invoices for services and goods purchased to operate their enterprises. Each small business should have a standard invoice payment system that facilitates the organization and simplifies the small business accounting process. Companies should pay their invoices on time to avoid incurring late payment fees and to foster positive relationships with their vendors. According to statistics, 13% of invoice payments to these organizations in the United States are delinquent, and 10% of those bills are written off as bad debt.

Benefits of Fast Invoice Processing

Payable accounts are unlikely to be your company’s most glamorous department. Nonetheless, it is a necessary component of doing business, which you should avoid at all costs. Indeed, if left unchecked, the most severe accounts payable concerns might collapse your business. That is certainly not what you want to happen, especially when resolving such issues is relatively straightforward. One of these concerns is the amount of time required to process invoices. This may be a minor issue, but it can significantly influence the department. Your cost per invoice increases exponentially as the processing time for each invoice increases. If these delays are prolonged enough to cause you to fall behind on payment dates, they can also wreak havoc on your vendor relationships. You require a method for expediting your invoice payment processes. Automation is the most dependable method of accomplishing this. If you’re interested, here’s a rundown of its benefits.

Tips in Tracking Payment Invoices

Having a simplified invoicing process requires having mechanisms to ensure that invoices are sent and payments are received in a timely and organized manner. The following recommendations will assist you in managing your billing workflow:

1. Quickly send invoices

You will not get compensated if you do not submit an invoice. The first suggestion for effective invoice handling is to issue an invoice immediately following the completion of a job. This is simple using invoices, enabling you to create and send invoices directly from your smartphone.

2. Distribute the invoice to the appropriate individuals.

Occasionally, the invoice is handled by someone other than the client — perhaps a bookkeeper or the business’s chief financial officer. This allows you to email both your client and whoever is responsible for paying the invoice, ensuring that you receive payment as promptly as feasible.

3. Utilize electronic invoicing and Establish Terms

Online invoicing aids in the prevention of invoices becoming “lost in the mail.” Since online bills are transmitted digitally, clients can always quickly locate them – all they have to do is search their inbox. Also, your terms and conditions must be clearly stated in advance (on your quotation) and the final invoice. This includes any late fees incurred as a result of late payments. Having everything in writing is critical for avoiding awkward back and forth interactions.

4. Possess an organizational structure

You should keep track of all invoices in a single, organized area. This is critical for accounting and tax concerns and for remaining organized. According to research, the organizational structure provides direction to all employees by outlining the official reporting connections that regulate the company’s workflow. A detailed outline of a business’s design also makes it easy to establish additional employees, giving a flexible and ready means of expansion.

How To Get Invoices Paid More Effortlessly

Small firms and freelancers rely on prompt invoices to maintain a sufficient cash flow to cover their expenses. Utilize the following strategies to encourage clients to pay for your services more quickly:

-

Step 1 Deposits or Prepayments Are Requested

One of the most straightforward strategies to expedite payment and ensure that you receive compensation for your work is to seek a deposit or even the entire cost for a project before you begin. This is particularly beneficial and pertinent for more extensive, longer-term initiatives that may take many months to complete. A deposit ensures that you have some income to cover the expenditures of completing the project, such as acquiring materials or software. Additionally, it will assist you in maintaining a healthy cash flow to cover your other business expenses.

-

Step 2 Create Invoices That Are Unambiguous

If you’re having difficulty getting clients to pay you on time, part of the problem may be with your bills. Ascertain that your invoice design is simple. Poorly designed invoices can delay payment since crucial information may be challenging to locate, confusing your clients. Ascertain that your invoices contain all the required information to make a payment for your client. The most critical information should be highlighted, including the total amount due and the payment date.

-

Step 3 Immediate Invoice

The quicker you send out invoices requesting payment for your services, the sooner you will be paid. Make it a practice to send an invoice to your client immediately upon completion of the project; you may even include the invoice with your final draft of the work. Not only will the invoice be due sooner than if you waited until the next billing period, but the project will still be fresh in your client’s memory, which may serve as a reminder to pay the balance owed promptly. If your invoice immediately, the work is still new in your mind, and you’re less likely to make invoice errors that result in delayed payment.

-

Step 4 Always Maintain a Polite Attitude

Maintaining a professional demeanor with clients is critical while mailing invoices and following up on past payments. Include a kind “please” and “thank you” on your invoice and accompanying email to demonstrate your appreciation and make a favorable impression. Being fantastic and polite to clients when their payment is late will help you retain a positive connection and avoid sabotaging future job chances with the company.

-

Step 5 Implement Late Fees

Consider incentives as the carrot and late fees as the stick: incentives reward positive conduct, whereas late fees penalize individuals who have a terrible record of missing payment deadlines. You should assess late fees on delinquent invoices to motivate clients to adhere to all deadlines. Ensure that your invoice clearly states your late charge policy in the payment terms section. Also, it is an excellent concept to discuss your late charge policy with a client directly before beginning work with them to avoid unpleasant surprises down the road.

-

Step 6 Allow Payments to be Automatic

Allowing automatic payments for your invoices is an excellent approach to getting paid faster and knowing exactly when you will get income from a client. Automatic payments enable clients to have the balance due automatically charged to their Credit Card or debit card on the same day each month, eliminating the need for them to lift a finger to pay you. This streamlines the procedure for the client and the uncertainty of when you will be compensated for your services.

FAQs

Is the invoice the same as the payment?

An invoice is a demand for payment sent by the seller following the completion of the sale of goods/services. In their simplest form, invoices are used to ensure that your business is paid.

What is a post-payment invoice?

An invoice is a record that a business sends to a customer. A bill is anything that a consumer must pay. When a customer pays their statement, the company issues a receipt as proof of payment. An invoice is given before the charge, but a permit is issued upon payment.

Invoices are processed in the following manner.

Invoice processing encompasses the entire process of receiving a supplier invoice, authorizing it, setting a remittance date, paying the invoice, and finally entering it in the general ledger. It is a vital component of company operations.

To expedite payment, small businesses and freelancers should consider imposing late fees on past-due invoices. By including a late fee policy on your invoices, you may encourage clients to pay their bills on time to avoid incurring extra charges. Ascertain that each invoice you send states the terms of your policy. Additionally, it will help if you discuss late costs with clients before beginning a project. The number of late fees that you can impose will vary by state. States regulate the maximum yearly interest rate that a firm may charge. Small businesses are frequently charged 1.5 percent interest per month, which should not violate your state’s usury rules. You may find out the maximum interest rate permitted in your form online.