30+ Sample Commercial Invoice

-

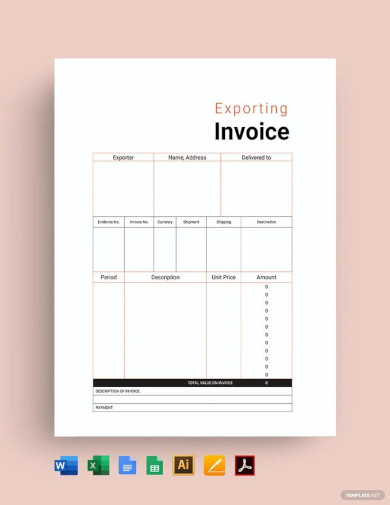

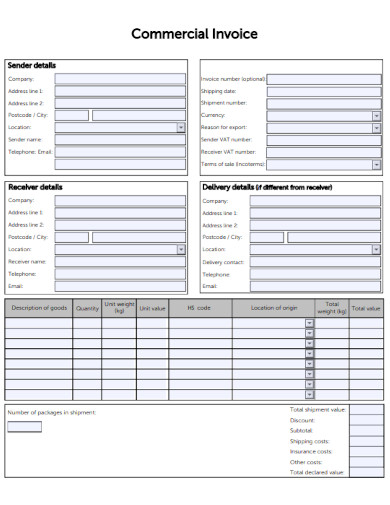

Commercial Export Invoice

download now -

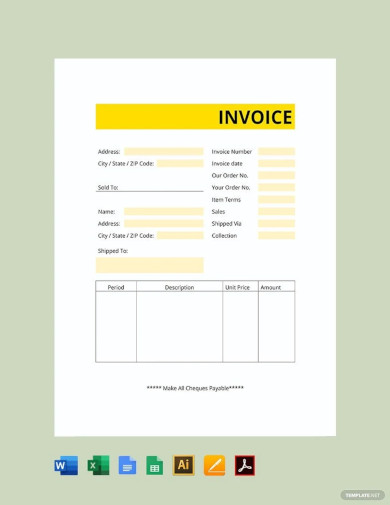

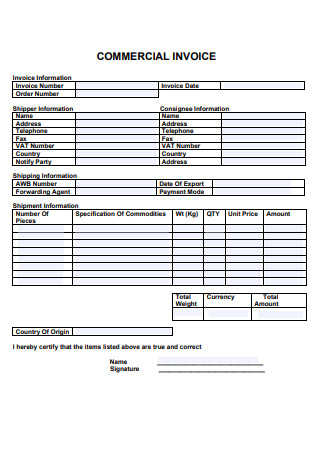

Commercial Business Invoice

download now -

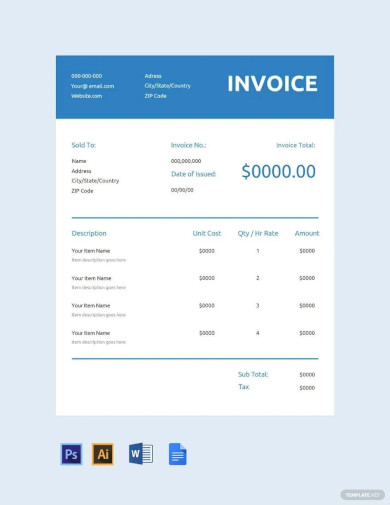

Generic Commercial Invoice

download now -

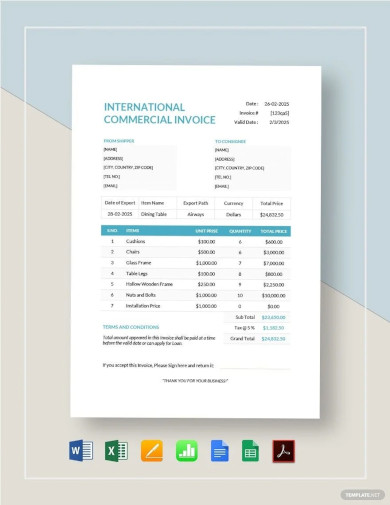

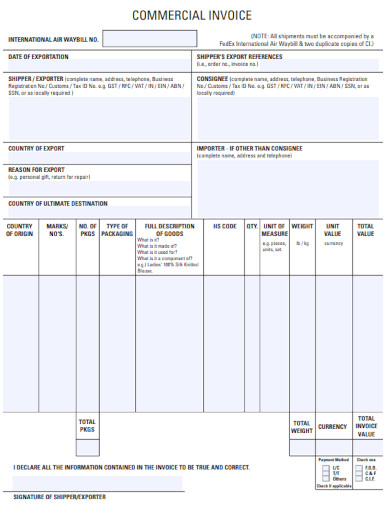

International Commercial Invoice

download now -

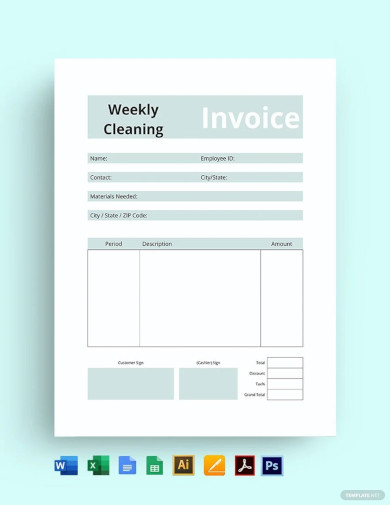

Commercial Cleaning Invoice

download now -

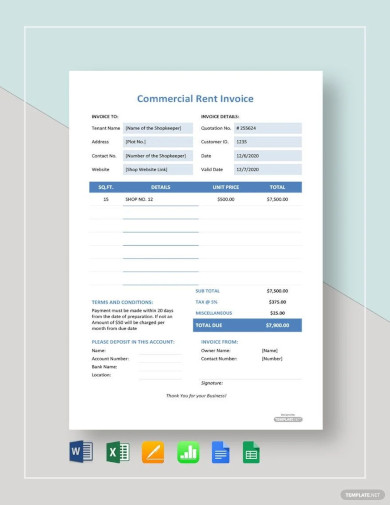

Commercial Rent Invoice

download now -

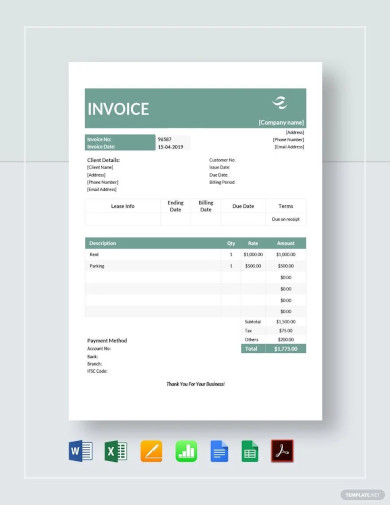

Commercial Lease Invoice

download now -

Commercial Blank Invoice

download now -

Commercial Invoice Layout

download now -

Commercial Customer Invoice

download now -

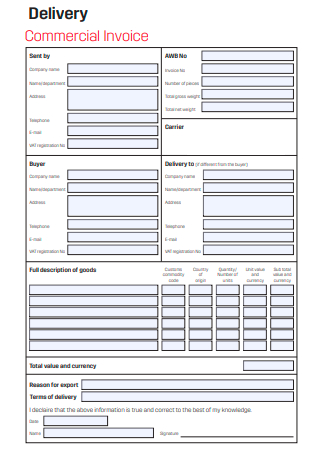

Delivery Commercial Invoice

download now -

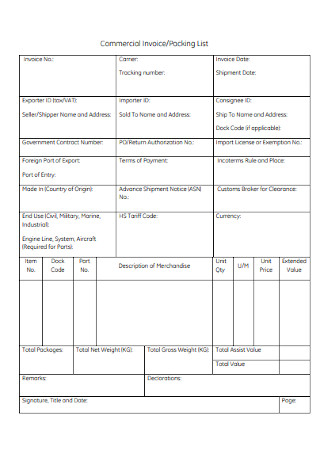

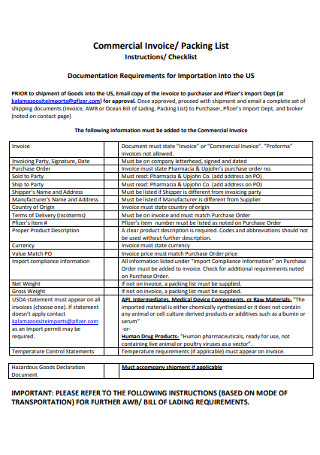

Commercial Invoice and Packing List

download now -

Standard Commercial Invoice

download now -

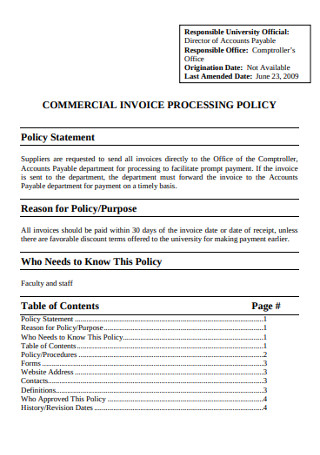

Commercial Invoice Processing Policy

download now -

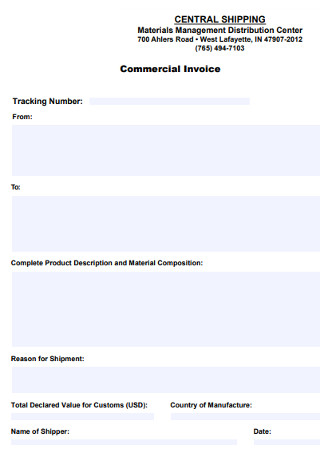

Commercial Materials Invoice

download now -

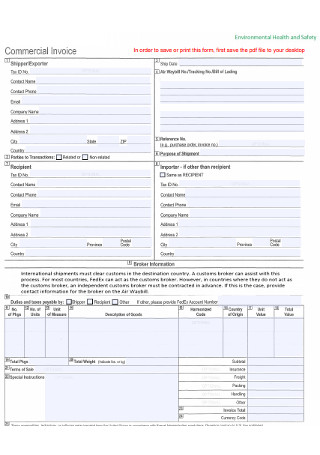

Commercial Health and Safety Invoice

download now -

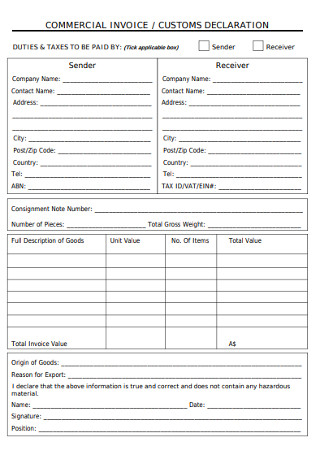

Commercial Custom Declaration Invoice

download now -

Commercial Company Invoice

download now -

Commercial Market Invoice

download now -

Commercial Invoice Checklist

download now -

Commercial Packing List Invoice

download now -

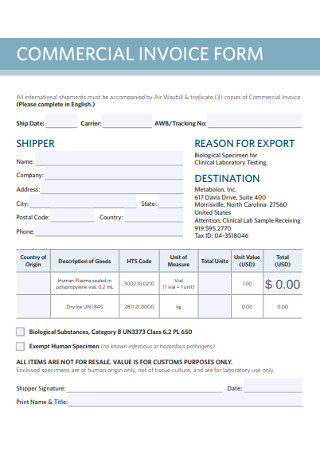

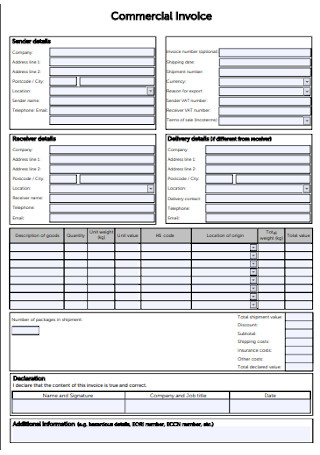

Commercial Invoice Form

download now -

Proforma and Commercial Invoice

download now -

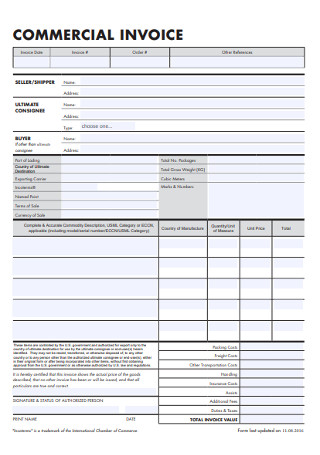

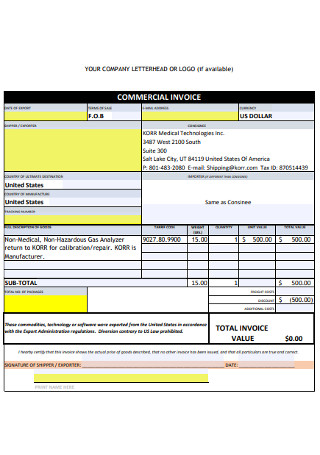

Commercial Invoice

download now -

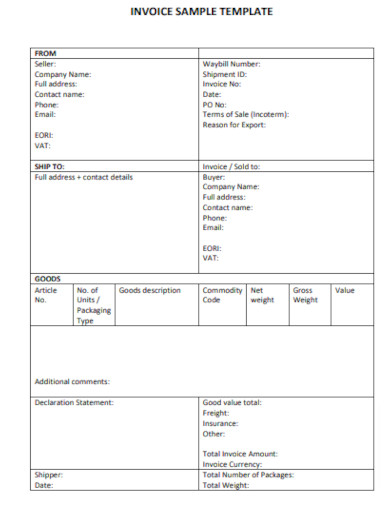

Sample Commercial Invoice

download now -

Commercial Invoice in PDF

download now -

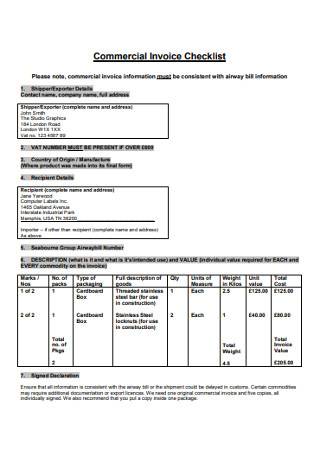

Commercial Invoice Checklist

download now -

Product Commercial Invoice

download now -

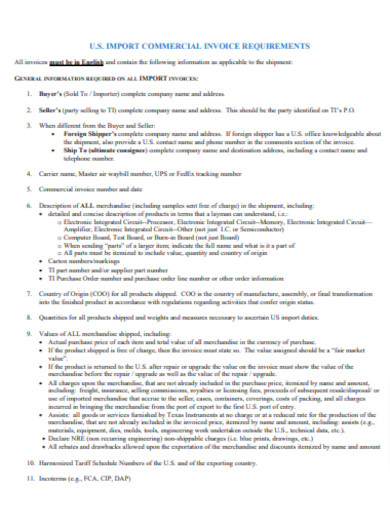

Import Commercial Invoice

download now -

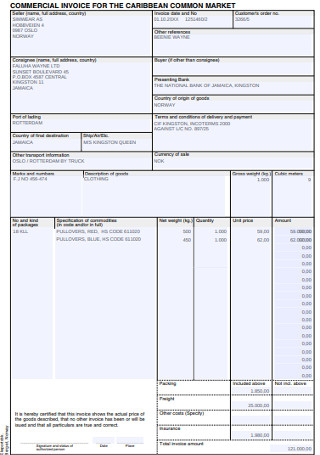

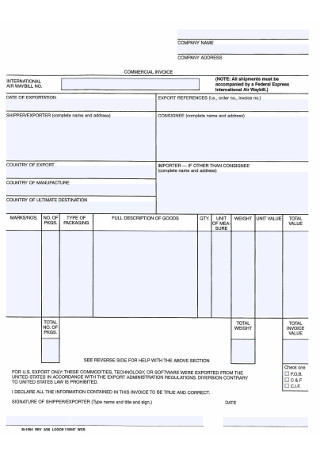

International Shipping Commercial Invoice

download now -

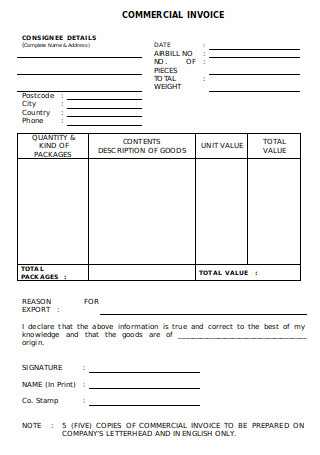

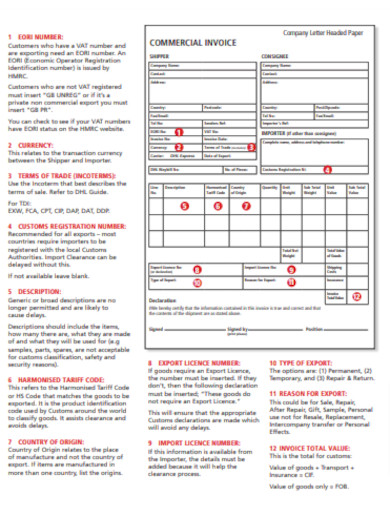

Customs Commercial Invoice

download now

FREE Commercial Invoice s to Download

30+ Sample Commercial Invoice

Definition and Purpose

Key Components of a Commercial Invoice

The Role in Customs Declaration and Duties

Best Practices for Drafting a Commercial Invoice

FAQ’S

How does a commercial invoice differ from a standard invoice?

How is the value of goods determined on a commercial invoice?

Are there specific formats or templates for commercial invoices?

Is a commercial invoice legally binding?

Can a commercial invoice be amended?

Is a commercial invoice required for all international shipments?

Definition and Purpose

A commercial invoice, in essence, is a legal document between the supplier and the customer. It details the goods sold, the quantifiable amount of product, and the pertinent price. Beyond its role as a bill for goods or services, this document serves multiple purposes

Regulatory Compliance

It ensures that traders comply with the requirements set by importing and exporting countries.

Determination of Value

It helps customs authorities evaluate goods, which is essential for levying the right duties and taxes.

Proof of Transaction

For businesses, it serves as compelling evidence of the sale, which is crucial for both accounting and audit trails.

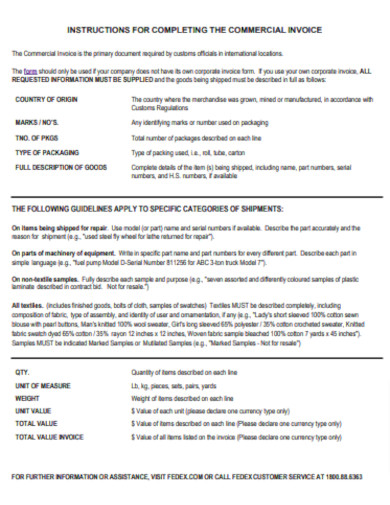

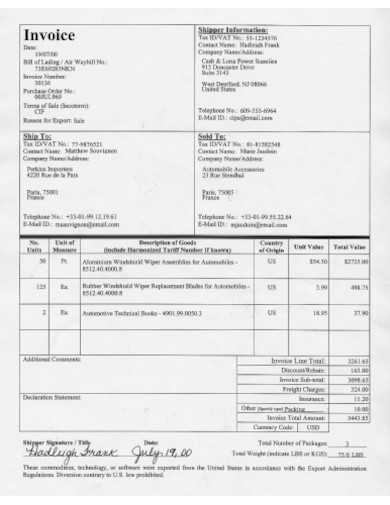

Key Components of a Commercial Invoice

A well-constructed commercial invoice consists of various important elements, each playing a significant role in maintaining its integrity and usefulness.

Seller and Buyer Details

Names, addresses, and contact information for both parties.

Invoice Number

A unique reference number for tracking and documentation purposes.

Description of Goods

Detailed descriptions, including quantities, weights, and other pertinent specifics.

Harmonized System (HS) Codes

These codes, devised by the World Customs Organization, categorize products for tariff and statistical purposes.

Total Value

The total value of the transaction, typically expressed in the currency of the sale.

Shipping Details

Pertinent information regarding the mode of transport, shipping terms (like CIF or FOB), and port of entry or destination.

Payment Terms

Conditions concerning the mode and timeline of payment, be it through letters of credit, online transfers, or other mechanisms.

The Role in Customs Declaration and Duties

One cannot overstate the importance of the commercial invoice in the realm of customs clearance. This document, replete with detailed product and transaction information, aids customs officials in

Assessing Applicability

Not all goods might be subject to duties. The invoice aids in discerning which ones are.

Valuation of Goods

To compute customs duties, the value of the goods—often denoted in the invoice—is paramount.

Verification of Shipment

The invoice corroborates the accuracy of the shipment, ensuring what was declared aligns with what is sent.

Ensuring Regulatory Adherence

For nations with prohibitions or restrictions on certain imports, the invoice is a tool for compliance checks.

Best Practices for Drafting a Commercial Invoice

To ensure effective utility and smooth customs clearance, businesses should follow certain best practices.

Precision

Every aspect, from the description of the product to its valuation, should be portrayed with the utmost precision.

Clarity

Avoid ambiguity. Clear categorization and terminology help with faster processing.

Adherence to Local Regulations

Regulations may differ depending on the importing country. Being familiar with local norms can help reduce possible issues.

Multilingual Presentation

In some cases, providing an invoice translation in the language of the importing country can speed up clearance.

FAQ’S

How does a commercial invoice differ from a standard invoice?

While both documents detail transactions, a standard invoice is primarily for billing purposes within domestic markets. In contrast, a commercial invoice contains specific details for customs clearance during international trade, assisting in determining duties and tariffs.

How is the value of goods determined on a commercial invoice?

The value of goods on a commercial invoice is typically determined by the transaction value or the price paid or payable for the goods. It may also take into account any additional costs, like packing or freight fees, not included in the price.

Are there specific formats or templates for commercial invoices?

While there isn’t a universal format, many countries have specific requirements for the presentation of commercial invoices. It’s advisable to use templates or software tailored to the requirements of the countries you’re trading with.

Is a commercial invoice legally binding?

Yes. A commercial invoice is a legally binding document. It provides a record of the goods sold and verifies the shipment’s details. Any discrepancies or fraudulent information can lead to legal consequences.

Can a commercial invoice be amended?

Amendments are possible but might complicate the customs clearance process. If changes are necessary, it’s advisable to create a new, corrected invoice and ensure all parties involved have the updated document.

Is a commercial invoice required for all international shipments?

Most international shipments require a commercial invoice. However, some exceptions might apply, like shipments labeled as gifts, documents, or personal effects. Always check with customs regulations for the destination country.

In the complex web of global trade, the commercial invoice serves not only as a sales money receipt but also as a strong foundation supporting the framework of international commerce. By maintaining careful attention to detail and following global best practices, businesses can utilize this document to simplify their cross-border operations, ultimately promoting growth and strengthening global relationships.