24+ Sample Asset Lists

-

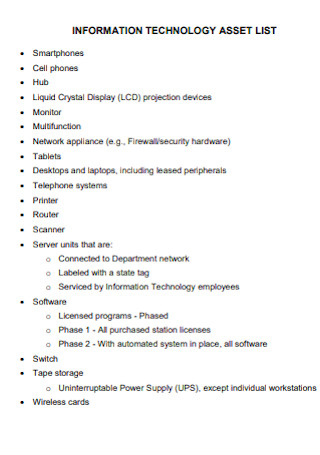

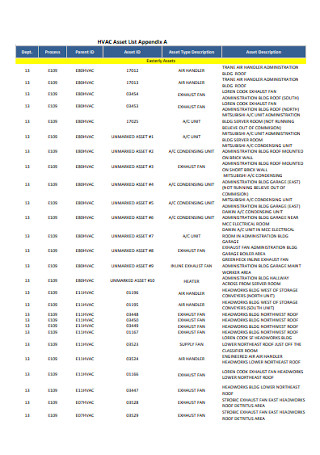

Informatation Technology Asset List

download now -

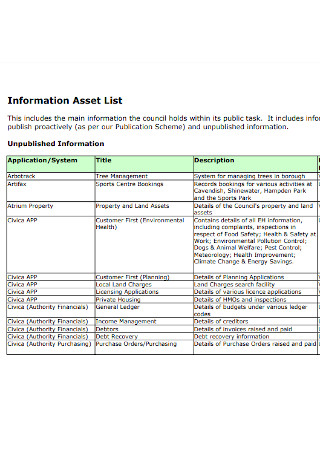

Information Asset Lists

download now -

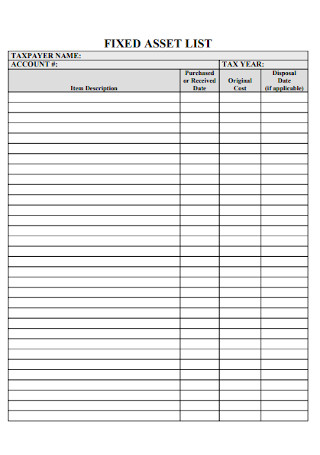

Fixed Asset List

download now -

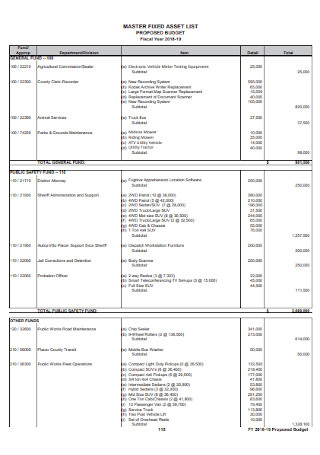

Master Fixed Asset List

download now -

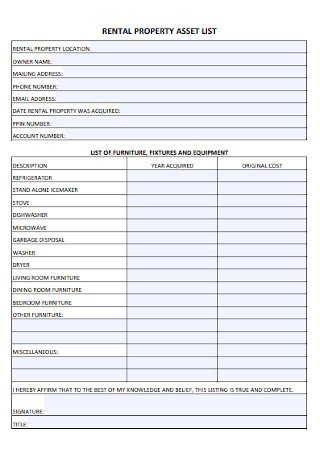

Rental Property Assest List

download now -

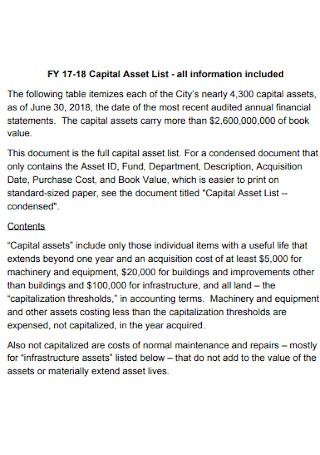

Capital Asset List

download now -

Business Assest List

download now -

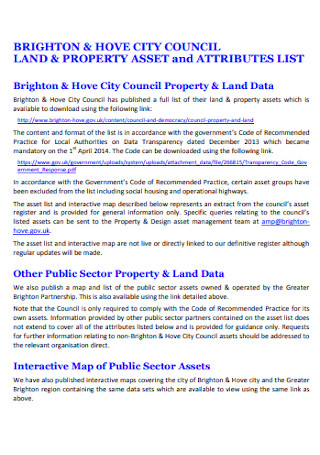

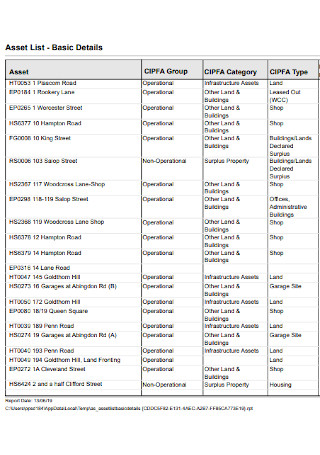

Land and Property Asset List

download now -

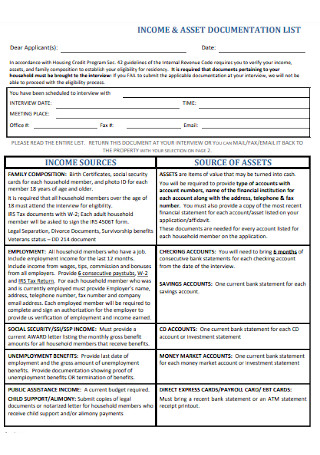

Asset Documentation List Template

download now -

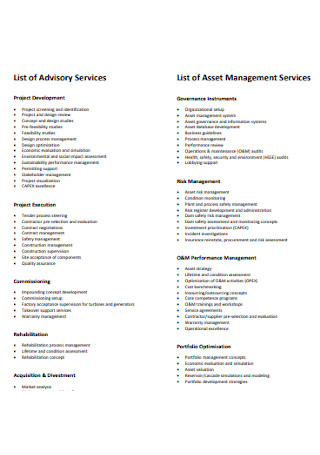

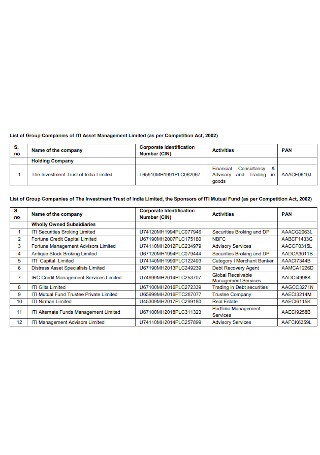

List of Asset Management Services

download now -

Sample Asset List Template

download now -

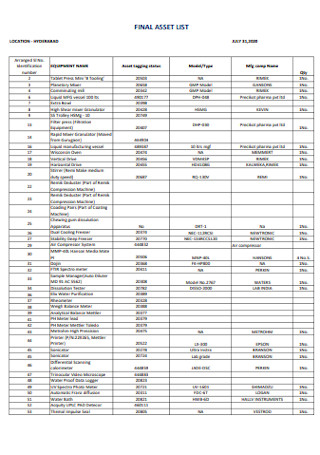

Final Assest List Template

download now -

Company Asset List Template

download now -

Asset and Equipment List

download now -

Basic Asset List Template

download now -

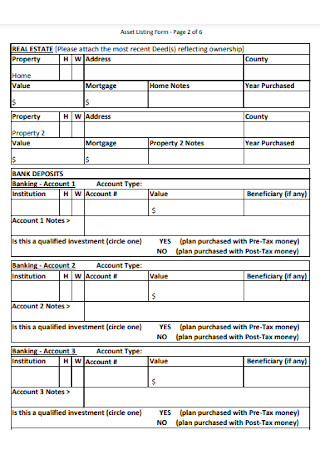

Asset List Form Template

download now -

Asset Management Price List

download now -

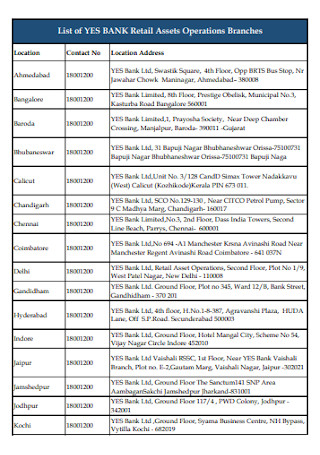

Bank Asset List Template

download now -

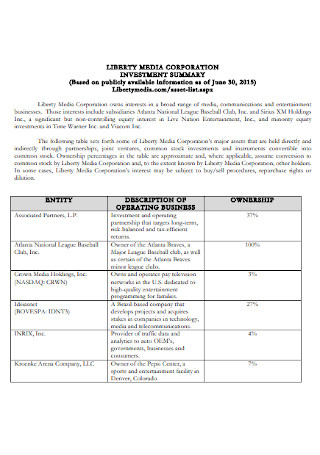

Corporation Asset List

download now -

Business Asset List Template

download now -

Asset Management List Template

download now -

Asset Community Value List

download now -

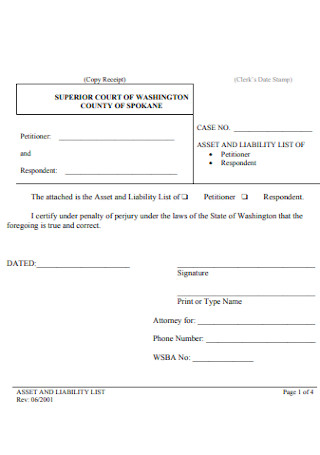

Asset and Liability List

download now -

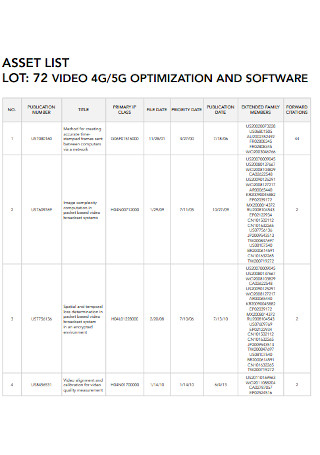

Information Asset List Template

download now -

Basic Asset List Example

download now

FREE Asset List s to Download

24+ Sample Asset Lists

Asset List: What Is It?

Information in an Asset List

Tips in Writing an Asset List

Classifications and Types of Assets

Classes of Assets

FAQs

What is the importance of assets in a business?

What is asset management, and why is it important?

How do you protect your assets?

Asset List: What Is It?

An asset list details different types of assets owned by a company or organization. Assets owned are recorded from current and fixed assets, tangible and intangible assets. It is necessary to write assets and classify them according to nature, physical characteristics, and usage. The asset list serves as a document that helps fulfill balance sheets. Every company must have a copy of an asset list in the case of checks and balances. An asset list presents a detailed description of the acquisition of the assets throughout the years of operation.

According to statistical data by Statista from 2018, non-financial organizations’ financial assets reach $28.06 trillion in the US. From 2000 to 2018, assets increased by a margin, and data shows it will continue to develop in the following years. Assets are a prominent factor for both non-financial and financial organizations in making themselves financially known. It allows them to attract more people to their business.

Information in an Asset List

Asset lists contain important information regarding the company. The details included must be accurate and precise. Different types of the list exist to serve various purposes. However, here are the most common things to look out for in an asset list.

Tips in Writing an Asset List

Writing an asset list can feel overwhelming and tedious work. However, it is significant to understand what relevance the list holds. An asset list can save time in the long run when circumstances arise. Here are some tips for writing an asset list.

Step 1: Take the Time to Identify All Assets

It is necessary to list all assets that come to mind. By doing this, you don’t leave anything out. Once you’ve recorded everything, you can start placing them in particular categories or systems to narrow it down. It is the simplest and most efficient way to identify assets.

Step 2: Importance of Assets and Inventory Intersection

Keeping a record of your assets also allows you to track and manage your equipment. It helps save time when doing inventories as the asset list contains the number of equipment available to the company.

Step 3: Managing Your Assets List Saves Money

Having an updated list of assets also shows you which materials, equipment, or product you have based on the sales made beforehand. It helps you plan ahead of time which items need to be restocked or replaced, allocating money as required.

Step 4: Attach Evidence of Ownership

Evidence of ownership are documents that represent intangible assets such as deeds, certificates, titles, financial statements, and accounts. It is also advisable to include your account name, number, and social security number. If there are individuals who have the authority to use any of the aforementioned assets, include them.

Step 5: Provide Acquisition Details As Necessary

Acquisition information is the detail about where you’ve acquired the assets. It must include the name, place, date, and the seller’s information. Include the means of acquisition, if it is a gift, inheritance, or purchase.

Classifications and Types of Assets

An asset list contains different classifications. The classification of assets is according to their convertibility, physical existence, and usage. Below lists the types of assets following their classes.

Classes of Assets

An asset class is a group of assets with similar characteristics, including how they function in the marketplace, purchasing methods, and government regulations. It is essential that these classes have equal bearings to protect yourself from losing most of your assets.

FAQs

What is the importance of assets in a business?

According to the Forbes Global 2000 list in 2020, the Industrial and Commercial Bank of China ranks first in the world has an asset of more than $4.3 trillion. Assets generate value for the company in terms of intellectual property and customer connections. It is necessary to have assets because they produce income, increase business worth, and facilitate operations. The larger your assets are, the more prominent your business will be. The company’s capacity to maintain and develop its assets, including selling and leasing its current assets, has a significant effect on the overall value of the company’s cash flow and profitability.

What is asset management, and why is it important?

Asset management is a service offered by a firm or institution to manage a company or a client’s investments on their behalf. It is best suited for affluent entities or individuals that handle numerous assets. Each asset management firm has its specializations. Generalists tailor their financial services to what investors want and need. Some firms focus on specifics, concentrating on a single area and working with long-term clients. Other firms focus on wealthier clients in terms of private accounts, otherwise known as hedge funds. Some firms specialize in retirement planning, like pension plans, and even manage money for non-profit institutions.

Albeit the many specializations, the importance of it stays the same. The importance of asset management lies in providing a structured plan. The plan covers investment planning that delivers the most cost-effective solutions in producing quality service with minimal risk to existing assets. Having an asset management plan also results in better decision-making. It also presents better day-to-day management of the condition of assets, preventing costly repairs, failures, even lawsuits and problems in customer relation.

How do you protect your assets?

In a survey conducted by the National Retailers Federation, losses amounted to about $50.6 billion in 2018. Assets play a significant role in a company’s identity and growth. The bigger your assets are, it is most likely to be desired by other companies or gain unnecessary attention. One way to protect it is to understand the risks. Another way is for you to secure a business attorney. The attorney can help with questions regarding the protection of assets and licensing issues. It is also vital that business assets have insurance. Purchasing insurance to protect the business and its assets ensures it is running for years to come. Separating multiples entities is also beneficial for the company.

Starting your own business is a risky task, but there are safeguards to guarantee the company is continually running and growing. A starting point you need to have is to create your asset list. It is also convenient to keep the list updated annually as it helps with checks and balances, as well as record keeping. In creating it, remember to write down every asset of the company and consider the evidence of ownership and acquisition details. Also, keep in mind that having equity in all your assets guarantees its stability.

Remember the importance of possessing assets in your business, managing your assets well, and how you can safeguard them. Any help, especially by professionals and attorneys, is always essential in making decisions. As the late Steve Jobs once said, “If you really look closely, most overnight successes took a long time.” Remember that there is no quick path to success; we need to take risks along the way. However, whenever possible, planning is the best way to reduce facing risks. Start an asset list for your company today and save worrying in the future!