Employee File Checklist Samples

-

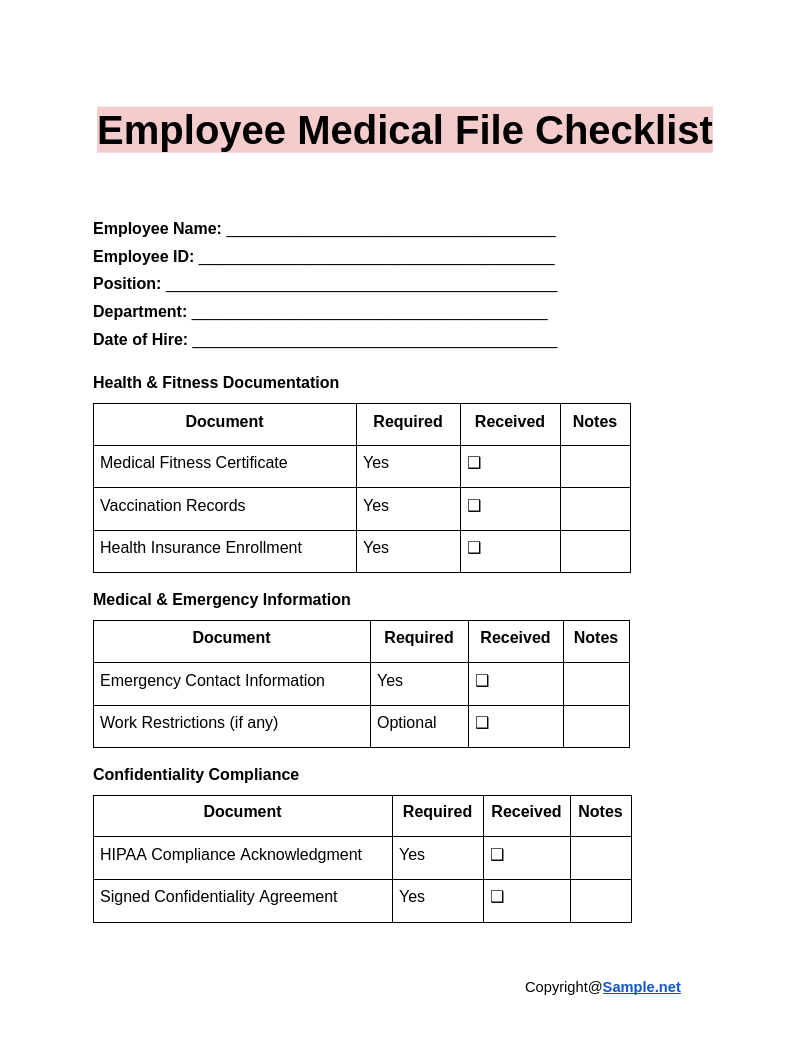

Employee Medical File Checklist

download now -

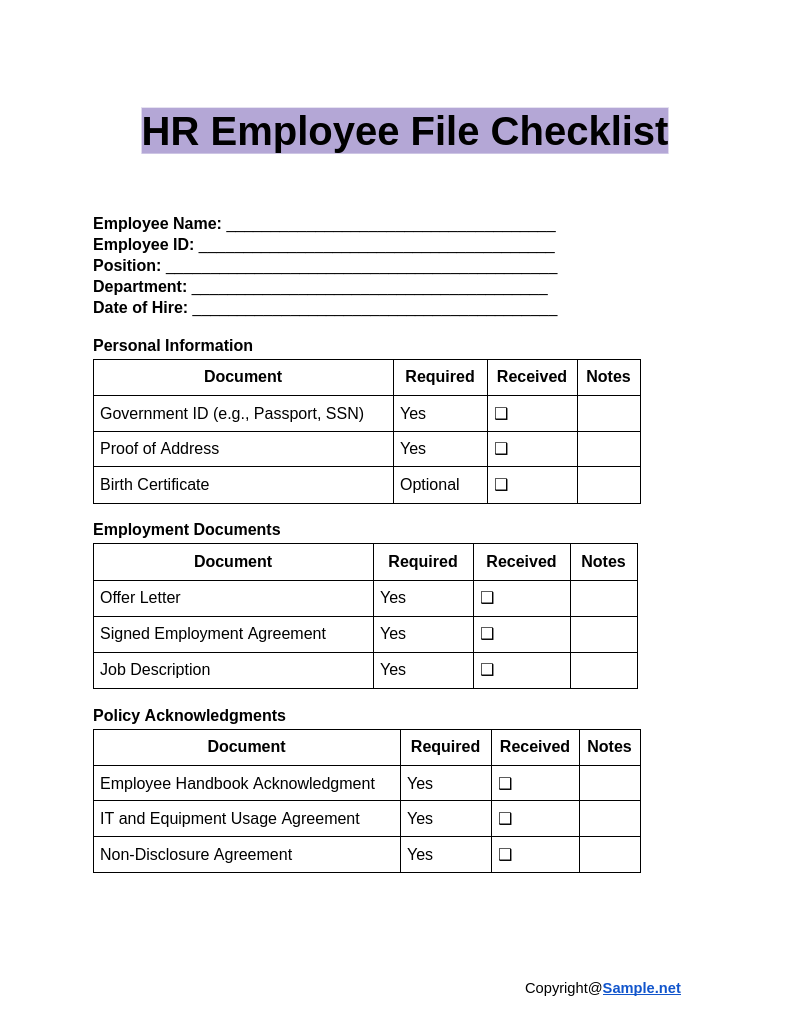

HR Employee File Checklist

download now -

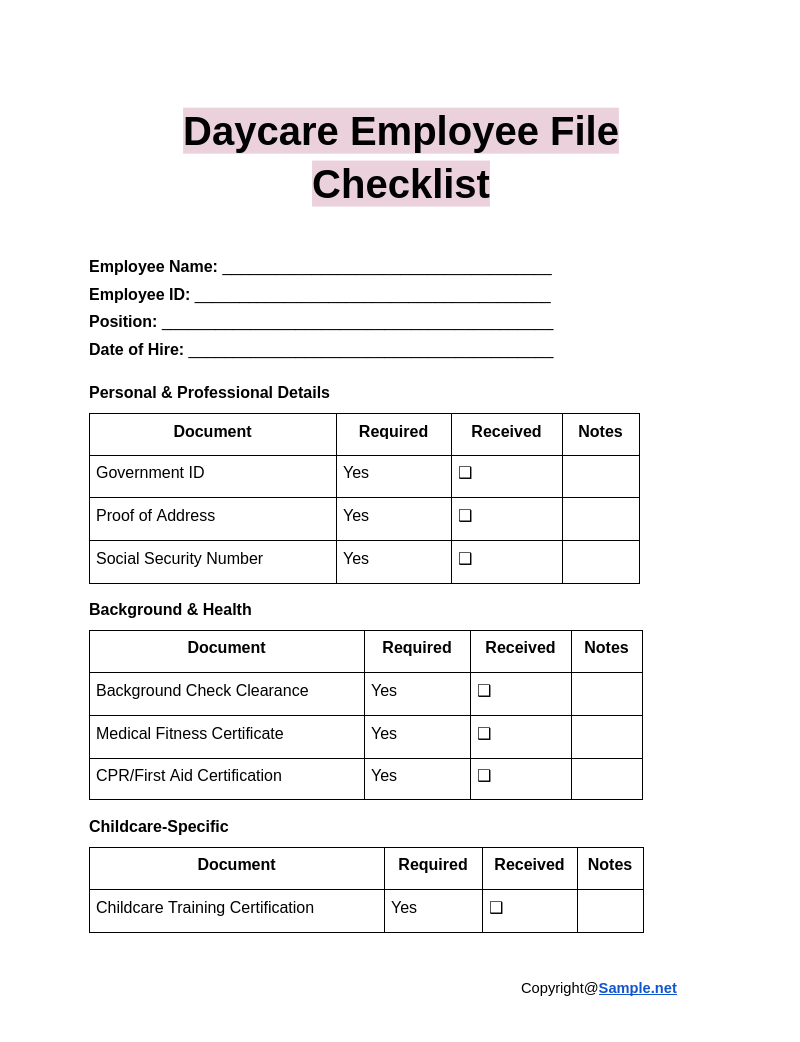

Daycare Employee File Checklist

download now -

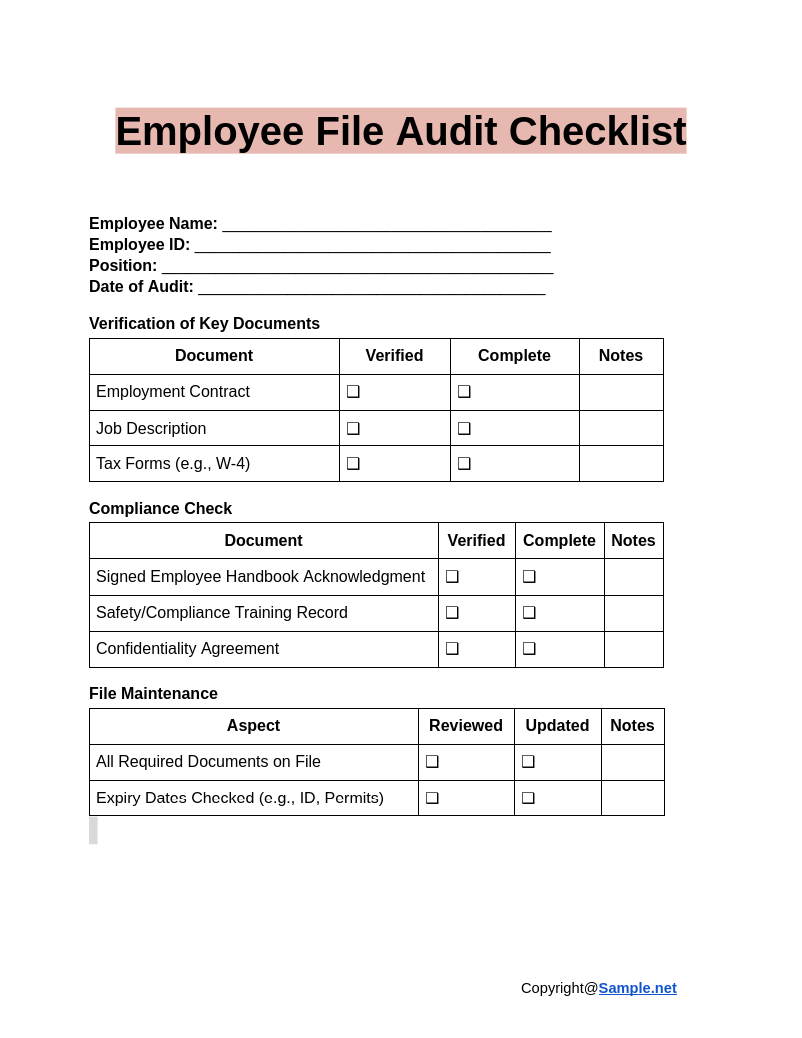

Employee File Audit Checklist

download now -

Employee Personal File Checklist

download now -

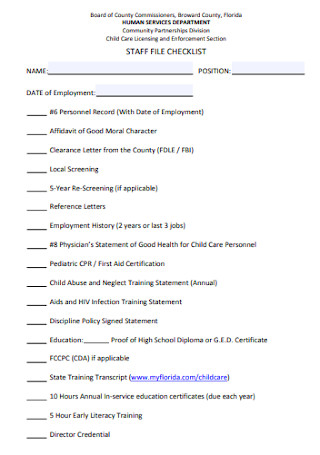

Staff File Checklist Template

download now -

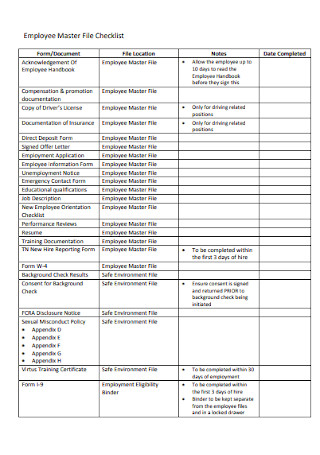

Employee Master File Checklist

download now -

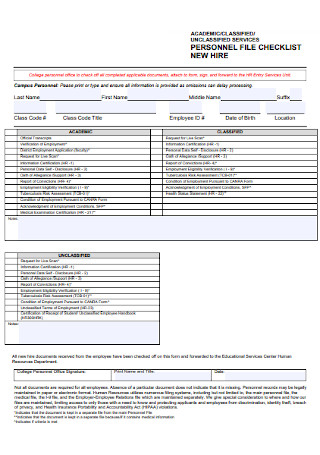

Part-time Faculty Personnel File Checklist

download now -

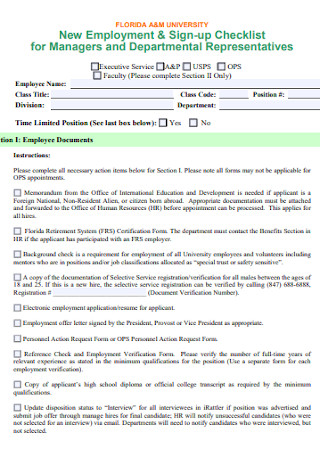

New Employment and Sign-up Checklist

download now -

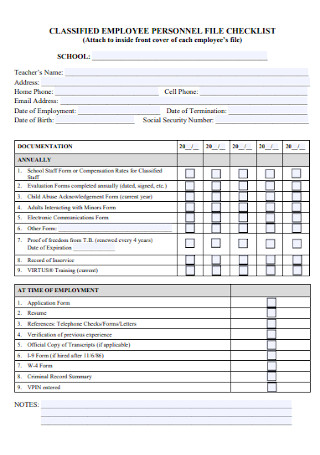

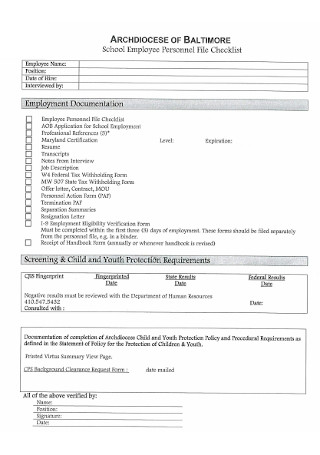

School Employee File Checklist

download now -

Sample Employee File Checklist

download now -

Employee Personnel Files Checklist

download now -

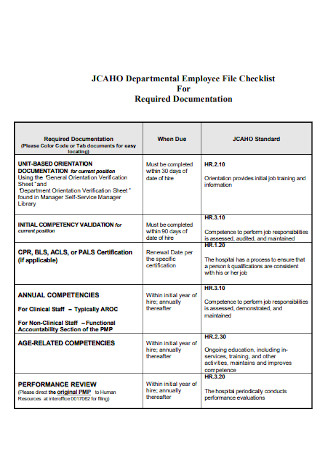

Departmental Employee File Checklist

download now -

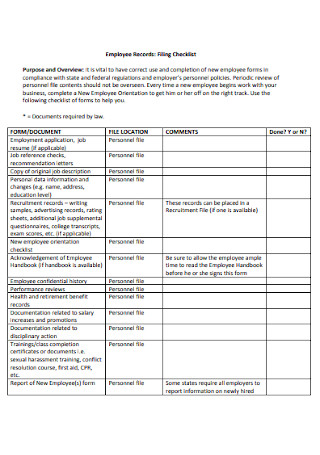

Employee Records Filing Checklist

download now -

Employee File Checklist Format

download now -

Employee File Record Checklist

download now -

Volunteer File Checklist Template

download now -

Employee Hire File Checklist

download now -

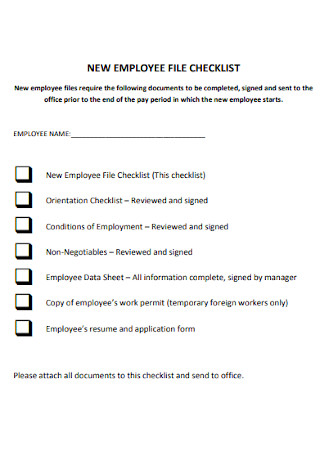

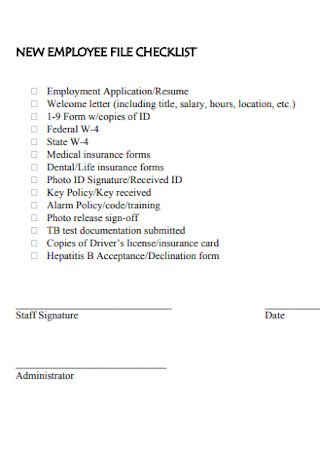

New Employee File Checklist Template

download now -

Simple Employee File Checklist

download now -

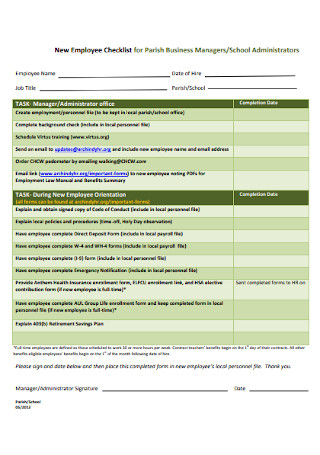

New Employee Checklist for School

download now -

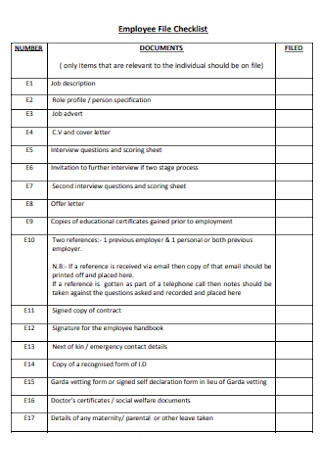

Standard Employee File Checklist

download now -

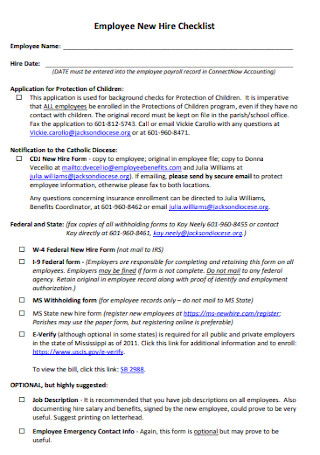

Employee New Hire Checklist Example

download now -

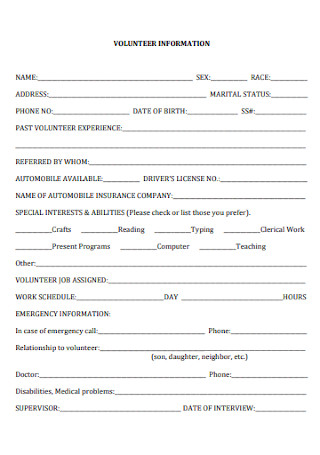

Volunteer Employee File Checklist

download now -

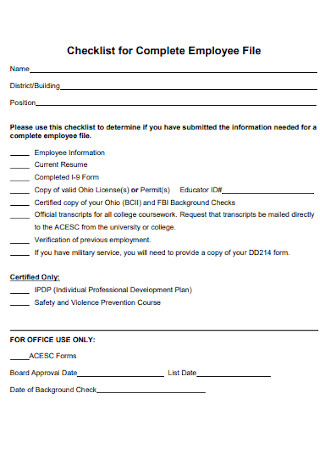

Checklist for Complete Employee File

download now -

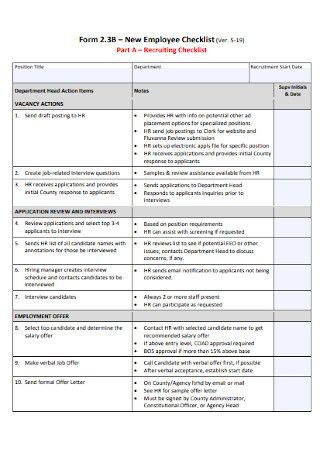

Employee Recruiting Checklist

download now -

Employee Personal File Checklist Format

download now

FREE Employee File Checklist s to Download

Employee File Checklist Format

Employee File Checklist Samples

What is an Employee File Checklist?

Purposes of an Employee File Checklist

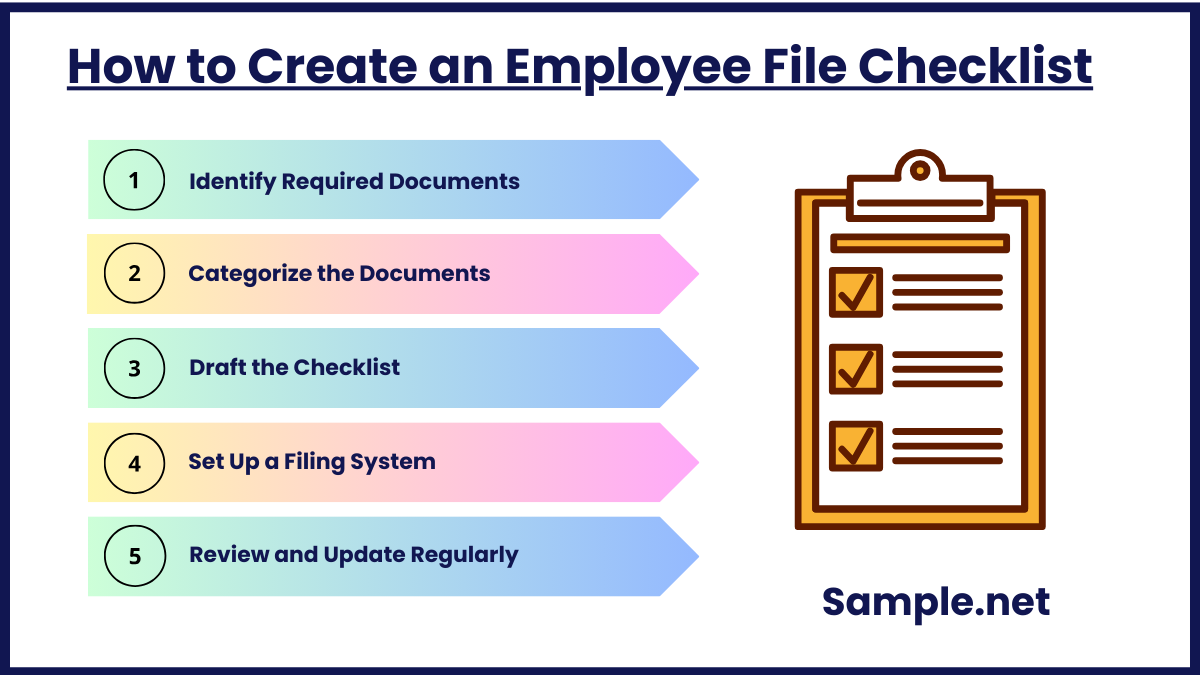

How to Create an Employee File Checklist

FAQs

What are the advantages of keeping employee files?

What are the common categories of an employee file checklist?

What should you not include in the employee file checklist?

What are the legal requirements for employee file checklists?

How do organizations secure employee file checklists?

What challenges do companies face without an employee file checklist?

How can small businesses implement an employee file checklist?

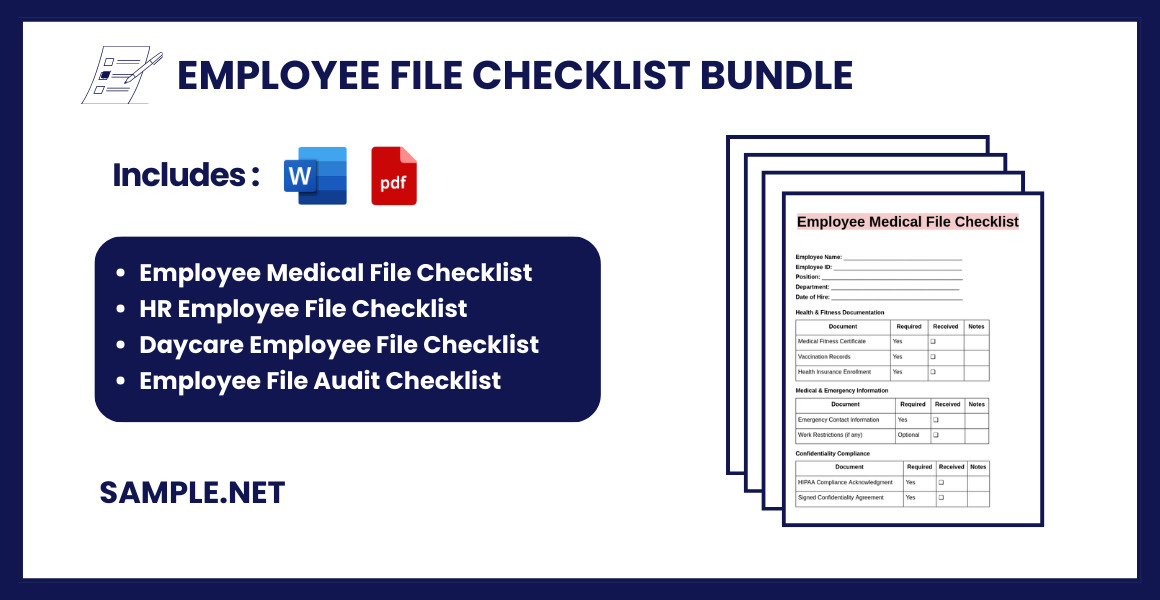

Download Employee File Checklist Bundle

Employee File Checklist Format

Employee Name: _____________________________________

Employee ID: ________________________________________

Job Title: ____________________________________________

Department: ________________________________________

Date of Hire: _________________________________________

Pre-Employment Documents

| Document | Required | Received | Notes |

|---|---|---|---|

| Offer Letter | Yes | ❑ | |

| Employment Contract | Yes | ❑ | |

| Background Check/Verification Report | Yes | ❑ | |

| Signed Job Description | Yes | ❑ | |

| References | Optional | ❑ |

Personal Identification

| Document | Required | Received | Notes |

|---|---|---|---|

| Government ID (e.g., Passport, SSN) | Yes | ❑ | |

| Proof of Address | Yes | ❑ | |

| Birth Certificate | Optional | ❑ | |

| Work Permit/Visa (if applicable) | Yes | ❑ |

Tax & Banking Information

| Document | Required | Received | Notes |

|---|---|---|---|

| Tax Declaration Form | Yes | ❑ | |

| Bank Account Details | Yes | ❑ | |

| Social Security/Taxpayer Number | Yes | ❑ |

Health & Insurance

| Document | Required | Received | Notes |

|---|---|---|---|

| Medical Fitness Certificate | Optional | ❑ | |

| Health Insurance Enrollment Form | Yes | ❑ | |

| Emergency Contact Information | Yes | ❑ |

Training & Certifications

| Document | Required | Received | Notes |

|---|---|---|---|

| Orientation Checklist | Yes | ❑ | |

| Required Certifications (if any) | Optional | ❑ | |

| Safety/Compliance Training Records | Yes | ❑ |

Company Policies & Agreements

| Document | Required | Received | Notes |

|---|---|---|---|

| Signed Employee Handbook Acknowledgment | Yes | ❑ | |

| Confidentiality/Non-Disclosure Agreement | Yes | ❑ | |

| Code of Conduct Acknowledgment | Yes | ❑ | |

| IT/Equipment Policy Acknowledgment | Yes | ❑ |

Other Documents

| Document | Required | Received | Notes |

|---|---|---|---|

| Any Other Agreements (if applicable) | Optional | ❑ | |

| Additional Notes |

Checklist Reviewed By:

Name: ___________________________

Title: ___________________________

Date: ____________________________

What is an Employee File Checklist?

An employee file checklist is a structured document used by HR teams to ensure that all necessary employee records are collected, maintained, and updated. It acts as a reference guide for verifying that all legally required and company-specific documents are present in an employee’s file. This checklist helps organizations comply with employment laws, avoid legal risks, and maintain a clear record of each employee’s professional journey. You can also see more on Employee Checklists.

Purposes of an Employee File Checklist

1. Ensuring Legal Compliance

An employee file checklist helps organizations comply with labor laws and regulations. It ensures that critical documents like tax forms, contracts, and identification proofs are collected and maintained systematically. Failure to comply can lead to penalties, audits, or legal disputes. The checklist provides a clear framework for meeting statutory requirements in different regions and industries. This minimizes risks and ensures that the company operates within legal boundaries.

2. Streamlining HR Processes

The checklist serves as a structured guide for HR teams to collect, organize, and update employee records. It simplifies complex processes like onboarding, performance reviews, and offboarding by providing a step-by-step approach. This improves efficiency and reduces time spent searching for missing or incomplete documentation. A streamlined process ensures that employees have a smoother experience during critical HR interactions. Ultimately, it enhances the overall productivity of HR departments. You can also see more on HR Audit Checklist.

3. Protecting Confidential Employee Information

By using a checklist, companies can ensure sensitive employee data, such as medical records or financial details, is stored securely. It promotes consistent record-keeping practices and prevents unauthorized access to confidential information. A well-maintained checklist includes protocols for securing physical and digital records. This reduces the risk of data breaches and ensures compliance with privacy laws. Protecting employee information builds trust and maintains organizational integrity.

4. Preparing for Internal Audits and External Inspections

The checklist ensures that all necessary employee documents are in place and readily available for audits or inspections. This reduces last-minute scrambling and demonstrates a company’s commitment to compliance and transparency. Proper documentation also simplifies the auditing process, saving time and resources. It ensures that the organization meets regulatory standards during external reviews. A prepared approach minimizes risks of fines or operational disruptions.

5. Enhancing Employee Management and Transparency

A comprehensive checklist promotes clear communication and transparency between employers and employees. It ensures that both parties are aware of the documents required and why they are essential. The checklist also allows HR to track employee growth, performance, and milestones effectively. This organized approach strengthens employee relationships and fosters trust. In the long run, it contributes to a positive and professional workplace culture. You can also see more on Work Checklists.

How to Create an Employee File Checklist

Step 1: Identify Required Documents

Start by determining the essential documents you need to include in the employee file checklist. Research legal requirements specific to your industry and region to ensure compliance. Common documents include tax forms, identification proofs, employment agreements, and medical records. Consider the unique needs of your organization, such as role-specific certifications or internal policy acknowledgments. Create a comprehensive list to ensure all necessary documents are covered from the outset. You can also see more on Employee Exit Checklist.

Step 2: Categorize the Documents

Organize the documents into logical categories to streamline the checklist. Common categories include onboarding documents (offer letters, ID proofs), compliance records (tax forms, medical reports), and performance documents (reviews, training records). This categorization ensures that HR teams can easily locate and manage specific documents. Clearly define each category to prevent overlap and confusion. A well-organized checklist simplifies both document collection and future audits.

Step 3: Draft the Checklist

Create a detailed document listing all required items, with clear explanations for each. Use simple language to specify what needs to be collected, why it is required, and the format (digital, physical, or both). Ensure the checklist includes a section for verifying document completion and signatures where applicable. Design the checklist to be user-friendly, allowing HR teams to easily track progress. Include flexibility to adapt the checklist to different roles or regions.

Step 4: Set Up a Filing System

Establish a secure and efficient filing system to store employee records. Decide whether to use physical files, digital storage, or a hybrid model based on your organization’s needs. For digital files, invest in reliable HR software or cloud storage platforms that offer encryption and access controls. Label files systematically and establish access permissions to maintain confidentiality. A well-structured filing system ensures quick retrieval and protects sensitive information. You can also see more on New Hire Checklists.

Step 5: Review and Update Regularly

Schedule periodic reviews of the checklist to incorporate changes in legal regulations or company policies. Regular updates ensure the checklist remains relevant and effective for ongoing compliance and organizational needs. Train HR staff on using the updated checklist to maintain consistency in record-keeping practices. Encourage feedback from the HR team to identify gaps or inefficiencies in the current process. This continuous improvement approach ensures long-term usability and accuracy.

A well-managed Employee File Checklist boosts HR efficiency, fosters a transparent work environment, and minimizes compliance risks. By maintaining accurate records, organizations safeguard employees’ data, streamline onboarding, and promote trust. Embracing this structured approach leads to a more cohesive, organized, and law-abiding workplace. Ultimately, everyone benefits from consistent, reliable documentation. You can also see more on Orientation Checklist.

FAQs

What are the advantages of keeping employee files?

A business that continues to keep employee files would experience these advantages:

- To comply with the local, state, or federal labor laws

- To have personnel documents prepared during an audit

- To bring evidence in court when an employee complains

- To have access to all the necessary employee files from onboarding to offboarding

- To automate and handle employee data in the most efficient approach possible

What are the common categories of an employee file checklist?

Dividing the enlisted files into categories was discussed in step three earlier. So if you need ideas on what the common categories of the employee file checklist are, these are the basic employee information, employment history, employee performance development, legal documentation, and employee termination records. You can also see more on Induction Checklists.

What should you not include in the employee file checklist?

Since you have already learned the necessary inclusions to an employee file checklist, what you should not include there are the pre-employment records (except the job application), medical information, driver’s licenses, bank accounts, immigration letters, and other private data.

What are the legal requirements for employee file checklists?

Legal requirements vary by country and industry but typically include maintaining tax forms, identification proofs, medical records, and employment agreements. These documents ensure compliance with labor laws, safeguard against audits, and reduce the risk of legal disputes. Companies must stay informed about regional regulations to keep their checklist compliant. You can also see more on Turnover Checklist.

How do organizations secure employee file checklists?

Organizations can secure checklists by using encrypted digital systems, limiting access to authorized personnel, and regularly auditing security measures. Physical files should be stored in locked cabinets with controlled access. These practices prevent unauthorized access and ensure confidentiality.

What challenges do companies face without an employee file checklist?

Without a checklist, companies may struggle with disorganized records, legal non-compliance, and increased risks during audits or disputes. It can also lead to inefficiencies in onboarding and offboarding processes, impacting employee satisfaction and organizational credibility.

How can small businesses implement an employee file checklist?

Small businesses can create a simple yet effective checklist by focusing on key legal and operational requirements. They can use free templates or software tools to digitize records and ensure secure, organized storage, making it manageable even with limited resources. You can also see more on Payroll Checklists.