50+ Sample Estate Planning Checklists

-

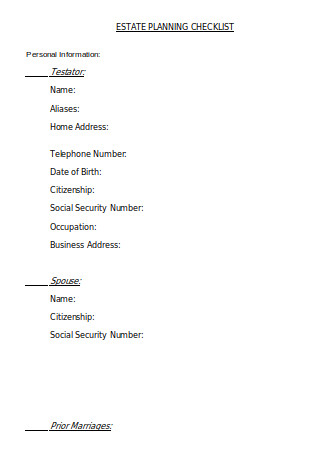

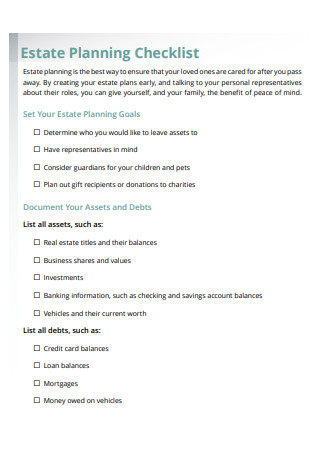

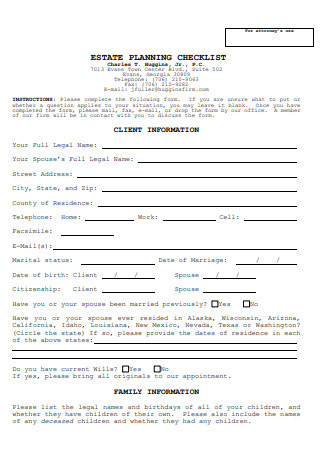

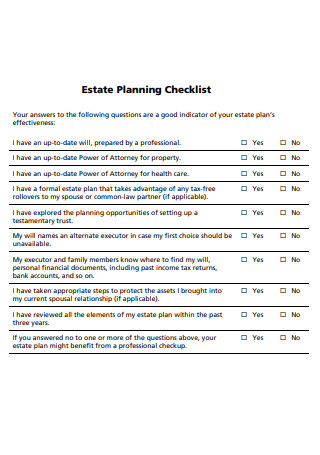

Estate Planning Checklist

-

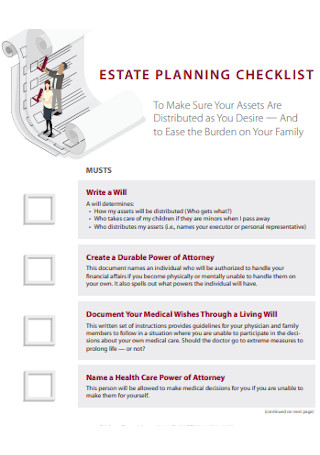

Basic Estate Planning Checklist

-

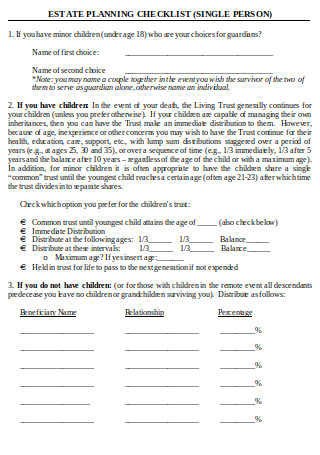

Estate Planning Checklist (Single Person)

-

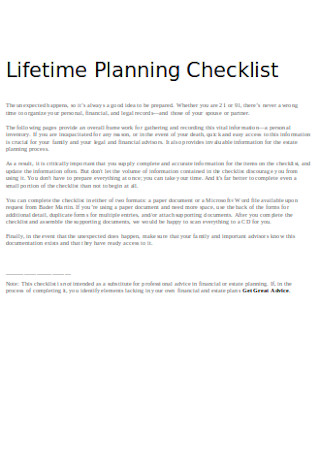

Lifetime Planning Checklist

-

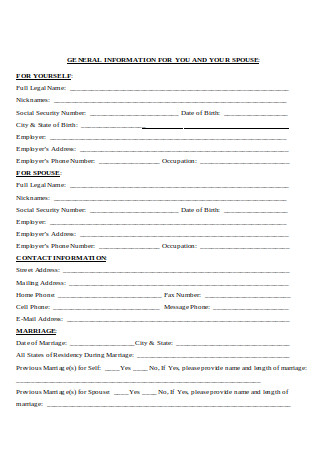

Estate Planning Checklist Fact Finder

-

Estate Planning and Management Checklist

-

Estate Planning Checklist Manual

-

Estate Planning (Checklist)

-

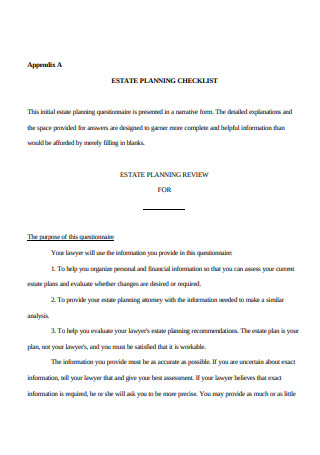

Estate Planning Questionnaire

-

Client Document Checklist

-

Survivor Planning Checklist

-

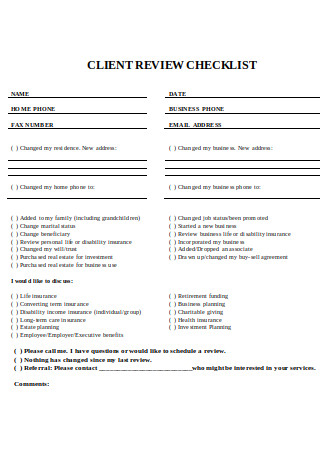

Client Review Checklist

-

Estate Planning Checklist Sample

-

Estate Planning Checklist for 2014

-

Formal Estate Planning Checklist

-

Simple Estate Planning Checklist

-

Professional Estate Planning Checklist

-

Estate Planning Checklist Format

-

Standard Estate Planning Checklist

-

Format of Estate Planning Checklist

-

Estate Planning Checklist Quick Start

-

Printable Estate Planning Checklist

-

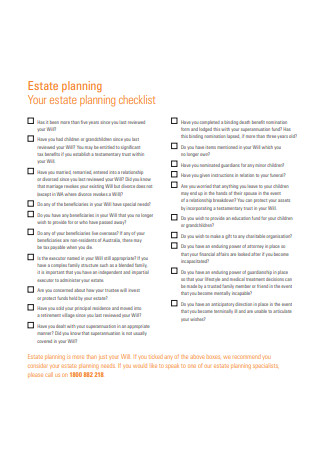

Your estate planning checklist

-

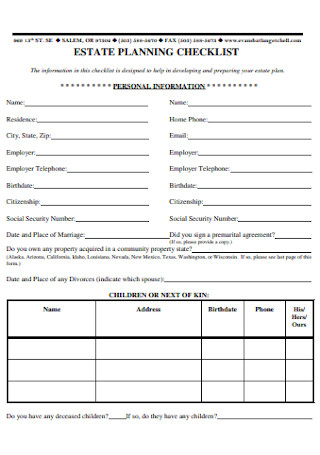

Estate Planning – Checklist

-

Estate Planning Checklist in PDF

-

Estate Planning Deficiencies Checklist

-

Comprehensive Estate Planning Checklist

-

Estate Planning Checklist Outline

-

Simple Estate Planning Checklist Outline

-

Current Estate Planning Checklist

-

Estate Planning Review Checklist

-

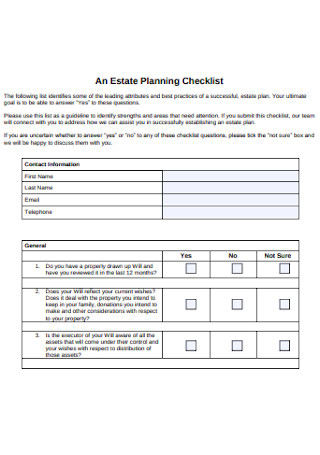

An Estate Planning Checklist

-

Standard Format of Estate Planning Checklist

-

Estate Planning Checklist Printable Form

-

Formal Estate Planning Checklist in PDF

-

Simple Estate Planning Checklist in PDF

-

Printable Estate Planning Checklist Sample

-

Sample Estate Planning Checklist

-

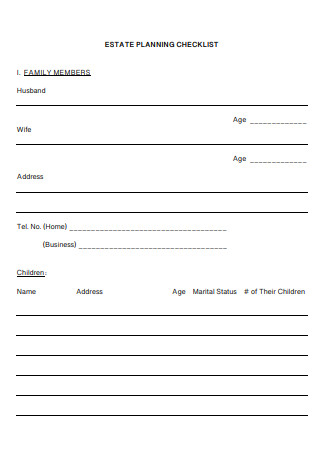

Family Members Estate Planning Checklist

-

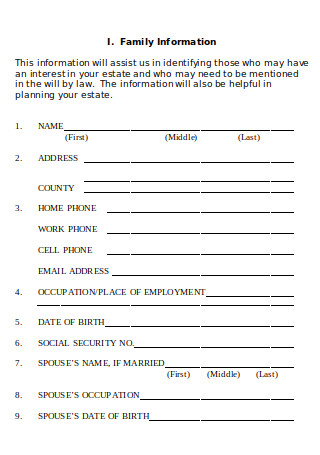

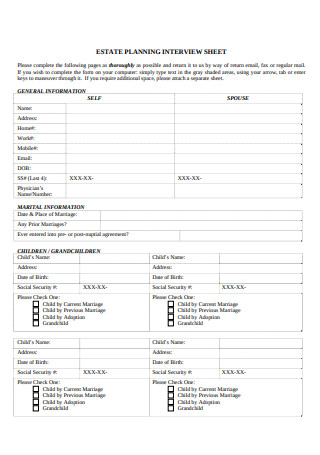

Estate Planning Interview Sheet

-

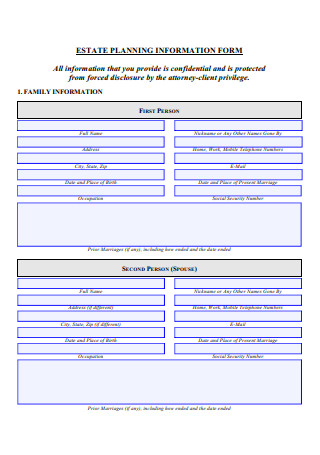

Estate Planning Information Form

-

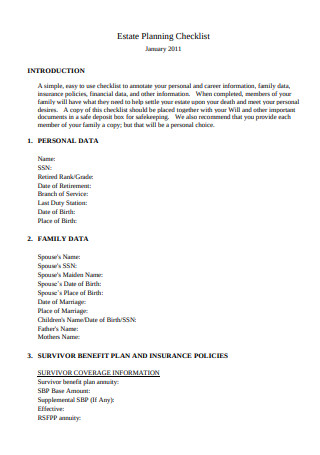

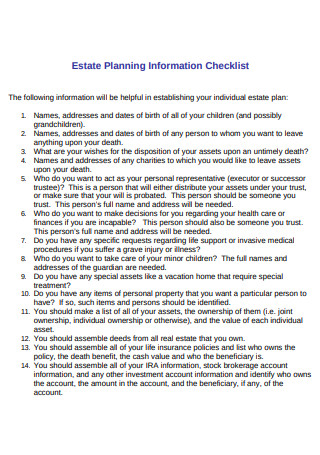

Estate Planning Information Checklist

-

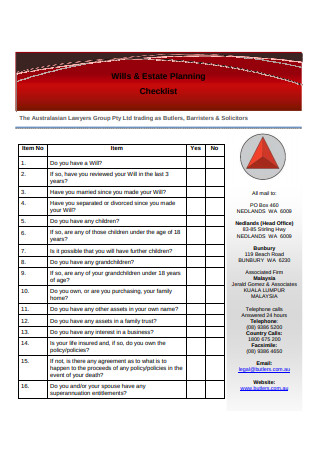

Wills and Estate Planning Checklist

-

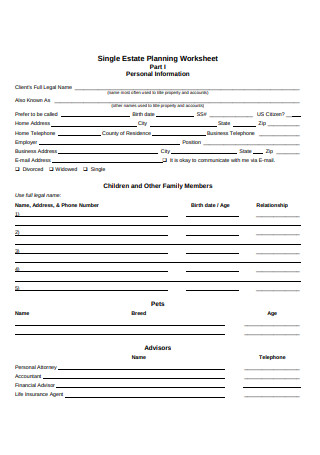

Single Estate Planning Worksheet

-

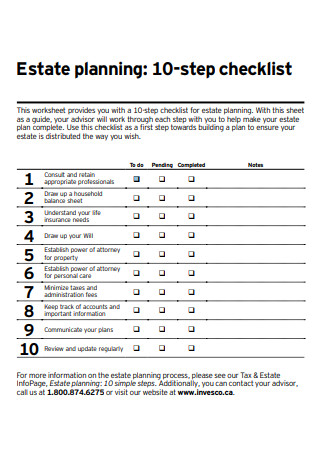

Estate Planning 10-Step Checklist

-

Your Estate Planning Checklist Sample

-

Personal Estate Planning Checklist

-

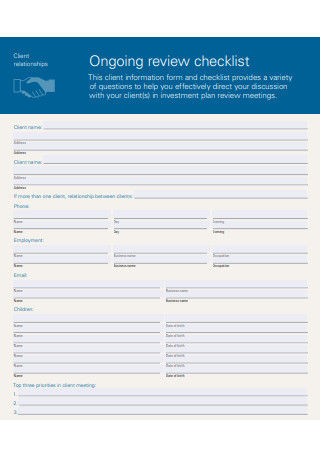

Ongoing Review Checklist

-

Annual Estate Plan Checklist

-

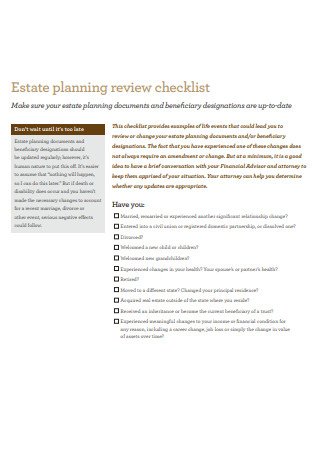

Sample Estate Planning Review Checklist

-

Estate Planning Attorney Checklist

FREE Estate Planning Checklist s to Download

50+ Sample Estate Planning Checklists

What Is Estate Planning?

The Importance of Estate Planning

How to Create an Estate Plan

The Dos and Don’ts of Estate Planning

What Is Estate Planning?

Estate planning is the process of transferring the rights and responsibilities to handle your assets following your death or incapacitation. This is done to avoid the unfortunate and often costly consequences brought by the inevitable. When you are unable to make important decisions and live independently anymore, the estate plan will help guide your chosen executor and/or agent in making decisions that meet your desires.

The Importance of Estate Planning

Truth is, we’re all living on borrowed time. We can never predict the future or what happens to the people around us when we’re gone. But living with a “whatever happens, happens” mindset isn’t exactly the best option to set for ourselves and the people we love.

According to the AARP Foundation, 29% of people claim that the reason they don’t have an estate plan is that they don’t think they have enough assets to leave to anyone. Contrary to this belief, estate planning isn’t only for the rich or privileged. You don’t need to have a multimillion-dollar home, a valuable art collection, or a large IRA to pass on in order to qualify for an estate plan. Anyone with an estate plan is likely to live a less complicated life than those without it. Not only does estate planning allow you to choose who gets what from your assets, but it also minimizes the likelihood of conflict and ugly legal battles between family members. The last thing any parent would want is for their children to pit against each other because of their selfish intentions.

Nobody wants to think about dying at a young age, especially for parents to young children. But as heartbreaking as it is for you to think about, planning for the inevitable is a crucial part of responsible parenting. Parents are encouraged to name guardians for their children in the event of an untimely death before the child turns 18. Without a plan in place, the child will be taken under the custody of state officials until the court decides what happens next. This can be a frustrating experience for relatives of the family who are more than willing to raise the child close to home. With all that said, it’s safe to say that estate planning can go a long way toward keeping your finances, assets, and loved ones in good hands.

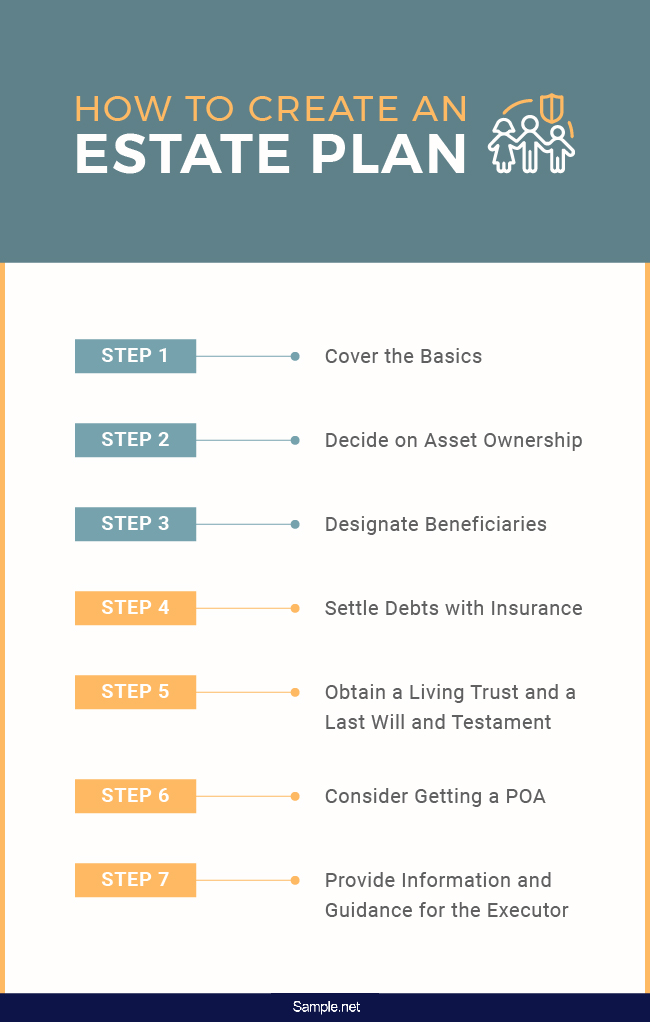

How to Create an Estate Plan

Talking about one’s death is sometimes treated as a taboo in modern society. People don’t like thinking about what might happen to them when they’re no longer capable of doing the things they do now due to a terminal illness or a sudden death. But putting your reluctance aside to plan out the future of your assets and the people you leave is an essential part of living. Unfortunately, most people don’t know where to start with their estate plan. Writing a will is only a part of a more complex process that the author of the estate plan would want to complete. To learn more about the basics of estate planning, check out this estate planning checklist.

Step 1: Cover the Basics

A well-laid plan should consider the circumstances of both death and disability of the plan’s author. What happens to your property, the financial well-being of your family and the means of eliminating estate taxes should all be considered in estate planning. This section of the checklist must also take the guardianship of any minor children and the medical treatment planning of the grantor into account.

Step 2: Decide on Asset Ownership

You might own the title to a few major assets that are strictly covered under your names, such as that of real estate properties and motor vehicles. In such scenarios, title documents must be set to make sure that the title of these assets is automatically passed to its co-owner. While having a joint owner does have its fair share of disadvantages, it does ensure that the property stays with someone you trust.

Step 3: Designate Beneficiaries

If you want someone to receive one of your properties upon your death without giving them the rights of ownership, this may be specified in the estate plan. This is typically done through the assistance of your bank and other financial accounts that allow you to designate a beneficiary. A transfer-on-death deed can be useful for those who want to avoid the probate process and to enable the grantor to fully and freely own the property until his or her death.

Step 4: Settle Debts with Insurance

As much as we hate to admit it, the expenses that the family of the deceased incurs after the death of their loved one can be pretty hefty. Thankfully, estate planning allows you to settle all of your debts to ensure that your loved ones are provided for in the event of death or disability. This is usually addressed through auto, homeowners, disability, and life insurance plans.

Step 5: Obtain a Living Trust and a Last Will and Testament

These are three crucial documents you must consider getting as you prepare your estate plan. A living trust is essential to ensure that your property is distributed accordingly. This is especially beneficial for those that have a large estate and many beneficiaries to address. Having a last will and testament also makes it easy to transfer the rights of your property to its designated beneficiaries or owners. This can also help deal with the care and well-being of any minor or disabled children.

Step 6: Consider Getting a POA

A financial power of attorney and a medical (health care) power of attorney authorizes a trusted individual to handle financial or medical affairs on your behalf. The person giving the authority is called the principal, while the person who is granted to perform the act instructed by the principal is known as the agent or attorney-in-fact. The terms of the power of attorney must be carefully worded to limit the authority granted to the agent. It is also important to ensure that the individual appointed to take action is properly briefed on the matter so that the POA may be executed as expected.

Step 7: Provide Information and Guidance for the Executor

Leaving valuable information and guidance for the executor to take note of will help clarify and identify your financial accounts, insurance policies, credit cards, vehicle loans, and mortgages correctly in case of incapacity or death. You can even provide your relatives and friends with instructions on what they are authorized to do with your body once your heart stops beating.

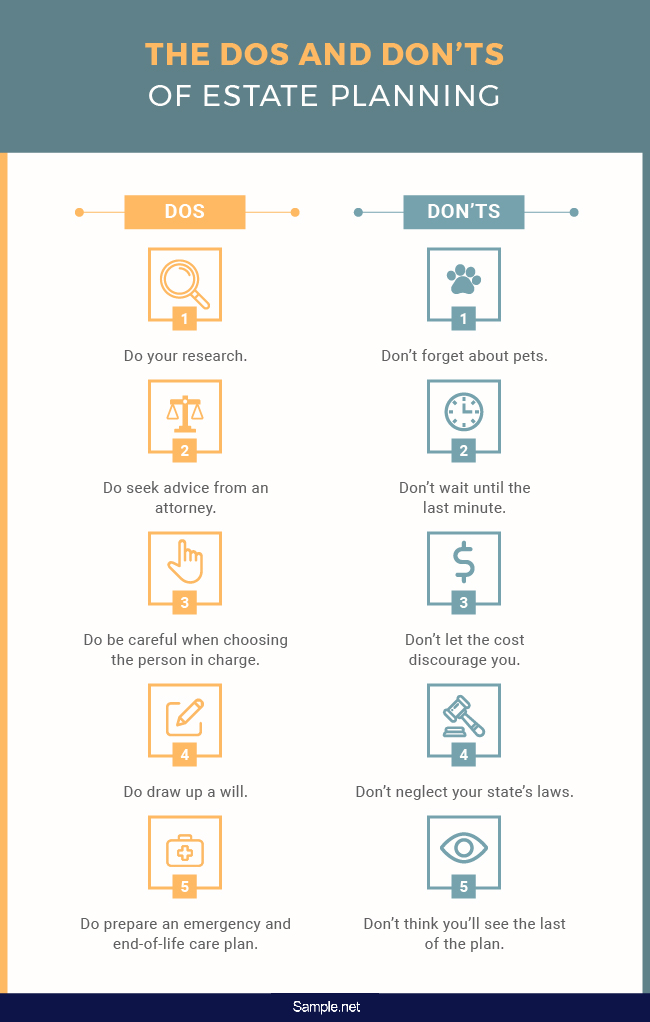

The Dos and Don’ts of Estate Planning

As if dealing with the death of someone close to you doesn’t put a strain on your emotional state, there’s a long and exhausting process of handling the person’s estate in order to earn the right to manage their assets. You can avoid the heavy paperwork and regular court hearings by making sure that the basic documents are in place. Despite the weight of responsibility that comes with the task, estate planning does not need to be complicated for anyone. Listed below are a few reminders to consider when planning.

Dos

1. Do your research.

Now that we live in the age of technology, you can easily learn about the basics of estate planning simply by surfing the Internet. There are many resources available online that can help you get started with the early stages of the process. While you might already know the importance of a last will and testament, there are other relevant matters that are also worth learning. This includes a living will or a medical power of attorney that will direct the health care proxy in determining the best care and treatment you wish to receive in the event that you are no longer capable of communicating these wishes yourself. Educating oneself on matters that concern your well-being will always come as an advantage at some point in your life.

2. Do seek advice from an attorney.

Even if you think you don’t need the help, it’s still a good idea to consult a legal expert to make sure you have every single aspect of the plan covered. Seeking assistance from an attorney is also essential when it comes to conforming with the laws of your state. As much as you hate to admit it, the law can be pretty complex to someone who doesn’t have the slightest clue about the rules and regulations that apply to an estate plan. Note that it is crucial to handle legal matters with someone who is already familiar with how it is done; otherwise, you could end up complicating what’s supposed to be simple.

3. Do be careful when choosing the person in charge.

Choose someone you believe is knowledgeable and reliable enough to manage your affairs. Don’t make the decision unless you’re certain. It’s easy to leave everything to your spouse or adult child, but you still need to consider factors that could affect the purpose of your estate plan. For instance, appointing your spouse might seem like an easy answer, but is he or she capable of executing your will? Will he or she have the mental and emotional capacity to make decisions on your behalf, particularly in times of emergency? It’s a tough decision to make, so be sure to discuss this dilemma with your family and your lawyer beforehand.

4. Do draw up a will.

If you only need one estate planning document to complete, most people prioritize their last will over anything else. People who die without a will are considered “intestate,” which means that everything they own will be distributed according to the intestacy laws of the state. A last will allows you to designate who gets what after your death to ensure that your possessions do not wind up in the wrong hands. It even lets you specify a guardian for your children who are below the age of legality. That way, the court will not have the authority to make this decision for you.

5. Do prepare an emergency and end-of-life care plan.

Another thing that deserves a top spot on your list of estate planning must-haves includes an advance directive. This document provides instructions regarding the medical care and treatment you wish to receive in such a time that you are unable to make this decision yourself. While you might not feel the importance of an emergency and end-of-life care plan at this point in time, your future self will definitely see its purpose come to play when faced with a life-threatening condition from a disease or accident.

Don’ts

1. Don’t forget about pets.

You’ve probably heard the news about a hotel heiress leaving her precious pooch with millions of dollars in inheritance. But as ridiculous as it sounds, a lot of pet owners feel the need to include their pets in the planning of their estate. The law recognizes pets as the principal’s personal property, so it’s only natural to decide who will be in charge of caring for them once you’re gone—that is, assuming that they outlive you. Setting a trust fund for your pet is also a real thing that you can consider doing as a personal wish. The trust should detail the funds along with the instructions on how the money will be handled to take care of the animal.

2. Don’t wait until the last minute.

Estate planning is for everyone, regardless of age and health. You don’t want to wait until something bad happens to finally realize the importance of having an estate plan in place. It’s always a good idea to tackle the subject while you’re still in the position to make rational decisions for yourself. A person who is of legal age and with a sound mind is considered competent under the lawful condition of estate planning. This must be done carefully and objectively to ensure that your goals are met and that the plan is legally valid. After all, there’s no time like the present to get moving with your estate plan.

3. Don’t let the cost discourage you.

Just because it’s going to cost you doesn’t mean it isn’t worth it. Every single document drafted for the estate plan comes with a price. Keep in mind that these documents must be drafted professionally in order to meet the state’s legal requirements. If not, the executor or the attorney-in-fact may find it difficult to adhere to your wishes after finding out that your will or POA is deemed impossible to enforce in court. Seeing how much a lawyer might charge you for the services might leave a huge dent in your savings, but it’s always better to be safe than sorry.

4. Don’t neglect your state’s laws.

One of the things to always remember is that laws often vary from state to state. If you decide to move to another state only a few years after establishing your will, you may want to double-check its validity to ensure that it is in accordance with the law. Consider working with a legal expert who is highly knowledgeable about your state’s requirements as well. You can read about your state laws that cover the terms of estate planning from various government-based sources online for your reference.

5. Don’t think you’ll see the last of the plan.

Don’t assume that once you have everything signed, you’re set for life. The reality is that you’re never really through with your estate plan for as long as you are capable of changing its terms. Major events in your life may force you to change some parts of the estate plan in order to keep it relevant. Births, deaths, marriages, and divorces are just some examples of life-changing events that can affect the validity of your estate plan. Thus, be sure to update these documents as soon as the time calls for it.

Everyone needs some kind of estate plan for the unforeseeable future. It’s not something exclusively for the wealthy, as anyone can benefit from planning how their finances and other assets are taken care of when they are no longer capable of doing so themselves. With the use of an estate planning checklist, you can minimize the risks and pricey consequences that come with state estate taxes and state inheritance taxes.