50+ SAMPLE Legal Checklist

-

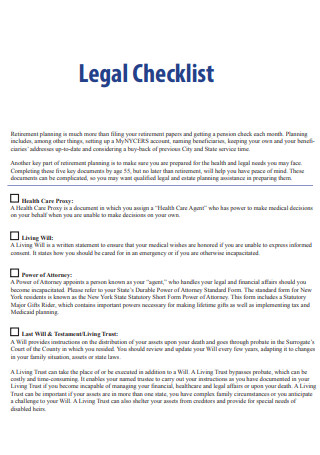

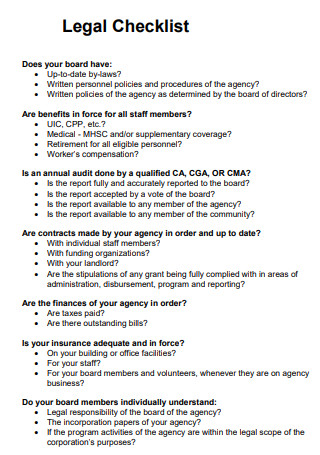

Legal Checklist

download now -

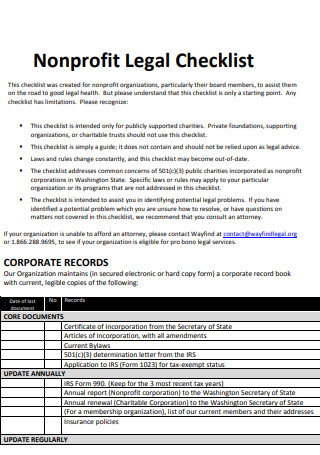

Nonprofit Legal Checklist

download now -

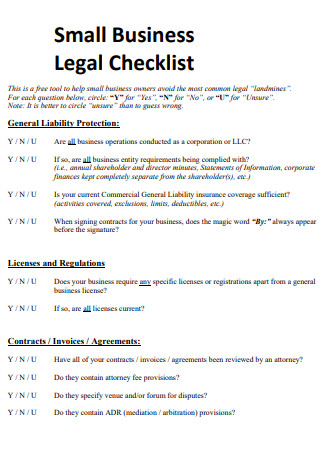

Small Business Legal Checklist

download now -

Legal Audit Checklist

download now -

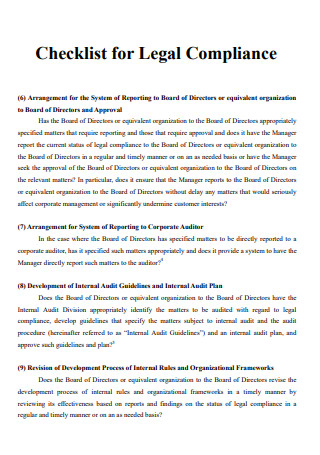

Legal Compliance Checklist

download now -

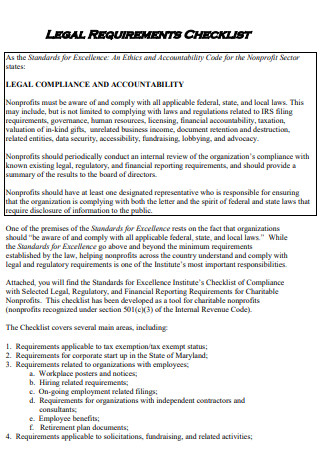

Legal Requirements Checklist

download now -

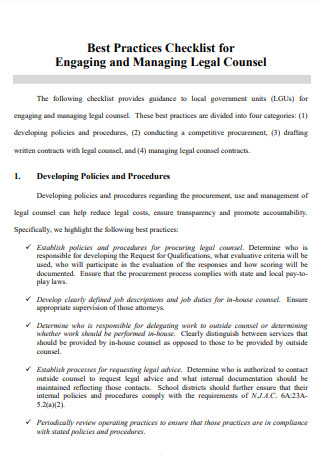

Managing Legal Counsel Checklist

download now -

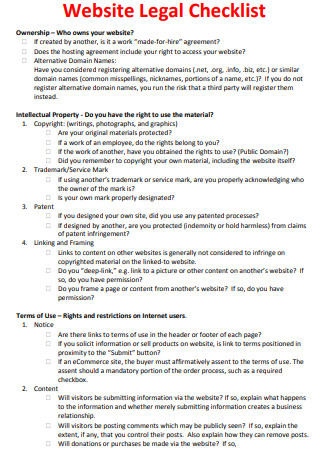

Website Legal Checklist

download now -

Sample Legal Checklist

download now -

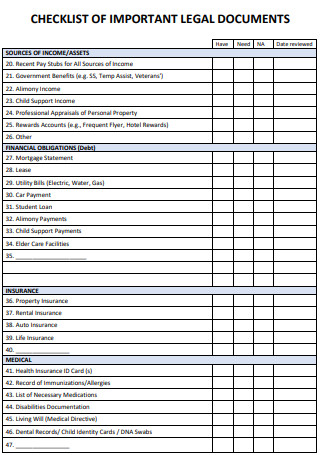

Important Legal Document Checklist

download now -

Annual Legal Review Checklist

download now -

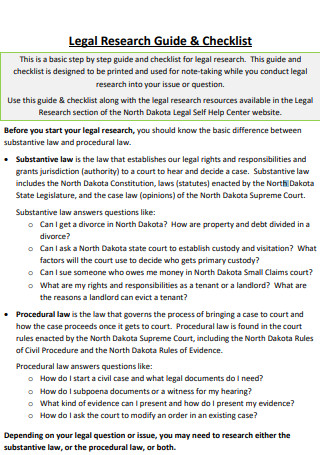

Legal Research Guide & Checklist

download now -

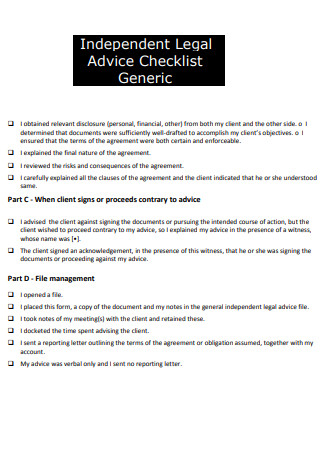

Independent Legal Advice Checklist Generic

download now -

Legal Description Checklist

download now -

Startup Legal Checklist

download now -

Accounting Legal Service Provider Checklist

download now -

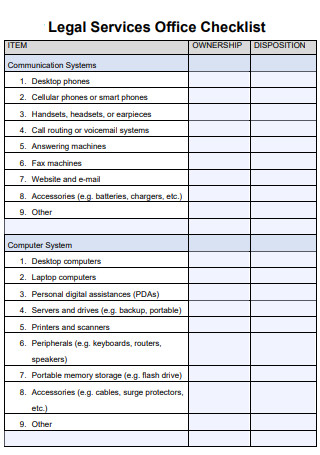

Legal Services Office Checklist

download now -

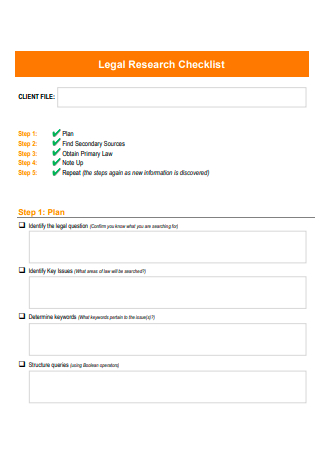

Legal Research Checklist

download now -

IT and Legal Checklist

download now -

Simple Legal Checklist

download now -

Conforming a Legal Name Checklist

download now -

Legal and Business Considerations Checklist

download now -

Legal Checklist for Congregations

download now -

Legal Office Checklist

download now -

Legal Readiness Checklist

download now -

Legal Lot Status Checklist

download now -

10-Step Legal Checklist for Your Adult Child

download now -

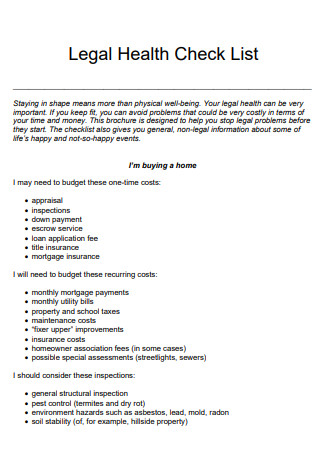

Legal Health Checklist

download now -

Legal Industry Checklist

download now -

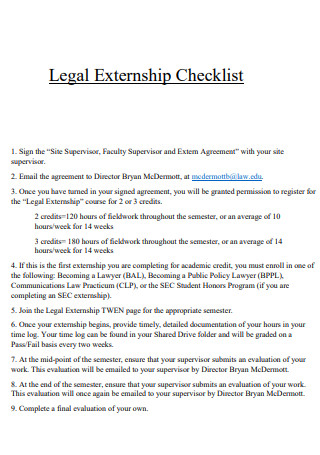

Legal Externship Checklist

download now -

Legal Checklist for Veterinarians

download now -

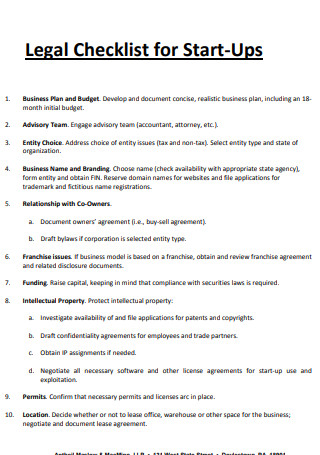

Legal Checklist for Start-Ups

download now -

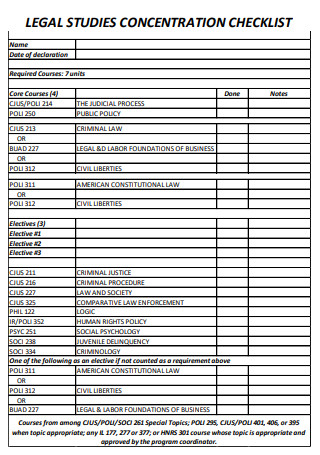

Legal Studies Concentration Checklist

download now -

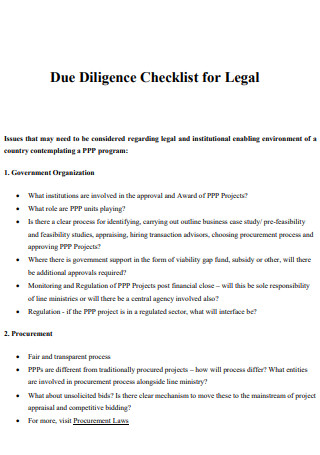

Legal Due Diligence Checklist

download now -

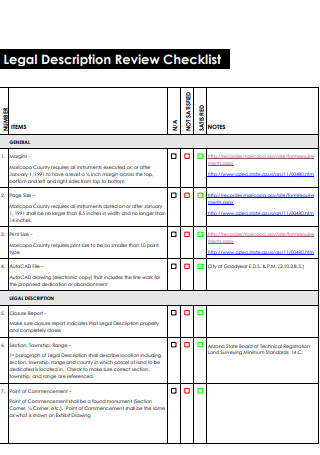

Legal Description Review Checklist

download now -

Legal Checklist Example

download now -

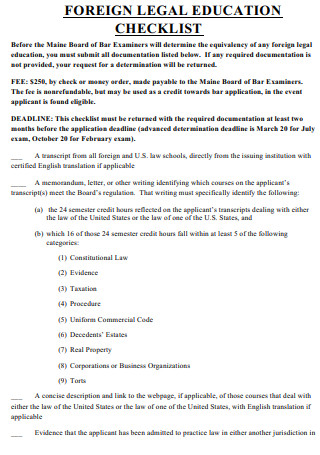

Foreign Legal Education Checklist

download now -

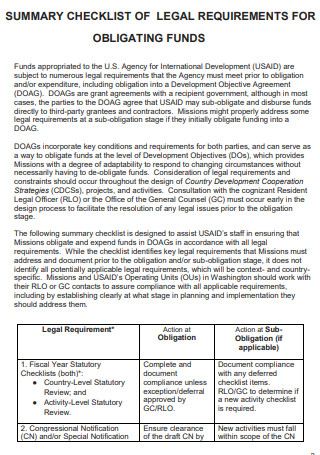

Legal Requirements for Obligating Checklist

download now -

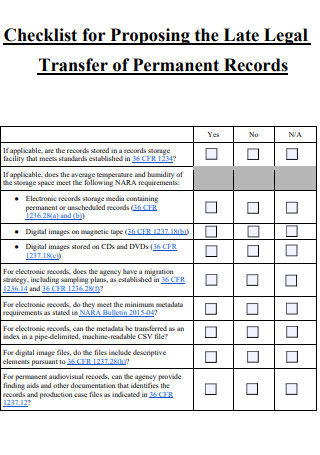

Late Legal Transfer Checklist

download now -

Legal Checklist for Womens Economic Equality

download now -

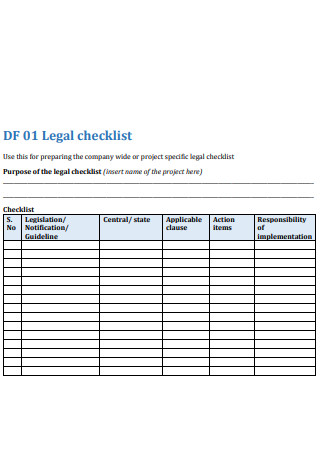

Legal Checklist Template

download now -

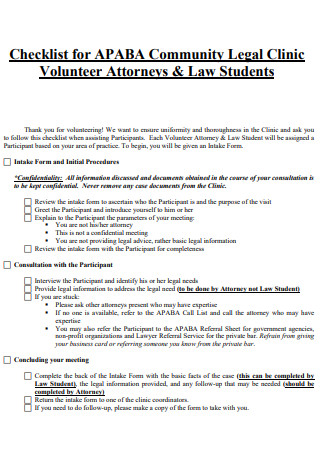

Community Legal Clinic Checklist

download now -

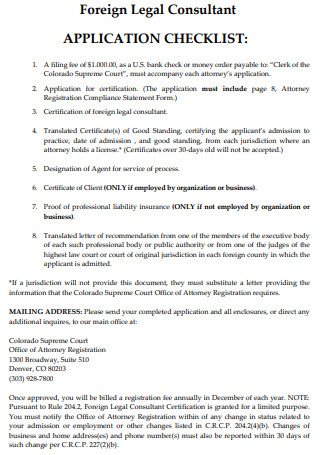

Foreign Legal Consultant Checklist

download now -

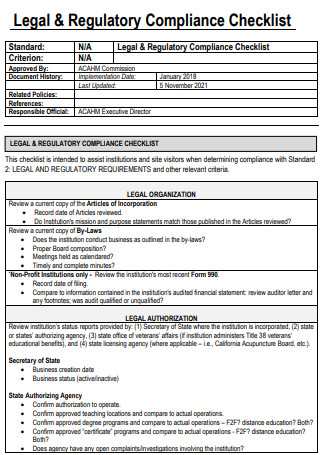

Legal & Regulatory Compliance Checklist

download now -

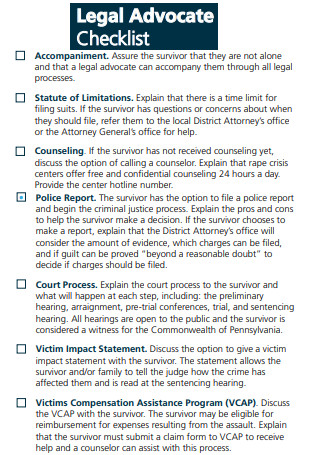

Legal Advocate Checklist

download now -

Legal Isuues Checklist

download now -

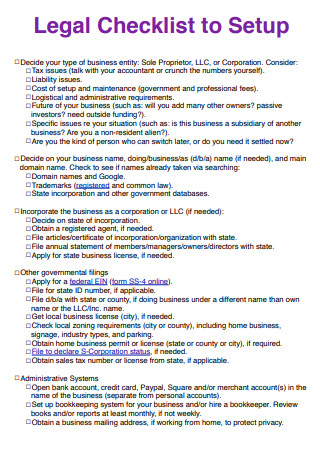

Legal Checklist to Setup

download now -

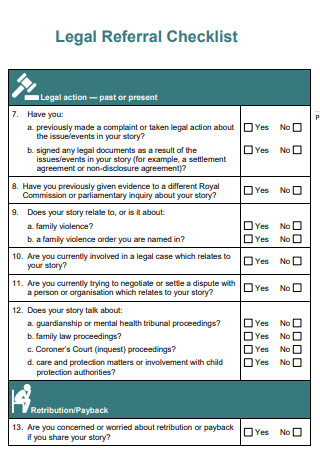

Legal Referral Checklist

download now -

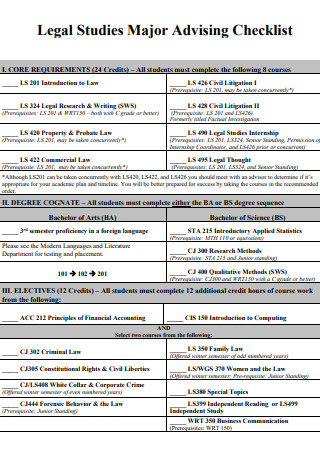

Legal Studies Major Advising Checklist

download now -

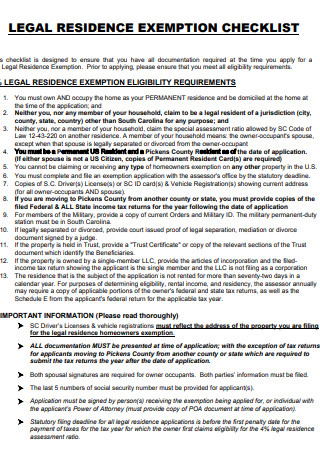

Legal Residence Checklist

download now -

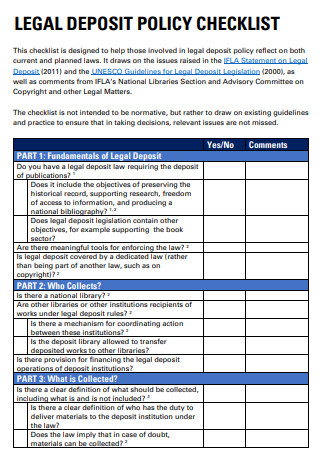

Legal Deposit Policy Checklist

download now

What Is Legal Checklist?

Legal Checklist is any document prepared by the assessor in the course of the exercise of the professional duty, specifically a decision, report, indictment, legal opinions, and other acts that prove the person’s professional capacities. Checklists will help make sure you do not miss critical steps or questions, especially when they seem mundane and familiar because you have done them many times before. Legal Checklists help lawyers ensure that they are covering all issues when working through a project. Using timelines, flowcharts, tables, decision trees, and lists of issues, you can track steps to completion of any legal undertaking.

While legal matters can appear to be fairly simple and routine in their initial stages, they often end up being more complex as clients may not mention relevant details about their circumstances, and it is easy to overlook asking a key question in an intake interview. In addition, drafting an agreement may appear as a simple task at the start only to become more complex as details are fleshed out and pen is put to paper. The demands and pressures of a busy practice can make it easy to misunderstand or overlook the importance of something a client has told you or miss a deadline. Your clients expect you to identify and highlight all relevant issues for them.

What Does a Legal Checklist for Startups Include?

This legal checklist for startups will help you avoid falling into the kinds of traps that we often see businesses falling into. Basically, you want to have all of the following in place as soon as possible:

Steps on How to Write Legal Checklist of Businesses:

Step 1: Designate The Proper Business Entity

Choose the proper business entity or structure for your startup. This is crucial because it affects your personal liability, what you pay in taxes, and your fundraising ability. Possible structures include sole proprietorship, general and limited partnership, C-corporation, S-corporation, and limited liability company. Once you decide which structure is best for your company, officially designate it through your secretary of state.

Most small businesses start out as sole proprietorships or partnerships because these require minimal paperwork and set up time. However, these types of businesses also do not offer sufficient liability protection for business owners.

Step 2: Check the Needed Licenses, Permits, and Registrations

Depending on your type of business and where it is located, you might need particular business licenses and permits. Licenses, permits, and registrations come in many variations like local business licenses, building permits, health safety-related permits, permits for home-based businesses, fire permits, industry-related permits (like running a legal practice, hospitality, construction, or manufacturing business), liquor licenses, and many more.

Make sure to do thorough research with the help of your counsel—on what you need to be compliant with the law in your area.

Step 3. Make Sure You Are Paying Proper Business Taxes

Every business owner is legally required to pay taxes. This includes income tax, self-employment taxes, and for some businesses, sales tax. It is wise to hire an accountant or tax advisor to make sure you are compliant with all tax laws. Accounting software can also help you figure when to file taxes and what forms you need to fill out.

Step 4: Do Proper Bookkeeping

In most places, you are obligated by law to record all business transactions according to a specific accounting method. See what’s required of you for your industry and location in terms of record-keeping obligations, and set up a proper filing and bookkeeping system for all documents and transactions. This will greatly help you down the line in doing taxes or if you ever run into other legal troubles.

Step 5: Get a Founder’s Agreement in Writing

If your business operates with multiple business owners, it is important to make sure that each person knows and understands their rights and responsibilities in relation to the business. You need designated legal counsel to make sure the agreements and articles are sound. How this comes about depends on your business structure. If you form a corporation, you need a proper shareholder agreement and articles of incorporation. If you form an LLC, you will need articles of organization and an LLC operating agreement.

Step 6: Set a Vesting Schedule for All Founders and Early Employees

This is a practical measure many startups often overlook when they are just starting out and excited about getting off the ground. But this will protect your business down the line and ensure a certain level of commitment each founder or early employee brings to the table.

Creating a vesting schedule upon incorporation states that stock ownership will vest over time, preventing investors from selling all their stock whenever they please.

Step 7: Protect Your Intellectual Property

Intellectual property includes patents, copyrights, trademarks, and trade secrets as well. Be sure to file any patents as soon as possible—a process that can take more than five years. Protecting your intellectual property will be attractive to investors—but it will also help you sleep easier at night. Having exclusive rights to reproduce and display your work will make your life much, much easier down the line and make sure that no one tries to rip any IP rugs out from under you.

Step 8: Classify Your Workers Properly

Many startups often misclassify their early employees. It is important to know what kind of worker you are hiring—essentially, the difference between an independent contractor vs. employee. This is important for tax reasons for both you and the employee and will help clarify what is and is not expected from you and the employee. If you misclassify an employee as an independent contractor, you could be on the hook for costly penalties and back wages.

Step 9: Purchase Workers’ Compensation Insurance

In some places, most businesses with employees are legally required to purchase workers’ compensation insurance. Coverage should begin from the very first day your employee starts working. This insurance covers medical and legal costs associated with work-related employee injuries and illnesses. State laws about workers’ compensation vary, so make sure you check your state’s rules.

Step 10: Make Sure You Are in Compliance with Securities Laws

Founders and investors of LLCs, C-corporations, and partnerships are subject to federal and state securities laws. These laws were made to require companies to provide reliable and accurate information about their businesses to enable a fair market. In addition, they also protect from insider trading and trading fraud. Failure to comply with these laws can result in the startup having to repurchase all of its shares at the issuance price, even if the company has lost all of its money.

Step 11: Follow Email Regulations

Email marketing is a huge part of many businesses. When you send emails to your customers or when you are targeting potential customers via email campaigns, you need to find out what the applicable email regulations are.

Step 12: Establish a Privacy Policy

A privacy policy is a legal statement that specifies what a business does with the personal data collected from users or customers, along with how the data is processed and why. Violation of privacy laws can lead to criminal liability—depending on your state, this can mean hefty fines—so it is important that startups have proper privacy policies in place and carefully adhere to them. The Small Business Administration has a great guide for establishing an appropriate privacy policy for your business.

Step 13: Create a Company Handbook

Once you have all the legal headaches sorted out and sounded, make sure everyone in the company is aware and understands your company’s legal liabilities just as well as you do—as a business owner, you could be liable for anything your employees do while representing your organization. Company or employee handbooks are a great way to instill the values and legal boundaries of your company. It can also help to establish what is and is not appropriate behavior internally and externally. Have your legal counsel look this over well or even help you write it, and then get the company together to go over the material.

Step 14: Hire Competent Legal Counsel

In case this has not been clear throughout, work with lawyers on these complicated legal issues from the start. Startups are often so concerned about expenses that they overlook the importance of sound legal advice that could save them thousands, if not millions, down the line. You really can’t put a price on having the right lawyers on your side.

Basically, you will hire an experienced business attorney on employment law, contract law, securities law, and intellectual property law. You could hire a general counsel on your staff at some point, but it is common for the work to be spread out between different firms and attorneys. The cost is worth avoiding any legal trouble.

FAQs

What Is a Legal Responsibility?

Legal obligation means particular duties imposed upon a person to care or provide for another including liability for personal obligations as granted through a Power of Attorney or Court order.

Who Determines Legal Duty?

A judge, rather than a jury, ordinarily determines whether a defendant owed a duty of care to a plaintiff, and will normally find that a duty exists if a reasonable person would find that a duty exists under similar circumstances.

Why Are Legal Requirements Necessary?

Conducting some form of legal requirement training is mostly required by the government. Not only does it allow employees to understand their rights and responsibilities, but it also helps the business to reduce liability in the case of any mistakes made by the staff.

Planning and starting out a new business is a challenging pursuit. Part of what makes it so complicated is all the legal implications that come with it. As a business owner, you want to make sure you have covered all your legal bases to avoid any fines, lawsuits, or even jail time.

The good thing is, there are a lot of legal resources available to small businesses both online and through hired legal counsel. Checking these off the Legal Checklist will help you make sure that you do not run afoul of any laws. The sooner you take care of these things, the sooner you can focus on what you do best—selling your product or service.