5+ SAMPLE Payroll Audit Checklist

FREE Payroll Audit Checklist s to Download

5+ SAMPLE Payroll Audit Checklist

a Payroll Audit?

Benefits of Conducting a Payroll Audit Checklist

Mistakes To Avoid in Payroll Management

How To Perform a Payroll Audit

FAQs

What constitutes a payroll audit?

How are audit procedures defined?

How is payroll processed?

What Is a Payroll Audit?

A payroll audit is an examination of a business’s payroll processes to ensure their accuracy. Payroll audits look at various factors, including the number of active employees, pay rates, wages, and tax withholdings. At the very least, you should conduct a payroll audit to ensure your process is current and legally compliant once a year. Payroll audits are typically internal, meaning they are driven by you or another employee in your business. Internal audit reports can assist you in identifying errors and avoiding future external audits. Examine your payroll audit report following the review. Make any necessary adjustments for future payroll processing. Additionally, you may need to make changes retroactively. For instance, you could pay an employee retroactively or remit additional taxes to the IRS. Payroll expenses between 15% to 30% of gross income, according to research, are a safe zone for the majority of organizations.

Benefits of Conducting a Payroll Audit Checklist

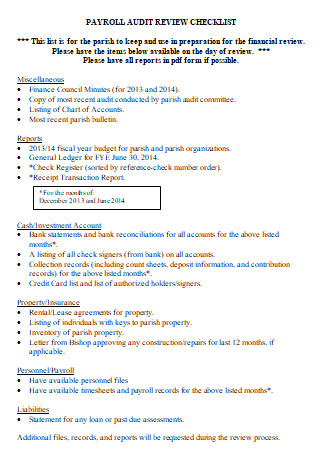

As you may be aware, many multi-employee businesses conduct payroll audits – also known as compliance audits report – to ensure compliance with a contributing employer’s records to verify that the employer made contributions to the plan as required by a collective bargaining agreement. Internal auditing is frequently conducted to ensure that documents are accurate and adequately maintained and identify problems early. This section will discuss several of the most compelling reasons to conduct routine internal payroll audits.

Mistakes To Avoid in Payroll Management

Payroll administration is a recurring responsibility and issue for every organization. Human resources and payroll personnel must be aware of the ongoing rule and regulatory changes, any new or updated forms, and the numerous layers of compliance necessary at the federal, state, and local levels. With all of these considerations, it’s understandable why many business owners lack confidence in their payroll process. Indeed, a recent survey revealed that more than half of organizations surveyed believe their payroll processes might be improved. There are probably dozens of errors and omissions that a regular payroll department can – and frequently does – make. The following is a rundown of some of the most commonly encountered issues with traditional payroll administration systems for businesses that handle payroll in-house:

1. Administrative Personnel

Numerous firms, particularly smaller ones, continue to manage payroll in-house and manually. Frequently, payroll personnel is overworked. A manual payroll system often needs a significant amount of paperwork, and it also places an administrative strain on your human resources team. For example, data entry errors might result in payment complications and the misapplication of regulations—inadequate staffing results in mistakes.

2. Payroll Records

A frequent issue is simply organizing all of your critical payroll and employee records and information efficiently and correctly. It is often a workflow: failing to centralize files and documents or establish uniform filing systems. A frequent difficulty is storing and organizing paper checks.

3. Configuration of Software and Payroll

A perplexing truth of technology is that not all payroll applications are compatible. For instance, the program used to create employee profiles or maintain employee information forms may be distinct from the system used to calculate salary and benefits. For some businesses, the issue is exacerbated by mismatched performance management programs. Too frequently, the methods used to establish a payroll process result in blunders and errors.

4. Absences of Employees

Keeping track of your employees’ vacation and sick days manually is a time-consuming operation that carries a high risk of error. Utilizing paper time cards or even simple monthly timesheets exposes a business to misuse and unintentional errors. Along with payroll, it is vital to track which employees are unavailable due to various forms of absences for optimal planning and maximum production.

5. Payroll Withholdings

Processing employee payroll deductions is undoubtedly one of the most challenging aspects of the payroll process for most businesses and payroll personnel. Due to the vast volume of state and federal rules governing deductions, it’s common for smaller firms and human resource departments to make errors. Along with being a difficult task, it is also a frequent source of errors during payroll processing.

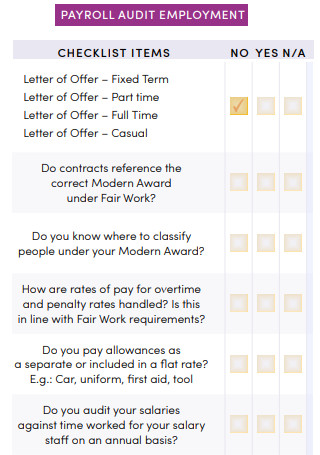

6. Classification of Employees

Numerous small firms use a variety of various types of employees. This includes full-time and part-time permanent employees, temporary employees, independent contractors, and vendors. This diversity of employee kinds and classifications frequently results in payroll complications. A business’s employees must be classified appropriately for tax purposes, as misclassification can result in employees failing to pay their required taxes. Failure to pay payroll taxes on time will almost certainly result in the IRS compelling the business to pay taxes on employee compensation, as well as fines and penalties.

7. Compliance with Regulations

As stated at the beginning of this section, payroll laws and regulations are subject to change. Almost annually, substantial changes are made to how payroll is processed at the federal and state levels. While organizations usually endeavor to stay current on regulatory developments, abundant knowledge frequently results in compliance gaps.

How To Perform a Payroll Audit

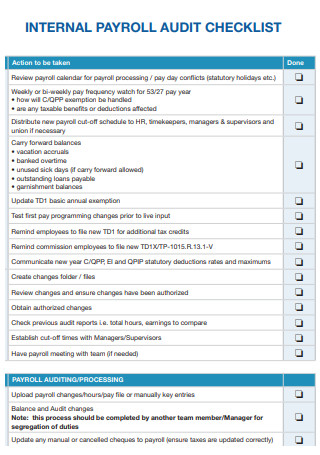

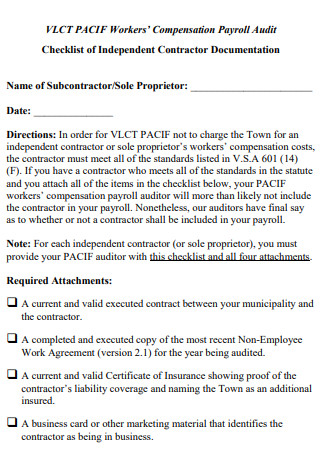

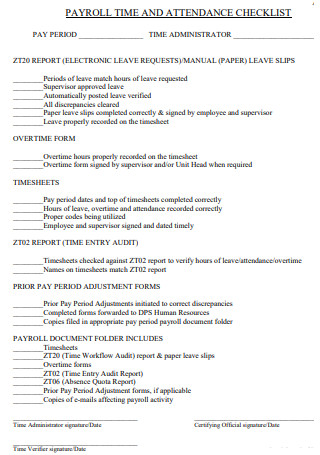

Let’s take a deep dive into your payroll budget spreadsheets to determine what’s happening. The following are the primary payroll audit procedures you should perform at least once or twice a year. You may wish to collaborate with an accountant to create a customized internal payroll audit checklist for your business.

Step 1: Take a look at the employees on your payroll.

Take a look at the employees listed on your payroll. Confirm that each of these individuals worked for you during the specified time. If you have more employees listed on your payroll than you employed, you may have a problem. Some employees commit payroll fraud by adding fictitious employees to payroll. Alternatively, you may have overlooked terminating an employee from your payroll. Ascertain that the list of employees on your payroll corresponds to your personnel records. Eliminate any employees who you no longer employ. You may need to conduct additional research to determine why those employees are on your payroll.

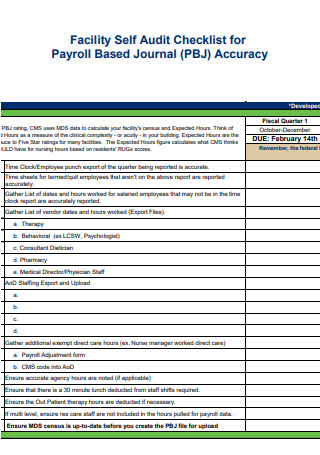

Step 2: Analyze your data.

You cannot avoid analyzing numbers when conducting a payroll audit. Payroll administration is primarily a numbers game—pay rate, hours worked, total pay for the period, and withheld taxes are just a few critical payroll figures. Examine the pay rate for each employee to ensure you paid the correct amount. Ascertain that the pay rate is current and consistent with the employee’s record. If you gave the employee a raise or salary reduction, ensure that the pay rate was changed on the applicable date. Examine the employee’s work hours. Were they genuinely employed during that pay period? Is your payroll system consistent with the information stored in your time and attendance software?

Step 3: Ascertain that the time is labeled correctly.

The majority of employers provide employees with time off, with many offering paid time off. Do you offer vacation time? If this is the problem, ensure that you or your employees properly label time for payroll purposes. Thus, you will be able to determine when an employee worked and when they did not. If you give a fixed number of paid vacation days, deduct them from the employee’s available vacation days. Label time off as vacation, personal, sick, bereavement, or whatever labels you choose.

Step 4: Payroll reconciliation.

After that, take a look at your payroll. Comparing your findings to other records will ensure that your totals are accurate. If there is a discrepancy, thoroughly examine your records to determine the source of the error. Contrast your payroll records with the general ledger of your business. Payroll expenses recorded in the public register should correspond to payroll audit findings. Following that, you must reconcile your payroll records and bank statements. Contrast the amounts recorded in your payroll records with those deducted from your account. Consider creating a separate payroll account to facilitate bank reconciliation.

Step 5: Ascertain the accuracy of tax withholdings, remittances, and reports.

Verifying the accuracy of your employment taxes is another critical step in the payroll audit procedure. Ascertain that the correct amount of taxes was withheld from each employee’s wages. Federal income, Social Security, and Medicare taxes must be withheld. Additionally, you may be required to withhold state and local income taxes. Also, verify that the tax amounts remitted are correct. Contrast the values on your payroll reports with the values in your payroll files. Payroll reports should accurately reflect the wages and tax withholding amounts in your payroll records.

Step 6: Ascertain compliance with applicable labor and record-keeping laws.

This is the last step, but it can occur at any point during your payroll audit program. Make yourself at home on the websites of the federal Department of Labor and state labor departments. That is the most reliable source for information about minimum wage changes, overtime laws, and payroll record-keeping policies. It is critical to stay current on changes to labor laws. Not only is noncompliance with labor laws unjust to your employees, but it also costs your business money.

FAQs

What constitutes a payroll audit?

A payroll audit can occur for various reasons:

- The government contacts you to inquire about possible wrongdoing. An employee complains about unfair pay practices.

- You decide to review your procedures, internally or through the use of an independent third party such as an accountant.

How are audit procedures defined?

Audit procedures are the methods and techniques that auditors use to gather sufficient, suitable audit evidence to make a professional judgment regarding an organization’s internal controls.

How is payroll processed?

Payroll is described as the process of paying a company’s employees their salaries. It begins with the preparation of a payroll list and concludes with the recording of payroll expenses. A payroll cycle is a time between two salary payments. Businesses might choose to pay employees weekly, biweekly, or monthly.

You are not required to conduct a payroll audit after the fiscal year. Pay attention to your gut. If something appears to be amiss in your accounting system or payroll bank account, it is time to investigate. After all, your money and business reputation are in danger if payroll breaches occur that you are unaware of. By conducting frequent payroll audits, you can prevent paying delinquent taxes or being sued for unfair pay practices.