50+ SAMPLE Risk Checklist

-

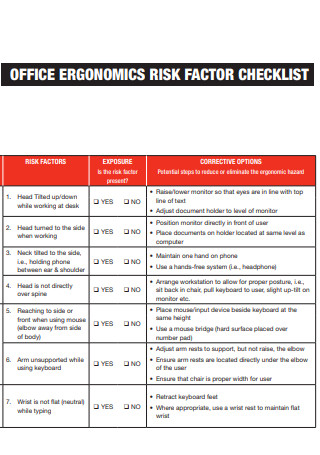

Office Risk Factor Checklist

download now -

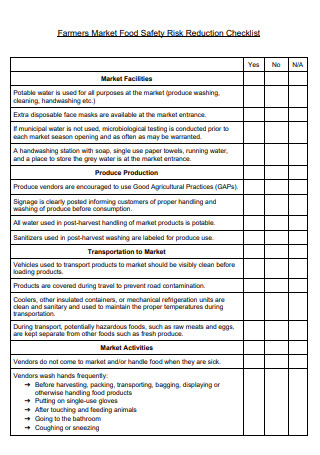

Farmer Market Food Safety Risk Reduction Checklist

download now -

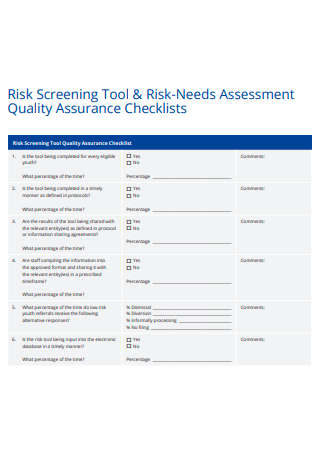

Risk Needs Assessment Quality Assurance Checklist

download now -

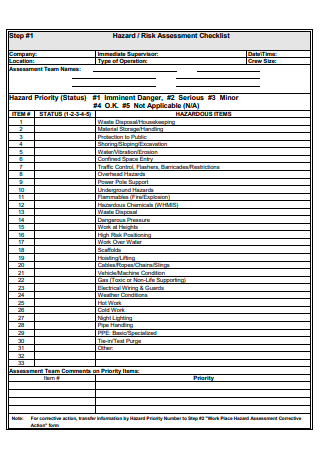

Hazard Risk Assessment Checklist

download now -

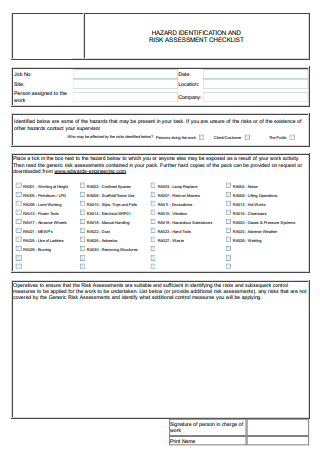

Hazard Identification and Risk Assessment Checklist

download now -

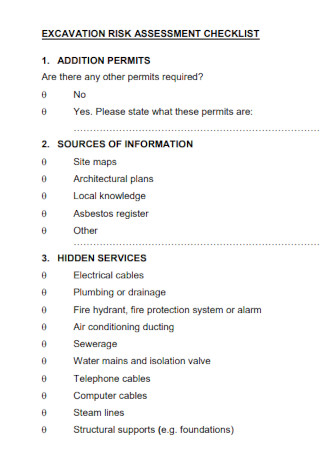

Excavation Risk Checklist

download now -

Reduce Risk Home Safety Checklist

download now -

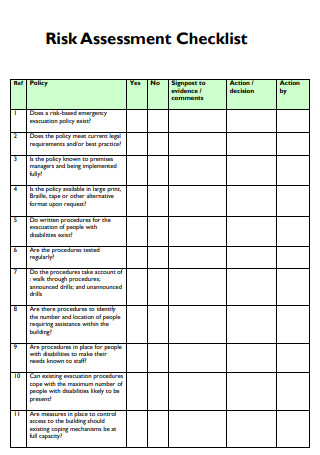

Risk Assessment Checklist

download now -

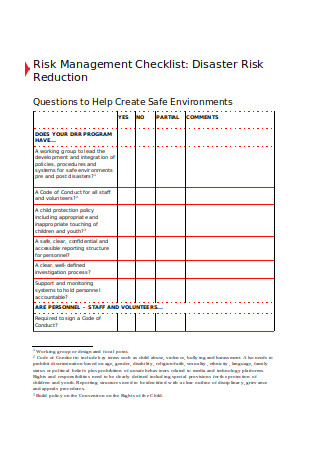

Risk Management Checklist

download now -

Dash Risk Checklist

download now -

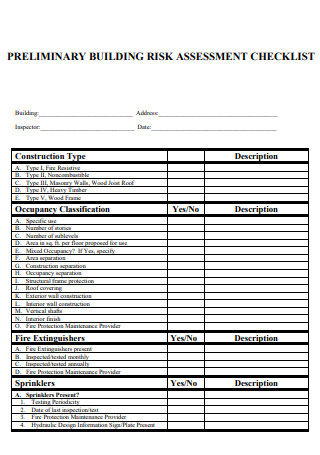

Preliminary Building Risk Assessment Checklist

download now -

Risk Control Self-assessment Checklist

download now -

Risk Governance Checklist

download now -

Risk Reduction Gender-Sensitive Checklist

download now -

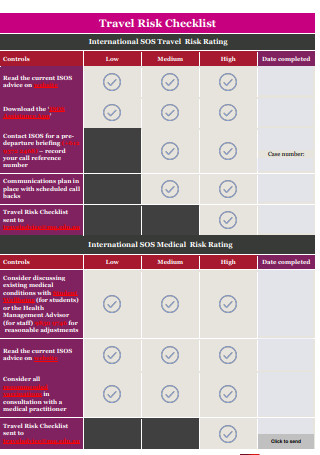

Travel Risk Checklist

download now -

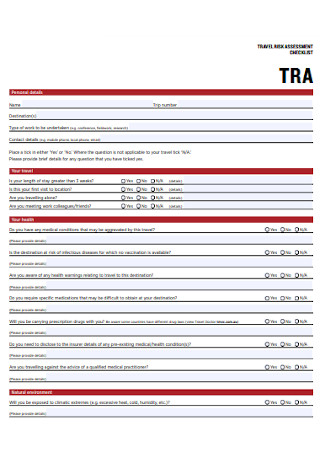

Travel Risk Assessment Checklist

download now -

Travel Risk Management Checklist

download now -

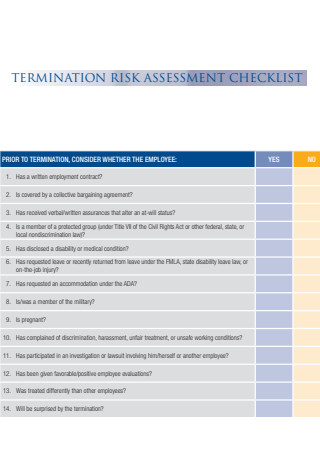

Termination Risk Assessment Checklist

download now -

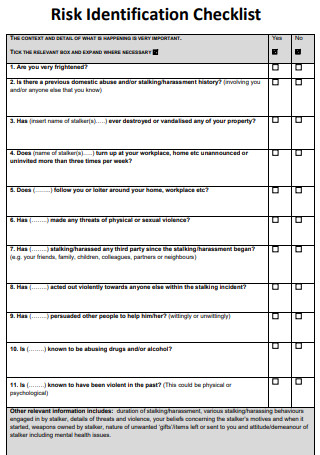

Risk Identification Checklist

download now -

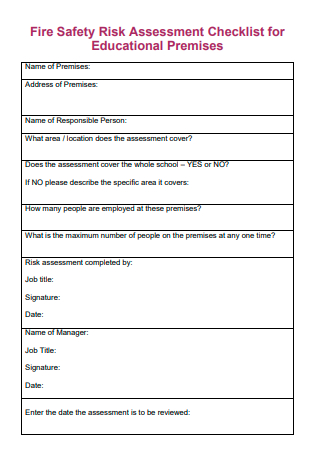

Fire Safety Risk Assessment Checklist

download now -

Checklist for Operational Risk Management

download now -

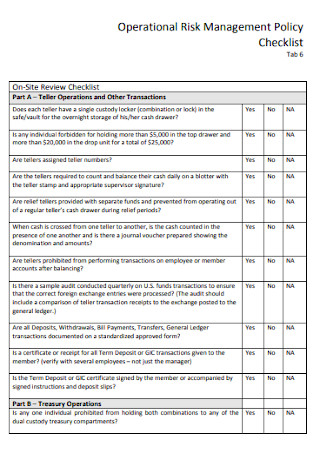

Risk Management Policy Checklist

download now -

Center Risk Management Checklist

download now -

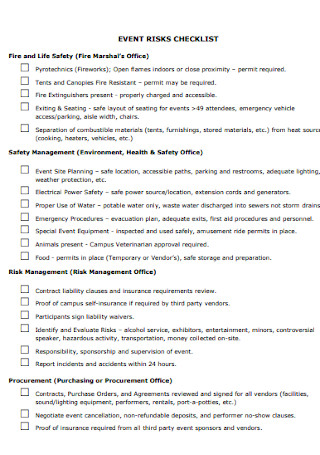

Event Risk Checklist

download now -

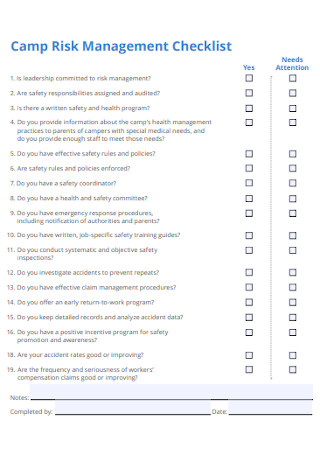

Camp Risk Management Checklist

download now -

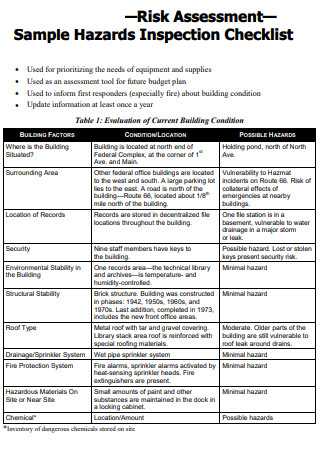

Risk Assessment Inspection Checklist

download now -

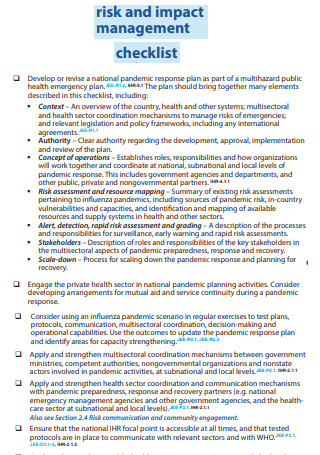

Risk and Impact Checklist

download now -

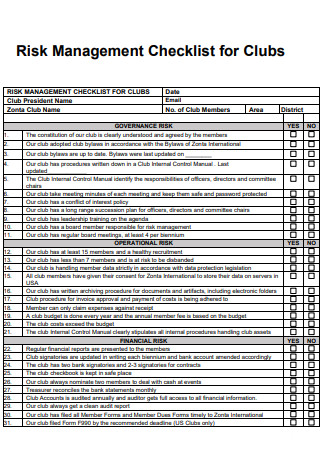

Risk Management Checklist for Clubs

download now -

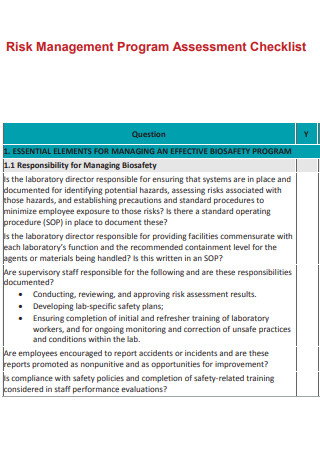

Risk Management Program Assessment Checklist

download now -

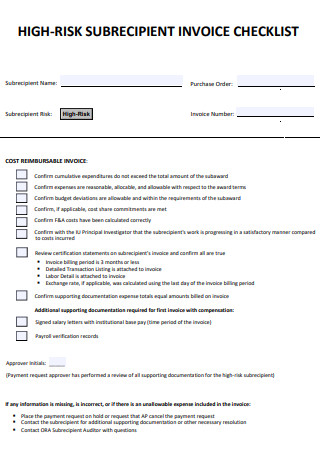

High-Risk Subrecepient Checklist

download now -

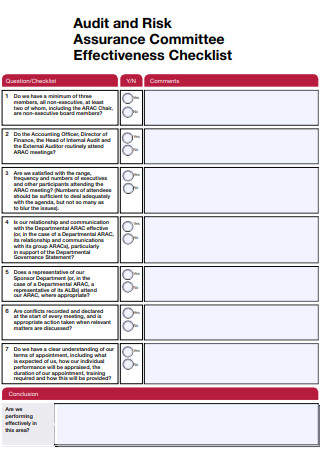

Audit and Risk Assurance Checklist

download now -

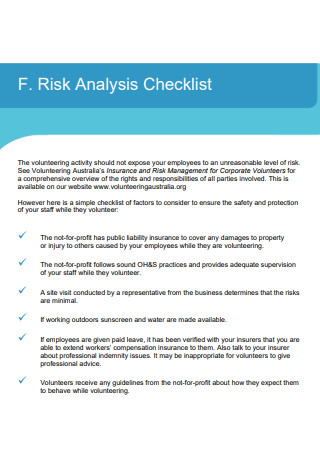

Risk Analysis Checklist

download now -

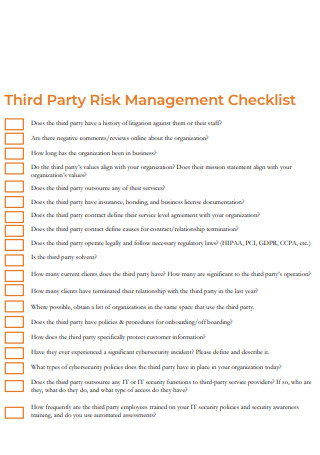

Third-Party Risk Management Checklist

download now -

Adult Risk Assessment Checklist

download now -

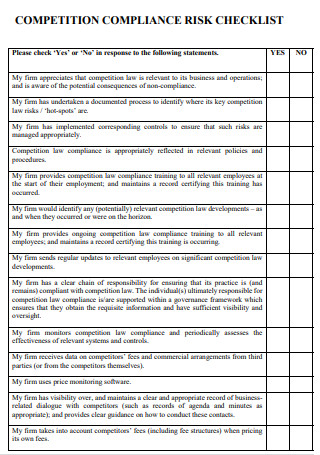

Competition Compliance Risk Checklist

download now -

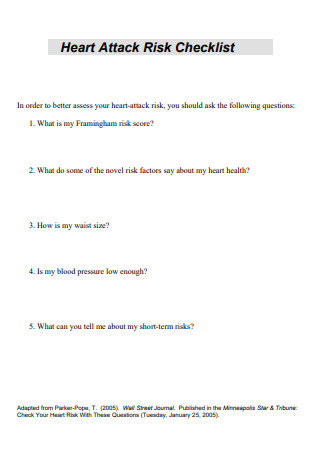

Heart Attack Risk Checklist

download now -

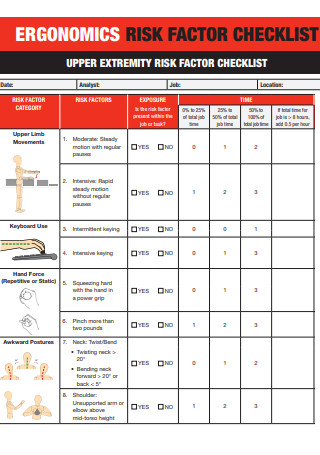

Ergonomic Risk Factor Checklist

download now -

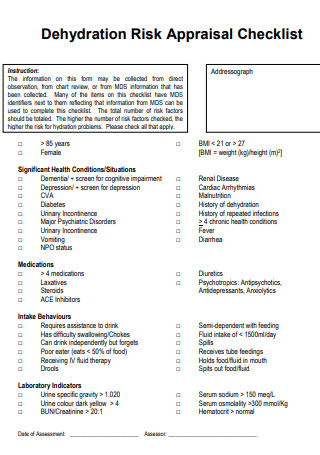

Dehydration Risk Appraisal Checklist

download now -

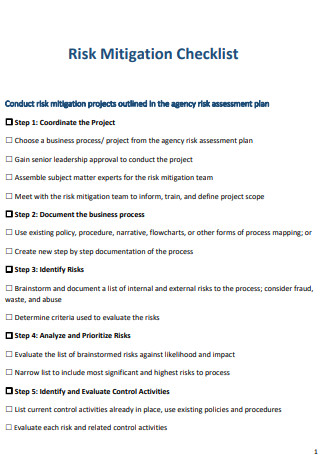

Risk Mitigation Checklist

download now -

Risk Role Checklist

download now -

Workplace Risk Assessment Checklist

download now -

Risk Rating Filter Checklist

download now -

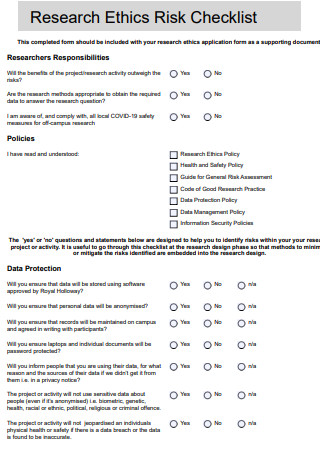

Research Ethics Risk Checklist

download now -

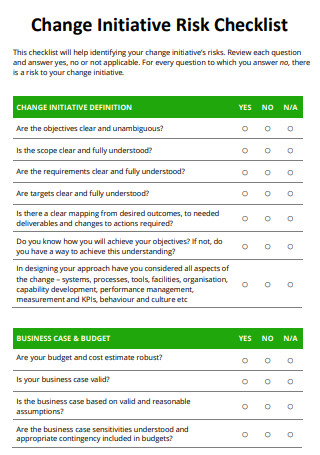

Change Initiative Risk Checklist

download now -

Fall Risk Checklist

download now -

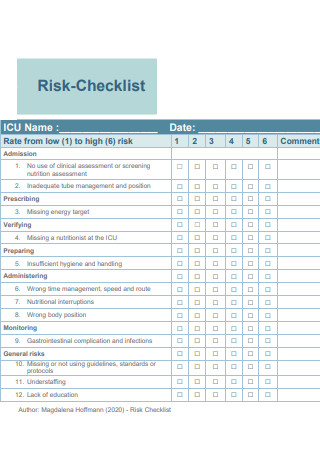

Risk Checklist

download now -

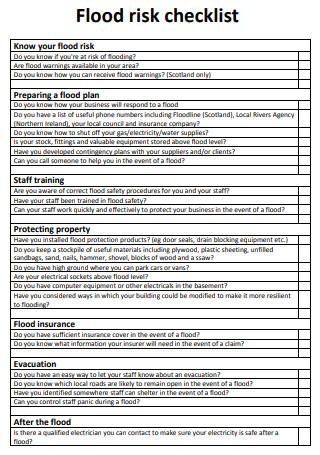

Flood Risk Checklist

download now -

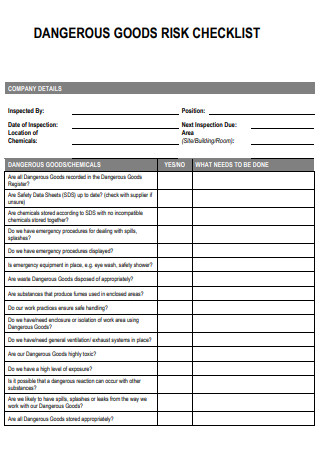

Dangerous Goods Risk Checklist

download now -

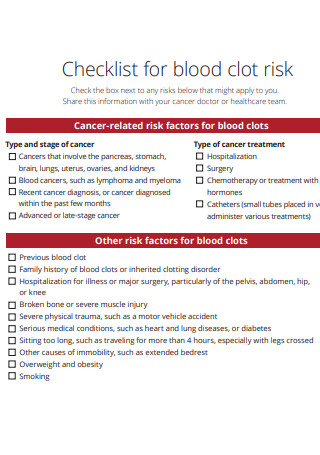

Blood Clot Risk Checklist

download now -

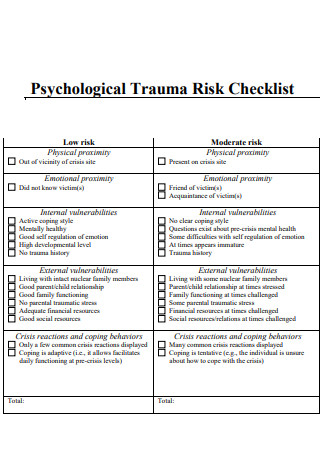

Psychological Trauma Risk Checklist

download now -

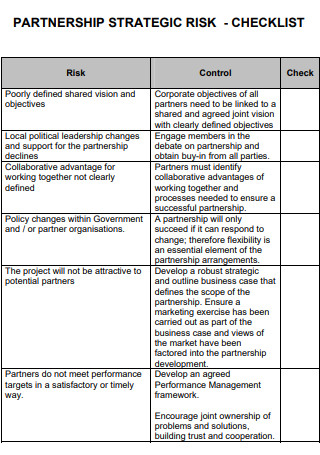

Partnership Strategic Risk Checklist

download now

What Is a Risk Checklist?

Risk checklists provide a historical record of hazards that have been recognized or mitigated on previous projects. Risk checklists are intended to be shared between estimators and discipline groups on all projects. According to statistics, violence accounted for 17% of workplace fatalities.

Benefits of Risk Management

Risk management is a critical component of leadership because it guarantees that any possible challenges to success are detected and addressed before the derailment of your project. Risk management is an essential process for a project manager to oversee. The project manager can plan for any possibility when armed with a risk log and a vigilant team. However, risk management encompasses much more. It has far-reaching implications and can radically alter how a management team chooses. Here are eight lesser-known but equally significant benefits of a solid enterprise-wide risk management strategy.

Types of Risk

Given the post-2008 market environment, practically every investor understands that there is no such thing as a free lunch. If you want to profit from the markets, you must be willing to tolerate volatility – and, based on how items have been going since 2008, this is continual volatility. However, during the wild journey we’ve all been on over the last three years, there have been some incredible possibilities for wealth growth. And those who have conditioned themselves to remain steadfast in their investing practices have amassed substantial wealth despite the hazards. This is the investing behavior that will assist you in achieving your life objectives via both equities and debt investments. Today, with interest rates at an all-time high, debt, or fixed-income assets, can also be an excellent location to invest, depending on your investment objective, time horizon, and risk tolerance. With equities markets volatile, prices might be appealing as well. As a result, both equity and debt are attractive investment options at the moment. With both asset classes offering excellent investment opportunities, it’s prudent to educate yourself on the risks and rewards associated with each before investing. There are several distinct forms of risk that every investor should be aware of, including the following:

-

1. Credit Risk

Credit risk is simply the risk that the person to whom you have extended credit, whether a business or an individual, may be unable to repay your interest or principal on its debt obligations. Credit risk is lowest with government bonds, whereas credit risk is highest with low-rated corporate deposits. Before investing in a bind or a corporate deposit, ensure that a reputable rating agency rates the bond or deposit highly.

2. Country Risk

When a country defaults on its deficit, it affects all of its stocks, mutual funds, bonds, and other financial investment instruments and the countries it has economic relations with. A country with a large budget deficit is riskier than a small fiscal deficit, ceteris paribus. Emerging economies are regarded as more dangerous than industrialized economies.

3. Reinvestment Risk

This is the risk that you will lock in a high-yielding fixed deposit or corporate deposit at the highest available rate. When your interest payments begin to accrue, there will be no comparable high-yield investment opportunity to reinvest your interest proceeds. At the moment, with reasonable rates at an all-time high, it would be prudent to lock in for long to avoid facing reinvestment risk.

4. Interest Rate Risk

A golden rule in debt investing is as follows: Bond prices fall when interest rates rise—additionally, vice versa. Thus, we look to be at an interest rate peak in our current scenario. This indicates that bond prices will increase as interest rates continue to decline. Therefore, if you invest in debt funds today, you will be purchasing at a discount and will be able to sit back and oversee your investments grow in value as interest rates decline.

5. Market Risk

This is the risk that the value of your investment will decrease as a result of market risk factors, which include equity risk, interest rate risk, currency risk, and commodity risk (risk of fluctuations in commodity prices). There are additional risk categories, including legislative risk, global risk, and timing risk. Still, for this essay, the ones discussed above are the primary ones to consider, both macro (nation) and micro individual investments.

How To Identify Risk at Work

Even if you are unaware, your organization is undoubtedly utilizing some form of risk management. Throughout time, you build procedures to ensure that things don’t go wrong and mitigate the organizational impact. Creating a risk management plan is simply a matter of formalizing that process and maximizing the effectiveness of your resources. The first and most critical stage in this approach recognizes your risks. You’ll need to compile a list of all the individual dangers that potentially affect your business. This can be a daunting endeavor, much more so for new companies that lack the benefit of years of expertise and history. Fortunately, some methods can assist you:

-

1. Dissect the enormous image

Identifying hazards at the start of the risk management process can be intimidating. Begin with a comprehensive analysis. What are the most obvious ways your business or sector could go wrong? Your business strategy and day-to-day operations can determine this. Risk comes in various forms. Dissect your organization into each category and analyze each department’s unique vulnerabilities. Insightful questions can identify problems in your company that you were unaware of. For instance, is your manufacturing process completely risk-free? Are you sure that all of your personnel are adequately trained? What would happen if your largest customer ceased to exist? Would you know how to manage a significant situation if it occurred and who was responsible? If you cannot answer a question like this, it indicates a risk to be better addressed.

2. Maintain a gloomy attitude

What is the worst-case scenario for your organization? What would the chain of events look like if everything went wrong one day? While being too pessimistic is not the optimal approach to operating a firm, it is highly beneficial to detect hazards. At this point, it’s critical to resist arrogance and the belief that something “can’t” or “won’t” happen.

3. Consult a professional

You certainly already have ties with several individuals who can assist you in identifying risks, such as your insurance broker, accountant, or financial advisor. Insurance brokers are familiar with your claim history, giving them insight into industry trends. If you consistently incur the same type of loss, this indicates an incorrectly managed risk. Brokers can also assist you in assessing your business risks and proposing insurance coverage to help protect you in an incident. If they do not suggest this service, they will likely recommend a qualified consultant. Likewise, accountants and financial consultants will be aware of your regularly making types of payments. Additionally, they can provide advice and assist in identifying financial risks within the firm.

4. Internally conduct research

If you manage your claims and losses or have workers who deal with them daily, you can do internal research to identify risks throughout the firm. Simple observation may enable you to identify situations where procedures are not followed appropriately. Costs that are unusually high in one department may potentially indicate an unchecked risk. You can determine the root causes of occurrences using data and trend analysis. Incidents and near-misses are critical indicators of risk management team-mandated issue areas.

5. Consistently solicit feedback from employees

From frontline employees to the CEO, everyone will have a unique perspective on the business and daily dangers. As such, employees are a critical resource for recognizing risks. All employees, particularly crucial stakeholders, may know about dangers they confront in their daily business activities that you were unaware of. You can solicit anonymous employee feedback through one-on-one interviews or in a group setting. Allowing anonymous event reporting may improve response from employees fearful of punishments for speaking out, whereas group conversations may increase brainstorming and result in a significant number of identified risks.

FAQs

How are checklist techniques defined?

Checklists are used to promote or verify that a researcher is pursuing or has pursued several specific areas of inquiry, steps, or actions. These embody themselves in various ways during data collection, analysis, and subsequent writing and evaluation.

What is the purpose of a checklist analysis?

Checklist analysis is a method for systematically evaluating items against predefined criteria using one or more checklists. A concise description of the qualities. A methodical technique based on the historical information contained in the checklist questions and used for summary or in-depth analysis, including root cause analysis.

What purpose does a checklist serve?

Checklists detail each stage of a procedure, which helps keep things organized. It can be used as a visual reminder, a method for prioritizing chores, and a means to schedule all that has to be done to avoid missing deadlines. Simple to use and highly effective at ensuring that all procedures are completed.

At no point in time should we overlook hazards? It could have a severe impact on our job and cause significant damage. The ideal method is to document your risk checklist using one of the above templates and constantly monitor for risks.