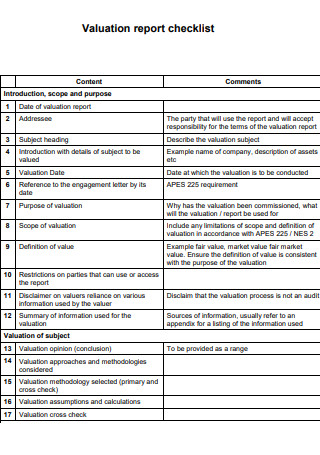

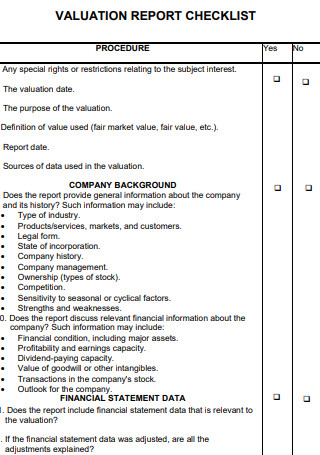

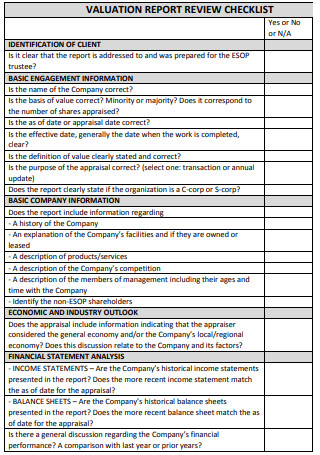

3+ SAMPLE Valuation Report Checklist

FREE Valuation Report Checklist s to Download

3+ SAMPLE Valuation Report Checklist

a Valuation Report?

Benefits of Business Valuation

Methods of Valuation

How To Establish Your Business Valuation

FAQs

Who is qualified to provide an appraisal report?

What happens once the valuation report is completed?

How long is the validity of a value report?

What Is a Valuation Report?

A valuation report is a certified valuer’s expert appraisal of the market value of a property. The information is based on the home’s overall condition (as determined during a visit), recent and relevant sales history, and other applicable market data. According to statistics, 60% of all houses sold in London are subject to low valuations.

Benefits of Business Valuation

A business valuation gives the company owner a lot of information about how much the company is worth in terms of market competition, asset values, and income values, among other things. The value of your business should be looked at on at least three levels over the last year. If you haven’t done this, you should think about it. This is something that every business owner should have. Getting a business valuation should also be done every year to show how the company has changed. People who get a business valuation see these seven things that happen to their business.

Methods of Valuation

With this in mind, let’s check at some of the most common ways to value a business. Once again, one approach may be better than another, depending on your situation. However, you’ll usually want to work with a business appraiser to get the most objective assessment of how much your company is worth.

-

1. Market Value Valuation

It is likely the most subjective method of determining the worth of a corporation. This strategy establishes the value of your firm by comparing it to recently sold comparable enterprises. Naturally, this strategy is only effective for organizations with adequate market data on their competition. In this regard, the market value method is particularly problematic for sole proprietors, for example, because similar data on the sale of similar enterprises are scarce. Having said that, because this approach of small business valuation is very imprecise, the value of your business will ultimately be determined through negotiation, especially if you’re selling or seeking an investor. While you may be able to persuade a buyer of your business’s worth based on intangible characteristics, this technique is unlikely to be very effective in attracting investors. Nonetheless, this way of valuation is an excellent starting point for determining the potential value of your business. Still, you’ll want to take another more measured approach to the negotiation table.

2. Asset-Based Valuation Method

Following that, you can determine the value of your business using an asset-based business valuation method. As the name implies, this approach examines your business’s overall net asset value less the entire liability value as shown on your balance sheet. Businesses that intend to continue functioning and not immediately sell their assets should employ the going-concern approach to asset-based company valuation. This calculation considers the present total equity of the business—in other words, your assets less your liabilities. By contrast, the liquidation value asset-based approach to valuation assumes that the company has ceased operations and its assets will be liquidated. The value of a business’s assets will almost certainly be lower than typical under this approach—as liquidation value is frequently significantly less than fair market value. Finally, the liquidation value asset-based technique functions with an urgency that other methods do not.

3. ROI-Based Valuation Method

An ROI-based business valuation approach determines the value of your firm based on its earnings and the possible return on investment (ROI) that an investor could receive by investing in your business. Here is an illustration: If you’re pitching your business to a group of investors to obtain equity financing, they’ll begin with a 100% valuation. To illustrate, split the sum by the percentage provided. Practically speaking, the ROI approach makes sense—an investor wants to know their return on investment before investing. A “good” return on investment is ultimately market-dependent, so business valuation is subjective.

4. Discounted Cash Flow

While the three outlined ways are frequently regarded as the most common, they are not the only ones available. Indeed, while the ROI- and market-value-based methodologies are very subjective, specific alternative ways rely on a more significant amount of financial facts about your organization to arrive at a more accurate valuation. For example, the discounted cash flow method, often known as the income approach, assesses a corporation using expected cash flows that have been adjusted to their current value. The DCF approach is particularly advantageous if you expect your profits to fluctuate in the future.

5. Capitalization of Earnings Valuation

Following that, the capitalization of earnings technique forecasts a business’s future profitability using its cash flow, the annual return on investment, and predicted value. Unlike the DCF method, this methodology is most effective for stable enterprises because the formula assumes that computations for a specific time would continue. In this sense, this strategy based the current worth on its future profitability.

6. Multiples of Earnings Valuation

Similar to the capitalization of earnings approach, the multiple of earnings method determines the worth of a corporation based on its future earnings potential. This small business valuation technique, also known as the time revenue method, defines a business’s maximum value by multiplying its current revenue by a multiplier. Multipliers vary by industry, economic environment, and other variables.

7. Book Value Valuation

Finally, the book value approach uses your balance sheet to determine the value of your business at any point in time. This approach utilizes your balance sheet to compute the value of your equity—or total assets minus total liabilities—which represents the value of your business. The book value strategy may be advantageous if your business generates little revenue but has valuable assets.

How To Establish Your Business Valuation

Consider business valuation as a five-step procedure. The steps are sequential, beginning with the definition of the work at hand and concluding with the conclusion of business value. Let us examine each stage in depth.

-

1. Plan and Prepare

Like successful business management, compelling company valuation involves forethought and attention to detail. The two critical first steps toward establishing your organization’s worth are determining why you require business valuation and gathering the necessary data. You may be surprised to understand that the reasons for the business appraisal can affect the results. Isn’t the worth of a business absolute? Not at all. True, you utilize business valuation to determine the value of a business objectively. However, the conclusion is contingent upon two critical factors: how company value is measured and under what circumstances. These aspects are referred to as the standard of matter and the premise of value in appraiser jargon.

2. Making corrections to historical financial statements

Business valuation is an exercise in economic analysis. Unsurprisingly, the business’s financial performance provides critical inputs to the process. The income statement and balance sheet are the two primary financial statements required for business valuation. To conduct an accurate assessment, you should have three-five years of historical income and balance sheets accessible. Numerous business owners organize their enterprises to minimize taxable income. However, when determining the company’s value, you must emphasize the overall earning potential of the corporation. Because business owners have an extensive choice over how business assets are used and what income and costs are recognized, previous financial statements for the company may need to be normalized or amended. The objective is to establish an accurate relationship between corporate assets, expenses, and the amounts of business income that these assets may provide. Business valuation requires normalizing changes to both the balance sheet and income statement.

3. Methods of business valuation

Once you have all of your data, it’s time to decide how you’ll measure business value. Given the variety of well-established procedures available, it’s good to cross-check your results using several. Suppose you are dealing with a company that has a lot of assets. You may have to deal with the cost and complexity of asset-based valuation approaches such as asset accumulation. Along with evaluating individual firm assets and liabilities, the system can be beneficial for determining the purchase price allocation in an asset purchase agreement. Bear in mind, however, that the process involves substantial skill in valuing particular assets and liabilities, which sometimes makes application costly and time-consuming.

4. Implementing the chosen business valuation methodologies

With the necessary data gathered and the valuation methods chosen, determining the value of your firm should yield exact and readily justifiable conclusions. One reason to employ multiple business valuation techniques is to double-check your figures. For instance, if one method of business appraisal yields unexpectedly different results, it’s essential to re-evaluate your inputs to determine whether anything was forgotten.

5. Concluding on the business value

Finally, with the results from the valuation methods you chose, you can figure out how much the business is worth so that you can buy or sell it. Here, we will look at how much money a company has and what it’s worth. Because no single valuation method can give you the best answer, combining the results you got to get an overall opinion of how valuable something is is a good idea. You may have used different methods to value things. If you want to conclude the business value, you need to figure out how to get these differences to work together. Business appraisers usually use a weighting scheme to determine how much a business is worth. You can give each method result a weight to show how important it is to the business value estimate.

FAQs

Who is qualified to provide an appraisal report?

In this instance, a valuation report from a registered valuer is required. A merchant banker’s valuation report is necessary for income tax purposes whenever a firm issues new shares or transfers existing shares.

What happens once the valuation report is completed?

After receiving the surveyor’s appraisal, the lender’s underwriter will have all the information necessary to make a final decision and will then be able to give a mortgage offer. When the mortgage lender is willing to provide you with a request, you will receive it via mail.

How long is the validity of a value report?

Residential property valuations are typically valid for three months after completion. In most circumstances, the validity of the appraisal can be extended for an additional three months. The surveyor must conduct further desktop research within two weeks of the survey’s initial expiration date.

Therefore, if you need to buy or sell a home, our samples will give you the template necessary to begin evaluating your property. Additionally, we have a sizable collection of templates and examples. These samples are ready for download in PDF and DOC formats! Check them now!