10+ SAMPLE Audit Memo

-

Audit Report Duplicate Payments Memo

download now -

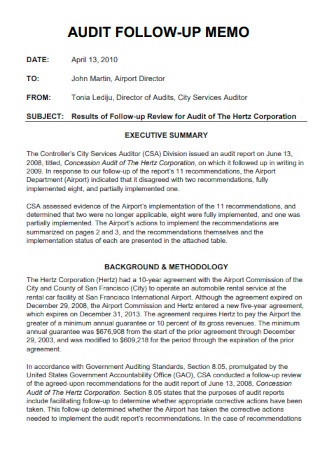

Audit Follow Up Memo

download now -

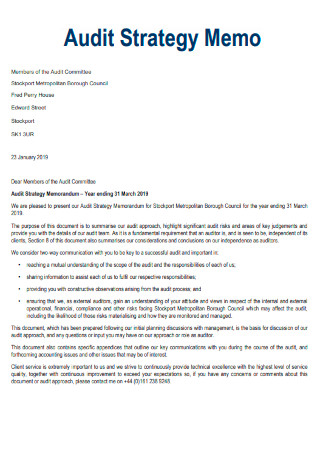

Audit Strategy Memo

download now -

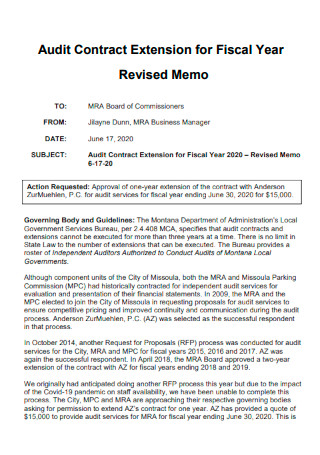

Audit Contract Extension for Fiscal Year Revised Memo

download now -

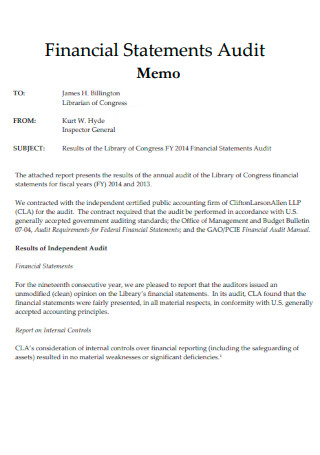

Financial Statements Audit Memo

download now -

Interim Audit Memo

download now -

Sample Audit Memo

download now -

Audit Planning Memo

download now -

Walking Audit Memo

download now -

Formal Audit Memo

download now -

Internal Audit Plan Memo

download now

What Is an Audit Memo?

An audit memo is a brief document issued during an audit. It summarizes a business’s current finances and assets based on a physical count performed in comparison to the records stated in its books or acquired balance information from external sources. It demands the same mathematical acumen as when making a debit memo, the same attention to precision and detail as when creating research or legal memo, and the professional tone anticipated in any formal memo or company communication. According to statistics, 97 percent of audit methods and testing are accurate.

Benefits of Audit

Suppose your organization is required to undergo an audit due to industry requirements or to satisfy potential investors or other stakeholders. In that case, the process does not have to be hostile or stressful. In this post, we’ll discover firsthand how an audit may benefit your organization by presenting you with an opportunity to improve. Here, we’ll outline just a handful of the significant benefits that an audit delivers.

Types of Audit

Audits are a type of investigation. Financial statements, management accounts, accounting records, operational reports, income reports, and expense reports may all be examined by auditors. A certified public accountant is retained in various audits to get “reasonable assurance” that the records are presented fairly and accurately and adhere to specified criteria. The audit team communicates its findings to the company’s shareholders and other internal stakeholders via an audit report. External stakeholders, such as banks, creditors, the general public, or the government, may occasionally get audit reports. A widespread notion is that audits are harmful — this is untrue. Although the process can be lengthy, businesses can profit from audits! They can use audit results to strengthen financial management and internal controls, identify fraud risks, and assist stakeholders in making more informed choices. We will discuss 11 types of audits, who does them, and some everyday real-world situations.

How To Create an Audit Memo

While audits may appear daunting and onerous business activities, they may help firms improve their finances, streamline procedures, and boost profit margins. An audit memo summarizes the audit and the recommendations made to the organization. Businesses can either engage external auditors or undertake the audit internally. If you’re still interested in creating one, here are the steps.

1. Adhere to the format for Audit Memorandums

The audit memo’s format will vary according to the organization and the type of audit done. Internal audits can be conducted on financial statements, operations, or procedures. It is recommended that small firms do an internal audit yearly to ensure that all finances and processes are in order. Internal audits can assist your small business in increasing efficiency and preparing for tax season. External audits are undertaken by a third party not affiliated with the organization. The independent auditor’s objective is to examine if the business’s financial statements accurately reflect its financial status. If there is a distinction, the auditor will explain where it occurred and make recommendations to help the business improve its financial records.

2. Begin With the Engagement Terms

Begin the audit memo by establishing the audit’s context. The audit memo’s introduction should include sufficient information to notify the reader of the audit’s high-level objectives and parameters. After that, the reader can peruse the memo’s body to understand more about the results and recommendations concerning the objectives.

3. Describe the Audit Process in Detail

Review the auditor’s audit procedure in the following section of the audit memo. This may include meetings the auditor has had with senior business executives and the issues discussed. Additionally, it will comprise the papers and financial statements examined by the auditor during the audit. The auditor may also include a list of the auditing team’s members and their certificates as part of the procedure. The reader must understand who is doing the audit and their level of competence and experience.

4. Describe the Findings

Following the procedural section, summarize the audit memo’s findings. This is the critical information revealed by the auditor throughout their inquiry. An example audit findings letter may cover areas of high risk and considerable mismatch between the financial statements and the company’s financial standing. Be as precise as possible with money amounts and other numerical values. It is critical to use the audit note to summarize the findings, including essential items discovered during the audit.

5. Make Suggestions for Improvement

Finally, make specific recommendations to the firm on improving any areas of risk or discrepancy. Relate these recommendations directly to the organization’s results and objectives. Suppose one of the audit’s primary objectives was to enhance the company’s financial processes to mitigate risk, for example. In that case, the suggestions should demonstrate how the firm might do so more effectively. Additionally, it is critical to mention areas working as intended so that the firm knows that particular processes and financial practices should be maintained. Additionally, the audit letter may include recommendations for improving the efficiency and accuracy of specific processes.

FAQs

What is a memo of internal audit?

This internal audit engagement note notifies an auditee of an approaching audit and contains information on the audit’s goals, proposed timeline, and audit team members. Internal audit requests a meeting with the department head to discuss audit objectives and solicit input on this sample. According to research, audits should typically be done at least once a year and include all your activities, particularly those related to your management system. Depending on the audited procedure, this frequency may need to be adjusted.

What exactly is an audit notebook?

The Audit NoteBook is a journal used by the audit staff to record significant observations, errors, dubious inquiries, and explanations and clarifications received from customers. Additionally, it offers specific information about the day-to-day job performed by audit clerks.

What is a certificate of audit?

The audit certificate is a document issued by an external auditor (or, in the case of a public body, a competent public officer) certifying that the costs claimed for a certain period comply with the contractual conditions specified in the FP6 model contract.

What is audit example?

An audit is a piece of written documentation that details errors on your tax return. An audit is a term that refers to the process of analyzing and evaluating anything. An audit is when an IRS official examines the accuracy of a tax return. The process of verifying a business’s financial statements.

Auditing is thoroughly examining or inspecting financial records and accounting paperwork. While the phrase is frequently used to refer to an organization’s financial audit, there are various audits, as stated previously. Any of these sample memos and more management memo samples available on our site should assist you in developing the form and content of your note.