20+ SAMPLE Credit Memo

-

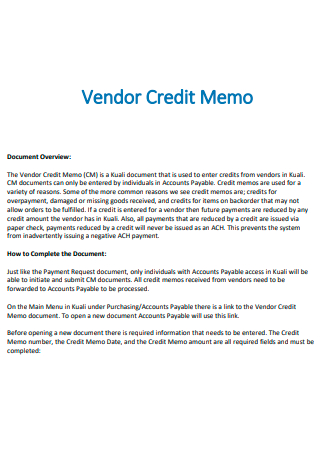

Vendor Credit Memo

download now -

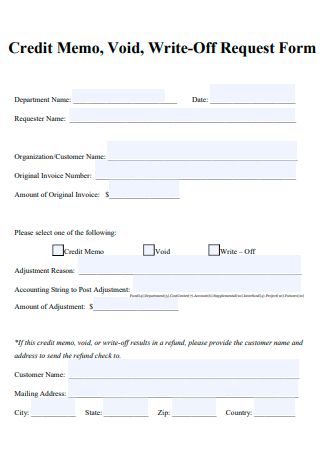

Credit Memo Request Form

download now -

Credit Memo Example

download now -

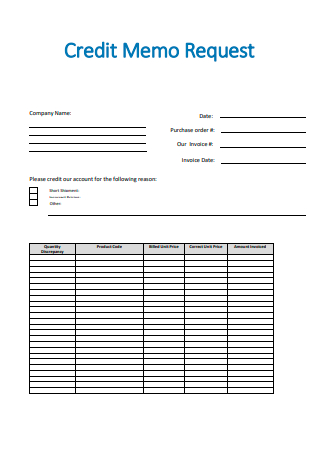

Credit Memo Request

download now -

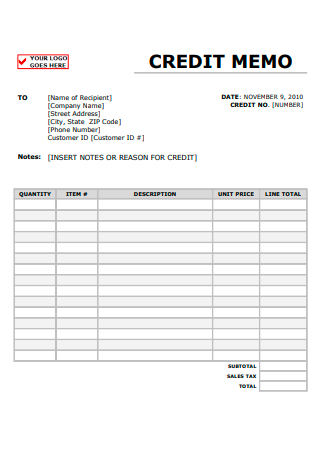

Basic Credit Memo

download now -

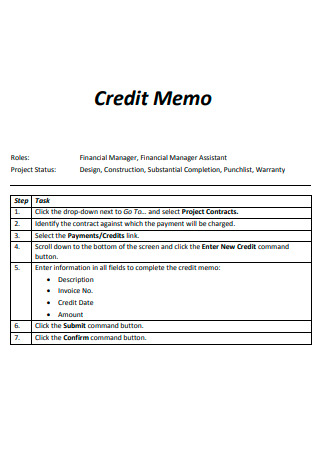

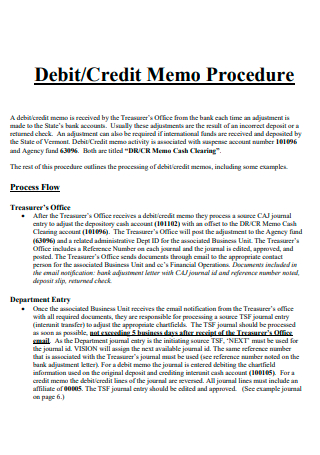

Credit Memo Procedure

download now -

Credit Memo in PDF

download now -

Credit Memo Form

download now -

Credit Memo Processing

download now -

Printable Credit Memo

download now -

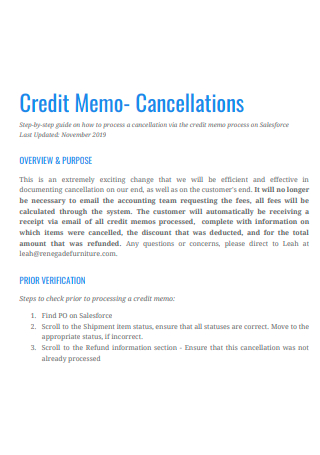

Credit Memo Cancellations

download now -

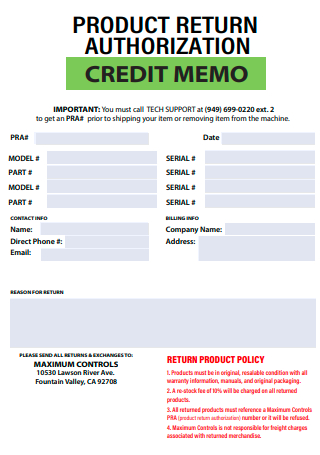

Product Return Authorization Credit Memo

download now -

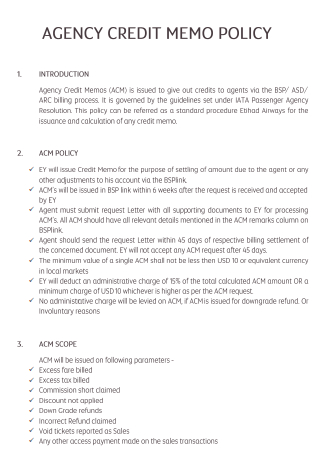

Agency Credit Memo Policy

download now -

Credit Memo Acceptance

download now -

Standard Credit Memo

download now -

Credit Memo Summary

download now -

Formal Credit Memo

download now -

Receivable Vendor Credit Memo

download now -

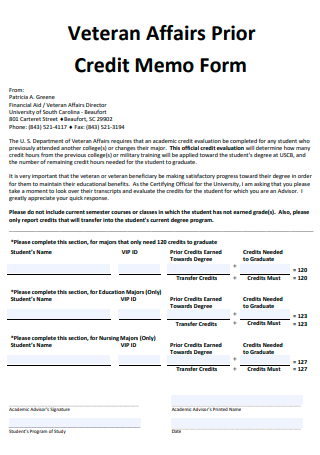

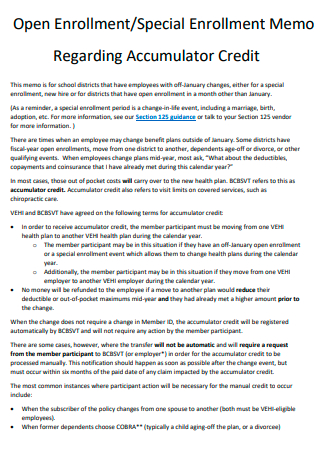

Accumulator Credit Special Enrollment Memo

download now -

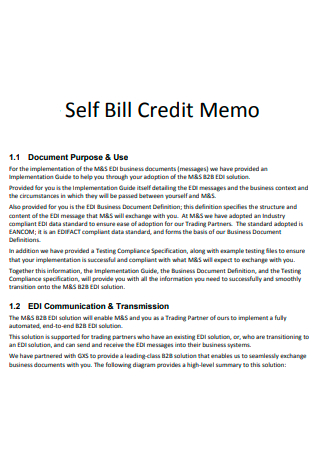

Self Bill Credit Memo

download now -

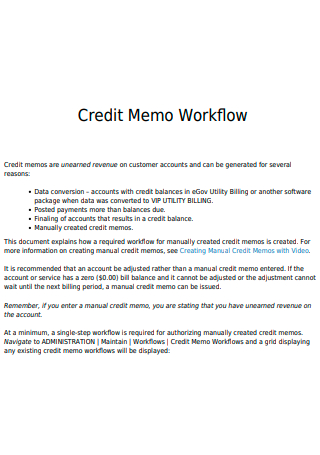

Credit Memo Workflow

download now

What is a Credit Memo?

What does a credit memo mean? A credit memo is a document that is given by sellers to customers that denotes that they still have a buying credit from their store or company. It happens when customers return or exchange products and get a credit from the money that they have already paid to the seller. A vendor has to make an account of the money that the buyer has paid. It will be in a form of a credit that the buyer can use for future purchases. In the case of a cash sale, the credit memo is the amount of benefit that the seller owes to the buyer.

A credit memo is the shortened form of a credit memorandum. It is also called a credit note. It is the overpayment from goods that are exchanged or returned. When the seller sends an invoice to the buyer next time, the amount in the credit memo can be credited and can be subtracted from the present amount of goods. A credit memo is a good accounting tool that helps sellers to settle the buying accounts of customers. A customer may have some benefits from a credit memo. He or she will have future funds to be spent on future purchases. It can also be good for a supplier because they do not have to return the remaining credit and that amount can also be spent in their store.

In times of a discount, a credit memo is also produced. Especially, if the customer pays in advance. The payment will turn into a credit that can be used for other things that the customer may buy. Sometimes, the customer does not have to pay in cash if the credit memo balance is sufficient. It can be a form of a debit that the customer has in the store. A supplier can have a great way to handle their accounts payable through a credit memo. Even in bank reconciliation, a credit memo is good. A bank credit memo is also good for customers.

Is a credit memo a refund? No, they are different. In a refund, you can get the cash from the products that you have returned. But in a credit memo, you can use the remaining amount to buy other products in the same store or supplier. A refund is actual money and the credit memo, on the other hand, is an existing balance that you can use as a benefit. Having a credit memo can be good, especially if you are a regular customer of the supplier. You can be sure that you can use it in the future. In times when you do not have cash, it can provide a great benefit. To give a credit memo to customers is just being fair to them. They should use every cent that they have paid you. It is one good way to return their money.

When Do You Issue a Credit Memo?

There are various reasons by which a seller may issue a credit memo to a customer. The most common scenarios are the following:

- The buyer returned the products for some reason. Or he or she may have rejected the services. In times like this, the seller should issue a credit memo that will give credits in return for the money that has been spent.

- The goods that are delivered are damaged and defective. The buyer may return or exchange the products. The costs are not the same and the excess money should be credited through a credit memo.

- There are clerical errors in the invoice. The buyer has paid an extra amount and the seller has to return it. It can be credited in the way of having a credit memo.

- The buyer has overpaid the products. In times like this, the money that is excess from the original amount should be credited in the credit memo.

Benefits of a Credit Memo

Have you wondered what a credit memo sample or credit memo example is for? Have you thought about the benefits that it can give? If you want to know the benefits and advantages of a credit memo, you can consider the following:

How to Create a Credit Memo

Are you looking for a credit memo template? Are you going to create a credit memo? Maybe you are looking for steps that you can use. We can offer you some steps that you can use in creating. They are the following:

1. Title the Document

The first thing that you need is to write the title of the document. Write “Credit Memo” at the top of the page. Then, write your business name, address, contact information, website, and tax identification number.

2. Customer Information

After your business details, you must write the customer’s information. Place it on the right side of the page. If there is a number code to identify the customer, you must write it. Write the name of the customer, address, and contact information. If you have their email, you can add it also.

3. Credit Memo Details

Then you should write the date when the credit memo is issued. Write the number of the credit memo. You should include the original invoice number. Add also the payment terms on the left side of the page.

4. Write the Credit

Divide the middle of the page into five columns. The first column should have the quantity of the credited item. The second column is the item identification number. The third column is the reason for the credit. The fourth column is the price of the item. The fifth column is the calculation of the credit.

FAQs

Why are credit memos used?

If there is an error or if the customer wants to return the product, the monetary credit will be given to the customer’s account.

What if all the credits are applied to invoices?

The credit memo will be marked as closed if all credits have been spent on invoices.

Is a credit memo important?

Yes, it is important to both the buyer and the seller. The buyer will be confident about his or her money. The seller can be assured that customers will trust their company.

A credit memo is the best resort when there is something wrong with the products of the seller. It is good for some issues that can be encountered by a seller and a buyer. It can settle everything so that there will be no need for conflict. Well, do you need a template for a credit memo? This post has 20+ SAMPLE Credit Memo in PDF. You can create a great credit memo through these templates. Download now!