26+ SAMPLE Investment Memo

-

Investment Memo Template

download now -

Private Equity Investment Memo Template

download now -

Investment Memorandum Template

download now -

Investment Memo Template

download now -

Editable Private Equity Investment Memo Template

download now -

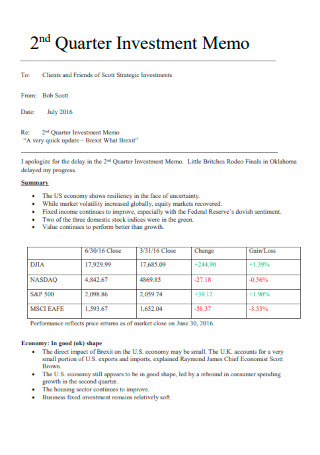

2 Quarter Investment Memo

download now -

Investment Memo Executive Summary

download now -

Policy Memo on New Public Investment Bank

download now -

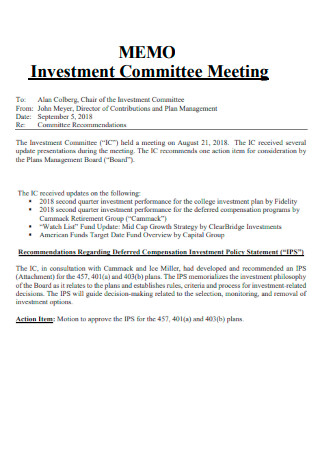

Investment Committee Meeting Memo

download now -

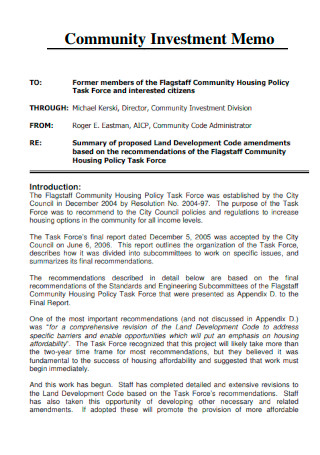

Community Investment Memo

download now -

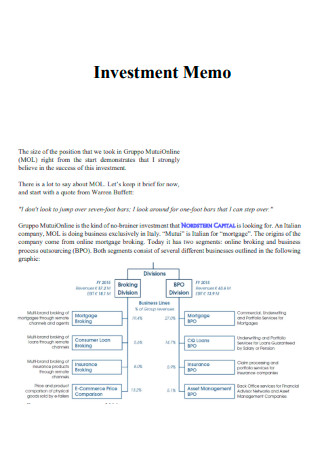

Startup Investment Memo

download now -

Memo of Understanding Investment Bank

download now -

Investment Memo for Minerals

download now -

Sample Investment Memo

download now -

Clean Energy Investments Memo

download now -

Energy Resources Investment Memo

download now -

Memo Segregation & Investment

download now -

Annual Investment Performance Report Memo

download now -

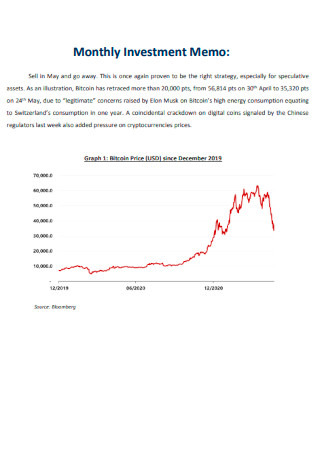

Monthly Investment Memo

download now -

Investment Information Memo

download now -

Investment Memo & Approval Process

download now -

Basic Investment Memo

download now -

Technology and Cloud Investment Notification Processes Memo

download now -

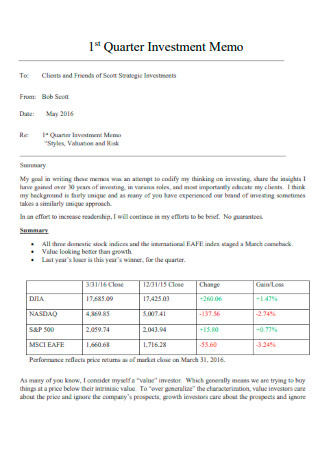

1st Quarter Investment Memo

download now -

Printable Investment Memo

download now -

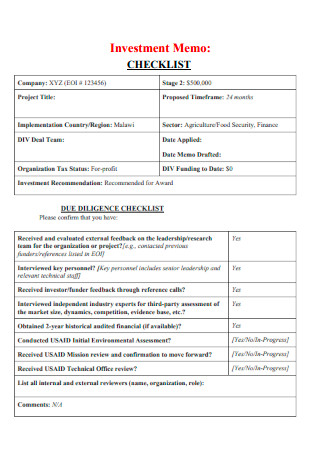

Investment Memo Checklist

download now -

Financial Modelling and Investment Memo Writer

download now

What Is an Investment Memo?

An Investment memo is a succinct and straightforward explanation of your company’s major components and why you should invest in them. Writing one clarifies the story and pitch of your company. Venture capital firms draft an investment committee memo after doing due diligence to decide whether or not to invest in a startup. As a start-up entrepreneur seeking investors, however, producing your own letter makes sense in order to assist investors and maintain control over your company’s presentation. If you are still puzzled with the layout of your memo, then you can view the investment memo sample so you can have a basis.

Tips for Writing an Investment Memorandum

Many people go through the process of writing an investment memorandum. There are important distinctions regarding what you should or should not include depending on the type of money you are seeking. A comprehensive understanding of the company and financial modeling is required in a meaningful information Memorandum for equity investors. Keep these tips in mind so that when you prepare an investment memo startup, the reader will be able to understand everything present in the document.

Different Types of Investment Risks

When it comes to risk, the reality of the situation is that all investments involve some level of risk. If market circumstances deteriorate, stocks, bonds, mutual funds, and exchange-traded funds may lose value, maybe all of their value. Even safe, insured investments like bank and credit union deposit accounts are vulnerable to inflation. They may not be able to keep up with the rising expense of living over time. Discover how various hazards can impact your investment returns. Proceed to view the example of an investment memorandum for an additional reference you can use when encountering difficulties in writing out the document.

How to Write an Investment Memo

Writing an investment memo especially when you are new to the experience could be tricky to perfect. But what you don’t know is investors or the readers don’t need to receive a perfect document, but one that is organized in neat in stating the data and information regarding the necessary usage of the funds or its specific purpose. Either way, you can attain that by making use of the investment memo format this article has prepared for you. And if you don’t want one that is already made, then you can follow the guide below to make one from scratch.

-

1. Introduction

As for the first section of your investment memo, you will need to start off by presenting an introduction while ensuring you cover the various important points. Dedicate at least one paragraph to each point. State your Company overview, this involves describing what you do and what problem you are attempting to address. Followed immediately by the unique solution you are coming up with to solve the issue. Next, would be the financial viability and the opportunity to scale and gain money. You need to present these points so that investors will understand where you are coming from and understand the page you are in.

-

2. Market Analysis and Opportunities

Establish the marketability of your product by discussing the specific market you operate in. You must be aware of the specifications of the industry you are in to show the investors that you are aware of the direction of the business. It is also a means to express your grasp of the scale of the industry you are in since you can’t leave it to chance. You also have the option to include your personal insight regarding the market you are interested in so you can showcase how it was able to capture your attention in bringing up a way to solve the concern through an investment.

-

3. Competitor Landscape

Direct rivals, prior attempts to tackle the problem, and how they failed must all be described in an investment document. Demonstrate how your organization bridges the gap to outperform the competition. A marketing strategy concept that applies to the competitive conditions and rivalry that a company and its products must face in the market they are a part of is essential because a competitive landscape is a full explanation of competitors and their relative position in a particular market.

-

4. Company Traction and Growth Metrics

This section explains your current traction and uses line graphs over time to show your growth. Don’t be concerned if the outcomes aren’t fantastic. The majority of start-ups are still losing money. Just be truthful. Company KPIs like revenue numbers and other metrics like customer churn and average revenue per customer, financial growth, relevant customer testimonials are even better if they are market leaders in your Customer segment; if you are raising a pre-seed or seed round, show early feedback from your initial customers, and achievements are four aspects of business traction to consider. Make sure to include all of these details in your investment memo.

-

5. Team

Give a brief description of each significant team member’s background. Investors want to know if your team is capable of carrying out the vision you presented in the previous parts. Consider how your domain expertise, credentials, and experiences give your team an unfair advantage in terms of success.

-

6. Funding Request and Use of Funds

Discuss how much you have raised previously and how much you would like to raise this time. You might also want to discuss how you intend to use the increased funds to expand your company. Soft selling through networking, placing your outcomes in the front, pitching a return investment, addressing investment concerns, presenting a startup accelerator, and many other tips will help you persuade investors to give you Funding.

FAQs

How long is an investment memo?

After hearing a startup pitch and conducting due diligence, a venture capitalist will prepare an investment letter. A five- to ten-page investment document, excluding appendices, is typical. It’s a medium-length company presentation that provides the most important facts about the company. The transaction letter should include all information needed to persuade partners to make an investment choice, such as the opportunity’s benefits and drawbacks. A one-page investment memo could be rare but if specified by the other party, then you can look into how to concisely arrange the data.

What does an investment fund do?

According to Investopedia, an investment fund offers a bigger range of investment options, more management skills, and lower investment fees than an individual investor might get on their own. Equity funds, exchange-traded funds, money market accounts, and hedge funds are examples of investment funds. A fund manager is in charge of the fund and determines which securities to hold, in what quantities, and when to buy and sell them. This article provides you with an investment memo example so you can look into one that is already made.

What is the role of an investor?

A trader and an investor are usually not the same people. A trader aims to make short-term profits by repeatedly buying and selling stocks, whereas an investor uses cash for long-term gain. Typically, investors produce profits by investing in either stock or debt securities. Investors are usually paid in proportion to their interest in the company, or the percentage of the business they own based on their investment. This can be repaid only on the basis of the amount owed to them, or it can be done through preferred payments.

Not everyone will be aware of the investment memo components that complete the document. You may not mean it but you could leave out important information that investors or readers will look for. To avoid a situation where you will need to keep on doing revisions, make sure you went through all the information present in this article and keep them in mind.