Advance Receipt Samples

-

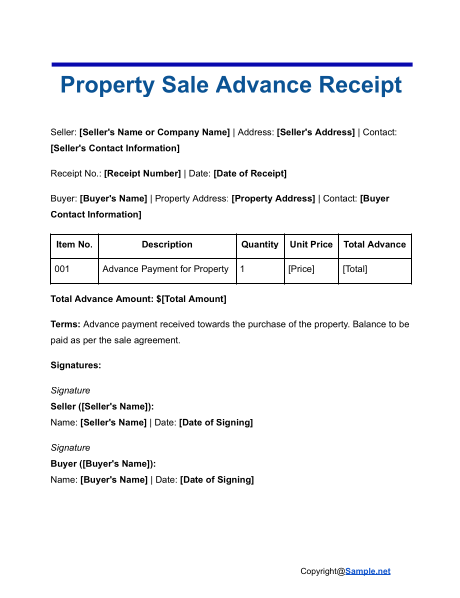

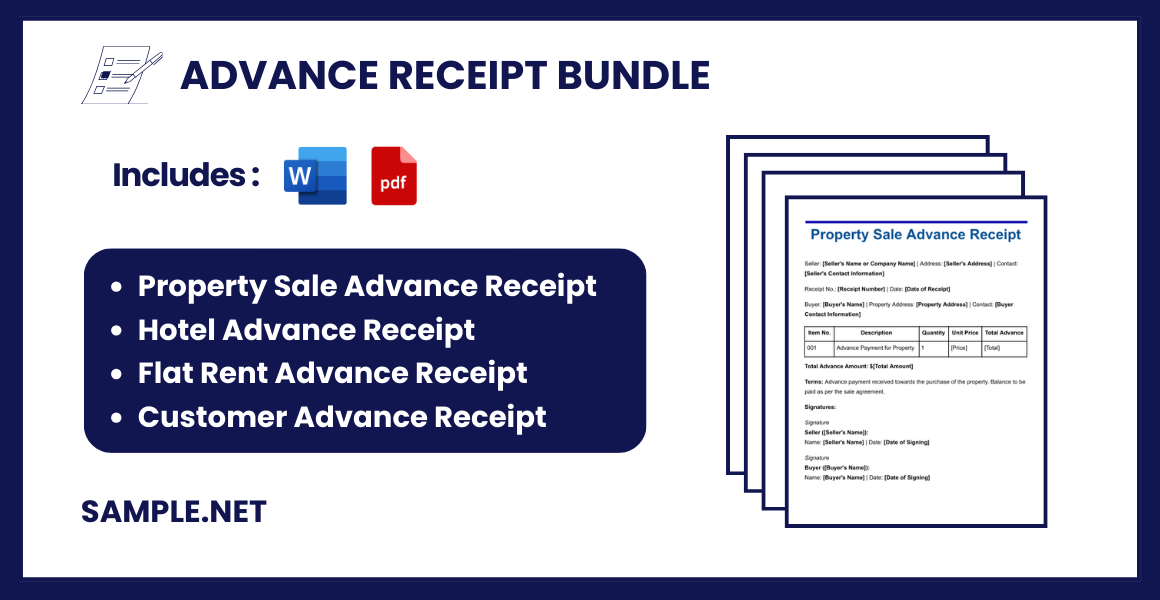

Property Sale Advance Receipt

download now -

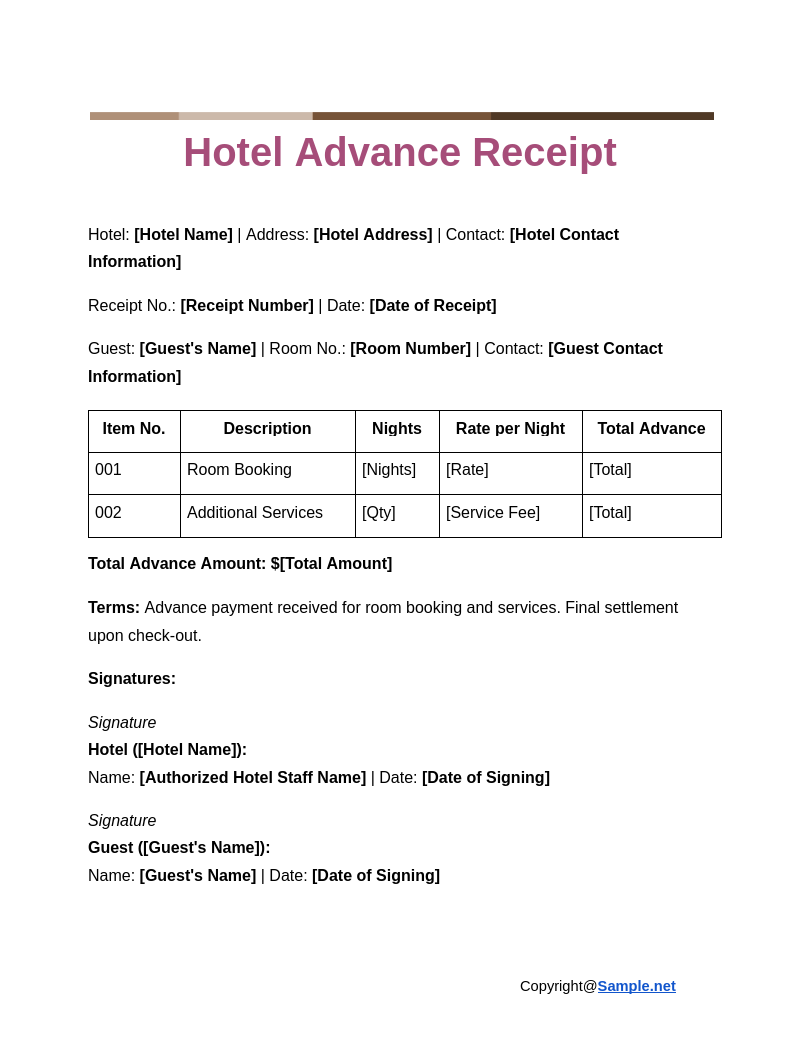

Hotel Advance Receipt

download now -

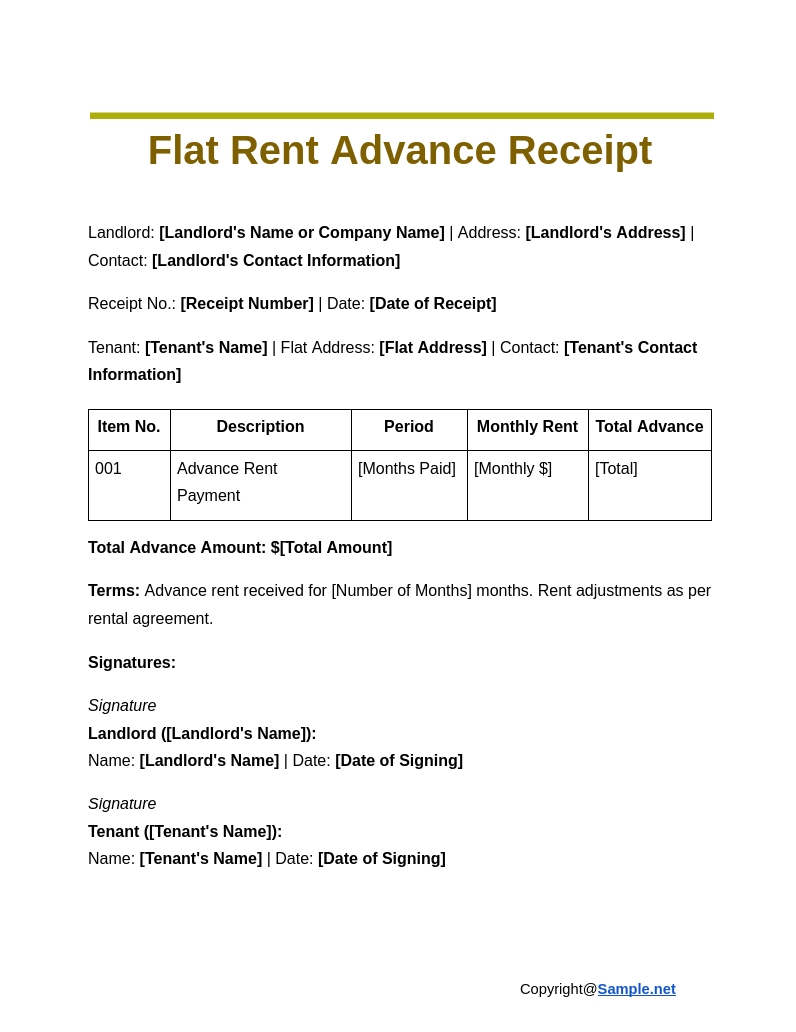

Flat Rent Advance Receipt

download now -

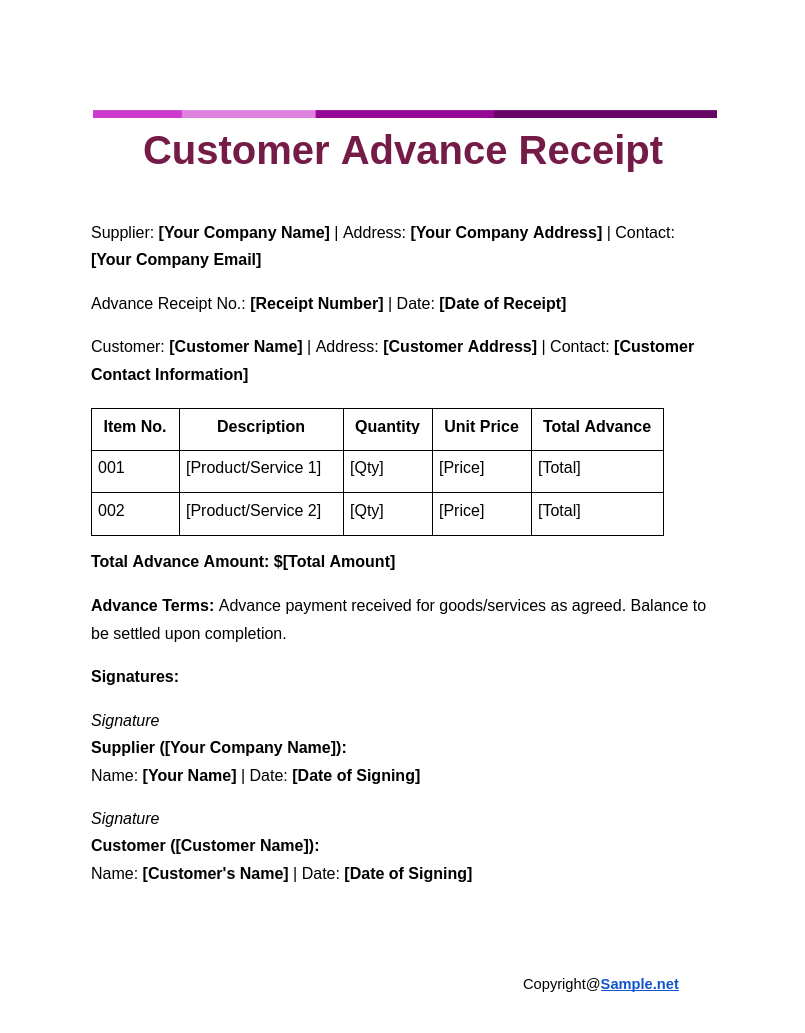

Customer Advance Receipt

download now -

Payment Advance Receipt

download now -

Advance Receipt Format

download now -

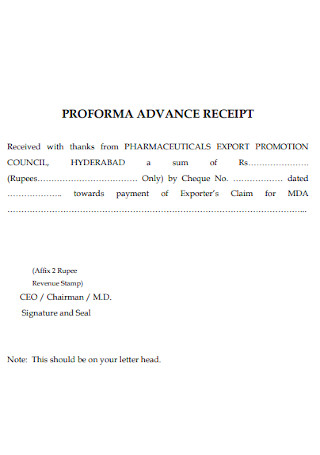

Proforma Advance Receipt

download now -

Advance Deposit Receipt

download now -

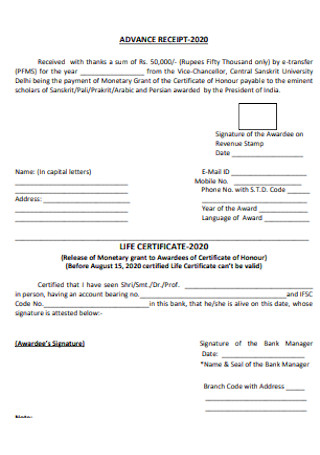

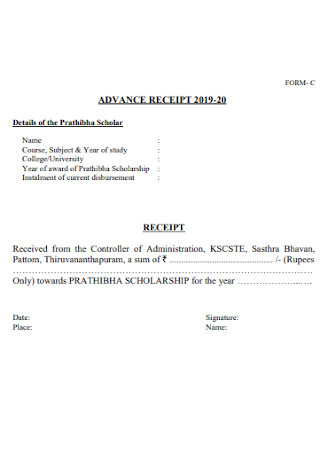

University Advance Receipt

download now -

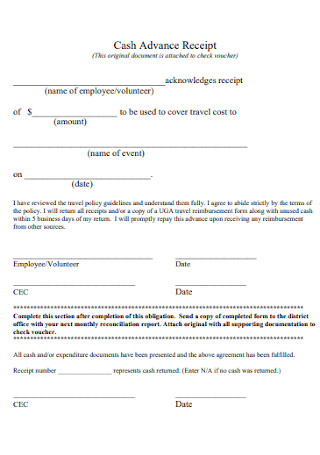

Sample Cash Advance Receipt

download now -

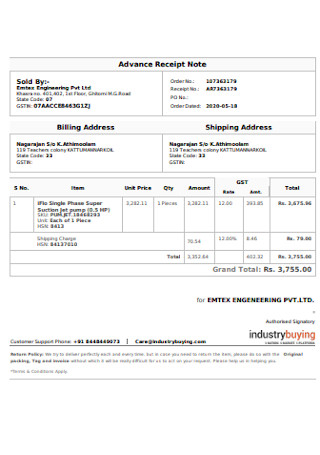

Advance Receipt Note Template

download now -

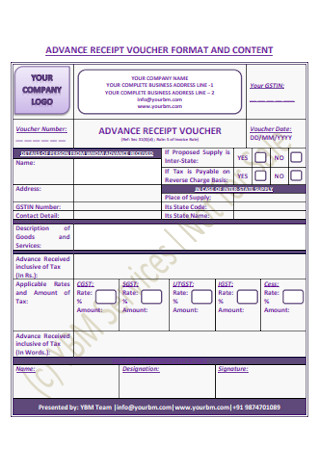

GST Advance Receipt

download now -

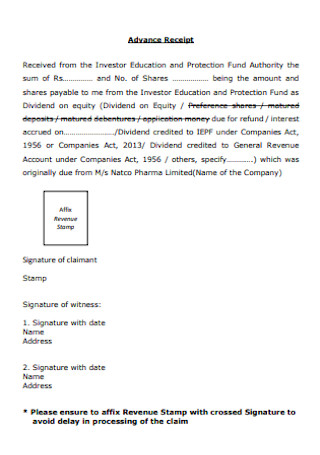

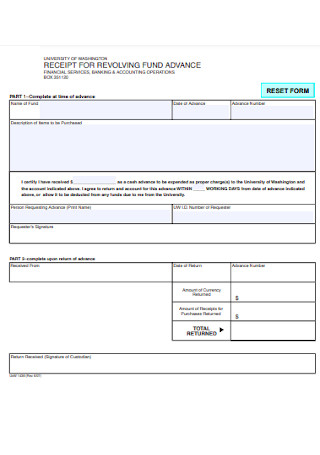

Fund Advance Receipt

download now -

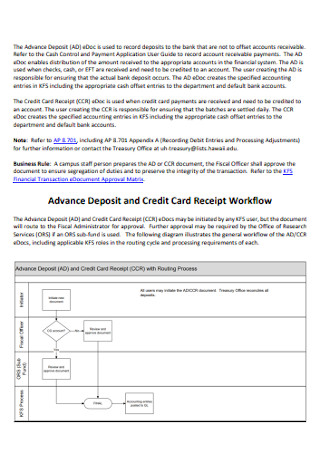

Advance Credit Card Receipt

download now -

Cash Advacnce Receipt

download now -

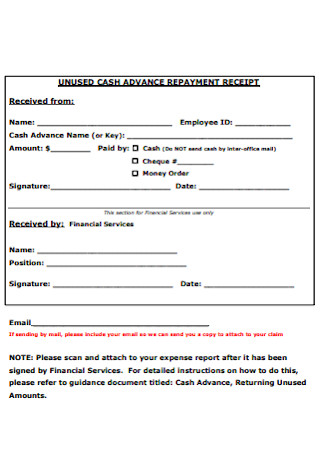

Cash Advance Repayment Receipt

download now -

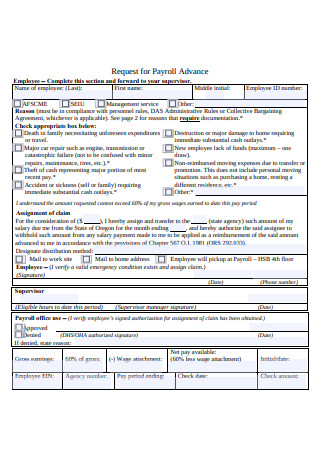

Payroll Advance Receipt

download now -

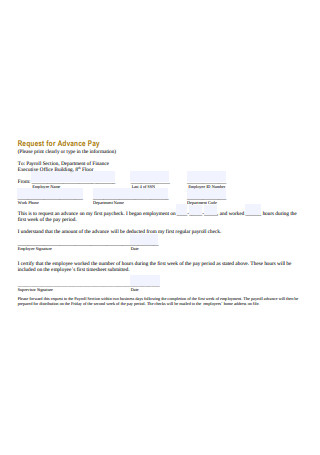

Request for Advance Pay Receipt

download now -

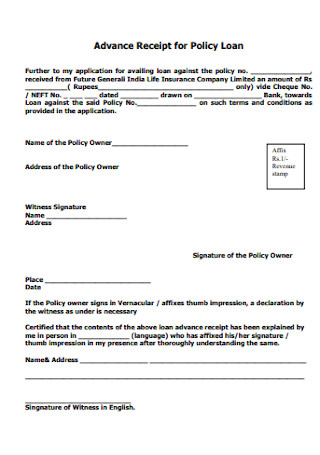

Advance Receipt for Policy Laon

download now -

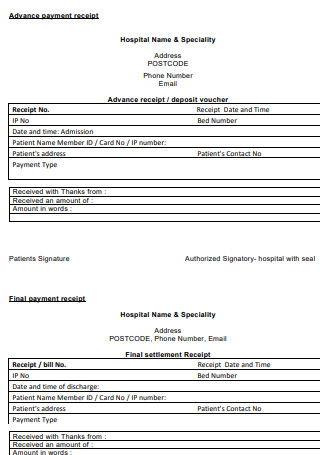

Advance Payment Receipt

download now -

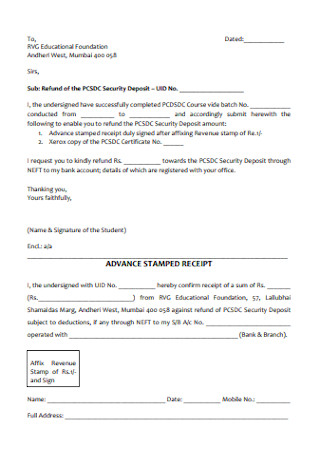

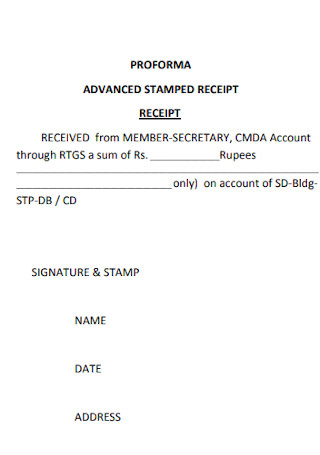

Advanced Stamped Receipt

download now -

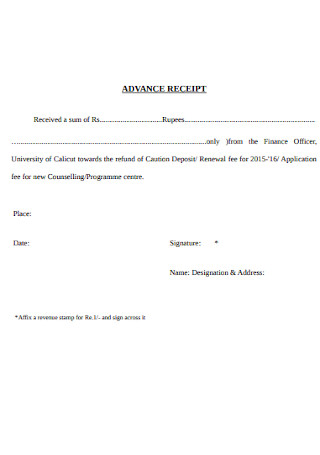

Simple Advance Receipt

download now -

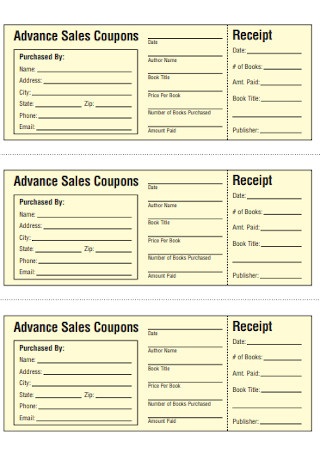

Advance Sales Coupons Receipt

download now -

Advance Receipt Vocher Format

download now -

Basic Advance Receipt

download now

FREE Advance Receipt s to Download

Advance Receipt Format

Advance Receipt Samples

What is Advance Receipt?

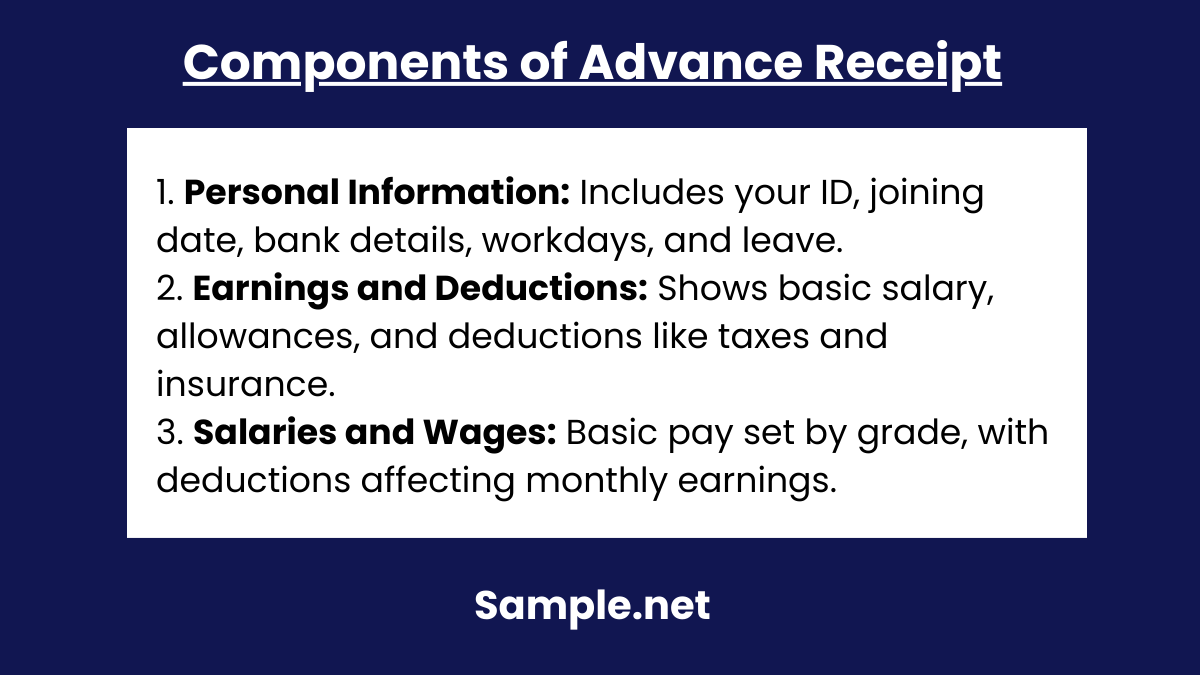

Components of Advance Receipt

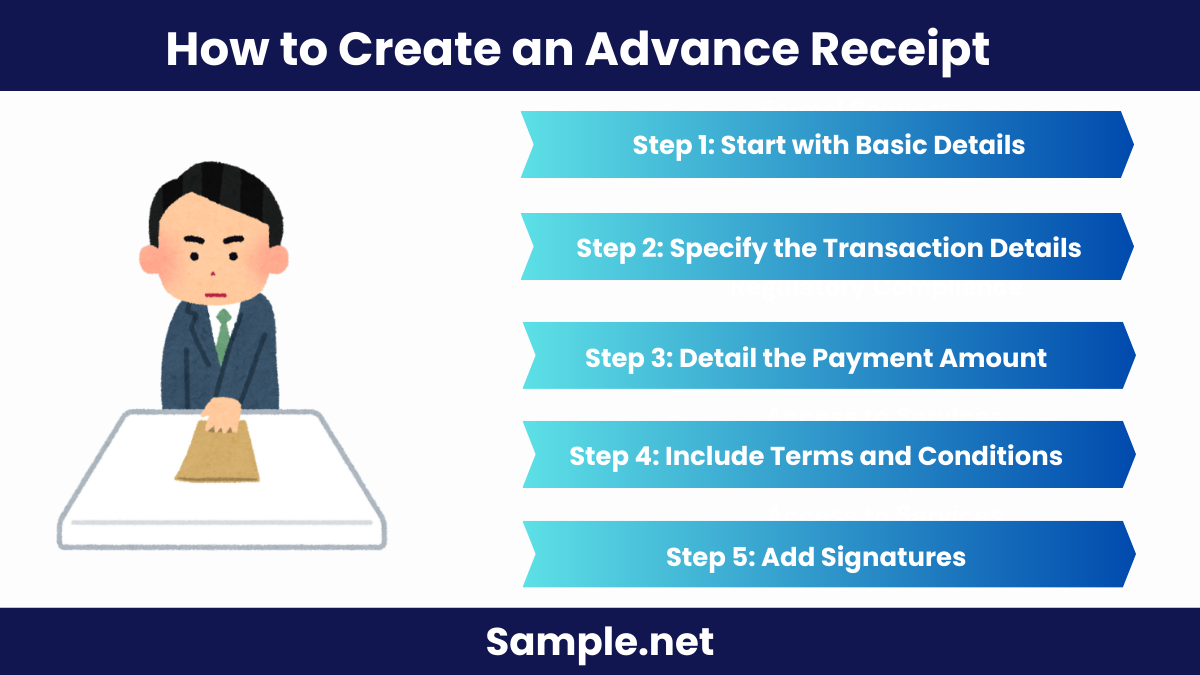

How to Create an Advance Receipt

FAQs

How Is Advance Received from a Customer Treated?

How Is Advance Payment Recorded on a Receivable?

When to Use a Template for Advance Payment?

What’s the difference between an advance receipt and an invoice?

How does an advance receipt impact a company’s balance sheet?

How does an advance receipt support financial planning?

Download Advance Receipt Bundle

Advance Receipt Format

Advance Receipt

Supplier: [Your Company Name] | Address: [Your Company Address] | Contact: [Your Company Email]

Advance Receipt No.: [Receipt Number] | Date: [Date of Receipt]

Customer: [Customer Name] | Address: [Customer Address] | Contact: [Customer Contact Information]

| Item No. | Description | Quantity | Unit Price | Total Advance |

|---|---|---|---|---|

| 001 | [Product 1, e.g., Model X1234] | [Qty] | [Price] | [Total] |

| 002 | [Product 2, e.g., Model Y4567] | [Qty] | [Price] | [Total] |

| 003 | [Product 3, e.g., Model Z7890] | [Qty] | [Price] | [Total] |

Total Advance Amount: $[Total Amount]

Advance Terms: Advance payment received for the items listed. Balance to be paid upon delivery or as per the agreed payment schedule.

Signatures:

Signature

Supplier ([Your Company Name]):

Name: [Your Name] | Date: [Date of Signing]

Signature

Customer ([Customer Name]):

Name: [Customer’s Name] | Date: [Date of Signing]

What is Advance Receipt?

An advance receipt is an official document issued by a business to confirm payment received from a customer before the actual delivery of goods or services. It serves as proof of payment and helps in managing pre-payment records for transparent financial tracking. You can also see more on Payroll Receipts.

Components of Advance Receipt

Despite the fact that the advance receipt issued by each business is unique, there are some facts that must be included on every receipt, and we can find these details in every advance receipt template we use, regardless of the business. You can also see more on Collection Receipts. These are the specifics:

How to Create an Advance Receipt

Step 1: Start with Basic Details

Include the name, address, and contact details of both the payer and the receiver. This helps in identifying the parties involved and ensures there’s no ambiguity about the transaction. You can also see more on School Fee Receipt.

Step 2: Specify the Transaction Details

List the date, receipt number, and purpose of the payment. Clearly describe what the advance is for, whether it’s a product, service, or booking, to avoid any confusion later on.

Step 3: Detail the Payment Amount

Include the exact amount paid in advance, the payment method (cash, bank transfer, credit card), and any applicable taxes. This clarifies the financial specifics and shows transparency in the transaction. You can also see more on Loan Receipts.

Step 4: Include Terms and Conditions

If there are any terms associated with the advance, such as refundability, delivery timelines, or conditions of use, outline them here. This prevents future disputes regarding the payment’s purpose or refundability.

Step 5: Add Signatures

Ensure both parties sign the document to confirm the terms, amount, and purpose. Digital or physical signatures validate the receipt, making it a legally binding acknowledgment of the advance payment. You can also see more on Investment Receipts.

Advance receipts are essential documents in various business settings, serving as proof of payment before the actual provision of goods or services. By documenting upfront payments, these receipts provide clarity, reduce financial risks, and foster trust between businesses and clients. With detailed records and transparent terms, advance receipts play a crucial role in accurate bookkeeping and smooth transaction management, supporting effective financial planning for both parties. You can also see more on Cash Receipt.

FAQs

How Is Advance Received from a Customer Treated?

Contrary to accrued income, an advance received from a customer serves as an excellent example of unearned income or postponed revenue. Due to the fact that the relevant revenue has not yet been produced by the business, funds acquired as an advance from a client are classified as a liability. Creating a journal entry for a customer’s advance payment.

How Is Advance Payment Recorded on a Receivable?

The ERPNext system treats any Payment Entry that is not associated with an invoice as if it were payment in advance of the invoice. A credit entry against the Customer’s Receivable account will be made in the event that the Customer provides $5,000 in cash as a cash advance to the company. You can also see more on Taxi Receipt.

When to Use a Template for Advance Payment?

The entire amount of money that was paid in the form of a down payment This template is typically utilized by those that require the use of advance receipts on a regular basis. The receipt template saves them the time and effort of having to develop a receipt from start and invests their time in adding details for every advance payment that is made. You can also see more on

What’s the difference between an advance receipt and an invoice?

An advance receipt is issued when a payment is made before delivery, whereas an invoice is a request for payment after the goods or services are provided. The receipt confirms a completed transaction, while an invoice initiates one. You can also see more on Sponsorship Receipts.

How does an advance receipt impact a company’s balance sheet?

Advance payments appear as liabilities on the company’s balance sheet until the goods or services are delivered. Once fulfilled, they are recognized as revenue, affecting the company’s financial statements.

How does an advance receipt support financial planning?

Advance receipts provide upfront capital, helping businesses manage cash flow and plan future operations. They serve as evidence of prepaid income, aiding in budgeting and forecasting financial needs. You can also see more on School Receipt.