24+ Sample Business Receipt Templates

-

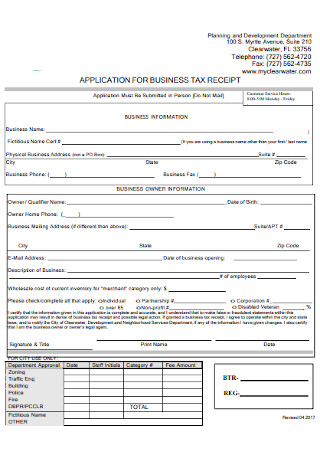

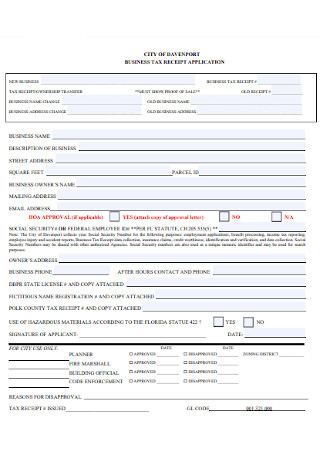

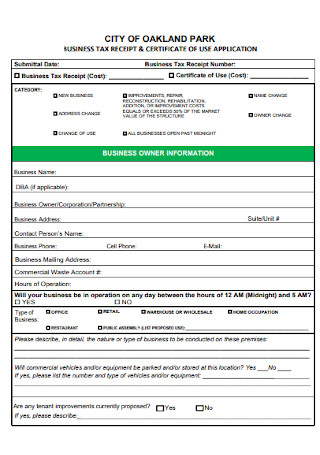

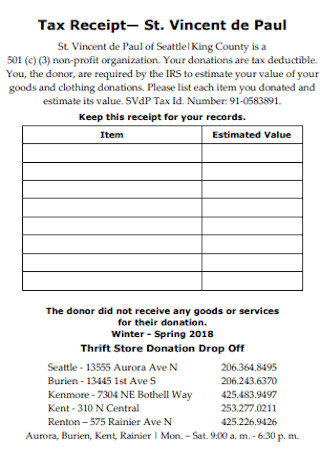

Business Tax Receipt

download now -

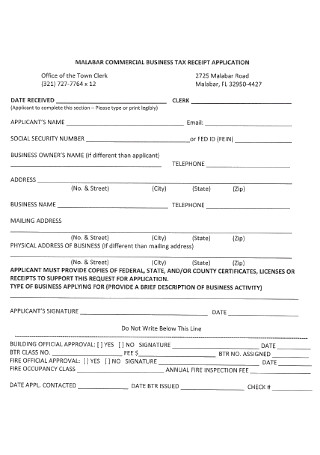

Commercial Business Receipt

download now -

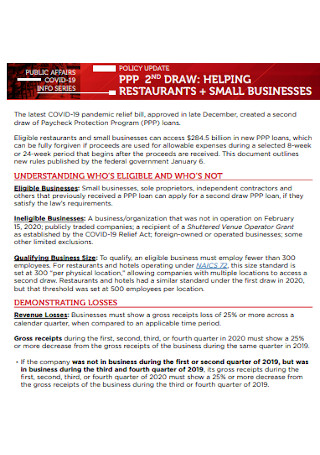

Restaurants Business Receipt

download now -

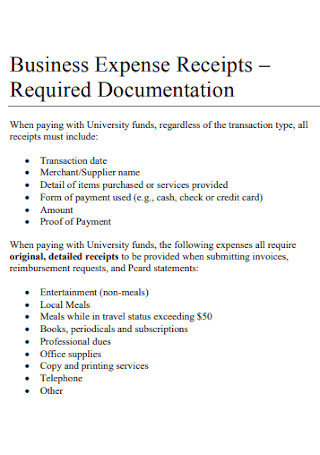

Business Expense Receipt

download now -

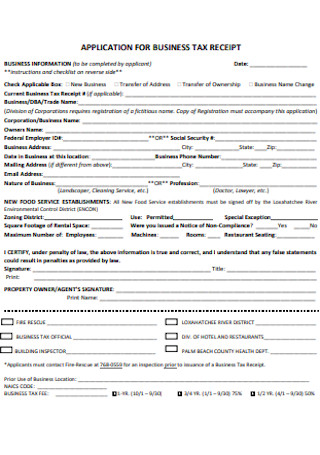

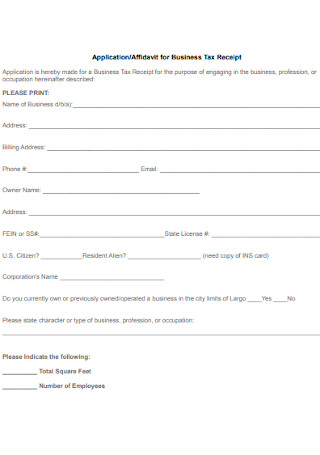

Application for Business Receipt Template

download now -

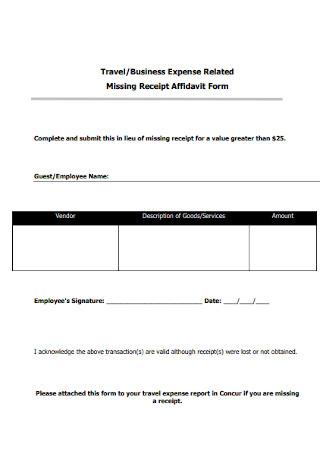

Travel Business Receipt

download now -

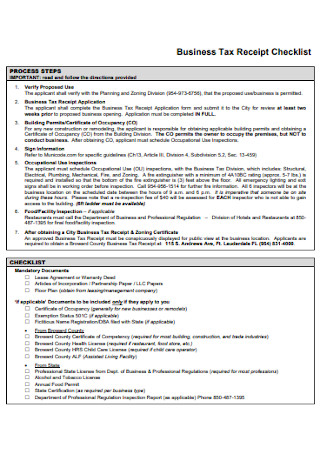

Business Receipt Checklist

download now -

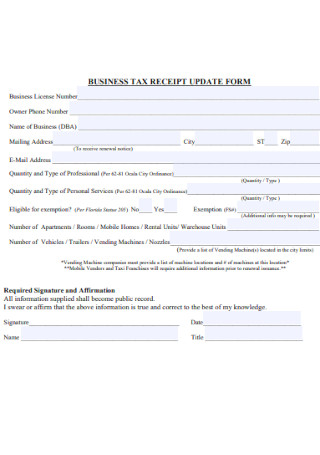

Business Receipt Update Form

download now -

Local Business Receipt Template

download now -

Business Tax Property Receipt

download now -

Business Equipment Receipt

download now -

Business Office Lost Receipt Form

download now -

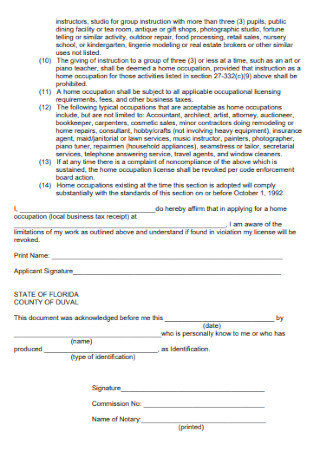

Affidavit for Business Tax Receipt

download now -

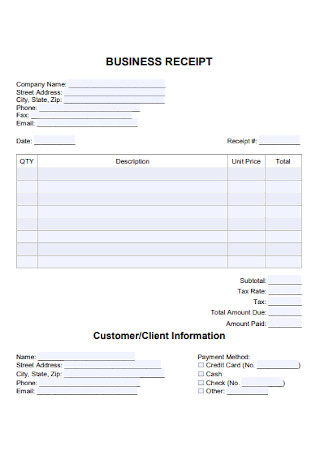

Business Receipt Format

download now -

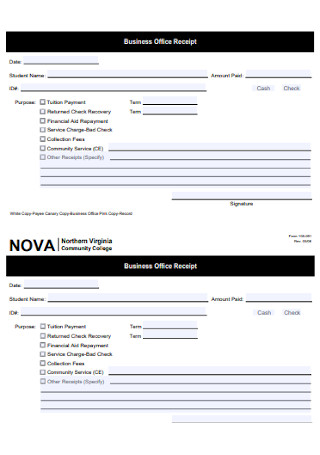

Business Office Receipt

download now -

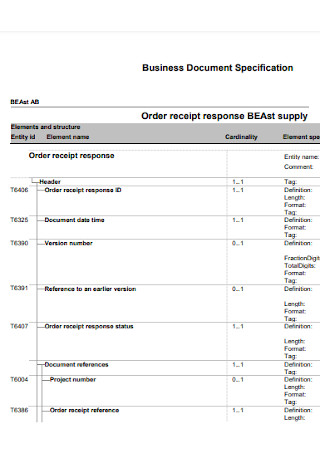

Business Document Receipt

download now -

Port Business Tax Receipt

download now -

Business Park Receipt Template

download now -

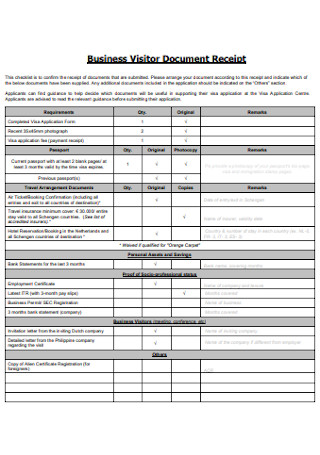

Business Visitor Document Receipt

download now -

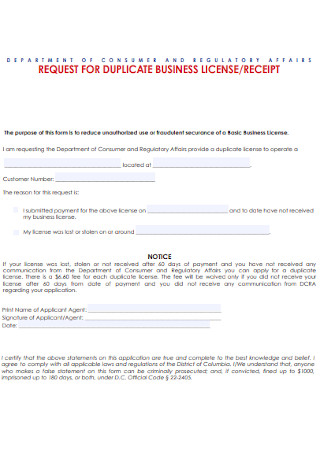

Business Licence Receipt

download now -

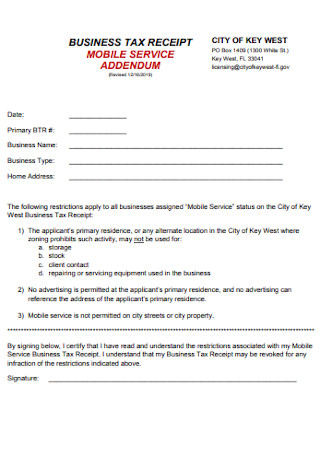

Mobile Business Receipt Template

download now -

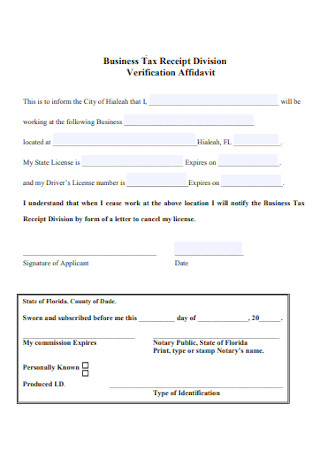

Business Tax Verification Receipt

download now -

Business Receipt Format

download now -

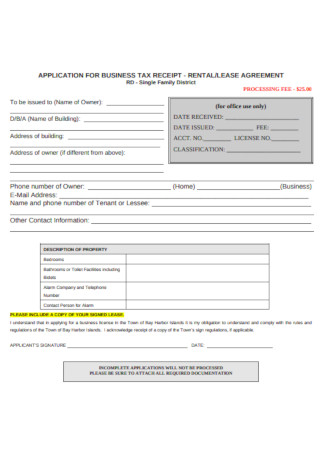

Rental Business Tax Receipt

download now -

Business Certification and Receipt

download now

FREE Business Receipt s to Download

24+ Sample Business Receipt Templates

Business Receipts: What Are They?

Elements of a Business Receipt

How Do You Create Business Receipts?

FAQs

Why are business receipts important?

How long should I keep official receipts?

What is the difference between receipt and invoice?

Business Receipts: What Are They?

A receipt has many names depending on who you ask. It is sometimes called a payment receipt, official receipt, or business receipt. Despite that, this little piece of paper is an essential document to all businesses, especially when it involves financial transactions. A business receipt can be a written or digitally-issued acknowledgment that something of value has been transferred from one party to another either in business-to-business (B2B) or business-to-consumer (B2C) deals. In addition, receipts are typically received from vendors, service providers, and stock market undertaking.

According to Turbo Tax, receipts of medical, childcare, unreimbursed work-related, self-employment, and other expenses are required if you apply for deductions on your personal income tax return.

Meanwhile, the Internal Revenue Service (IRS) suggested keeping official receipts for at least three years or as long as necessary.

An individual can be charged up to $500,000.00 for tax evasion and other tax crimes according to the Criminal Defense Lawyer.

Elements of a Business Receipt

Whether you are a startup or a business operating for many years, issuing receipts should be on top of your priority list. Non-compliance with this order can result in tax evasion or other tax crimes. The Criminal Defense lawyer said that the penalty for such crimes is between $250,000.00 for individuals and $500,000.00 for corporations. Other tax frauds can cost an individual $100,000.00 and a corporation $250,000.00. Hence, learning to create receipts is a crucial skill for having a business. Before starting to make your official receipt, make sure you know what it is consists of. The list below will tell you everything you need to know about elements of an official receipt.

How Do You Create Business Receipts?

Making receipts is not as difficult as you think. In fact, you can download sample receipt templates on the internet to aid you if you are to create an official receipt. On top of that, user-friendly word processors and editing tools to modify these templates are easily-accessible online as well. With a template, you are not required to start from scratch because it comes with suggested content written by professional writers suitable for different types of business transactions. As a result, you can save some time and spend it on other tasks on your priority list. For more convenience, below is a list of tips to guide you in creating your own business receipts.

Tip 1: Begin with an Outline

There are many ways to make a business receipt. It is up to you to choose between using a template and starting from scratch. If you want to use a template, this list is for you. In this article, we will help you create a payment receipt that is efficient. But before that, make sure you have downloaded a template. To save you from the hassle, start browsing through our website and discover a collection of printable templates. Click the download button to get started with your task. After that, begin the outline. The advantage of outlining is it gives you time to visualize what you want the final receipt to look like. The outline is just temporary, which means you can incorporate all elements that you think are necessary for your receipt. Next, tone down the outline by excluding unnecessary elements and leaving the important ones.

Tip 2: Organize the Content

Like any other important business documents, your business receipt’s content must be organized. Take note that receipts are proof of the existence of a financial transaction. It means every time a business issues one, it is recorded to their ledger or accounting journal. Because of that, receipts should be comprehensible so that it is easy to document. Organizing a receipt’s content can be done by adding tables and separating the non-related elements from each other. Might as well consider the proper labeling of elements as it is helpful in recognizing what that element is for. And because a receipt should sum up the total value of the products or services, make sure to encode the right formula. But do not worry too much about this since a template is already formulated. Yet, check it to avoid errors.

Tip 3: Keep It Simple

Apart from being an effective proof of purchase, a receipt also serves as a communication tool between a business and its customers. Being a part of their marketing strategy, some businesses incorporate slogans, announcements, or ads on their receipts. This way, they can promote the business and expand its customer base by spreading brand awareness and informing new customers of the products and services they offer. Thus, keeping your receipt simple and using concise words conveys the right message. Also, your receipt must be tailored to your demographics to align it to their needs. For example, not all receivers would want to know how the price per unit came to be. Rather, some of them prefer only seeing the fixed price per unit, sub-total, applicable tax, discount, and grand total.

Tip 4: Make It Appealing

Being a formal business document is not an excuse to keep the business receipt plain. To make it stand out, make it visually appealing. However, finding the balance between the elements and the design must be put into consideration. Overdesiging the receipt can deficit its purpose, while the bland design makes it boring. But why choose one when you can hit two birds at a time? Using your business’s logo, color scheme, and other symbols that are easily recognizable as your belonging makes the receipt eye-catching and at the same time on brand. Always stick to your identity and let it represent the business in the market. Doing this results in an appealing business receipt and a branding strategy.

Tip 5: Format Your Receipt

Now, the completion of your business receipt is up to the remaining two tips. In addition to tip number four, putting your receipt into format is necessary, especially in working on a template. Every template is unique and created with different features. One of those is it allows users to modify the suggested content. So, use this feature to your advantage. Keep in mind that formatting your template has no limit. Thus, take your time arranging your receipt’s content until you are convinced it is good enough to be given out to customers.

Tip 6: Finalize the Receipt Form

Lastly, review your receipt from top to bottom. Try to be as critical as possible in looking for errors—misspelled words, wrong grammar, capitalization, indention, etc. If there is any, make necessary adjustments. Even though a business receipt contains lesser texts compared to a business proposal or a payment plan, it requires proofreading. Furthermore, you do not have to make another version of your business receipt if you issue one digitally. The same receipt can be used.

FAQs

Why are business receipts important?

Recordkeeping is essential to your business. And properly storing receipts and other business records will help you with that. Strong record retention has several benefits. First, it monitors your business progress by helping you see how your business is doing. Whether you are improving in terms of sales or declining customer feedback, accurate records help measure your business. Second, receipts are part of the preparation for financial statements, which is essential to properly track profit and loss. And lastly, receipts keep a trail of deductible expenses. The Turbo Tax suggested keeping the receipts of the following expenses if you want to lower taxable income and increase your potential for a tax refund: medical, childcare, unreimbursed work-related, self-employment, and other expenses.

How long should I keep official receipts?

Keeping official receipts depends on your situation. In general, an individual should keep documents that support an item of income, deduction, or credits. However, IRS said that you can keep records for three to seven years or until it is necessary.

What is the difference between receipt and invoice?

An invoice is a document sent by a seller to a customer. It serves as a request for payment in exchange for the purchased products or services. Similar to a bill, an invoice lists what goods or services were provided, how much this costs, and which payment method the seller accepts. On the contrary, a receipt is the proof of payment confirming that a customer received products or services they paid a business for.

Business receipts benefit businesses in more than one way. It helps you with chargebacks or when a customer disputes a financial transaction with your business and most importantly for tax purposes. Whether you are operating in the retail industry or the construction market, receipts play an important role in your business success. What are you waiting for? Download a receipt template now and start accomplishing your business goals.