Collection Receipt

-

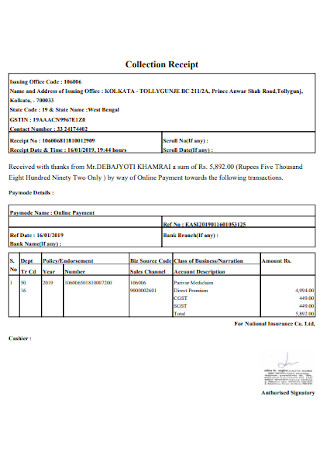

Insurance Collection Receipt

download now -

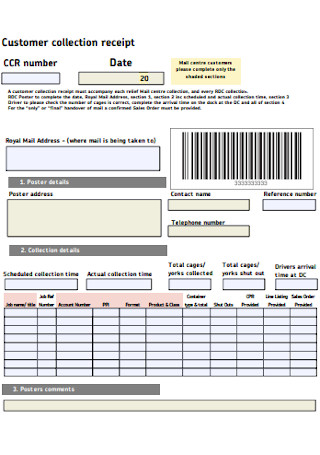

Customer Collection Receipt

download now -

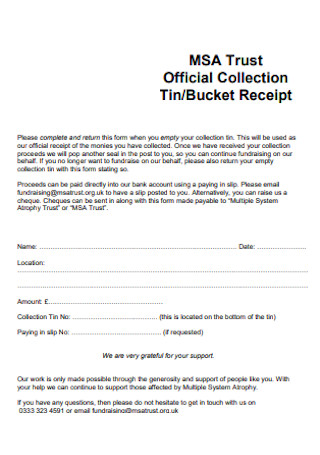

Trust Official Collection Receipt

download now -

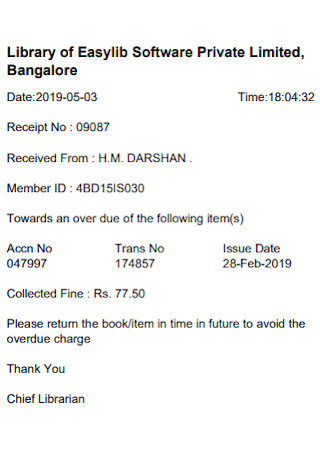

Library of Collection Receipt

download now -

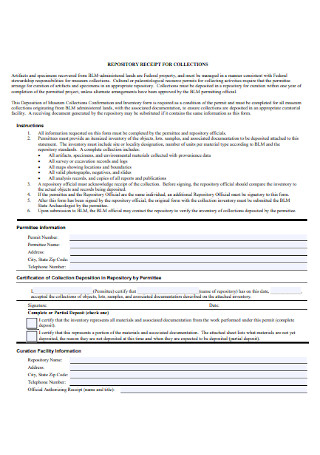

Repository Receipt for Collection

download now -

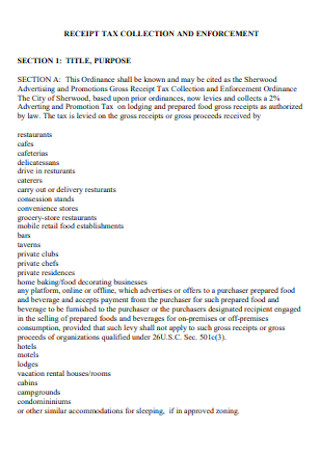

Receipty Tax Collection

download now -

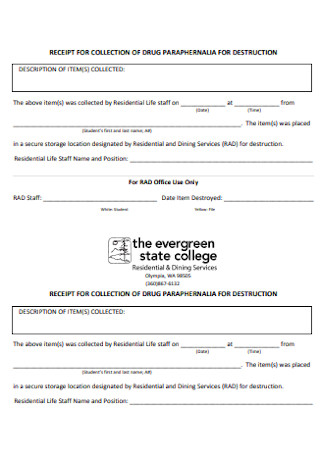

Drug Distribution Collection Receipt

download now -

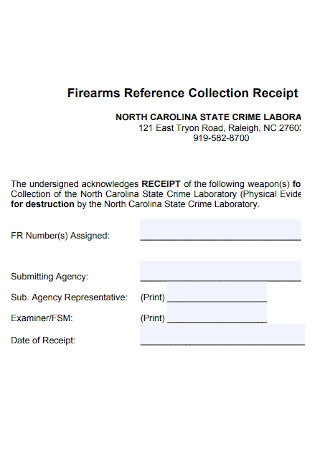

Firearms Reference Collection Receipt

download now -

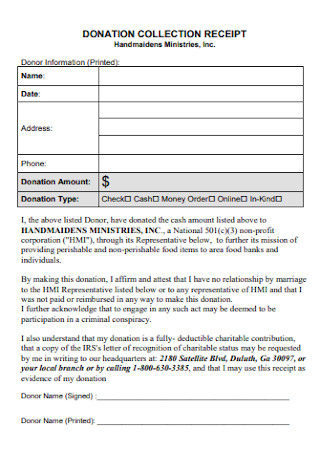

Donation Collection Receipt

download now -

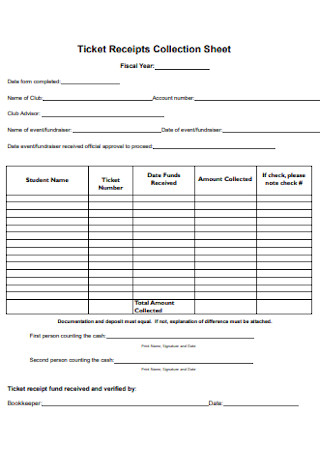

Ticket Receipts Collection Sheet

download now -

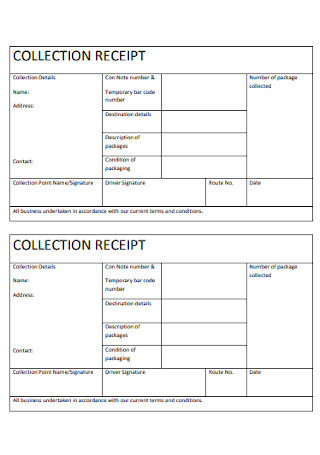

Sample Collection and Receipt

download now -

Simple Collection Receipt

download now -

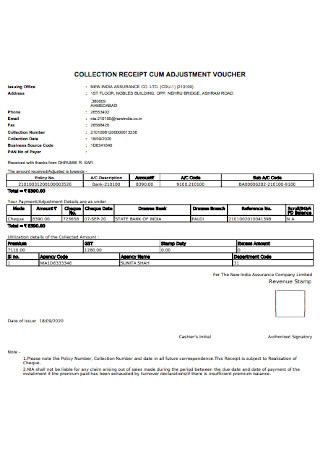

Collection Receipt Cum Adjustment Voucher

download now -

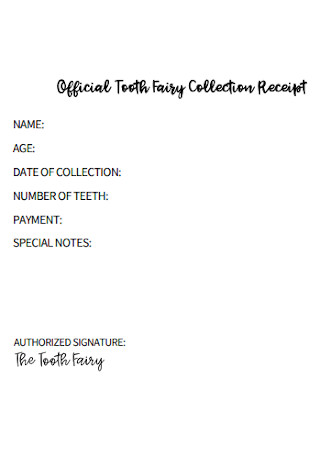

Official Tooth Fairy Collection Receipt

download now

FREE Collection Receipt s to Download

Collection Receipt

What is a Collection Receipt?

Types of Receipts

How to Improve Collections and Cash Flow Effectively

How to Create a Collection Receipt

FAQs

What are some examples of collection receipts?

Are cash receipts and cash collections the same?

How to record a cash collection?

What is the difference between an invoice and a collection receipt?

What are the basic steps of the collection process?

What is a Collection Receipt?

A collection receipt is a business document that proves that a payment transaction between a buyer and seller has been completed. This paper is beneficial for both the person who made the payment and the person who received it as it acts as proof of purchase or as a documentation tool for tax purposes. It contains the date of the transaction, the paid amount, the payment method, and the buyer’s full name, as well as item descriptions. Collection receipts should be stored in a secure and organized way for easy access when needed.

These purchase receipts are useful documents for a wide array of reasons. They are mainly used to provide clear evidence that a person made the payment in full and on time. These receipts are important for businesses and organizations in providing accurate documentation of payment for items or services, for accounting and tax purposes, and necessary in some circumstances to bring out evidence that payment has been made, especially if there happens to be a dispute over the products or services purchased. Plus, business owners and managers use collection receipts to help them closely monitor their spending and budget more efficiently.

Types of Receipts

Small businesses, shops, convenience stores, large corporate firms, institutions, and organizations use different types of receipts including collection receipts, petty cash receipts, and honorarium receipts to confirm that a payment transaction has taken place. Each receipt varies depending on the type of purchase made. Here are some of the common types of receipts.

How to Improve Collections and Cash Flow Effectively

It can be challenging and stressful for small businesses like convenience shops and grocery stores to collect, manage, and keep track of money from customers. Several businesses have poor invoicing and collection processes which can lead to inaccuracy in the documentation of payment receipts and unorganized accounting systems. Whether you are a small business owner or a manager of a B2B company, there are some ways to improve your collections and keep the cash flowing properly.

How to Create a Collection Receipt

It is essential for all business owners and managers to design a suitable cash collection process for their businesses. For example, systematization is useful when it comes to solving issues in accounts for payment and identifying problematic customers. Also, using better invoices and receipts like collection receipts is important to keep proof of payment in your business. Follow the steps indicated below in creating a simple collection receipt.

Step 1: Use a Collection Receipt Template

Go to Sample.net as you look for templates for simple collection receipts such as original receipts, consignment receipts, and donation receipts that you need. Choose from our wide-ranging receipts and document form template collection. Search for a collection receipt template that is perfect for your business and payment transaction needs and use it well.

Step 2: Download and Customize the Selected Collection Receipt Template

When you are done looking for your preferred collection receipt template, easily and quickly download your selected collection receipt template. Then, customize the format and style of your collection receipt template based on the brand identity of your business. Insert your business brand name, logo, and color palette.

Step 3: Insert the Proper Fields for the Main Components of the Collection Receipt

After you customized the collection receipt, insert clear fields for important information such as details about the buyers and sellers like the names, addresses, phone numbers, and email addresses, a list of the items and services purchased, a breakdown of the paid fee including prices, discounts, promotional codes or credit, and taxes, the total amount paid, and the payment method.

Step 4: Edit, Save, and Print the Collection Receipt

Check your collection receipt if you need to edit or change some fields and options on the content and overall appearance of your document. Then, save your collection receipt to your preferred document format. Add the collection receipt to your business website or e-commerce shop. Use this receipt template for collecting payments and print it when your customers made their purchases.

FAQs

Some examples of collection receipts are insurance collection receipts, customer collection receipts, collection of car receipts, trust official collection receipts, a library of collection receipts, repository receipts for collection, school fee receipt collection, drug distribution collection receipts, firearms reference collection receipts, collection of day care receipts, and donation collection receipts.

Cash receipts are business documents that show proofs of purchases issued when the buyers have paid in cash. Cash collections or payment collections are cash flow statements that present the total amounts of cash receipts for the accounting period.

Manage and record your cash collection while using a cash receipts journal so that you have a clear and detailed chronological record of your cash transactions. Record each cash transaction using your sales receipts in your cash receipts journal. Aon’t record the sales tax you collected in the journal, instead record it in the sales journal.

An invoice is a request for payment, while a collection receipt is a business document that confirms a customer received the products or services they paid for or that the business or company was properly compensated for the products or services they sold to a customer.

The basic steps of the collection process are assigning the overdue invoice to an employee for the collection process, verifying the past due amount, issuing dunning letters, calling the customer to discuss the reasons for lack of payment, settling payment arrangements over the phone or an extension of the payment deadline, adjust credit limit based on the credit team’s discretion and policy, keeping track payments under settlement arrangements, and referring to a collection agency to place the customer on a credit hold list.

What are some examples of collection receipts?

Are cash receipts and cash collections the same?

How to record a cash collection?

What is the difference between an invoice and a collection receipt?

What are the basic steps of the collection process?

Keeping an accurate and detailed record of your business activities is crucial for the growth and success of your business. Using simple and clear collection receipts is fundamental to help you track the products and services you are selling to your customers and shed light on critical areas of your business such as accounting, finances, and tax return preparation. Remember the different types of receipts that you will use and the steps to improve your collections and manage your cash flow in an organized manner. Simply download and use our sample printable collection receipt templates and other receipt samples such as hospital bill receipts in PDF, loan receipts, and more.