29+ Sample Employee Receipts

-

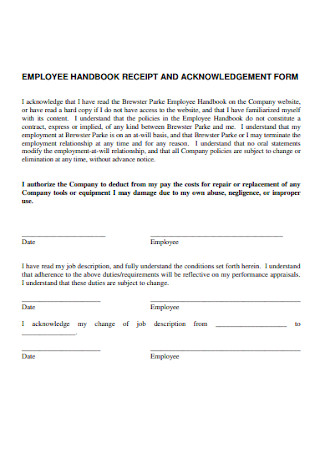

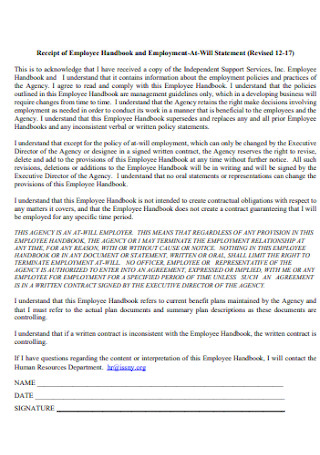

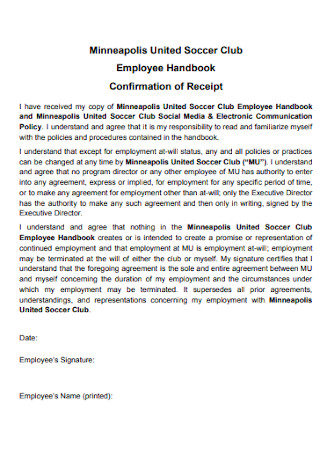

Employee Handbook Receipt

download now -

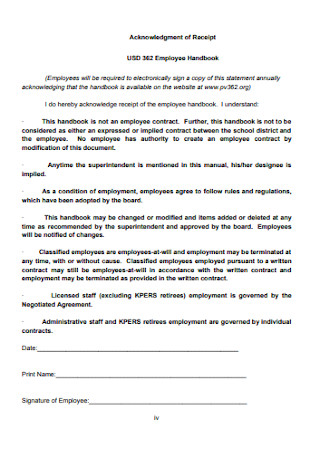

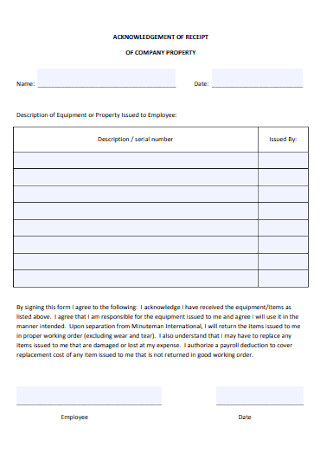

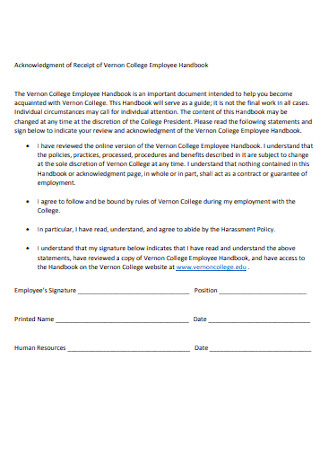

Employee Acknowledgment of Receipt

download now -

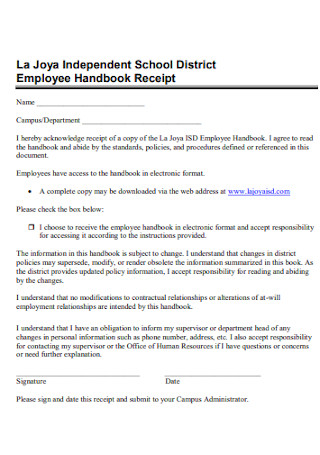

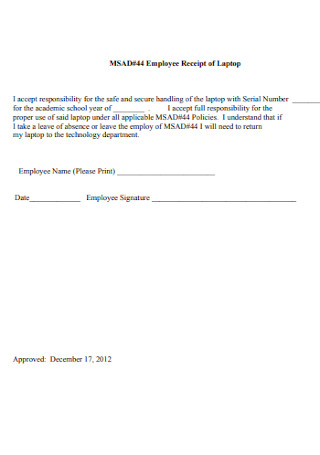

School Employee Receipt

download now -

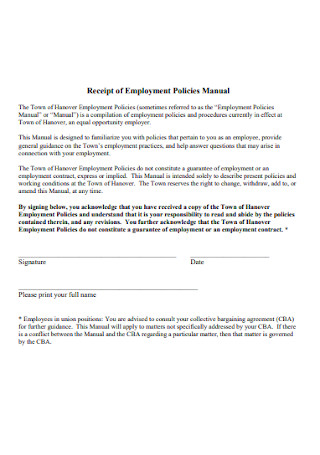

Receipt of Employment Policies Manual

download now -

Employee Gift Receipt

download now -

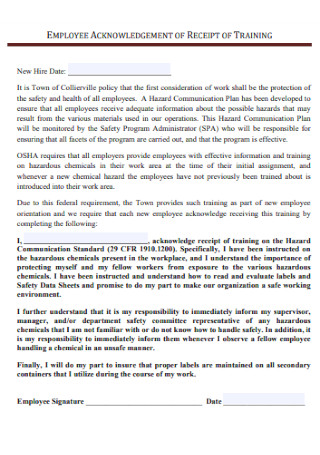

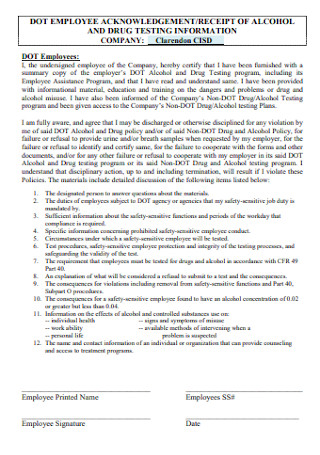

Employee Training Acknowledgement Receipt

download now -

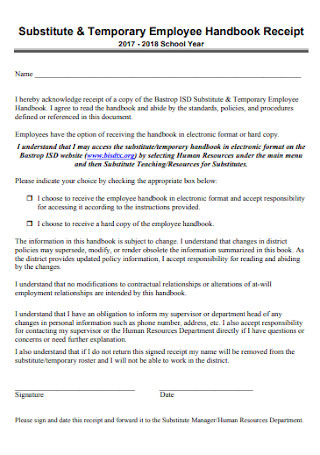

Temporary Employee Receipt

download now -

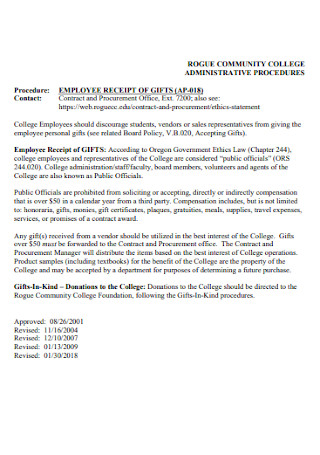

Employee Receipt of Gifts Template

download now -

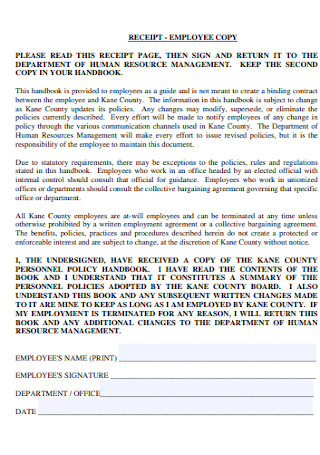

Employee Copy Receipt Template

download now -

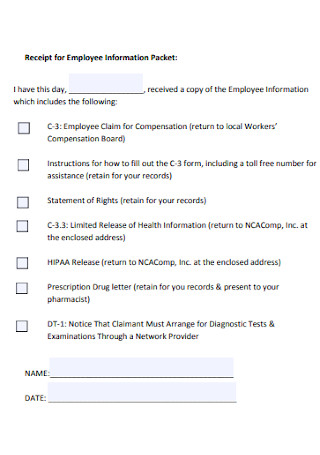

Receipt for Employee Information Packet

download now -

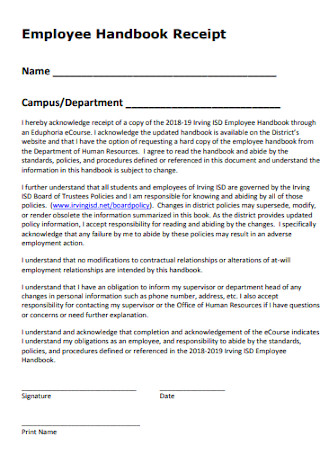

Employee Handbook Receipt Template

download now -

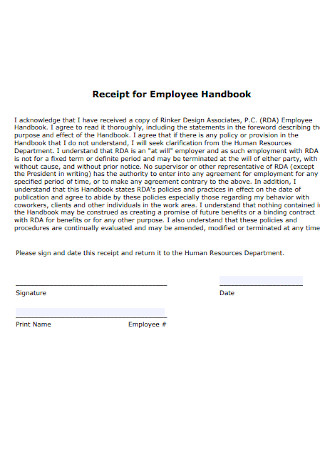

Receipt for Employee Handbook

download now -

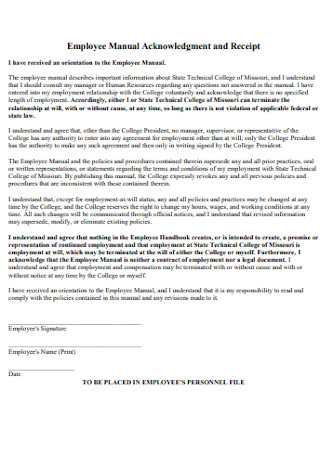

Employee Manual Acknowledgment and Receipt

download now -

Company Employee Receipt

download now -

Standard Receipt of Employee

download now -

Employee Receipt of Laptop Template

download now -

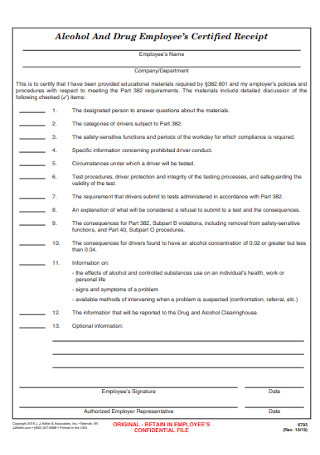

Employees Certified Receipt

download now -

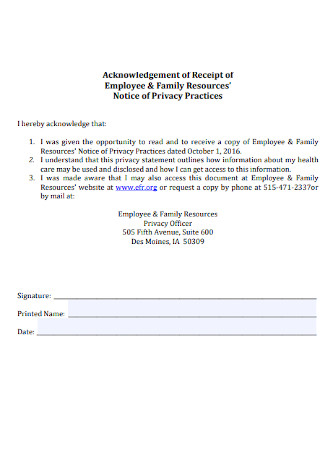

Employee and Family Receipt Template

download now -

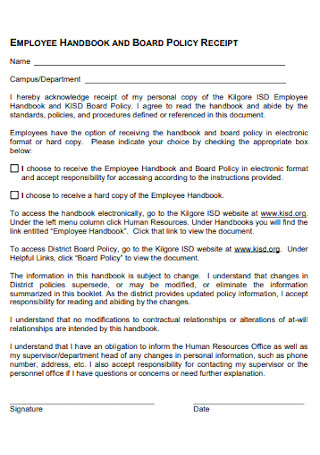

Employee Board Policy Receipt

download now -

State Employee Receipt of Gifts

download now -

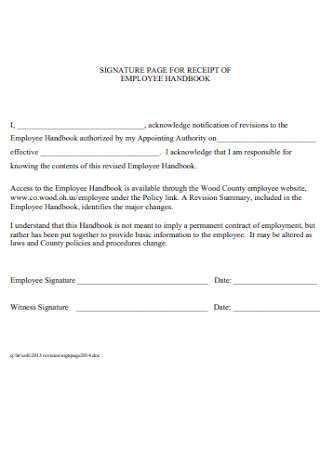

Signature Page of Employee Receipt

download now -

Employee Education Receipt Template

download now -

Employee Confirmation of Receipt

download now -

College Employee Receipt

download now -

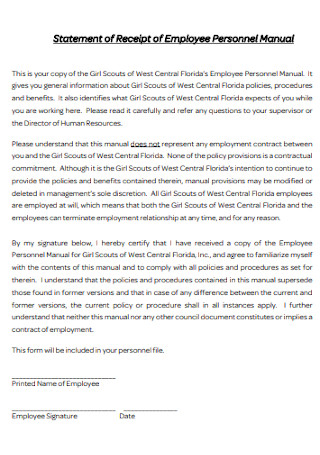

Statement of Receipt of Employee

download now -

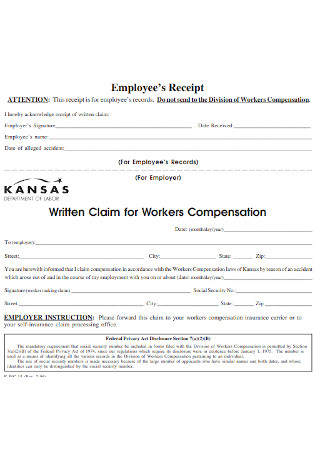

Employee Workers Receipt

download now -

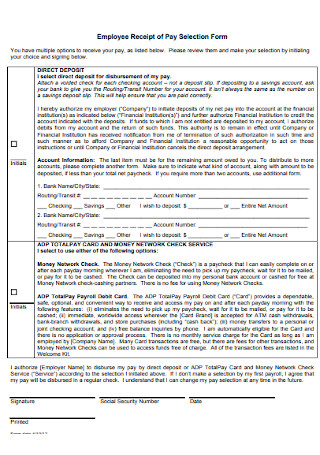

Employee Receipt of Pay Selection Form

download now -

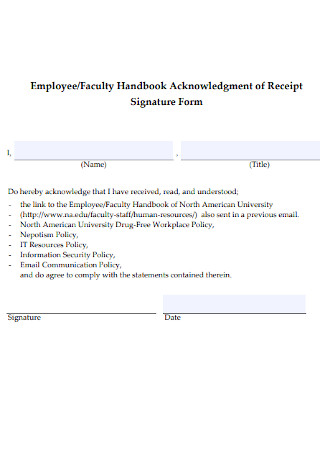

Employee and Faculty Receipt Template

download now -

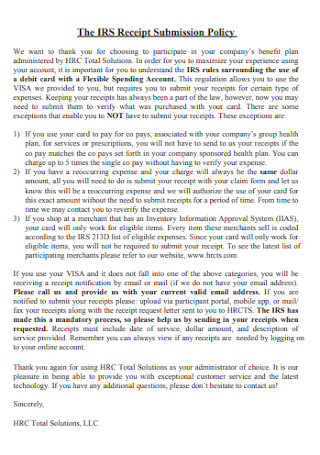

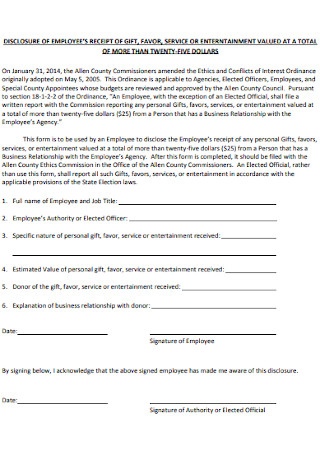

Disclosure of Employee Receipt

download now -

Formal Employee Receipt Template

download now

FREE Employee Receipt s to Download

29+ Sample Employee Receipts

What are Employee Receipts?

Types of Employee Receipts

How to Manage Expenses and Receipts Properly

How to Use an Employee Receipt Template

FAQs

What is an acknowledgment receipt?

What is a cash payment receipt?

What is an employee payroll receipt?

What is an employee receipt form?

How can tracking employee receipts benefit the expense management of a company?

What are Employee Receipts?

Employee receipts are fundamental documentation tools for any company’s record-keeping, expense management, and financial accountability. These receipts come in various forms, including acknowledgment receipts, payroll receipts, cash payment receipts, expense receipts, and electronic acknowledgments of employee handbooks. Using employee receipt templates makes it easier to track and manage these receipts by providing that all relevant data is gathered and arranged in a clear and coherent way. In turn, this supports businesses in maintaining detailed records and adhering to legal and financial standards. Because they offer a precise and unbiased record of transactions, receipts may also be very useful in circumstances of dispute settlement.

Furthermore, according to a study by the Aberdeen Group, businesses that use automated receipt collection and management may complete expense reports up to five times faster than those that rely on manual processes. Yet according to a poll, 42% of small firms and 70% of mid-sized enterprises use mobile applications to track their spending, and many of these apps come with built-in receipt templates. The use of receipt templates and other digital tools, according to 75% of respondents in an Institute of Management Accountants research, increased their accuracy and efficiency when reporting expenses. The significance of adopting employee receipts for small businesses, mid-sized organizations, and major corporate firms is well demonstrated by these statistical reports.

Types of Employee Receipts

Employee receipts serve as crucial documentation for businesses, from tracking expenses to acknowledging policy acceptance. Here are ten types of employee receipts, including acknowledgment receipts, employee payroll receipts, cash payment receipts, and electronic acknowledgments of employee handbooks.

How to Manage Expenses and Receipts Properly

Managing expenses and receipts such as collection receipts and tax receipts properly is crucial for businesses of all sizes, as it helps to ensure accurate financial records and compliance with tax and other legal regulations. Here are seven steps businesses can take to manage expenses and receipts properly:

How to Use an Employee Receipt Template

Using an employee receipt template can help businesses manage expenses more efficiently and accurately. By providing a standardized format for tracking and documenting expenses, an employee receipt template can streamline the reimbursement process, prevent errors and discrepancies, and ensure compliance with company policies and legal requirements. Here are four steps businesses and corporate firms can follow to use an employee receipt template for expense management:

Step 1: Select an Employee Receipt Template

You can find a variety of templates online or create your own. Browse Sample.net for sample employee receipt form templates that you need. Select from our wide-ranging document form template collection that fits the needs of your business.

Step 2: Customize and Distribute the Template

Customize the template with your company’s name, logo, and any other relevant information. Make sure to include fields for tracking important details like the date, amount, and purpose of the expense. After that, distribute the template to employees who need to submit receipts for reimbursement. Make sure they understand how to fill out the template and what supporting documentation is fundamental.

Step 3: Track Receipt Submissions

After you customized and distributed the employee receipt forms, the next step is to track receipt submissions in a centralized location, such as a shared drive or expense management software. This can help ensure that all receipts are accounted for and prevent any duplicate submissions.

Step 4: Review and Approve Employee Receipts

Lastly, review and approve employee receipts in a timely manner. This can involve checking that all necessary information is included, the receipt is valid, and the expense is within company policy. Once approved, be sure to compensate workers in a systematic way.

FAQs

A document known as an acknowledgment receipt verifies that a worker has received and read a certain corporate policy or document, such as an employee handbook. It acts as verification that the employee is aware of the information provided in the paper.

A cash payment receipt is a document that confirms a cash payment received by the company. It normally contains facts such as the date, amount, and reason for the payment, along with the payer’s name and any other pertinent information.

An employee payroll receipt is a document that confirms an employee’s salary or wage payment. It typically includes information based on employee payrolls such as the pay period, gross pay, and any deductions or taxes.

An employee receipt form is a document that serves as proof of an expense incurred by an employee on behalf of the company. It generally contains facts such as the date, amount, and reason for the spending, along with the name of the employee and any other key information.

A business may manage costs more effectively by tracking employee receipts to make sure that all expenditures are accounted for and correctly recorded. Also, it can assist in locating areas where costs can be minimized or optimized as well as actually prevent fraud and other unlawful expenses. Also, keeping track of receipts can assist a business in adhering to tax and other legal requirements.

What is an acknowledgment receipt?

What is a cash payment receipt?

What is an employee payroll receipt?

What is an employee receipt form?

How can tracking employee receipts benefit the expense management of a company?

Sample employee receipts in PDF can provide businesses with a helpful starting point for managing expenses and tracking important documentation. By choosing the right template and customizing it to their needs, companies can ensure that their employees are accurately documenting expenses and acknowledging important policies. Tracking employee receipts can also help businesses optimize their expense management processes, reduce errors and discrepancies, and ensure compliance with legal and regulatory requirements. Overall, using sample employee receipts in PDF can help businesses improve their expense management practices and reduce the administrative burden associated with manual tracking and reimbursement. Easily download and use our sample receipts like equipment receipts, investment receipts, and other form templates such as delivery forms.